Overview

Families often face challenges when upgrading their homes, and choosing a broker home loan can be a significant step forward. The main reasons families opt for this route include:

- Personalized support

- Access to diverse loan options

- Competitive rates

We know how overwhelming home financing can be, but independent brokers like F5 Mortgage are here to help. They provide tailored guidance and flexible financing solutions that empower families to navigate these complexities.

By working with a broker, families can secure better terms than traditional lenders. This personalized approach not only simplifies the process but also ensures that each family’s unique needs are addressed. We’re here to support you every step of the way, making the journey to your dream home smoother and more achievable.

Introduction

Families today face a myriad of options when it comes to securing a home loan, and we know how daunting this can be. Broker home loans have emerged as a compelling choice for many, offering personalized service and diverse financing options tailored to individual needs. But what are the specific advantages that make families gravitate toward this approach? How do brokers ensure they navigate the complexities of the mortgage landscape effectively? We’re here to support you every step of the way as you explore these options.

F5 Mortgage: Personalized Service for Tailored Home Loan Solutions

At F5 Mortgage, we understand how challenging it can be for families to broker a home loan. That’s why we excel in providing personalized consultations tailored to your unique needs. Our dedicated financial advisors are just a call or message away, taking the time to understand your financial circumstances. This ensures that we suggest customized financing solutions, including how to broker home loans, that align with your goals, whether you’re looking to acquire a new home or refinance an existing mortgage.

We’re committed to making your mortgage experience stress-free. By leveraging user-friendly technology and offering no-pressure guidance, we foster trust and satisfaction every step of the way. Our personalized approach, often referred to as the ‘red carpet treatment,’ ensures you feel valued and understood throughout the process. With quick financing closings often completed in under three weeks, we strive to make your journey as smooth as possible.

Moreover, we know that every family has different financial situations. Our expertise includes managing various immigration statuses and addressing distinct financial circumstances, guaranteeing that you receive the support you need. We’re here to support you every step of the way, ensuring that your broker home loan experience is both positive and empowering.

Access to Diverse Loan Options: Flexibility in Financing Your Home

At F5 Mortgage, we understand how challenging the mortgage process can be. That’s why we collaborate with over twenty leading lenders, providing you with a diverse selection of loan options. Whether you’re considering fixed-rate loans, FHA loans, VA loans, or jumbo loans, we’re here to help you find the financing that best suits your needs.

This flexibility empowers families, whether you’re a first-time homebuyer or looking to improve your current home. We know how important it is to compare various options, and we’re committed to ensuring you can secure the most advantageous terms available.

Let us support you every step of the way as you navigate your mortgage journey. Together, we can find the right solution for your family’s future.

