Overview

This article is dedicated to helping families identify low credit mortgage lenders who can support them in upgrading their homes. We understand how challenging this journey can be, and we’re here to guide you through it. It highlights various lenders, including F5 Mortgage, that offer tailored solutions designed for individuals with low credit scores. These lenders provide flexible loan options and down payment assistance programs, making homeownership more attainable despite financial hurdles. By exploring these opportunities, families can take meaningful steps toward achieving their dreams of owning a home.

Introduction

Navigating the mortgage landscape can feel overwhelming, especially for families with low credit scores who are eager to upgrade their homes. We understand how challenging this can be. Fortunately, a range of specialized lenders is stepping up to provide tailored solutions designed to meet these unique financial circumstances. This article explores ten low credit mortgage lenders that not only recognize the hurdles faced by families but also offer valuable resources and support to help turn the dream of homeownership into a reality.

So, how can families identify the best fit for their specific needs and overcome the obstacles of low credit? We’re here to support you every step of the way.

F5 Mortgage: Personalized Solutions for Low Credit Borrowers

At F5, we understand how challenging it can be for families with low credit ratings to navigate the mortgage process with . That’s why we specialize in providing tailored to your unique needs. By leveraging a wide range of loan programs, including , we ensure that you receive that work for you.

Our user-friendly technology simplifies the mortgage journey, empowering families to make informed decisions about their financing options without feeling pressured. Clients have shared their experiences with us, highlighting our commitment to outstanding service. One client mentioned, “They guided me as a step by step,” while another remarked, “The process was simple and worry-free, with quick loan closing in under three weeks, making it a genuinely stress-free experience.”

With a strong focus on , F5 stands out as a reliable ally for those encountering credit challenges, especially when seeking assistance from low credit mortgage lenders in their home buying journey. We’re here to support you every step of the way, ensuring that your dream of homeownership becomes a reality.

