Overview

Navigating the world of FHA cash-out refinancing can be challenging, but we’re here to support you every step of the way. This article outlines four key strategies that can help you achieve success:

- Improving your credit scores

- Understanding eligibility requirements

- Setting clear financial goals

- Maintaining a low debt-to-income ratio

Each of these strategies plays a crucial role in securing better loan terms and effectively managing your finances while accessing the equity in your home.

We know how important it is to feel confident in your financial decisions. By focusing on enhancing your credit score, you’ll not only improve your chances of approval but also unlock more favorable rates. Understanding the eligibility requirements can feel overwhelming, but breaking them down into manageable steps can empower you to take charge of your refinancing journey.

Setting clear financial goals is essential. It gives you a direction and purpose, making the process feel less daunting. Lastly, maintaining a low debt-to-income ratio is vital for securing the best possible terms. By keeping your debts in check, you can position yourself as a responsible borrower, which lenders appreciate.

These strategies are designed with your needs in mind, helping you to navigate the complexities of refinancing with confidence. Remember, you’re not alone in this process, and with the right approach, you can make informed decisions that benefit your financial future.

Introduction

Navigating the complexities of FHA cash-out refinancing can feel overwhelming for homeowners who want to tap into their property’s equity. We understand how challenging this can be. This financial strategy not only opens doors to funds for essential needs—like home improvements and debt consolidation—but it also brings unique challenges that deserve thoughtful consideration.

As mortgage rates change and eligibility criteria shift, how can you, as a property owner, ensure you maximize the benefits of this refinancing option while minimizing potential pitfalls?

In this article, we’re here to support you every step of the way by exploring four key strategies that can lead to FHA cash-out refinancing success. Our goal is to equip you with the knowledge you need to make informed financial decisions.

Understand FHA Cash-Out Refinancing Basics

FHA cash out allows property owners to replace their current mortgage with a new, larger FHA-backed loan, providing them access to the equity they’ve built in their homes. The FHA cash out process allows homeowners to borrow against their property’s value, which can be especially helpful for those looking to consolidate debt, fund home improvements, or manage unexpected expenses. Unlike conventional refinancing, cash extraction refinancing provides a one-time payment at closing, making it a flexible financial tool. However, it’s important to consider the implications of increasing your mortgage balance, as this could lead to higher monthly payments and a greater overall debt burden.

As we look ahead to 2025, the FHA withdrawal refinance effective rate averages 6.80%, which is higher than the conventional withdrawal rate of 6.25%. Homeowners can borrow up to 80% of their home’s appraised value, as long as they maintain at least 20% equity. For example, a property owner with a home valued at $400,000 and a loan balance of $250,000 could potentially access $65,000 in cash after accounting for closing costs, typically ranging from $8,000 to $24,000, as well as equity requirements.

FHA loans are accommodating, allowing credit scores as low as 500. However, lenders usually prefer scores between 600 and 660. This flexibility can be beneficial for those with less-than-perfect credit, enabling them to effectively leverage their home equity. It’s essential to keep in mind the requirement for mortgage insurance, which can increase overall loan costs.

As mortgage rates remain high, understanding the intricacies of FHA cash out options becomes vital for property owners looking to enhance their financial choices. We know how challenging this can be, and we’re here to support you every step of the way as you navigate the complexities of the mortgage landscape.

