Overview

Navigating the mortgage process can feel overwhelming, but we’re here to support you every step of the way. The article outlines three essential steps to successfully secure a pre-approved mortgage:

- Gathering necessary documentation

- Avoiding common mistakes

- Understanding the benefits of pre-approval

Each step highlights the importance of preparation and financial stability. We know how challenging this can be, but having the right documents ready and steering clear of pitfalls can significantly enhance your chances of obtaining pre-approval. This, in turn, strengthens your position as a homebuyer, empowering you to move forward with confidence.

Introduction

Navigating the world of mortgage pre-approval can often feel overwhelming, especially for first-time homebuyers. We know how challenging this can be. Understanding the intricacies of this process is crucial, as securing a pre-approved mortgage not only strengthens your position as a buyer but also brings clarity to your home-buying journey. However, with the potential for missteps lurking at every turn, how can you ensure that you are adequately prepared?

Let’s explore how to avoid common pitfalls and maximize your chances of success. By acknowledging your challenges, we can work together to empower you with actionable steps that will guide you through this important journey.

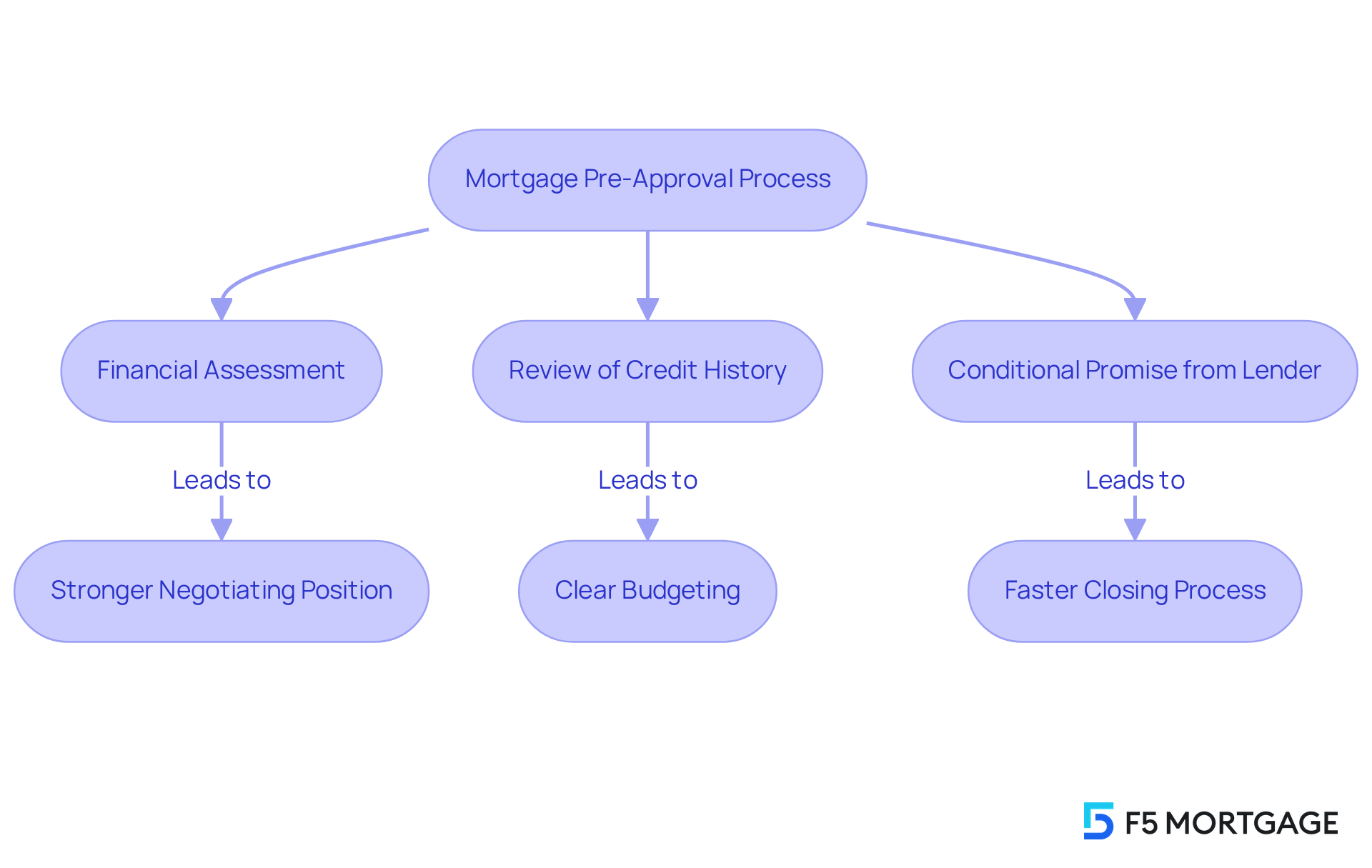

Understand Mortgage Pre-Approval

Mortgage pre-qualification is a formal process where a lender assesses your financial circumstances to determine how much they are willing to provide for a home purchase. We understand that navigating this can be daunting, so it’s important to know that this involves a thorough review of your credit history, income, and debts. Unlike a pre-approved mortgage, which offers a rough estimate of what you might be able to borrow, a pre-approved mortgage with lender commitment provides a more precise overview and a conditional promise from the lender. A pre approved mortgage can significantly enhance your credibility as a buyer, making you more appealing to sellers in a competitive market. It typically lasts for 90 days, allowing you to shop for homes with confidence, knowing your budget.

Key Benefits of Pre-Approval

- Stronger Negotiating Position: Sellers are more likely to take your offer seriously if you have a pre-approval letter.

- Clear Budgeting: Knowing your borrowing limit helps you focus on homes within your price range.

- Faster Closing Process: Pre-approval can expedite the closing process since much of the paperwork is already completed.

We know how challenging this can be, but with a pre approved mortgage, you can approach your home search with assurance and clarity. You’re not just looking for a house; you’re finding a place to create memories. Remember, we’re here to support you every step of the way.