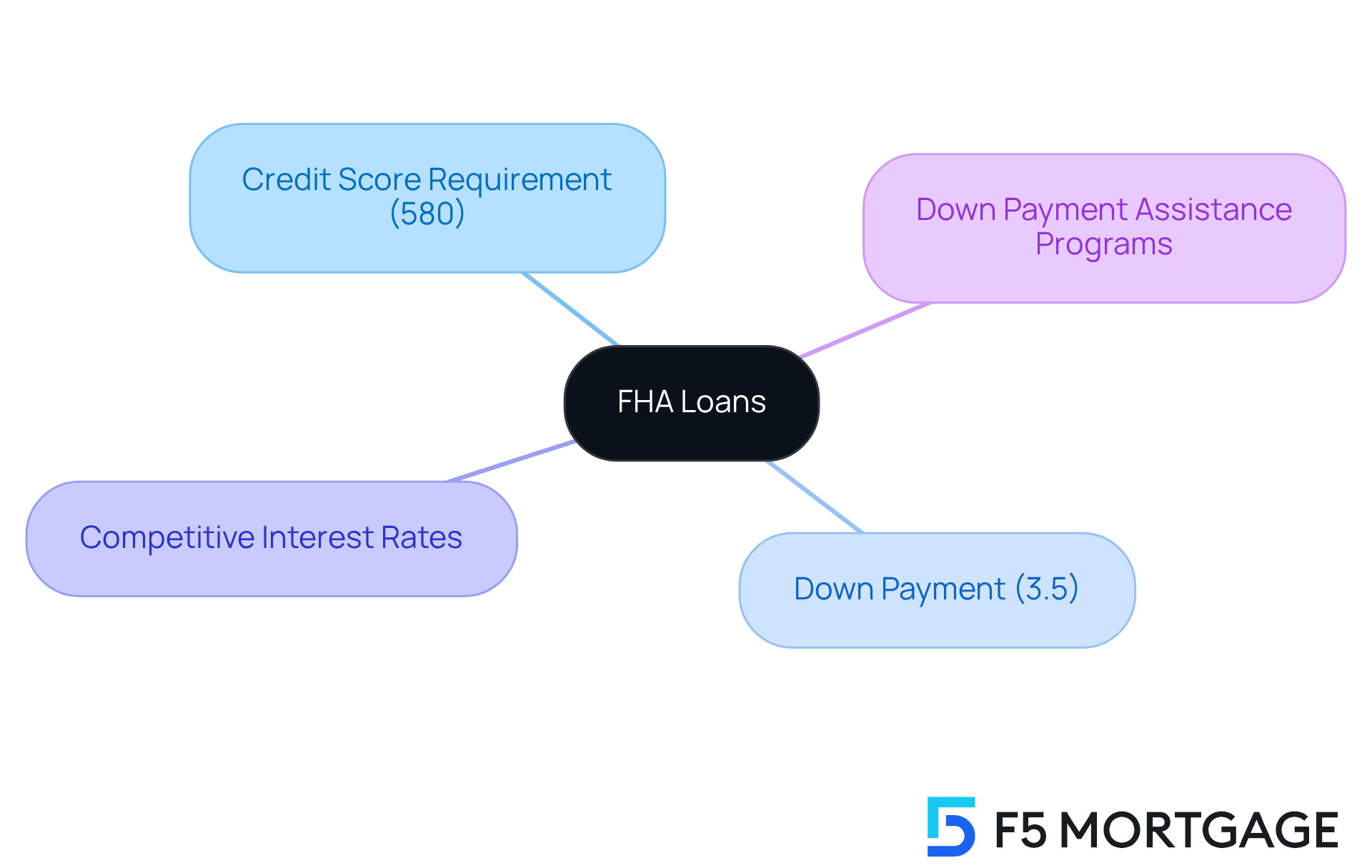

Rocket Mortgage: Best for FHA Loans with Low Credit

At F5 Financing, we understand how challenging it can be to secure a loan, particularly for those seeking assistance from . That’s why we proudly offer , designed to help families like yours. With a of just 580, our makes it easier for households to apply for loans.

Imagine being able to purchase a home with and flexible down payment options. With FHA loans, you can get started with as little as 3.5% down. This means that even if your credit isn’t perfect, low credit mortgage lenders still provide you with a great opportunity to buy the property you’ve been dreaming of.

We also provide access to various , which can significantly improve your chances of upgrading your home. We’re here to support you every step of the way, ensuring that you have the resources and guidance needed to navigate the home buying process with confidence.

Guild Mortgage: Ideal for No Credit Borrowers

At , we understand how challenging it can be for individuals with low credit scores to secure a mortgage from . That’s why we stand out as an ideal lender, offering quick and adaptable options that empower families to achieve , even when traditional credit profiles pose obstacles.

Our skilled team is dedicated to providing , guiding clients through the with care and compassion. We ensure that you comprehend your options and feel confident in your choices. Satisfied clients, like Alley Cohen, have praised our seamless process, while Bryce Leonard highlighted our expertise.

Moreover, we provide access to various , including FL Assist and the MI Home Loan program, which significantly improve purchasing prospects for families looking to upgrade their homes. This client-centric approach fosters exceptional satisfaction and opens doors for those who might otherwise struggle to secure financing through low credit mortgage lenders.

We’re here to support you every step of the way, making the a reality.

