Overview

Choosing finance brokers near you for your mortgage can truly make a difference. Their local expertise, personalized service, and ability to negotiate better rates are designed to enhance your mortgage experience. We know how challenging this process can be, and that’s why these brokers are here to provide tailored solutions that meet your unique needs.

Imagine having someone by your side who understands your situation and can simplify the application process for you. With quick approvals and a focus on empowering clients, these brokers help you make informed decisions about your home financing needs. They genuinely care about supporting you every step of the way, ensuring that you feel confident in your choices.

By choosing a local broker, you’re not just getting a service; you’re gaining a partner who is invested in your financial journey. Let’s take this step together towards a brighter future in your home financing.

Introduction

Navigating the complexities of securing a mortgage can often feel overwhelming. We know how challenging this can be, especially in a market where local expertise and personalized service are crucial. By choosing finance brokers near you, individuals gain access to tailored solutions that align with their unique financial situations. This ensures a smoother path to homeownership.

However, with so many options available, how can one determine the true value of enlisting a local broker’s help in this intricate process? We’re here to support you every step of the way as you explore the possibilities.

F5 Mortgage: Personalized Solutions for Your Mortgage Needs

At F5 Mortgage, we understand how challenging navigating the mortgage process can be. That’s why we provide tailored loan consultations that take into account your unique financial circumstances. Whether you’re a first-time homebuyer or a family looking to refinance, our approach ensures that you receive mortgage solutions that truly meet your needs.

We know that each situation is different, and that’s why we offer a diverse array of loan programs. This variety streamlines your decision-making process, helping you select the most suitable option for your specific circumstances. We’re here to support you every step of the way, making the journey to homeownership or refinancing a little easier and more manageable.