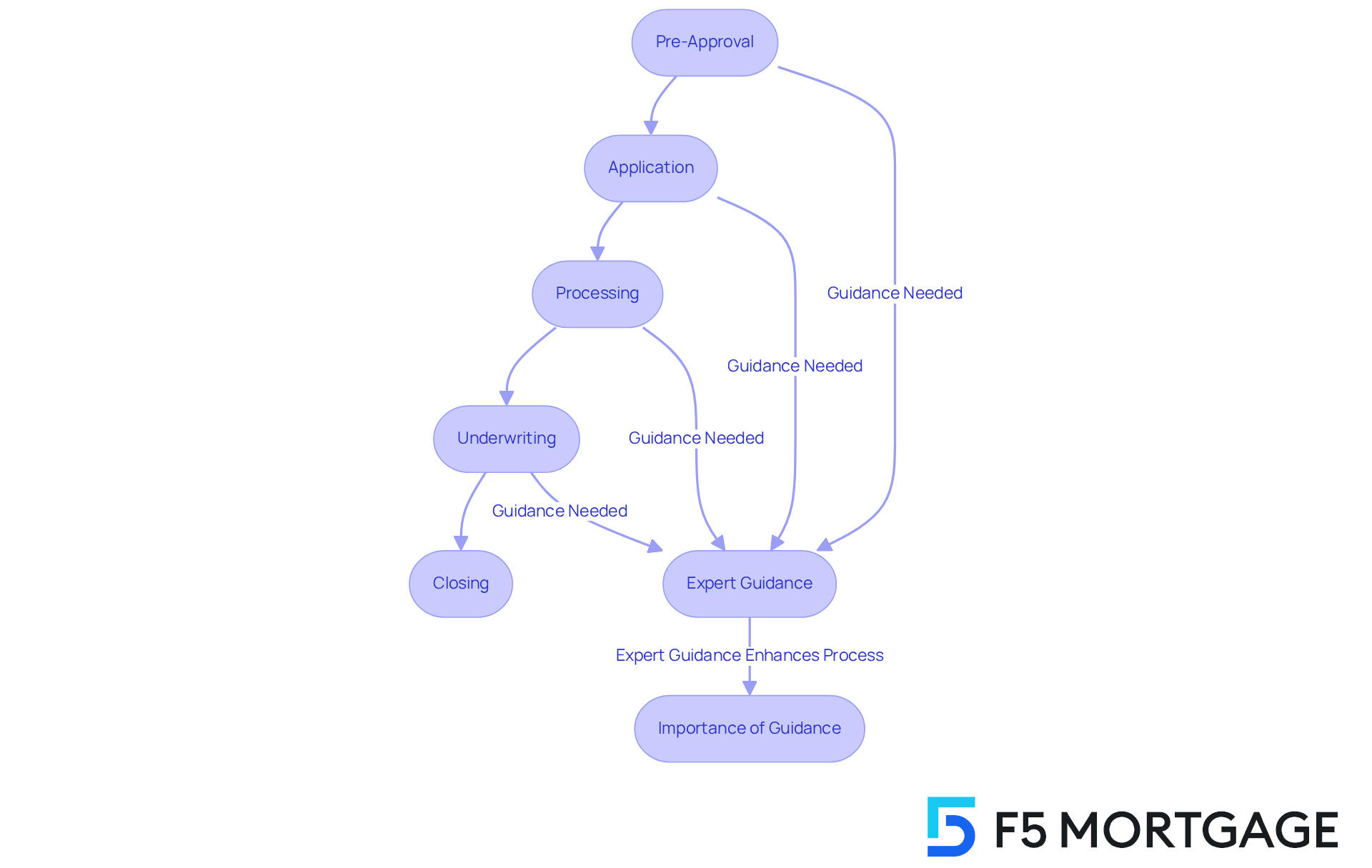

Expert Guidance: Navigating the Complexities of Mortgage Financing

Navigating the mortgage process can feel overwhelming. We know how challenging this can be, with numerous regulations and requirements that households must consider. At F5 Mortgage, we are here to support you every step of the way, providing expert guidance to ensure that you fully understand each step from pre-approval to closing. This personalized assistance empowers you to make informed choices tailored to your unique financial circumstances.

Many families have successfully navigated the complexities of home financing with the help of our dedicated broker home loan experts. They provide valuable insights into the best broker home loan options available, making the journey less daunting. Finance specialists emphasize that having professional guidance is crucial; it not only simplifies the process but also significantly impacts your decision-making.

Recent data shows that households who seek advice from mortgage experts are more likely to obtain advantageous terms and rates. This ultimately leads to a smoother home purchasing experience. By collaborating with F5 Home Loans, you can confidently embark on your home financing journey, knowing you have a committed advocate by your side.

