Overview

Upgrading your home can feel overwhelming, but a mortgage expert is here to help. By offering personalized consultations, they tailor loan options to your unique financial situation. This ensures that you can make informed decisions, leading to a smoother process.

We understand how challenging navigating the mortgage landscape can be. The expertise of a mortgage professional not only streamlines the process through administrative support and negotiation for better terms but also enhances your confidence. They guide you through potential pitfalls in home buying, ensuring you feel supported every step of the way.

Imagine having someone by your side, addressing your concerns and helping you make the best choices for your family. With their guidance, you can move forward with peace of mind, knowing that you have a trusted ally in your corner. Don’t hesitate to reach out and discover how a mortgage expert can simplify your journey.

Introduction

Navigating the complexities of home financing can often feel overwhelming, especially for those looking to upgrade their living situation. We understand how challenging this can be. With a myriad of options available, grasping the nuances of mortgages is essential for making informed decisions.

This article explores how a mortgage expert can simplify the home upgrade process. They offer personalized guidance and support tailored to your unique financial needs. But what specific advantages do these professionals bring to the table? How can they help you avoid common pitfalls in your mortgage journey? We’re here to support you every step of the way.

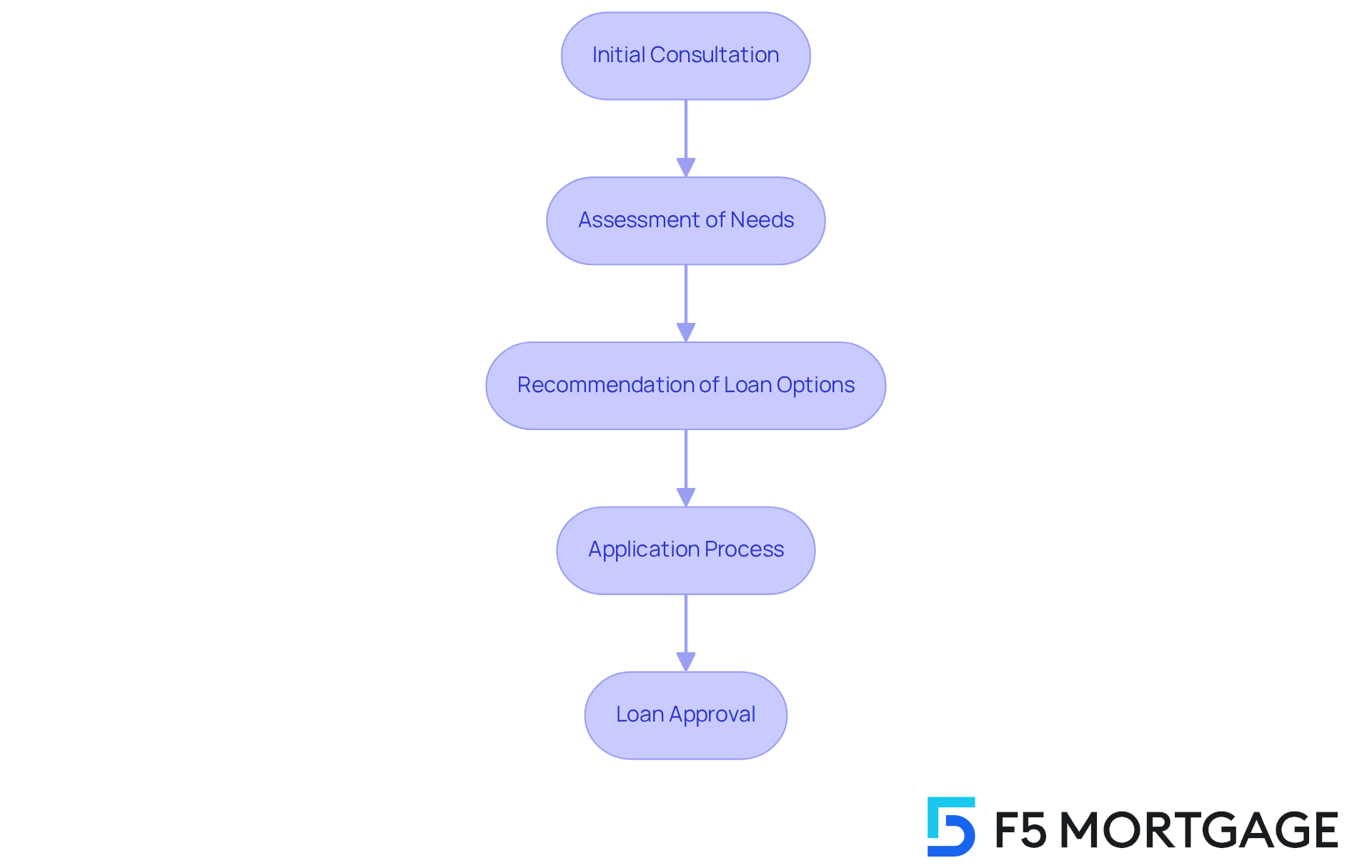

F5 Mortgage: Personalized Mortgage Consultations for Homebuyers

At F5 Mortgage, we understand how challenging the mortgage process can be, which is why we have a to assist you. That’s why we offer with a mortgage expert tailored to your . By taking the time to assess your individual needs, preferences, and financial capabilities, our to recommend the most suitable loan options for you.

