Overview

Finding the right home loan broker to meet your needs can feel overwhelming, but you’re not alone in this journey. We understand how challenging it can be to navigate the mortgage landscape. To make this process easier, it’s essential to conduct thorough research. Evaluate brokers based on:

- Experience

- Lender relationships

- Customer reviews

- Communication style

- Fee structures

Utilizing online resources is a great starting point. Don’t hesitate to seek referrals from friends or family who have been through the process. Engaging with potential brokers armed with prepared questions can significantly enhance your chances of securing favorable loan options tailored to your unique financial situation. Remember, we’re here to support you every step of the way as you explore your options.

Introduction

Navigating the complex world of home financing can feel overwhelming, especially for first-time buyers. We know how challenging this can be with so many options available. Home loan brokers serve as trusted advisors, simplifying the journey and connecting borrowers with the best loan products tailored to their unique needs.

But with countless brokers to choose from, how can you ensure that you select the right partner for your financial journey? Understanding the essential steps to find reliable home loan brokers nearby is key. This knowledge can unlock favorable loan terms and lead to a smoother home-buying experience.

We’re here to support you every step of the way as you embark on this important journey.

Understand the Role of Home Loan Brokers

near me are essential partners for borrowers, assisting them in navigating the often daunting lending landscape. They take the time to assess your financial situation, gather necessary documents, and explore various lenders to find the most competitive loan rates and terms. With their extensive network, agents can connect you to a broader array of financing options than a single lender might provide. This includes specialized programs tailored for , veterans, and those with , such as bank statement financing for self-employed individuals.

In 2025, we’ve seen a significant trend: . This shift underscores the growing reliance on their expertise, especially as affordability challenges become more pronounced in today’s market.

We know how overwhelming the home-buying process can be, which is why experts recommend . This proactive step allows you to better understand your financing options and establish a realistic budget, helping you avoid the heartache of falling in love with homes that are out of reach. For instance, many first-time buyers mistakenly believe they need to put down 20% for a loan. However, —some options from , such as F5 Mortgage, even allow for down payments as low as 3% or 0% in certain circumstances.

Building successful relationships between intermediaries and clients hinges on effective communication and education. Brokers not only assist in securing loans but also empower individuals with knowledge about the loan process, ensuring informed decisions are made. As the market evolves, the role of home loan brokers near me is increasingly viewed as advisory, offering personalized support to assist borrowers in and achieving their homeownership dreams. F5 Mortgage, for example, boasts a , a testament to how advisors positively influence client experiences, especially through their tailored loan services and expertise in .

