Overview

Securing a no PMI mortgage is a vital step in reducing homeownership costs, and we understand how challenging this can be. The article explores various strategies that can help families like yours navigate this process with confidence. Options such as:

- Utilizing lender-paid PMI

- Piggyback loans

- VA loans for veterans

- Homebuyer assistance programs

- Leveraging gift funds

are all valuable tools to avoid the financial burden of private mortgage insurance.

By considering these alternatives, you can take control of your homeownership journey. We’re here to support you every step of the way as you explore these options. Each strategy offers unique benefits that can make a significant difference in your mortgage experience, allowing you to focus on what truly matters—creating a loving home for your family.

Introduction

Navigating the complexities of home financing can feel overwhelming. We understand how challenging it can be, especially when it comes to grasping Private Mortgage Insurance (PMI) and its implications. For many prospective homeowners, avoiding PMI is a critical goal, as it can lead to significant savings over time. This article explores ten effective strategies for securing a no PMI mortgage. From leveraging lender-paid options to utilizing gift funds and homebuyer assistance programs, we’re here to support you every step of the way.

But what happens when the desire for your dream home collides with the financial realities of PMI? Discover how to navigate these challenges and unlock the door to homeownership without the burden of additional costs. Your journey to a home you love starts here.

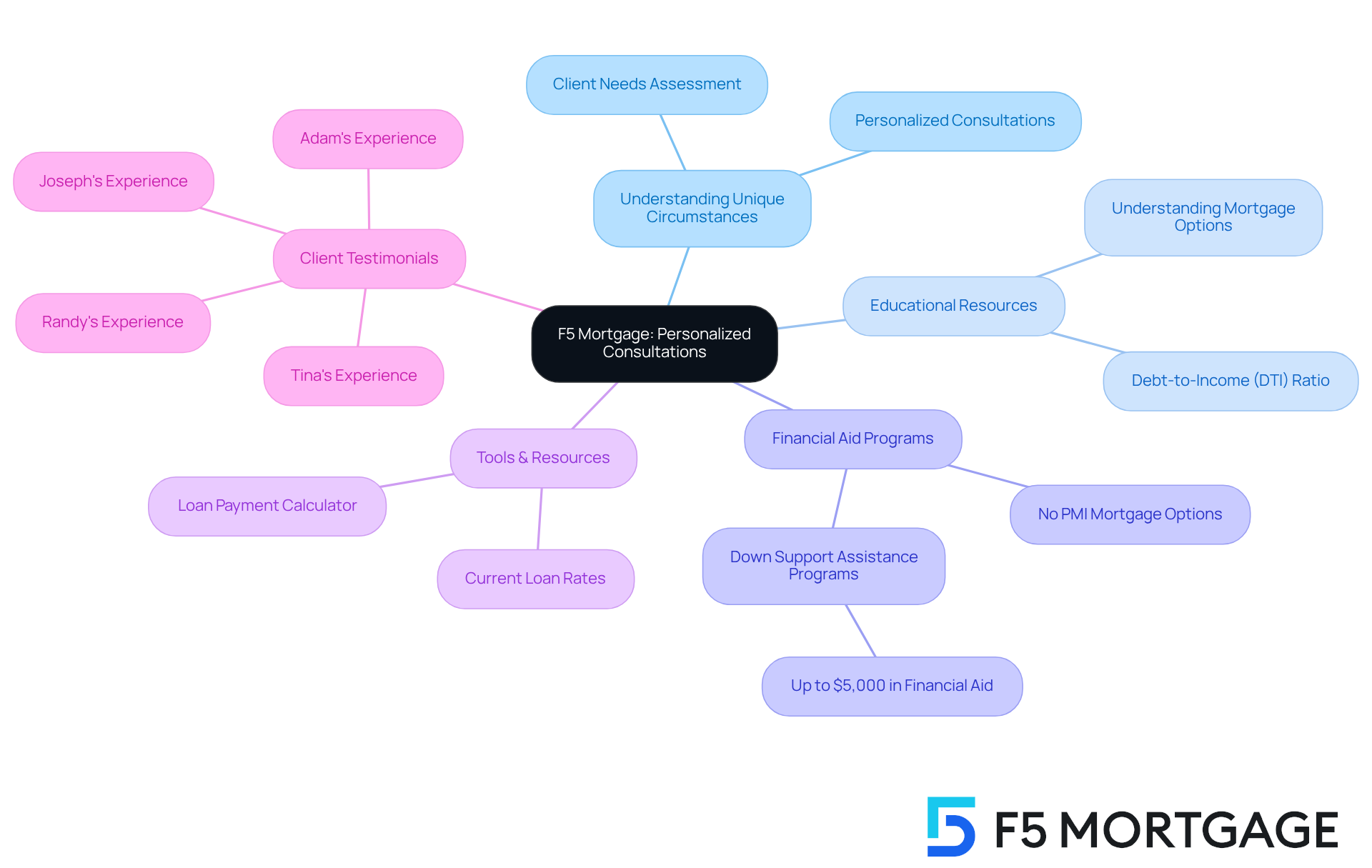

F5 Mortgage: Personalized Consultations for No PMI Mortgages

At F5 Mortgage, we understand how challenging navigating your financial situation and homeownership aspirations can be. That’s why we offer personalized consultations designed to thoroughly evaluate your unique circumstances. By gaining a deep understanding of your needs, we can devise effective strategies to help you secure a no PMI mortgage.

This tailored approach not only educates you about your options but also highlights important resources, like down support assistance programs that can provide up to $5,000 in financial aid. We also explore alternative loan arrangements that involve a no PMI mortgage to eliminate PMI expenses. Furthermore, understanding your Debt-to-Income (DTI) ratio is crucial, as it influences your financing choices and rates.

To empower you further, we provide tools like a loan payment calculator, allowing you to estimate your payments. This ensures you have a comprehensive understanding of how to navigate the financing landscape. Our assessment helps you make informed decisions that align with your financial goals, especially considering that current loan rates can vary due to state-specific factors.

As one of our satisfied clients, Randy, shared, “Quick and thorough. Very kind and courteous. They answered our questions and helped us understand the process.” This level of personalized service guarantees that families enhancing their homes feel supported and confident in their financing journey. We’re here to support you every step of the way.

