Overview

This article outlines four essential steps for successfully consolidating a mortgage and home equity loan, emphasizing the importance of:

- Understanding loan types

- Assessing financial situations

- Following a structured consolidation process

- Troubleshooting common issues

We know how challenging this can be, but each step is supported by practical advice, such as:

- Researching lenders

- Gathering necessary documentation

- Managing new debt

Together, these elements aim to simplify the consolidation process and enhance financial stability for homeowners. Remember, we’re here to support you every step of the way.

Introduction

Many homeowners are currently grappling with the rising costs of mortgages and home equity loans, leading to significant financial strain. We understand how challenging this can be, which makes the idea of consolidating these debts increasingly appealing. By merging these loans, individuals can potentially lower their monthly payments and simplify their financial obligations, offering a sense of relief.

However, navigating the intricacies of loan consolidation can feel overwhelming. How can one effectively manage this process? This guide is here to support you every step of the way, outlining essential steps and considerations that will empower you to achieve successful consolidation. Together, we can pave the way for improved financial stability.

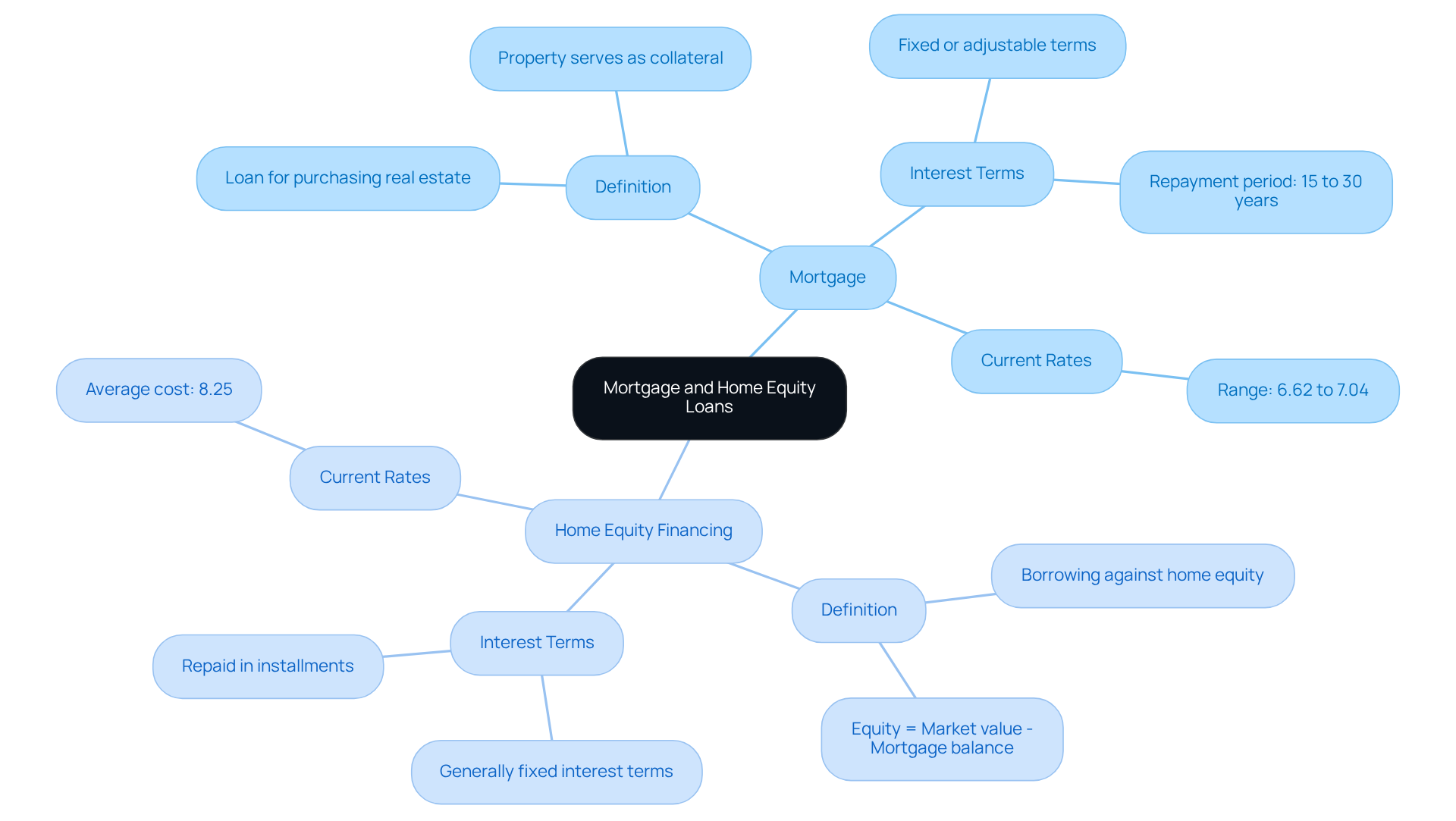

Understand Mortgage and Home Equity Loan Basics

Before we dive into the consolidation process, it’s important to understand what a mortgage and a home equity loan really mean:

- Mortgage: A mortgage is a loan specifically designed for purchasing real estate, with the property itself serving as collateral. These loans can have fixed or adjustable interest terms, typically repaid over 15 to 30 years. As of 2025, mortgage costs have varied between 6.62% and 7.04%, which can significantly impact affordability for many families.

- Home Equity Financing: This type of financing allows homeowners to borrow against the equity they have built up in their property. Equity is the difference between the home’s current market value and the remaining mortgage balance. Home equity financing generally offers fixed interest terms and is repaid in installments. In 2025, borrowing costs for home equity are averaging around 8.25%, making it a viable option for those looking to consolidate mortgage and home equity loan high-interest debt.

Understanding these basics is crucial for evaluating your financial situation and determining if you need to consolidate mortgage and home equity loan. In today’s economic climate, where home equity products are becoming increasingly attractive due to rising HELOC rates, being informed can empower you to make wiser financial decisions. We know how challenging this can be, but we’re here to .