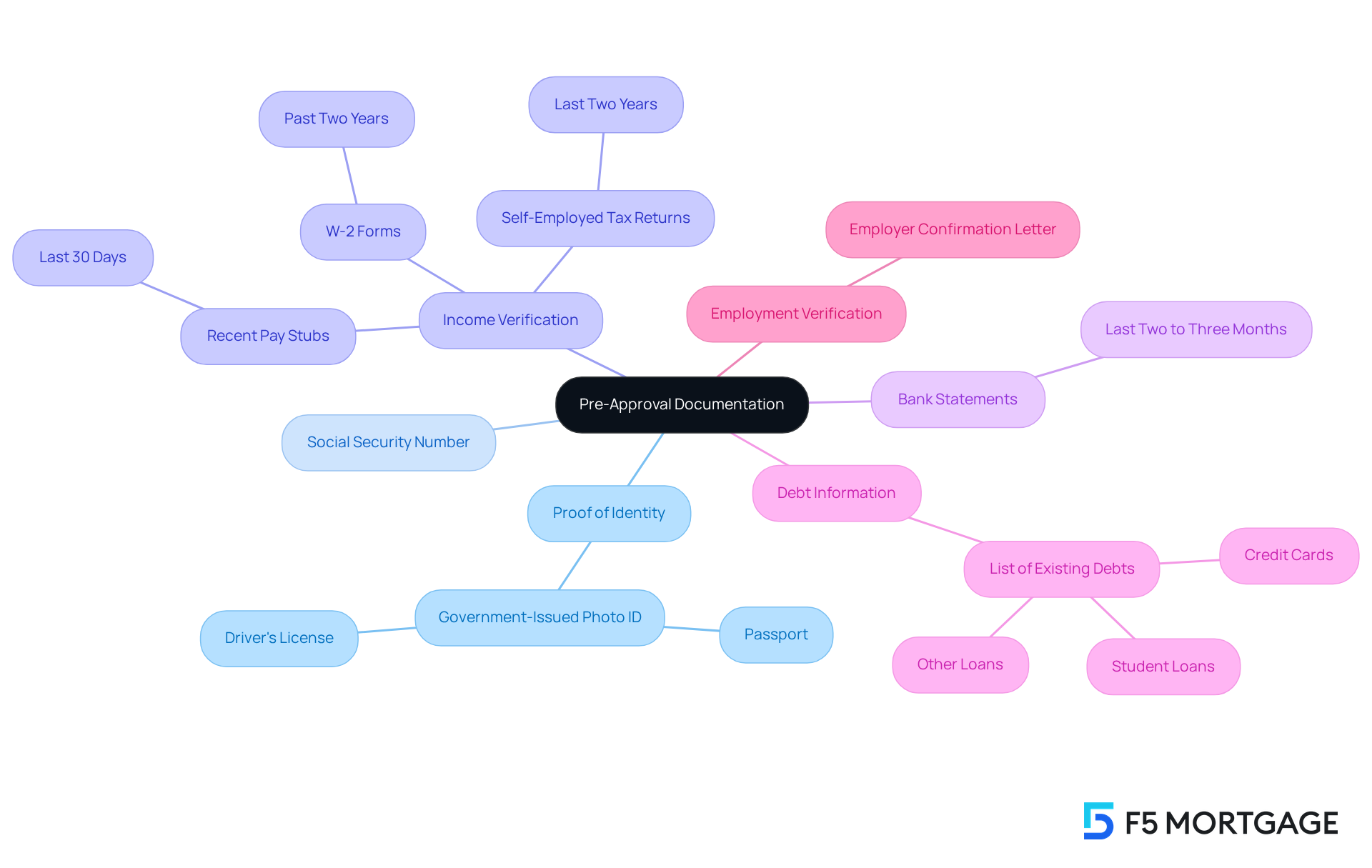

Gather Necessary Documentation for Pre-Approval

Securing a pre approved mortgage can feel daunting, but gathering essential documents that showcase your financial stability is a crucial step. Here’s a helpful checklist of the items you will need:

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport.

- Social Security Number: Required for performing financial assessments.

- Income Verification: Recent pay stubs (typically from the last 30 days) and W-2 forms from the past two years. If you’re self-employed, tax returns for the last two years are necessary.

- Bank Statements: Statements from the last two to three months to verify your assets and savings.

- Debt Information: A detailed list of any existing debts, including credit cards, student loans, and other loans.

- Employment Verification: A letter from your employer confirming your position and salary may also be necessary.

Having these documents ready can greatly simplify the preliminary approval steps for a pre approved mortgage, demonstrating to lenders that you are prepared. Many families have successfully gathered these documents within a week, ensuring they are well-positioned to move forward in their home-buying journey. In fact, F5 Mortgage has helped over 1,000 families achieve their homeownership goals, boasting a customer satisfaction rate of 94%.

By being organized and proactive, you can significantly improve your odds of obtaining a pre approved mortgage. We understand that the initial approval procedure may entail a hard credit check, which can temporarily reduce your credit score. Being aware of these factors can further prepare you for a successful mortgage application. Remember, we’re here to support you every step of the way.