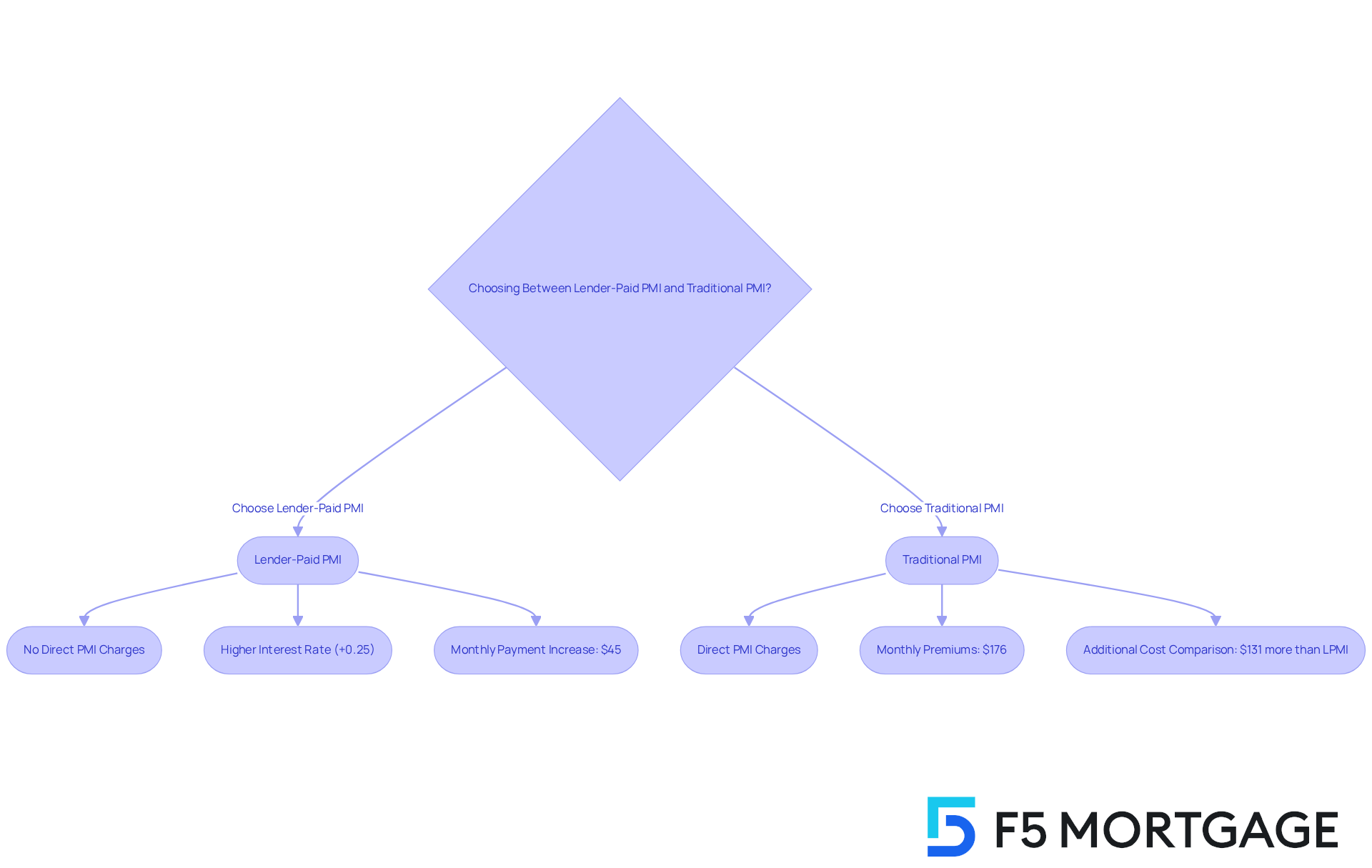

Lender-Paid PMI: Shift the Cost to Your Lender

Lender-paid PMI can be a helpful option for borrowers looking to avoid direct PMI charges. In this arrangement, the lender takes on the expense, allowing you to focus on your goals without the immediate financial burden. In exchange, borrowers typically accept a slightly higher interest rate—averaging around a 0.25% increase for those with excellent credit. This can be especially beneficial for families aiming to reduce initial costs while securing a no PMI mortgage for financing.

For example, if you’re securing a $300,000 loan with a 10% down payment, you might see your monthly payment rise by about $45 due to lender-paid PMI. In contrast, with traditional PMI, your monthly premiums could be $176, which is $131 more than the additional cost of LPMI. However, it’s important to weigh the long-term financial implications against these immediate savings. We understand how challenging this can be, and financial advisors often recommend assessing whether the higher interest rate offsets the benefits of avoiding upfront costs.

Additionally, remember that the interest paid on a loan, including LPMI costs, may be tax-deductible if you itemize deductions. This can provide some relief as you navigate your financial journey. Ultimately, understanding how lender-paid PMI functions and its effect on your overall loan expenses is crucial for making informed financing decisions, especially when considering a no PMI mortgage. We’re here to support you every step of the way as you explore your options.

