Overview

Securing the lowest rate on a home equity loan can feel overwhelming, but we’re here to support you every step of the way. This article outlines four essential steps that can help you navigate this process with confidence.

First, it’s important to understand home equity. Knowing how much equity you have in your home is the foundation for making informed decisions.

Next, explore the different types of loans available. Each option has its own benefits, and understanding them can empower you to choose what fits your financial needs best.

Then, take the time to compare rates from multiple lenders. This step ensures you’re getting the most competitive offers, which can make a significant difference in your overall costs.

Finally, when you’re ready, apply for the loan. Throughout this journey, remember to evaluate your property value, loan options, and lender proposals carefully.

By doing so, you can make decisions that align with your goals and financial situation. We know how challenging this can be, but with these steps, you can approach the process with clarity and assurance.

Introduction

Understanding the intricacies of home equity can profoundly influence the financial decisions of homeowners. With property values at historic highs, many are eager to leverage their investments through home equity loans. However, securing the best rates can feel overwhelming. We know how challenging this can be.

What strategies can homeowners employ to navigate this complex landscape and ensure they access the lowest possible rates for their home equity financing? This guide breaks down essential steps, empowering homeowners to make informed choices and maximize their financial opportunities. We’re here to support you every step of the way.

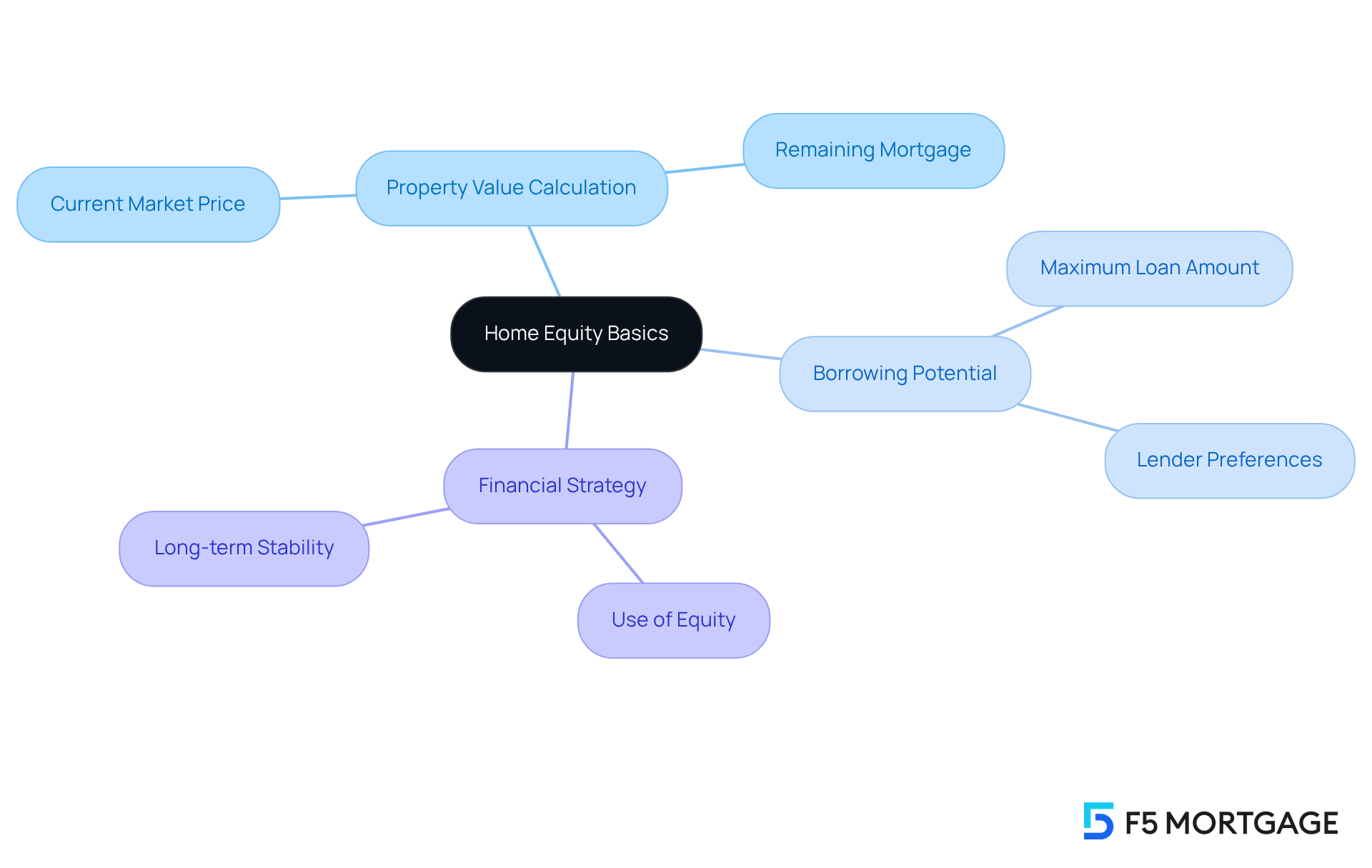

Understand Home Equity Basics