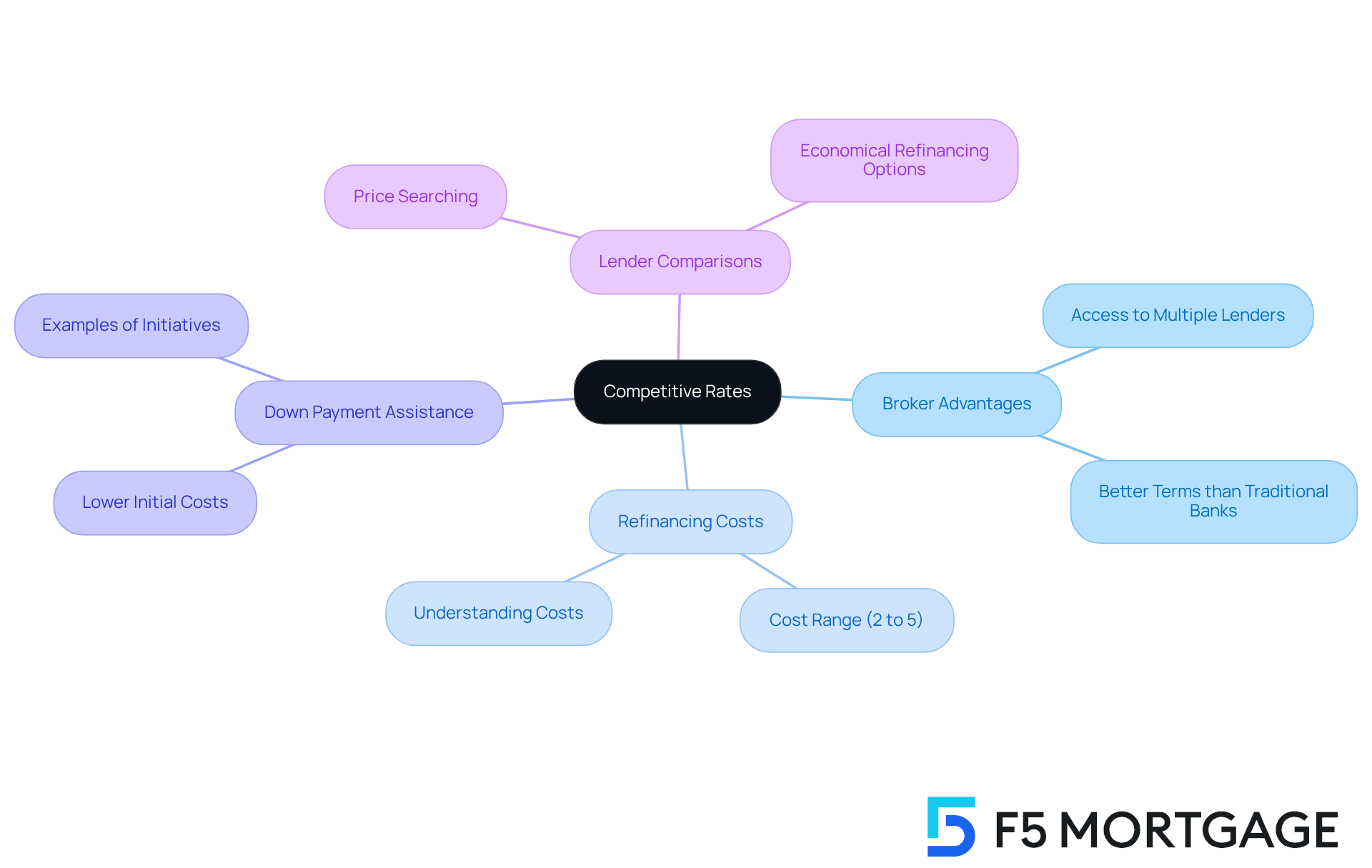

Competitive Rates: Brokers Negotiate Better Terms for Your Mortgage

One of the key advantages of collaborating with F5 Home Loans is the ability to access competitive rates while understanding the costs associated with refinancing. We understand how challenging this can be, and as an independent broker home loan expert, F5 Financial is here to support you every step of the way. We can broker home loans on your behalf, leveraging our relationships with multiple lenders to secure better terms than those typically available through traditional banks.

This support not only assists households in comprehending that refinancing expenses usually vary from 2% to 5% of the overall amount borrowed, but also enables them to benefit from down payment assistance initiatives that can lower initial costs. By enabling comparisons between lenders and price searching for the most economical refinancing choices, F5 can lead to possible savings over the borrowing period with a broker home loan. Our goal is to make homeownership more accessible for families, ensuring you feel empowered and informed throughout the process.