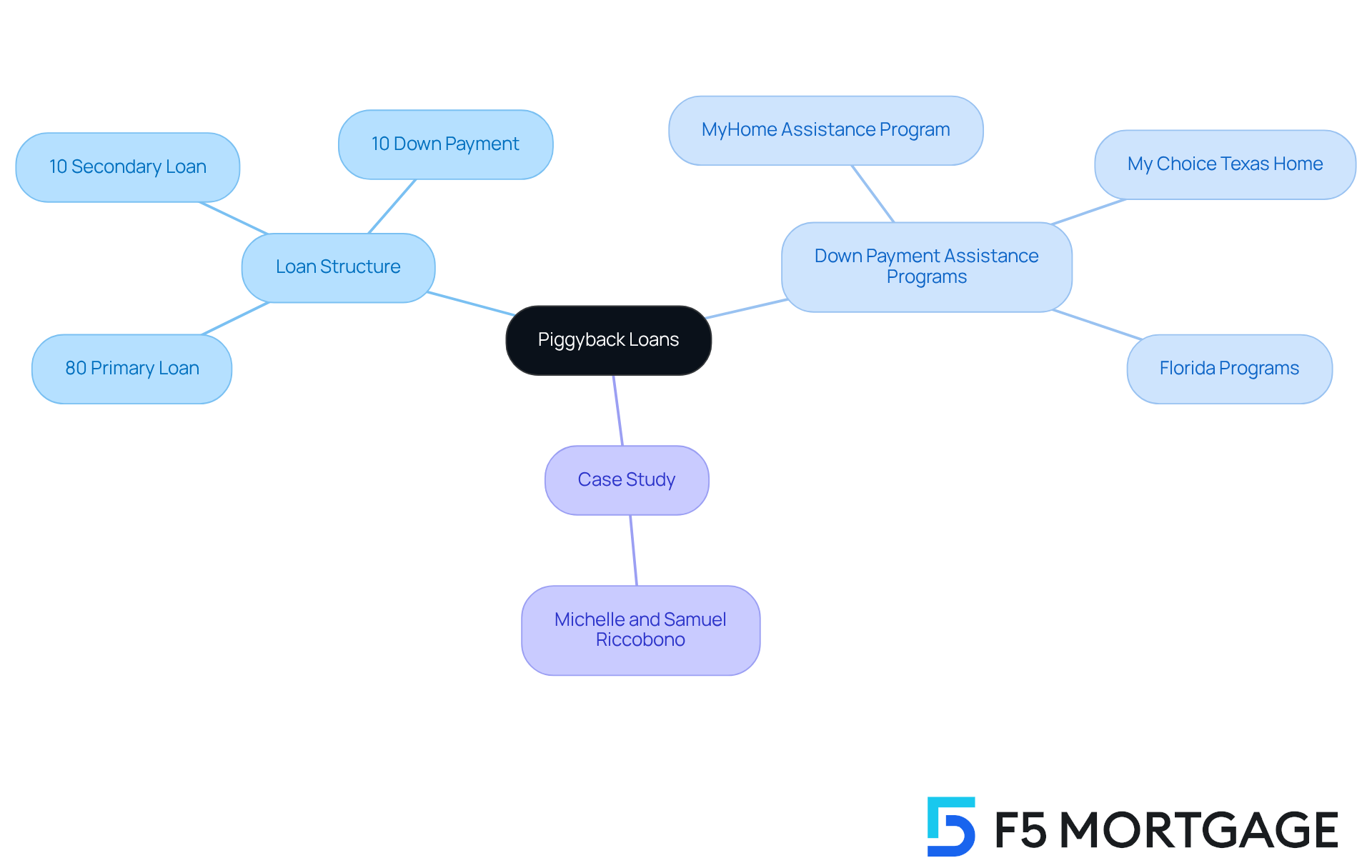

Piggyback Loans: Combine Mortgages to Eliminate PMI

Navigating the world of home financing can be challenging, and we understand how important it is to find the right solutions for your family. A piggyback loan, often arranged as an 80-10-10 loan, allows borrowers to secure two loans simultaneously, which can be a great way to ease the financial burden. In this setup, the primary loan covers 80% of the property’s value, while the secondary loan represents 10%, enabling the borrower to provide a 10% down payment. This strategy effectively avoids a no PMI mortgage by keeping the first mortgage below the 80% loan-to-value ratio.

By utilizing this approach, families can minimize their upfront costs while still securing their ideal residence. Additionally, F5 Mortgage offers various down payment assistance programs that can further support you. For instance:

- The MyHome Assistance Program in California provides up to 3% of the property’s purchase price.

- The My Choice Texas Home program grants up to 5% for down and closing support.

- In Florida, several programs supply up to $10,000 in upfront expenses.

Consider the story of Michelle and Samuel Riccobono, a newly married couple from Philadelphia. They took advantage of this arrangement and saved around $250 a month on their home loan payments, highlighting the financial benefits of piggyback loans.

Moreover, homeowners can explore refinancing options to achieve a no PMI mortgage, especially in a market characterized by high home appreciation rates. This can help achieve a lower loan-to-value ratio, further easing financial stress. As the popularity of piggyback loans continues to rise, they present a viable option for homebuyers like you, seeking to navigate the complexities of home financing with a no PMI mortgage to avoid additional costs. Remember, we’re here to support you every step of the way.

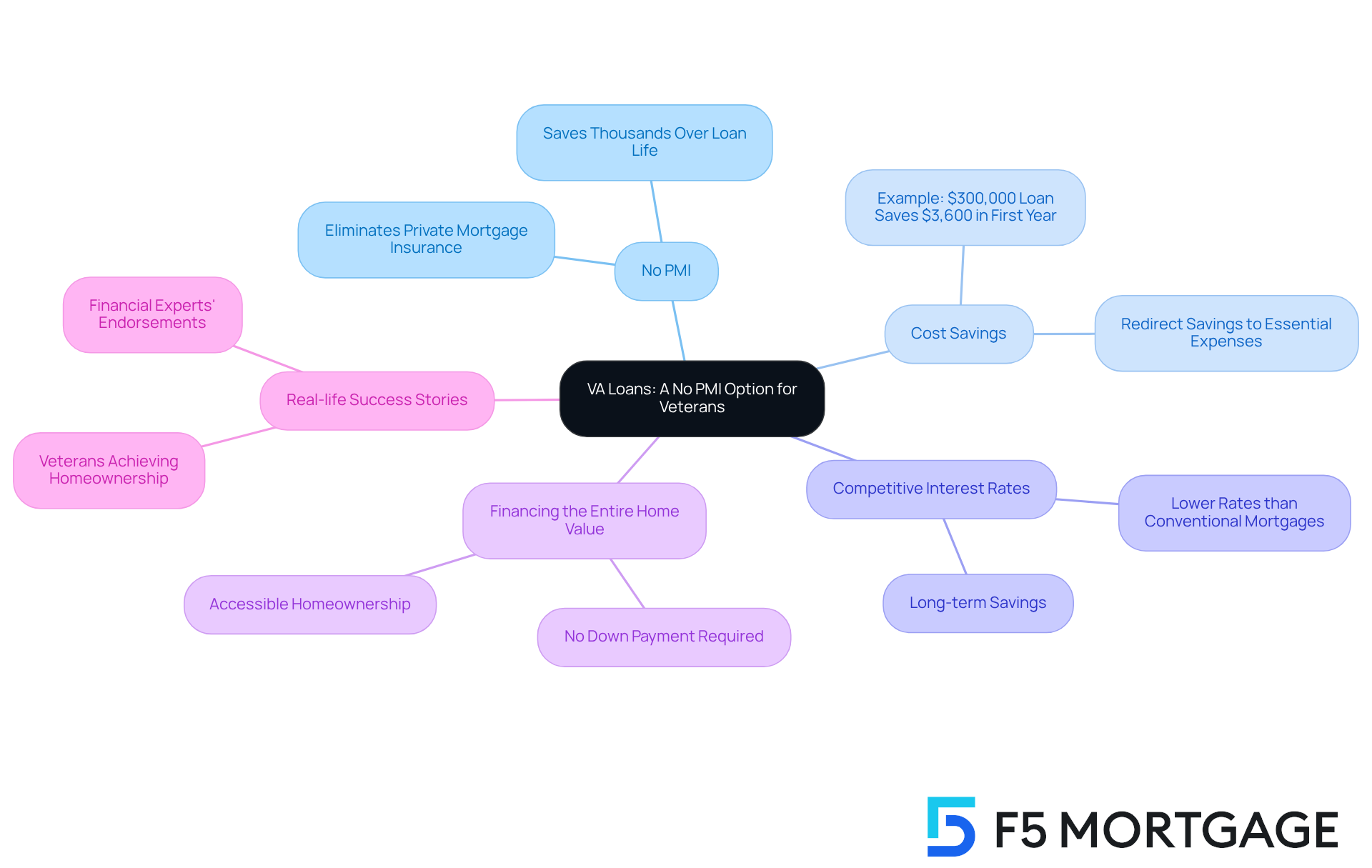

VA Loans: A No PMI Option for Veterans

VA loans provide a remarkable opportunity for qualified veterans and active-duty personnel, as they offer a no PMI mortgage, eliminating the need for private insurance regardless of the down payment size. This significant benefit can lead to substantial savings, potentially amounting to thousands of dollars over the life of the loan. For example, a veteran securing a $300,000 loan without PMI could save around $3,600 in the first year alone, which translates to about $300 each month.

Additionally, VA loans often come with competitive interest rates, frequently lower than those of conventional mortgages, further enhancing affordability. Veterans can finance the entire value of a home without any upfront costs, making the dream of property ownership more attainable.

