Overview

This article aims to help you identify reliable sources for finding the best Home Equity Line of Credit (HELOC) rates available today. We know how challenging this can be, and we’re here to support you every step of the way. It highlights various platforms and experts who provide valuable insights, comparisons, and personalized guidance. Our goal is to empower homeowners like you to make informed decisions and secure favorable rates tailored to your financial needs.

Introduction

Navigating the world of Home Equity Lines of Credit (HELOCs) can feel overwhelming. We understand how challenging it is, especially with fluctuating interest rates and numerous lenders competing for your attention. For homeowners eager to leverage their property equity, knowing where to find the best HELOC rates is essential for making informed financial decisions. This article will explore ten valuable sources that provide insights into competitive HELOC rates, empowering you to optimize your borrowing options. But with so many choices available, how can you determine which source truly offers the best insights and rates? We’re here to support you every step of the way.

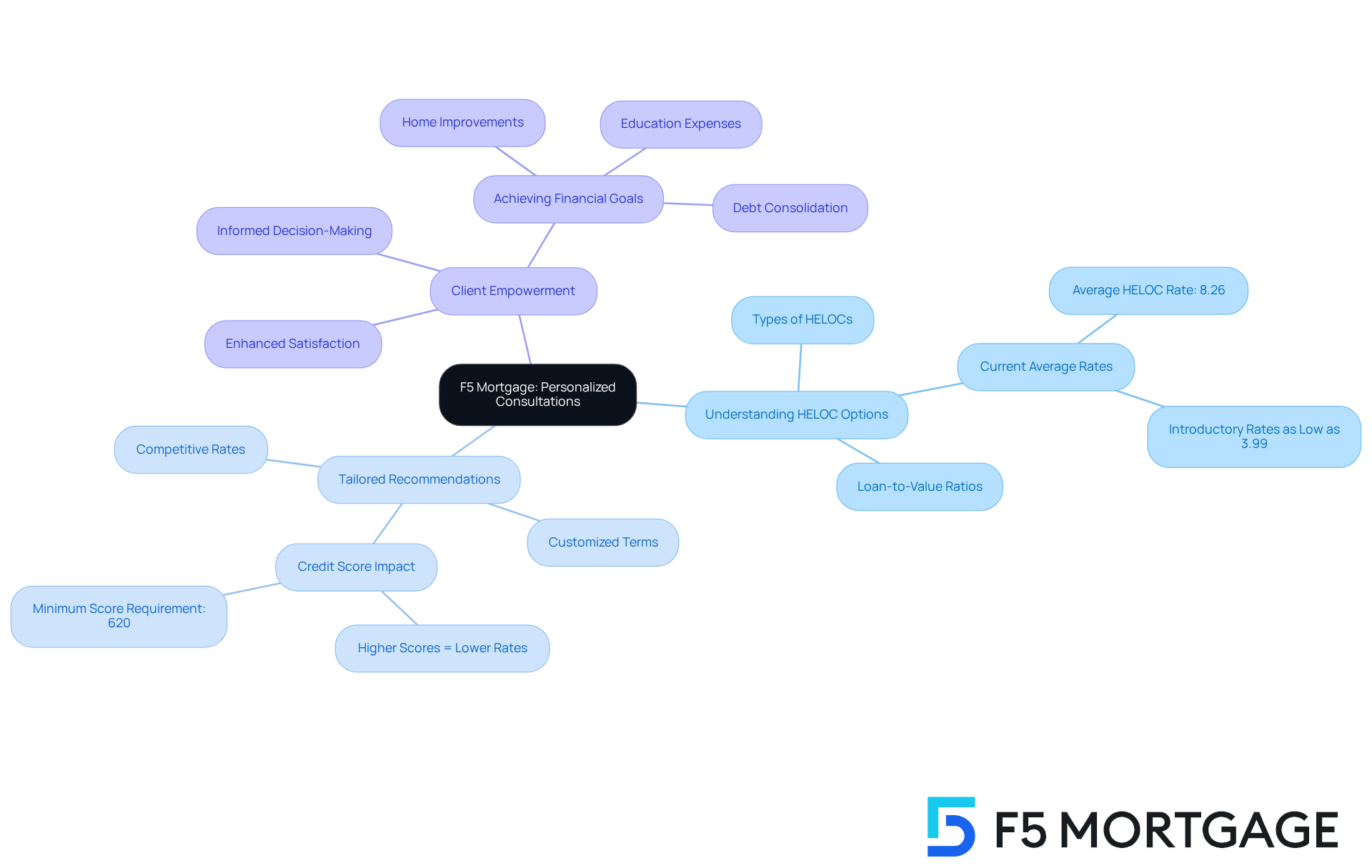

F5 Mortgage: Personalized Consultations for Competitive HELOC Rates

At F5 Mortgage, we understand how overwhelming it can be to navigate your Home Equity Lines of Credit (HELOC) options. That’s why we offer personalized consultations designed to empower you every step of the way. Our dedicated loan officers bring extensive experience to the table, taking the time to assess your unique financial situation. This allows us to recommend competitive rates and terms tailored specifically for your needs.

By simplifying the decision-making process, we equip you with the knowledge needed to utilize your property equity wisely and secure the HELOC best rates. Statistics show that personalized mortgage consultations significantly enhance client satisfaction and boost decision-making confidence, leading to better financial outcomes. We have seen firsthand how these consultations can transform lives, enabling families to achieve their financial goals—whether that’s funding home improvements, covering education expenses, or consolidating debt.

In today’s market, seeking personalized guidance on HELOC best rates is more crucial than ever for property owners looking to maximize their equity. Let us support you in making informed decisions that align with your aspirations.

Bankrate: Insights on Average HELOC Rates and Market Trends

As of October 8, 2025, the national average HELOC interest rate is now at 8.47%. This marks a significant decline from previous highs, providing a breath of fresh air for property owners. Understanding the HELOC best rates is essential for those looking to utilize their property equity wisely. With homeowners currently holding over $34 trillion in equity, this moment presents a valuable opportunity to consider a home equity line of credit for various financial needs, such as home improvements or debt consolidation.

We know how challenging it can be to navigate financial decisions, and economists suggest that the recent drop in HELOC best rates is related to the Federal Reserve’s efforts to stimulate economic growth. This change has made it easier for homeowners to access funds without affecting their existing low-rate primary mortgages. For example, a homeowner with a $400,000 property could withdraw $50,000 from a HELOC, resulting in monthly payments of around $375. This option can be a lifeline for many families.

