Overview

This article addresses the different types of home equity loans available for families eager to enhance their living spaces. Options like HELOCs, conventional loans, and cash-out refinancing provide a range of choices tailored to your unique needs. We understand how important it is to find flexible financing solutions for renovations, debt consolidation, and other significant expenses.

Recent trends show an increase in borrowing among property owners for home improvements. This shift highlights the growing desire for families to invest in their homes, making it essential to explore the right loan options. We know how challenging this can be, and we’re here to support you every step of the way.

By considering these loans, you can take proactive steps toward achieving your home improvement goals. Let’s navigate this journey together, ensuring you find the best fit for your family’s needs.

Introduction

As families increasingly seek to enhance their living spaces, we know how challenging it can be to navigate the options available. The demand for home equity loans has surged, providing a viable path to funding renovations and managing significant expenses. This article explores ten distinct types of home equity loans available for families looking to upgrade their homes. Each option comes with unique benefits and considerations that can make a difference in your journey.

With so many choices, how can families determine which type of loan best aligns with their financial goals and home improvement aspirations? We’re here to support you every step of the way, helping you find the right solution for your needs.

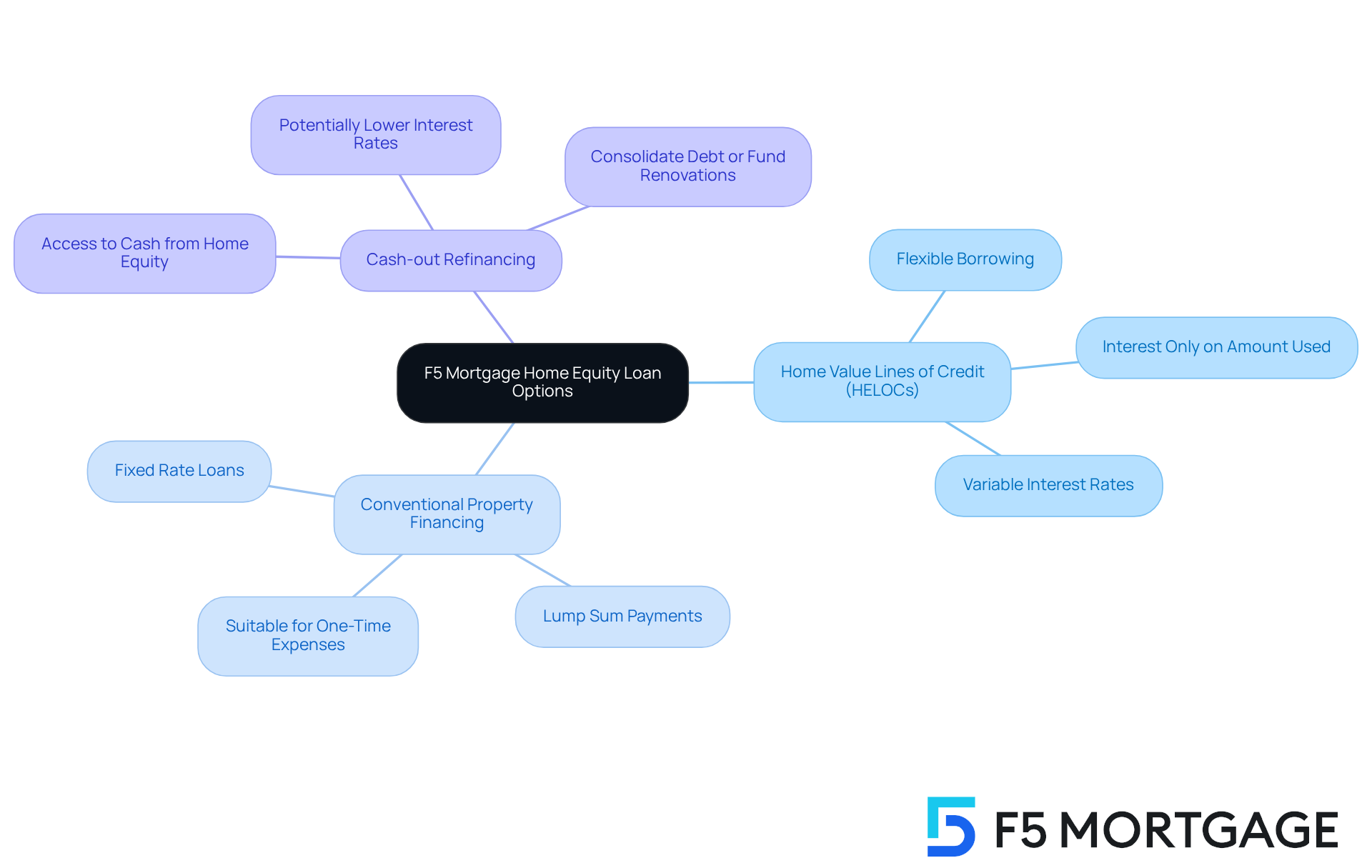

F5 Mortgage: Diverse Home Equity Loan Options for Families

At , we understand how challenging it can be to find the right financing solutions for your home. That’s why we provide an extensive selection of designed specifically for families looking to enhance their properties. Our offerings include various types of , such as:

- Conventional property financing

Each tailored to meet your unique financial needs and goals.

As more households turn to for improvements, we want you to know that F5 Mortgage is here to guide you through these options with compassion and expertise. By leveraging a robust network of over two dozen lenders, we help families secure the most favorable terms available, ensuring you feel supported every step of the way.

Recent trends indicate that are considering , primarily driven by a desire for renovations. This growing interest underscores the importance of to find the best types of home equity loans that suit your situation. At F5 Mortgage, we are committed to being a reliable partner in your property enhancement journey, ready to assist you in making informed decisions that align with your dreams.

