Overview

Understanding a $350,000 mortgage payment over 30 years can feel overwhelming, but we’re here to support you every step of the way. This article outlines the essential components and calculations involved, focusing on principal, interest, taxes, and insurance (PITI).

We know how challenging it can be to navigate these elements. Comprehending them, along with the total costs associated with a mortgage, is crucial for effective budgeting and financial planning. Remember, the total expense can significantly exceed the initial loan amount due to interest and additional costs like property taxes and insurance.

By breaking down these factors, we aim to empower you with the knowledge you need to make informed decisions. Let’s explore these components together, ensuring you feel confident and prepared as you embark on this journey.

Introduction

Understanding a mortgage payment can feel overwhelming, especially when considering a significant loan like $350,000 over a 30-year term. Each payment includes various components—principal, interest, taxes, and insurance—collectively known as PITI. These elements can have a profound impact on your financial situation. As homeowners, you might find yourself asking: how can you manage these costs effectively while making informed decisions about your mortgage options?

We know how challenging this can be, and that’s why this article is here to help. We’ll break down the essential elements of mortgage payments, offering clarity and strategies that empower you to take control of your budget. Together, we can navigate this complex financial commitment with confidence.

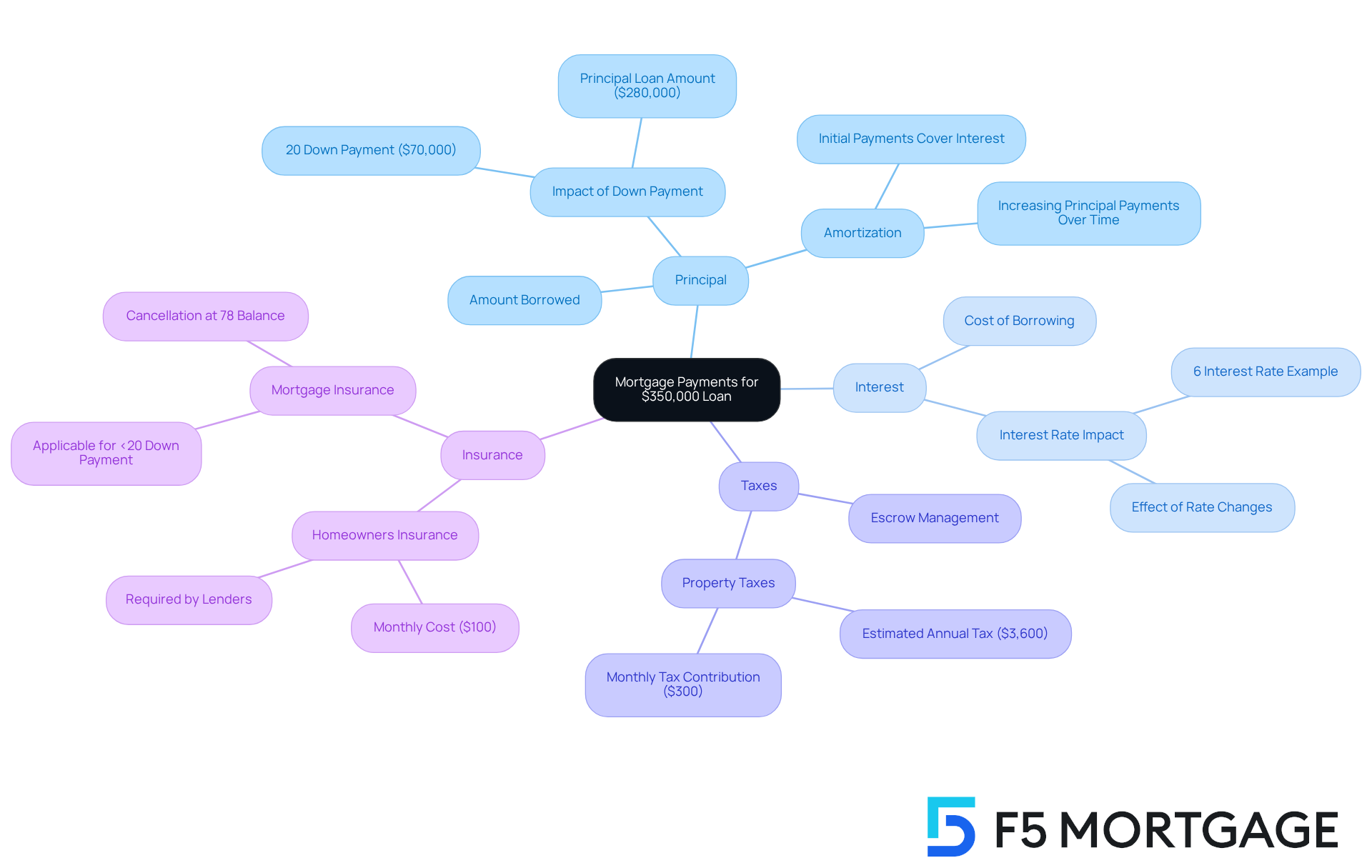

Explore the Basics of Mortgage Payments for a $350,000 Loan