Practical examples highlight the benefits of understanding HELOC terms. Homeowners who have acted on recent rate declines have successfully funded renovations or consolidated higher-interest debts by securing HELOC best rates. These stories showcase the strategic advantages of making timely financial decisions. As the market evolves, we encourage prospective borrowers to explore their options and negotiate terms that align with their financial goals. Remember, we’re here to support you every step of the way.

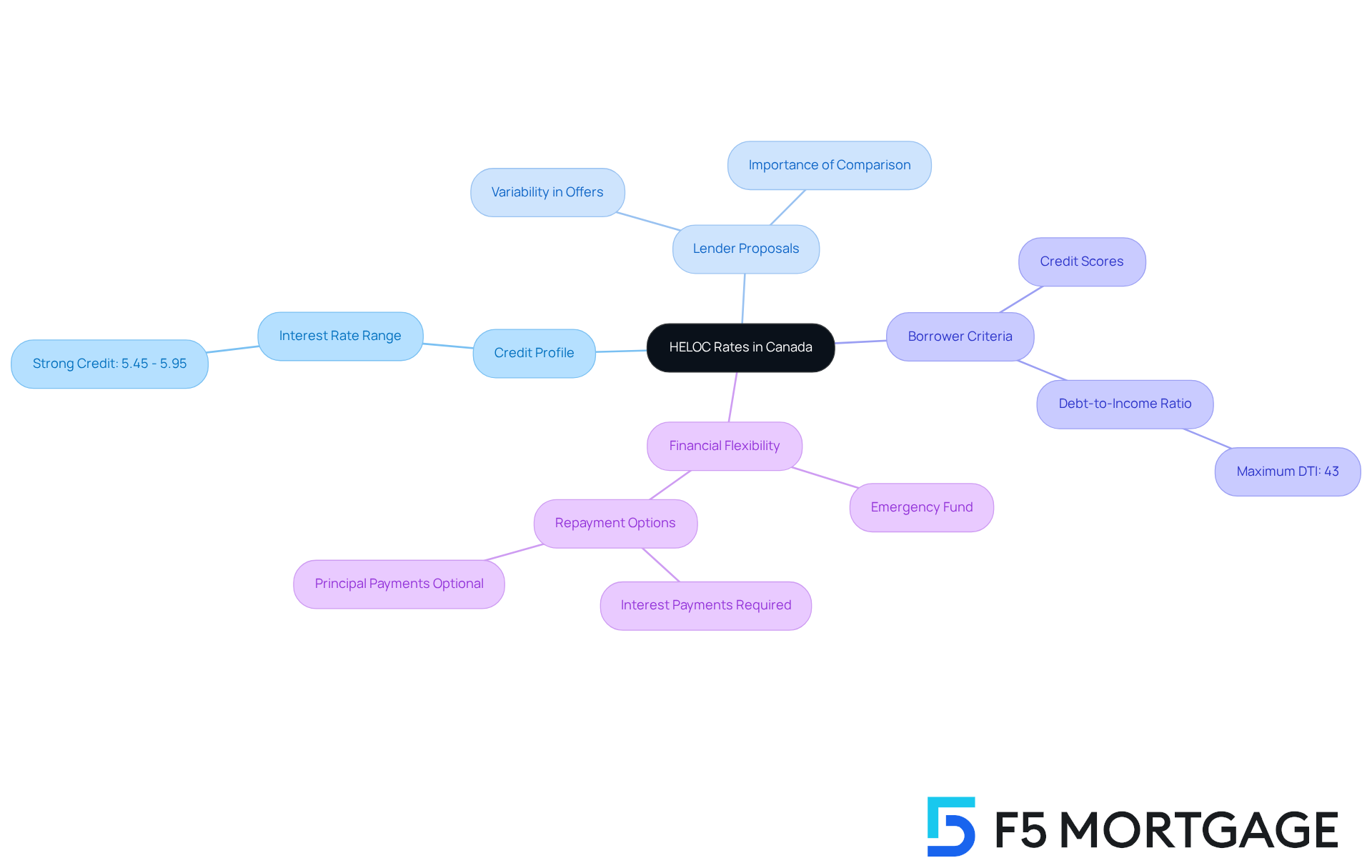

Lotly: Complete Guide to Current HELOC Rates in Canada

At Lotly, we understand how navigating the world of home equity lines of credit can feel overwhelming. Our comprehensive guide to current HELOC best rates in Canada highlights the considerable differences that can arise based on lender proposals and borrower criteria. For example, if you have a strong credit profile, you might encounter interest rates ranging from 5.45% to 5.95%. This range emphasizes the importance of comparing various lenders to secure the heloc best rates for your situation.

As a Canadian property owner looking to leverage your equity, it’s essential to grasp these dynamics. The right HELOC can provide you with vital financial flexibility, which can be a game-changer in times of need. Moreover, understanding your debt-to-income (DTI) ratio is crucial; typically, a maximum DTI of 43% is required for home loans, which can significantly influence your eligibility for favorable mortgage conditions.

Experts agree that borrower qualifications, such as credit scores and DTI ratios, are essential in determining the heloc best rates you receive. It’s also important to remember that interest payments on a home equity line of credit must always be made. As the market evolves, staying informed about these aspects is essential for making wise financial choices. We know how challenging this can be, but we’re here to support you every step of the way.