This personalized approach not only streamlines your decision-making process but also empowers you to make about your home financing. As an independent agent, we leverage our extensive network of lenders to ensure you receive and flexible terms, making homeownership not just a dream, but a reality.

We know how important it is to feel supported during this journey. Our commitment to as a mortgage expert means you will receive complete assistance throughout the entire loan process, whether you are buying a new home or refinancing your current loan. We’re here to support you every step of the way, ensuring that your experience is as stress-free as possible.

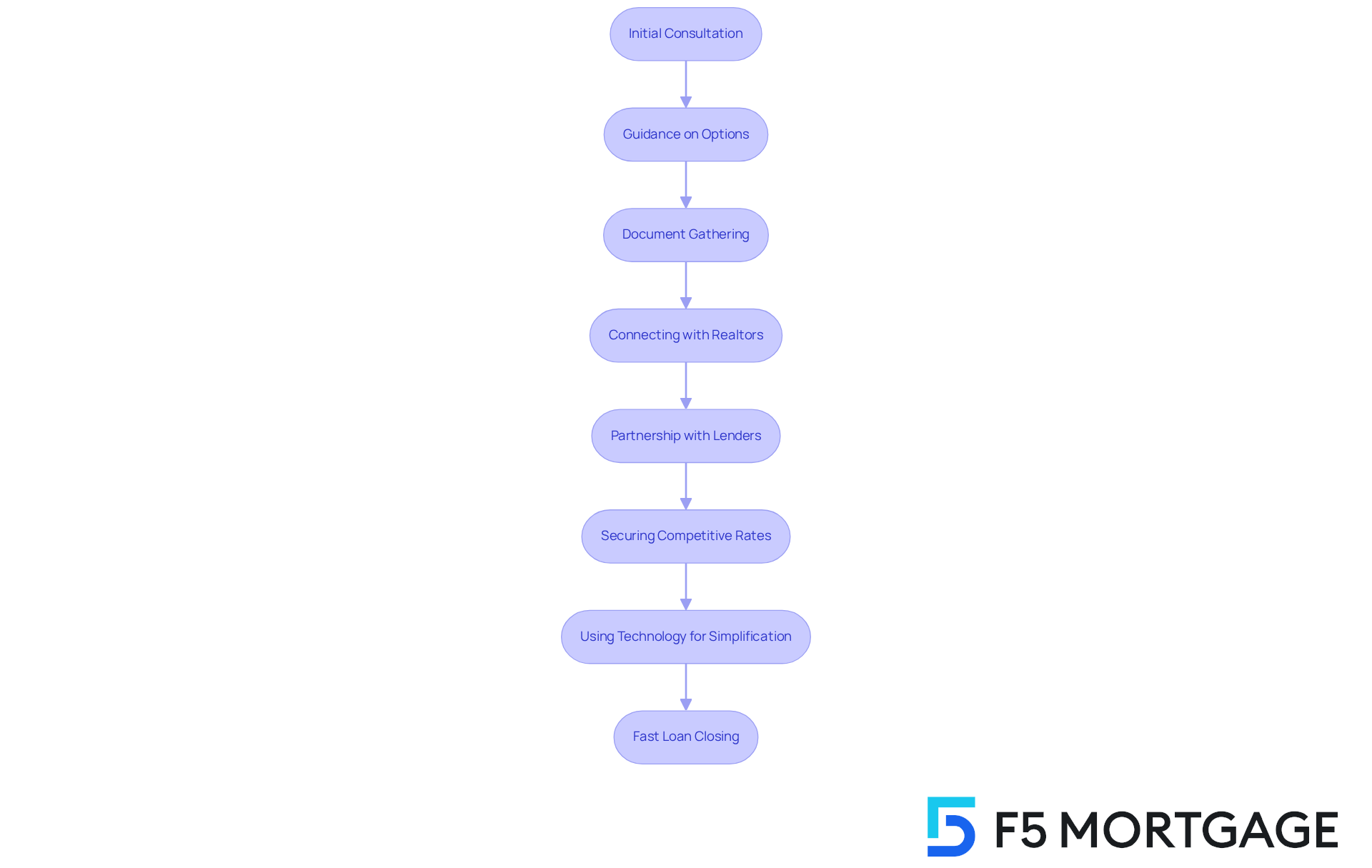

Mortgage Broker: Your Intermediary in the Home Buying Process

Navigating the can feel overwhelming, but a is here to help. At F5 Mortgage, we understand how challenging this can be. We not only guide you through your options and assist in but also connect you with top realtors in your area. This ensures you have the best support throughout your .