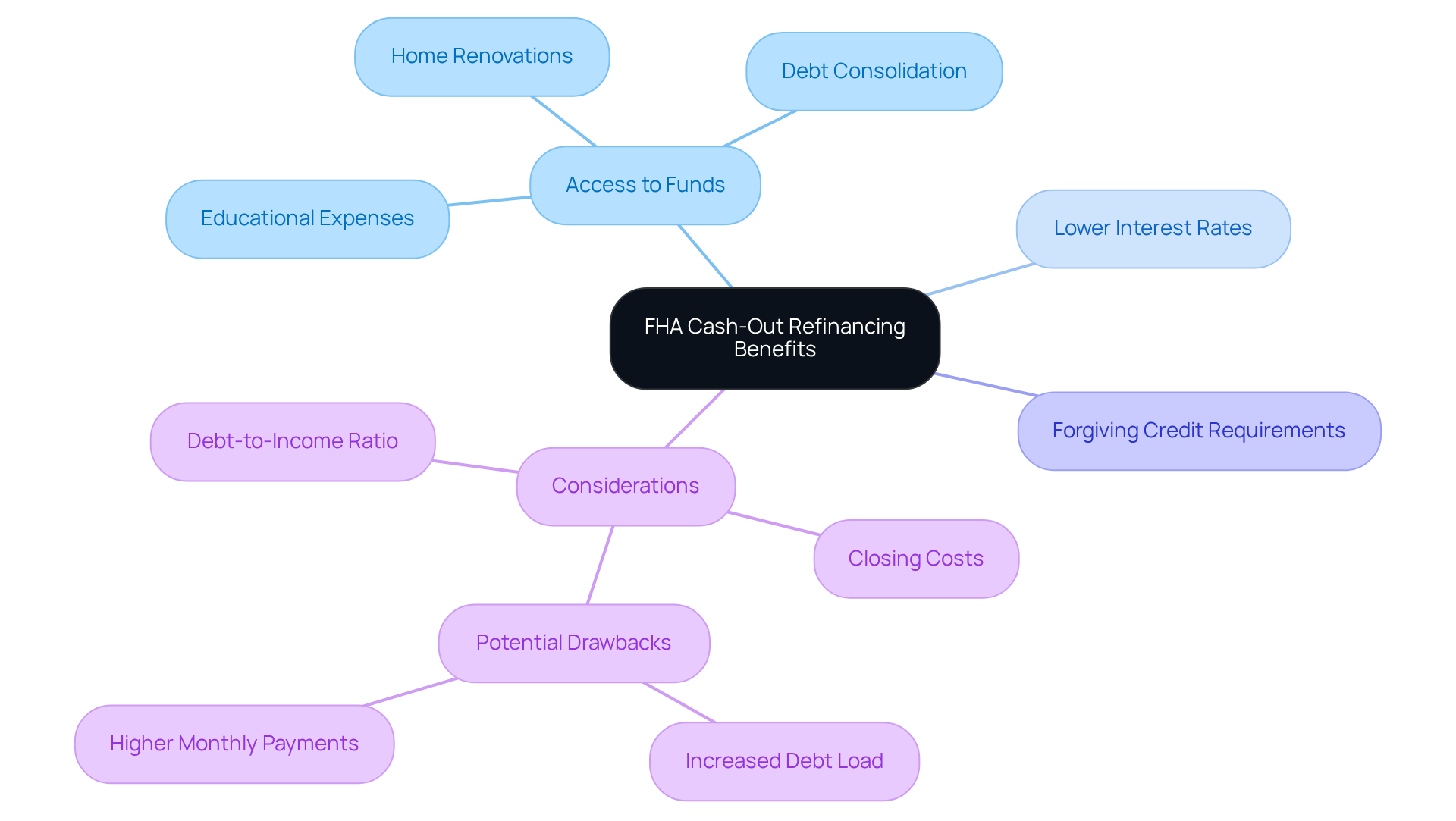

Identify Key Benefits of FHA Cash-Out Refinancing

FHA cash out restructuring provides property owners a wonderful opportunity to access funds at lower interest rates compared to personal loans or credit cards. Imagine being able to borrow up to 80% of your property’s appraised value—this means you could secure significant funds for important needs like home renovations, debt consolidation, or educational expenses. This option is especially beneficial for those who may have less-than-perfect credit, as FHA loans often have more forgiving credit score requirements, typically starting at a minimum of 580.

However, we understand that it’s crucial to consider the closing costs associated with FHA refinancing, which usually range from 2% to 6% of the loan amount. For example, if your property is valued at $400,000 and you have an existing mortgage balance of $250,000, you could potentially access $65,000 in cash after accounting for closing costs. This figure is calculated by taking 80% of the home’s value ($320,000), subtracting the current loan balance ($250,000), and factoring in the closing costs.

Moreover, to qualify for an FHA refinance, property owners need to maintain a debt-to-income ratio of 43% or lower. The process is generally quicker than conventional methods, allowing you to secure funds when you need them most. While FHA cash out restructuring provides considerable benefits, it’s also important to recognize potential drawbacks, such as increased debt and higher monthly mortgage payments. This combination of competitive rates, accessibility, and speed makes FHA equity extraction an appealing option for property owners looking to make the most of their home equity. We know how challenging navigating these choices can be, and we’re here to support you every step of the way.

Clarify Eligibility Requirements for FHA Cash-Out Refinancing

If you’re considering FHA cash out refinancing, it’s important to understand the key criteria that can help you achieve your goals. We know how challenging this can be, and we’re here to support you every step of the way. Generally, a minimum credit score of 580 is necessary, though some lenders may ask for at least 600 under certain circumstances. Maintaining at least 20% equity in your home, calculated from the appraised value minus your existing mortgage balance, is also crucial.