Real-life stories illustrate the power of VA loans in helping veterans achieve their homeownership goals. Many veterans have successfully used these loans to purchase homes with a no PMI mortgage, which allows them to redirect those savings toward essential expenses or investments. Financial experts emphasize that choosing a no PMI mortgage not only reduces monthly payments but also significantly lowers the overall cost of borrowing, making VA loans a preferred choice for many.

In conclusion, VA loans emerge as a financially beneficial option for veterans. By combining the no PMI mortgage with favorable loan terms and competitive rates, they ultimately support veterans on their path to homeownership. We understand how challenging this journey can be, and we’re here to support you every step of the way.

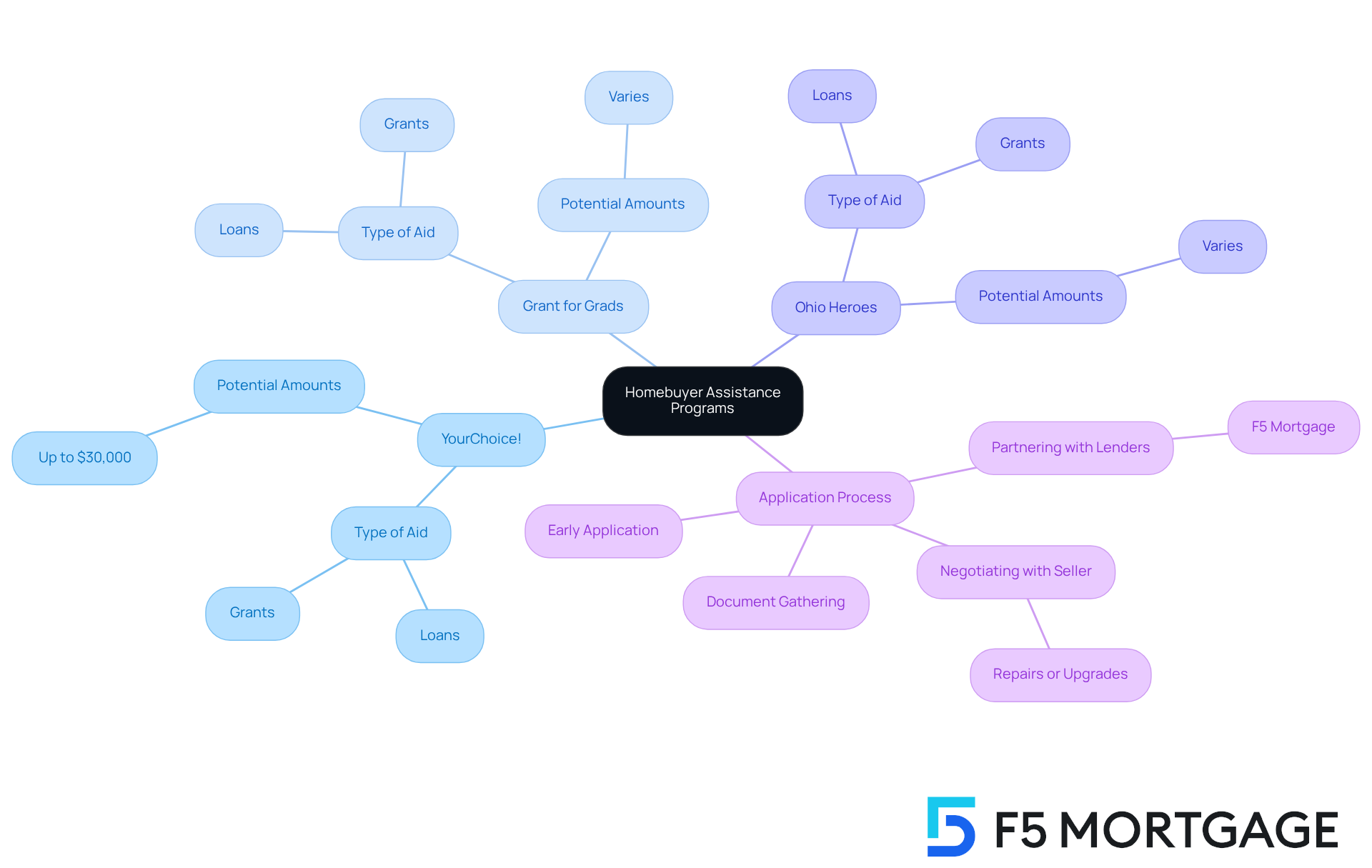

Homebuyer Assistance Programs: Financial Aid to Bypass PMI

Many states and local authorities offer homebuyer support initiatives designed to provide financial assistance for deposits and closing costs. In Ohio, for example, programs can offer anywhere from a few thousand dollars to over $30,000, either as loans or grants. This financial aid can significantly lessen the amount needed upfront, which helps you obtain a no pmi mortgage.

To begin your journey toward down payment assistance, start by researching programs like:

- YourChoice!

- Grant for Grads

- Ohio Heroes

Gather the necessary documents, and consider partnering with an experienced lender like F5 Mortgage. They can guide you through the application process with ease.

It’s essential to apply for these options early in the homebuying process. Doing so maximizes your benefits and can ensure a smoother loan approval experience. Additionally, think about negotiating with the seller for repairs or upgrades. This strategy can enhance your financial position when purchasing a home. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

