Overview

We know how challenging it can be to save for a down payment on a house. This article outlines four essential steps to help you effectively reach your goal.

- Budgeting is crucial. By setting clear financial goals, you can create a roadmap tailored to your needs.

- Additionally, utilizing dedicated savings accounts can make a significant difference.

- As you implement these strategies, consider exploring assistance programs that may be available to you.

- Seeking guidance from knowledgeable lenders can also empower you on your journey.

Remember, you’re not alone in this process. By taking these steps, you can enhance your ability to accumulate the necessary funds for a successful home purchase. We’re here to support you every step of the way.

Introduction

Understanding the significance of a down payment is crucial for anyone embarking on the journey to homeownership. We know how challenging this can be, and that’s why it’s important to recognize that a substantial down payment not only reduces monthly mortgage costs and improves loan conditions but also helps avoid costly private mortgage insurance while building equity from day one. However, the path to saving for this essential upfront cost can be fraught with challenges. Many potential buyers may wonder: how can one effectively accumulate the necessary funds without sacrificing financial stability?

This article delves into practical strategies and resources that empower aspiring homeowners to overcome obstacles and secure their dream home. We’re here to support you every step of the way as you navigate this important milestone.

Understand the Importance of a Down Payment

A down payment for a house is a crucial component of the home-buying process, representing a percentage of the home’s purchase price that you pay upfront. Its significance extends beyond just an initial payment, influencing various aspects of your mortgage experience.

- Reduced Monthly Costs: Making a larger down payment decreases the total amount borrowed, leading to lower monthly mortgage expenses. For example, while the median initial contribution among first-time buyers is only 9%, striving for a larger amount can greatly alleviate financial pressure.

- Improved Loan Conditions: Lenders are more willing to present advantageous interest rates to borrowers who can supply a significant upfront contribution. This is due to a larger initial deposit lowering the lender’s risk, possibly conserving you thousands throughout the duration of the loan. As of April 2025, the average 30-year fixed mortgage rate stands at 6.62%, and securing a lower rate can be pivotal in long-term savings.

- Avoiding Private Mortgage Insurance (PMI): If your deposit is less than 20%, you may be required to pay PMI, which increases your monthly expenses. By targeting a larger initial contribution, you can prevent this extra cost, making homeownership more accessible.

- Increased Equity: A larger initial contribution means you start with more equity in your home. This can be advantageous if you need to sell or refinance in the future, as it provides a buffer against market fluctuations and enhances your financial stability.

Numerous , such as YourChoice!, Grant for Grads, and Ohio Heroes, can help reduce the burden of saving for a down payment for a house. To take advantage of these programs, research your options and gather necessary documents like proof of income and tax returns. Collaborating with a knowledgeable lender such as F5 Mortgage can help you navigate the application process, ensuring you optimize your chances of qualifying for support.

- Steps to Apply for Assistance: To enhance your likelihood of qualifying for assistance with a down payment for a house, consider the following steps: improve or maintain your good credit score, save for additional costs, and get pre-qualified by lenders. Officially submit your application once you have gathered all necessary documentation.

- Consideration of VA Loans: For qualifying veterans and active-duty service members, VA loans permit a down deposit as low as 0%. This option can significantly reduce the upfront costs associated with purchasing a home.

Comprehending these elements can inspire you to prioritize setting aside funds for your down payment for a house. With approaches like establishing a high-yield savings account and automating your savings, you can work towards securing a deposit that not only fulfills lender criteria but also prepares you for a successful home-buying experience. However, it’s essential to be aware of the potential risks associated with low-down financing options, which may lead to higher monthly costs and increased financial strain. Investigating state and local down support assistance programs can also offer valuable resources to aid you on your journey to homeownership.

