Overview

Achieving a 700 credit score for home upgrades may seem daunting, but we know how challenging this can be. It’s important to focus on understanding the components of your credit score. Start by checking your credit reports for accuracy; this is a crucial first step. Implementing strategies to improve your ratings and adopting good financial habits can make a significant difference.

A 700 credit score opens up better mortgage options and lowers interest rates. Imagine the possibilities! You can enhance your financial future with practical steps. Timely bill payments, maintaining low credit utilization, and regularly reviewing your financial history are all key actions that lead to long-term success.

We’re here to support you every step of the way. By taking these steps, you empower yourself to achieve your home upgrade goals. Remember, every small action counts towards building a brighter financial future.

Introduction

Achieving a 700 credit score is a pivotal milestone for anyone looking to enhance their financial standing. We know how challenging this can be, especially when it comes to securing favorable mortgage options for home upgrades. This score not only signifies reliability to lenders but also opens the door to competitive interest rates, which can lead to significant savings over time.

However, the journey to this benchmark can often seem daunting. What steps can individuals take to navigate the complexities of credit improvement? We’re here to support you every step of the way, ensuring your financial future is secure. Let’s explore the path together.

Understand Credit Scores and Their Importance

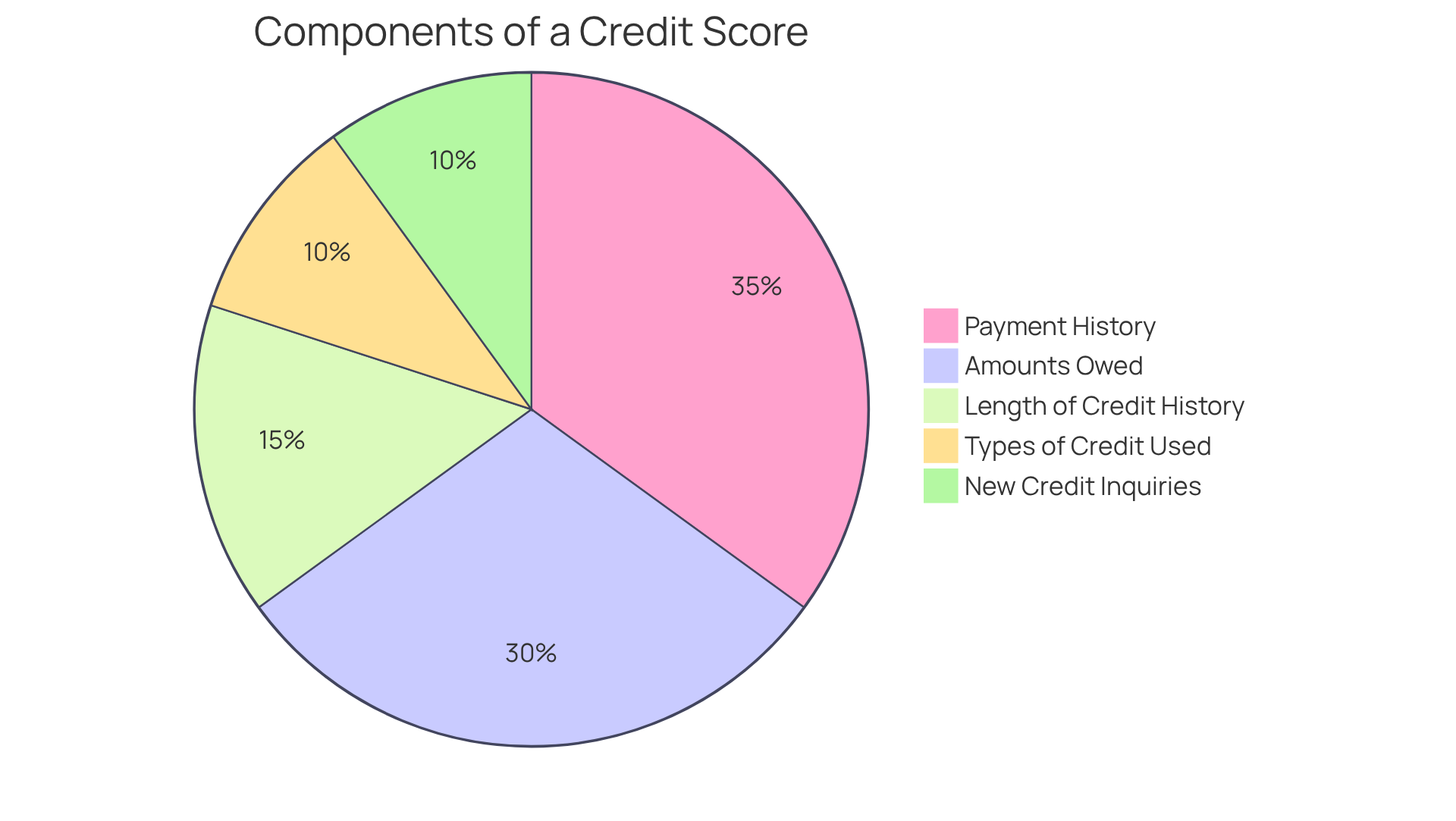