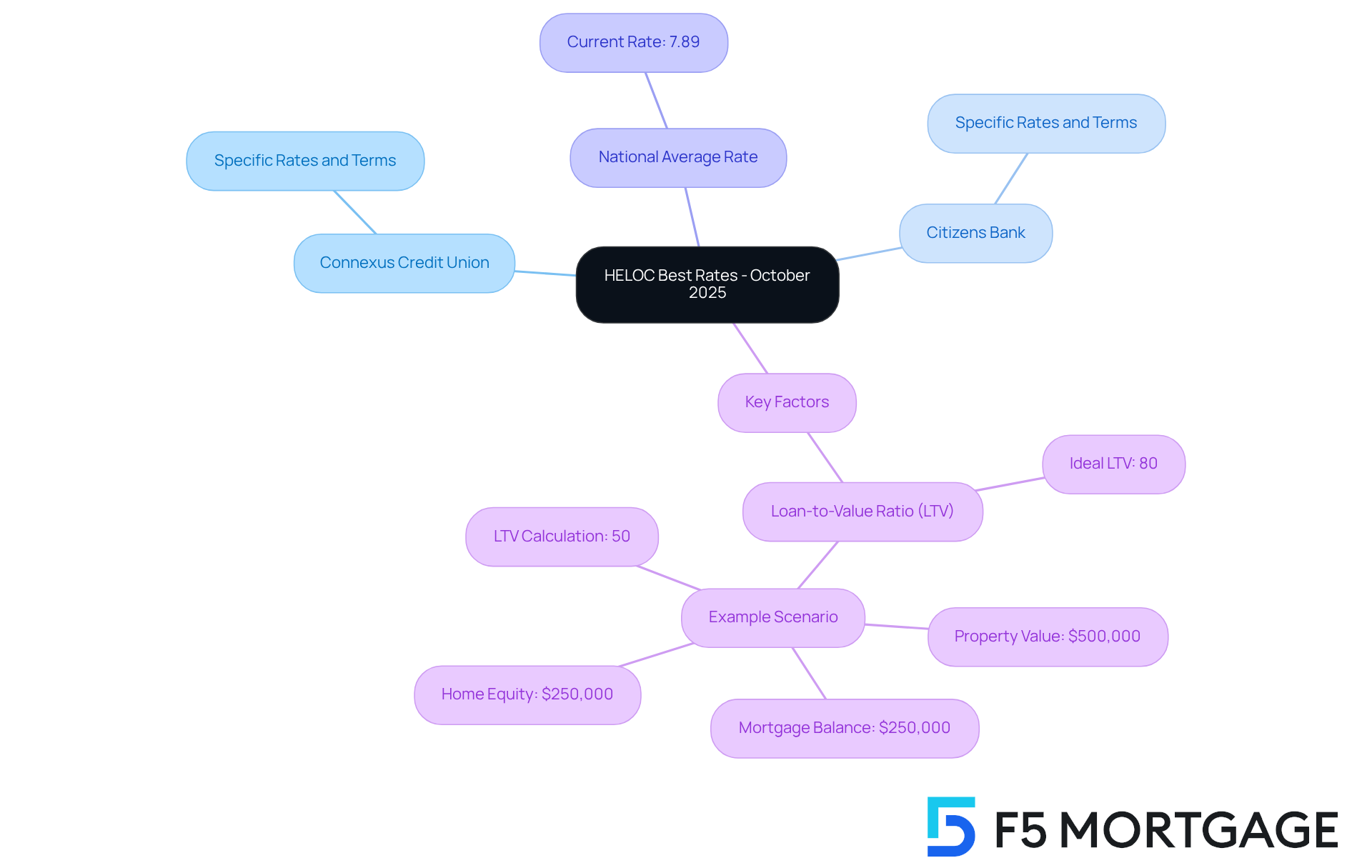

Forbes: Comparison of the Best HELOC Rates for October 2025

In October 2025, a variety of lenders are providing the HELOC best rates, creating a wonderful opportunity for homeowners to explore their options. Notable lenders, such as Connexus Credit Union and Citizens Bank, provide HELOC best rates that can significantly impact borrowing costs. For instance, the national average home equity line of credit rate has recently increased to 7.89%. While this indicates a slight rise, it remains near its lowest point in over a year and a half.

