Overview

Conventional mortgages are traditional home loans offered by private lenders, not backed by the government. They come with flexible terms and competitive interest rates, making them an important option for many families. We know how challenging navigating the housing market can be, which is why understanding these loans is crucial.

This article highlights key characteristics of conventional mortgages, such as:

- Down payment options

- Interest rate types

- Stricter qualification criteria

By detailing these aspects, we aim to help you see how these loans can be a viable option for financing your home.

We’re here to support you every step of the way as you explore your options. Understanding these elements can empower you to make informed decisions that align with your family’s needs.

Introduction

Navigating the complex world of home financing can feel overwhelming, and understanding the intricacies of conventional mortgages is crucial. These loans, distinct from government-backed options, offer a blend of flexibility and competitive rates that can significantly ease your path to homeownership. However, we know how challenging this can be. With stricter qualification criteria and varying terms, how can you determine if a conventional mortgage is the right choice for your financial journey?

Exploring the key characteristics and implications of these loans can empower you to make informed decisions that align with your homeownership goals. We’re here to support you every step of the way as you consider your options.

Define Conventional Mortgage: Key Characteristics and Structure

Many families looking to secure financing for their dream home often wonder what is a conventional mortgage and if it can be a great option for them. Unlike government-backed alternatives such as FHA or VA loans, these loans are not insured or guaranteed by the government. They are offered by private lenders and can be classified as either conforming or non-conforming.