Additionally, a debt-to-income (DTI) ratio of 43% or less is preferred, ensuring that you can manage your new mortgage payments comfortably. It’s essential to have resided in the dwelling for at least 12 months before applying for an FHA refinance. A steady employment history and a positive payment record on your existing mortgage will further strengthen your application.

As we look ahead to 2025, the average credit score of FHA refinance applicants reflects these standards, highlighting the importance of maintaining good credit health. Remember, as Reyna Gobel wisely notes, “Your debt-to-income ratio (DTI) should be at or below 43% of your gross monthly income,” underscoring the need for financial stability.

Moreover, the FHA cash out options allow property owners to borrow as much as 80% of their residence’s appraised worth, providing substantial opportunities for financial restructuring. By understanding these criteria and preparing accordingly, you can take confident steps toward securing the refinancing you need.

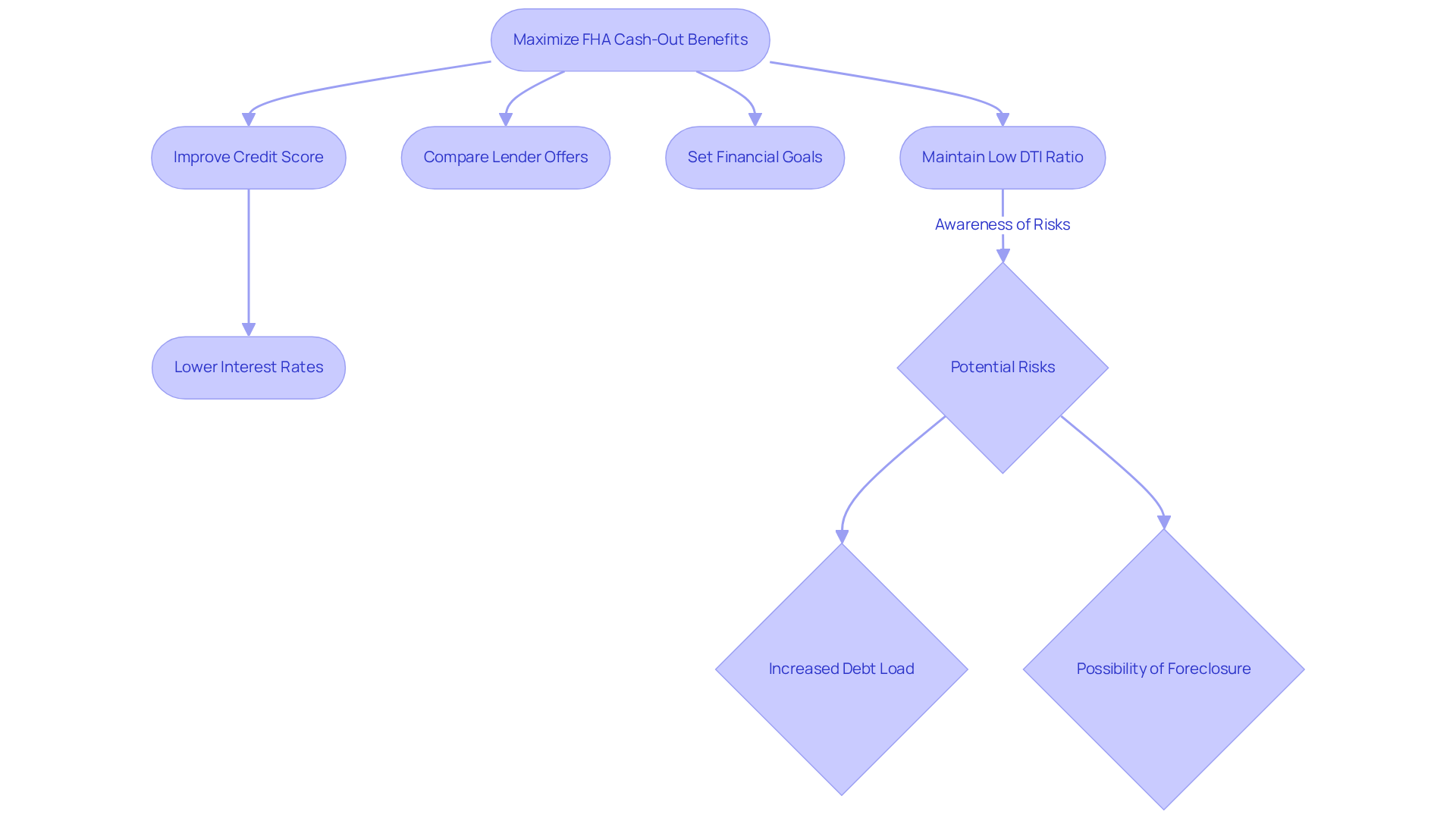

Implement Strategies to Maximize Cash-Out Benefits

To fully harness the benefits of FHA cash out, it’s important for homeowners to prioritize improving their credit scores before applying. We understand that navigating this process can feel overwhelming, but a better credit score can significantly lower interest rates and enhance loan conditions. This makes obtaining a new loan more advantageous. In 2025, average interest rates among FHA lenders have shown notable variations, highlighting the need to compare offers from multiple lenders to secure the most favorable rates and terms. Notably, the average contract interest rate for 30-year fixed-rate mortgages has decreased to 6.73 percent, presenting an opportune moment to consider refinancing.

Setting clear financial goals for the funds is also essential, whether it’s for home renovations, debt consolidation, or other investments. This clarity ensures that your financial restructuring aligns with your long-term strategy. Additionally, maintaining a low debt-to-income (DTI) ratio is crucial, as most lenders set the DTI ratio limit at 45% for refinance eligibility. This not only helps in qualifying for the refinance but also supports effective management of future payments. By applying these strategies, you can enhance your loan modification experience and work towards achieving your financial objectives.

However, it’s important to remain aware of the potential risks associated with FHA cash out refinancing. We know how challenging this can be, as it may lead to an increased debt load or even the possibility of foreclosure if payments are not maintained. Remember, we’re here to support you every step of the way.

Conclusion

FHA cash-out refinancing offers a wonderful opportunity for homeowners to access their home equity for various financial needs. By replacing an existing mortgage with a larger FHA-backed loan, property owners can unlock significant funds while benefiting from more lenient credit requirements compared to conventional loans. However, it’s essential to approach this financial tool with a clear understanding of the associated costs and implications, ensuring that the decision aligns with your long-term financial goals.