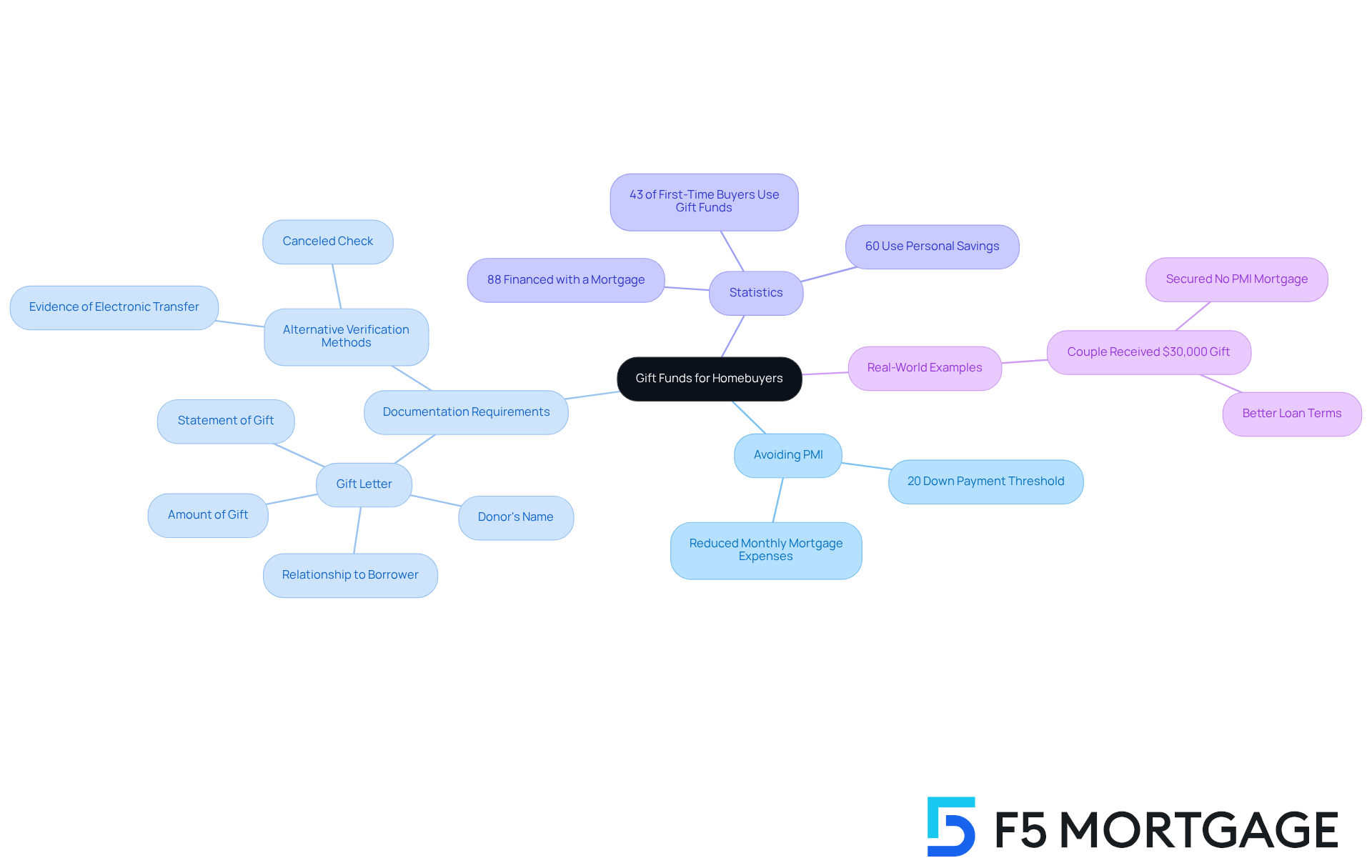

Gift Funds: Leverage Family Support to Avoid PMI

Gift funds from family members serve as a crucial resource for homebuyers who want to avoid the burden of Private Mortgage Insurance (PMI). By utilizing these funds for the down payment, buyers can often reach the 20% threshold necessary to eliminate PMI, significantly reducing their monthly mortgage expenses. We know how challenging this can be, and recent statistics reveal that around 43% of first-time buyers rely on gift funds from relatives or friends to assist with their down payment. This highlights the vital role of family support in achieving homeownership.

To ensure that the gift is recognized by lenders, proper documentation is essential. A gift letter must be provided, confirming that the funds are indeed a gift and do not require repayment. This letter should include details such as the donor’s name, their relationship to the borrower, the amount of the gift, and a statement affirming that the funds are a gift. Additionally, borrowers can now verify gift funds without needing the donor’s bank statement, using alternatives like a canceled check or evidence of electronic transfer.

Real-world examples illustrate how families effectively leverage gift funds. For instance, a couple looking to purchase their first home received a $30,000 gift from their parents, enabling them to surpass the 20% down payment requirement. This strategic use of gift funds not only helped them secure a no PMI mortgage but also positioned them for better loan terms. We’re here to support you every step of the way.

Mortgage professionals emphasize the importance of understanding the documentation process. As Amanda Pendleton, a personal finance expert, notes, “First-time buyers often believe that a 20% down payment is necessary, but that’s not always true.” By utilizing gift funds and ensuring proper documentation, homebuyers can navigate the complexities of mortgage financing with greater ease and confidence.

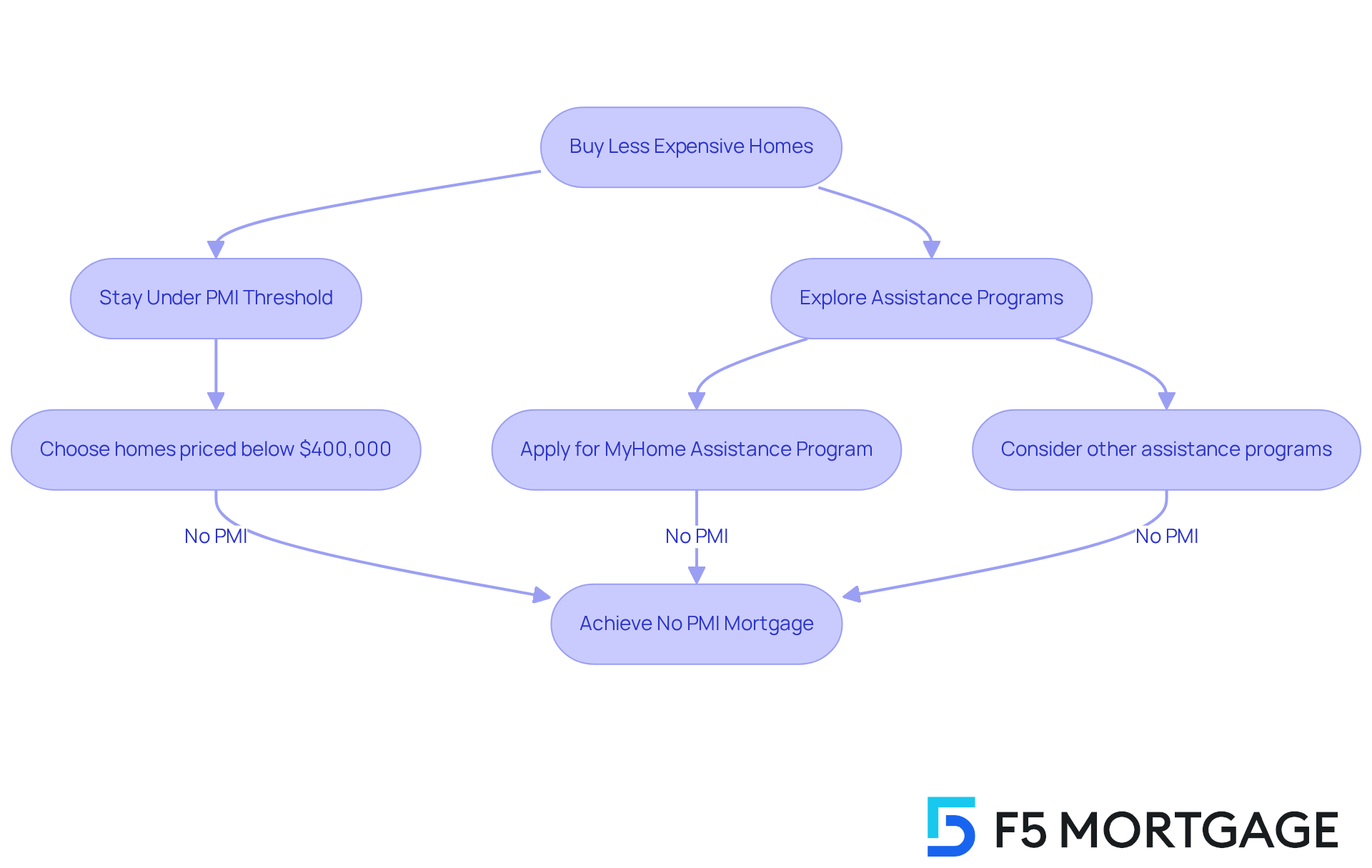

Buy Less Expensive Homes: Stay Under PMI Thresholds

To effectively avoid Private Mortgage Insurance (PMI), one of the most straightforward strategies is to pursue a no PMI mortgage by purchasing homes priced below the threshold that requires a 20% deposit. By choosing more affordable properties, buyers can greatly decrease their upfront costs and secure a no PMI mortgage, thereby eliminating PMI expenses completely. This method not only aids in preventing extra monthly costs but also enables purchasers to manage their budgets and handle their monthly expenditures more effectively.

