Overview

Buying your first home can feel overwhelming, but we’re here to support you every step of the way. This article outlines four essential steps to help you navigate this exciting journey:

- Assessing your financial readiness

- Exploring mortgage types and options

- Engaging a real estate agent

- Making an offer to close the deal

First, it’s crucial to review your finances. Understanding your financial situation is the foundation for a successful home-buying experience. Next, take the time to explore different mortgage options. Knowing what’s available can empower you to make informed decisions that suit your needs.

Engaging a real estate agent is another important step. A professional can guide you through the complexities of the home-buying process, ensuring you feel supported and informed. Finally, when you’re ready, making an offer can be both exciting and nerve-wracking. Remember, each step is designed to prepare you for a successful purchase.

We know how challenging this can be, but with practical advice and the right support, you’ll be well-prepared to embark on this journey. Take a deep breath, and let’s get started together!

Introduction

Embarking on the journey to homeownership can be both thrilling and daunting, especially for first-time buyers. We understand how challenging this can be. The process involves a series of critical steps that not only determine your financial readiness but also influence your long-term satisfaction with your new home.

This guide offers essential insights on:

- Assessing your finances

- Exploring mortgage options

- Engaging with real estate agents

Along the way, we’ll highlight potential pitfalls that could derail your dream of owning a home.

What are the key strategies that can empower you to turn your aspirations into reality? How can you avoid common missteps along the way? We’re here to support you every step of the way.