Local Expertise: Understanding Your Community’s Mortgage Landscape

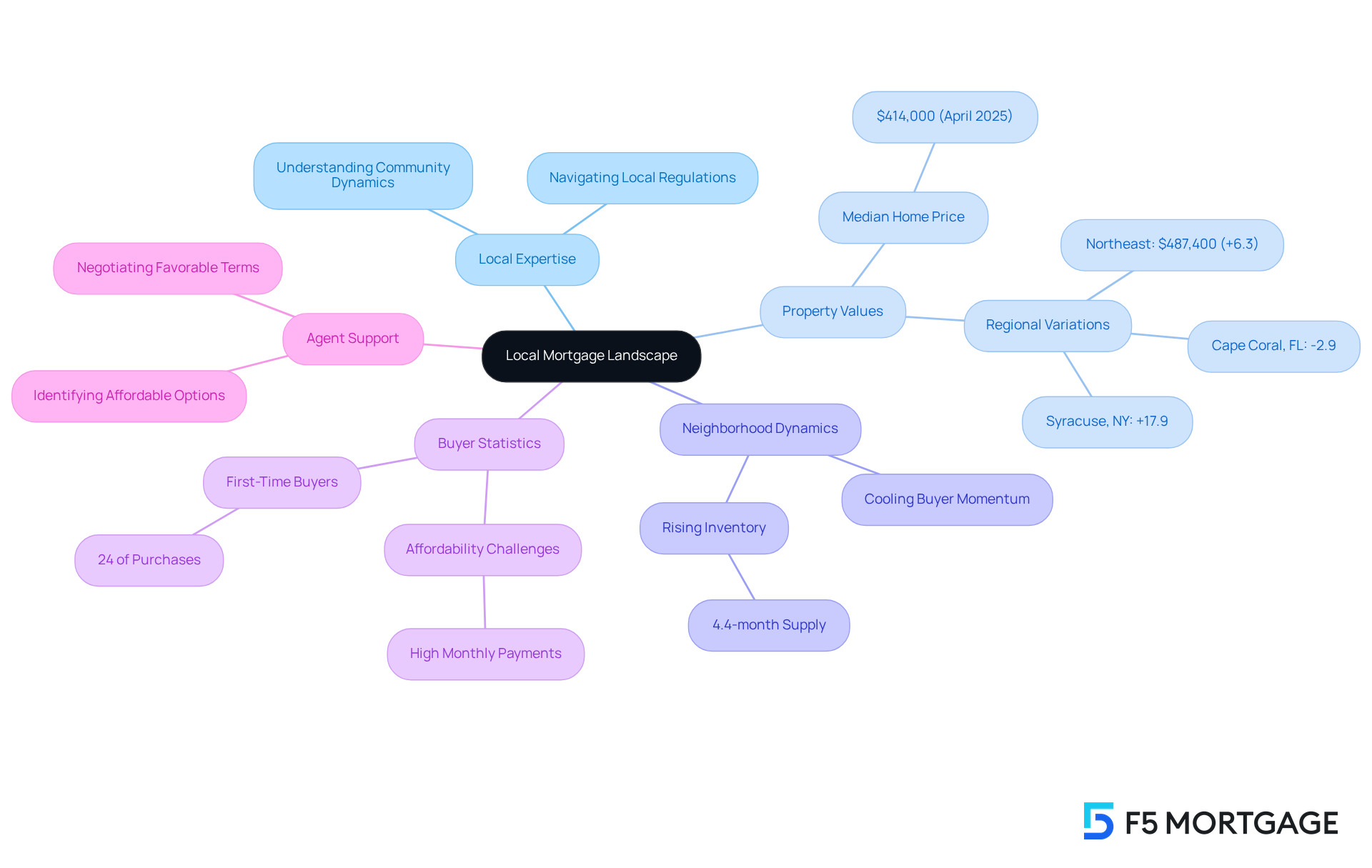

Finance advisors with local expertise truly understand the community’s real estate landscape, including property values, neighborhood dynamics, and local regulations. This specialized knowledge allows them to provide personalized guidance that aligns with the unique characteristics of the area, addressing your specific needs.

For instance, as of April 2025, the national median existing-home price reached a record $414,000, showcasing significant regional variations. Local agents are equipped to navigate these complexities effectively. In markets where affordability is a concern—only 24% of home purchases were made by first-time buyers—brokers can offer valuable insights that help you make informed decisions about your financing options.

Local agents are here to assist you by identifying affordable options and negotiating favorable terms. This support is crucial in a market where rising inventory, now at a 4.4-month supply, and cooling buyer momentum can create unpredictability. By leveraging their community expertise, agents guide clients through the intricacies of home financing and help you locate finance brokers near me to secure the most favorable terms and rates tailored to your needs.

As Shuai Guan, Co-founder/CEO of Thunderbit, wisely states, “the market is always changing, and the best decisions are the ones grounded in real, up-to-date data.” This highlights the importance of local knowledge in navigating the ever-evolving lending environment. We know how challenging this can be, but with the right support, you can confidently make choices that benefit your family’s future.