Implement Effective Saving Strategies

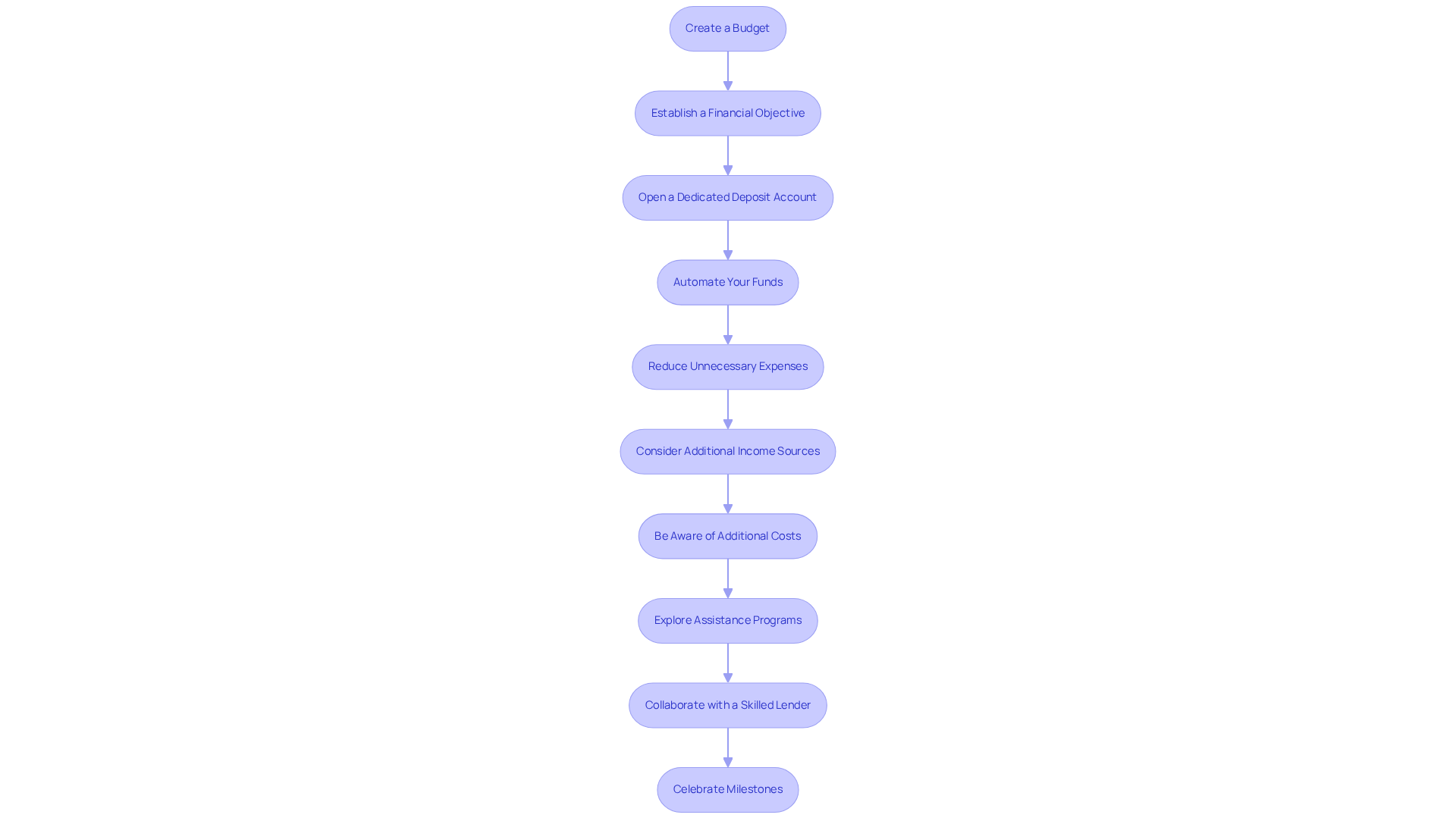

To effectively save for a down payment, consider implementing these strategies:

- Create a Budget: We know how challenging it can be to manage finances. Begin by evaluating your income and expenses. Identify areas where you can cut costs, such as dining out or membership services, and direct those funds straight to your deposit account.

- Establish a Financial Objective: Setting a clear monetary target can make a big difference. Create a specific goal based on your desired home price. For example, if you target a house priced at $400,000, a 10% down payment for house would require $40,000. This goal provides a , helping you stay focused.