Our partnerships with over two dozen leading lenders enable us to secure tailored specifically to your needs. The mortgage expert plays a vital role in making the . We leverage to simplify the process, providing no-pressure guidance every step of the way.

Ultimately, our goal is to achieve in under three weeks, so you can focus on what truly matters—finding your dream home. We’re here to , making your journey smoother and more enjoyable.

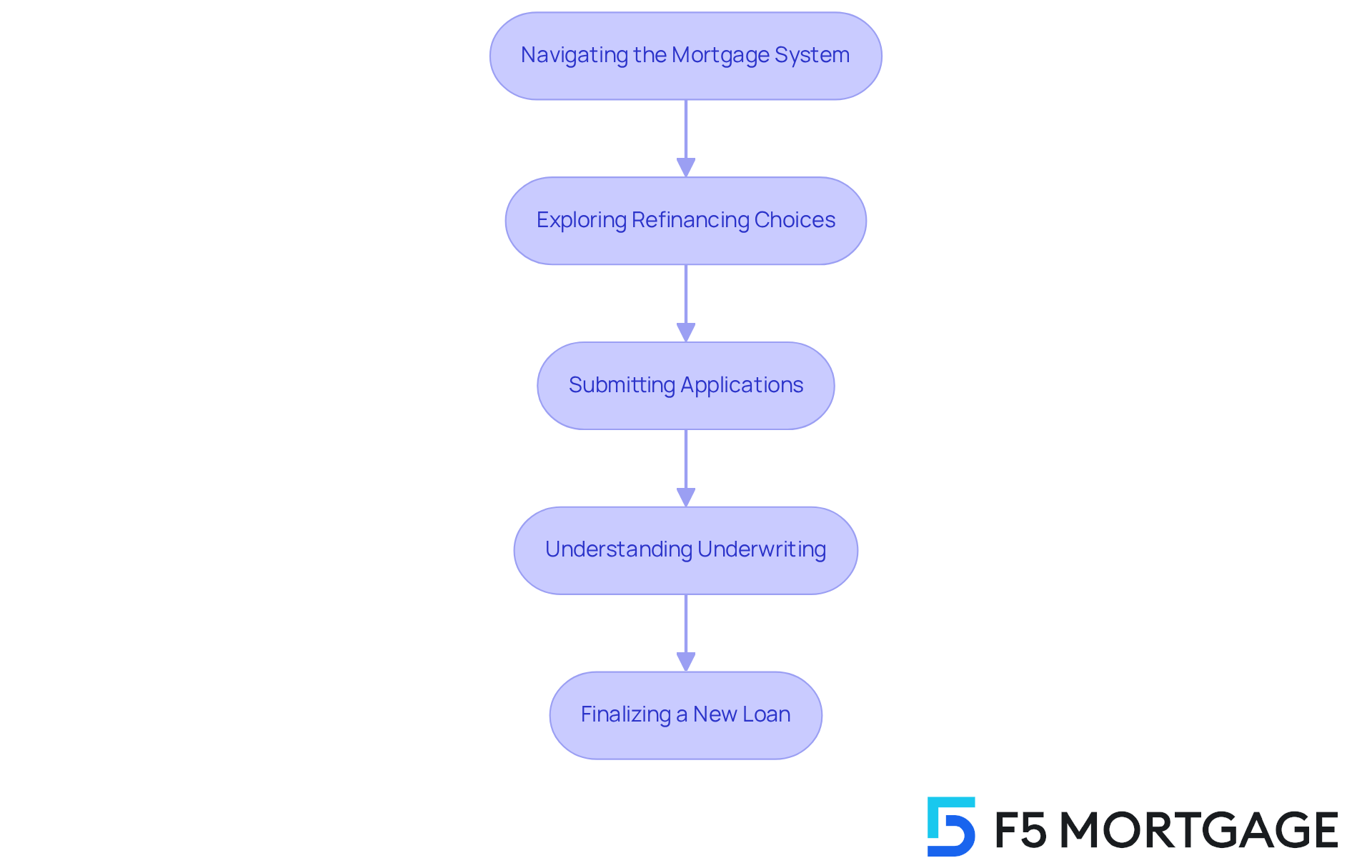

Mortgage Expert: Navigating the Complex Mortgage System

Navigating the can feel overwhelming. We understand how complex it can be with various regulations, paperwork, and options to consider. That’s where a , like those at F5 Mortgage, comes in. They provide , helping you comprehend the intricacies of loan financing.

These and explain processes, ensuring you feel informed and supported at every step. This guidance can significantly reduce anxiety and confusion. From exploring to submitting applications, and to finalizing a new loan, a financing specialist can streamline each phase for you.

