Overview

Navigating the process of securing a conforming loan can feel overwhelming, but we’re here to support you every step of the way. This article outlines four essential steps that can help you succeed in obtaining a loan:

- Understanding qualification requirements

- Following the application process

- Addressing potential challenges along the way

Preparation is key. We know how challenging this can be, so gathering the necessary documentation and maintaining a favorable credit profile is crucial. By taking these steps, you can enhance your likelihood of loan approval and secure more favorable terms. Remember, being organized not only eases the process but also empowers you to face any hurdles that may arise with confidence.

Introduction

Navigating the mortgage landscape can feel overwhelming, especially with the many options available to homebuyers. We understand how challenging this can be. Conforming loans, which adhere to the guidelines set by government-sponsored enterprises, provide a stable and often more affordable path to homeownership. However, grasping the specific requirements and application process is essential for success.

What challenges might arise in securing a conforming loan?

We’re here to support you every step of the way as you explore how potential borrowers can effectively overcome these hurdles.

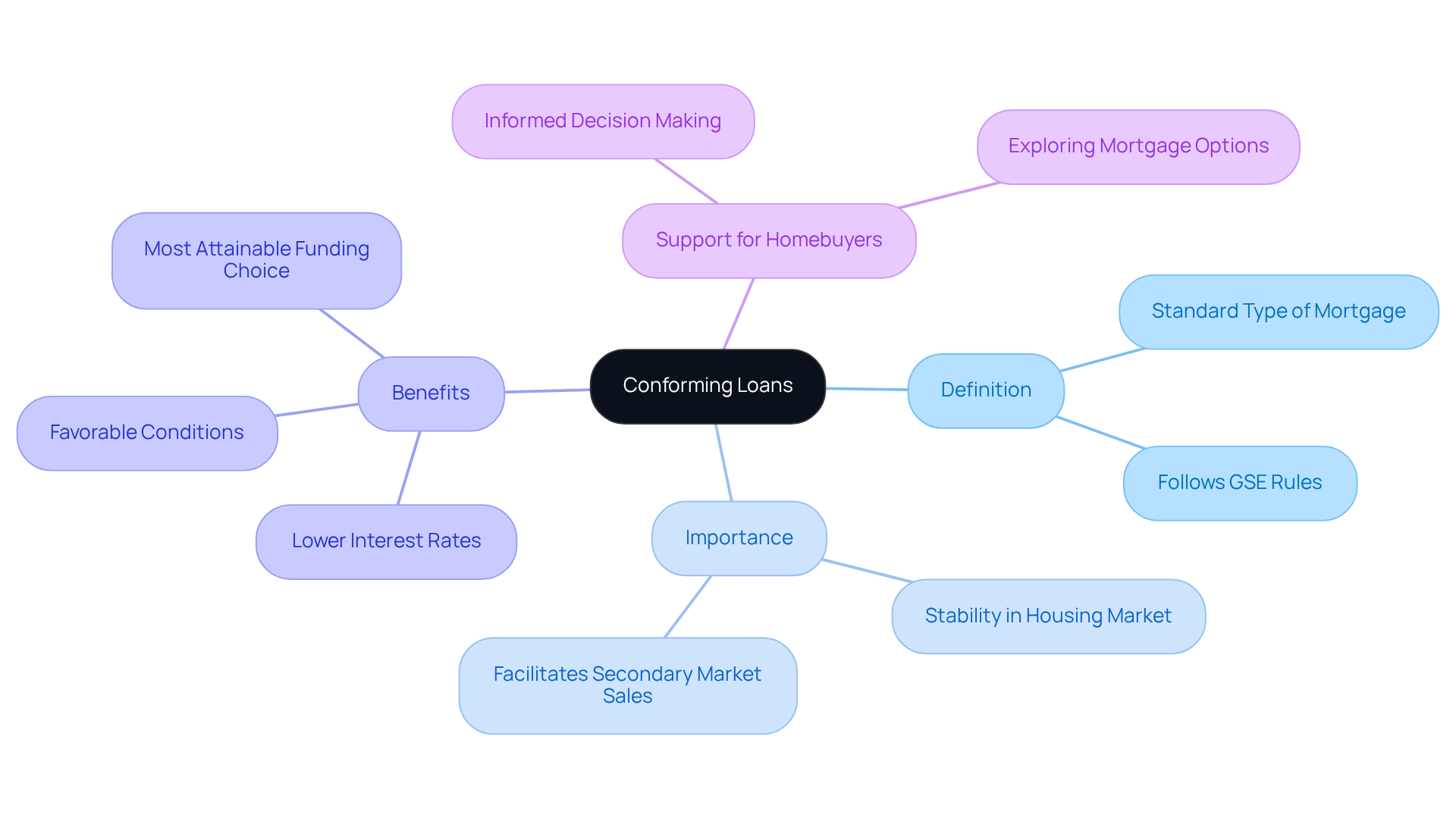

Understand Conforming Loans and Their Importance

A conforming loan is a standard type of mortgage that follows the rules set by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. We understand how important it is for families to find stable and secure financing options. These financial products are designed to promote stability in the housing market, helping lenders sell these instruments in the secondary market.

