Overview

Navigating the world of VA loans can feel overwhelming, especially when it comes to understanding credit score requirements. While the VA does not set a minimum score, it’s important to know that most lenders typically look for a score of at least 620. This insight is crucial as it helps families gauge their eligibility.

Lenders assess creditworthiness through various factors, including:

- Credit scores

- Debt-to-income ratios

- Other compensating factors

We know how challenging this can be, and we’re here to support you every step of the way. By understanding these elements, families can better navigate their path to VA financing.

Ultimately, being informed empowers you to take the next steps with confidence. Remember, you are not alone in this journey; there are resources available to help guide you through the process.

Introduction

Navigating the complexities of VA loans can feel overwhelming for many families. We understand how challenging it can be, especially when it comes to grasping credit score requirements. While these loans offer remarkable benefits—like no down payment and no private mortgage insurance—the nuances of credit scores can significantly impact eligibility.

So, what should families know about the minimum credit score needed to secure a VA loan? How can they effectively enhance their financial standing?

This article delves into essential insights on VA loan credit score requirements, empowering families to make informed decisions on their journey to homeownership. We’re here to support you every step of the way as you explore your options and work towards achieving your dream.

Explore VA Loans and the Role of Credit Scores

VA financing is a unique mortgage choice available to veterans, active-duty personnel, and specific members of the National Guard and Reserves. Supported by the U.S. Department of Veterans Affairs (VA), these financial products often come with significant benefits, such as no down payment and no private mortgage insurance (PMI). In Colorado, VA financing typically offers excellent mortgage rates and a streamlined application process, making it an appealing option for eligible families.

We understand how overwhelming the mortgage process can feel, especially when navigating your options. While the VA loan credit score does not have a minimum requirement, most lenders, including F5 Mortgage, generally look for a score of at least 620. This score serves as a benchmark for assessing a borrower’s creditworthiness and ability to repay the loan. Recognizing the connection between VA financing and the VA loan credit score is essential for families aiming to make informed financial decisions.

At F5 Mortgage, we’re here to support you every step of the way. We can help review your eligibility and ensure you meet all necessary requirements, guiding you towards achieving your homeownership dreams. Remember, you’re not alone in this journey; we’re committed to helping you find the best path forward.