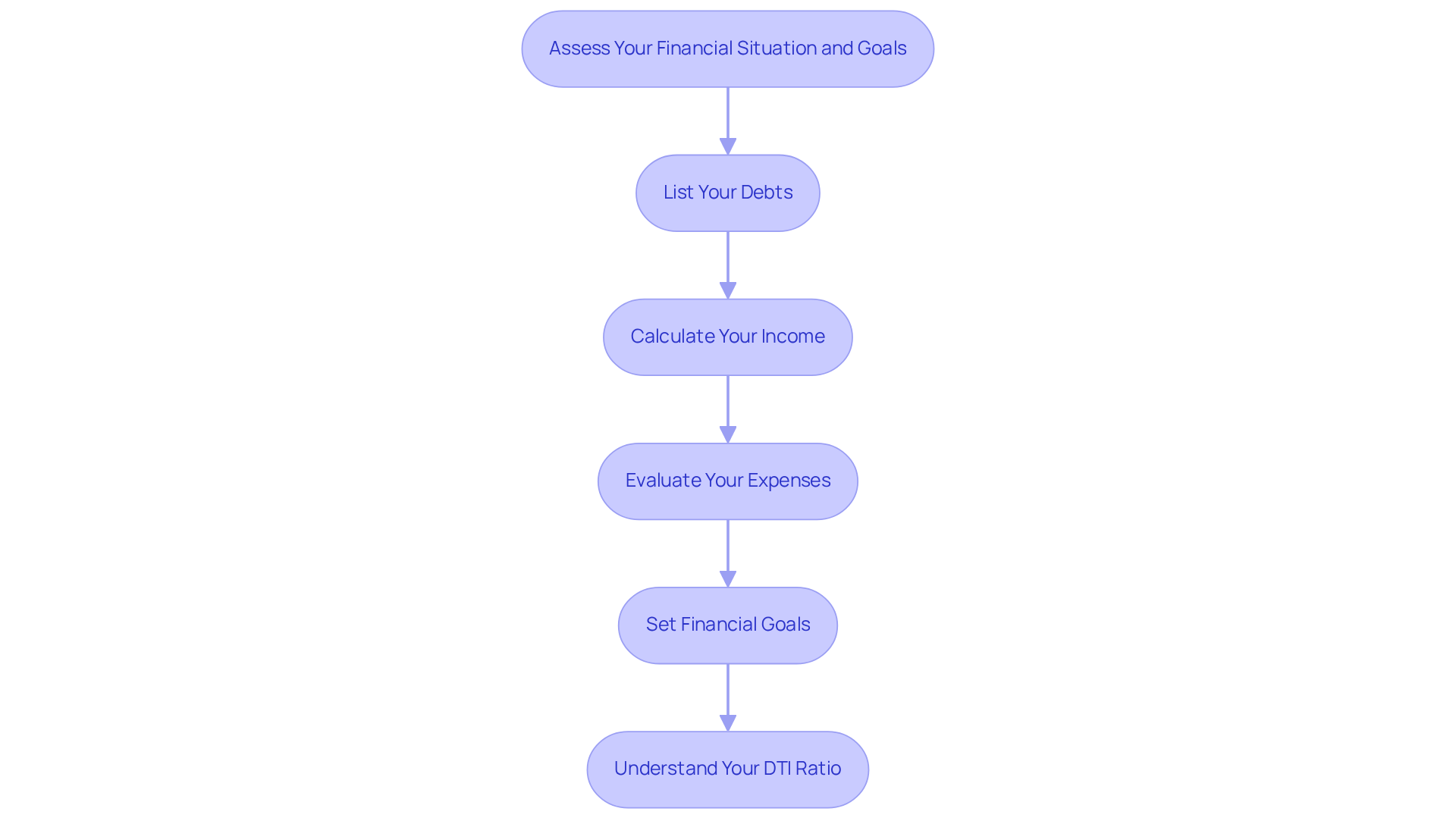

Assess Your Financial Situation and Goals

To effectively assess your financial situation, we know how challenging this can be. Here are some steps to guide you:

- List Your Debts: Start by compiling a comprehensive list of all your current debts. This includes your mortgage, credit cards, and any other loans, as well as the option to consolidate mortgage and home equity loan. Be sure to note the outstanding balances and interest rates for each.

- Calculate Your Income: Next, determine your total monthly income. Factor in salaries, bonuses, and any additional sources of income. In 2025, families seeking mortgage integration typically have an average income of approximately $85,000, reflecting their financial goals and obligations.

- Evaluate Your Expenses: It’s essential to track your monthly expenses to gain a clear understanding of your cash flow. This should encompass fixed costs, such as mortgage payments, as well as variable costs like groceries and entertainment.

- Set Financial Goals: Clearly define what you aim to accomplish through merging. Are you looking to consolidate mortgage and home equity loan to lower your monthly payments, reduce interest rates, or simplify your finances? Establishing specific monetary goals will guide your consolidation strategy effectively.

Understanding your is crucial. A maximum of 43% DTI is typically required for home loans, which can impact your eligibility for refinancing options. Many families establish monetary objectives that align with their long-term aspirations, such as reducing overall debt or improving credit scores. Financial advisors stress the significance of adopting a systematic method for establishing these objectives, as it can greatly influence the effectiveness of your unification efforts. As financial expert Jennifer Streaks says, “Having a clear financial goal is essential for effective debt management and organization.