The significance of adhering to these mortgage guidelines lies in their typically lower interest rates and more favorable conditions compared to a conforming loan. We know how challenging navigating the mortgage landscape can be, and comprehending these financial products is crucial for homebuyers. They often represent the most attainable funding choice for purchasing a home or refinancing an existing mortgage.

By understanding the benefits of standard mortgages, families can make informed decisions that align with their financial goals. We’re here to support you every step of the way as you explore your options and find the for your needs.

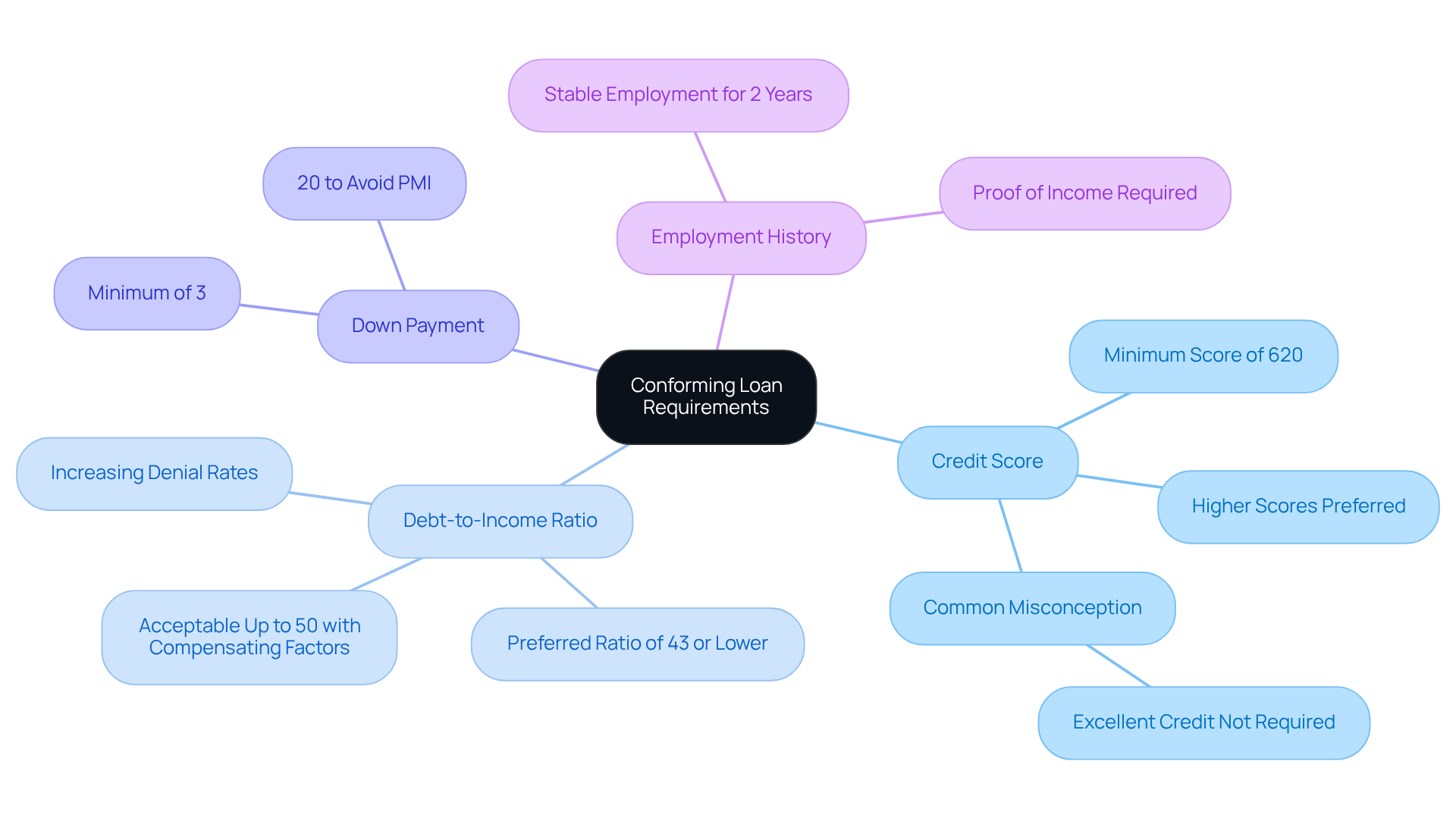

Identify Qualification Requirements for Conforming Loans

Navigating the world of conforming loans can feel overwhelming, but understanding the essential requirements for a conforming loan can help ease your worries. Here’s what you need to know:

- Credit Score: Generally, a minimum credit score of 620 is necessary. However, many lenders prefer higher scores for more favorable interest rates. It’s a common misconception that you need excellent credit to qualify. Remember, most lenders are looking for that baseline score.