Understanding the is essential; it represents the portion you fully own, calculated by subtracting your remaining mortgage from your property’s current market price. For instance, if your home is valued at $300,000 and you owe $200,000, your property value is $100,000. This knowledge is crucial as it influences how much you can borrow through a home equity loan at the lowest rate. Typically, lenders allow you to borrow up to 80% of your property’s value, which in this case would enable you to access $80,000. However, it’s important to remember that lenders usually prefer to keep 20% of a property’s worth untouched as a safeguard against defaults. Recognizing your property value is vital for assessing your financial health and planning for future expenses, such as renovations or debt consolidation.

In 2025, the average property value percentage for homeowners remains near historic highs, with U.S. borrowers collectively acquiring $115 billion in residential value during the first quarter. Current trends indicate that 35% of borrowers with mortgage rates between 4% and 5.99% are considering obtaining a home equity loan at the lowest rate, reflecting a growing interest in leveraging property value for financial needs. Moreover, property owners are encouraged to consult with their lenders to explore the best options for accessing their residential value, whether through property loans, lines of credit (HELOCs), or cash-out refinancing.

Grasping residential value goes beyond just securing funds; it plays a significant role in your financial strategy. As property values rise, homeowners can build substantial equity over time, which can be used for various purposes, including funding renovations that enhance property value or consolidating higher-interest debts. This thoughtful use of residential assets can foster long-term financial stability and growth. As Andrew Dehan, Senior Writer at Bankrate, wisely notes, “Comprehending how residential value functions, and how to utilize it, is crucial for any property owner.

