Overview

Navigating the mortgage approval process can feel overwhelming, but we’re here to support you every step of the way. This article outlines four essential steps to help you successfully move forward:

- Understanding mortgage basics

- Gathering necessary documentation

- Completing the application efficiently

- Following up with lenders

First, let’s talk about understanding mortgage basics. We know how challenging this can be, and having a clear grasp of the terms and processes can make a significant difference. Next, gathering the necessary documentation is crucial. Thorough documentation not only speeds up the process but also enhances your chances of approval.

Completing the application efficiently is the third step. This is where effective communication with financial institutions comes into play. By being organized and clear, you can make this step much smoother. Finally, following up with lenders is vital. It shows your commitment and keeps you informed about your application status.

Each of these steps is supported by practical advice and insights that can help you feel more confident. Remember, you are not alone in this journey. By taking these actionable steps, you can empower yourself and increase your likelihood of approval.

Introduction

Navigating the mortgage approval process can often feel like a daunting journey, especially for first-time homebuyers. We understand how challenging this can be. With an array of mortgage types, fluctuating interest rates, and stringent eligibility requirements, grasping the landscape is essential for making informed decisions.

This guide offers a clear roadmap through the four crucial steps to securing mortgage approval, empowering you with the knowledge to enhance your chances of success.

But what happens when unexpected hurdles arise during this process? We’re here to support you every step of the way, helping you effectively overcome them.