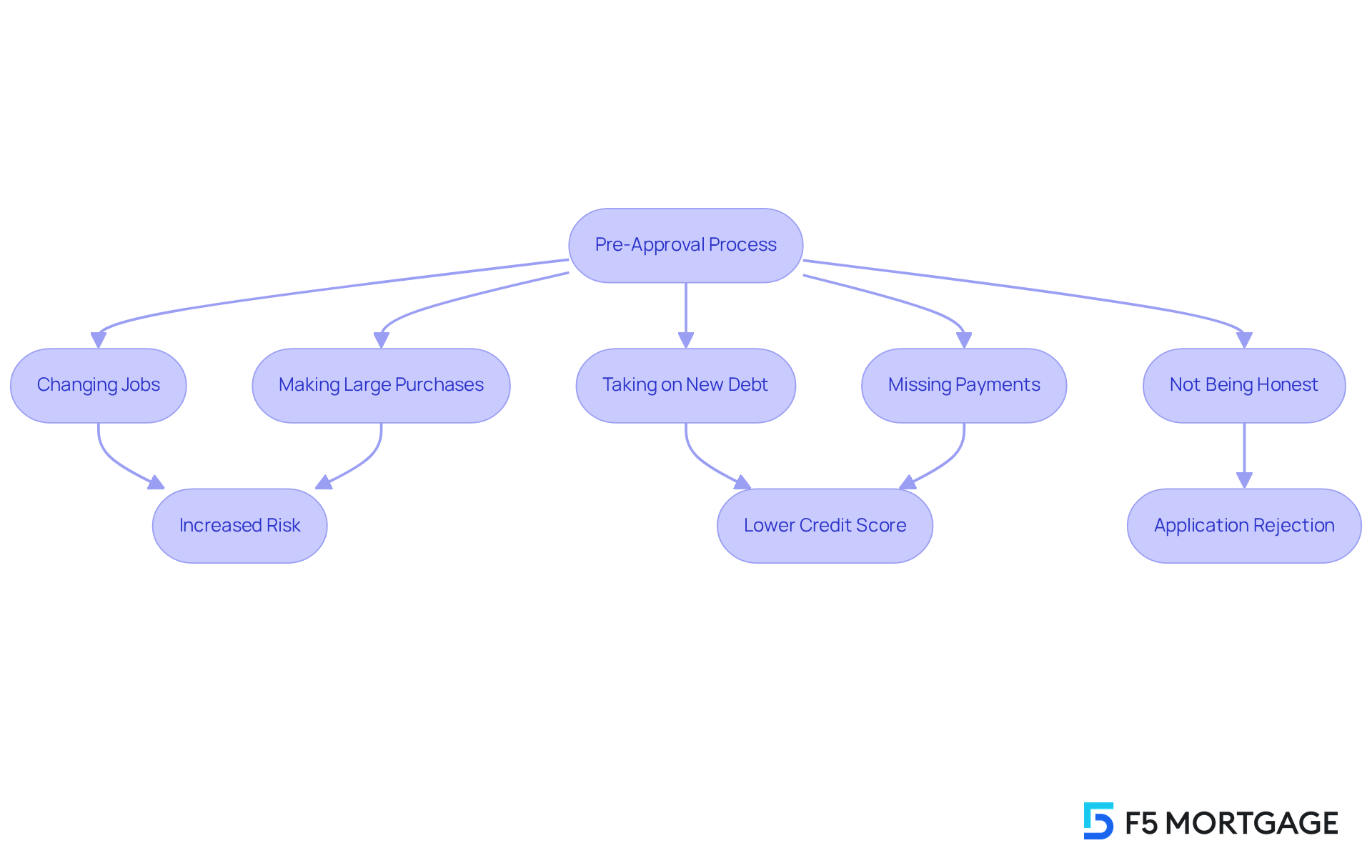

Avoid Common Mistakes During Pre-Approval

Obtaining a pre approved mortgage is a significant step in the home-buying journey. However, we know how challenging this can be, and careful navigation is essential to avoid common pitfalls that could jeopardize your chances. Here are some essential mistakes to steer clear of:

-

Changing Jobs: Employment stability is paramount. Avoid switching jobs or industries during the process of securing a pre-approved mortgage. Lenders may view this as a risk factor, raising concerns about your financial reliability.

-

Taking on New Debt: Refrain from applying for new cards or loans. New debt can adversely affect your credit score and raise your debt-to-income (DTI) ratio, both of which are essential factors in determining your eligibility for a pre approved mortgage.

-

Missing Payments: Timely payment of all bills is crucial. Delayed payments can rapidly decrease your credit rating, which lenders will examine during the approval process. Setting up automatic payments can help ensure you never miss a due date, maintaining a good credit score.

-

Making Large Purchases: Avoid substantial monetary changes, such as buying a new car or making large cash withdrawals. These actions can alter your economic landscape and affect your mortgage application.

-

Not Being Honest: Transparency is key. Always provide accurate and complete information to your lender. Distorting your monetary circumstances can result in application rejection or withdrawal of prior consent, underscoring the essential importance of truthfulness in the mortgage application.

By identifying and steering clear of these typical errors, you can improve your odds of a seamless and successful application process for a pre approved mortgage. Remember, maintaining your financial stability close to the pre approved mortgage snapshot is essential to ensure that your application remains strong. We’re here to support you every step of the way.

Conclusion

Securing a pre-approved mortgage is a significant milestone in your home-buying journey. It not only provides you with a competitive edge but also offers clarity regarding your financial capabilities. This process enhances your credibility with sellers and streamlines the overall home purchasing experience. With pre-approval, you can focus on finding your dream home with confidence.