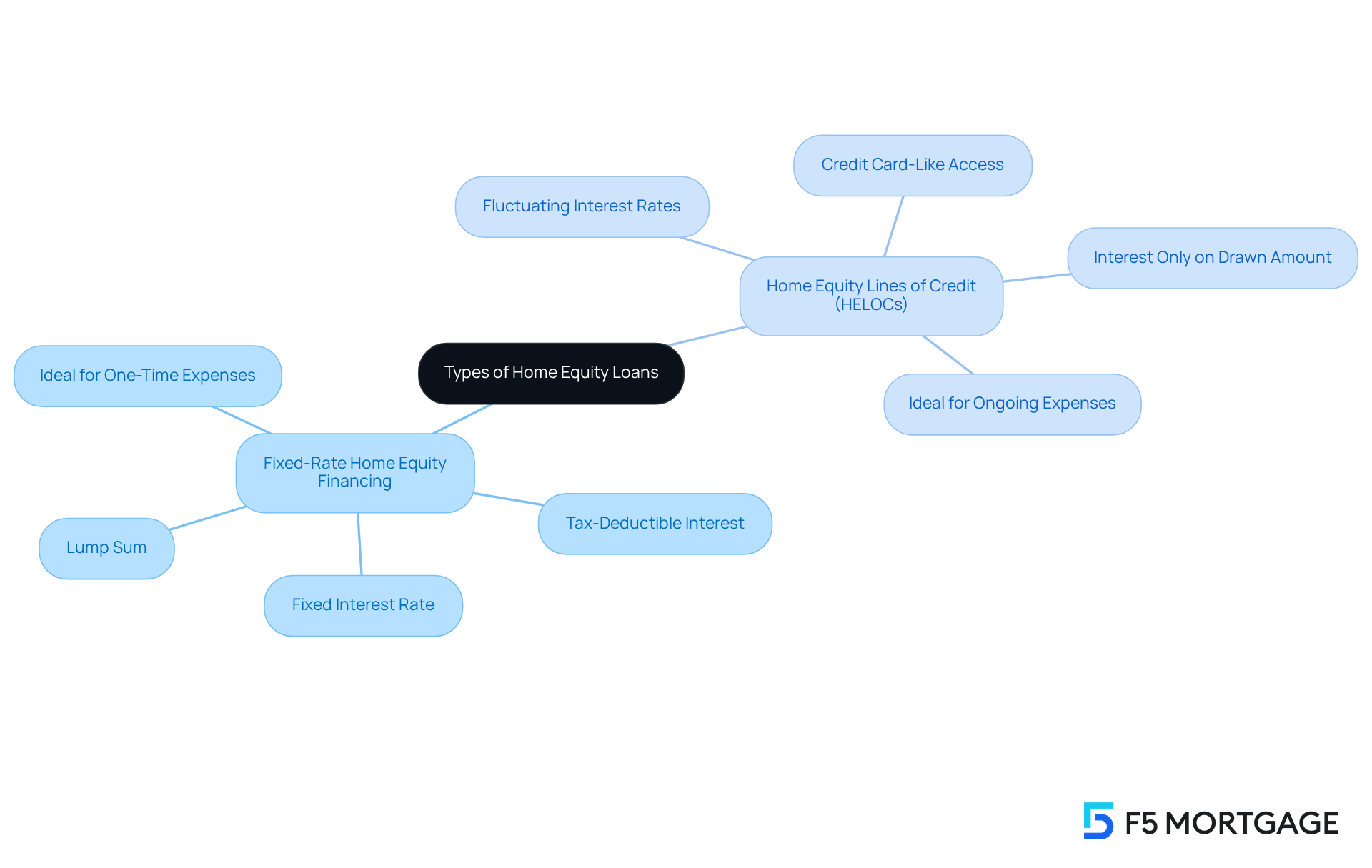

Explore Types of Home Equity Loans

Equity loans primarily come in two forms: fixed-rate equity loans and home equity lines of credit (HELOCs).

- Fixed-Rate Home Equity Financing: These financial products offer a lump sum that you repay over a set term at a fixed interest rate. This option is particularly helpful for those seeking a specific amount for one-time expenses, like major home renovations. With current average rates around 8.25%, similar for both property-backed financing and HELOCs, securing the can provide peace of mind against potential future increases. Additionally, if you use the loan for home improvements, the interest may be tax-deductible, offering extra financial benefits.

- Home Equity Lines of Credit (HELOCs): A HELOC functions similarly to a credit card, allowing you to draw against your home equity up to a certain limit. This choice is ideal for ongoing expenses, such as education costs or unexpected financial needs. You only pay interest on the amount you draw, providing flexibility in repayment. However, it’s important to be aware that interest rates on HELOCs can fluctuate based on market conditions.

Understanding these options is crucial for determining which financing route aligns best with your financial situation. We know how challenging this can be, so experts suggest evaluating your specific needs, risk tolerance, and how you intend to use the funds. Additionally, aiming for a credit score of at least 680 and a debt-to-income ratio below 43% can help you secure more favorable terms. As demand for property-backed financing grows, especially with rising property values—averaging around $400,000—property owners are encouraged to consider these options carefully. Remember, such financing often incurs fewer ongoing costs compared to HELOCs, making it a thoughtful choice for many families.