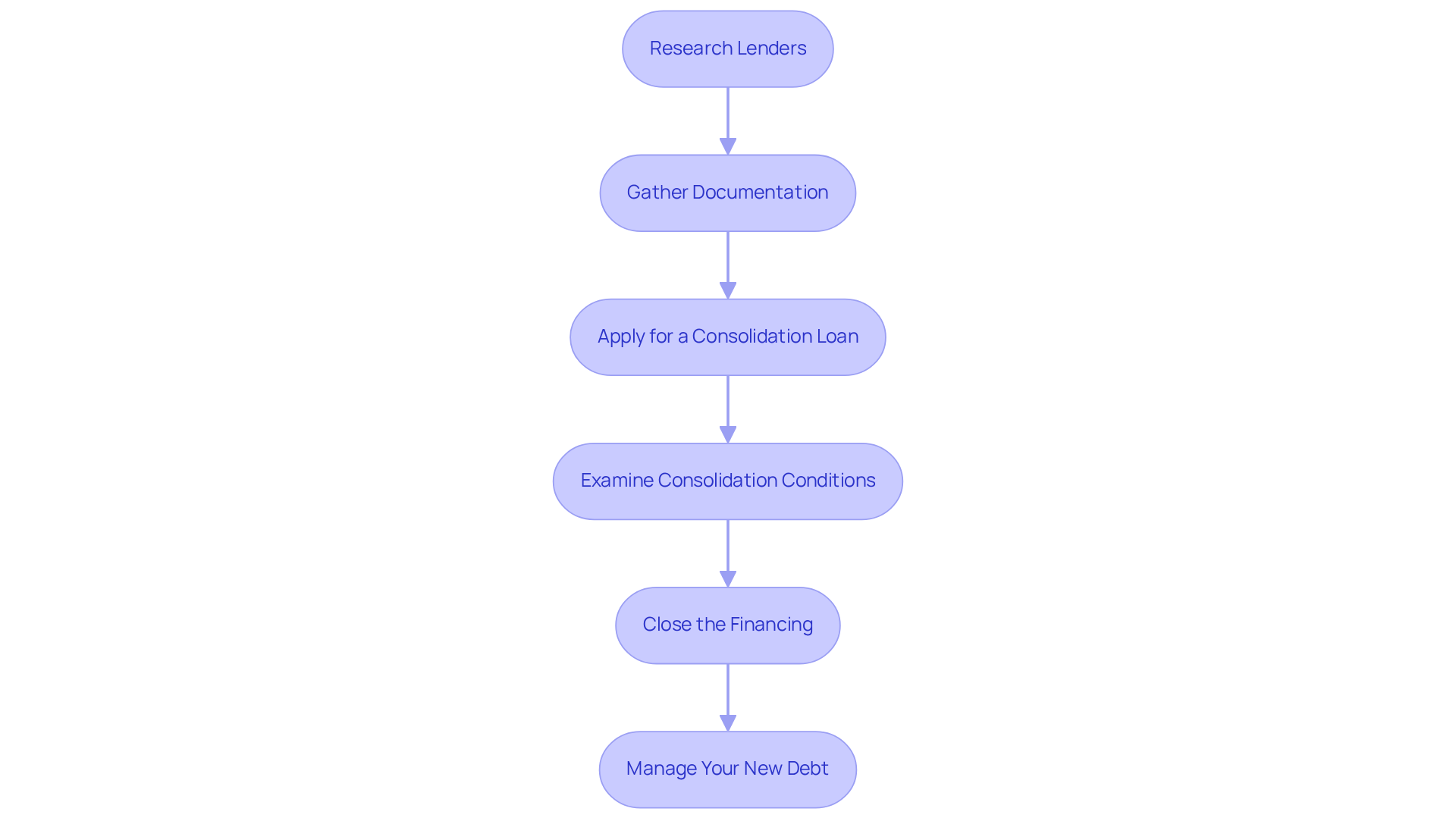

Follow Steps to Consolidate Your Loans

Consolidate mortgage and home equity loan can feel overwhelming, but we’re here to support you every step of the way. By following these essential steps, you can simplify the process and alleviate some of the stress.

- Research Lenders: Begin by identifying lenders that offer consolidation financing. Focus on those with competitive rates and favorable terms. Remember, comparing at least three lenders can help you save between 0.5% to 1% on your interest rate, making a significant difference in your financial journey.

- Gather Documentation: Collect all necessary documents, such as proof of income, credit reports, and information about your current debts. This preparation will streamline the application process and give you peace of mind.

- Apply for a Consolidation Loan: Once you’ve done your research, submit applications to your selected lenders. Take the time to compare the offers carefully, ensuring you find the best deal that aligns with your financial situation.

- Examine Consolidation Conditions: It’s crucial to analyze the terms of the consolidation agreement. Pay close attention to interest percentages, repayment durations, and any related charges. Understanding these details can protect you from hidden costs that may increase your overall expenses.