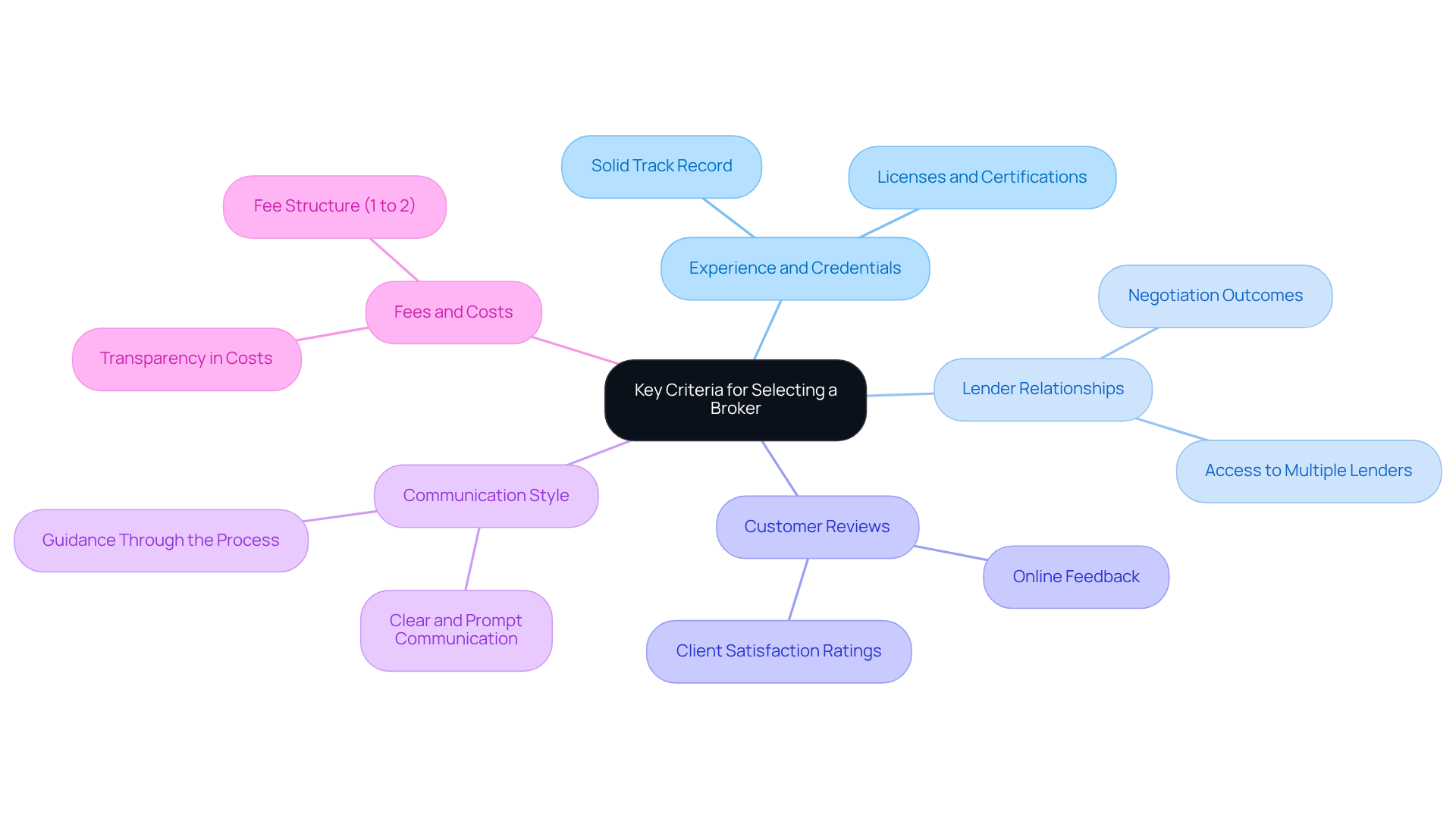

Evaluate Key Criteria for Selecting a Broker

When selecting a home loan broker, we understand how crucial it is to evaluate the following criteria:

- Experience and Credentials: We know how challenging this can be, so seek agents with a . Verify their licenses and any relevant certifications, as these indicators reflect their expertise and professionalism.

- Lender Relationships: A broker with established connections to multiple lenders can provide a and potentially secure more favorable rates. For instance, and investors nationwide, ensuring that you have access to competitive offers tailored to your needs. Robust connections often lead to improved negotiation outcomes, making this factor essential in your selection process.

- Customer Reviews: Investigate online feedback and testimonials to gauge the firm’s reputation. , like and customized loan solutions, indicate a professional’s ability to meet client needs effectively. Clients have shared their appreciation for the team’s to assisting them throughout the financing process, which can significantly enhance your experience.

- Communication Style: Opt for who communicate clearly and promptly. is vital for a seamless financing process, ensuring you feel informed and supported at every step. Brokers play a crucial role in guiding you through the complexities of mortgage applications, making this aspect particularly important. F5 Mortgage’s customers have expressed gratitude for the team’s patience and educational approach, creating a nurturing atmosphere for first-time homebuyers.

- Fees and Costs: Familiarize yourself with the broker’s fee structure to ensure it fits within your budget. Brokers typically charge around 1% to 2% of the amount borrowed, which may be covered by you or the lender. Understanding these costs upfront is essential for financial planning. Additionally, , ensuring you are well-informed before making decisions.