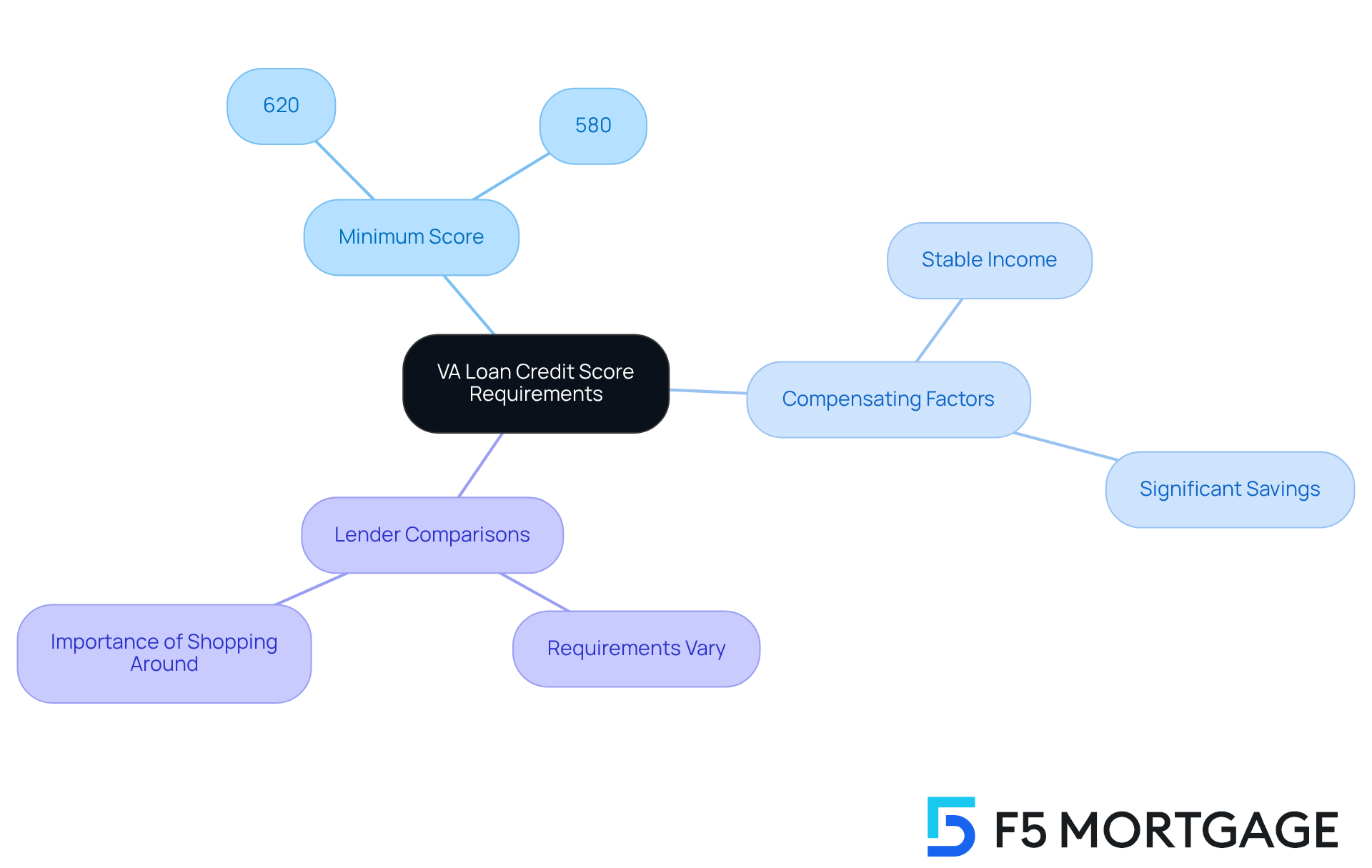

Identify Minimum Credit Score Requirements for VA Loans

While the VA does not set a minimum credit rating, we understand that most lenders typically require a VA loan credit score of at least 620 to qualify for a VA loan. Some lenders may be open to accepting lower ratings, especially if you have strong compensating factors, such as a stable income or significant savings. For example, lenders like Veterans United generally look for a minimum VA loan credit score of 620, while others might allow VA loan credit scores as low as 580 under certain conditions.

It’s important for families to shop around and compare lenders, as requirements can vary greatly. Understanding these thresholds can empower you to assess your eligibility and prepare for the application process. Additionally, we know how vital it is to negotiate with sellers, which may include making repair requests as part of your offer. This knowledge can aid you in making informed decisions when purchasing a home. Remember, we’re here to support you every step of the way.