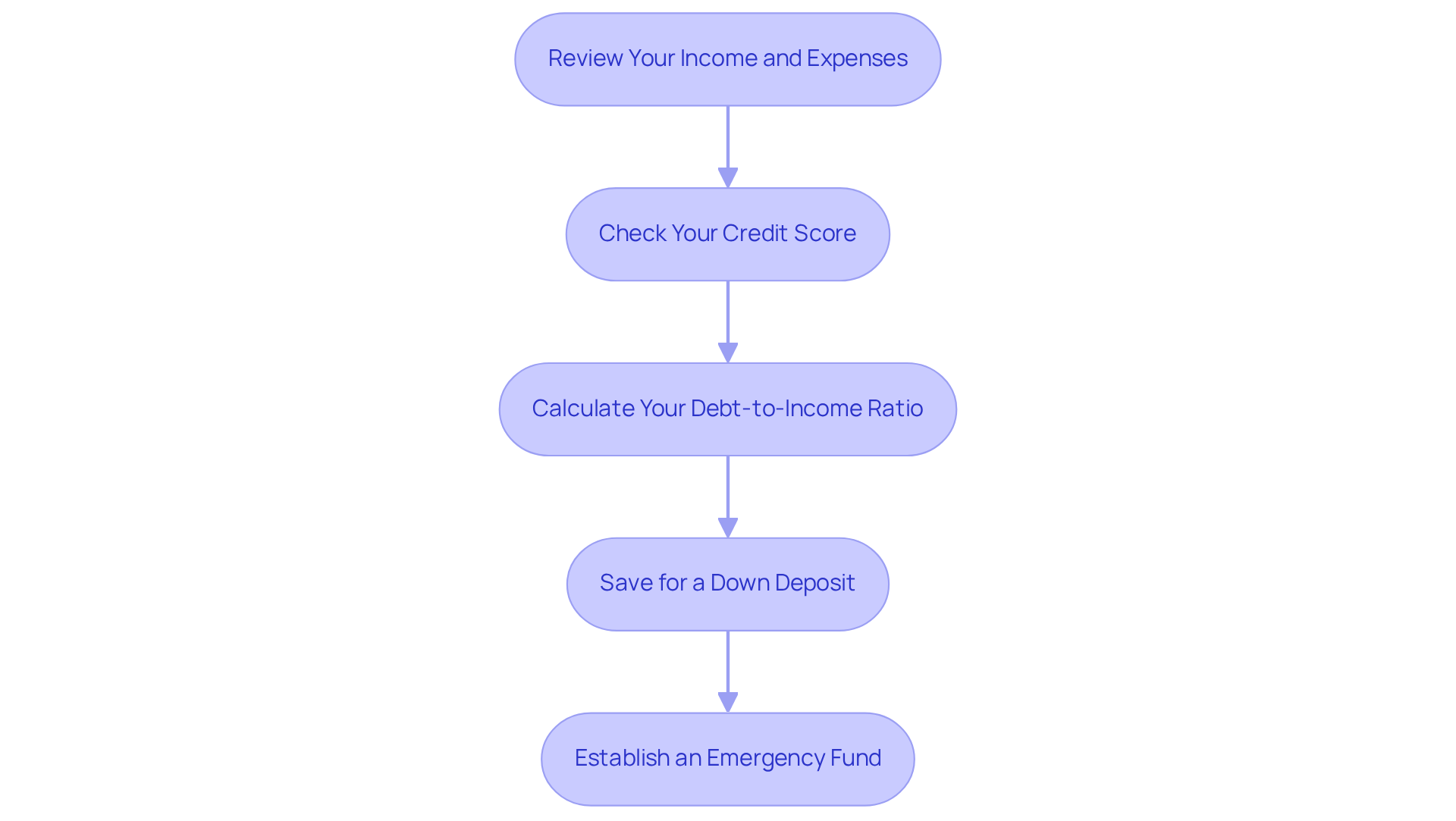

Assess Your Financial Readiness

- Review Your Income and Expenses: We understand how overwhelming it can be to manage finances. Start by calculating your total monthly income and listing all your expenses. This assessment will clarify your cash flow and help you see how much you can allocate toward a mortgage as a 1st time home buyer.

- Check Your Credit Score: Knowing your credit score is crucial. Obtain your credit report and verify your score. For conventional loans, a score of 640 or higher is typically required, while FHA loans may accept scores as low as 580. We’re here to support you in understanding this process.

- Calculate Your Debt-to-Income Ratio: This ratio compares your monthly liabilities to your gross monthly income. Aim for a ratio below 36% to enhance your chances of mortgage approval, as lenders prefer borrowers with manageable debt levels. Remember, this is a step towards your dream home as a 1st time home buyer.

- Save for a Down Deposit: Saving for a down deposit can feel daunting, but it’s essential. Determine the amount required; traditional mortgages frequently necessitate 3% to 20%, whereas FHA options may demand as little as 3.5%. Starting your savings early is crucial to meet this goal, and every little bit counts.

- Establish an Emergency Fund: Life can be unpredictable, and setting aside savings for unexpected expenses is wise. Aim to cover 3-6 months of living costs. This financial cushion will provide you with security as you as a 1st time home buyer, giving you peace of mind during this exciting journey.

Explore Mortgage Types and Options

Understand Different Mortgage Types: We know how overwhelming it can be to navigate mortgage options. Familiarizing yourself with common types can ease this process:

- Conventional Loans: These are often best for buyers with strong credit. They require a minimum down payment of 3%. If your down payment is less than 20%, you will need to pay for private mortgage insurance (PMI).

- FHA Financing: Designed for first-time buyers with lower credit scores, FHA financing allows down payments as low as 3.5%. If you have a FICO score of 580 or above, you can take advantage of reduced upfront costs, making homeownership more attainable.

- VA Financing: If you are a veteran or an active-duty military member, VA financing may be the perfect fit for you. It often requires no upfront payment and does not mandate property insurance, making it a budget-friendly choice.

- USDA Financing: Targeted at rural homebuyers, USDA financing offers zero upfront cost options, helping you achieve your dream of homeownership in qualifying areas.

Examine Fixed vs. Adjustable Rates: Choosing between fixed and adjustable-rate loans can be daunting. Fixed-rate loans provide a stable interest rate throughout the term, ensuring predictable monthly payments. On the other hand, adjustable-rate loans (ARMs) may start with lower rates but can fluctuate after an initial fixed period. Consider your risk tolerance and financial stability carefully, as ARMs could lead to higher payments if rates rise.

Get Pre-Approved: Before you start your house-hunting journey, we encourage you to seek pre-approval from lenders. This essential step involves a thorough review of your financial situation, helping you and strengthening your position as a buyer.

Compare Lenders: Taking the time to shop around and compare offers from various lenders can make a significant difference. Look for competitive interest rates, favorable terms, and reasonable fees. This diligence ensures you secure the best possible deal for your mortgage.

Engage a Real Estate Agent and Start House Hunting

- Find a qualified real estate agent: We understand how important it is to find the right agent, especially for a 1st time home buyer. Look for someone who specializes in this area. Ask friends or family for referrals, and don’t hesitate to interview multiple agents to discover the best fit for you. At F5 Mortgage, we can connect you with knowledgeable agents who truly understand the unique needs of families looking to enhance their homes. Our clients often express their gratitude, saying, ” was incredibly helpful in guiding us through the process!”

