Overview

If you’re considering an equity loan for your home upgrade, you’re not alone. Many homeowners face the challenge of navigating this process, and we know how overwhelming it can feel. But don’t worry; we’re here to support you every step of the way.

First, it’s essential to assess your eligibility. This means taking a close look at your home equity and credit score. Having sufficient equity and a good credit score can significantly enhance your chances of securing favorable financing. Remember, understanding these requirements is key to feeling more confident in your journey.

Next, gather the necessary documentation. This step can often feel daunting, but it’s crucial for a smooth application process. Think of it as preparing for a big presentation; the more prepared you are, the better you’ll feel. By organizing your documents ahead of time, you can alleviate some of the stress that comes with applying.

When it comes to applying, consider reaching out to multiple lenders. This not only gives you a better chance of finding the best rates but also allows you to compare different offers. It’s like shopping for the best deal; you want to ensure you’re making the right choice for your family.

Throughout this process, you may encounter common issues. Don’t let these setbacks discourage you. Troubleshooting these problems with a proactive mindset can make a world of difference. Remember, thorough preparation is your ally.

In conclusion, by following these essential steps and understanding the requirements, you can significantly improve your chances of securing the financing you need. So take a deep breath, stay organized, and know that you have the tools to succeed.

Introduction

Homeowners often find themselves in a tough spot when it comes to funding significant renovations while keeping their finances in check. We understand how challenging this can be. Equity loans can be a helpful solution, allowing you to tap into the value you’ve built in your home for those much-needed upgrades.

This guide walks you through the essential steps for securing an equity loan. We’ll highlight the benefits and eligibility criteria that can empower you to enhance your living space. However, we know that navigating the application process can feel overwhelming.

What challenges might arise, and how can you effectively overcome them to achieve your home improvement goals? We’re here to support you every step of the way.