In 2024, many buyers successfully navigated the market by acquiring properties with a no PMI mortgage, showing that affordability is still attainable even in competitive markets. For instance, families who strategically focused on properties valued at $400,000 or less were able to obtain a no PMI mortgage, which can increase monthly mortgage costs by $150 to $250. This financial relief can be especially advantageous as rising property insurance costs continue to affect overall housing expenses.

Furthermore, families can explore down payment aid initiatives offered by F5 Mortgage. Programs like the MyHome Assistance Program in California provide up to 3% of the property’s purchase price, while the My Choice Texas program grants up to 5% for down payment and closing support. In Florida, initiatives such as the Florida Assist Second Mortgage Program can offer up to $10,000 in upfront costs. These resources can significantly ease the financial burden of acquiring a home and help families secure a no PMI mortgage.

Real estate experts emphasize the importance of budget management for homebuyers. They advise considering not just the purchase price but also the long-term implications of PMI. By staying informed about current property values and market trends, buyers can make choices that align with their financial objectives. Ultimately, buying a property that qualifies for a no PMI mortgage, combined with available assistance programs, can lead to substantial savings and a more manageable financial future.

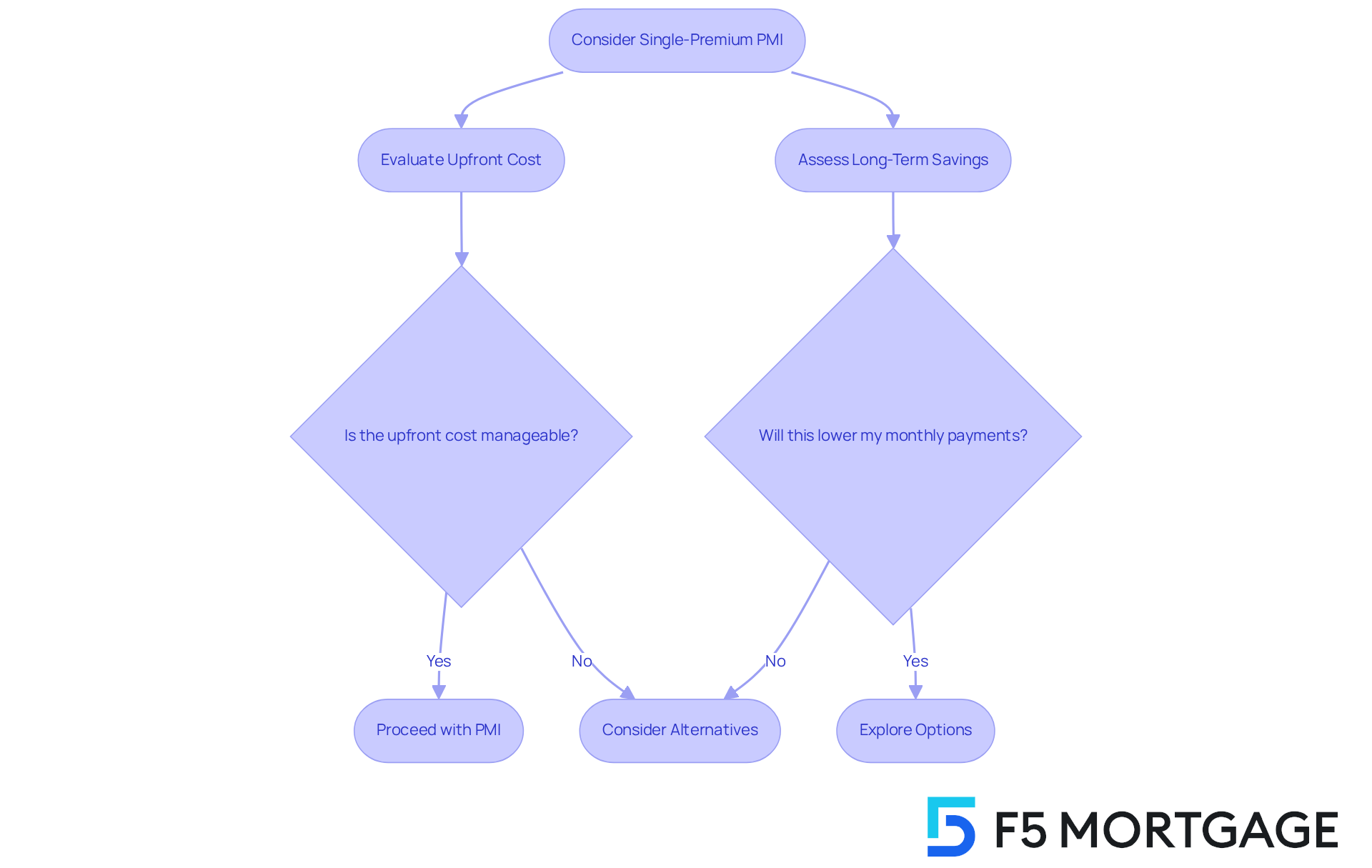

Single-Premium PMI: Pay Upfront to Avoid Monthly Costs

If you’re looking for a way to simplify your mortgage payments, single-premium PMI might be the solution you need. This option allows you to pay the entire mortgage insurance premium upfront at closing, providing a no PMI mortgage solution that eliminates those monthly PMI charges that can feel overwhelming. We understand how important it is to avoid ongoing costs, especially if you’re ready for a larger initial investment.

While the upfront cost can be significant—averaging around 1% of the loan amount—it can lead to lower overall expenses in the long run. For instance, if you’re purchasing a $400,000 home, you might face a single-premium PMI cost of about $4,000. This could lower your monthly payments by approximately $365. Imagine the peace of mind that comes with simplified budgeting and faster equity building.

Financial advisors often highlight that although the initial expense may seem daunting, the long-term savings and relief from monthly payments, particularly with a no PMI mortgage, can outweigh the upfront cost, especially in a rising housing market. However, it’s crucial to remember that the upfront charge for single-premium PMI is non-refundable if you refinance your mortgage, so it’s essential to consider this aspect carefully.

We’re here to support you every step of the way as you navigate these decisions. Understanding your options can empower you to make the best choice for your financial future.