They also assist in calculating your break-even point, which helps you determine how long it will take to recoup refinancing costs through savings. With their support, families can confidently navigate the . We’re here to ensure you make informed decisions that align with your financial goals.

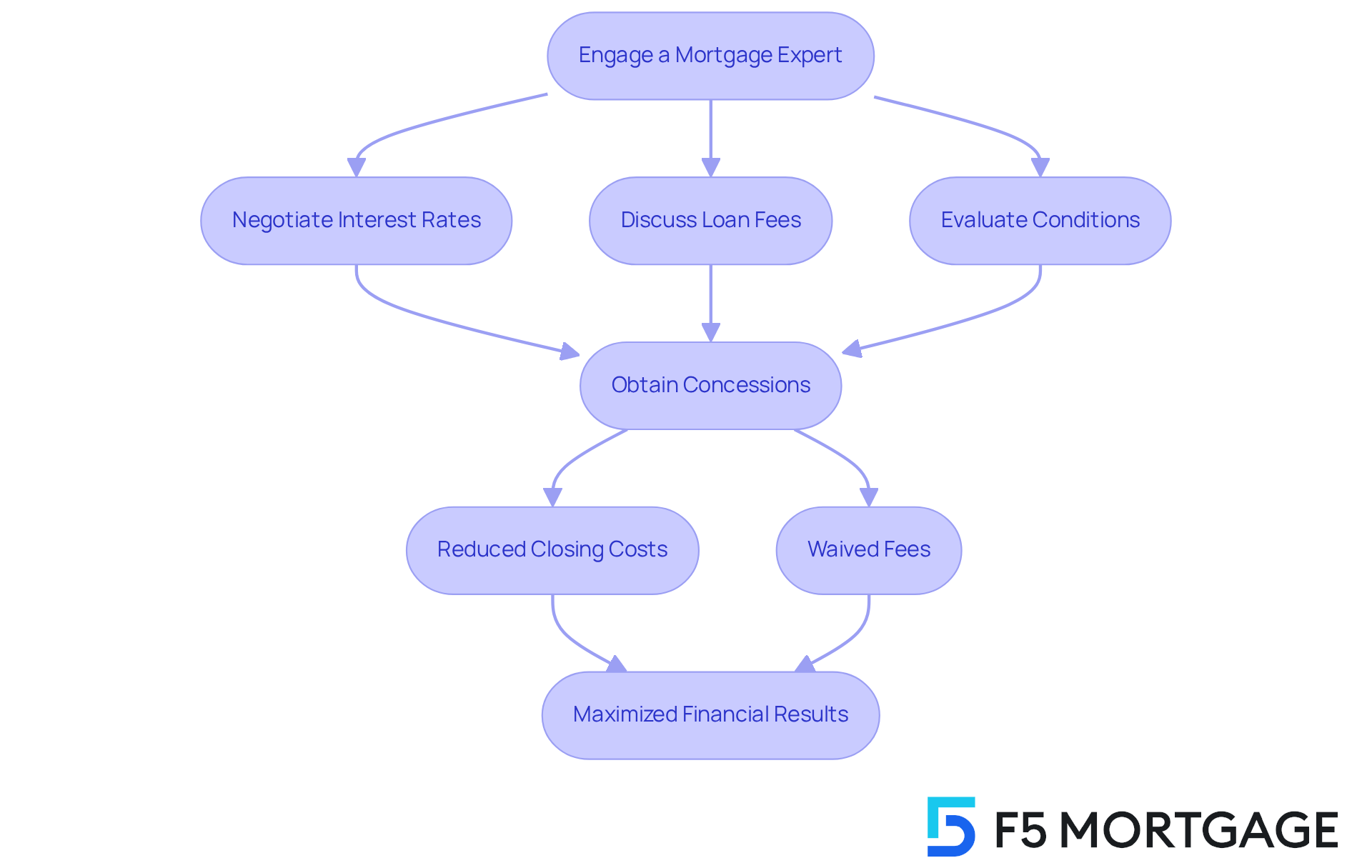

Skilled Negotiator: Securing the Best Mortgage Terms

Navigating the mortgage process can be overwhelming, and that’s where a steps in as your . They work tirelessly to secure the tailored to your needs. This includes , loan fees, and various conditions that can significantly impact the overall cost of your mortgage.

Brokers have established connections with lenders, often achieving than individuals could on their own. Research indicates that customers who collaborate with agents can save an average of 0.25% to 0.5% on their interest rates compared to negotiating directly with financial institutions. Imagine the relief of knowing you’re getting a better deal!

Moreover, skilled negotiators excel at obtaining concessions, such as reduced or waived fees, leading to . Picture this: brokers frequently secure lower rates for clients by advocating for temporary rate buydowns or negotiating seller concessions. These are real opportunities for you to save money and make your home financing experience smoother.