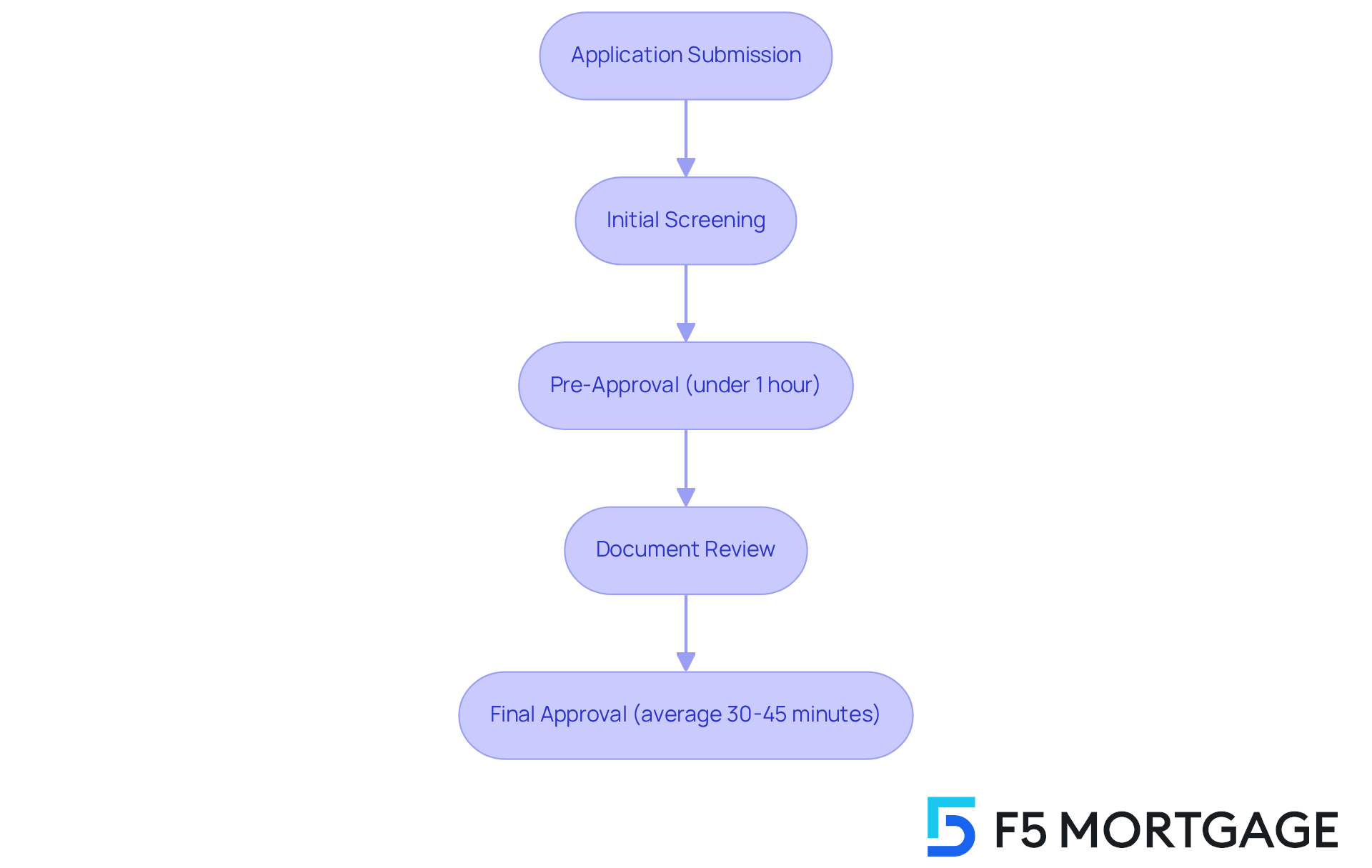

Time Efficiency: Streamlined Processes for Faster Approvals

At F5 Mortgage, we understand how challenging the process to broker home loan can be for families. That’s why we excel in providing quick outcomes, with most agreements closing in under three weeks. Our efficient application and approval procedures allow households to obtain pre-approval in under an hour—this is a significant improvement compared to the prolonged waits often faced with conventional lenders.