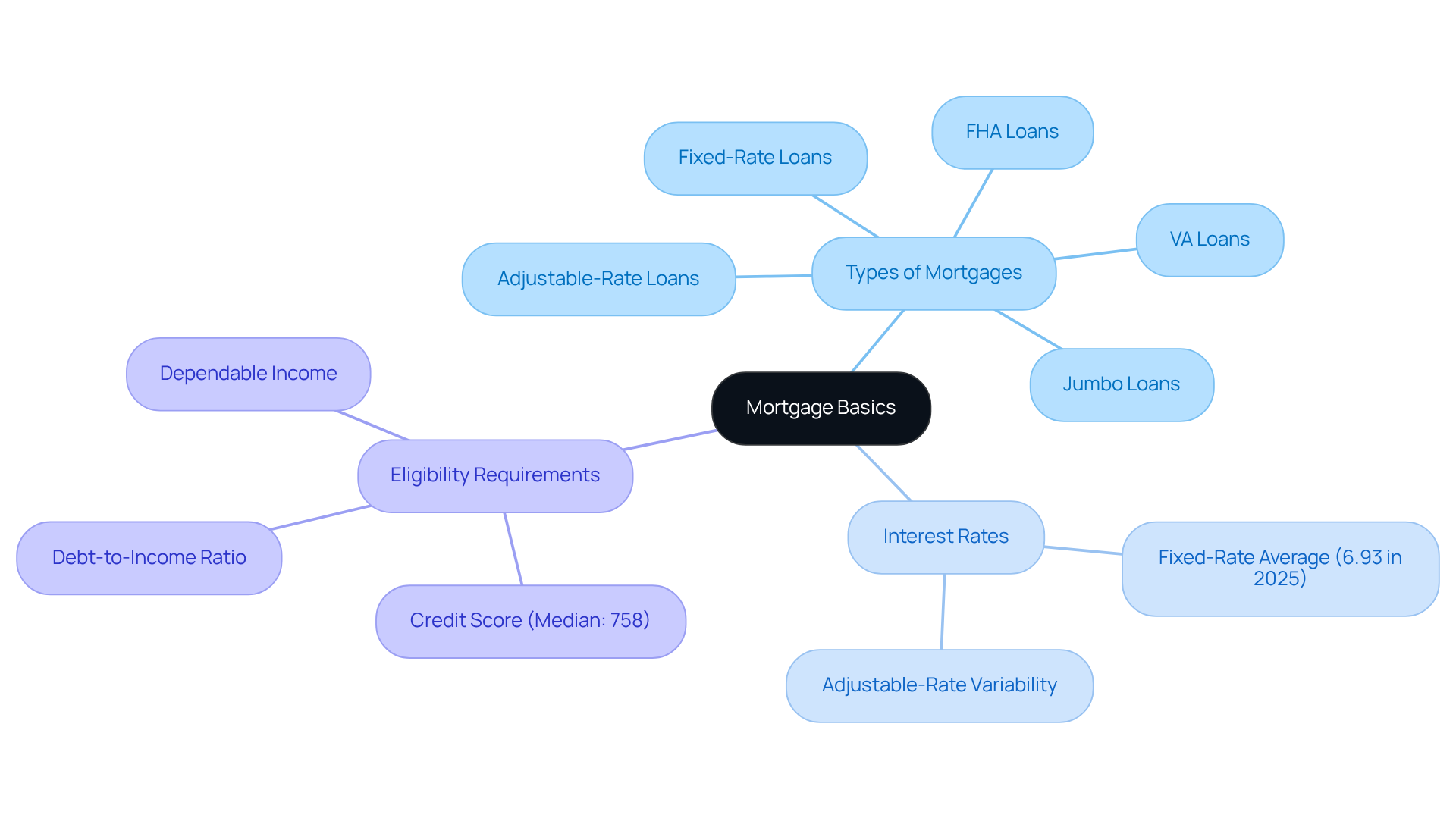

Understand Mortgage Basics and Requirements

Understanding the basics of home loans is crucial before embarking on the mortgage approval process. A home loan is a financial product designed specifically for purchasing a residence, with the property itself serving as collateral. Let’s explore some key concepts that can help you feel more prepared:

-

Types of Mortgages: It’s important to familiarize yourself with the different types of mortgages available, such as fixed-rate, adjustable-rate, FHA, VA, and jumbo loans. Each type comes with unique features and eligibility criteria. For example, fixed-rate loans offer stability with consistent monthly payments, while adjustable-rate loans may start with lower rates that can change over time.

-

Interest Rates: Understanding how interest rates affect your monthly payments and overall loan costs is vital. As we look ahead to 2025, the average interest rate for fixed-rate loans is around 6.93%. Adjustable-rate loans can fluctuate significantly based on market conditions and your individual credit profile. Keeping an eye on these rates can empower you to make informed choices.

-

Eligibility Requirements: Lenders generally seek borrowers with dependable income, a solid credit score (the median credit score among new loan applicants is 758), and a reasonable debt-to-income ratio. By grasping these requirements, you can better assess your readiness to apply.

By mastering these fundamentals, you’ll feel more equipped to navigate the mortgage approval journey with confidence. Remember, we’re here to support you every step of the way, ensuring a smoother path toward homeownership.