A financial rating serves as a numerical representation of your borrowing reliability, typically ranging from 300 to 850. A 700 credit score is often seen as a benchmark for favorable financial standing, signaling to lenders that you are a trustworthy borrower. Credit ratings are determined by several key factors:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Types of credit used (10%)

- New credit inquiries (10%)

Understanding these elements is crucial, as they directly impact your ability to secure financing with beneficial terms, including lower interest rates and better repayment options.

For those considering home improvements, obtaining a 700 credit score can significantly enhance your mortgage options. Borrowers who have a 700 credit score are more likely to qualify for competitive mortgage products, leading to substantial savings over the life of the loan. In 2024, for instance, the average FICO score for home buyers reached around 717, indicating a trend toward stronger financial profiles among buyers. This trend is vital as it correlates with lower default rates and improved credit conditions.

Moreover, as of Q1 2025, borrowers with ratings of 720 and above accounted for approximately 80% of all mortgage originations, underscoring the importance of maintaining a strong rating. Conversely, those with lower ratings may face higher interest rates and less favorable loan terms, which can hinder their ability to finance home improvements effectively. Therefore, prioritizing the enhancement of your financial rating is essential for maximizing your borrowing capacity and ensuring a smoother mortgage process. We know how challenging this can be, but we’re here to support you every step of the way.