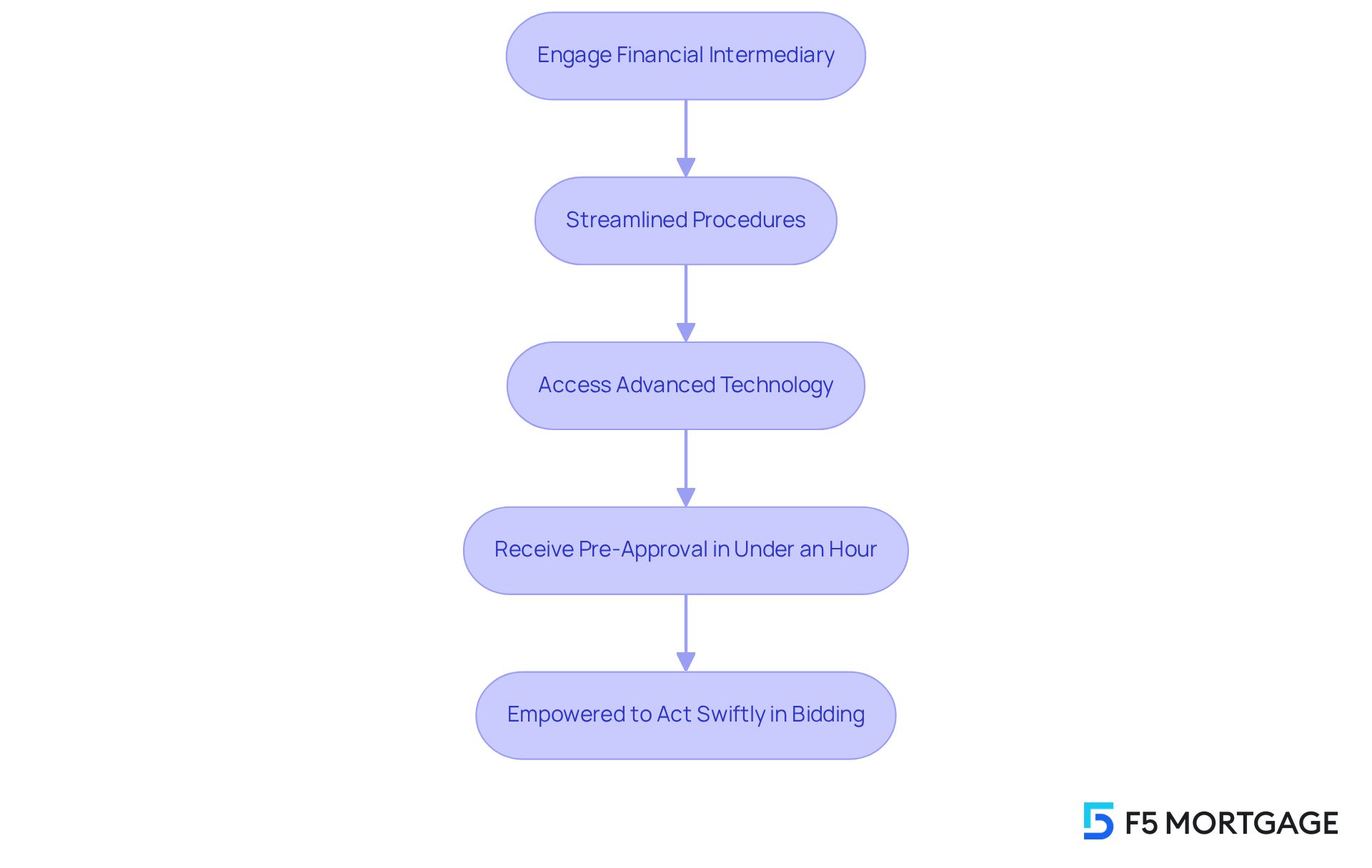

Fast Approvals: Quick Access to Mortgage Solutions

We know how challenging the mortgage process can be, and one of the key advantages of collaborating with financial intermediaries is their ability to facilitate quick mortgage approvals. With streamlined procedures and access to advanced technology, agents can often offer pre-approval in under an hour. This speed not only improves your experience but also positions you advantageously in competitive bidding situations.

Imagine discovering the right property and being able to act swiftly—that’s the empowerment we aim to provide. We’re here to support you every step of the way.

Diverse Loan Options: Tailored Financing for Every Situation

We know how challenging navigating loan options can be. Finance brokers near me provide access to a diverse array of loan choices, including:

- Fixed-rate loans

- FHA loans

- VA loans

- Jumbo loans

This variety allows you to select financing that best fits your unique financial situation and long-term goals. By collaborating with various lenders, we can help you obtain attractive rates and advantageous conditions, enhancing your overall loan experience. We’re here to support you every step of the way.