- Debt-to-Income Ratio (DTI): Lenders typically prefer a DTI ratio of 43% or lower. Some may accept ratios up to 50% if there are compensating factors. It’s important to be aware that increasing denial rates are linked to applicants exceeding these standards, so keeping your DTI in check can be beneficial.

- A down payment of at least 3% is often required for a conforming loan. If you can contribute 20%, you may avoid private mortgage insurance (PMI), which can significantly lower your monthly payments.

- Employment History: Lenders usually require proof of stable employment for at least two years. This stability is reassuring for lenders, as it reflects your ability to repay the loan.

Understanding these requirements is crucial as you prepare your finances and documentation. We know how challenging this can be, but before applying can lead to lower borrowing costs and better rates. Being proactive in your financial planning is essential, and we’re here to support you every step of the way.

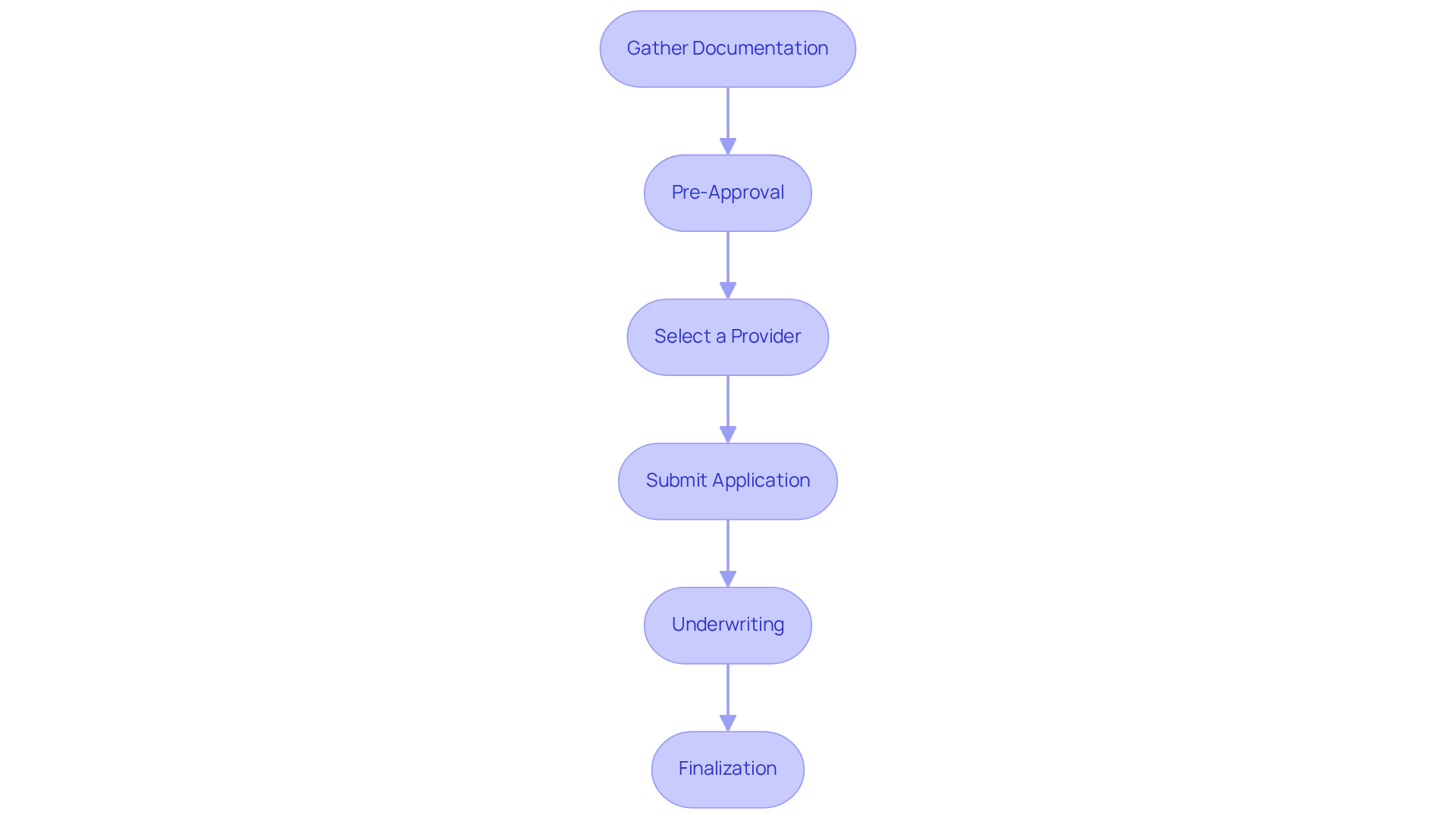

Follow the Application Process for a Conforming Loan

Securing a conforming loan may seem overwhelming, but with a systematic approach, you can smoothly navigate the application process. Let’s walk through the essential steps together:

- Gather Documentation: Start by collecting key documents like W-2s, tax returns, bank statements, and proof of income. Having these ready will make your application process easier and less stressful.

- Pre-Approval: We recommend seeking pre-approval from financial institutions by submitting your financial information for an initial assessment. This step helps clarify your borrowing capacity and sets realistic expectations moving forward.

- Select a Provider: Take the time to assess rates and conditions from different financial institutions to find the best fit for your unique situation. Evaluating proposals can lead to significant savings throughout your financing journey.

- Submit Application: Once you’ve chosen a provider, complete the financing application, ensuring all necessary documentation is included. This thoroughness can help expedite the process, giving you peace of mind.

- Underwriting: The lender will review your application and documentation, and the value of the property. This step is crucial for determining whether your credit will be approved.

- Finalization: After approval, you’ll finalize the process by signing the necessary paperwork and receiving your funding. This is an exciting step toward homeownership!

By following these steps and ensuring all your paperwork is in order, you can enhance your chances of a successful mortgage application. Remember, a conforming loan often requires smaller down payments, making it a viable option for many families. We know how challenging this can be, and we’re here to support you every step of the way.

Address Challenges and Considerations in Securing a Conforming Loan

Obtaining a can be challenging, and we understand how overwhelming this process may feel. Here are some common considerations to help you navigate it:

- Credit Issues: If your credit score falls below the required threshold, it’s important to take steps to improve it before applying. This could involve paying down debts or correcting any errors on your credit report.