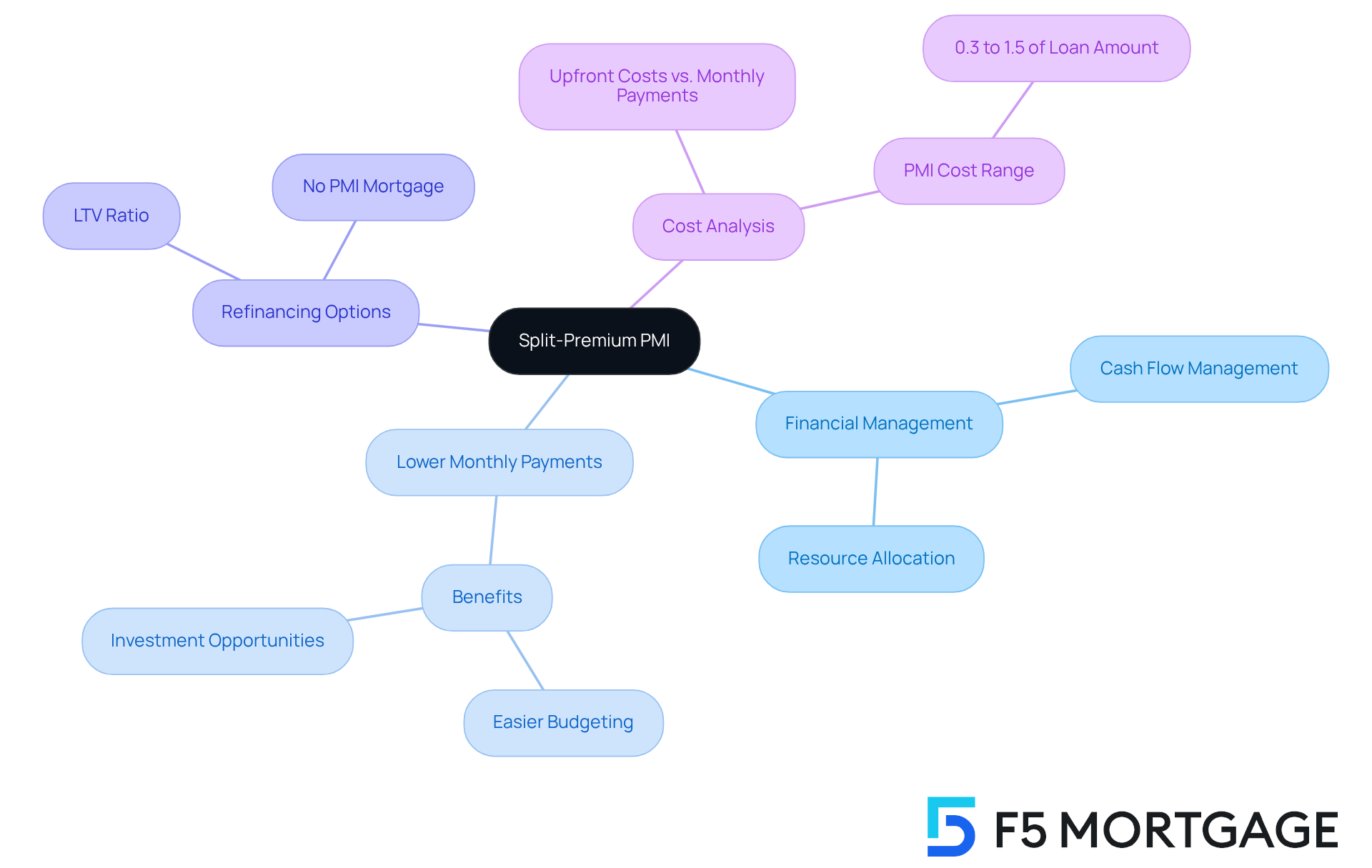

Split-Premium PMI: Balance Upfront and Monthly Payments

Split-premium PMI offers a strategic solution for families navigating the complexities of home financing. By allowing borrowers to pay a portion of the premium upfront and spread the remaining cost over monthly installments, this option can significantly ease monthly financial burdens. We understand how important it is for families to manage their cash flow effectively. With split-premium PMI, families can allocate their resources more efficiently, ensuring they maintain necessary insurance coverage without overwhelming their monthly budget.

Mortgage experts often emphasize the importance of balancing initial and monthly costs when evaluating split-premium PMI. By structuring payments this way, families can enjoy lower monthly obligations while still benefiting from the protective coverage that PMI provides. This approach not only assists in budgeting but also enables families to invest in other crucial areas, such as renovations or savings, which can enhance their overall quality of life.

Moreover, the connection between split-premium PMI and refinancing options is vital for families seeking to optimize their financial situation. Families can leverage refinancing to secure a no PMI mortgage by adjusting the duration or term of their loan. For those who acquired their residence with a conventional loan and put down less than 20%, refinancing may allow for a no PMI mortgage, especially given the high property appreciation rates in California. This empowers families to calculate their new loan-to-value (LTV) ratio using their property’s increased value, potentially accelerating their path to a no PMI mortgage.

When considering the typical cost analysis of split-premium PMI, families will find that it generally includes a larger upfront payment, which can be incorporated into the loan, followed by lower monthly premiums. PMI costs typically range from 0.3% to 1.5% of the loan amount annually, depending on various factors. This structure allows families to navigate the complexities of property financing while keeping their long-term financial goals in sight. As one financing specialist noted, understanding how to manage cash flow with split-premium PMI can empower families to make informed decisions that align with their financial aspirations.

To maximize the advantages of split-premium PMI and refinancing, families should regularly evaluate their property’s value. Considering refinancing alternatives when they achieve a favorable LTV ratio is crucial, as obtaining a no PMI mortgage is possible once the principal balance is less than 80% of the original appraised value. This offers additional financial relief, allowing families to breathe easier and focus on what truly matters.