- Open a dedicated deposit account: Consider establishing a separate account specifically for your down payment for house. This not only helps you track your progress but also minimizes the temptation to dip into these funds for other expenses. A high-yield deposit account can maximize your interest earnings, further supporting your goal.

- Automate Your Funds: Simplifying the savings process can ease your journey. Arrange automatic transfers from your checking account to your dedicated account each month. This ‘set and forget’ method guarantees regular contributions, making it easier to accumulate your down payment for house fund over time.

- Reduce Unnecessary Expenses: Regularly reviewing your monthly expenses can reveal opportunities for savings. Identify non-essential items that can be cut back and channel these funds into your deposit account. For instance, reducing dining out expenses can significantly enhance your financial potential.

- Consider Additional Income Sources: Exploring new income opportunities can accelerate your progress. Look into part-time jobs, freelancing, or selling unused items. Direct this additional income straight into your savings to speed up your advancement toward your goal of a down payment for house.

- Be Aware of Additional Costs: It’s important to remember that besides your initial deposit, you will need to account for closing expenses, which usually range from 2% to 6% of the loan amount. Preparing for these costs will provide you with a more thorough understanding of your monetary needs.

- Explore programs that assist with the down payment for house purchases: In Ohio, initiatives such as YourChoice!, Grant for Grads, and Ohio Heroes can offer financial aid to assist you with your deposit. Research these options to see if you qualify, as they can significantly ease the burden of upfront costs.

- Collaborate with a Skilled Lender: Teaming up with an informed lender such as F5 Mortgage can provide essential support during the application process for down payment aid. They can help you understand eligibility criteria and gather necessary documentation, guiding you through the process.

- Celebrate Milestones: As you reach financial milestones, take the time to celebrate your achievements. Acknowledging these moments can help maintain motivation and keep you focused on your goal of homeownership.

By following these strategies and considering available assistance programs, you can effectively build your down deposit fund and move closer to homeownership, even in a challenging market where interest rates are at over 20-year highs.