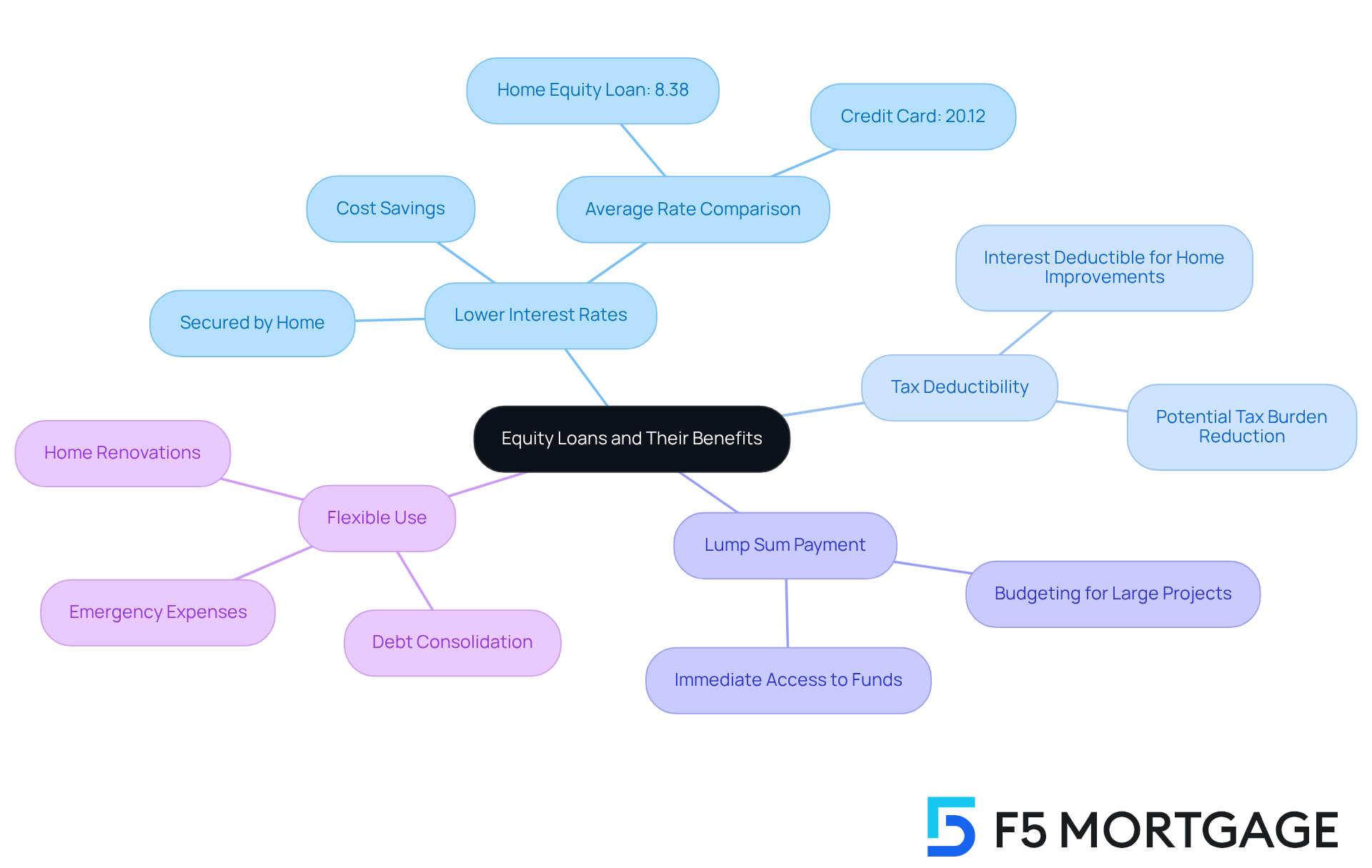

Understand Equity Loans and Their Benefits

Equity financing, often referred to as property value financing or second mortgages, is a way for homeowners to learn how to get an equity loan to tap into the value they’ve built in their properties. This option can be a game-changer, especially for those looking to find out how to get an equity loan for renovating their homes. With generally lower interest rates compared to personal loans or credit cards, it’s a smart choice for funding your next project. At F5 Mortgage, we’re dedicated to helping you find some of the lowest rates available, so you can keep more of your hard-earned money.

Why Consider Equity Financing?

- Lower Interest Rates: Since these loans are secured by your home, lenders typically offer more favorable rates. For instance, the national average interest rate for a 10-year property financing is about 8.38%, which is significantly lower than the average credit card rate of 20.12%. That’s a big difference in costs!

- Tax Deductibility: Did you know that the interest paid on home financing might be tax-deductible when used for home improvements? This could help lower your overall tax burden.

- Lump Sum Payment: Equity financing gives you a one-time lump sum, making it easier to budget for larger projects like kitchen remodels or bathroom upgrades. These improvements can really boost your home’s value.

- Flexible Use: The funds from home financing can be used for a variety of purposes—whether it’s renovations, repairs, or even consolidating higher-interest debts. This flexibility can be a real lifesaver.

At F5 Mortgage, we leverage user-friendly technology to make the refinancing process as smooth as possible. We’re here to guide you through each step without any pressure. Understanding how to get an equity loan can help you determine if this financing option aligns with your home improvement goals. Many homeowners have successfully used these borrowing options to enhance their living spaces, proving that this financial resource can effectively support your renovation dreams. We know how challenging this can be, and we’re here to support you every step of the way.

Identify Eligibility Requirements for Equity Loans

Before you think about requesting a property value loan, it’s important to ensure you meet the eligibility criteria set by lenders. We know how challenging this can be, so let’s break it down together. Here are some key criteria to consider:

- Home Equity: Typically, homeowners should have at least 15-20% equity in their property. With the average home ownership value around $300,000, this means you should ideally have at least $45,000 to $60,000 in equity.

- Credit Score: A good credit score is crucial. Most lenders require a minimum score of 620, but if you aim for a score of 700 or higher, you’ll likely secure more favorable terms.

- Debt-to-Income Ratio: Lenders will look at your debt-to-income (DTI) ratio, which should ideally be below 43%. This ratio helps them assess your ability to manage monthly debt payments relative to your income.

- Work Background: A consistent work history can significantly strengthen your application, showcasing your reliability and ability to repay the loan.

By examining these criteria, you can better assess your readiness to understand how to get an equity loan. Remember, we’re here to support you every step of the way, and understanding these factors can improve your chances of acceptance.