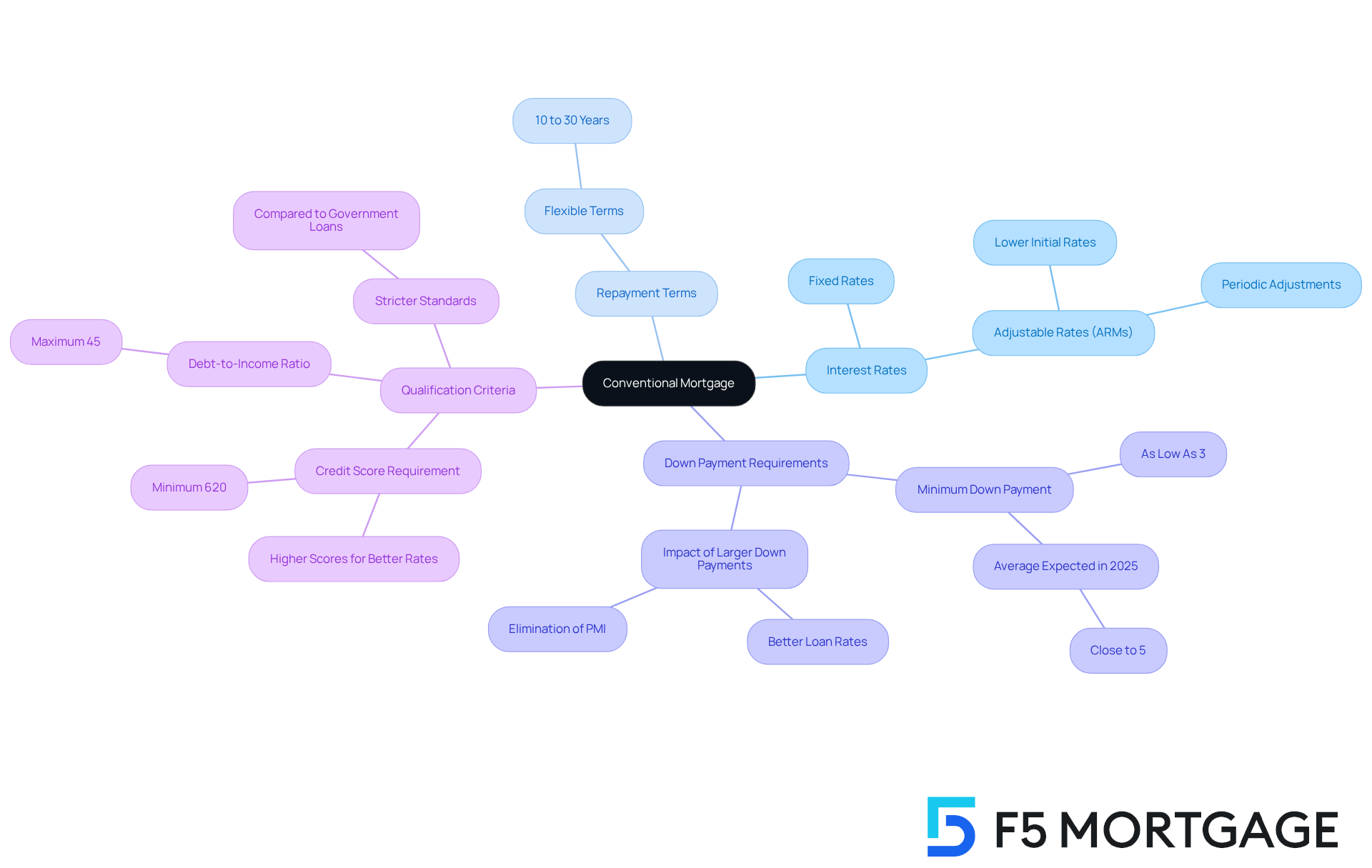

Interest Rates: Conventional mortgages can feature fixed or adjustable interest rates. Adjustable-rate mortgages (ARMs) typically start with lower initial rates that adjust periodically—usually every six months—based on market conditions. This regular modification can make ARMs particularly appealing for borrowers who plan to pay off their loan quickly or refinance in a few years.

Repayment Terms: One of the advantages of conventional loans is the variety of repayment terms available. Borrowers can choose from terms generally ranging from 10 to 30 years, allowing for flexibility based on their individual financial situations.

Down Payment Requirements: The down payment for conventional loans can be as low as 3%, making them accessible for many homebuyers. However, a larger down payment may lead to better loan rates and eliminate the need for private insurance (PMI). In 2025, the average down payment percentage for traditional loans is expected to remain close to 5%, indicating a shift towards more attainable home financing alternatives. For comparison, FHA mortgages allow down payments as low as 3.5%, while VA and USDA financing can provide opportunities with 0% down payment, leading many to wonder what is a conventional mortgage.

Stricter Qualification Criteria: It’s important to note that, due to the absence of government insurance, lenders often impose stricter credit score requirements—typically a minimum of 620—and a debt-to-income ratio cap of 45%. This makes it essential for loan seekers to maintain a strong financial profile, as these standards can significantly influence their ability to secure a home loan. An endorsement from a lender signifies that they view you as a suitable candidate for financing based on your financial details, providing an estimate of your funding amount, interest percentage, and potential monthly payment.

We understand how challenging navigating the world of home loans can be, and comprehending what is a conventional mortgage and its framework and prerequisites is essential for prospective borrowers. These financial products often offer competitive rates and flexibility compared to government-supported options. For example, conventional financing can be especially beneficial for those looking to acquire primary residences, investment properties, or vacation homes, as they do not carry the same limitations as government-backed financing. We’re here to support you every step of the way in making informed decisions about your home financing options.