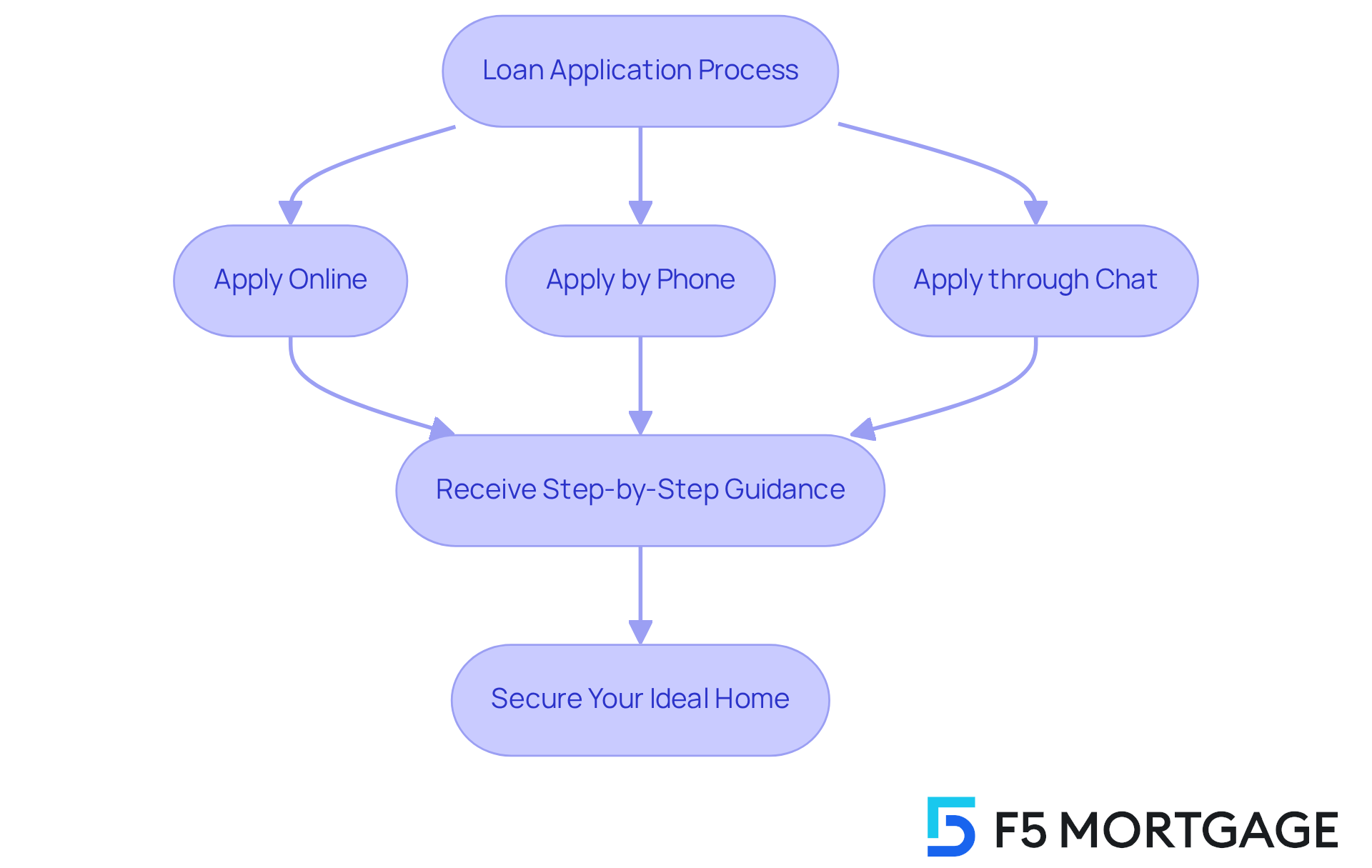

Families can conveniently apply online, by phone, or through chat. This not only allows for personalized loan solutions tailored to their specific needs but also significantly reduces stress for homebuyers who broker home loan options. Imagine being able to make swift decisions in a competitive housing market, where every moment counts.