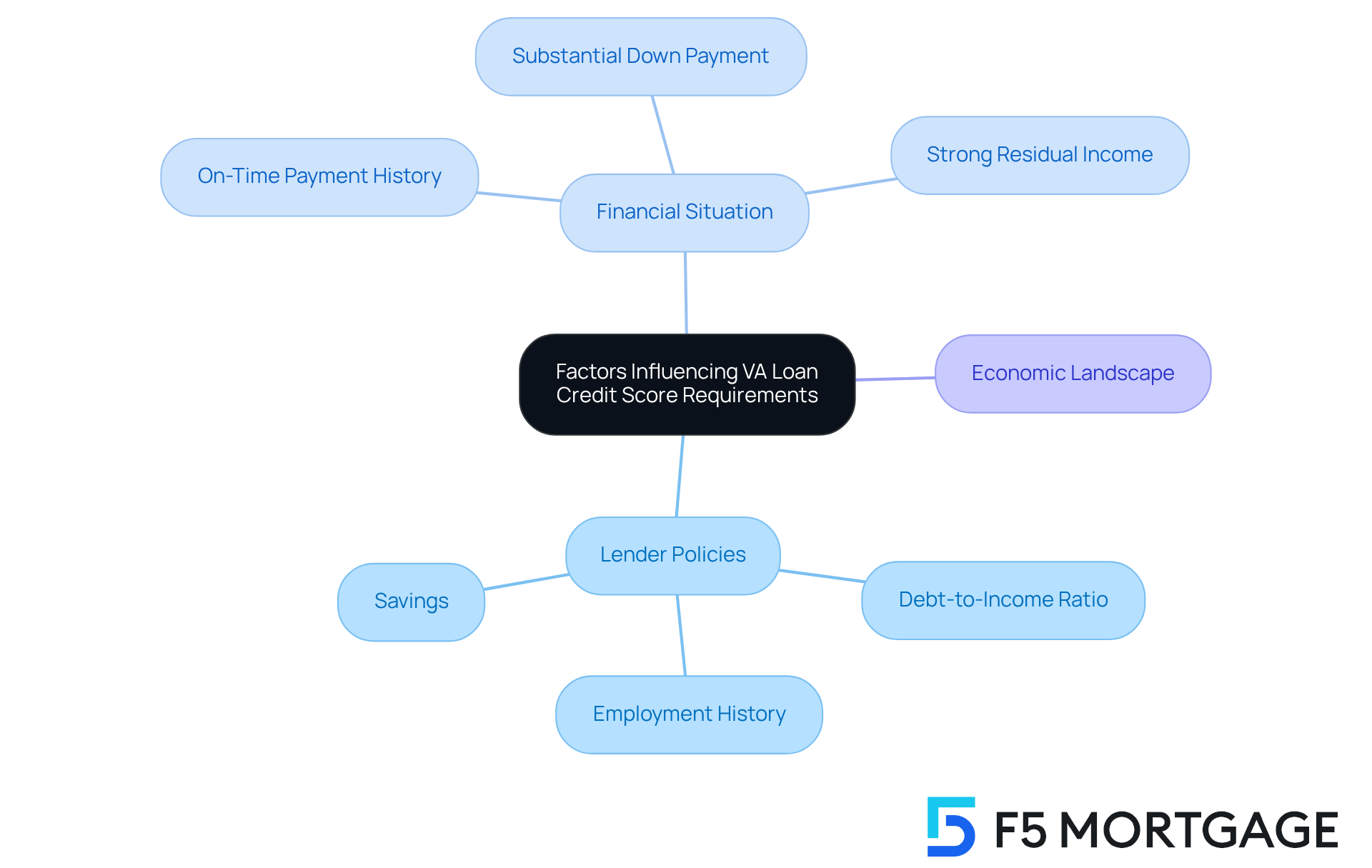

Examine Factors Influencing VA Loan Credit Score Requirements

Navigating the world of VA loans can feel overwhelming, especially with so many factors at play. Multiple elements can influence rating criteria, including the lender’s policies, your financial situation, and the broader economic landscape. Lenders look beyond just the rating; they also assess your debt-to-income (DTI) ratio, employment history, and savings. If your DTI ratio is lower, ideally below 41%, it can significantly enhance your profile, even if your credit score isn’t perfect.

In addition to VA financing, we understand that Colorado residents may be exploring other refinancing options. Conventional loans and FHA offerings could also be suitable, depending on your unique circumstances. For those with existing FHA mortgages, the streamlined refinance option is a valuable choice to consider, allowing you to lower your interest rates with ease.

Lenders may also take into account compensating factors, such as:

- A solid history of on-time payments

- A substantial down payment

- A strong residual income

Understanding these elements is crucial; it empowers you to plan your application effectively. We know how challenging this can be, but we’re here to support you every step of the way, especially when evaluating the various refinancing alternatives offered by F5 Mortgage.