When considering a loan for a house, it’s important to understand the fundamental elements of a $350,000 mortgage payment over 30 years. A standard loan payment consists of four primary components: principal, interest, taxes, and insurance, collectively known as PITI. The principal is the amount you borrow, while interest is the cost of borrowing that money. Property taxes, assessed by local authorities, contribute to the tax segment, and insurance includes homeowners insurance and possibly mortgage insurance if your down payment is less than 20%.

For instance, if you make a 20% down payment of $70,000, your principal loan amount would be $280,000. With a $350,000 mortgage payment over 30 years and a 6% interest rate, your monthly payment could be around $1,676. This figure not only covers the principal and interest but also includes estimated property taxes and insurance, which can vary based on your location and coverage options.

Understanding these components helps you anticipate your ongoing obligations and total financial commitment throughout the loan’s term. For example, if property taxes are estimated at $3,600 annually, that adds $300 to your monthly costs, while homeowners insurance might add another $100. This means your total monthly contribution could reach approximately $2,076, especially when factoring in a $350,000 mortgage payment over 30 years, illustrating how each element impacts your financial landscape.

Moreover, the length of your loan term, such as a $350,000 mortgage payment over 30 years, can significantly affect your monthly expenses. A longer term can help keep your monthly payments lower, allowing you to allocate funds for home improvement projects or bolster your savings. Conversely, a shorter term means you’ll pay off your loan more quickly, incur less interest, and build equity in your home faster. By breaking down your home loan costs into these components, you can manage your budget more effectively and make informed decisions about your financing options. We know how challenging this process can be, and we’re here to support you every step of the way.