- Close the Financing: After choosing a lender, complete the financing process. Use the resources from the to settle your current mortgage and home equity debt, simplifying your obligations and providing relief.

- Manage Your New Debt: After consolidation, make sure to keep up with timely payments on your new debt. This will help maintain a good credit score and avoid penalties. By managing your credit responsibly, you can enhance your economic adaptability and work towards accumulating wealth over time.

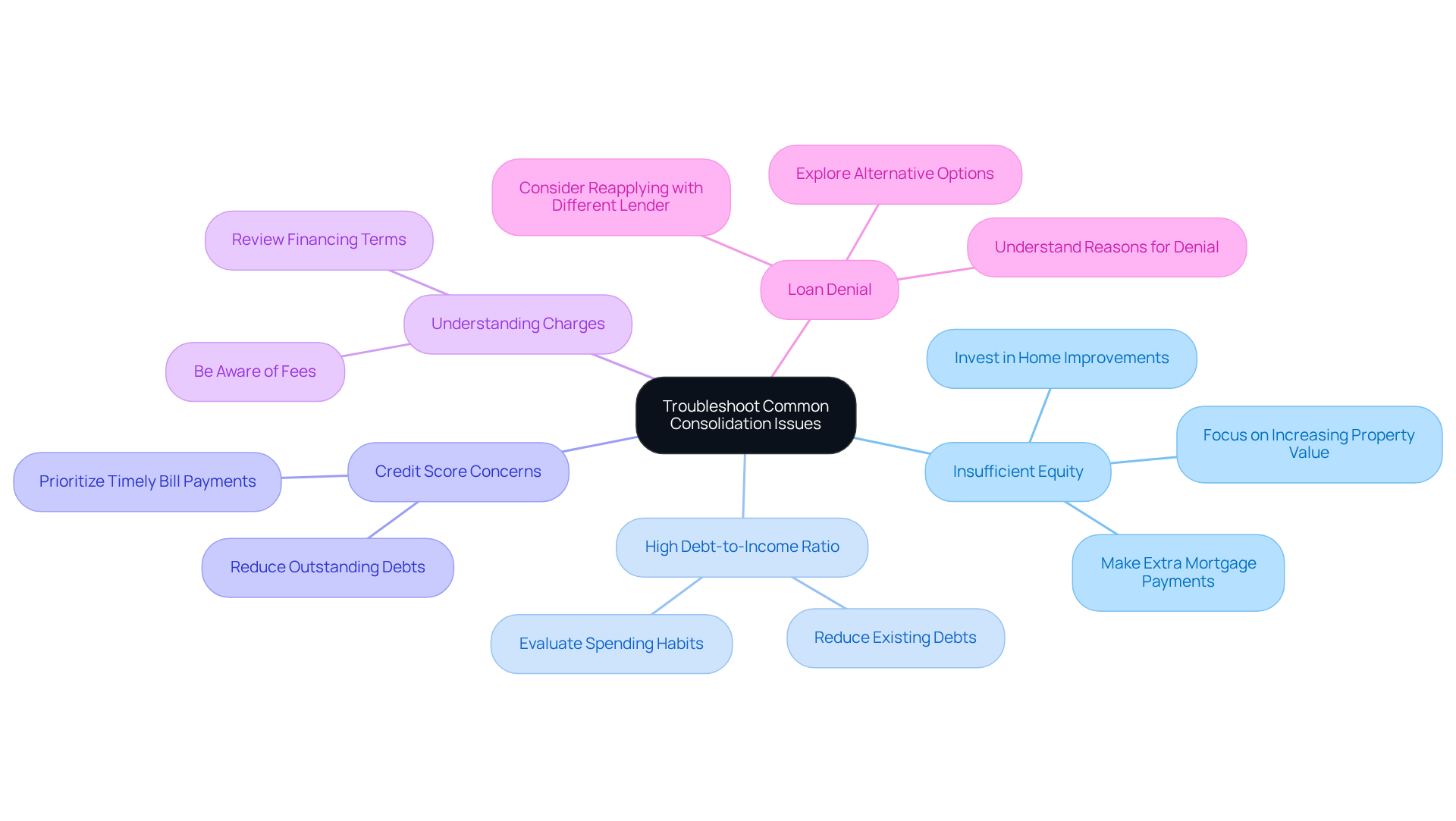

Troubleshoot Common Consolidation Issues

Consolidating loans can offer significant financial relief, but we understand that homeowners may encounter several challenges along the way.