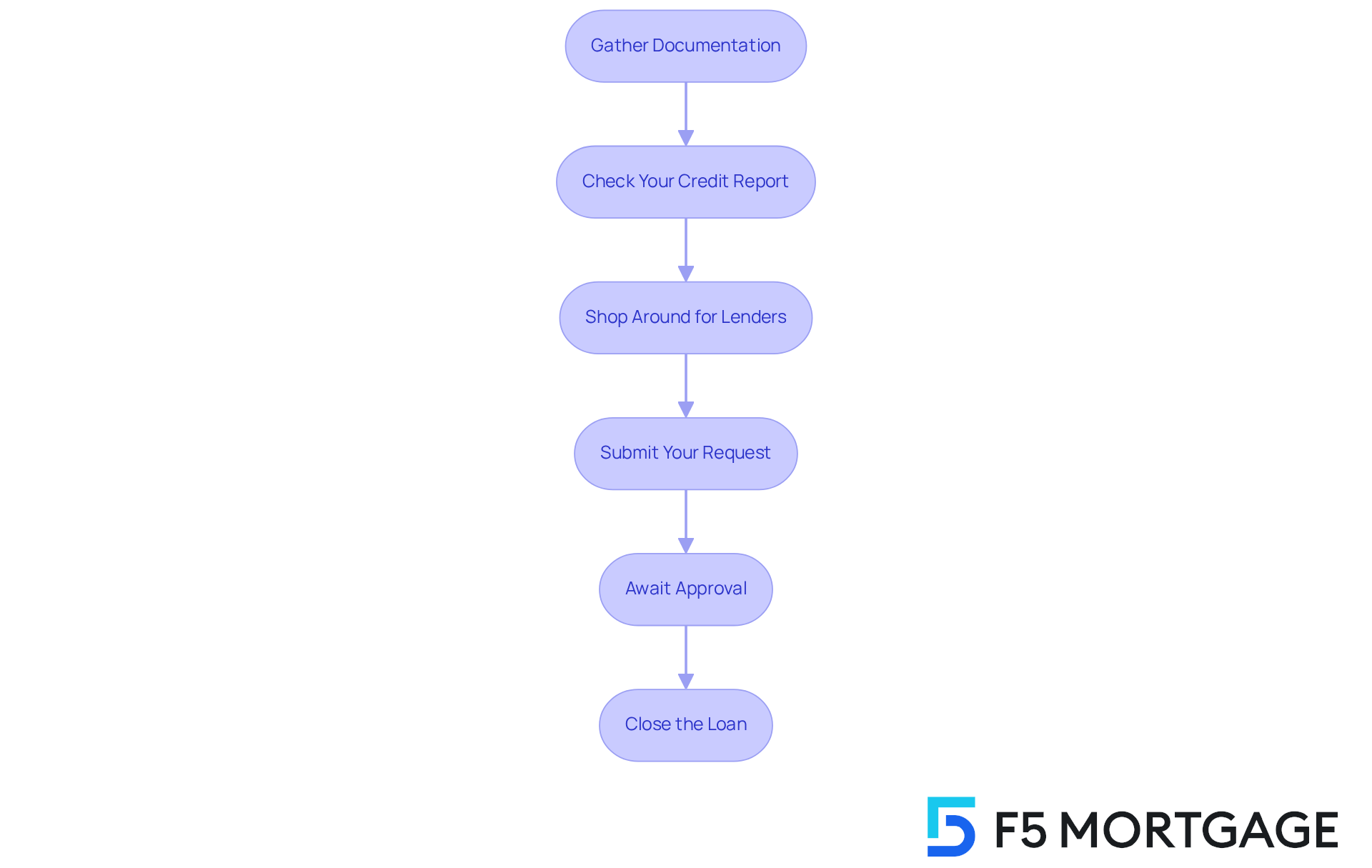

Navigate the Application Process for an Equity Loan

Navigating the application process for how to get an equity loan can feel overwhelming, but it doesn’t have to be. By following these essential steps, you can make the journey smoother:

Gather Documentation: Start by compiling necessary documents like proof of income, tax returns, and details about your current mortgage. Lenders typically require thorough financial records to assess your situation and provide guidance on how to get an equity loan that you can afford.

Check Your Credit Report: Take a moment to scrutinize your credit report for any inaccuracies. It’s important to ensure your score meets lender requirements—generally, a score of at least 620 is preferred. Remember, higher scores can lead to better rates.