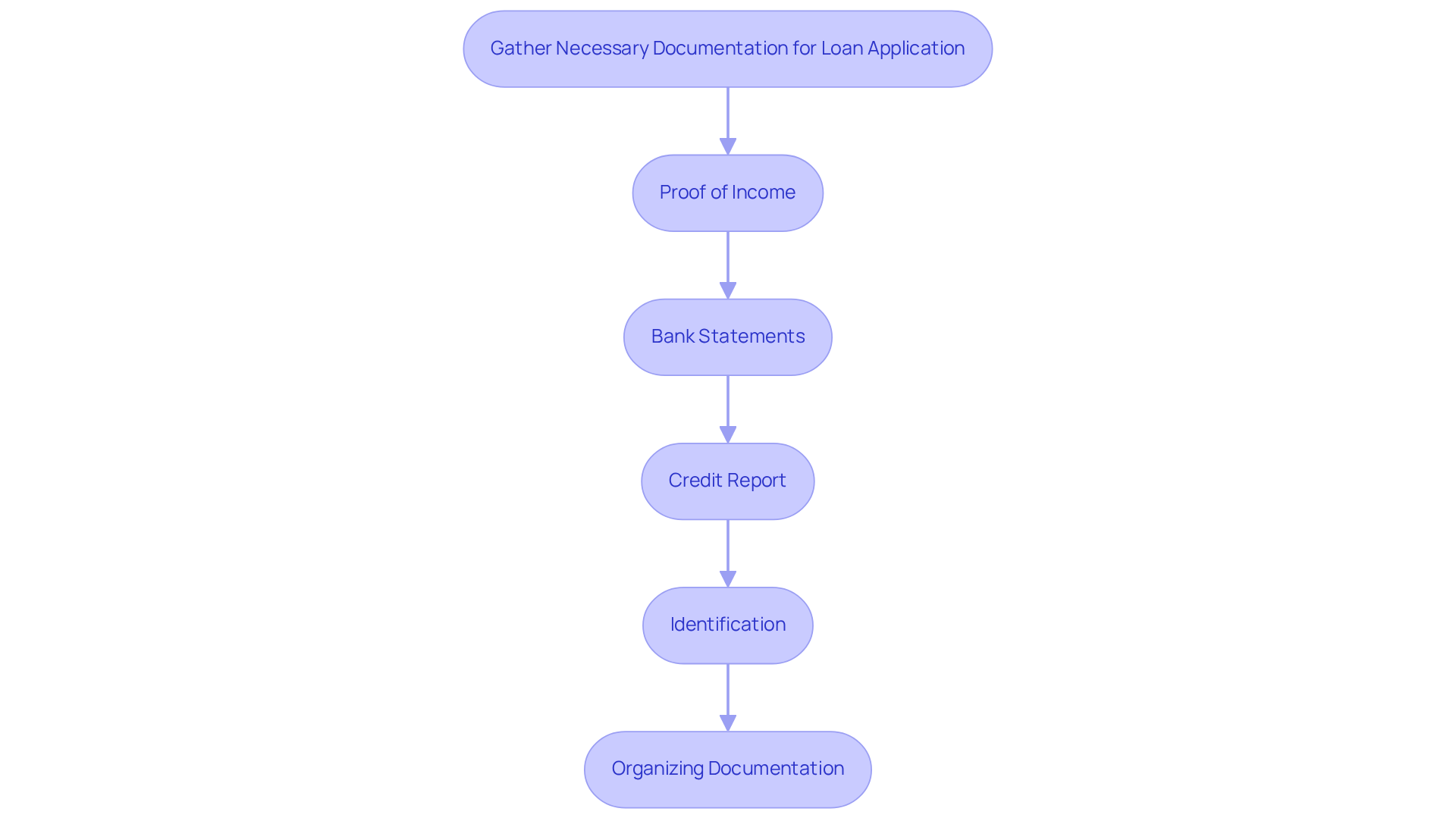

Gather Necessary Documentation and Financial Information

Applying for a loan can feel overwhelming, and we understand how challenging this process can be. Gathering several key documents is essential to showcase your financial stability and repayment capability. Here’s a helpful checklist of essential documents:

- Proof of Income: Include recent pay stubs from the last 30 days, W-2 forms for the past two years, and tax returns for the last two years.

- Bank Statements: Provide statements for all accounts—checking, savings, and investment—for the last two months to demonstrate your financial health.

- Credit Report: Lenders will assess your credit history, so it’s advisable to review your report for any discrepancies before submission.

- Identification: A government-issued ID, such as a driver’s license, along with your Social Security number, is typically required.

Arranging these documents beforehand can greatly simplify your submission process, increasing your appeal to lenders. In 2025, a significant percentage of loan applications are denied due to incomplete documentation, underscoring the importance of thorough preparation. We know how vital proof of income is in evaluating your capacity to manage the loan, so it’s important to ensure all documentation is precise and comprehensive. By following these guidelines, you can enhance your likelihood of a successful mortgage approval. We’re here to support you every step of the way.