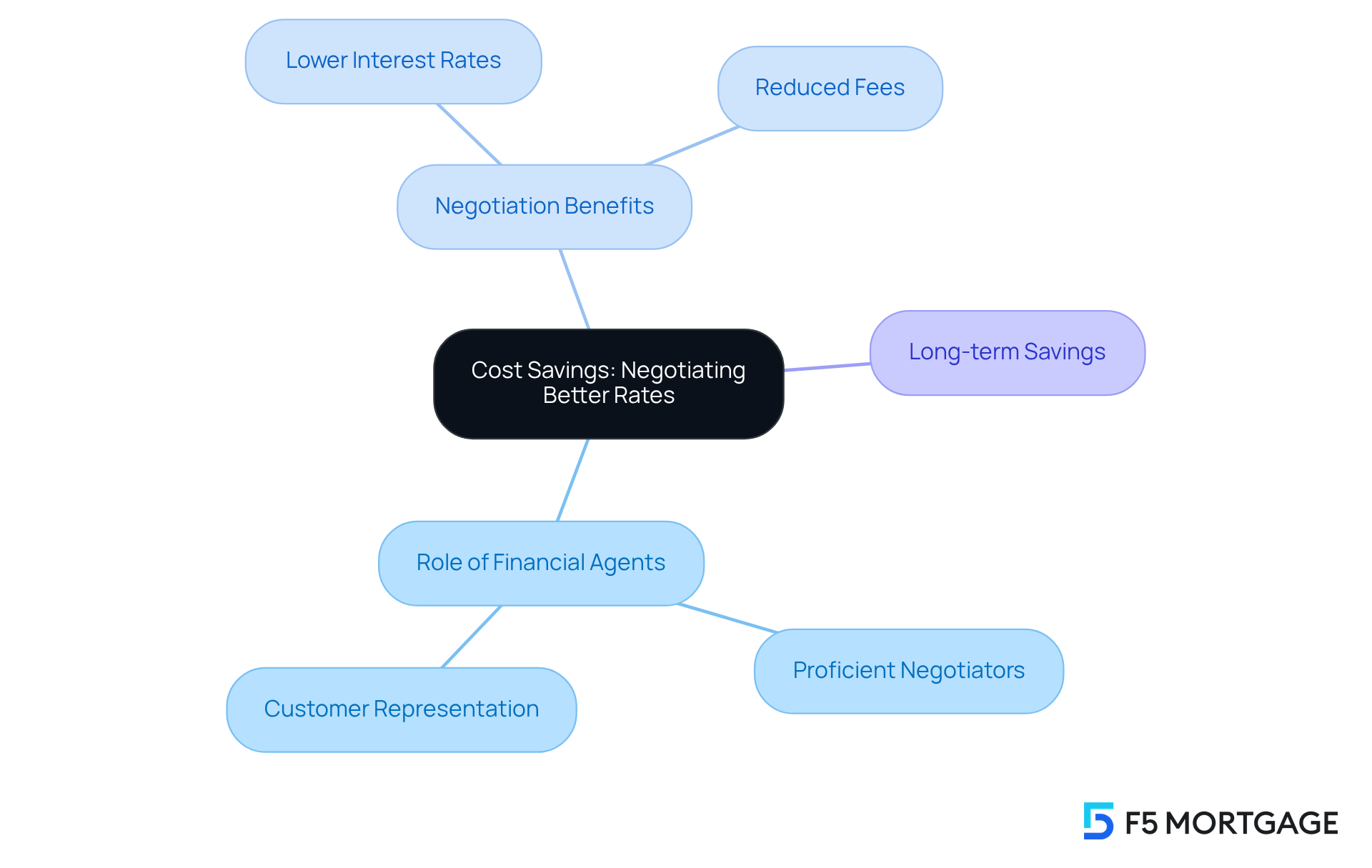

Cost Savings: Negotiating Better Rates with Finance Brokers

Navigating the world of home financing can be a daunting task, and we know how challenging this can be. Financial agents are proficient negotiators who genuinely care about representing their customers in securing the most favorable loan rates. By leveraging their connections with various lenders, these agents can often negotiate lower interest rates and reduced fees. This means considerable cost savings for you throughout the duration of the loan.

Imagine the relief of knowing that you have someone in your corner, working tirelessly to ensure you get the best possible deal. This financial benefit is not just a number; it’s a persuasive reason to consider selecting an intermediary for your home financing journey. We’re here to support you every step of the way, making the process smoother and more manageable.