Home Equity Line of Credit (HELOC): Flexible Borrowing Against Your Home

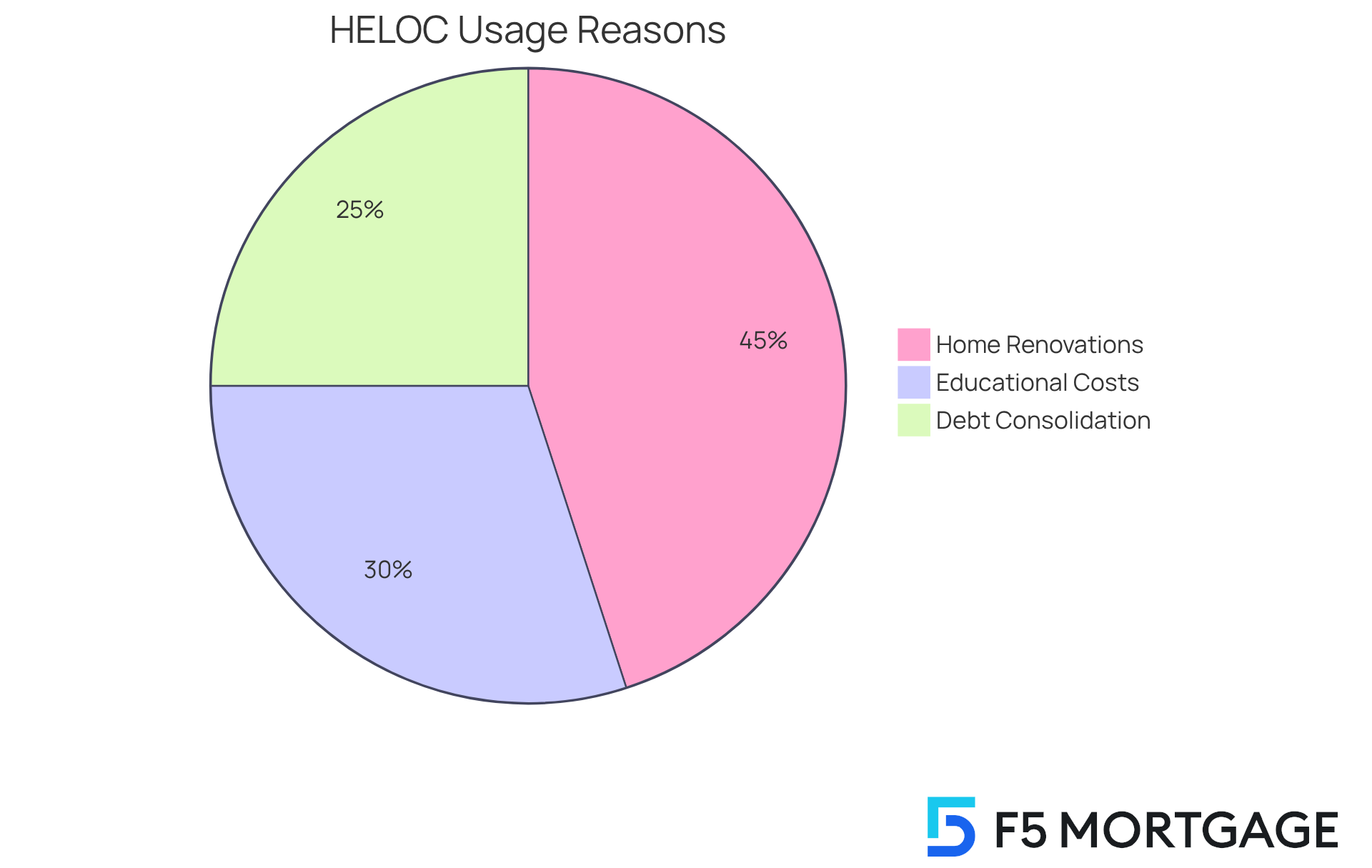

A (HELOC) can be a valuable resource for property owners, allowing you to . This revolving line of credit is particularly beneficial for families managing ongoing projects or unexpected expenses. With a HELOC, you can , up to a specified limit, and you only pay interest on the amount you use. This flexibility makes HELOCs an appealing option for various , such as , educational costs, or debt consolidation.

We understand that property enhancement is a significant motivation for many families when considering borrowing. In fact, 45% of property owners cite it as their . As households increasingly seek to improve their living spaces, the average HELOC balance has risen notably, reaching $45,157 in 2024—a 7.2% increase from the previous year. This trend reflects a broader change in consumer behavior, as families recognize the advantages of leveraging their equity to enhance property value and appeal.

Financial advisors emphasize the importance of , especially during major life events or expenses. As interest rates remain high, we encourage you to explore HELOC options rather than waiting for potential rate reductions. This proactive approach can help you achieve your while keeping your current low-rate primary mortgage intact. Overall, HELOCs are becoming an increasingly popular looking to improve their homes in 2025.