Shop Around for Lenders: Don’t settle for the first offer you see. To understand how to get an equity loan, it’s important to explore options from multiple lenders, as home equity loans can vary significantly in rates and terms. Gathering quotes from at least three to five lenders can enhance your chances of approval and help you secure the best deal.

Submit Your Request: When you’re ready, complete the application form accurately and send it along with your documentation. Make sure all information is complete to avoid any delays in processing.

Await Approval: After submission, the lender will review your request and may ask for additional information. Keep in mind that the typical processing time for residential financing can take up to four weeks, so patience is key.

Close the Loan: Once approved, you’ll move on to the closing process. This is where you’ll sign the necessary documents and receive your funds.

By following these steps, you can simplify the process and significantly improve your chances of understanding how to get an equity loan for your home upgrade. We know how challenging this can be, and as highlighted by industry specialists, thorough preparation and organization are essential for a successful submission. Remember, we’re here to support you every step of the way.

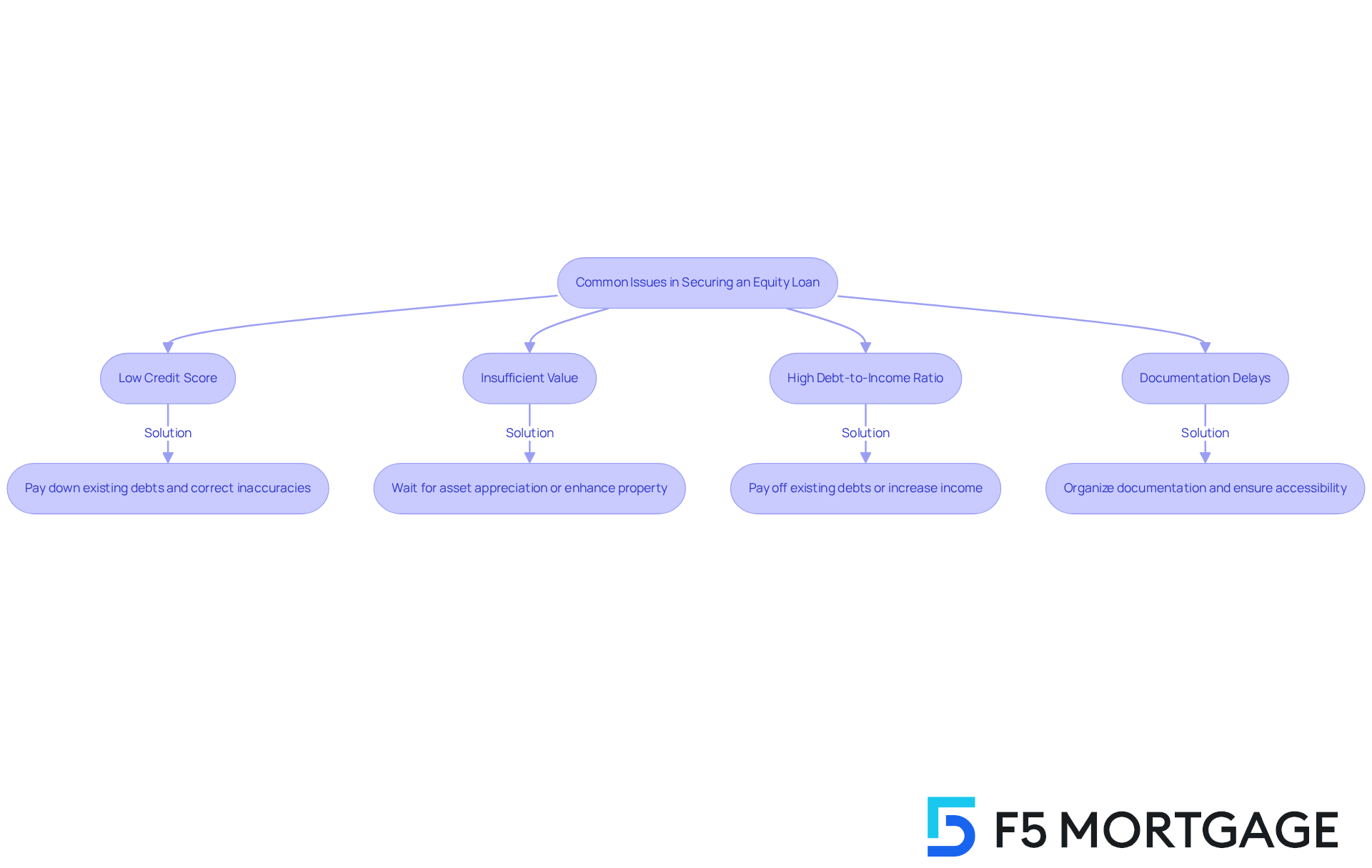

Troubleshoot Common Issues in Securing an Equity Loan

Navigating the financing request process can be tough, and we know how challenging this can be. However, understanding common issues and their solutions can significantly improve your chances of approval. Let’s explore some frequent problems and how to tackle them:

Low Credit Score: If your credit score is below the typical threshold of 680, it can hinder your application. To improve your score, focus on paying down existing debts and correcting any inaccuracies on your credit report. In 2025, the average credit score for loan applicants is expected to be around 749, highlighting the importance of maintaining a strong credit profile.

Insufficient Value: If your property ownership is lacking, consider waiting for your asset to appreciate or investing in enhancements that can increase its worth. This strategy not only boosts your equity but also positions your home more favorably in the market.

High Debt-to-Income Ratio: A debt-to-income (DTI) ratio exceeding 43% can lead to denials of requests. To improve your DTI, prioritize paying off existing debts and think about increasing your income through side jobs or other means. This proactive approach can truly make a difference in your loan request.

Documentation Delays: Delays in processing often stem from disorganized documentation. Ensure that all required documents, including income statements, tax returns, and your refinancing request, are easily accessible and well-organized. This preparation can speed up the approval process and show lenders that you’re reliable. Remember, you’ll need details like Social Security numbers, bank statements, tax returns, and pay stubs to complete your application.

By proactively addressing these potential issues, you can learn how to get an equity loan more effectively and secure the funding needed for your home upgrade. We’re here to support you every step of the way!