Personalized Service: Dedicated Support Throughout Your Mortgage Journey

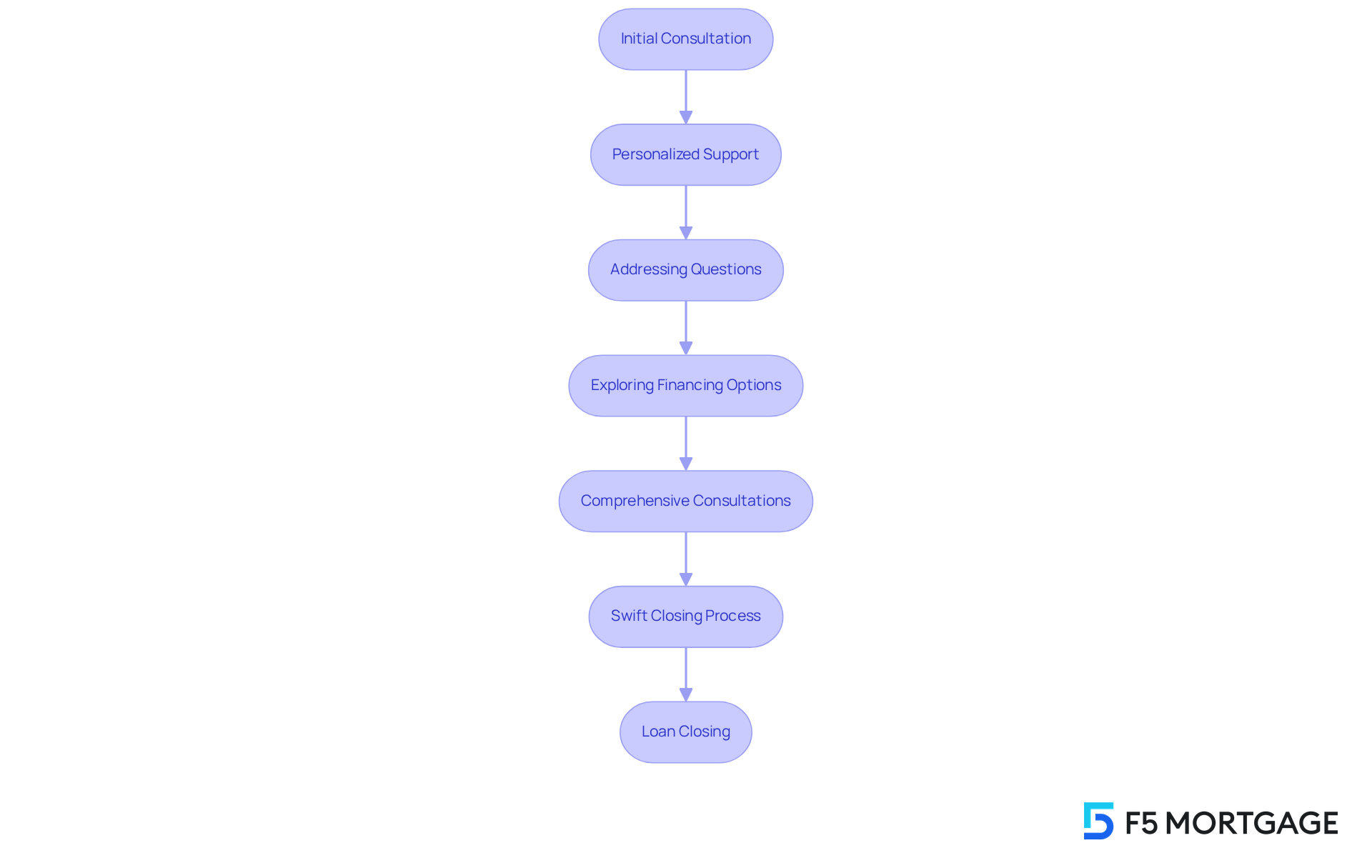

Working with finance brokers near me means having a dedicated expert by your side throughout the entire loan process. From the initial consultation to the final closing, finance brokers near me, such as F5 Mortgage, provide personalized support that addresses your questions and concerns promptly. This tailored approach not only eases your worries but also empowers you to make informed decisions about your financing options, with the assistance of finance brokers near me, including fixed-rate loans, FHA loans, VA loans, and jumbo loans.