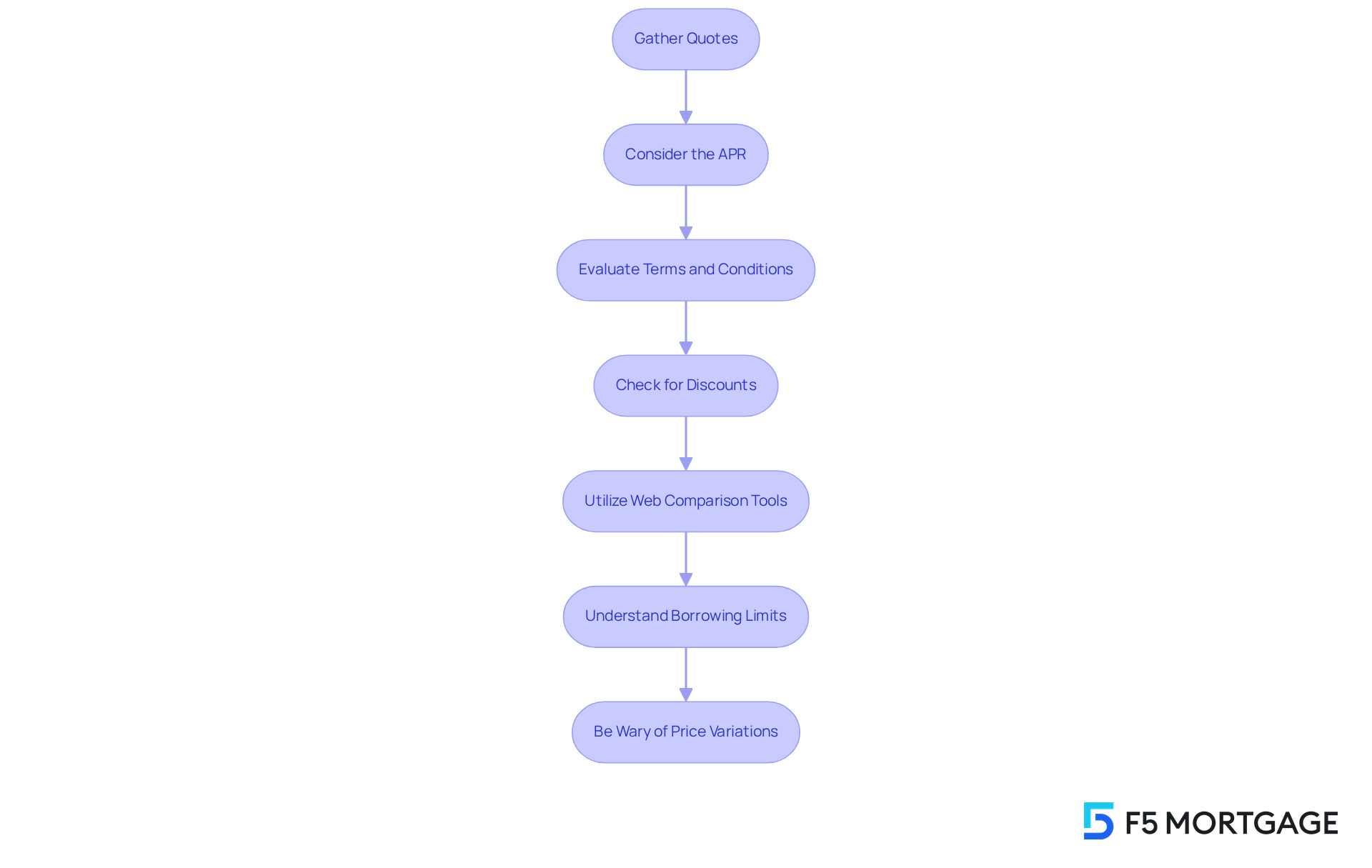

Compare Rates from Multiple Lenders

To secure the home equity loan lowest rate on your financing, it’s crucial to evaluate proposals from multiple lenders. We understand how overwhelming this process can feel, but here’s a straightforward way to navigate it effectively:

- Gather Quotes: Reach out to at least three to five lenders, including banks, credit unions, and online lenders. This variety will provide you with a broader perspective on the available prices.

- Consider the APR: Don’t just focus on the interest rate; the Annual Percentage Rate (APR) is vital as it encompasses fees and other borrowing-related expenses. Understanding the APR can significantly influence your overall borrowing costs.

- Evaluate Terms and Conditions: Take the time to carefully review the financing terms, including repayment periods and any fees for early repayment. These factors can greatly impact your overall costs throughout the financing period.

- Check for Discounts: Ask about potential discounts that some lenders offer for existing customers or those who set up automatic payments. These savings can make a meaningful difference.

- Utilize Web Comparison Tools: Leverage online platforms that allow you to compare prices and terms side by side. This can simplify your search and help you identify the best deal quickly.

- Understand Borrowing Limits: Generally, borrowers can access up to 80 or 85 percent of their property’s appraised value with a residential financing option, while some HELOCs allow borrowing up to 90 to 95 percent. Knowing these limits empowers you to make informed decisions.