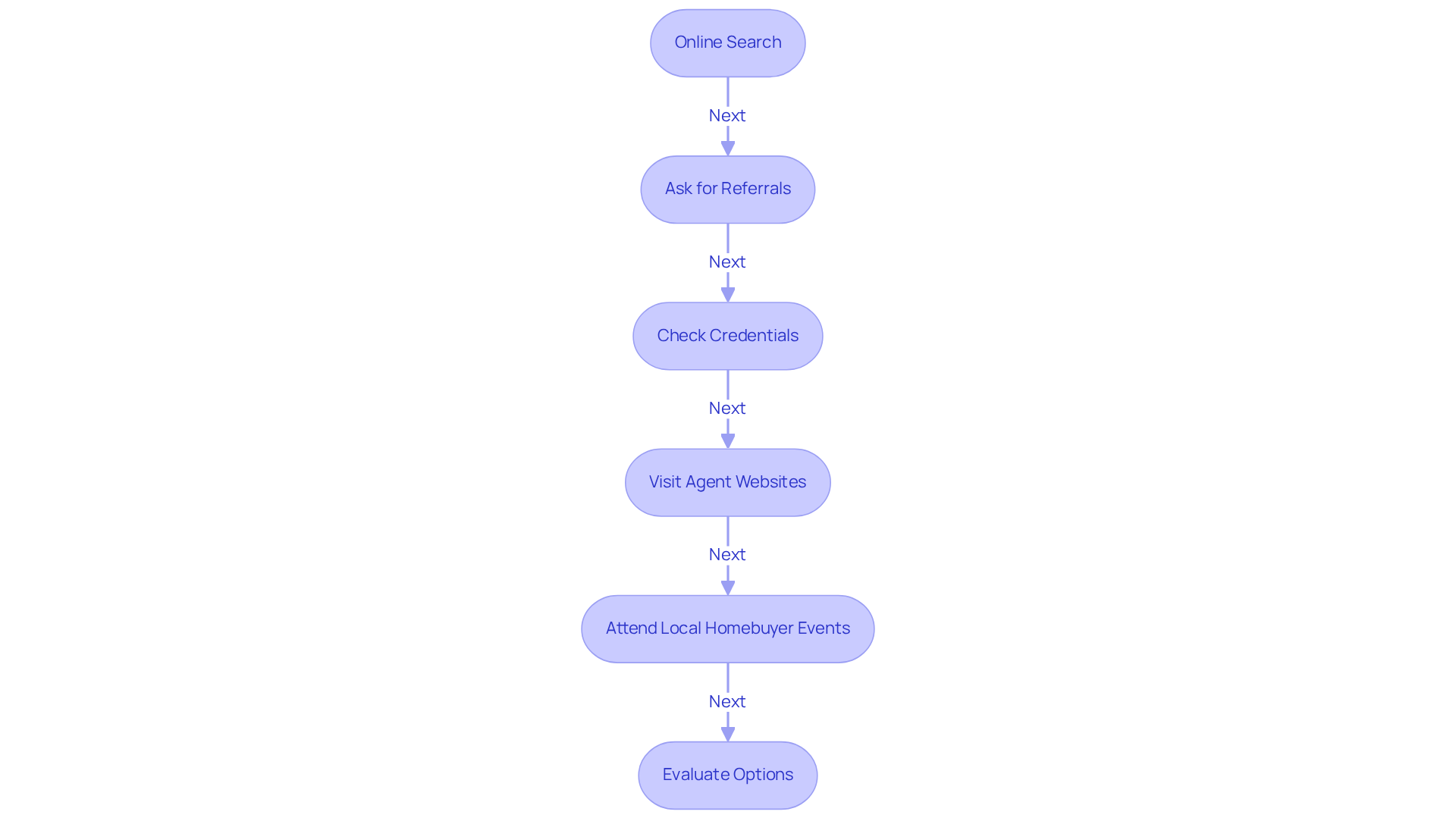

Research Local Home Loan Brokers

To effectively research , we understand how challenging this can be. Here are some steps to guide you:

- Online search: Start by utilizing search engines to identify home loan brokers near me. Websites like Zillow, NerdWallet, and Yelp provide extensive lists of agents, along with that can assist in your selection process. Pay attention to the experiences shared by clients; agents with high ratings often reflect exceptional client satisfaction, similar to the on platforms like Lending Tree and Google.

- Ask for Referrals: Reach out to friends, family, or real estate agents for . Insights from individuals with firsthand experience can guide you to in negotiating advantageous conditions, including repair requests and offer strategies.

- Check Credentials: Ensure the legitimacy of potential agents by verifying their licenses and credentials through state regulatory websites or the Nationwide Mortgage Licensing System. This step is essential for ensuring you collaborate with qualified experts who can assist you through the intricacies of financial disclosures and negotiations.

- Visit Agent Websites: Explore the websites of local agents to gain insights into their services, loan options, and any special programs they may offer. This can help you evaluate which home loan brokers near me align best with your needs, especially in terms of understanding property valuation and .

- Attend Local Homebuyer Events: Participate in homebuyer seminars or workshops where agents may be present. Interacting with agents face-to-face enables you to inquire and assess their proficiency and method of client support.

Studies show that borrowers who compare options for their home loan can save an average of $600 to $1,200 each year, as stated by Freddie Mac. This emphasizes the significance of choosing the appropriate agent. Furthermore, savings from seeking a mortgage can total tens of thousands of dollars throughout the duration of the financing. Online reviews greatly influence agent selection, as numerous prospective clients depend on the experiences of others to guide their decisions. It’s also important to consider that broker fees typically range from 1% to 2% of the total cost of the loan, which can affect your overall budget.