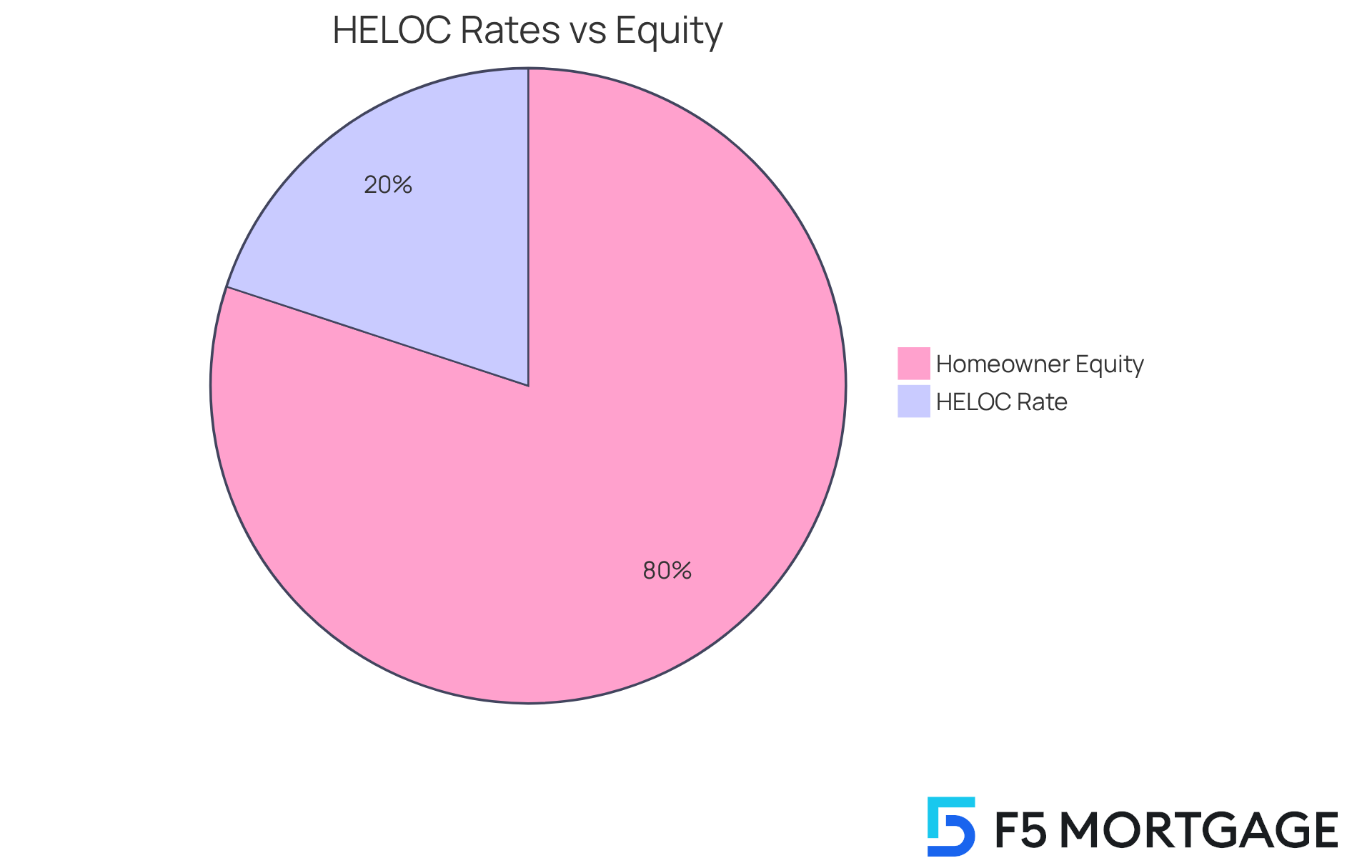

When considering HELOC lenders, it’s essential for property owners to reflect on several factors. One key aspect is the loan-to-value (LTV) ratio, which typically should not exceed 80% for many lenders. This ratio is vital as it determines how much equity can be accessed. For example, an individual with a property valued at $500,000 and a mortgage balance of $250,000 has a home equity of $250,000, resulting in a favorable LTV of 50%.

Real-life scenarios highlight the importance of comparing values. One homeowner chose a $250,000 HELOC to fund a significant renovation project, ultimately selecting a lender that offered lower interest costs and beneficial terms. This decision not only provided the necessary funds but also ensured manageable monthly payments, underscoring the importance of thorough cost comparisons.

Financial experts emphasize the need for property owners to assess their unique financial situations before selecting a lender to find the HELOC best rates. As industry analysts note, choosing the right lender can make a substantial difference in securing the HELOC best rates, which impacts your overall borrowing costs and financial flexibility. Given the current landscape of home equity line offerings, homeowners are encouraged to leverage their home equity wisely, ensuring they secure the best possible deals and terms that meet their needs.

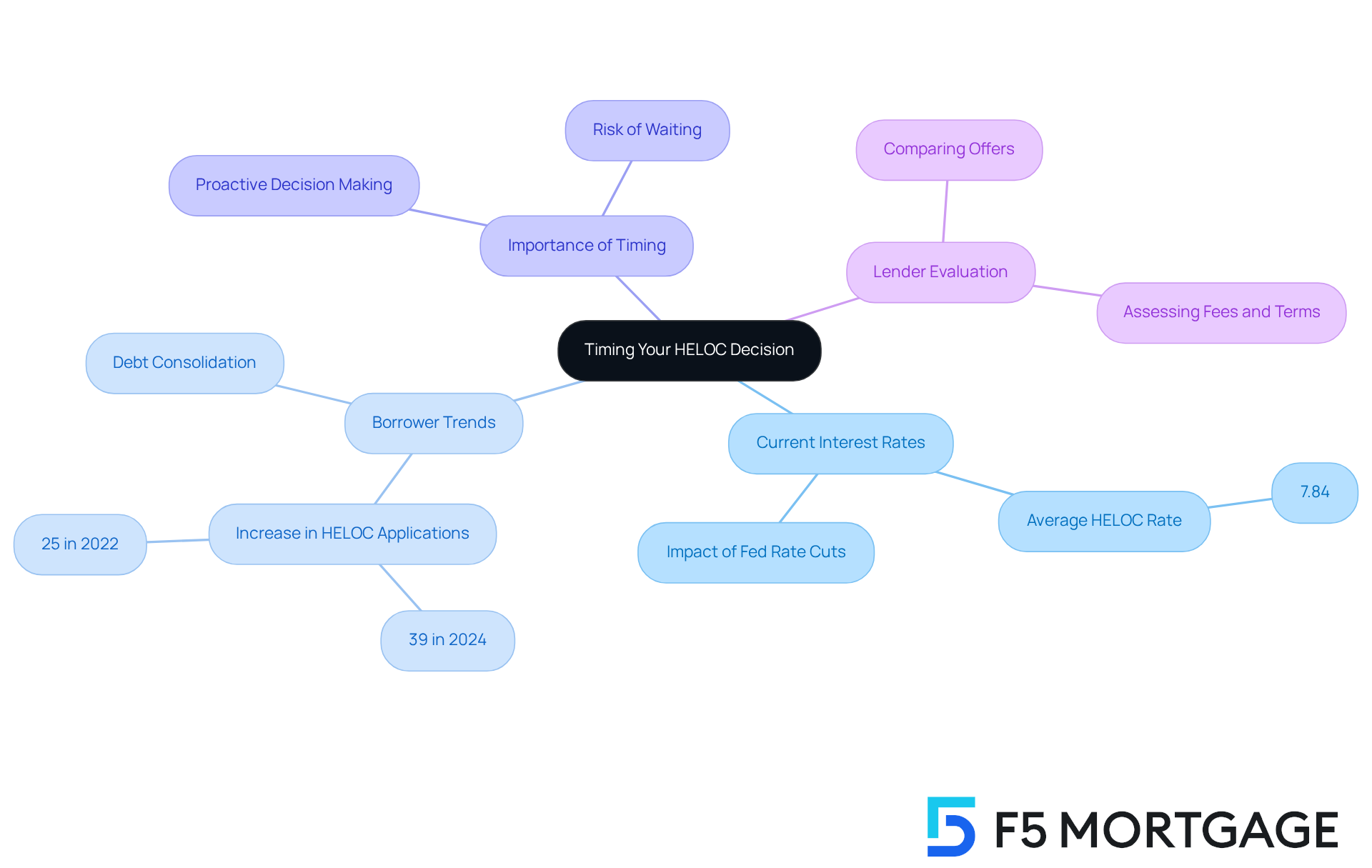

CBS News: Timing Your HELOC Decision Amid Falling Rates

At CBS News, we understand how crucial timing is when it comes to obtaining a Home Equity Line of Credit, especially to secure the HELOC best rates while interest rates are currently on the decline. With the average home equity line of credit percentage at 7.84%, we encourage property owners to act swiftly to take advantage of the HELOC best rates before any potential increases. This proactive approach can lead to significant savings over the life of the loan.