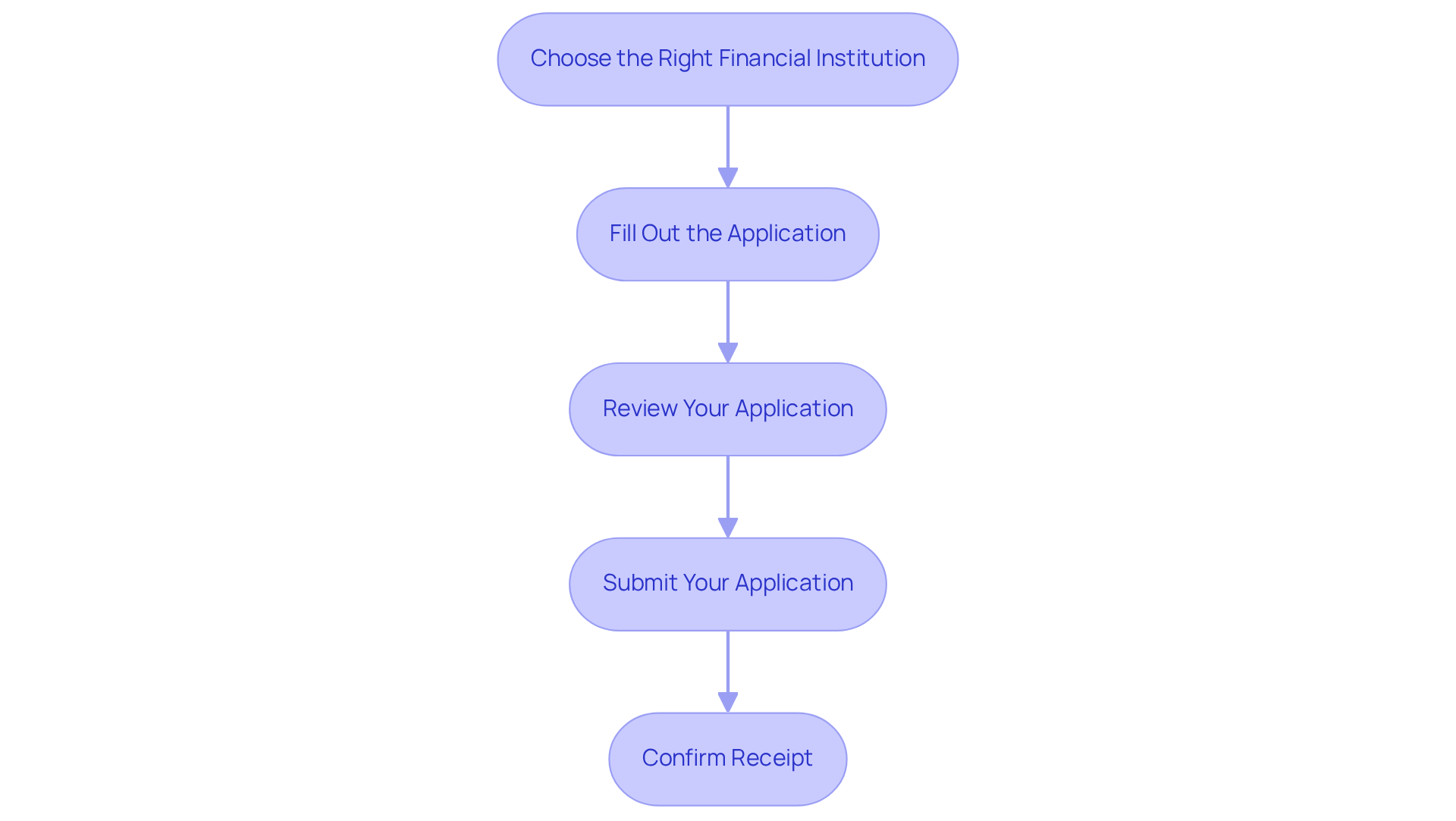

Complete Your Mortgage Application Efficiently

Completing your mortgage application for mortgage approval can feel overwhelming, but we’re here to support you every step of the way. By following these steps, you can navigate the process with confidence:

-

Choose the Right Financial Institution: Begin by researching and selecting a provider that aligns with your needs. In 2025, homebuyers are placing greater importance on factors like interest rates, fees, and customer service. With the average loan request rejection rate rising to nearly 21 percent in 2024, it’s crucial to pick a provider that fits your financial profile.