In this article, we’ve discussed key strategies for successful FHA cash-out refinancing. We understand how challenging this process can feel, so recognizing eligibility criteria, improving credit scores, and managing debt-to-income ratios are crucial steps to take. Additionally, we highlighted potential benefits, such as lower interest rates and access to substantial cash, while also emphasizing the importance of being aware of risks like increased debt and higher monthly payments.

Ultimately, we encourage homeowners to take proactive steps to educate themselves about FHA cash-out refinancing and consider their unique financial situations. By leveraging the insights provided, you can make informed decisions that enhance your financial well-being. Whether it’s for consolidating debt, funding home improvements, or managing unexpected expenses, the right approach to FHA cash-out refinancing can lead to greater financial freedom and stability. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is FHA cash-out refinancing?

FHA cash-out refinancing allows property owners to replace their current mortgage with a new, larger FHA-backed loan, enabling them to access the equity they have built in their homes.

What are the benefits of FHA cash-out refinancing?

It helps homeowners borrow against their property’s value, which can be useful for consolidating debt, funding home improvements, or managing unexpected expenses.

How does FHA cash-out refinancing differ from conventional refinancing?

Unlike conventional refinancing, FHA cash-out refinancing provides a one-time payment at closing, making it a more flexible financial tool.

What are the potential drawbacks of FHA cash-out refinancing?

Increasing your mortgage balance could lead to higher monthly payments and a greater overall debt burden.

What is the average effective rate for FHA cash-out refinancing as of 2025?

The average effective rate for FHA cash-out refinancing is 6.80%, which is higher than the conventional withdrawal rate of 6.25%.

How much can homeowners borrow through FHA cash-out refinancing?

Homeowners can borrow up to 80% of their home’s appraised value, provided they maintain at least 20% equity.

Can you provide an example of how much cash can be accessed through FHA cash-out refinancing?

For a home valued at $400,000 with a loan balance of $250,000, a property owner could potentially access $65,000 in cash after accounting for closing costs, which typically range from $8,000 to $24,000.

What are the credit score requirements for FHA loans?

FHA loans allow credit scores as low as 500, but lenders generally prefer scores between 600 and 660.

Is mortgage insurance required with FHA cash-out refinancing?

Yes, mortgage insurance is required, which can increase the overall loan costs.

Why is understanding FHA cash-out options important for property owners?

With high mortgage rates, understanding FHA cash-out options is vital for property owners looking to enhance their financial choices.