Context and Importance of Conventional Mortgages in Home Financing

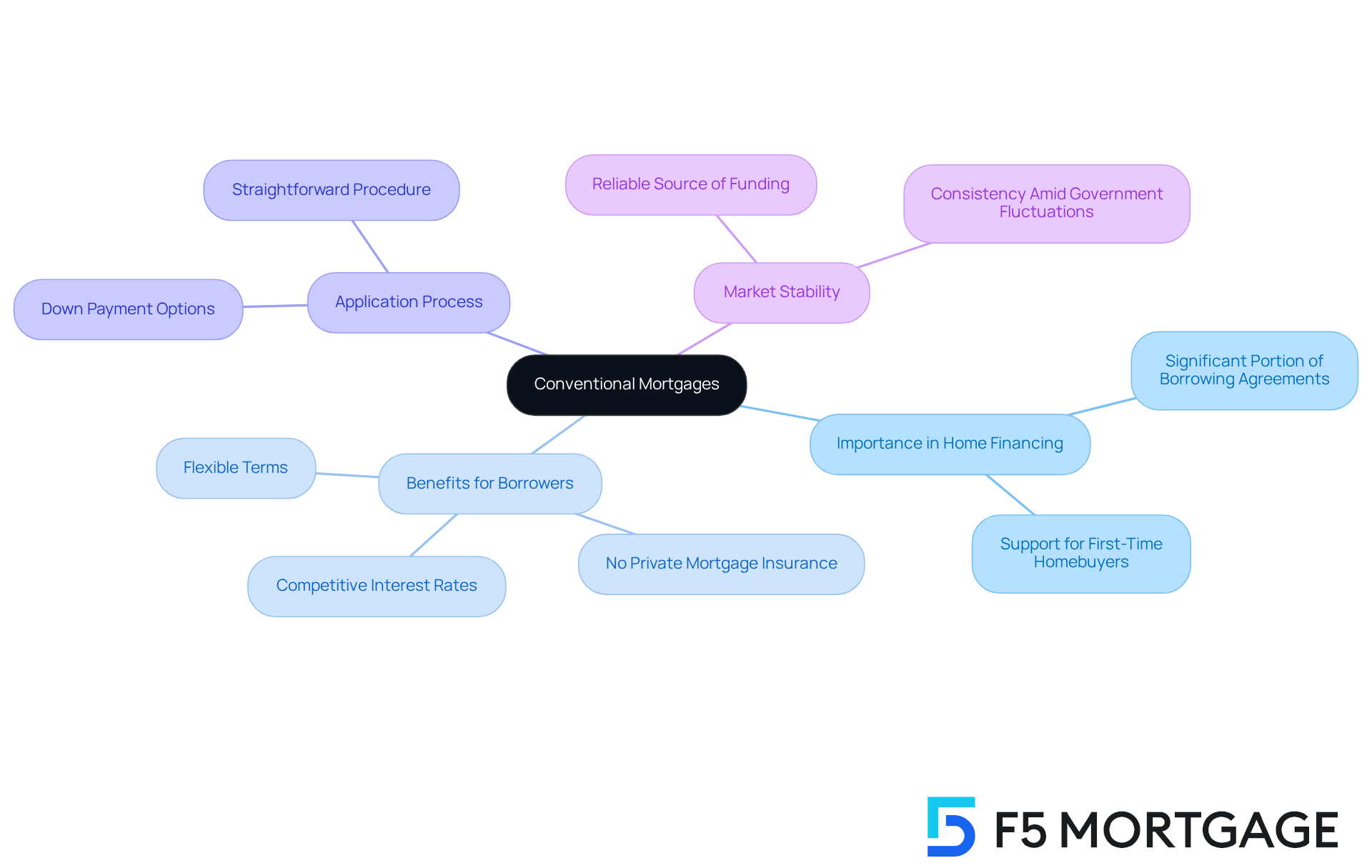

In the home funding landscape, understanding what is a conventional mortgage is vital, as traditional financing options represent a significant portion of borrowing agreements in the United States. For first-time homebuyers and those considering refinancing, learning what is a conventional mortgage can provide options that often offer competitive interest rates and flexible terms, which can alleviate some of the stress associated with financing a home.

We understand how daunting this process can be. The appeal of what is a conventional mortgage lies not only in the straightforward application procedure but also in the ability to eliminate the need for private mortgage insurance when a down payment of 20% or more is made. This can provide a sense of relief as you navigate your home financing journey.

Moreover, understanding what is a conventional mortgage contributes to the stability of the housing market. They provide a reliable source of funding that remains consistent, regardless of fluctuations in government programs. Knowing that you have access to such dependable options can empower you to make informed decisions about your future home. We’re here to support you every step of the way as you explore these financing opportunities.