In this guide, we’ve outlined essential steps to navigate the pre-approval process successfully. We understand how challenging this can be, so it’s vital to grasp the significance of pre-approval, gather necessary documentation, and avoid common pitfalls. By being organized and informed, you can significantly improve your chances of obtaining favorable mortgage terms that align with your financial goals.

Ultimately, the journey to homeownership is filled with both opportunities and challenges. By taking proactive steps and being mindful of potential obstacles, you can pave the way for a successful mortgage pre-approval. Embracing this process not only brings you closer to homeownership but also fosters a sense of empowerment as you make one of life’s most significant investments. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage pre-approval?

Mortgage pre-approval is a formal process where a lender evaluates your financial situation, including your credit history, income, and debts, to determine how much they are willing to lend for a home purchase.

How does mortgage pre-approval differ from pre-qualification?

Pre-qualification provides a rough estimate of what you might be able to borrow, while pre-approval offers a more precise overview with a conditional promise from the lender.

What are the key benefits of obtaining a mortgage pre-approval?

Key benefits include a stronger negotiating position with sellers, clearer budgeting for your home search, and a faster closing process since much of the paperwork is already completed.

How long does a mortgage pre-approval typically last?

A mortgage pre-approval typically lasts for 90 days.

How does having a pre-approval letter affect my home buying process?

Having a pre-approval letter enhances your credibility as a buyer, making your offers more appealing to sellers in a competitive market.

What should I focus on when searching for a home after getting pre-approved?

After getting pre-approved, you should focus on homes within your borrowing limit to ensure you are looking at properties that fit your budget.