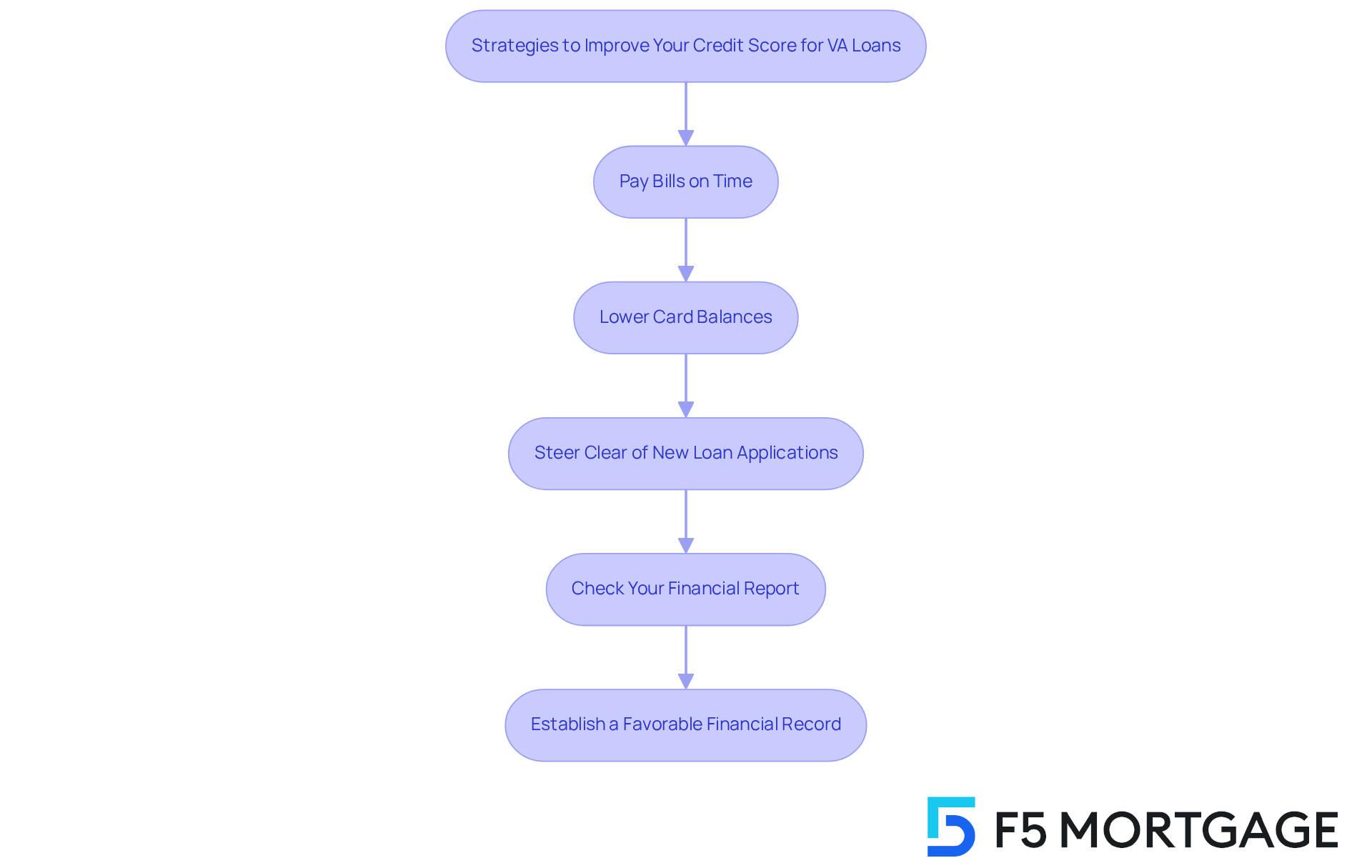

Implement Strategies to Improve Your Credit Score for VA Loans

Enhancing your financial rating is a crucial step in improving your VA loan credit score as you prepare for a VA loan application. We know how challenging this can be, but there are several strategies you can implement to improve your financial standing:

- Pay Bills on Time: Your payment history is the most significant factor influencing your rating. Setting reminders or automating payments can help ensure that you never miss a due date.

- Lower Card Balances: Aim to keep your credit utilization ratio below 30%. Reducing your current debt can significantly boost your rating.

- Steer Clear of New Loan Applications: Remember, every new inquiry can temporarily lower your rating. Focus on maintaining your existing accounts instead of opening new ones.

- Check Your Financial Report: Regularly reviewing your financial report for errors is essential. Disputing inaccuracies can lead to improvements in your results.

- Establish a Favorable Financial Record: If your financial history is limited, consider becoming an authorized user on a responsible person’s credit card. This can positively impact your score.

By following these strategies, you can enhance your credit profile and improve your VA loan credit score, thereby increasing your chances of qualifying for a VA loan. We’re here to support you every step of the way as you navigate this process.

Conclusion

Understanding the intricacies of VA loan credit score requirements is vital for families seeking to secure financing for their homes. This unique mortgage option, designed specifically for veterans and active-duty personnel, offers significant advantages such as no down payment and competitive rates. While the VA does not impose a minimum credit score, most lenders typically expect a score of at least 620. This makes it crucial for borrowers to be informed and prepared.

This article explores various aspects of VA loans, including:

- The factors that influence credit score requirements

- The importance of debt-to-income ratios

- Strategies for improving credit scores

We know how challenging this can be, but having a strong financial profile can enhance eligibility. Additionally, understanding the broader economic context and exploring refinancing options can further empower families in their home-buying journey.

Ultimately, the significance of maintaining a healthy credit score cannot be overstated, as it directly impacts the ability to qualify for VA loans. Families are encouraged to take proactive steps in managing their credit profiles, such as timely bill payments and reducing debt, to improve their chances of obtaining favorable financing. By leveraging available resources and support, families can confidently navigate the VA loan process, ensuring they make informed decisions on their path to homeownership.

Frequently Asked Questions

What is a VA loan?

A VA loan is a unique mortgage option available to veterans, active-duty personnel, and certain members of the National Guard and Reserves, supported by the U.S. Department of Veterans Affairs (VA).

What are the benefits of VA loans?

VA loans often come with significant benefits, including no down payment and no private mortgage insurance (PMI). They typically offer excellent mortgage rates and a streamlined application process.

Is there a minimum credit score required for VA loans?

While the VA loan credit score does not have a minimum requirement, most lenders, including F5 Mortgage, generally look for a score of at least 620 to assess a borrower’s creditworthiness.

Why is the credit score important for VA loans?

The credit score serves as a benchmark for assessing a borrower’s ability to repay the loan, which is essential for lenders when determining eligibility for VA financing.

How can F5 Mortgage assist with VA loans?

F5 Mortgage can help review your eligibility for VA loans, ensure you meet necessary requirements, and guide you towards achieving your homeownership goals.