As financial analysts point out, the landscape of prices can shift, and those who delay their decisions may miss out on beneficial conditions. For instance, a homeowner securing a HELOC at the HELOC best rates could save substantially compared to those who wait for interest rates to stabilize or possibly rise. Moreover, statistics show that 39% of borrowers applied for a HELOC or home equity loan in 2024 to consolidate debt, a remarkable increase from 25% in 2022. This trend highlights the growing practice of leveraging home equity during favorable borrowing conditions.

It’s important for homeowners to recognize that HELOCs typically come with variable interest charges, which can change during both the draw and repayment periods. This adds a layer of risk to waiting for rates to stabilize. To make informed choices, we recommend assessing fees, expenses, and terms from various lenders. Consider the total cost of borrowing, the flexibility of repayment options, and the potential for interest changes.

F5 Mortgage stands out with attractive pricing and personalized support, making it an excellent choice for families looking to enhance their homes. Remember, we’re here to support you every step of the way as you navigate these important decisions.

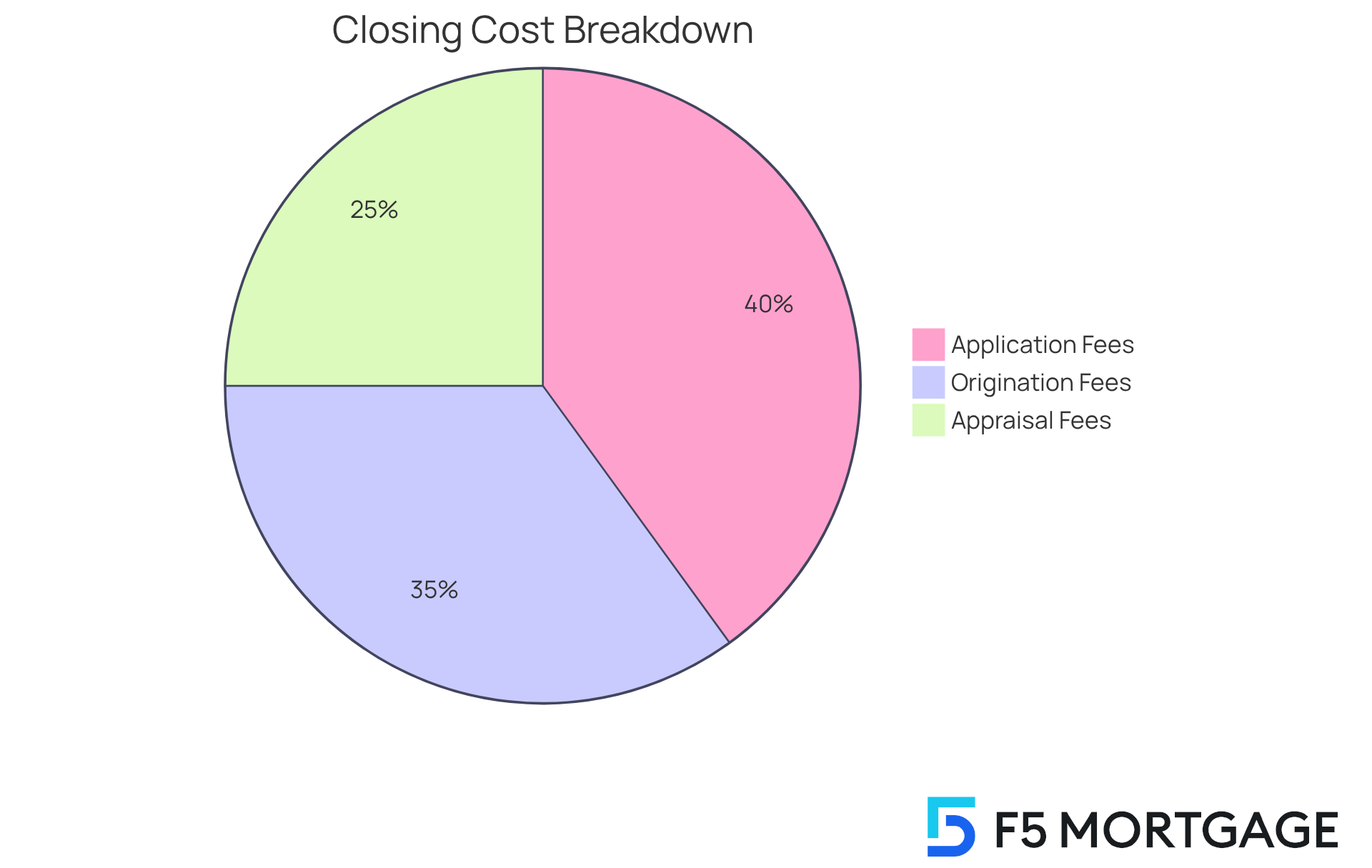

Investopedia: Comparing HELOCs with Other Financing Options

At Investopedia, we understand how overwhelming financial decisions can be, especially for property owners. That’s why it’s important to highlight the benefits of Home Equity Lines of Credit (HELOCs) in relation to HELOC best rates. Compared to personal loans and credit cards, HELOCs often offer the HELOC best rates, making them a more appealing option for those looking to consolidate debt or fund significant expenses.

However, we know how challenging it can be to navigate the expenses related to refinancing, particularly in California. Closing costs for refinancing can range from 2% to 5% of the loan amount. This includes various fees such as:

- Application fees

- Origination fees

- Appraisal fees

For example, homeowners refinancing a $300,000 mortgage might expect to pay between $6,000 and $15,000 in closing costs.

Determining the break-even point—essentially how long it takes to recover these costs through savings—can empower you to make informed choices about utilizing your equity effectively. By considering these factors, you can maximize your home equity and choose the financing option that offers the HELOC best rates to meet your needs. Remember, we’re here to support you every step of the way.

Ratehub: Finding the Best Mortgage and HELOC Rates

F5 Mortgage is a vital resource for families looking to compare the HELOC best rates and mortgage prices from various lenders. We understand how challenging this process can be, and with our comprehensive step-by-step guide, you can easily navigate the refinancing landscape. This ensures that you make informed financial choices that truly align with your goals.

Statistics reveal that many consumers benefit from comparison tools, often discovering lower prices through careful shopping. Financial technology specialists emphasize the importance of evaluating costs, as even minor differences can lead to significant savings over time. F5 Mortgage not only offers attractive pricing but also provides personalized assistance, making it an excellent choice for families enhancing their homes.