Explore Financial Tools and Resources

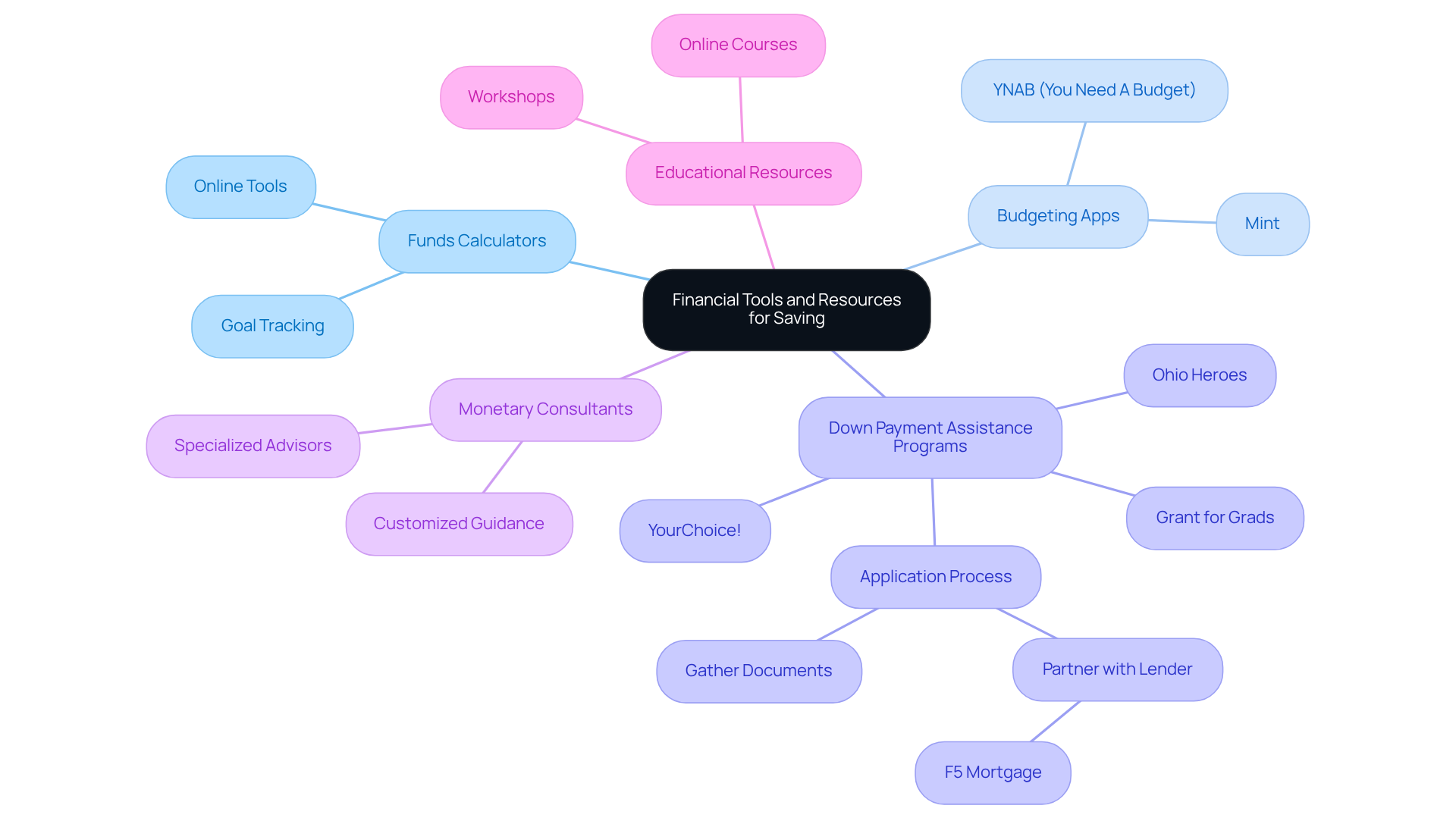

To enhance your saving efforts, we know how challenging this can be, so consider utilizing these financial tools and resources:

- Funds Calculators: Online funds calculators can help you gauge how long it will take to achieve your down payment objective based on your existing accumulation rate and contributions. This insight can be incredibly motivating.

- Budgeting Apps: Apps like Mint or YNAB (You Need A Budget) are designed to help you track your spending and manage your budget effectively. By doing so, you can ensure you stay on track with your savings.

- Down Payment Assistance Programs: Research local and state programs, such as YourChoice!, Grant for Grads, and Ohio Heroes, that provide support for down payments. Many first-time homebuyer programs offer grants or low-interest loans to help you reach your goal faster. To apply, gather necessary documents like proof of income and tax returns, and partner with an experienced lender like F5 Mortgage to guide you through the application process.

- Monetary Consultants: Think about seeking advice from an advisor who specializes in home purchasing. They can offer customized guidance and tactics suited to your economic circumstances, ensuring you feel supported.

- Educational Resources: Take advantage of online courses or workshops centered on home purchasing and economic literacy. These can provide valuable insights and tips to help you save more effectively. Remember, we’re here to support you every step of the way.