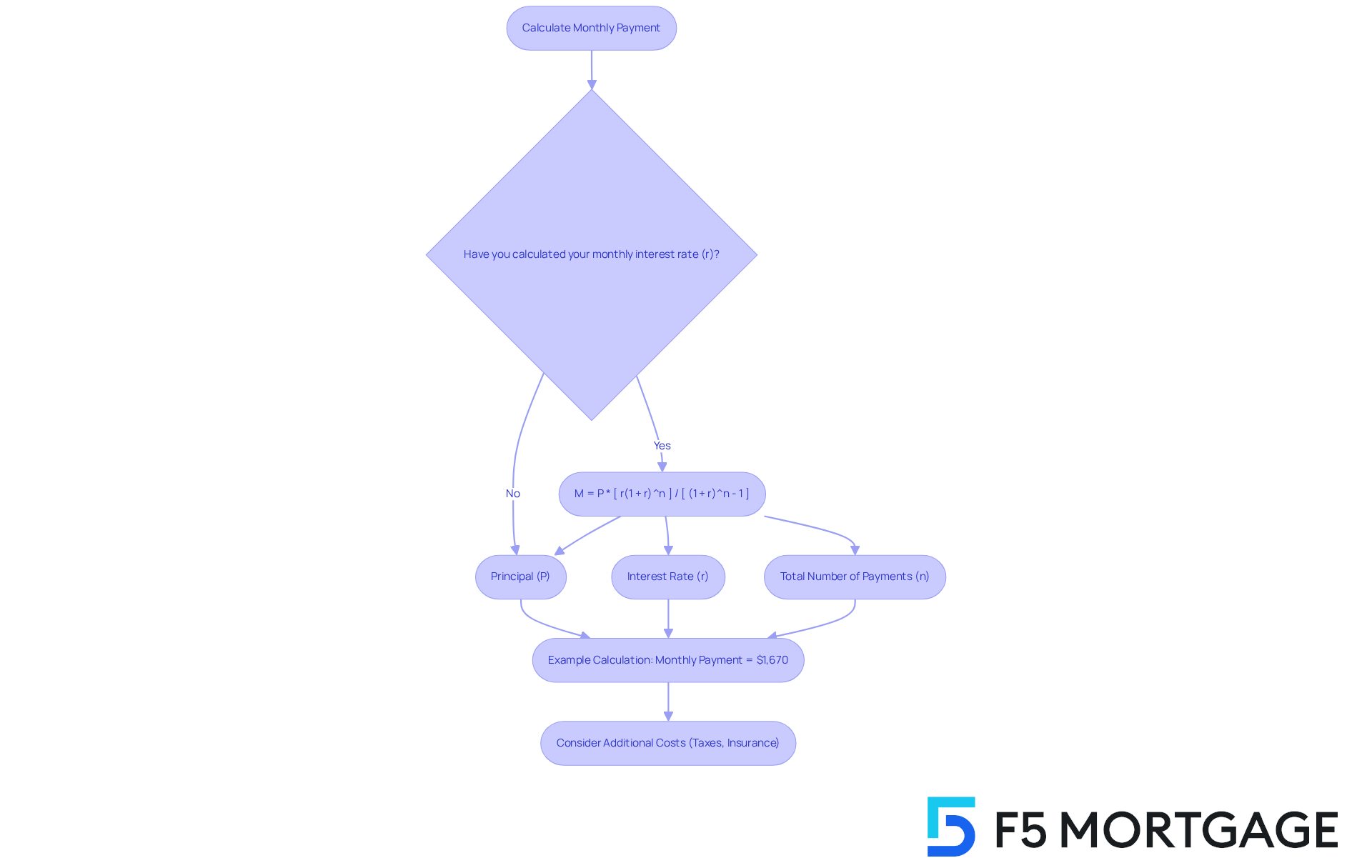

Calculate Your Monthly Payment: Formula and Example

Understanding your monthly mortgage payment can feel overwhelming, but we’re here to help you navigate this important financial decision. You can utilize the following formula to determine your payment:

M = P * [ r(1 + r)^n ] / [ (1 + r)^n - 1 ]

Where:

- M is your monthly payment.

- P is the principal loan amount (for example, $350,000).

- r is your fee rate (annual rate divided by 12).

- n is the total number of installments (loan term in months).

Let’s break it down with an example. If you secure a 30-year fixed loan at an interest rate of 4%, your monthly interest rate would be 0.00333 (4% divided by 12). Plugging these values into the formula gives you an approximate monthly charge of $1,670. This calculation is essential for grasping the financial obligation involved in your loan.

In 2025, the typical cost for a $350,000 loan can vary from $1,756.92 to $2,337.16, depending on the rate and duration of the loan. Families often use this formula to evaluate their mortgage costs. For instance, a family taking a loan structured as a $350,000 mortgage payment over 30 years at a 7% interest rate would encounter a monthly charge of approximately $2,328.56. Remember the ’28/36 rule’—it’s advisable to spend no more than 28% of your gross income each month on housing costs. This guideline can greatly aid in budgeting effectively.

It’s important to note that your monthly loan contribution may also include real estate or property taxes, homeowners insurance, and possibly private mortgage insurance (PMI) if your down payment is less than 20%. Many lenders, including F5 Mortgage, require homeowners to maintain at least an 80% home-to-value loan ratio. This means you should have paid down at least 20% of your original loan amount or that your home has appreciated in value. Additionally, a maximum DTI ratio of 43% is typically necessary for home loans, which is crucial for securing favorable loan rates.