F5 Mortgage truly stands out among finance brokers near me by offering comprehensive consultations and utilizing advanced technology to simplify your mortgage journey. With a focus on customer satisfaction, they have successfully assisted over 1,000 families, achieving an impressive 94% satisfaction rate. This level of dedicated support fosters a strong connection between you and your broker, ensuring you feel confident and informed throughout the process. Furthermore, F5 Mortgage’s swift closing process, with most loans concluding in under three weeks, significantly enhances customer satisfaction and sets them apart in the industry.

Community banks also exemplify the benefits of personalized support, much like finance brokers near me, by offering local expertise and dedicated service. They prioritize efficient communication and maintain consistent points of contact, which greatly enhances your experience while navigating the complexities of mortgage financing. Ultimately, the combination of personalized service and dedicated support significantly improves your overall experience, making the journey to homeownership smoother and more enjoyable. We know how challenging this can be, and we’re here to support you every step of the way.

Educational Resources: Empowering Clients with Mortgage Knowledge

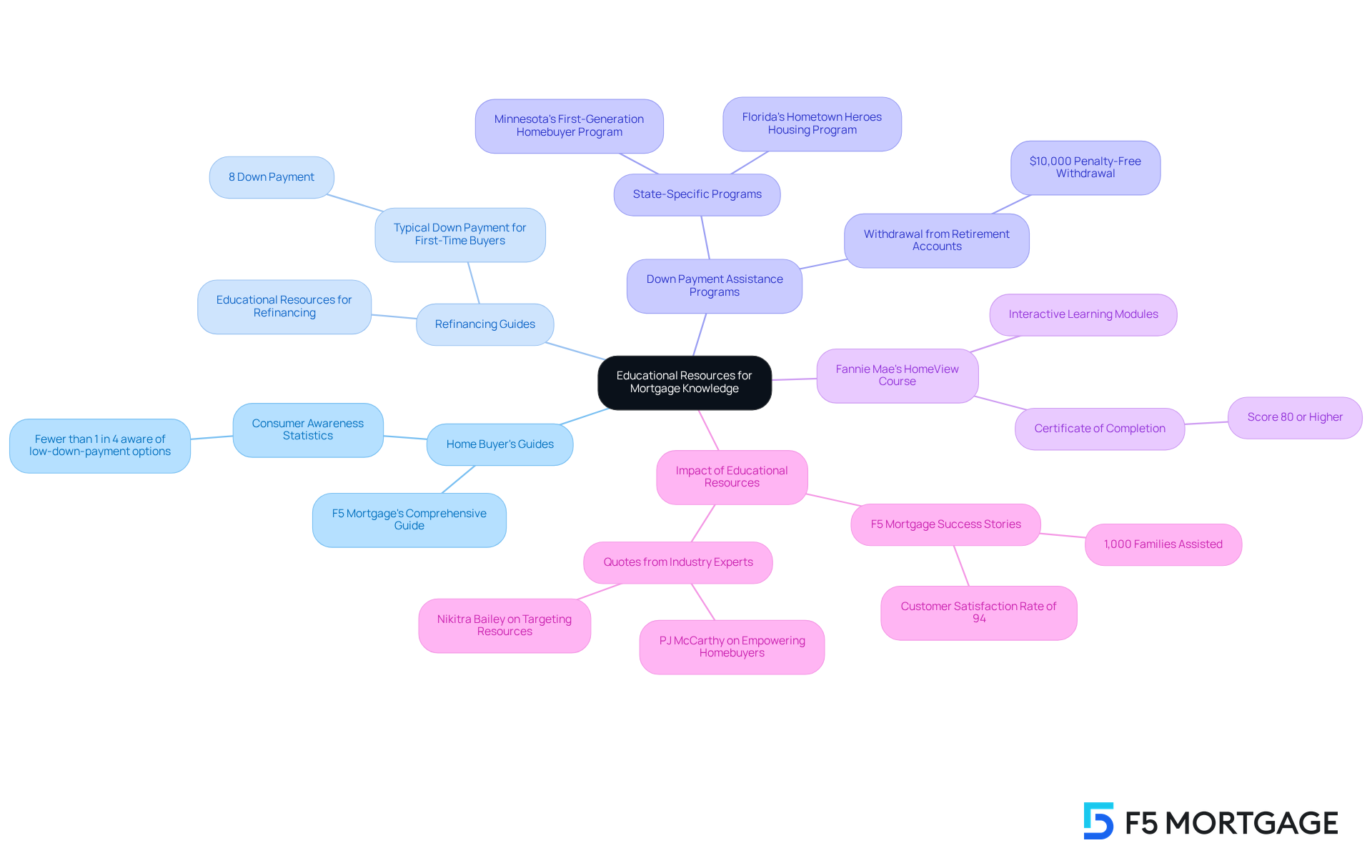

Mortgage brokers play a crucial role in providing individuals with essential educational resources, such as comprehensive home buyer’s guides, refinancing guides, and down payment assistance programs. These tools are designed to empower users with the information necessary to navigate the complexities of the financing environment with confidence. By understanding their options and the financing process, clients are better positioned to make informed decisions that align with their financial goals.

In 2025, the significance of loan education has never been more pronounced. With rising home prices and fluctuating interest rates, first-time homebuyers face unique challenges. Educational resources not only clarify the financing process but also highlight available options, such as low-down-payment loans that require as little as 3.5% or even 0% down. For many first-time buyers, it may come as a surprise that they can withdraw up to $10,000 penalty-free from retirement accounts to assist with their down payment. Additionally, the typical first-time homebuyer has an 8% down payment, emphasizing the financial hurdles many encounter.

The current trend indicates a growing reliance on home buyer’s manuals, with numerous consumers actively seeking information to enhance their understanding of loan qualification criteria. Fannie Mae’s Q2 2021 National Housing Survey reveals significant interest among consumers in learning about home purchasing and ownership. Alarmingly, fewer than 1 in 4 consumers are aware that low-down-payment options are available, underscoring the knowledge gap that educational resources aim to bridge. Fannie Mae’s HomeView course, featuring interactive modules designed to be completed in 30 minutes or less, exemplifies this shift. It equips aspiring homeowners with vital tools and resources, including checklists and calculators, to facilitate informed decision-making.