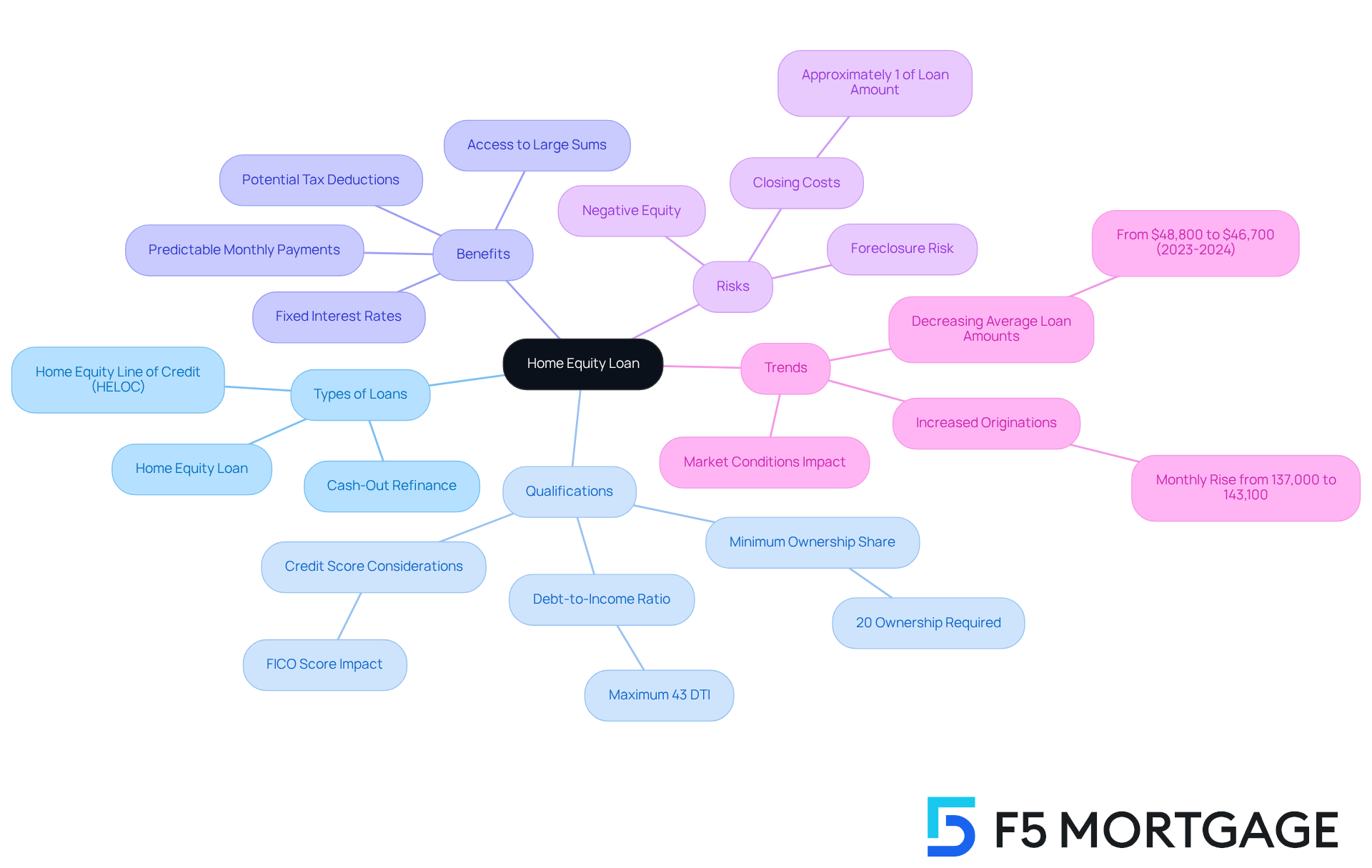

Home Equity Loan: One-Time Lump Sum for Major Expenses

We understand that navigating financial options can be overwhelming, especially when it comes to securing your family’s future. A is one of the types of , offering a single lump sum determined by the value of your residence, making it a wonderful choice for families looking to cover significant costs like property improvements or merging debts.

To qualify for a , it’s important to know that borrowers usually need a minimum ownership share of 20%. This aligns with the fact that many lenders expect property owners to maintain at least an 80% value-to-equity ratio. Additionally, grasping the is essential; typically, a maximum of 43% DTI is necessary for home financing, which can influence the competitiveness of .

With and predictable monthly payments, families can effectively budget and avoid unexpected financial burdens. However, it’s crucial to consider the potential risks associated with these financial agreements, including the possibility of foreclosure if payments are missed. The straightforward financing structure is particularly appealing for those who value a clear repayment plan.

Recent statistics indicate that the typical sum borrowed in residential financing has decreased from $48,800 in June 2023 to $46,700 in June 2024, reflecting . Closing expenses for property financing usually amount to about 1% of the overall loan, which is something households should factor into their budgeting.

Financial specialists emphasize that these credits not only provide stability through fixed rates but also may enable for property enhancements. As you navigate your , understanding the types of home equity loans can empower you to make informed choices that align with your long-term objectives.

Once your application is approved, securing your mortgage rates can protect you from market fluctuations during the processing period. This makes it a timely consideration for families, especially with the Federal Reserve anticipated to lower rates. We’re here to support you every step of the way as you .

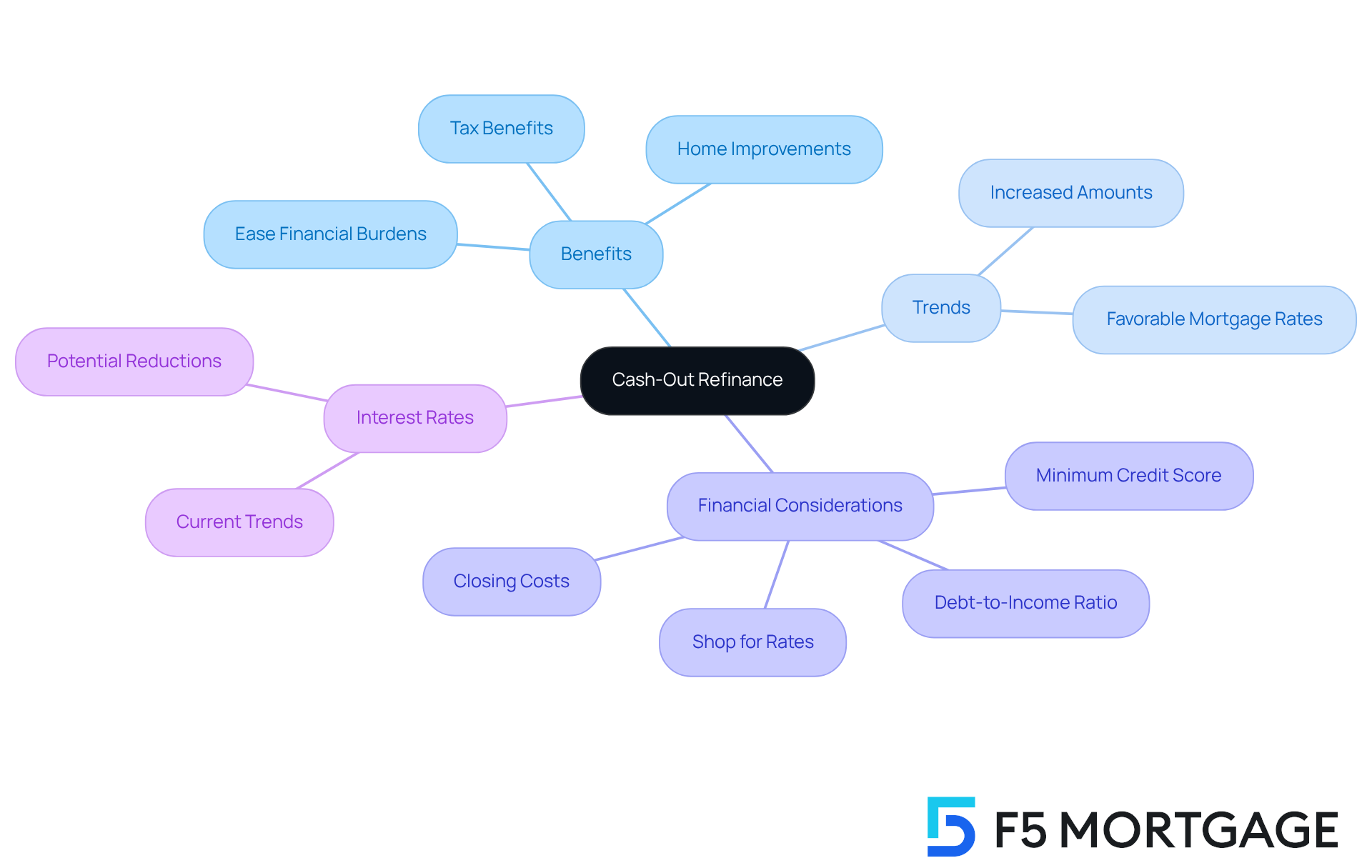

Cash-Out Refinance: Access Cash While Refinancing Your Mortgage

can be a helpful solution for homeowners looking to ease their . By refinancing their existing mortgage for more than what they owe, families can receive the difference in cash. This option is particularly beneficial for those wanting to , as it often comes with a on their mortgage.