Types of Conventional Mortgages: Variations and Their Implications

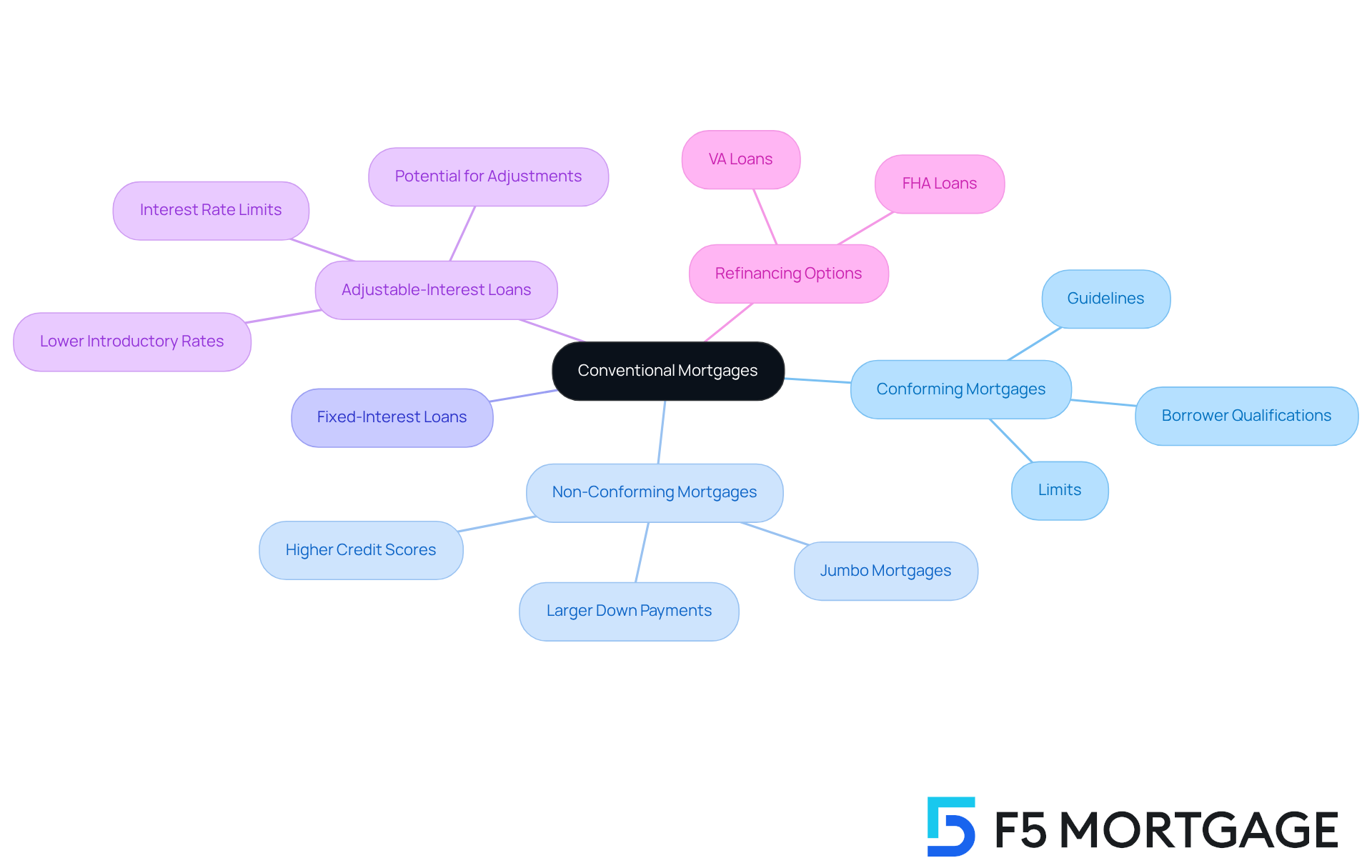

Navigating the world of mortgages can feel overwhelming, but understanding your options is the first step toward making the right choice for your family. There are various kinds of what is a conventional mortgage, each with its unique implications. The two primary classifications are conforming and non-conforming types. Conforming mortgages adhere to the guidelines set by government-sponsored entities like Fannie Mae and Freddie Mac. These include specific limits and borrower qualifications that can help you feel more secure in your decision.

On the other hand, non-conforming mortgages—often referred to as jumbo mortgages—exceed these limits. They typically require higher credit scores and larger down payments. To understand what is a conventional mortgage, it’s important to know that traditional home loans can be fixed-interest, where the interest remains constant throughout the loan duration, or adjustable-interest, where the interest rate may fluctuate after an initial fixed period.