Our guide covers essential steps—such as submitting an application, undergoing underwriting, and closing on a new mortgage—ensuring that you feel well-informed throughout the entire process. With F5 Mortgage’s user-friendly resources, you can secure the heloc best rates for a home equity line of credit available in today’s market. We’re here to support you every step of the way.

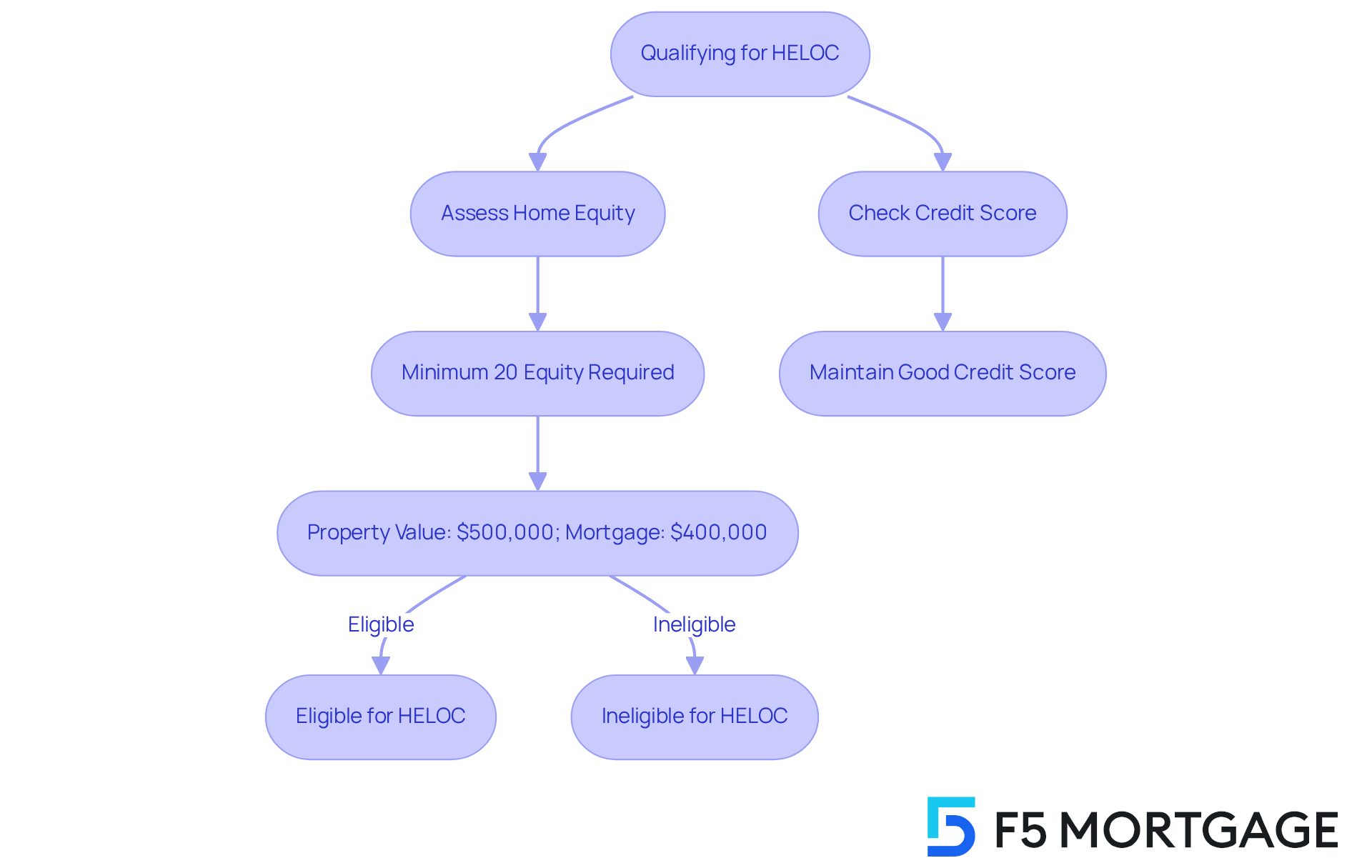

Canada.ca: Official Guidelines for Qualifying for a HELOC

At Canada.ca, we understand that navigating the world of Home Equity Lines of Credit to find the HELOC best rates can be daunting. That’s why we provide clear instructions on how to qualify, highlighting the importance of having adequate home equity and a solid credit score. Typically, property owners need a minimum of 20% equity in their home to qualify for a home equity line of credit. Grasping this requirement is essential for clients before they begin their application, as it helps set realistic expectations for the qualification process.

When a lender approves a borrower, it reflects their belief that the individual is a suitable candidate for a mortgage based on the financial information provided. This includes an estimate of the loan amount, interest rate, and potential monthly payment. For example, if a homeowner has a property valued at $500,000 and an outstanding mortgage of $400,000, they would only have 20% equity, making them eligible for a HELOC. On the other hand, those with less than 20% equity may find themselves ineligible. This highlights the importance of building equity through timely mortgage payments or home improvements.

Mortgage professionals emphasize that maintaining a good credit score is equally vital. As industry experts often remind us, “Understanding the interest rate structure—whether it’s fixed or variable—and being aware of hidden fees like annual charges or early repayment penalties is essential for borrowers.”

Statistics show that lenders frequently require property owners to have at least 15% to 20% equity in their property to qualify for the HELOC best rates. This statistic reinforces the need for homeowners to assess their financial standing and equity levels prior to applying. By understanding these guidelines, prospective borrowers can better prepare themselves for the home equity line of credit qualification process, empowering them to make informed financial decisions. Remember, we’re here to support you every step of the way.