In today’s competitive lending landscape, the role of a mortgage expert in negotiating effectively is not just advantageous; it is crucial for maximizing your . We know how challenging this can be, but with the right support, you can . We’re here to .

Administrative Support: Streamlining Your Mortgage Process

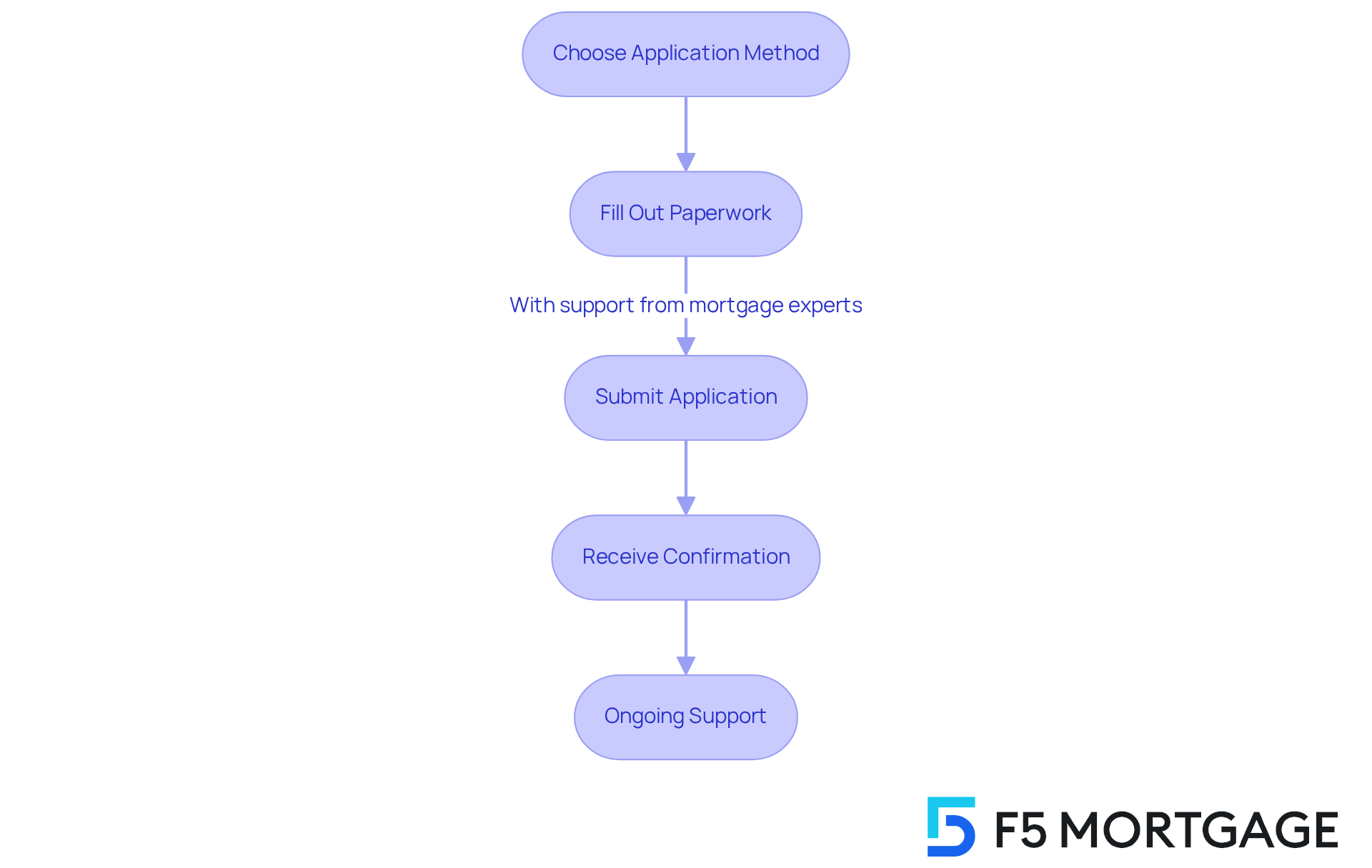

We understand that the can feel overwhelming, involving a significant amount of paperwork and administrative tasks. At F5 Mortgage, we’re here to . We offer convenient —so you can choose the method that works best for you.

Our dedicated , ensuring that all paperwork is filled out correctly and submitted on time. This support helps prevent delays and keeps the process flowing smoothly, allowing you to focus on what truly matters: your new home.

With our commitment to a stress-free experience, we leverage that simplifies the application process. We provide without any pressure, enhancing both efficiency and transparency. This sets us apart from competitors and makes your journey toward homeownership as seamless as possible.