Understanding these calculations empowers you to make informed decisions about your financial future. Moreover, making extra contributions towards the principal can significantly reduce the overall cost incurred over the duration of the loan, offering a smart strategy for managing loan expenses more efficiently. With F5 Mortgage’s fast and flexible solutions, you can achieve homeownership with exceptional service and competitive rates. We know how challenging this can be, and we’re here to support you every step of the way.

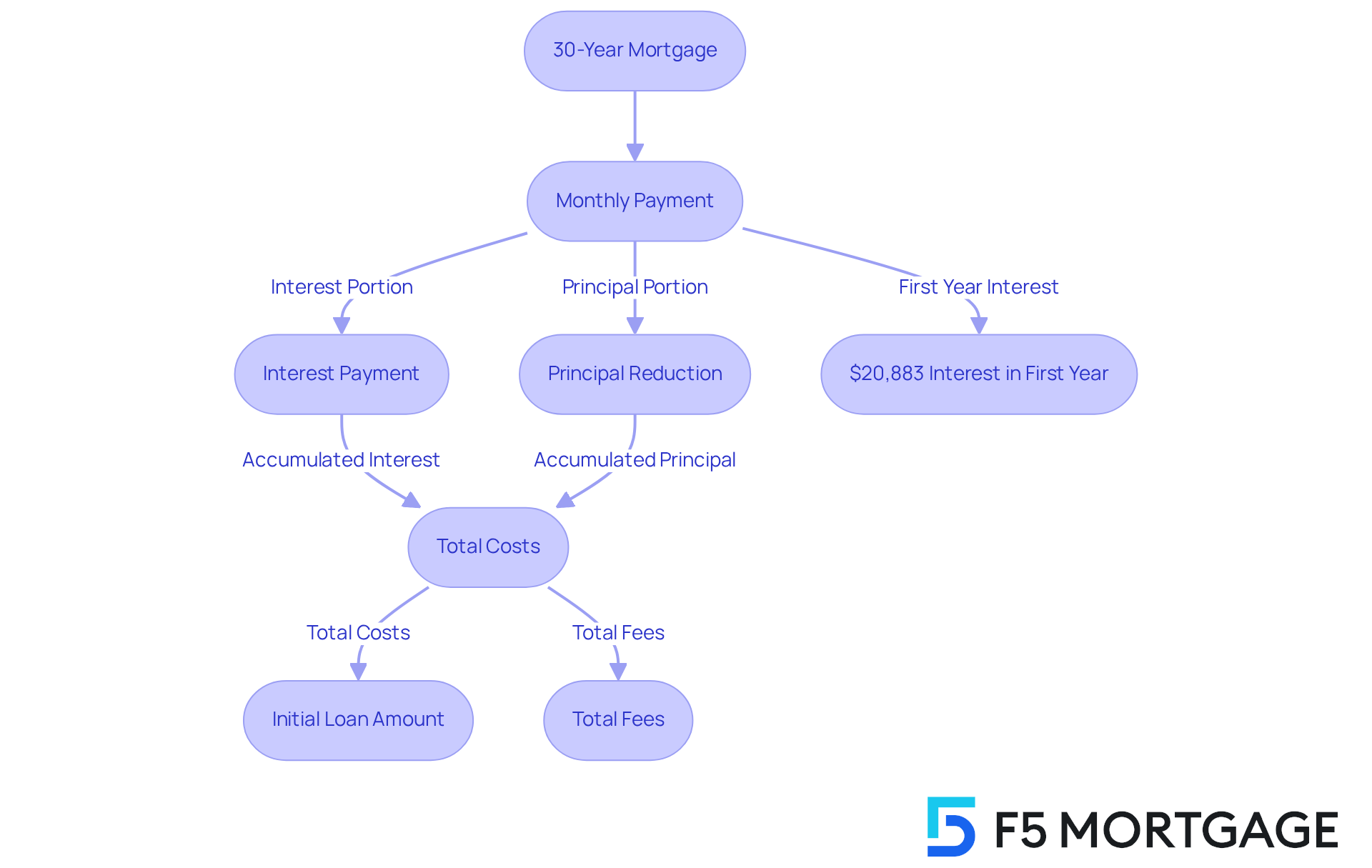

Understand Total Costs: Interest, Amortization, and Long-Term Financial Impact

When considering a 30-year mortgage, it’s important to recognize that the total expense can far exceed the initial loan amount due to accumulating charges. For instance, a $350,000 mortgage payment over 30 years at a 6% interest rate can result in approximately $405,433 in fees. This brings the total to around $755,433. We know how challenging this can be, and understanding amortization is crucial. In the early years, a significant portion of your monthly payment goes toward interest rather than reducing the principal. This means that even as your monthly payment stays the same, the amount that chips away at your loan balance increases over time. In fact, during the first year of a 30-year loan, the total interest paid can reach about $20,883. This highlights the importance of long-term financial planning.

It’s essential to grasp these dynamics to truly understand the cost of homeownership and to make informed decisions about your loan. Additionally, don’t forget to factor in other homeownership costs, like property taxes and maintenance, which can greatly influence your overall financial picture. At F5 Mortgage, we’re here to support you every step of the way, providing personalized assistance throughout your home buying or refinancing journey. Together, we can help you achieve your dream of homeownership with competitive rates and exceptional service.