- Be Wary of Price Variations: We know how tempting it can be to wait for prices to drop slightly. However, specialists recommend not delaying your application for property-backed credit, as prices can fluctuate. Securing a favorable deal now may be more beneficial in the long run.

By dedicating time to evaluate costs and understanding the full range of financing proposals, you can secure the home equity loan lowest rate for your property financing. With , based on borrower-specific factors, being thorough in your research is more crucial than ever. Remember, we’re here to support you every step of the way.

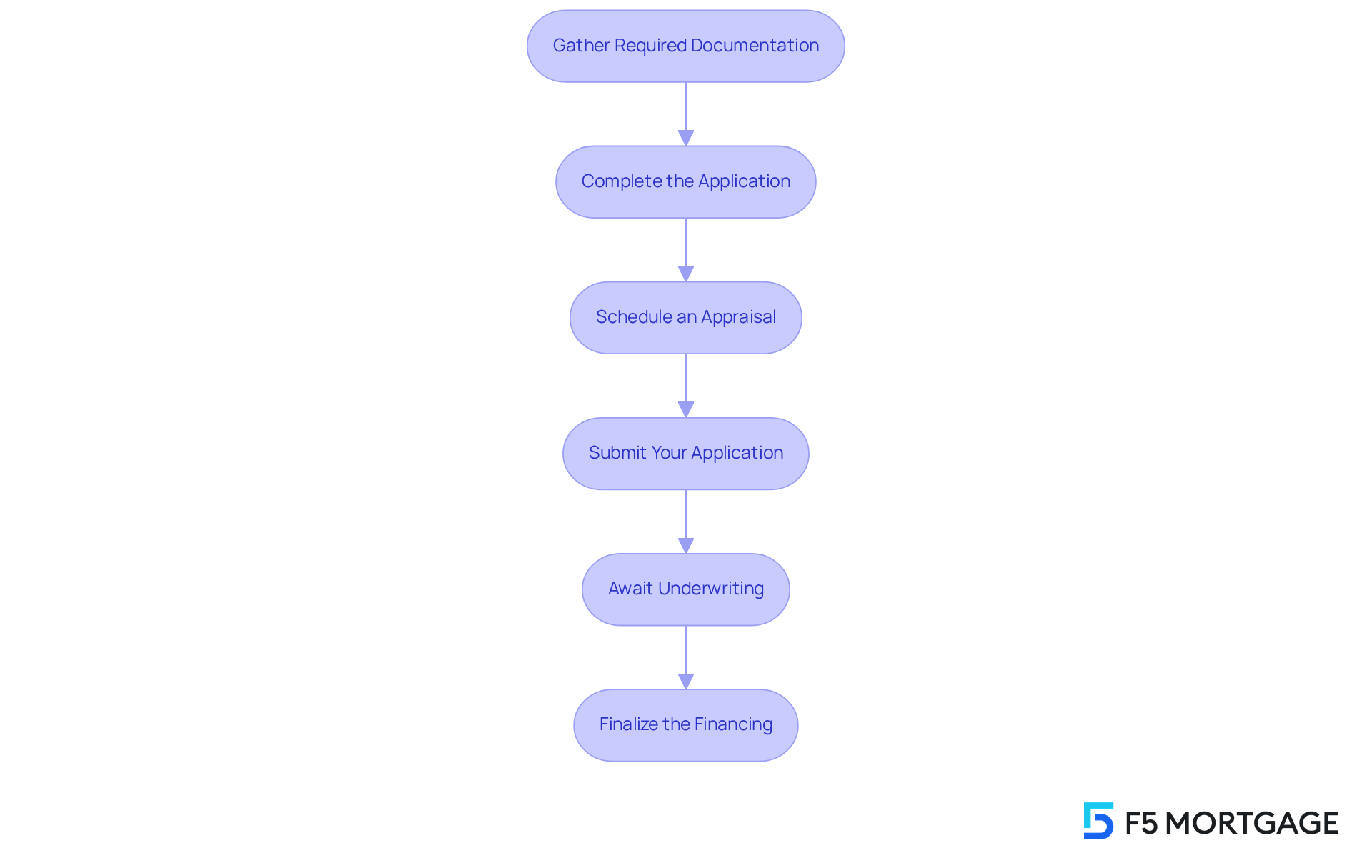

Apply for Your Home Equity Loan

Choosing a lender and evaluating rates can feel overwhelming, but once you’ve done that, you’re ready to apply for your equity financing. Here’s how to navigate the application process smoothly:

- Gather Required Documentation: Start by preparing essential documents. This includes proof of income—such as pay stubs and tax returns—a comprehensive list of your debts, and important information about your home, like your mortgage statement and property tax bill. Remember, lenders typically look for a credit score of 620 or higher, so it’s wise to check your credit report beforehand. Additionally, aim for a Debt-to-Income Ratio (DTI) below 40% to improve your chances of securing favorable financing terms.