We understand that many households face challenges when it comes to , consolidating high-interest debt, or managing large expenses. By tapping into their , families can address these needs while reorganizing their mortgage. With the current in Colorado, now may be the perfect time to explore cash-out refinancing.

Recent trends show that the typical cash-out refinance amount has significantly increased, indicating that more families are taking advantage of this opportunity. Mortgage experts emphasize that cash-out refinancing not only provides immediate financial support but also allows families to enhance their living spaces, making it a .

Additionally, it’s important for homeowners to consider potential tax benefits associated with refinancing and to shop around for the , as mortgage rates can change. With anticipated interest rate reductions from the Federal Reserve, families may find even more favorable refinancing options in the near future. Remember, we’re here to support you every step of the way as you .

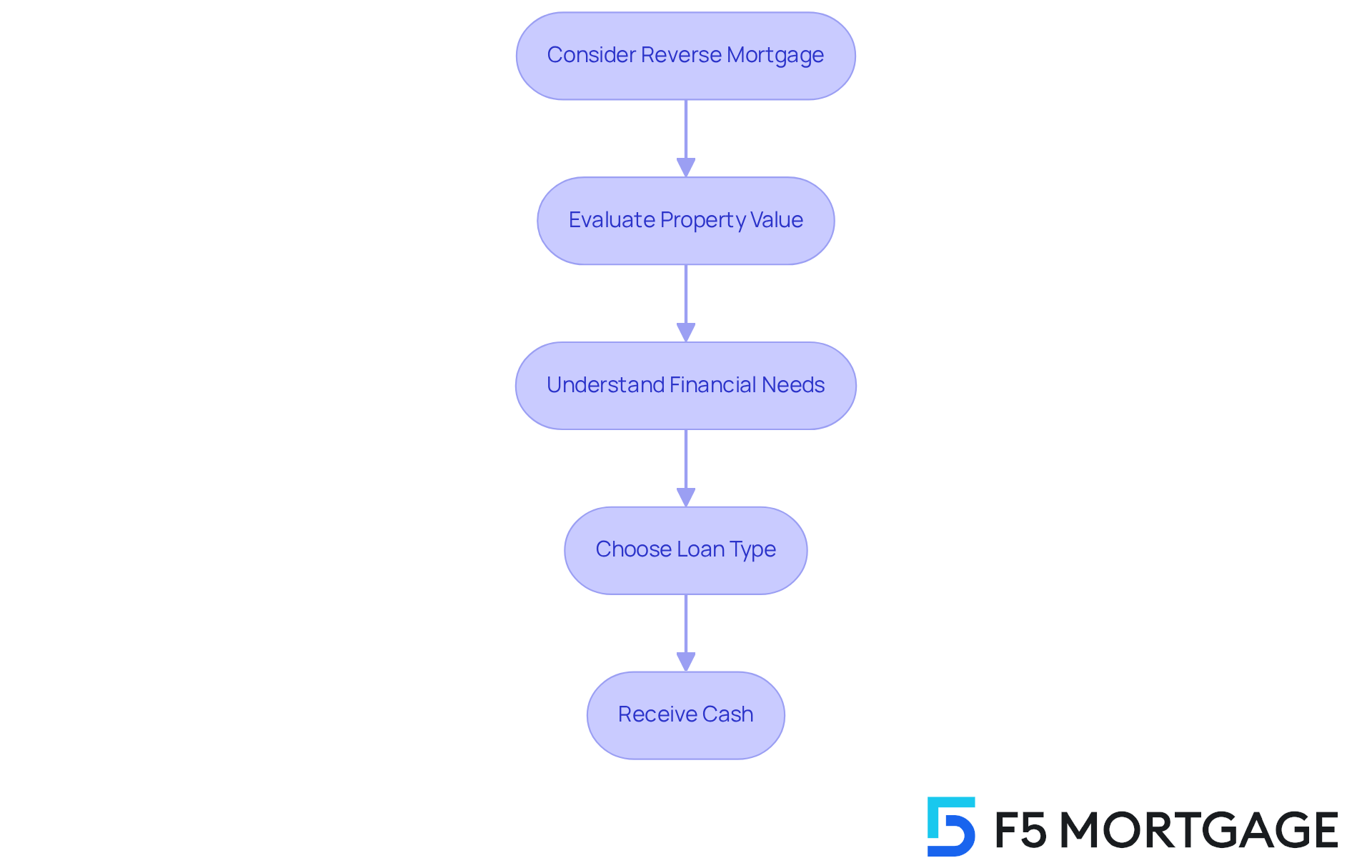

Reverse Mortgage: Financial Support for Seniors Using Home Equity

A can be a lifeline for older adults, allowing them to convert a portion of their property value into cash without the need to sell their beloved home or worry about monthly loan payments. We understand how challenging it can be to navigate . This for retirees looking to supplement their income or cover .

The beauty of a reverse mortgage lies in its flexibility. The financing is settled only when the property owner decides to sell their home, relocates, or passes away. This means you can stay in your residence while utilizing your assets, providing . We’re here to support you every step of the way as you explore this option to .