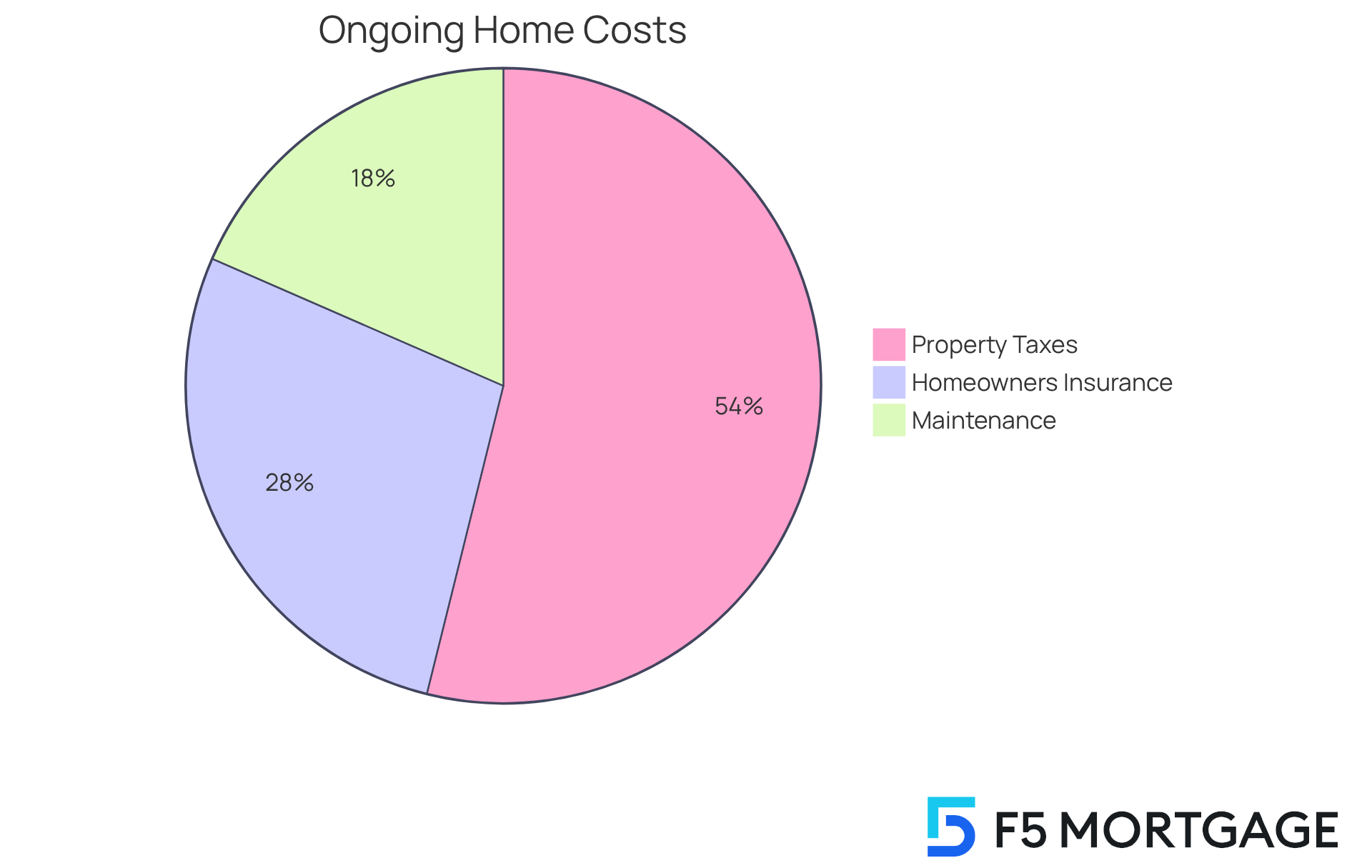

Consider Additional Factors: Down Payments and Ongoing Costs

Preparing for a loan can feel overwhelming, and we understand how crucial your initial deposit is in shaping your financial responsibilities. A larger down payment not only lowers your monthly expenses but also helps you avoid private mortgage insurance (PMI). This insurance is typically required if your down payment is less than 20%. For example, if you put down 10% on a $350,000 mortgage payment over 30 years, PMI costs can significantly add to your monthly budget.

It’s also important to think about the ongoing costs of homeownership. These include:

- Property taxes

- Homeowners insurance

- Maintenance

If property taxes are around $3,500 each year, that means roughly $292 added to your monthly expenses. By taking these additional costs into account, you can create a more thorough financial plan. This ensures you’re ready for the responsibilities that come with owning a home. This proactive approach not only helps in budgeting but also empowers you to make informed decisions about your mortgage options. Remember, we’re here to support you every step of the way.

Conclusion

Understanding a $350,000 mortgage payment over 30 years is crucial for potential homeowners. We know how challenging this can be, and recognizing the various components—principal, interest, taxes, and insurance, collectively known as PITI—can help alleviate some of that stress. Grasping these elements enables you to anticipate your monthly obligations and overall financial responsibilities throughout the loan term.

Throughout this article, we provided key insights on:

- How to calculate monthly payments

- The implications of interest rates

- The long-term costs associated with a mortgage

The significance of making a larger down payment was also highlighted, as it can reduce monthly expenses and help you avoid additional costs like private mortgage insurance. Moreover, understanding the impact of amortization on total payments over time underscores the importance of long-term financial planning.