Adjustable-rate loans (ARMs) can be appealing since they often start with lower introductory rates. This makes them attractive for families planning to pay off their loan quickly or refinance in a few years. However, it’s crucial to be aware of the potential for adjustments and understand the significance of interest limits that protect you from significant increases.

We know how challenging this can be, but grasping these variations is essential for choosing the optimal loan option that meets your needs. When evaluating refinancing choices available in Colorado, such as FHA and VA loans, remember that we’re here to support you every step of the way.

Eligibility Requirements for Conventional Mortgages: What You Need to Qualify

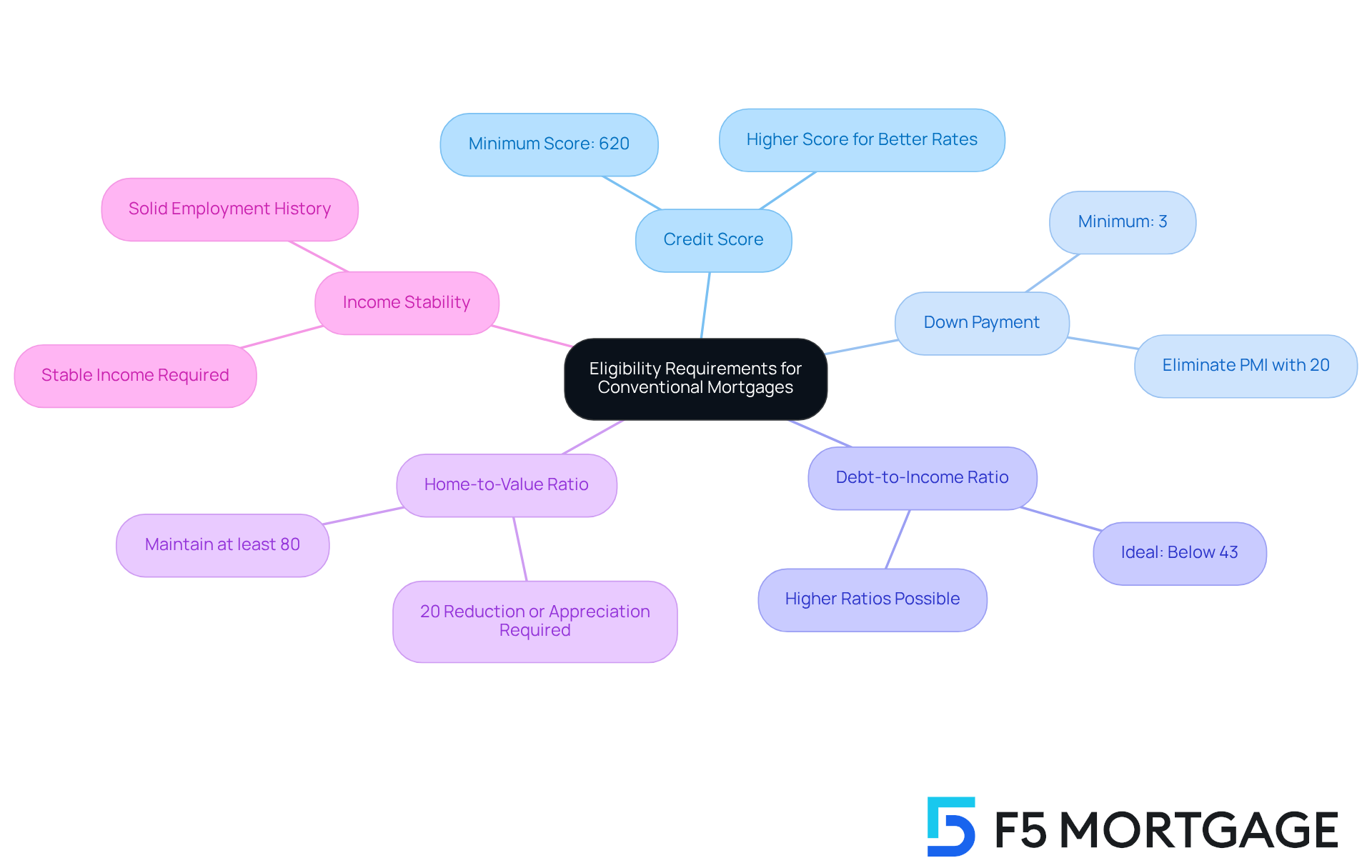

We know how challenging it can be to navigate the world of home loans. To qualify for a traditional home loan, individuals typically need a minimum credit score of 620. However, if you’re aiming for better rates and conditions, a higher score may be necessary. Additionally, a down payment of at least 3% is generally required, but if you can put down 20%, you can eliminate the need for private mortgage insurance (PMI).

Lenders also take a close look at your debt-to-income (DTI) ratio, which ideally should be below 43%. Some lenders may allow for higher ratios based on other financial factors, so it’s important to explore your options. Demonstrating stable income and a solid employment history is crucial, making it essential for potential applicants to prepare their financial documentation thoroughly.

It’s important to note that many lenders require homeowners to maintain at least an 80% home-to-value mortgage ratio. This means you need to have reduced at least 20% of your initial amount or that your property has appreciated in value. For those considering a cash-out home equity line, be aware that it may come with even higher equity requirements.

Understanding what is a conventional mortgage and its requirements is vital for navigating the mortgage approval process. We encourage you to examine the various financing programs offered by F5 Mortgage, including both standard and nontraditional alternatives. If you’re self-employed, bank statement loans can be a valuable option, as they allow income calculation based on your business cash flow. We’re here to support you every step of the way.

Conclusion

Understanding what a conventional mortgage is can be a vital first step for anyone navigating the complex landscape of home financing. We know how challenging this can be, and these loans, distinct from government-backed options, offer flexibility and competitive rates that many homebuyers find appealing. By grasping the structure and characteristics of conventional mortgages, you can make informed decisions that align with your financial goals.