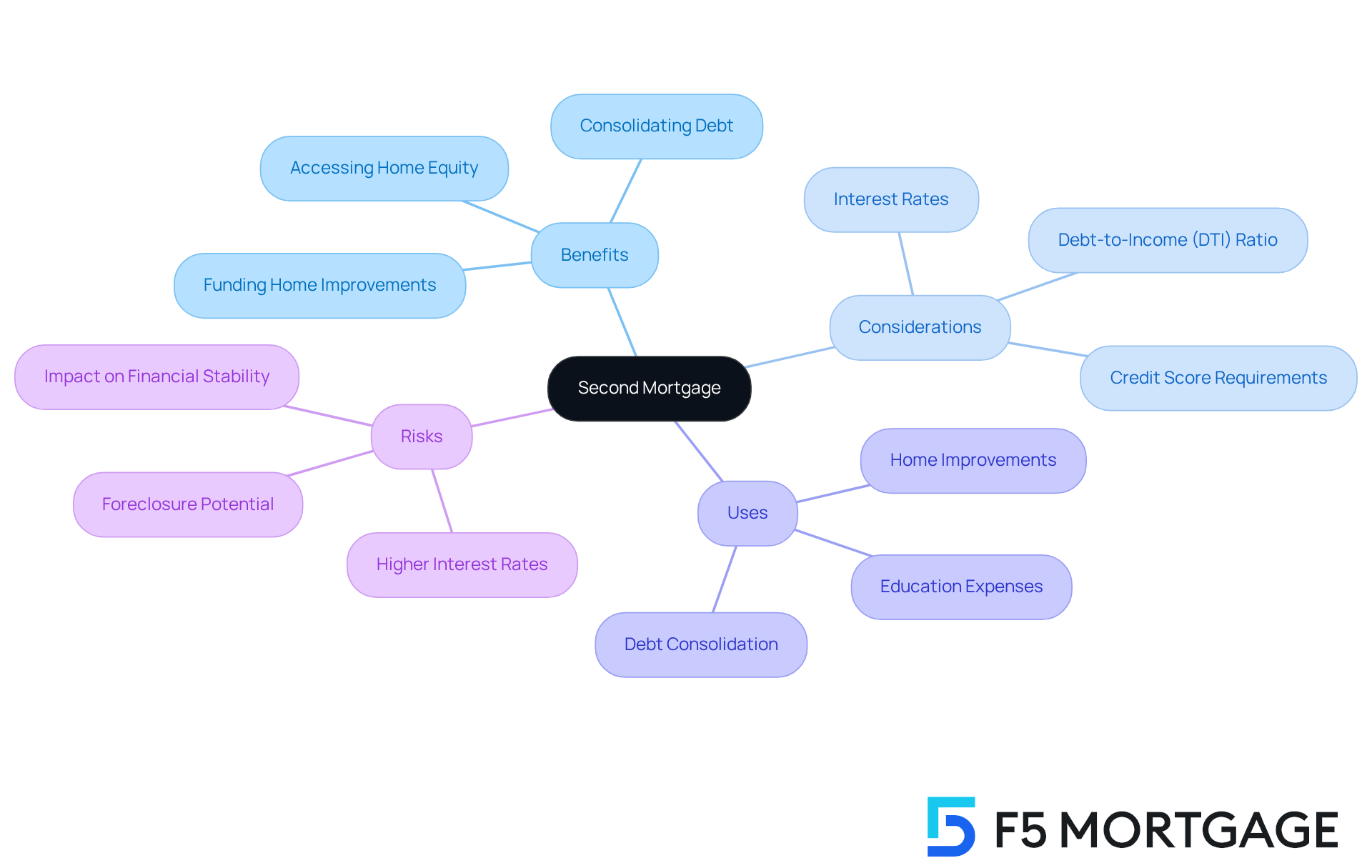

Second Mortgage: Additional Financing While Retaining Your Primary Loan

A can be a valuable resource for families, acting as an additional loan secured against a home that already has a primary mortgage. This option allows households to for various needs, such as , education, or other significant expenses. By choosing a second mortgage, families can access needed funds without the hassle of refinancing their current mortgage.

While it’s true that second mortgages often come with than primary mortgages, they can still be a strategic financial tool. In fact, statistics show that homeowners can typically borrow up to 80-85% of their home’s appraised value through a second mortgage. This makes it a feasible choice for those looking to enhance their living spaces.

Many families turn to second mortgages specifically for renovations, as these investments can significantly boost property value. Mortgage brokers frequently highlight the benefits of second mortgages, noting that they can help or finance . Understanding how second mortgages work is crucial; they allow homeowners to maintain their existing credit conditions while securing additional funding, providing .

Moreover, it’s important to grasp and maintain a healthy debt-to-income (DTI) ratio, as this can lead to more competitive mortgage rates. However, it’s essential to be aware of the risks associated with second mortgages, including the possibility of foreclosure if payments are missed. Evaluating how a second mortgage fits into your long-term financial plan is vital to ensure it aligns with your overall . We know how challenging this can be, and we’re here to support you every step of the way.