By minimizing delays, F5 Mortgage ensures that you can seize opportunities as they arise, enhancing your chances of securing a broker home loan to achieve your dream home. As industry expert Troy Carlsen states, “We’re doing more business with the same number of people. We needed speed, volume, and the flexibility to modify document creation processes to comply with regulations. We get all of that from ActiveDocs.”

Moreover, you can anticipate pre-approval durations averaging approximately 30 minutes, which further emphasizes our dedication to efficiency. For example, a recent customer was able to secure a loan approval within only 45 minutes, enabling them to act swiftly in a competitive market. We’re here to support you every step of the way.

Personalized Support: Dedicated Assistance Throughout Your Mortgage Journey

At F5 Mortgage, we understand how challenging the mortgage process can be. That’s why personalized support is essential to enhancing your experience. From the initial consultation through to closing and beyond, we ensure families receive dedicated assistance every step of the way. This ongoing support instills confidence, reassuring you that you have a knowledgeable advocate throughout your journey.

Our expert team is always ready to address your questions and provide updates, enhancing your overall experience. With a customer satisfaction rate of 94%, it’s clear that our commitment to dedicated assistance significantly boosts borrower confidence in home financing. Families often express gratitude for the tailored guidance we provide, which simplifies complex decisions and alleviates stress.

For instance, one customer shared, “Ryan and his team are amazing! I was pretty confused at the start of all this, but they helped me so much along the way.” Another customer remarked, “John truly made me feel like family with his patience, guidance, and kindness during the experience of being a first-time home buyer!” This level of tailored service not only cultivates trust but also enables individuals to traverse the financing process with ease.

As an independent broker home loan expert, F5 provides a competitive edge by working solely for you, the consumer, instead of lenders. We guarantee that you obtain the best possible options customized to your unique requirements. We’re here to support you every step of the way, making F5 a favored option for those seeking to enhance their homes.

Conflict of Interest Management: Ensuring Your Best Interests Are Served

At F5, we understand how challenging navigating the mortgage landscape can be. As an independent broker home loan expert, we prioritize your best interests above all else. Unlike conventional lenders who may push specific products, we offer impartial guidance tailored to the unique needs of your household. This commitment to managing conflicts of interest helps build a trusting relationship, allowing you to rely on advice that truly serves your financial goals.

As a result, families often experience better financial outcomes. Independent brokers like us can help broker home loan solutions to navigate the complexities of the mortgage environment without bias. Current trends show a growing preference for unbiased mortgage advice, with more households recognizing the value that independent brokers bring in securing favorable broker home loan terms and conditions.

By focusing solely on your needs, F5 exemplifies how independent brokers can effectively advocate for families. We ensure your interests are consistently prioritized throughout the loan process. Remember, we’re here to support you every step of the way.

Educational Resources: Empowering Clients with Knowledge and Tools

At F5 Lending, we understand how overwhelming the home financing process can be. That’s why we provide a wealth of educational resources, including comprehensive home buyer’s guides, refinancing guides, and down payment assistance programs tailored to specific states. We know how challenging this can be, and we’re here to support you every step of the way.

Understanding mortgage approval is a crucial part of your journey. This process involves lenders assessing your financial information to determine your eligibility for a mortgage. It not only provides an estimate of your loan amount and interest rate but also outlines potential monthly payments. This knowledge empowers you to make informed decisions.

By cultivating an environment of learning, F5 ensures that households are well-prepared to navigate the intricacies of refinancing options. We’re dedicated to helping you feel confident in your choices, so you can take the next steps in your home financing journey with clarity and assurance.