-

Fill Out the Application: When filling out your application, provide accurate information about your personal details, employment history, income, and financial assets. Be thorough yet concise. Remember, keeping an open dialogue with your lender about your financial situation can help avoid surprises down the road.

-

Review Your Application: Take a moment to double-check all entries for accuracy. Ensure that all necessary documents are included and that your submission is complete. Utilizing digital document signing can simplify this process, allowing you to review and sign documents at your convenience.

-

Submit Your Application: Finally, submit your application using the method preferred by the financial institution—whether online or in person. Confirm receipt with them to ensure your application was submitted successfully. Engaging with your financial institution early in this process can enhance your negotiation position and increase your chances of obtaining mortgage approval.

By following these steps, you can effectively finalize your mortgage request and prepare for mortgage approval. We know how challenging this can be, but with the right approach, you can make this journey smoother.

Follow Up and Respond to Lender Requests Promptly

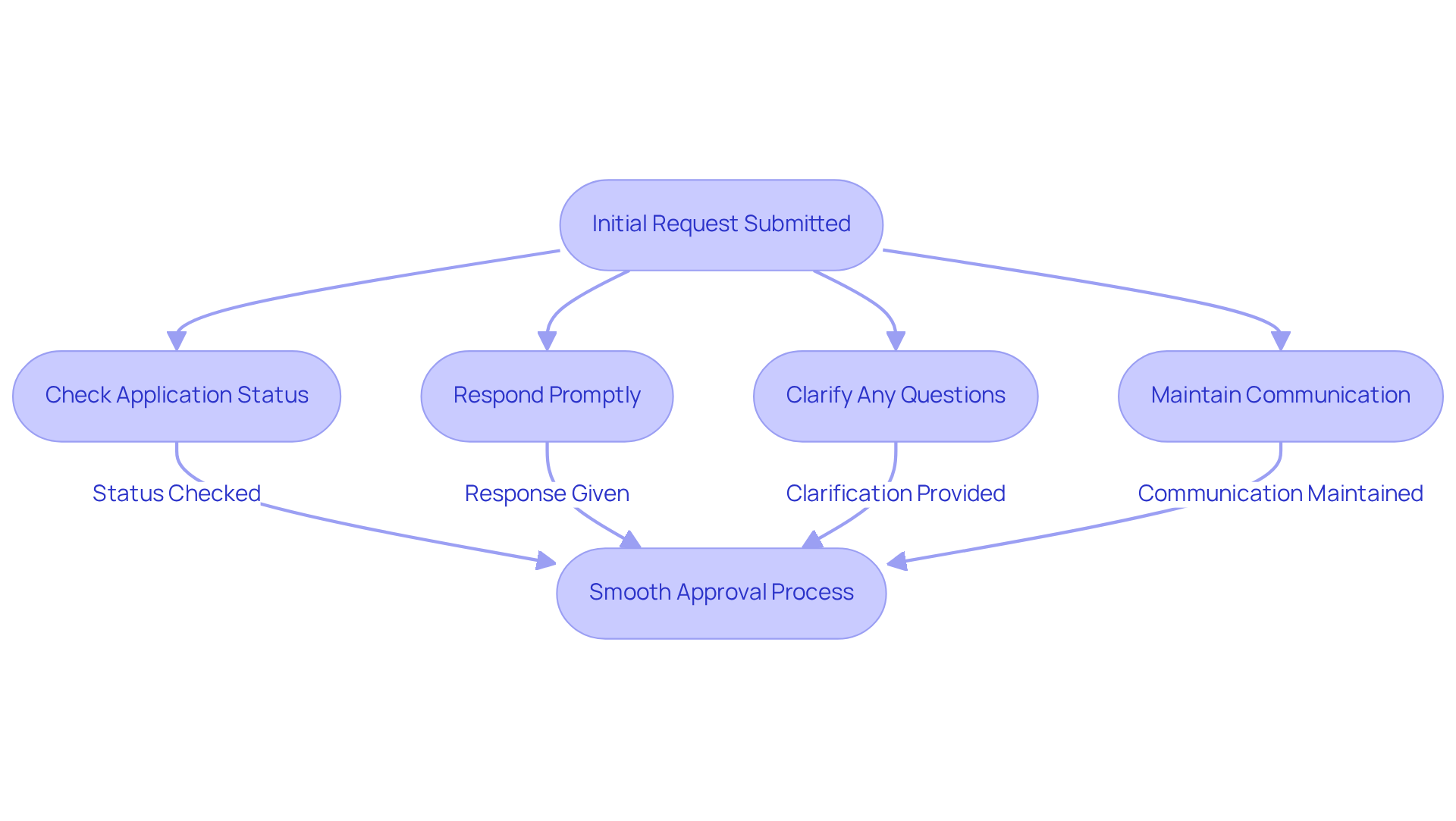

Once you submit your request, it’s vital to keep an open line of communication with your financial institution to ensure a smooth approval process. We understand how stressful this can be, so here are some effective strategies to help you follow up:

- Check Application Status: Regularly ask about your application status. While most financial institutions provide a processing timeline, staying informed can help you anticipate any potential delays.

- Respond Promptly: When your financial institution requests additional information or documentation, please respond as quickly as you can. Timely replies demonstrate your commitment and can significantly speed up the approval process.

- Clarify Any Questions: If you receive requests that are unclear, don’t hesitate to ask for clarification from your financial institution. Understanding their requirements ensures you provide the necessary information accurately.

- Maintain Communication: Keep an open dialogue with your financial institution throughout the process. Regular check-ins not only keep you updated but also allow you to address any issues proactively.