Darren Robinson: When to Choose a HELOC for Your Financial Needs

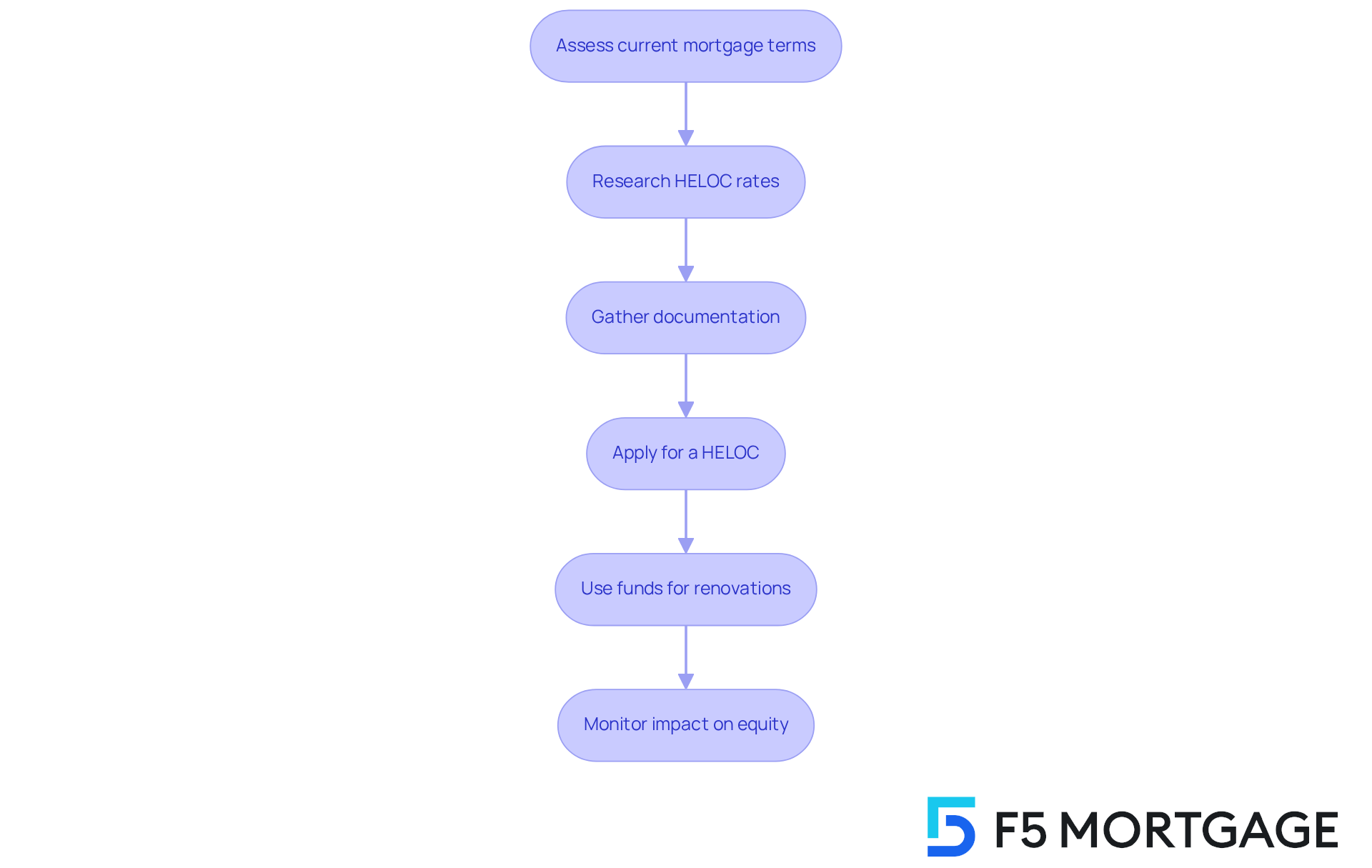

Darren Robinson emphasizes the strategic use of Equity Lines of Credit (HELOCs) for specific financial situations, particularly when it comes to financing property renovations or consolidating high-interest debt. By tapping into their equity, property owners can fund projects that not only enhance their living spaces—like kitchen renovations or energy efficiency upgrades—but also significantly increase their property value. This approach can be a financially wise choice, allowing families to create a more comfortable home.

Many clients have successfully leveraged HELOCs to undertake multiple renovation projects at once. This method helps them manage expenses effectively while minimizing disruption in their homes. Financial advisors often suggest that using a home equity line of credit for renovations can lead to HELOC best rates compared to personal loans or credit cards, which typically come with higher interest rates and less favorable terms.

To navigate the refinancing process in California, property owners can follow these steps:

- Assess current mortgage terms and determine refinancing goals.

- Research the HELOC best rates and various interest options available.

- Gather necessary documentation, including income and credit history.

- Apply for a home equity line with a lender.

- Use the funds for renovations or debt consolidation.

- Monitor the impact on home equity and overall financial health.

This structured approach empowers property owners to make informed decisions that align with their needs.

Moreover, the flexibility of a home equity line allows property owners to borrow when necessary, making it ideal for ongoing or unexpected renovation expenses. As financial specialists point out, this adaptability can be crucial for homeowners looking to enhance their properties without the stress of immediate full payments.

In summary, understanding when to utilize a home equity line of credit alongside refinancing can empower property owners to make informed financial choices that resonate with their long-term goals. This ultimately leads to improved living conditions and increased home equity, ensuring families feel supported every step of the way.