Simplified Paperwork: Reducing the Burden of Documentation

At F5, we understand how overwhelming the paperwork for obtaining a loan can be for families. This stress is a common challenge, and we’re here to help. To make the process easier, we’ve implemented streamlined documentation practices that simplify your application journey. You can apply conveniently online, by phone, or through chat, allowing you to customize a loan that fits your unique goals.

By reducing the amount of documentation required and providing clear, step-by-step guidance, we empower you to navigate your application with confidence. This approach not only speeds up the process but also significantly alleviates the anxiety often linked to home financing. In today’s industry, there’s a growing emphasis on minimizing documentation stress, with many brokers offering broker home loans to enhance customer experiences.

Families have shared that these streamlined processes enable them to concentrate more on their home-buying journey rather than getting bogged down by complex paperwork. As a result, F5 stands out as a leader in providing a more manageable and less stressful loan experience. We ensure that households receive the collaborative support they need to find and secure their ideal home, because we know how challenging this can be, and we’re here to support you every step of the way.

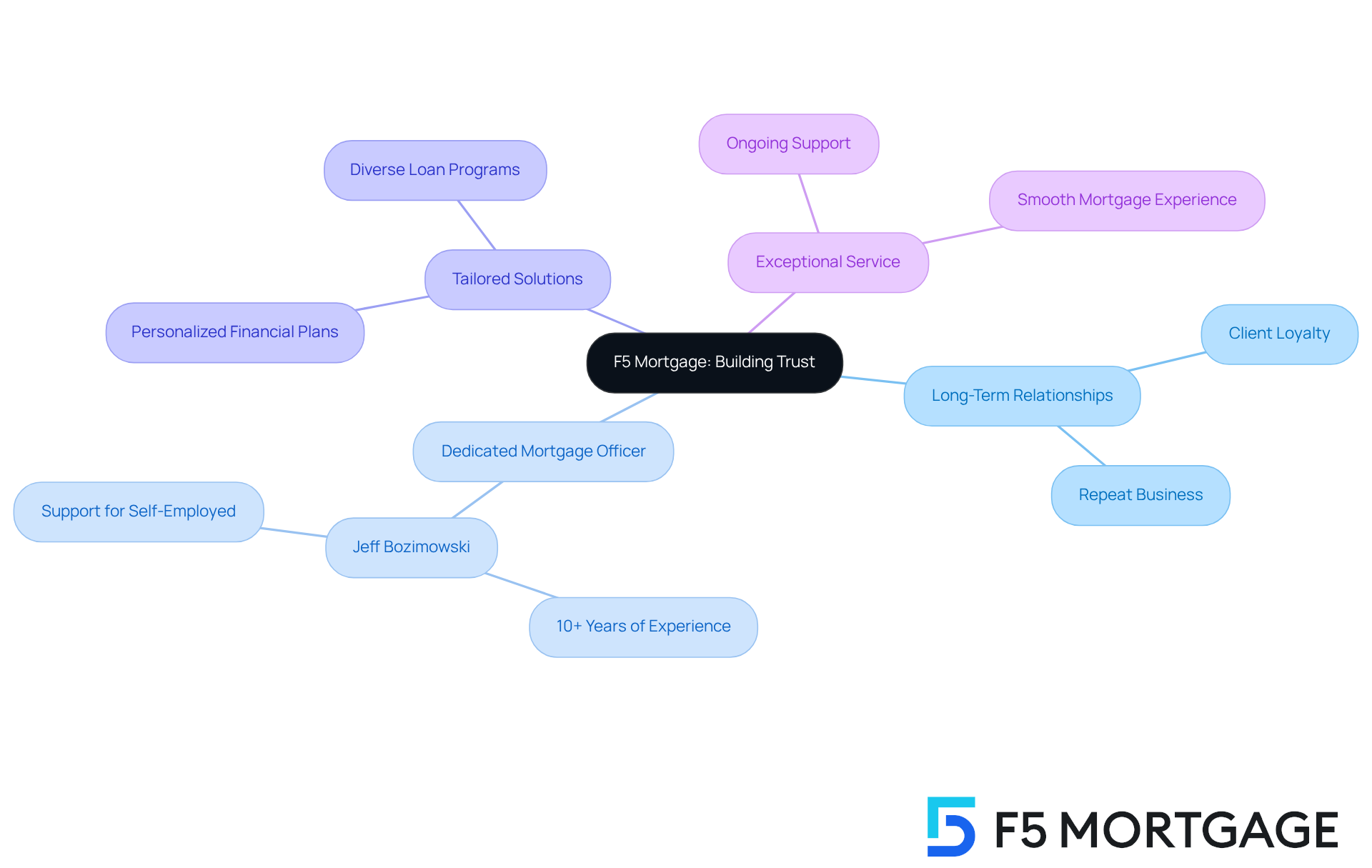

Long-Term Relationships: Building Trust for Future Mortgage Needs

At F5 Mortgage, we understand that families often face evolving mortgage needs. That’s why we prioritize developing long-term connections with our customers. With over 10 years of experience, our dedicated mortgage officer, Jeff Bozimowski, specializes in tailoring mortgage solutions to fit each individual’s unique financial situation, particularly for self-employed individuals.

We know how challenging navigating the mortgage landscape can be, and that’s why we are committed to providing exceptional service and support. Our diverse range of loan programs fosters trust and loyalty, encouraging clients to return for their future financing needs.

This commitment not only benefits families but also positions F5 Mortgage as a trusted partner in their homeownership journey. We’re here to support you every step of the way, ensuring that your mortgage experience is as smooth and personalized as possible.

Conclusion

Choosing a broker home loan can truly change the lives of families looking to enhance their homes. The benefits are significant, from personalized service to expert guidance, all tailored to meet unique financial needs. F5 Mortgage exemplifies this dedication with its customized solutions, ensuring families feel valued and supported throughout their mortgage journey.

Families often choose broker home loans for several key reasons:

- Access to a variety of loan options

- Competitive rates

- Efficient processes

F5 Mortgage stands out by providing a streamlined experience that minimizes paperwork and cultivates long-term relationships built on trust. This thoughtful approach not only simplifies the complexities of home financing but also empowers families to make informed decisions that align with their aspirations.

Ultimately, the importance of selecting a broker home loan is profound. It goes beyond a mere financial transaction; it’s about securing a stable future for families. By relying on the expertise of a dedicated broker, families can confidently navigate the mortgage landscape, ensuring their best interests are prioritized. Embracing this opportunity can lead to a more fulfilling and successful homeownership experience. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer for home loans?

F5 Mortgage provides personalized consultations tailored to individual financial needs, helping clients with acquiring new homes or refinancing existing mortgages. Their dedicated financial advisors offer customized financing solutions and support throughout the mortgage process.

How does F5 Mortgage ensure a stress-free mortgage experience?

F5 Mortgage focuses on user-friendly technology and offers no-pressure guidance, fostering trust and satisfaction. They provide a ‘red carpet treatment’ approach, ensuring clients feel valued and understood, with quick financing closings often completed in under three weeks.

What types of loan options does F5 Mortgage provide?

F5 Mortgage collaborates with over twenty leading lenders to offer a diverse selection of loan options, including fixed-rate loans, FHA loans, VA loans, and jumbo loans, catering to both first-time homebuyers and those looking to improve their current homes.

How does F5 Mortgage assist families with different financial situations?

F5 Mortgage understands that every family has unique financial circumstances, including various immigration statuses. They provide tailored support and guidance to ensure clients receive the assistance they need throughout the mortgage process.

What kind of expert guidance does F5 Mortgage offer?

F5 Mortgage offers expert guidance to help clients navigate the complexities of the mortgage process, from pre-approval to closing. Their dedicated broker home loan experts provide valuable insights and support, empowering clients to make informed decisions.

What are the benefits of seeking advice from mortgage experts at F5 Mortgage?

Households that seek advice from mortgage experts are more likely to obtain advantageous terms and rates, leading to a smoother home purchasing experience. F5 Mortgage acts as a committed advocate for clients throughout their home financing journey.