Ultimately, being well-informed about mortgage payments and their components empowers you to make sound financial decisions. By considering all aspects—from payment calculations to ongoing costs—you can better prepare for the responsibilities of homeownership. Taking proactive steps in understanding these factors can lead to a more manageable and rewarding mortgage experience. We’re here to support you every step of the way.

Frequently Asked Questions

What are the main components of a mortgage payment for a $350,000 loan?

The main components of a mortgage payment, known as PITI, include principal, interest, taxes, and insurance.

How is the principal amount determined in a mortgage?

The principal amount is the total amount you borrow. For a $350,000 mortgage with a 20% down payment of $70,000, the principal loan amount would be $280,000.

What is the estimated monthly payment for a $350,000 mortgage over 30 years at a 6% interest rate?

The estimated monthly payment would be around $1,676, which covers principal and interest, as well as property taxes and insurance.

How do property taxes and homeowners insurance affect monthly mortgage payments?

Property taxes and homeowners insurance add to your monthly costs. For example, if property taxes are estimated at $3,600 annually, that adds $300 to your monthly payment, while homeowners insurance might add another $100.

What could be the total monthly contribution for a $350,000 mortgage considering taxes and insurance?

The total monthly contribution could reach approximately $2,076 when factoring in the principal, interest, estimated property taxes, and homeowners insurance.

How does the length of the loan term impact monthly mortgage payments?

A longer loan term can help keep monthly payments lower, allowing more flexibility in budgeting, while a shorter term results in paying off the loan more quickly, incurring less interest, and building equity faster.

Why is it important to understand the components of a mortgage payment?

Understanding these components helps you anticipate ongoing obligations and total financial commitment throughout the loan’s term, allowing for better budget management and informed financing decisions.