- Discuss Your Needs and Preferences: It’s essential to clearly communicate your budget, desired location, and must-have features to your agent. This clarity will help them find properties that suit your needs. Additionally, consider exploring down payment assistance programs like the Mortgage Credit Certificate in Los Angeles County, which can offer significant tax benefits and make homeownership more attainable. Many of our clients have found these programs invaluable in their home-buying journey.

- Start House Hunting: Begin your search by utilizing online listings, attending open houses, and scheduling private showings with your agent. Keep an open mind and be ready to explore a variety of homes. With F5 Mortgage’s expertise, you can also learn about different down payment assistance options available in California, enhancing your buying power. Our clients frequently share how these options have made their home-buying experience much smoother.

- Evaluate Properties: As you view homes, take notes and reflect on important factors such as location, condition, and potential resale value. Take your time; finding the right place is a journey that deserves patience. Remember, F5 Mortgage is here to support you with competitive offers and low initial costs, so you can feel confident in your decision-making process.

- Stay Within Financial Limits: It’s crucial to ensure that the properties you consider align with your budget, including loan payments, property taxes, and maintenance costs. Our dedicated team at F5 Mortgage is committed to helping you navigate financing options that align with your financial goals. Contact us today, and let us assist you in achieving your dream of homeownership!

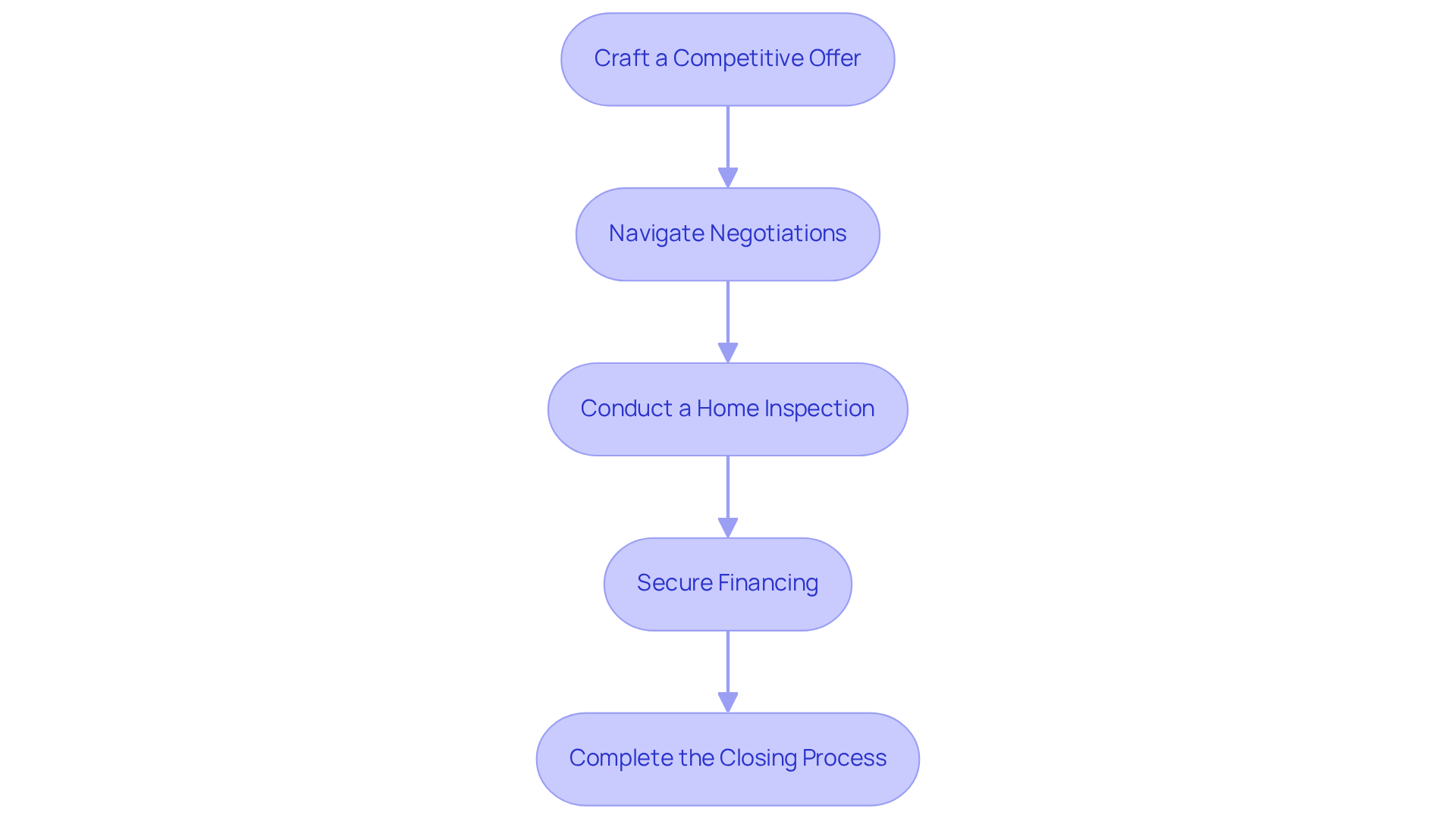

Make an Offer and Close the Deal

- Craft a Competitive Offer: We know how important it is to make a strong impression. Collaborate with your real estate agent to create a compelling offer letter that truly reflects your intent to purchase. Including an earnest money deposit can show sellers that you are serious, making your offer more appealing.

- Navigate Negotiations: We understand that negotiations can feel overwhelming. Be prepared for counteroffers, which are quite common in real estate transactions. Your agent will be there to about price, contingencies, and closing dates, ensuring you remain competitive while safeguarding your interests.

- Conduct a Home Inspection: Once your offer is accepted, it’s vital to schedule a home inspection. This step is crucial for uncovering any potential issues with the property, protecting your investment, and providing leverage in negotiations if repairs are necessary.

- Secure Financing: We’re here to support you every step of the way as you work closely with your lender to finalize your mortgage application. Prompt submission of necessary documentation is essential to prevent delays in securing your financing.

- Complete the Closing Process: When it comes time to close, carefully review the closing disclosure, which outlines the final terms of your loan and associated closing costs. Attend the closing meeting to sign the necessary documents, settle closing costs, and receive the keys to your new home.