Expert Guidance: Avoiding Common Home Buying Pitfalls

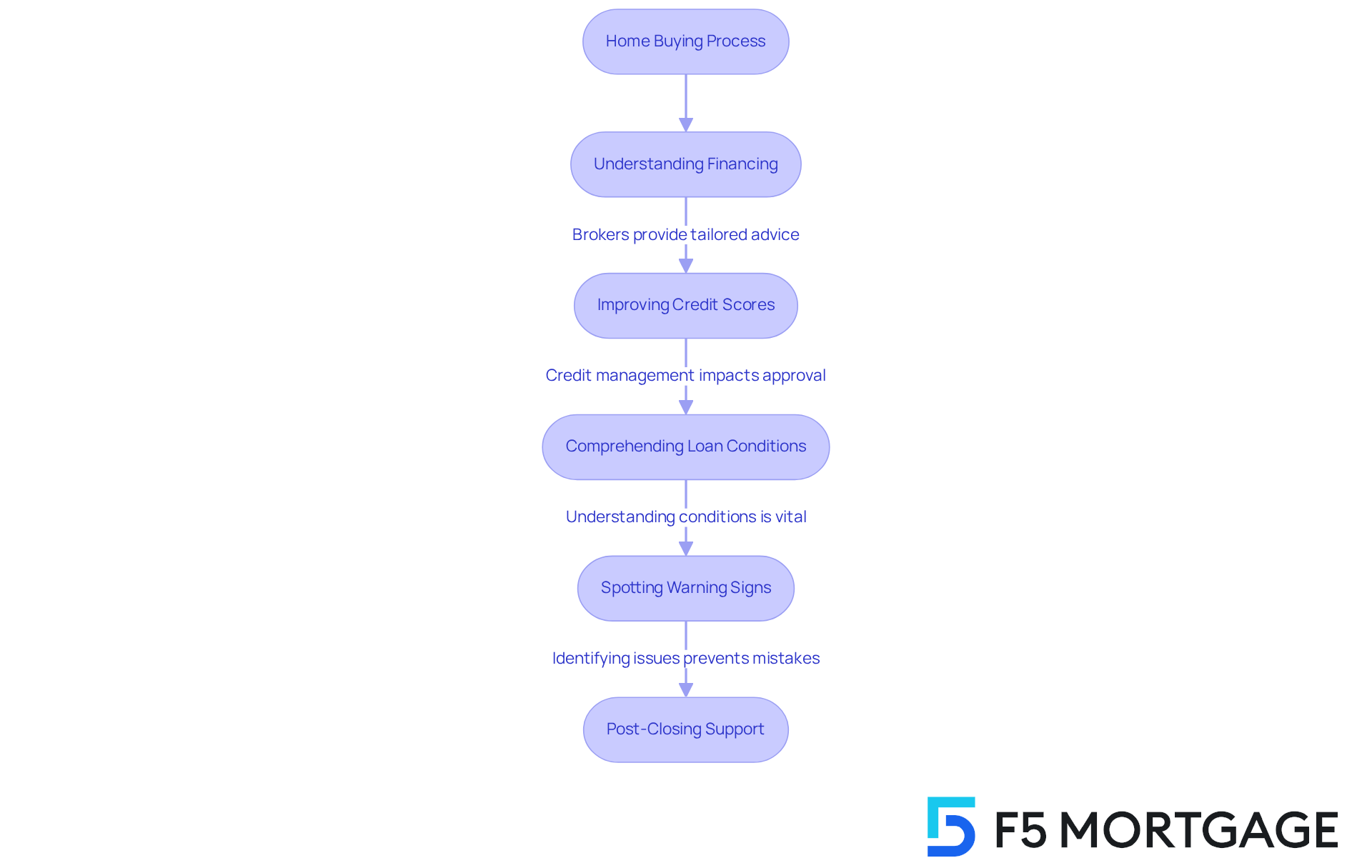

can be daunting, and an informed plays a crucial role in guiding individuals away from typical traps. At F5 Mortgage, we understand how challenging this can be. It’s important to clarify that customers will not make payments directly to us, as we are a broker and do not manage financing. Instead, payments will be made to the lender with whom the loan closes. This understanding is vital for customers to navigate their financial commitments effectively.

Brokers like us provide tailored advice on improving credit scores, which significantly impacts mortgage approval rates. For instance, we recently helped a customer receive within just six weeks, even while in a probation period. This highlights the significance of and how it can open doors.

Comprehending loan conditions is another vital aspect where our agents inform individuals. We ensure you understand the , repayment timelines, and possible charges. Furthermore, our agents assist in spotting warning signs during your home search, such as overpriced listings or properties with unresolved issues. A notable instance involves an individual who obtained 75% financing for a townhouse project after being turned down by their usual lender. This illustrates how intermediaries can enable favorable outcomes.

By equipping our customers with this knowledge, we empower you to , ultimately preventing costly mistakes that could disrupt your . Additionally, F5 Mortgage provides , ensuring you have access to assistance even after your loan has closed. Collaborating with a mortgage expert like F5 Mortgage can be transformative for first-time home purchasers, helping you maneuver through the intricacies of the market with confidence. We’re here to support you every step of the way.