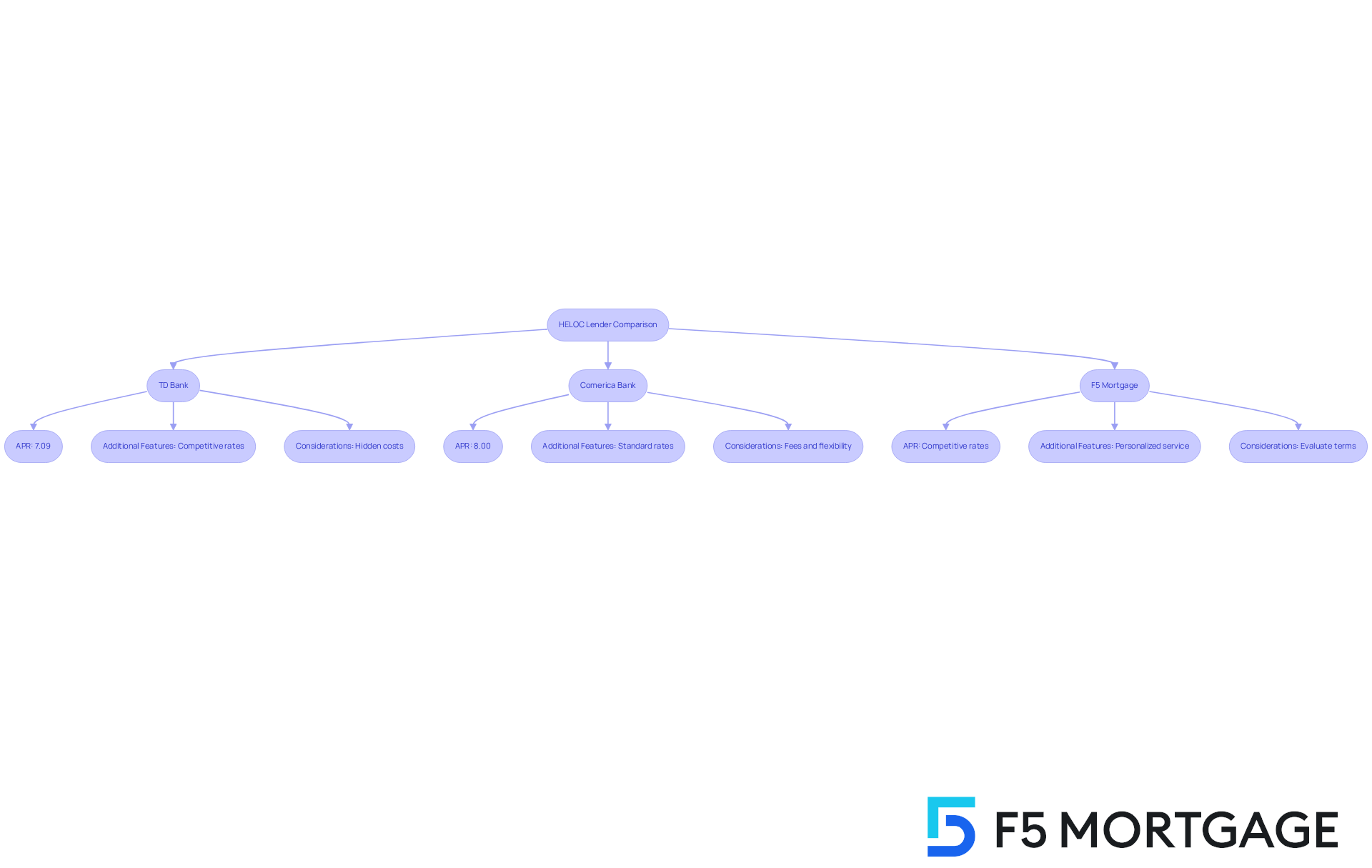

WSJ: Current HELOC Rates and Choosing the Right Lender

Navigating home equity line of credit options can be challenging, especially with current averages around 7.84%. Understanding this figure is crucial for homeowners as they explore various lenders. For instance:

- TD Bank offers a HELOC starting at an APR of 7.09%

- Comerica Bank’s rates are closer to 8.00%

By carefully comparing prices and terms, families can find a lender that offers the HELOC best rates and aligns with their financial goals.

F5 Mortgage stands out by providing competitive rates alongside personalized service tailored to the unique needs of families looking to enhance their homes. This thorough evaluation process is vital for borrowers to secure the best financing for their home equity needs. Financial specialists emphasize the importance of considering all aspects of a HELOC proposal, including potential fees and flexibility of terms, to make informed decisions.

Wendy Morrell, Head of Relationship Retail at U.S. Bank, highlights that a HELOC can be a valuable resource for homeowners facing significant life events or expenses. It’s important to remember that while some lenders may advertise lower rates, hidden costs can greatly affect the overall value of the loan. Therefore, we recommend comparing at least three lenders to gain a clear understanding of the true cost of borrowing and to find the HELOC best rates available.

Additionally, borrowers should be aware of the risks associated with HELOCs, such as how late payments can impact credit scores and the potential loss of their home if payments are missed. We know how challenging this can be, and we’re here to support you every step of the way in making the best financial choices for your family.

Conclusion

Understanding the landscape of Home Equity Lines of Credit (HELOCs) can be daunting for homeowners eager to leverage their property equity effectively. This article has explored various sources and insights for finding the best HELOC rates today. We emphasize the importance of personalized consultations, market trends, and strategic financial decisions because we know how challenging this can be. By being informed, property owners can navigate their options confidently and secure favorable terms that align with their financial goals.

Key arguments highlighted throughout the article include:

- The current average HELOC rates

- The significance of comparing lenders

- The financial benefits of timely decisions

Resources like F5 Mortgage, Bankrate, and Lotly provide valuable guidance and tools for borrowers, ensuring they understand the implications of their choices. Additionally, maintaining a solid credit score and adequate home equity is crucial, as these factors play a critical role in qualifying for the best rates.

In conclusion, taking proactive steps to explore and compare HELOC options can lead to significant savings and financial flexibility. Homeowners are encouraged to act swiftly in the current market environment, where falling rates present a unique opportunity. By leveraging available resources and making informed decisions, families can achieve their financial aspirations while maximizing their home equity. We’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer regarding HELOCs?

F5 Mortgage offers personalized consultations to help clients navigate their Home Equity Lines of Credit (HELOC) options, providing tailored recommendations based on individual financial situations.

Why are personalized consultations important for HELOC decisions?

Personalized consultations enhance client satisfaction and boost decision-making confidence, leading to better financial outcomes by equipping clients with the necessary knowledge to utilize their property equity wisely.

What are the current average HELOC interest rates in the U.S.?

As of October 8, 2025, the national average HELOC interest rate is 8.47%, marking a significant decline from previous highs.

How can homeowners benefit from the current HELOC rates?

Homeowners can leverage the current lower rates to access funds for various financial needs, such as home improvements or debt consolidation, without affecting their existing low-rate primary mortgages.

What factors influence HELOC interest rates in Canada?

In Canada, HELOC interest rates can vary based on lender proposals and borrower criteria, such as credit profiles. Strong credit profiles may encounter rates ranging from 5.45% to 5.95%.

What is the significance of understanding the debt-to-income (DTI) ratio for HELOC eligibility?

The DTI ratio is crucial for determining eligibility for favorable mortgage conditions, with a typical maximum DTI of 43% required for home loans.

What should borrowers keep in mind regarding interest payments on HELOCs?

Borrowers must remember that interest payments on a home equity line of credit must always be made, regardless of their financial situation.

How can prospective borrowers navigate the HELOC market effectively?

Prospective borrowers should explore their options, compare various lenders, negotiate terms that align with their financial goals, and stay informed about market trends.