Overcome Challenges in Saving for a Down Payment

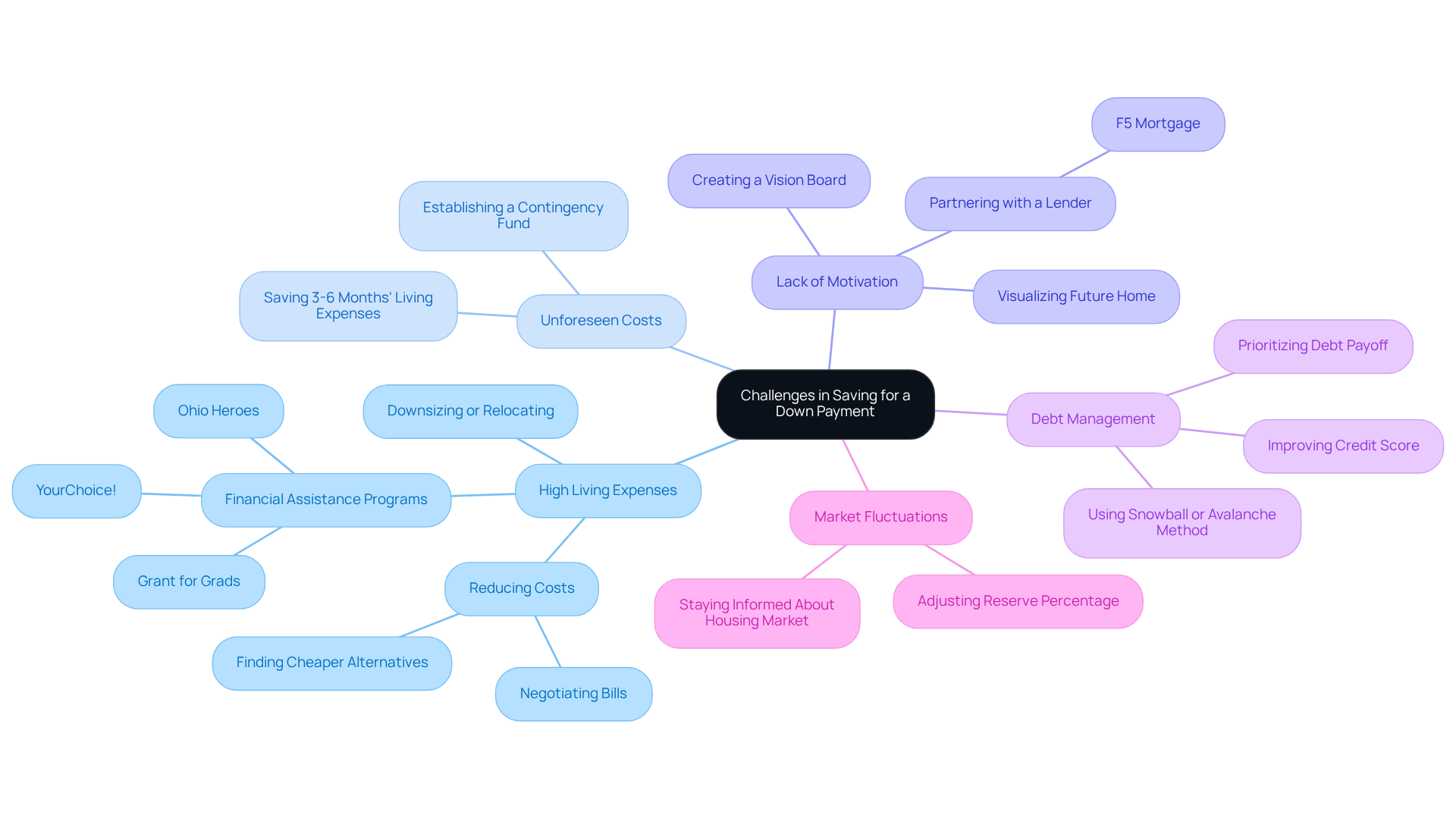

Setting aside funds for a deposit can be challenging, but understanding deposit support options in Ohio can help ease that burden. Let’s explore some common obstacles and how you can overcome them:

- High Living Expenses: We know how tough high monthly expenses can be. If you find yourself in this situation, consider downsizing or relocating to a more affordable area. Additionally, look for ways to reduce costs—perhaps by negotiating bills or finding cheaper alternatives for services. Programs like YourChoice!, Grant for Grads, and Ohio Heroes can offer financial assistance tailored to your unique circumstances.

- Unforeseen Costs: Life can be unpredictable, so establishing a contingency fund is crucial to manage unforeseen expenses. This way, you won’t have to dip into your reserves for the down payment for a house. Aim to save at least three to six months’ worth of living expenses. This strategy will help maintain your financial momentum while you explore support options.

- Lack of Motivation: Keeping your goal in sight is vital. Visualize your future home—consider creating a vision board or setting reminders to stay motivated. Partnering with an like F5 Mortgage can also provide the guidance and encouragement you need throughout this journey.