Commission Structure: Understanding Mortgage Broker Fees

Understanding the commission framework of s can feel overwhelming, but it’s essential for your peace of mind. At F5 Mortgage, our mortgage expert understands how challenging this can be, which is why we prioritize transparency. We clearly explain our , which are typically based on the loan amount and can vary depending on the lender and the services provided. This approach not only helps you budget appropriately but also fosters a .

Unlike conventional intermediaries who may rely on aggressive sales tactics and incomplete information, F5 Mortgage stands out as a mortgage expert dedicated to empowering you with the knowledge you need to make . We’re here to support you every step of the way, ensuring a more straightforward and . By choosing F5 Mortgage, you can feel confident in navigating this journey with clarity and support.

Loan Programs: Exploring Your Mortgage Options

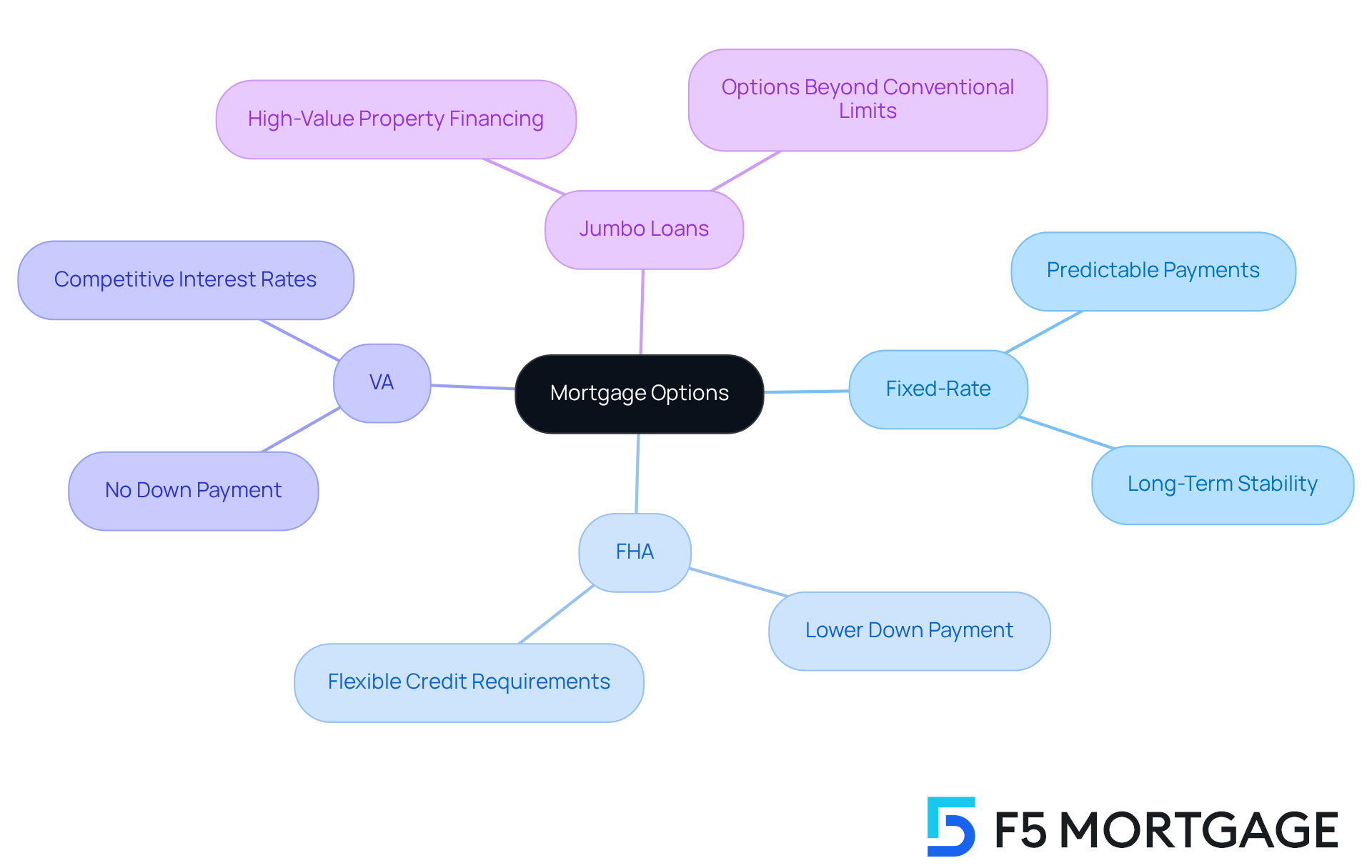

Mortgage brokers provide access to a wide range of , including fixed-rate, FHA, VA, and jumbo options, tailored to meet different financial situations and homeownership dreams. We understand how challenging this can be, especially for who often find appealing due to their lower down payment requirements. For veterans and active-duty service members, presents significant advantages, such as no down payment and competitive interest rates. If you’re looking to purchase a high-value property, can be an excellent fit, allowing you to explore options beyond conventional loan limits.