To enhance your loan opportunities, we recommend for errors on your credit report and managing your debts wisely. For tailored support and to discover more about in navigating the loan process, reach out to us today! We’re here to support you every step of the way.

Engage with Potential Brokers Effectively

Interacting effectively with prospective is essential for a successful experience in home financing. We know how challenging this can be, but here are key strategies to consider:

- Prepare Questions: Before your initial meeting, , fees, and . This preparation will help you assess their expertise and responsiveness.

- Discuss Your Needs: , goals, and any specific requirements for your mortgage. This clarity allows the agent to offer customized suggestions that correspond with your needs. For instance, agents can provide tailored solutions according to your distinct financial situation, ensuring you obtain the finest options accessible. , for example, is known for its , helping clients secure competitive rates and .

- Evaluate Their Responses: Observe how agents address your inquiries. Are they knowledgeable and transparent? Do they take the time to clarify complex terms? Effective communication is a strong indicator of an agent’s capability. As Phil Galante observes, a competent intermediary effectively maneuvers through the traits and characteristics of each lender on your behalf. At F5 Mortgage, customers have commended the team’s during the loan process, guaranteeing a seamless experience.

- Request References: Inquire about references from former customers to understand their experiences with the agent. This feedback can be invaluable in assessing the broker’s reliability and service quality. With F5 Mortgage having assisted over 1,000 families and boasting of 94%, you can trust that they prioritize customer satisfaction. Testimonials emphasize how customers value the team’s commitment and knowledge, establishing them as a trustworthy option for .

- : Ultimately, select an agent with whom you feel comfortable and who demonstrates a genuine interest in assisting you in achieving your homeownership goals. An agent’s dedication to client satisfaction is frequently demonstrated in their communication approach and readiness to help.

By following these steps, you can foster a productive relationship with home loan brokers near me, ensuring that your unique needs are addressed throughout the loan process.

Business Hours: F5 Mortgage operates Monday to Friday from 8:30 AM to 11:00 PM (EST) and Saturday from 8:30 AM to 5:00 PM (EST).

Conclusion

Finding the right home loan broker can truly transform your home-buying experience, turning what may feel overwhelming into a manageable journey. We understand how challenging this process can be. By recognizing the vital role brokers play, evaluating the key criteria for selection, conducting thorough research, and engaging effectively with potential candidates, you can secure favorable loan options tailored to your unique financial situation.

This guide highlights the importance of brokers in navigating the lending landscape. They connect you with a wide range of financing options and negotiate better terms on your behalf. When selecting a broker, consider essential criteria such as:

- Experience

- Lender relationships

- Customer reviews

- Communication style

- Fee transparency

Proactive engagement through well-prepared questions and open discussions about your financial needs can foster a productive partnership.

Ultimately, choosing the right home loan broker is about more than just finding someone to facilitate a loan; it’s about building a relationship that empowers you to make informed decisions and achieve your homeownership dreams. By taking the time to research and connect with local brokers, you can unlock significant savings and find the support you need to navigate the complexities of securing a mortgage. Remember, the journey to homeownership is within reach, and with the right guidance, it can be a truly rewarding experience.

Frequently Asked Questions

What is the role of home loan brokers?

Home loan brokers assist borrowers by assessing their financial situation, gathering necessary documents, and exploring various lenders to find competitive loan rates and terms. They connect clients to a wider array of financing options than a single lender might offer.

What trends have been observed in the home loan market in 2025?

In 2025, loan specialists are closing approximately 76.8% of all new residential home loans, indicating a growing reliance on their expertise, especially in response to affordability challenges in the market.

Why is it recommended to consult a financial advisor before searching for a home?

Consulting a financial advisor helps potential buyers understand their financing options, establish a realistic budget, and avoid the disappointment of pursuing homes that may be financially out of reach.

Do first-time homebuyers need to put down 20% for a loan?

No, many first-time homebuyers mistakenly believe they need a 20% down payment. Home loan brokers can clarify that there are various programs available that require much lower down payments, with some options allowing as low as 3% or even 0% in certain circumstances.

How do home loan brokers educate their clients?

Home loan brokers empower individuals with knowledge about the loan process, ensuring that clients make informed decisions. They provide personalized support to navigate unique financial situations and achieve homeownership goals.

What is F5 Mortgage’s customer satisfaction rate?

F5 Mortgage boasts a customer satisfaction rate of 94%, reflecting the positive influence of their advisors on client experiences, particularly through tailored loan services and expertise in down payment assistance programs.