- Debt Management: If you have existing debt, it’s important to prioritize paying it down while still contributing to your reserves. You might want to consider using the snowball or avalanche method to tackle debts efficiently. Remember, improving your credit score can also enhance your eligibility for programs that support down payment for a house.

- Market Fluctuations: Staying informed about the housing market is essential. If prices increase, you may need to adjust your reserve percentage to stay aligned with your desired down payment for a house. By proactively addressing these challenges and leveraging available assistance programs, you can remain on track to achieve your savings goal for a down payment for a house.

Conclusion

Understanding the significance of a down payment is essential for anyone aspiring to purchase a home. It plays a pivotal role not only in the initial stages of home buying but also in shaping the overall mortgage experience. A larger down payment can lead to reduced monthly costs, improved loan conditions, and the avoidance of private mortgage insurance. Ultimately, this fosters greater financial stability and equity.

Throughout this article, we’ve outlined key strategies for saving towards a down payment. Implementing a budget, setting clear financial goals, and utilizing dedicated savings accounts are effective methods to accumulate the necessary funds. Additionally, exploring down payment assistance programs and collaborating with knowledgeable lenders can significantly ease the financial burden associated with home buying. We know how challenging this can be, and recognizing common hurdles, such as high living expenses and unforeseen costs, is crucial for maintaining motivation and ensuring progress towards homeownership.

In conclusion, the journey to saving for a down payment is not only about accumulating funds but also about empowering yourself with knowledge and resources. By prioritizing savings, leveraging financial tools, and seeking assistance when needed, prospective homebuyers can navigate the complexities of the housing market more effectively. Taking proactive steps today can pave the way for a successful home-buying experience tomorrow, making the dream of homeownership a tangible reality. We’re here to support you every step of the way.

Frequently Asked Questions

What is a down payment in the context of buying a house?

A down payment is a percentage of the home’s purchase price that you pay upfront during the home-buying process. It is a crucial component that influences various aspects of your mortgage experience.

How does a larger down payment affect monthly mortgage costs?

Making a larger down payment decreases the total amount borrowed, which leads to lower monthly mortgage expenses. For instance, while the median initial contribution among first-time buyers is 9%, a larger down payment can greatly alleviate financial pressure.

What advantages do borrowers with larger down payments have regarding loan conditions?

Lenders are more inclined to offer favorable interest rates to borrowers who provide a significant upfront contribution, as it lowers the lender’s risk. This can potentially save you thousands over the duration of the loan.

What is Private Mortgage Insurance (PMI), and how can it be avoided?

PMI is an additional cost that may be required if your down payment is less than 20%. By making a larger initial contribution, you can avoid paying PMI, which helps make homeownership more affordable.

How does a larger down payment contribute to increased equity in a home?

A larger initial contribution means you start with more equity in your home, providing a buffer against market fluctuations and enhancing your financial stability, which can be beneficial if you decide to sell or refinance in the future.

What assistance programs are available in Ohio for down payment support?

Numerous support programs in Ohio, such as YourChoice!, Grant for Grads, and Ohio Heroes, can help reduce the burden of saving for a down payment. Researching these options and gathering necessary documents can help you take advantage of such programs.

What steps should one take to apply for down payment assistance?

To enhance your likelihood of qualifying for assistance, consider improving or maintaining a good credit score, saving for additional costs, and getting pre-qualified by lenders. Once you have gathered all necessary documentation, you can officially submit your application.

What are VA loans, and what benefit do they provide regarding down payments?

VA loans are available for qualifying veterans and active-duty service members and allow for a down payment as low as 0%. This option can significantly reduce the upfront costs associated with purchasing a home.

What strategies can help in saving for a down payment?

Strategies such as establishing a high-yield savings account and automating your savings can help you work towards securing a deposit that meets lender criteria and prepares you for a successful home-buying experience.

What should one be cautious about when considering low-down financing options?

It’s essential to be aware of the potential risks associated with low-down financing options, which may lead to higher monthly costs and increased financial strain.