This article delves into essential aspects of conventional mortgages, including:

- Interest rates

- Repayment terms

- Down payment requirements

- Stricter qualification criteria

It highlights the difference between conforming and non-conforming loans, emphasizing the importance of maintaining a robust financial profile to secure favorable terms. Moreover, it underscores the role of these mortgages in promoting stability within the housing market, offering reliable funding options not subject to the volatility of government programs.

In conclusion, recognizing the significance of conventional mortgages in home financing empowers you to explore your options confidently. As the landscape of home loans evolves, staying informed about current trends and eligibility requirements will be vital for making sound financial decisions. Whether you are considering a purchase or refinancing, understanding conventional mortgages can pave the way toward achieving your homeownership dreams.

Frequently Asked Questions

What is a conventional mortgage?

A conventional mortgage is a type of home loan that is not insured or guaranteed by the government, unlike government-backed loans such as FHA or VA loans. These loans are offered by private lenders.

What are the two types of conventional mortgages?

Conventional mortgages can be classified as either conforming or non-conforming loans.

What types of interest rates can conventional mortgages have?

Conventional mortgages can feature either fixed or adjustable interest rates. Adjustable-rate mortgages (ARMs) typically start with lower initial rates that adjust periodically based on market conditions.

What are the repayment terms available for conventional mortgages?

Conventional loans offer a variety of repayment terms, generally ranging from 10 to 30 years, allowing borrowers flexibility based on their financial situations.

What are the down payment requirements for conventional mortgages?

The down payment for conventional loans can be as low as 3%. However, a larger down payment may lead to better loan rates and can eliminate the need for private mortgage insurance (PMI).

What is the expected average down payment percentage for conventional loans in 2025?

The average down payment percentage for conventional loans is expected to remain close to 5% in 2025.

What are the qualification criteria for obtaining a conventional mortgage?

Conventional mortgages typically require a minimum credit score of 620 and a debt-to-income ratio cap of 45%. This means borrowers need to maintain a strong financial profile to secure a loan.

What types of properties can be financed with conventional mortgages?

Conventional financing can be beneficial for acquiring primary residences, investment properties, or vacation homes, as they do not carry the same limitations as government-backed financing.