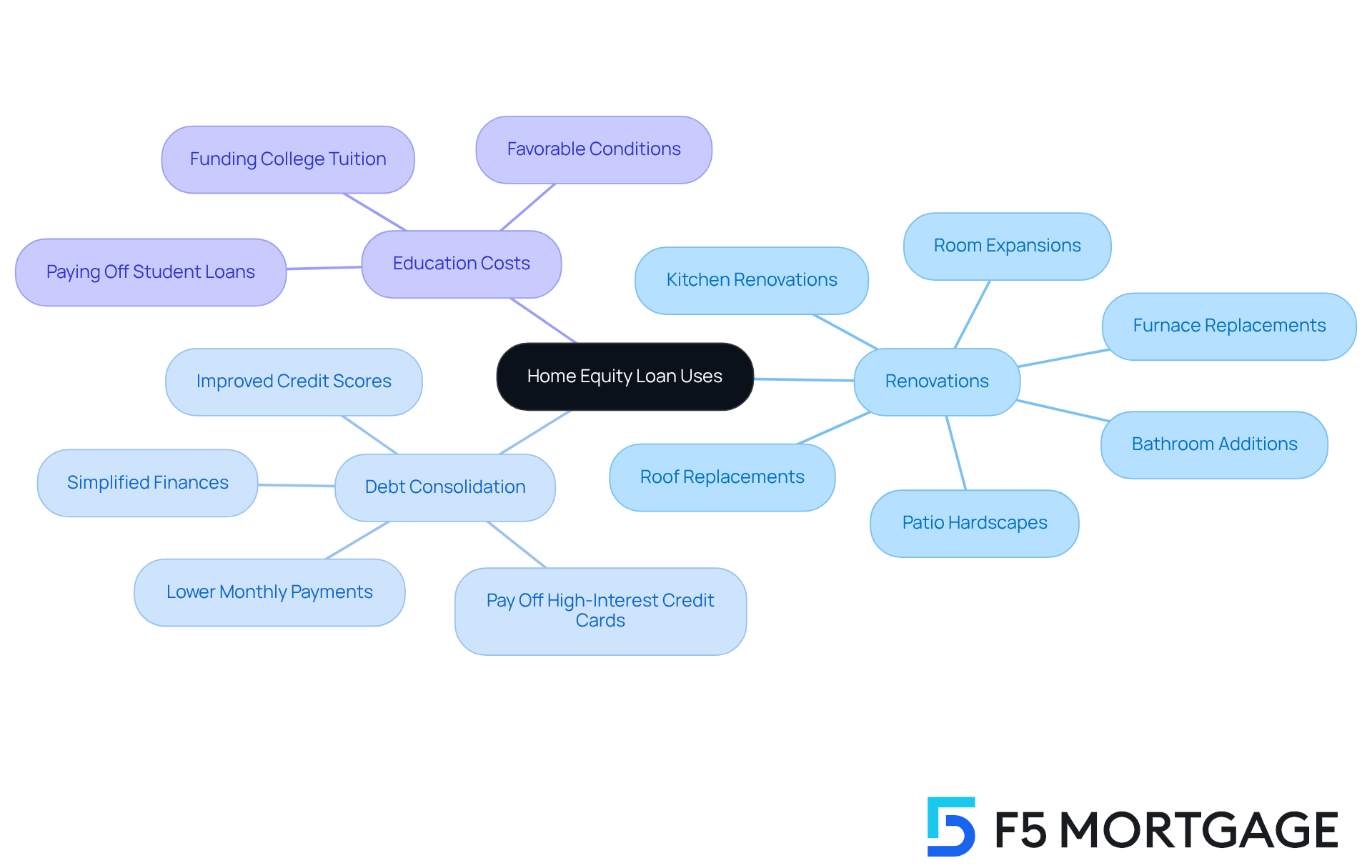

Home Equity Loan Uses: Funding Renovations, Debt, and Education

Property loans can play a crucial role in your family’s financial journey, especially when it comes to , consolidating debt, and addressing educational costs. We understand that many families look to their property’s value to like kitchen renovations, room expansions, or even college expenses. By tapping into this value, households not only enhance their living environments but also boost the overall worth of their homes.

Statistics indicate that a growing number of property owners are choosing to support renovations. Many families are opting to stay in their homes longer, investing in enhancements that truly matter to them. Property improvements remain the most common use of these funds, as families recognize the potential return on investment. Financial specialists emphasize that leveraging for renovations can be a smart financial choice, often leading to and an improved quality of life.

Moreover, merging high-interest debt through property value financing is becoming increasingly popular, especially as average credit card rates exceed 20%. This approach not only simplifies your finances but can also lead to significant savings over time. Families are discovering that using these financial products to cover educational expenses often provides more favorable conditions compared to traditional student financing options.

In summary, represent versatile financing options for families looking to invest in residential property. They enable you to , , and —all while potentially increasing your property’s value. Remember, we’re here to support you every step of the way as you navigate these important financial decisions.

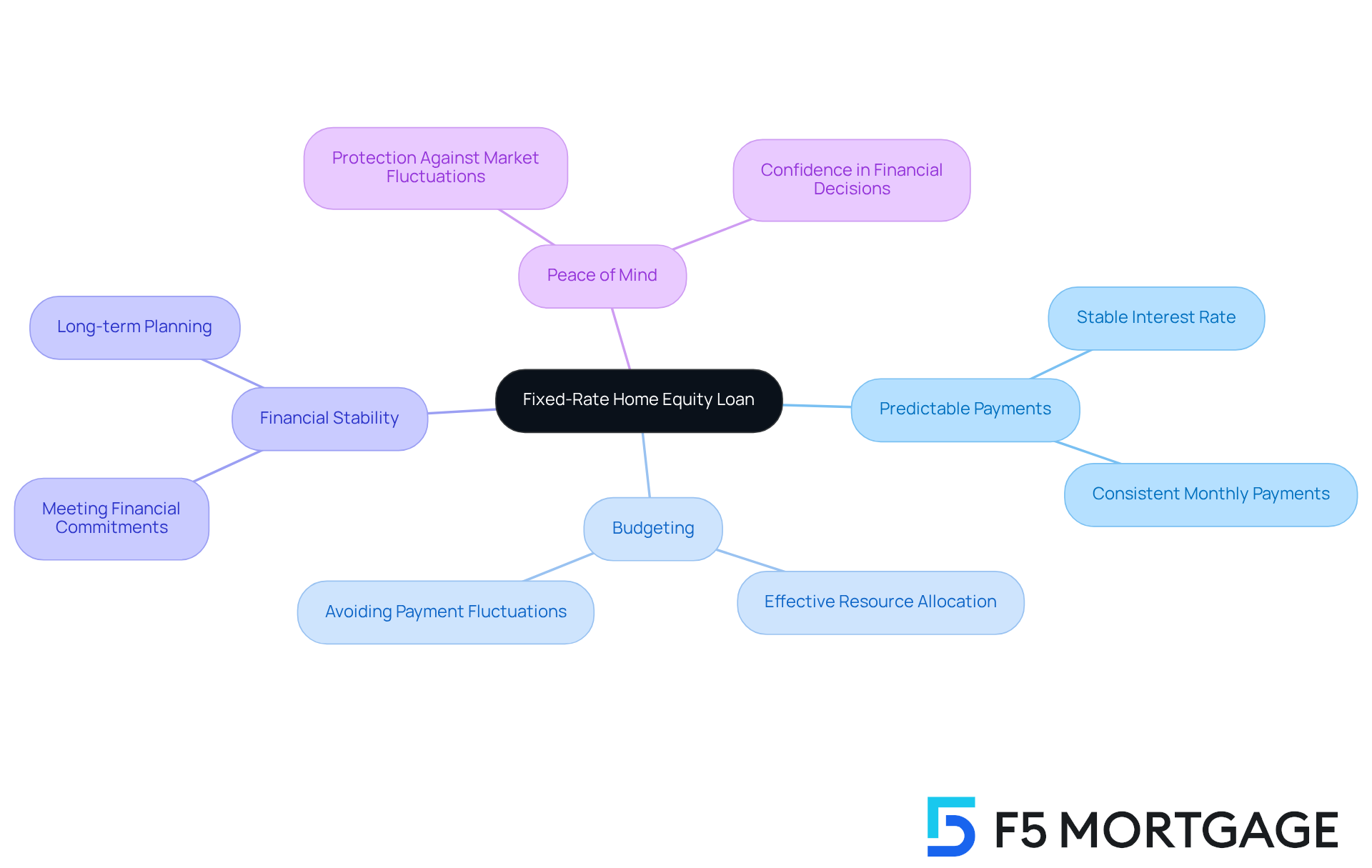

Fixed-Rate Home Equity Loan: Predictable Payments for Budgeting

One of the types of is a credit, which offers you a and consistent monthly payments during the borrowing period. We understand how important , especially for households aiming to manage their budgets effectively and avoid unexpected payment fluctuations. that the dependability of allows families to allocate their resources more efficiently, ensuring they can meet their without the stress of fluctuating payments.

Once your application is approved with , becomes crucial. This step protects you against market fluctuations during the processing period, giving you peace of mind. In 2025, the average fixed-rate borrowing amount is expected to be around $30,000. This makes it a feasible choice for families looking to tap into their property equity using types of home equity loans for enhancements or remodels.