In 2025, 1st time home buyers can expect to receive an average of three to five counteroffers during negotiations. This highlights the importance of being prepared and flexible. Successful negotiation strategies often involve clear communication and understanding the seller’s motivations, which can lead to favorable outcomes.

Conclusion

Navigating the journey of purchasing your first home can feel both exciting and intimidating. We understand how challenging this can be, and it’s crucial to grasp the essential steps to achieve success as a first-time home buyer. By assessing your financial readiness, exploring various mortgage options, engaging with a knowledgeable real estate agent, and effectively managing the offer and closing processes, you can position yourself for a smoother transition into homeownership.

This article outlines a comprehensive approach, starting with a thorough evaluation of your financial status, including income, expenses, credit scores, and debt ratios. It emphasizes the importance of saving for a down payment and establishing an emergency fund, which together lay a solid foundation for your future financial stability. Furthermore, understanding different mortgage types and the benefits of pre-approval is vital, as it allows you to make informed decisions that align with your needs and budget.

Ultimately, the path to homeownership is not just about securing a mortgage or finding a property; it’s about making informed choices that lead to long-term satisfaction and financial health. As the landscape for first-time buyers evolves, staying informed about current mortgage rates, assistance programs, and effective negotiation strategies is essential. Embracing these insights can empower you to approach your home-buying journey with confidence, ensuring you are well-prepared to turn your dream of owning a home into a reality.

Frequently Asked Questions

What should I do to assess my financial readiness for buying a home?

Start by calculating your total monthly income and listing all your expenses to understand your cash flow and determine how much you can allocate toward a mortgage.

Why is it important to check my credit score?

Knowing your credit score is crucial because it affects your mortgage options. Conventional loans typically require a score of 640 or higher, while FHA loans may accept scores as low as 580.

How do I calculate my debt-to-income ratio, and what is a good target?

The debt-to-income ratio compares your monthly liabilities to your gross monthly income. Aim for a ratio below 36% to enhance your chances of mortgage approval, as lenders prefer borrowers with manageable debt levels.

How much should I save for a down deposit?

Traditional mortgages often require a down deposit of 3% to 20%, while FHA loans may require as little as 3.5%. It’s important to start saving early, as every little bit counts.

Why is it necessary to establish an emergency fund?

Establishing an emergency fund is wise to cover unexpected expenses, aiming for 3-6 months of living costs. This financial cushion provides security as you transition into homeownership, offering peace of mind during the process.