- Insufficient Equity: We know how challenging it can be when a lack of adequate equity in your home hinders your ability to qualify for debt restructuring options. To , consider strategies such as making extra mortgage payments or investing in home improvements that increase your property’s value. In 2025, average home equity levels will be crucial for determining eligibility, so focusing on these improvements can truly make a difference.

- High Debt-to-Income Ratio: Lenders often evaluate your debt-to-income ratio when reviewing credit requests. If your ratio exceeds acceptable limits, it may be wise to take proactive steps to reduce existing debts before seeking consolidation. This approach can significantly improve your chances of approval, providing you with a clearer path forward.

- Credit Score Concerns: A low credit score can greatly affect your ability to obtain advantageous financing terms. To boost your credit score, prioritize timely bill payments and work on reducing outstanding debts. A strong credit profile not only enhances your eligibility but can also lead to better interest rates, ultimately easing your financial burden.

- Understanding Charges: It’s essential to be vigilant about any fees related to merging your debts, including closing costs or prepayment penalties. We encourage you to ensure that these costs do not undermine the financial advantages of merging. A thorough review of the financing terms can empower you to make an informed decision.

- Loan Denial: If your application is denied, take the time to understand the reasons provided by the lender. Address any identified issues and consider reapplying with a different lender or exploring alternative combining options. Many families have successfully navigated these challenges by seeking personalized guidance from trusted mortgage professionals.

By addressing these common issues, homeowners can better position themselves to consolidate mortgage and home equity loan, which ultimately leads to improved financial stability. Remember, we’re here to support you every step of the way.

Conclusion

Consolidating a mortgage and home equity loan can truly pave the way for improved financial health and reduced stress. We understand how challenging this can be, and by grasping the nuances of both loan types and the consolidation process, homeowners can make informed decisions that align with their financial goals. This journey involves a thorough assessment, strategic planning, and careful execution, all aimed at simplifying debt management and enhancing overall financial stability.

Key insights from the article emphasize the importance of assessing your financial situation, including debts, income, and expenses, as a solid foundation for effective consolidation. Researching lenders, gathering necessary documentation, and understanding the terms of consolidation are critical steps that can lead to significant savings. Additionally, addressing common challenges, such as insufficient equity or high debt-to-income ratios, is essential for a successful outcome.

Ultimately, the significance of consolidating mortgage and home equity loans extends beyond mere financial relief; it represents a proactive approach to achieving long-term financial goals. We encourage homeowners to take charge of their financial futures by exploring consolidation options, setting clear objectives, and seeking professional guidance when needed. Empowerment through knowledge and action can transform financial burdens into manageable solutions, fostering a path toward greater economic freedom.

Frequently Asked Questions

What is a mortgage?

A mortgage is a loan specifically designed for purchasing real estate, with the property itself serving as collateral. Mortgages can have fixed or adjustable interest terms and are typically repaid over 15 to 30 years.

What are the current mortgage costs as of 2025?

As of 2025, mortgage costs have varied between 6.62% and 7.04%.

What is home equity financing?

Home equity financing allows homeowners to borrow against the equity they have built up in their property, which is the difference between the home’s current market value and the remaining mortgage balance. It generally offers fixed interest terms and is repaid in installments.

What are the average borrowing costs for home equity financing in 2025?

In 2025, borrowing costs for home equity financing are averaging around 8.25%.

Why is it important to understand mortgages and home equity loans?

Understanding these basics is crucial for evaluating your financial situation and determining if you need to consolidate mortgage and home equity loan high-interest debt, especially in today’s economic climate.

How can rising HELOC rates affect homeowners?

Rising HELOC rates can make home equity products increasingly attractive, prompting homeowners to consider their options for consolidating high-interest debt.

What support is available for those considering consolidation?

There is support available to help you navigate the challenges of consolidating mortgage and home equity loans, ensuring you make informed financial decisions.