- High DTI Ratios: Should your debt-to-income (DTI) ratio be too high, you may need to explore options like reducing your monthly debt obligations or finding ways to increase your income to qualify.

- Market Conditions: Staying informed about current interest rates and market conditions is crucial, as these factors can significantly impact your loan terms.

- Documentation: Completing your refinancing application accurately is essential. Ensure that all documentation is thorough and correct to prevent delays in the underwriting process. When applying with F5 Mortgage, you will need to provide important details such as your Social Security numbers, bank statements, tax returns, and pay stubs.

- Lender Communication: Keeping the lines of communication open with your lender throughout this journey is vital. This way, you can address any questions or concerns as they arise.

By being proactive and informed, you can effectively navigate these challenges. Remember, we’re here to support you every step of the way.

Conclusion

Securing a conforming loan is a significant step toward achieving homeownership, and we know how challenging this can be. Understanding the intricacies of this process can empower potential buyers, allowing them to navigate the journey with confidence. By grasping the essential aspects of conforming loans—like their definition, qualification requirements, application steps, and common challenges—individuals can make informed decisions that align with their financial goals.

It’s crucial to maintain a solid credit score, manage debt-to-income ratios, and prepare necessary documentation. Each step, from gathering financial records to finalizing the loan, plays a vital role in enhancing the likelihood of a successful application. By addressing potential challenges proactively—such as credit issues or high DTI ratios—you can further improve your chances of securing favorable loan terms.

Ultimately, navigating the conforming loan landscape requires diligence and preparation, but the rewards can be substantial. By taking the time to understand the process and seeking guidance when needed, families can secure the financing necessary for their dream homes. Embrace this opportunity to explore conforming loans and take charge of your financial future—because a well-informed borrower is an empowered borrower. We’re here to support you every step of the way.

Frequently Asked Questions

What is a conforming loan?

A conforming loan is a standard type of mortgage that adheres to the rules set by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac.

Why are conforming loans important?

Conforming loans are important because they promote stability in the housing market and help lenders sell these instruments in the secondary market. They typically offer lower interest rates and more favorable conditions compared to non-conforming loans.

How do conforming loans benefit homebuyers?

Conforming loans often represent the most attainable funding choice for purchasing a home or refinancing an existing mortgage, making them a crucial option for families seeking stable and secure financing.

What should families consider when exploring mortgage options?

Families should understand the benefits of standard mortgages to make informed decisions that align with their financial goals while navigating the mortgage landscape.