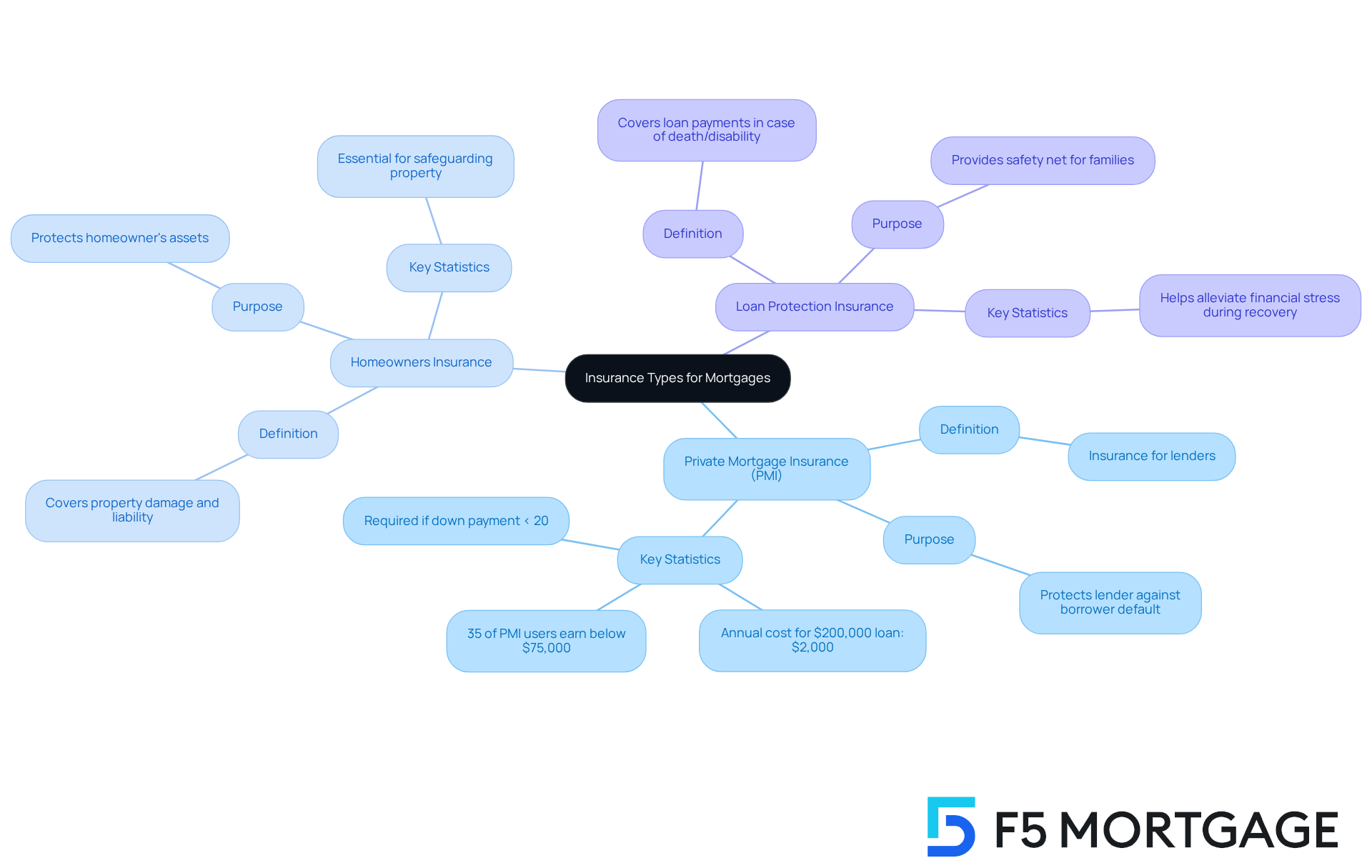

PMI vs. Other Insurance Types: Know Your Options

For borrowers, understanding the differences between Private Mortgage Insurance (PMI), homeowners insurance, and protection insurance is vital when considering a no PMI mortgage. We know how challenging this can be. A no PMI mortgage is designed to protect the lender in case of borrower default, particularly when the down payment is less than 20% of the property’s value. On the other hand, homeowners insurance protects against property damage and liability, safeguarding the homeowner’s assets. Meanwhile, loan protection insurance ensures that loan payments are covered in the event of the borrower’s death or disability, providing a safety net for families.

Statistics show that many borrowers lack clarity on these differences, which can lead to costly mistakes in financial planning. For instance, approximately 35% of borrowers using PMI in 2024 had annual incomes below $75,000. This highlights the need for accessible education on insurance options. Additionally, Florida ranks second in low down payment property buyers utilizing PMI in 2024, indicating the widespread use of PMI in areas with high property prices. Real-world examples further illustrate this gap: many first-time homebuyers mistakenly believe that a no PMI mortgage offers them protection, when in reality, it primarily benefits the lender.

Financial advisors stress the importance of understanding these insurance types. As Kristine Lee, an insurance analyst, noted, “It’s important to understand the difference between mortgage insurance and home insurance.” This understanding is crucial for homebuyers to make informed choices that align with their financial goals. By educating themselves on these distinctions, borrowers can navigate their insurance needs more effectively and enhance their overall financial strategy.

Conclusion

Securing a no PMI mortgage is not just a dream; it’s an attainable goal for many homebuyers. We understand how daunting the mortgage landscape can be, but this article outlines effective strategies to help you navigate it with confidence. From personalized consultations that assess your unique financial situation to exploring options like lender-paid PMI, piggyback loans, and VA loans, there are numerous pathways to eliminate the burden of private mortgage insurance.

Key insights discussed include:

- The advantages of utilizing homebuyer assistance programs

- The potential of gift funds

- Purchasing less expensive homes to help you stay under PMI thresholds

Each strategy presents unique opportunities to save money and streamline your homebuying process. Remember, informed decision-making is crucial in achieving your financial goals.

Ultimately, understanding the various options available for securing a no PMI mortgage is essential in today’s competitive market. Whether you’re considering assistance programs or leveraging family support, we encourage you to take proactive steps in your journey. By utilizing the resources and strategies outlined here, you can pave the way toward successful homeownership while minimizing unnecessary costs. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer for securing a no PMI mortgage?

F5 Mortgage offers personalized consultations to evaluate unique financial situations and help devise strategies for securing a no PMI mortgage. They also provide information on down payment assistance programs and tools like a loan payment calculator.

What is lender-paid PMI, and how does it work?

Lender-paid PMI is an arrangement where the lender covers the PMI costs, allowing borrowers to avoid direct charges. In exchange, borrowers typically accept a slightly higher interest rate, averaging a 0.25% increase. This can help reduce initial costs while securing a no PMI mortgage.

How does the cost of lender-paid PMI compare to traditional PMI?

For a $300,000 loan with a 10% down payment, lender-paid PMI might increase monthly payments by about $45, whereas traditional PMI could result in monthly premiums of $176, which is $131 more than the cost of lender-paid PMI.

What are piggyback loans, and how do they help eliminate PMI?

Piggyback loans, often structured as an 80-10-10 loan, involve securing two loans simultaneously. The primary loan covers 80% of the property’s value, and the secondary loan covers 10%, allowing the borrower to make a 10% down payment and avoid PMI by keeping the first mortgage below the 80% loan-to-value ratio.

What down payment assistance programs are available through F5 Mortgage?

F5 Mortgage offers various down payment assistance programs, such as the MyHome Assistance Program in California (up to 3% of the purchase price), the My Choice Texas Home program (up to 5% for down and closing support), and programs in Florida that provide up to $10,000 in upfront expenses.

Can refinancing help achieve a no PMI mortgage?

Yes, homeowners can explore refinancing options to achieve a no PMI mortgage, especially in markets with high home appreciation rates. This can help lower the loan-to-value ratio and reduce financial stress.

What is the importance of understanding your Debt-to-Income (DTI) ratio?

Understanding your Debt-to-Income (DTI) ratio is crucial as it influences your financing choices and rates. It helps borrowers make informed decisions that align with their financial goals.