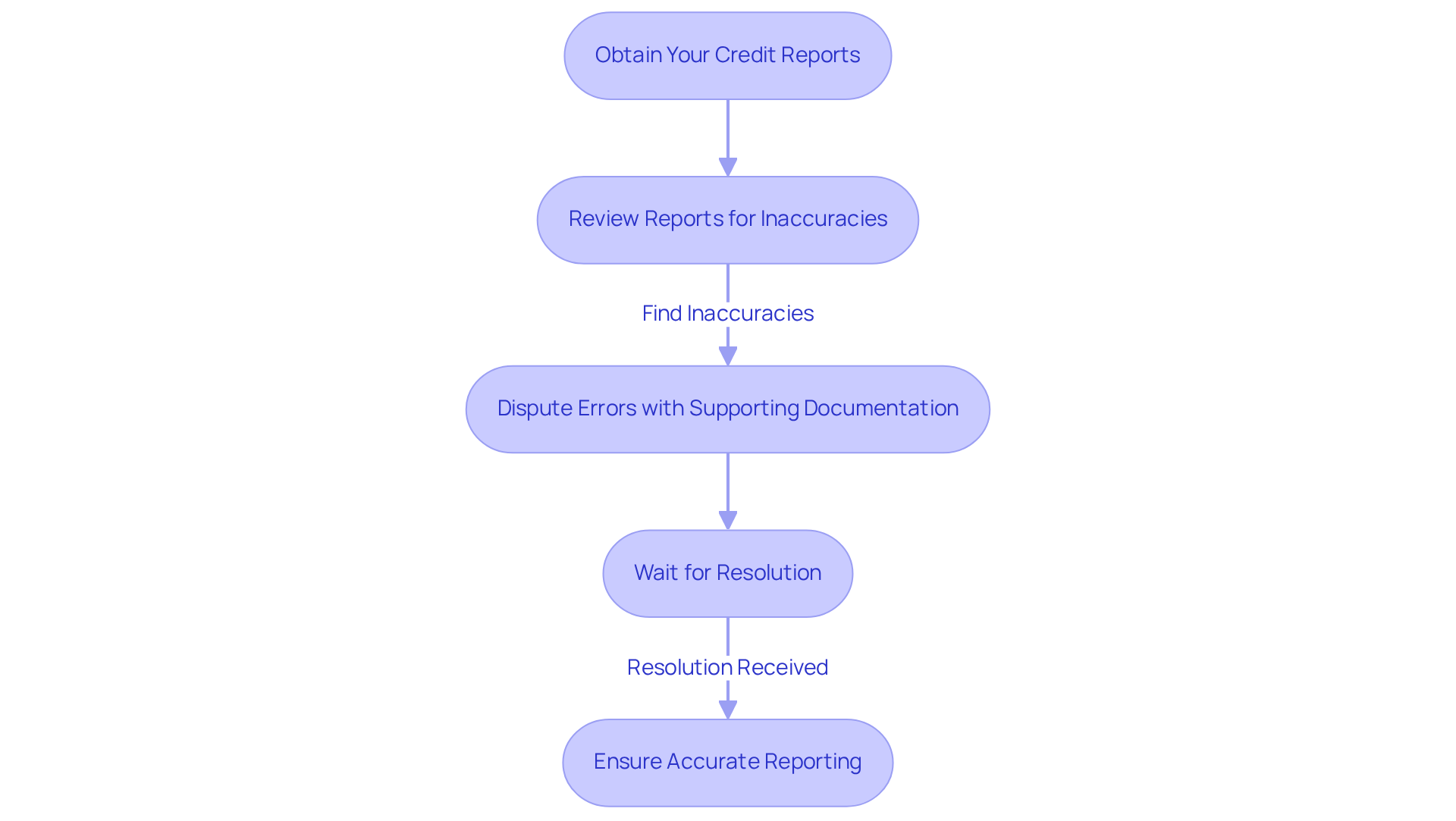

Check Your Credit Report for Accuracy

Start by obtaining a complimentary copy of your report from the three primary financial agencies: Experian, TransUnion, and Equifax. We understand how important it is to review each report carefully for inaccuracies, such as incorrect account details or late payments that may have been reported mistakenly. It’s disheartening to know that many consumers discover mistakes in their financial reports, which can negatively affect their ratings and borrowing capacity. If you find any inconsistencies, don’t hesitate to start a dispute with the bureau by providing supporting documentation. While this process may take some time, correcting these errors is vital for enhancing your financial rating.

Furthermore, ensure that all your accounts are reported accurately. This will provide a true reflection of your creditworthiness and significantly improve your chances of qualifying for favorable loan terms if you have a 700 credit score. Remember, we’re here to support you every step of the way as you navigate this important process.

Implement Strategies to Improve Your Credit

Improving your credit rating is an important step towards achieving your financial goals. Here are some strategies that can help you on this journey:

- Pay Your Bills on Time: We know how challenging it can be to keep track of payments. Establishing reminders or setting up automatic payments can ensure you never miss a due date. Remember, prompt payments contribute to around 35% of your rating, making this the most significant action you can undertake. A favorable rating is viewed as 750 and higher, so striving for on-time payments is essential for attaining a 700 rating.

- Lower Card Balances: Keeping your utilization rate under 30% of your overall limit is crucial. For instance, if your limit is $2,000, aim to maintain your balance below $600 to positively affect your rating. Surpassing $1,000 on a $2,000 borrowing limit could adversely affect your rating.

- Avoid Opening New Credit Accounts: Each new application can temporarily decrease your rating. Instead, focus on managing your current accounts effectively.

- Become an Authorized User: If a family member has a strong financial history, consider asking to be added as an authorized user on their card. This can improve your results without incurring debt.