With , you can confidently organize your finances, knowing exactly what to expect each month. This stability not only aids in budgeting but also empowers you to make informed choices regarding your improvement projects. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Interest-Only Home Equity Loan: Lower Initial Payments with Long-Term Considerations

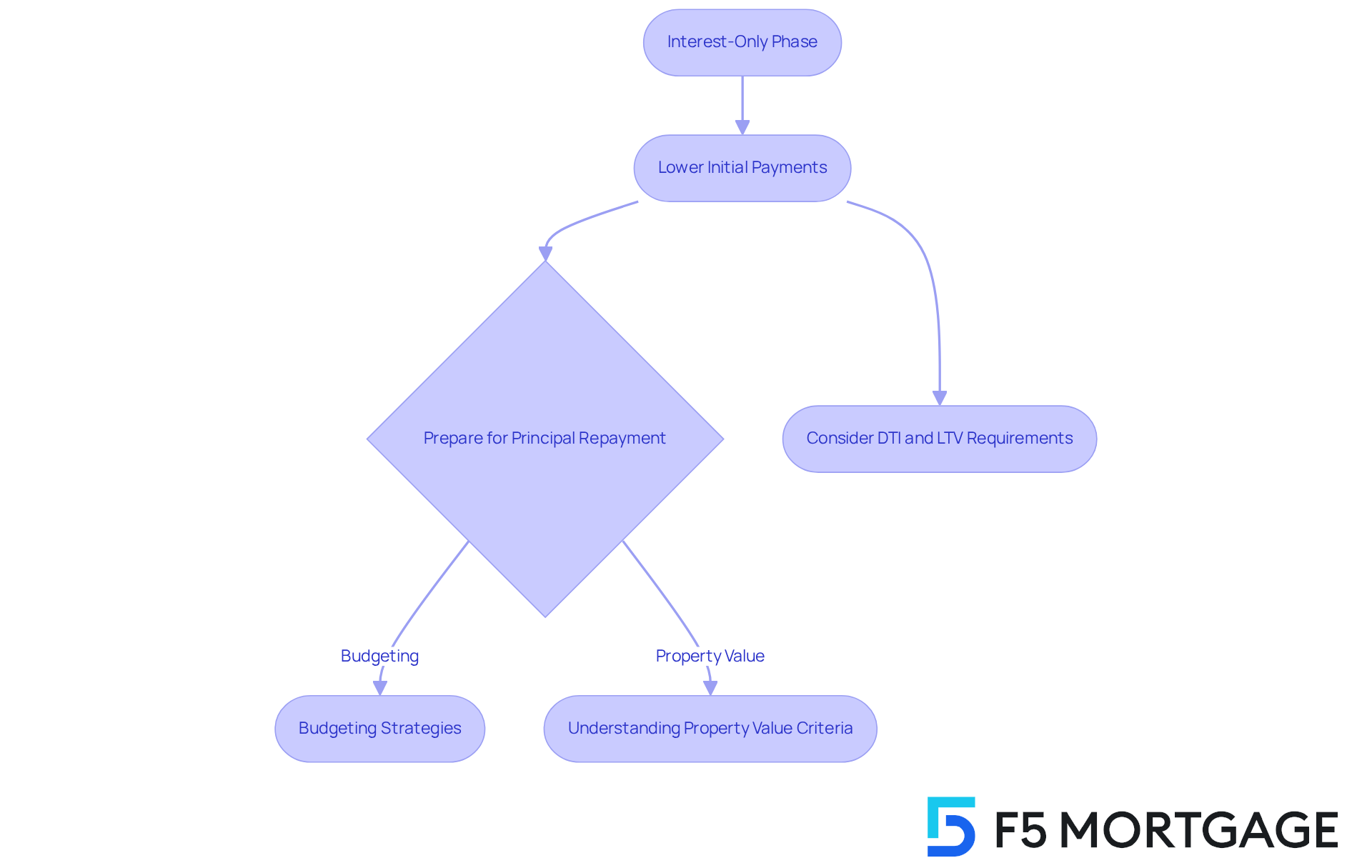

An interest-only equity line allows borrowers to pay only the interest for a set period, typically ranging from five to ten years. This arrangement can lead to lower initial monthly payments, which many families find appealing, especially when managing cash flow during renovations or other significant expenses. However, we know how challenging this can be, and of preparing for the eventual increase in payments once the interest-only phase concludes. Families will need to start repaying the principal, which can be a daunting transition.

Additionally, many creditors require property owners to maintain a minimum 80% mortgage-to-value ratio. This means they should have reduced at least 20% of their initial borrowing amount or that their property must have appreciated in value. It’s also common for a maximum of 43% to be necessary for residential financing, which can influence the competitiveness of .

Fortunately, many families have successfully navigated the shift from by implementing strategic budgeting and . This proactive approach ensures they are ready for the . Ultimately, a thorough assessment of and a clear understanding of property value criteria are vital steps before engaging in . We’re here to .

Tax Implications of Home Equity Loans: Understanding Deductions and Responsibilities