By working closely with you, a can tailor their recommendations based on your . This means you won’t be limited to just one lender’s offerings. This comprehensive approach not only increases your chances of securing favorable terms but also empowers you to make informed decisions. For example, if a family is considering home enhancements, exploring various financing alternatives can help them choose the most beneficial solution tailored to their specific circumstances.

Furthermore, recent trends indicate a growing preference for . Many borrowers are seeking options that adapt to their evolving financial situations. As mortgage experts stay updated on these trends, they can guide you toward the most suitable financing options, ultimately simplifying the . Remember, we’re here to support you every step of the way.

Client Satisfaction: Fast and Efficient Closing with F5 Mortgage

At F5 Mortgage, we understand how challenging the home buying process can be. That’s why we take pride in our rapid and effective , with most transactions concluding in under three weeks. This commitment to speed not only enhances but also alleviates the stress often linked to buying a home.

Our clients, like Ruth Vest and Artie Kamarhie, have shared their appreciation for our , including officer Jeff and president Ryan. They commend our outstanding service and meticulous approach, highlighting how we made their experience simple and stress-free.

By prioritizing efficiency and utilizing , we ensure that you can transition into your new home as swiftly as possible. We’re here to support you every step of the way, providing tailored to your needs. Let us help you with ease and confidence.

Personalized Service: Building Trust in Your Mortgage Journey

At F5 Mortgage, is at the . We understand how challenging the mortgage process can be, particularly for self-employed individuals and those in unique situations, which is why consulting a can be beneficial. With over a decade of experience, our , Jeff Bozimowski, focuses on to meet each customer’s distinct financial needs.

By taking the time to truly understand your preferences, we build trust and rapport with you and your mortgage expert throughout your journey. Our commitment to shines through in the heartfelt testimonials from our clients, who often highlight the and guidance they’ve received from our devoted team.

This dedication not only enhances your experience with a mortgage expert but also fosters , ensuring that you feel valued and supported every step of the way. We’re here to support you, and we know how important it is to have someone by your side during this journey.

Conclusion

Navigating the complexities of home upgrades can be daunting, and we know how challenging this can be. Enlisting the help of a mortgage expert can significantly simplify the process. With personalized consultations, expert guidance, and administrative support, professionals like those at F5 Mortgage empower homebuyers to make informed decisions tailored to their unique financial situations. This collaborative approach alleviates stress and enhances the overall home buying experience.

Throughout this article, we’ve highlighted how mortgage experts serve as intermediaries, helping clients understand various loan options, negotiate better terms, and avoid common pitfalls. Their extensive knowledge and established relationships with lenders enable them to secure favorable rates and streamline the application process. This comprehensive support ensures that homebuyers can focus on their ultimate goal: finding and financing their dream home.

In conclusion, the significance of partnering with a mortgage expert cannot be overstated. As the housing market continues to evolve, having a knowledgeable ally by your side is invaluable. Whether you are a first-time homebuyer or looking to refinance, we’re here to support you every step of the way. Consider reaching out to a mortgage professional who can guide you through the intricacies of the mortgage landscape, ensuring a smoother, more efficient journey toward homeownership.

Frequently Asked Questions

What services does F5 Mortgage offer to homebuyers?

F5 Mortgage offers personalized consultations with mortgage experts tailored to individual financial circumstances, helping to recommend suitable loan options and streamline the decision-making process.

How does F5 Mortgage support homebuyers during the mortgage process?

F5 Mortgage provides complete assistance throughout the entire loan process, ensuring a stress-free experience whether you are buying a new home or refinancing an existing loan.

What is the role of a mortgage expert at F5 Mortgage?

A mortgage expert guides clients through the mortgage application process, assists in gathering necessary documentation, connects them with top realtors, and clarifies loan terms and processes to reduce anxiety and confusion.

How does F5 Mortgage ensure competitive rates for its clients?

F5 Mortgage partners with over two dozen leading lenders, allowing them to secure competitive rates and flexible terms tailored specifically to the needs of their clients.

What technology does F5 Mortgage use to assist clients?

F5 Mortgage leverages user-friendly technology to simplify the mortgage process, providing no-pressure guidance and support throughout the home buying journey.

What is the typical timeline for loan closings at F5 Mortgage?

F5 Mortgage aims for fast loan closings in under three weeks, allowing clients to focus on finding their dream home.

How can a mortgage expert help with refinancing?

A mortgage expert assists in exploring refinancing options, calculating break-even points, and guiding clients through the refinancing process to ensure informed decisions that align with their financial goals.