Effective communication is essential. Research shows that financial institutions that engage borrowers early in the process see a notable increase in satisfaction ratings. For example, borrowers who turn to their lenders for advice report satisfaction levels that are significantly higher than those who do not. By following these practices, you can enhance your chances of obtaining a smooth and timely mortgage approval. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the mortgage approval process can feel overwhelming at first, but with a clear understanding of the essential steps, it becomes much more manageable. We know how challenging this can be, and by grasping the fundamentals of mortgages, gathering the necessary documentation, completing the application efficiently, and maintaining open communication with lenders, you can significantly enhance your chances of securing approval.

Throughout this article, we’ve shared key insights, such as the importance of understanding different mortgage types and the critical nature of accurate documentation. Timely communication with lenders also plays a vital role in ensuring a smooth approval journey. Each step, from preparing your financial information to following up on applications, is crucial. Awareness of eligibility requirements, interest rates, and the impact of thorough preparation cannot be overstated, as these factors can significantly influence your outcome.

Ultimately, the mortgage approval process is about more than just submitting documents; it’s about building a relationship with your lender and staying informed. By proactively engaging with financial institutions and ensuring all requirements are met, you can navigate this complex landscape with confidence. Embracing these strategies will not only facilitate a smoother approval experience but also empower you to take meaningful steps toward achieving your dream of homeownership.

Frequently Asked Questions

What is a home loan?

A home loan is a financial product designed specifically for purchasing a residence, with the property itself serving as collateral.

What are the different types of mortgages?

The different types of mortgages include fixed-rate, adjustable-rate, FHA, VA, and jumbo loans, each with unique features and eligibility criteria.

What is the difference between fixed-rate and adjustable-rate loans?

Fixed-rate loans offer stability with consistent monthly payments, while adjustable-rate loans may start with lower rates that can change over time based on market conditions.

How do interest rates impact mortgage payments?

Interest rates affect your monthly payments and overall loan costs. For example, the average interest rate for fixed-rate loans is around 6.93%, and adjustable-rate loans can fluctuate significantly based on market conditions and your credit profile.

What are the eligibility requirements for obtaining a mortgage?

Lenders generally look for borrowers with dependable income, a solid credit score (the median credit score among new loan applicants is 758), and a reasonable debt-to-income ratio.

How can understanding mortgage basics help me?

By mastering mortgage fundamentals, you can better assess your readiness to apply and navigate the mortgage approval journey with confidence.