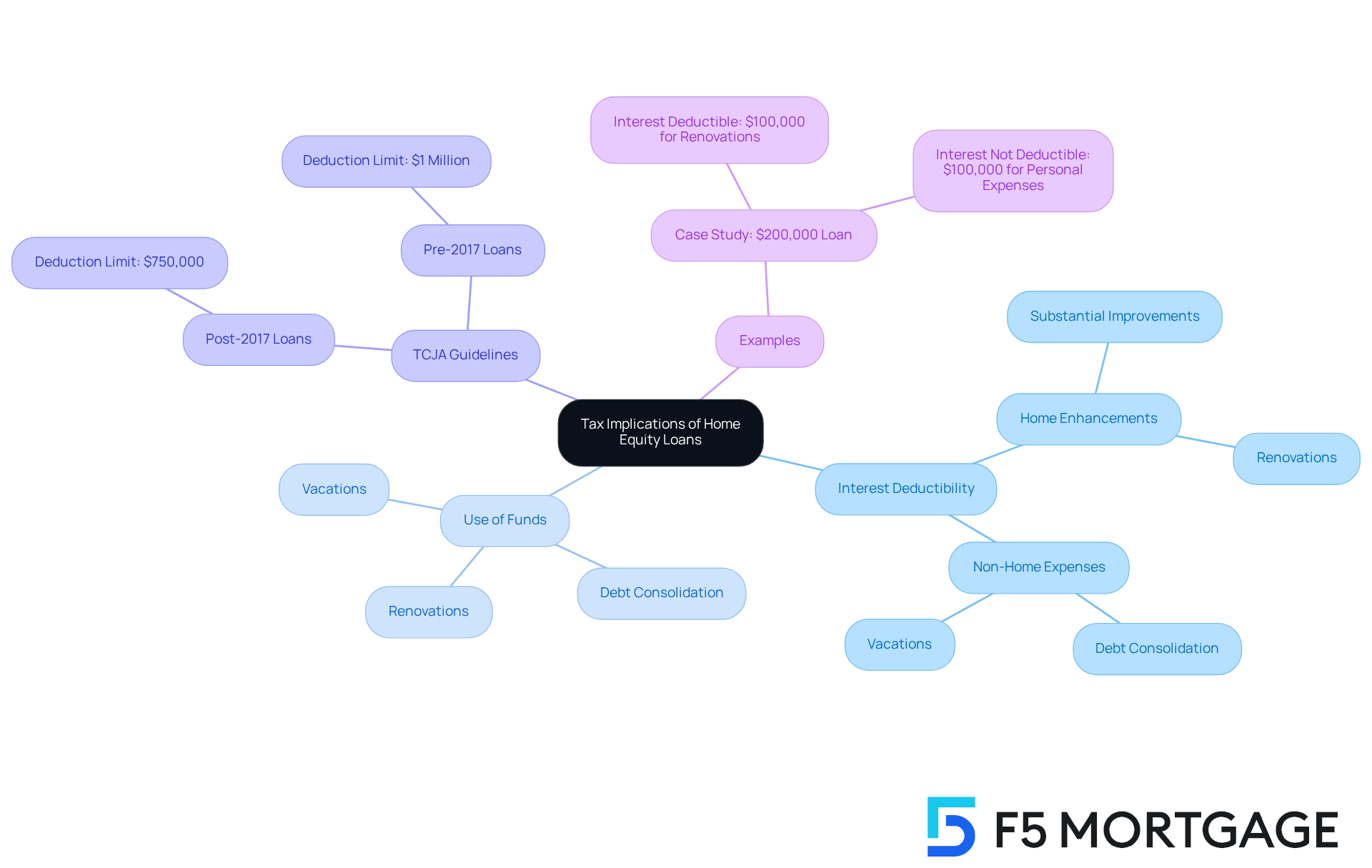

Home equity financing can provide significant , and we understand how important it is for families to navigate this complex area. The may be deductible from taxable income, depending on how the funds are used. For instance, if the funds are used for , the interest is typically deductible according to IRS guidelines. However, if the funds are allocated for non-home-related expenses, like consolidating debt or vacations, the interest is not deductible. We know how challenging this can be, so families should to manage these intricacies and ensure compliance with current tax regulations, especially by reviewing the to determine if the financing qualifies for a deduction.

To maximize financial benefits, it is crucial for families to grasp the specific requirements for deductibility. Taxpayers must detail their deductions to take advantage of . For borrowings obtained after December 15, 2017, taxpayers can deduct interest on up to $750,000 of eligible debts, provided the funds are used for purchasing, constructing, or significantly enhancing the residence. This means that , such as adding a new roof or remodeling a kitchen, can yield tax deductions, potentially lowering the overall tax burden.

Statistics show that only the interest on the portion of the credit used for qualifying projects is deductible. For example, if a household secures $200,000 in property financing, with half designated for renovations and the other half for personal expenses, only the interest on the $100,000 used for renovations would be eligible for a tax deduction. As Ryan Cicchelli, founder of The Safe Investing Expert, points out, “If that same financial obligation is used to consolidate credit card debt, take a vacation, or cover college tuition, even if it’s secured by the home—the interest is not deductible under current law.”

Understanding these nuances can empower families to make informed decisions regarding the types of available, ultimately enhancing their . As tax professionals emphasize, being proactive about tax responsibilities can lead to substantial savings and a more manageable financial future. We’re here to support you every step of the way.

Conclusion

Home equity loans provide families with a flexible and strategic way to tap into their property value for various financial needs. By exploring diverse options such as HELOCs, cash-out refinancing, and fixed-rate loans, families can discover solutions to enhance their homes, manage debt, or fund education. Understanding these financial tools empowers homeowners to make informed decisions that align with their long-term goals.

As we reflect on the growing trend of families utilizing home equity loans for renovations and significant expenses, it’s important to recognize that nearly 30% of American homeowners are considering these financing options. This underscores the value of consulting mortgage professionals. Each loan type offers unique benefits—from the flexibility of HELOCs to the predictability of fixed-rate loans—allowing families to select the best fit for their circumstances.

Ultimately, leveraging home equity can lead to improved living spaces and greater financial stability. We encourage families to evaluate their options carefully and consider how these loans can support their aspirations. By taking proactive steps and seeking guidance, homeowners can navigate the complexities of home equity loans and enhance their financial well-being for years to come.

Frequently Asked Questions

What types of home equity loan options does F5 Mortgage offer?

F5 Mortgage provides several home equity loan options including Home Value Lines of Credit (HELOCs), conventional property financing, and cash-out refinancing.

How does a Home Equity Line of Credit (HELOC) work?

A HELOC is a revolving line of credit that allows property owners to access funds as needed, up to a specified limit. Borrowers only pay interest on the amount they use, making it flexible for ongoing projects or unexpected expenses.

What are the primary reasons families consider obtaining a HELOC?

The main reason families seek a HELOC is for property enhancement, with 45% of property owners citing it as their primary motivation for obtaining a loan.

What is the average HELOC balance as of 2024?

The average HELOC balance has reached $45,157 in 2024, which is a 7.2% increase from the previous year.

What is a home equity loan and how does it differ from a HELOC?

A home equity loan provides a one-time lump sum based on the value of the property, making it suitable for covering significant costs like property improvements or debt consolidation, whereas a HELOC allows for borrowing as needed.

What are the qualification requirements for a home equity loan?

Borrowers typically need a minimum ownership share of 20% and a maximum debt-to-income (DTI) ratio of 43% to qualify for a home equity loan.

What are the benefits of a home equity loan?

Home equity loans offer fixed interest rates and predictable monthly payments, allowing families to budget effectively and avoid unexpected financial burdens.

What should families consider regarding the risks of home equity loans?

Families should be aware of the potential risks, including the possibility of foreclosure if payments are missed.

What are the typical closing costs associated with home equity loans?

Closing expenses for property financing usually amount to about 1% of the overall loan.

How can securing mortgage rates benefit families during the application process?

Securing mortgage rates upon application approval can protect families from market fluctuations during the processing period, making it a timely consideration, especially with anticipated rate reductions from the Federal Reserve.