Real-world examples illustrate the profound impact of these resources. F5 Mortgage has successfully assisted over 1,000 families, achieving an impressive customer satisfaction rate of 94%. Clients have reported feeling more empowered and informed throughout their financing journey, thanks to the comprehensive educational materials provided. This commitment to consumer education not only fosters confidence but also encourages sustainable homeownership, ultimately contributing to a more informed and engaged community of property owners. As PJ McCarthy, Vice President of Affordable Lending and Housing Equity, states, “Broadening access to quality, trustworthy homeownership education is a proven first step to empowering homebuyers to become successful homeowners.” To further empower themselves, potential buyers are encouraged to utilize available educational resources, such as Fannie Mae’s HomeView course or F5 Mortgage’s guides.

Convenience: Simplifying the Mortgage Application Process

We know how challenging the loan application procedure can be. It can often feel intimidating, leaving many feeling overwhelmed. However, financial advisors are here to support you every step of the way. By utilizing technology and streamlined procedures, these caring intermediaries can assist you in completing applications swiftly and effectively.

This convenience not only saves you time but also alleviates the stress associated with gathering documentation and navigating complex forms. Imagine having someone by your side, guiding you through each step, making the process smoother and more manageable. With their help, you can approach your loan application with confidence, knowing that you are not alone in this journey.

Building Trust: Establishing Strong Relationships with Your Broker

A successful loan experience hinges on the trust that develops between customers and agents. Financial agents shine in building strong relationships by prioritizing transparency, effective communication, and responsiveness. This foundation of trust encourages customers to share their worries and choices openly, which is vital for tailoring loan solutions to their unique needs. For instance, brokers who maintain regular communication can better understand their customers’ financial situations, leading to more informed decisions and favorable mortgage terms.

Moreover, strong client-broker relationships often lead to improved outcomes. Brokers who actively listen and adapt to their customers’ evolving needs can pinpoint the most suitable financing options, ensuring individuals secure the best rates and terms available. This personalized approach not only enhances customer satisfaction but also fosters long-term loyalty, as individuals are more inclined to return for future financing needs. Take Jill, a loan specialist, who experienced a remarkable 300% increase in her monthly loan volume after launching a new website that improved her communication with clients, enabling her to assist three times more individuals each month.