- Diversify Your Credit Mix: Adding different forms of borrowing, such as an installment loan, can demonstrate your ability to manage various types of financial obligations responsibly.

Families who have effectively enhanced their ratings frequently report substantial advancements by adhering to these measures. This can lead to improved mortgage rates and savings when renovating their homes. For example, one family shared that they increased their rating from 540 to 660 in just three months after applying these strategies.

At F5 Mortgage, we’re here to support you every step of the way. We offer resources and guidance to help you reach your financial goals.

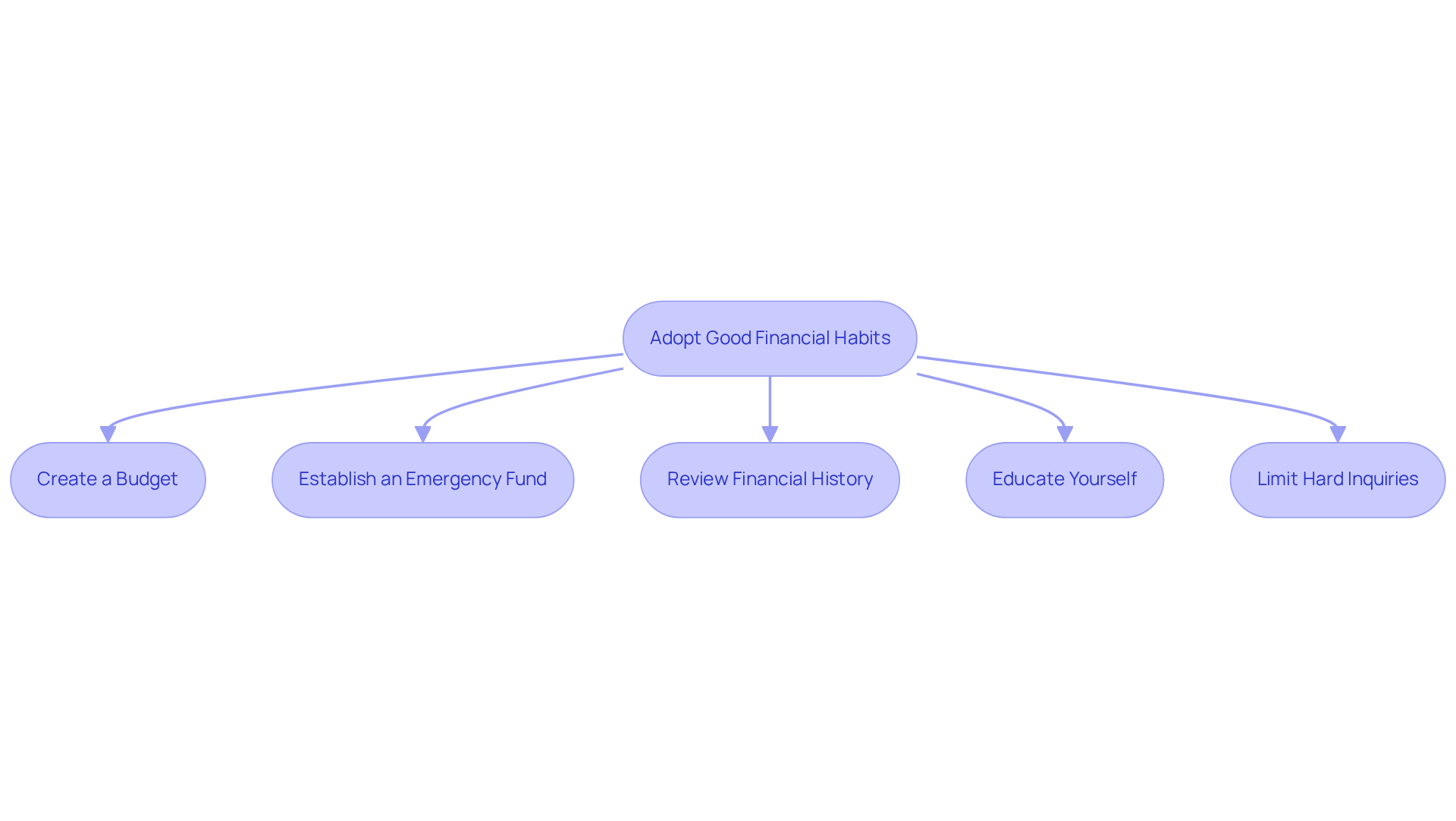

Adopt Good Financial Habits for Lasting Improvement

To maintain a healthy credit rating, we understand how important it is to adopt sound financial habits. Here are some nurturing steps you can take:

-

Create a Budget: Track your income and expenses. This will help you live within your means and feel more in control.

-

Establish an Emergency Fund: Having savings can truly make a difference. It can prevent you from relying on loans during unexpected situations, giving you peace of mind.

-

Review Your Financial History Regularly: We know how challenging it can be to keep track of everything. Checking your report at least once a year allows you to monitor your progress and catch any potential issues early.

-

Educate Yourself: Staying informed about debt management and financial literacy empowers you to make better decisions for your future.

-

Limit Hard Inquiries: Be cautious about how frequently you request new lines of financing. Excessive inquiries can adversely affect your rating, and we want you to succeed.

By adopting these habits, you’re not just setting yourself up for future financial success; you’re also aiming for a 700 credit score. Remember, we’re here to support you every step of the way.

Conclusion

Achieving a 700 credit score is not merely a financial milestone; it serves as a gateway to better mortgage options and home upgrades. This score signifies trustworthiness to lenders, which can lead to lower interest rates and improved loan terms. We understand how challenging it can be to navigate this process. By grasping the components that contribute to a credit score and taking proactive steps to enhance it, you can position yourself for financial success and turn your home improvement dreams into reality.

Throughout this article, we have highlighted several key strategies to help you improve your credit rating. These include:

- Checking your credit reports for accuracy

- Implementing effective payment habits

- Managing credit utilization

- Adopting sound financial practices

Each of these elements plays a crucial role in building a strong credit profile, essential for qualifying for favorable mortgage products. Remember, maintaining a good credit score is vital, as it directly influences your borrowing capacity and overall financial health.

Ultimately, the journey to a 700 credit score is a commitment to responsible financial management. By following the strategies outlined and fostering good habits, you can enhance your creditworthiness and unlock opportunities for home upgrades and renovations. Taking control of your financial future begins with understanding and improving your credit scores, paving the way for a more secure and prosperous life. We’re here to support you every step of the way.

Frequently Asked Questions

What is a credit score and what does it represent?

A credit score is a numerical representation of your borrowing reliability, typically ranging from 300 to 850. It indicates to lenders how trustworthy you are as a borrower.

What is considered a good credit score?

A credit score of 700 is often seen as a benchmark for favorable financial standing.

What factors determine a credit score?

Credit scores are determined by several key factors: Payment history (35%), Amounts owed (30%), Length of credit history (15%), Types of credit used (10%), New credit inquiries (10%).

Why is it important to understand credit scores?

Understanding credit scores is crucial because they directly impact your ability to secure financing with beneficial terms, including lower interest rates and better repayment options.

How does a good credit score affect mortgage options?

A credit score of 700 can significantly enhance mortgage options, making borrowers more likely to qualify for competitive mortgage products, which can lead to substantial savings over the life of the loan.

What was the average FICO score for home buyers in 2024?

In 2024, the average FICO score for home buyers reached around 717, indicating a trend toward stronger financial profiles among buyers.

What percentage of mortgage originations were from borrowers with scores of 720 and above as of Q1 2025?

As of Q1 2025, borrowers with ratings of 720 and above accounted for approximately 80% of all mortgage originations.

What are the consequences of having a lower credit score?

Borrowers with lower credit scores may face higher interest rates and less favorable loan terms, which can hinder their ability to finance home improvements effectively.

How can one improve their credit score?

While the article does not provide specific methods for improving credit scores, it emphasizes the importance of maintaining a strong rating to maximize borrowing capacity and ensure a smoother mortgage process.