Conclusion

Equity loans can be a wonderful opportunity for homeowners eager to finance their home upgrades by tapping into the value they’ve built in their properties. We understand how challenging it can be to navigate financing options, but by learning about equity loans, you can access funds at lower interest rates compared to traditional loans. This makes it an appealing choice for those looking to renovate and improve their homes.

To successfully obtain an equity loan, it’s essential to understand the steps involved. Start by familiarizing yourself with eligibility requirements and gathering the necessary documentation. We know that common issues can arise during the application process, so being prepared can make a significant difference. Key factors like home equity levels, credit scores, and debt-to-income ratios play a crucial role in your approval chances, and it’s important to keep these in mind.

The benefits of equity loans are noteworthy. Not only can they offer tax deductibility, but they also provide flexible use of funds, which can be a significant advantage for homeowners. By considering these factors, you can make informed decisions that align with your renovation goals.

In conclusion, tapping into your home equity can be a strategic move if you’re looking to enhance your living space while managing costs effectively. By being proactive and informed about the equity loan process, you can achieve your renovation dreams and potentially increase your property value over time. Remember, engaging with trusted lenders and ensuring you’re well-prepared can truly make all the difference in securing the funds you need for a successful home upgrade. We’re here to support you every step of the way!

Frequently Asked Questions

What is an equity loan?

An equity loan, also known as property value financing or a second mortgage, allows homeowners to borrow against the value they have built in their properties.

What are the benefits of equity financing?

The benefits of equity financing include lower interest rates compared to personal loans or credit cards, potential tax deductibility of interest paid on home financing, a lump sum payment for budgeting larger projects, and flexible use of funds for various purposes such as renovations or debt consolidation.

How do interest rates for equity loans compare to credit card rates?

The national average interest rate for a 10-year equity loan is about 8.38%, which is significantly lower than the average credit card rate of 20.12%.

Can the interest paid on equity loans be tax-deductible?

Yes, the interest paid on home financing may be tax-deductible when the funds are used for home improvements, potentially lowering your overall tax burden.

What can the funds from an equity loan be used for?

Funds from an equity loan can be used for various purposes, including home renovations, repairs, or consolidating higher-interest debts.

How does F5 Mortgage assist homeowners in obtaining equity loans?

F5 Mortgage utilizes user-friendly technology to streamline the refinancing process and provides guidance to homeowners throughout each step, helping them understand how to get an equity loan that aligns with their home improvement goals.