Expert opinions highlight the critical role of communication in these relationships. Successful intermediaries recognize that open and consistent communication is essential for building trust and ensuring individuals feel supported throughout the financing process. By leveraging technology, such as user-friendly websites and online tools, brokers can enhance customer interactions and simplify the application process, helping clients navigate the complexities of home financing with ease.

In conclusion, the interplay of trust and communication in client-broker relationships is vital for achieving favorable financial outcomes. Brokers who prioritize these elements are better equipped to meet their clients’ needs, ultimately leading to a more fulfilling and efficient lending experience. To improve your loan experience, seek out finance brokers near me who value transparency and maintain open lines of communication. We know how challenging this can be, and we’re here to support you every step of the way.

Overall Value: Why Finance Brokers Are Essential for Your Mortgage

Navigating the loan process can be challenging, and that’s where financial agents step in to provide essential assistance and knowledge. They offer tailored solutions and regional market expertise, ensuring quick approvals and financial savings. This support not only improves the overall lending experience but also empowers customers in their journey.

We understand how important it is for you to feel confident and supported. Financial agents are committed to education, convenience, and building trust, allowing clients to navigate their mortgage journey with ease. Choosing finance brokers near me is not merely a decision; it’s an investment in a smoother, more successful path to homeownership.

Remember, you’re not alone in this process. We’re here to support you every step of the way, helping you achieve your dream of homeownership with compassion and care.

Conclusion

Choosing to work with finance brokers near you for your mortgage is a decision that can significantly enhance your home financing experience. We know how challenging this can be, and by offering personalized solutions tailored to your unique financial circumstances, these brokers simplify the often daunting mortgage process and provide valuable local expertise. This combination not only empowers you as a buyer but also ensures that you are making informed decisions that align with your long-term goals.

Throughout this article, we have highlighted key advantages of partnering with finance brokers. From fast approvals and diverse loan options to cost savings through expert negotiations, these professionals are equipped to navigate the complexities of the mortgage landscape. Their commitment to personalized service and education ensures that clients feel supported and confident every step of the way, ultimately leading to a smoother journey toward homeownership.

The significance of utilizing finance brokers cannot be overstated. As the mortgage market continues to evolve, having a knowledgeable advocate by your side is invaluable. Whether you are a first-time buyer or looking to refinance, engaging with local brokers can provide the insights and assistance needed to secure the best possible terms. Take the next step in your home financing journey and consider the profound impact that finance brokers near you can have on achieving your dream of homeownership.

Frequently Asked Questions

What services does F5 Mortgage provide?

F5 Mortgage offers personalized loan consultations tailored to individual financial circumstances, providing mortgage solutions for first-time homebuyers and families looking to refinance.

How does F5 Mortgage ensure the right mortgage solutions for clients?

F5 Mortgage provides a diverse array of loan programs, streamlining the decision-making process and ensuring clients select the most suitable options for their specific needs.

Why is local expertise important in the mortgage process?

Local experts understand the community’s real estate landscape, including property values, neighborhood dynamics, and local regulations, allowing them to provide personalized guidance that addresses specific needs.

What recent trends are impacting the housing market?

As of April 2025, the national median existing-home price reached a record $414,000, with significant regional variations. Only 24% of home purchases were made by first-time buyers, highlighting affordability concerns.

How can local agents assist homebuyers in a changing market?

Local agents can identify affordable options, negotiate favorable terms, and guide clients through the complexities of home financing, helping them make informed decisions.

What advantages do financial intermediaries offer in the mortgage process?

Financial intermediaries facilitate quick mortgage approvals, often providing pre-approval in under an hour, which enhances the client experience and positions them favorably in competitive bidding situations.

How does F5 Mortgage support clients during the mortgage process?

F5 Mortgage supports clients by providing guidance throughout the mortgage journey, ensuring that they can confidently make choices that benefit their family’s future.