- Complete the Application: Take your time to fill out the lender’s application form accurately. Be sure to detail your financial situation and the intended purpose of the funds. This information is crucial for the lender to assess your eligibility and understand your needs.

- Schedule an Appraisal: Most lenders will require an appraisal to determine your property’s current market value. This step is essential for evaluating your available assets. Typically, the and costs between $400 and $600.

- Submit Your Application: Once your application is complete and all documents are gathered, submit it to the lender. Processing times for equity credit applications can vary, generally taking between 1 to 3 weeks, depending on the lender’s criteria and the pace of document submission.

- Await Underwriting: After submission, your application will undergo underwriting. This is where the lender assesses your creditworthiness and the value of your property. This process can take anywhere from a few days to a few weeks, so patience is key during this stage.

- Finalize the Financing: If approved, you’ll receive a closing disclosure outlining the final terms of your financing. It’s important to review this document carefully before signing. Once everything is finalized, you’ll receive your funds, which can be utilized as planned.

By following these steps, you can navigate the application process with confidence. We know how challenging this can be, and we’re here to support you every step of the way in securing your home equity loan effectively.

Conclusion

Understanding the intricacies of securing a home equity loan is essential for homeowners looking to leverage their property value for financial gain. We know how challenging this can be, but by grasping the basics of home equity, exploring the types of loans available, comparing rates from multiple lenders, and methodically applying for financing, you can position yourself to secure the lowest rates and make informed financial decisions.

Throughout this guide, we’ve shared key insights that matter to you. Knowing your property’s value is crucial, as is understanding the differences between fixed-rate home equity loans and HELOCs. We’re here to support you every step of the way, emphasizing the necessity of comparing various lenders to find the best terms. Each step, from gathering documentation to understanding the application process, plays a critical role in ensuring a smooth borrowing experience.

Ultimately, the journey to securing a home equity loan is not just about obtaining funds; it’s about making strategic choices that can lead to long-term financial stability and growth. By taking the time to understand the options available and acting decisively, you can unlock the potential of your equity, whether for home improvements, debt consolidation, or other significant expenses. Embracing this knowledge empowers you to navigate the lending landscape with confidence and achieve your financial goals.

Frequently Asked Questions

What is home equity and how is it calculated?

Home equity is the portion of your property that you fully own, calculated by subtracting your remaining mortgage from your property’s current market price. For example, if your home is valued at $300,000 and you owe $200,000, your home equity would be $100,000.

How much can I borrow through a home equity loan?

Typically, lenders allow you to borrow up to 80% of your property’s value. For instance, if your home equity is $100,000, you could access up to $80,000 through a home equity loan.

Why do lenders keep 20% of a property’s worth untouched?

Lenders usually prefer to keep 20% of a property’s worth untouched as a safeguard against defaults, ensuring they have a buffer in case the borrower is unable to repay the loan.

What financial opportunities can home equity provide?

Home equity can be leveraged for various purposes, such as funding renovations that enhance property value or consolidating higher-interest debts, which can contribute to long-term financial stability and growth.

What is the current trend regarding home equity loans?

In 2025, about 35% of borrowers with mortgage rates between 4% and 5.99% are considering obtaining a home equity loan, indicating a growing interest in leveraging property value for financial needs.

How can homeowners explore their options for accessing residential value?

Property owners are encouraged to consult with their lenders to explore the best options for accessing their residential value, which may include home equity loans, lines of credit (HELOCs), or cash-out refinancing.

Why is understanding residential value important for homeowners?

Understanding residential value is crucial for assessing financial health and planning for future expenses. It helps homeowners make informed decisions regarding borrowing and utilizing their property equity effectively.