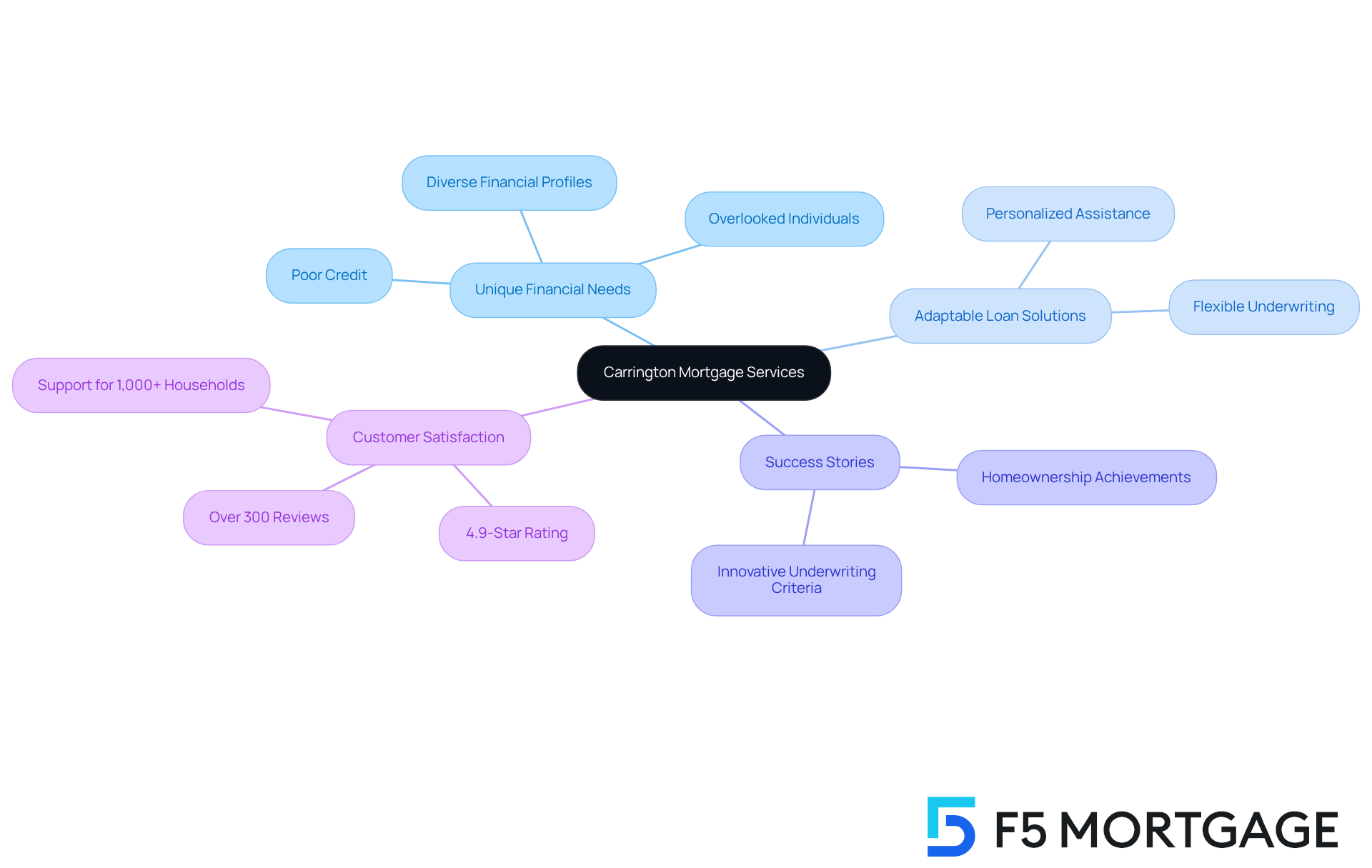

Carrington Mortgage Services: Non-Qualifying Mortgages for Unique Needs

At F5, we understand how challenging it can be to secure a loan, especially for those with , such as poor credit, where can often be a viable option. That’s why we specialize in offering adaptable loan solutions tailored to meet your specific needs. Our commitment to ensures that families can , even when traditional criteria are not met.

In recent years, many borrowers with diverse financial profiles have through . This reflects a growing acceptance of varied financial situations in the lending landscape. We’ve seen countless success stories, with numerous families achieving their dream of homeownership thanks to our innovative and .

Our lending specialists emphasize that this compassionate approach significantly enhances access to financing for individuals who might otherwise feel overlooked. Additionally, our dedication to inclusivity is highlighted by our impressive —a 4.9-star score from over 300 reviews. This underscores our exceptional service and our commitment to helping over 1,000 households upgrade their homes with the , despite facing credit challenges.

If you’re ready to explore your options, we invite you to get your free quote today. Take the first step towards homeownership with us—we’re here to support you every step of the way!

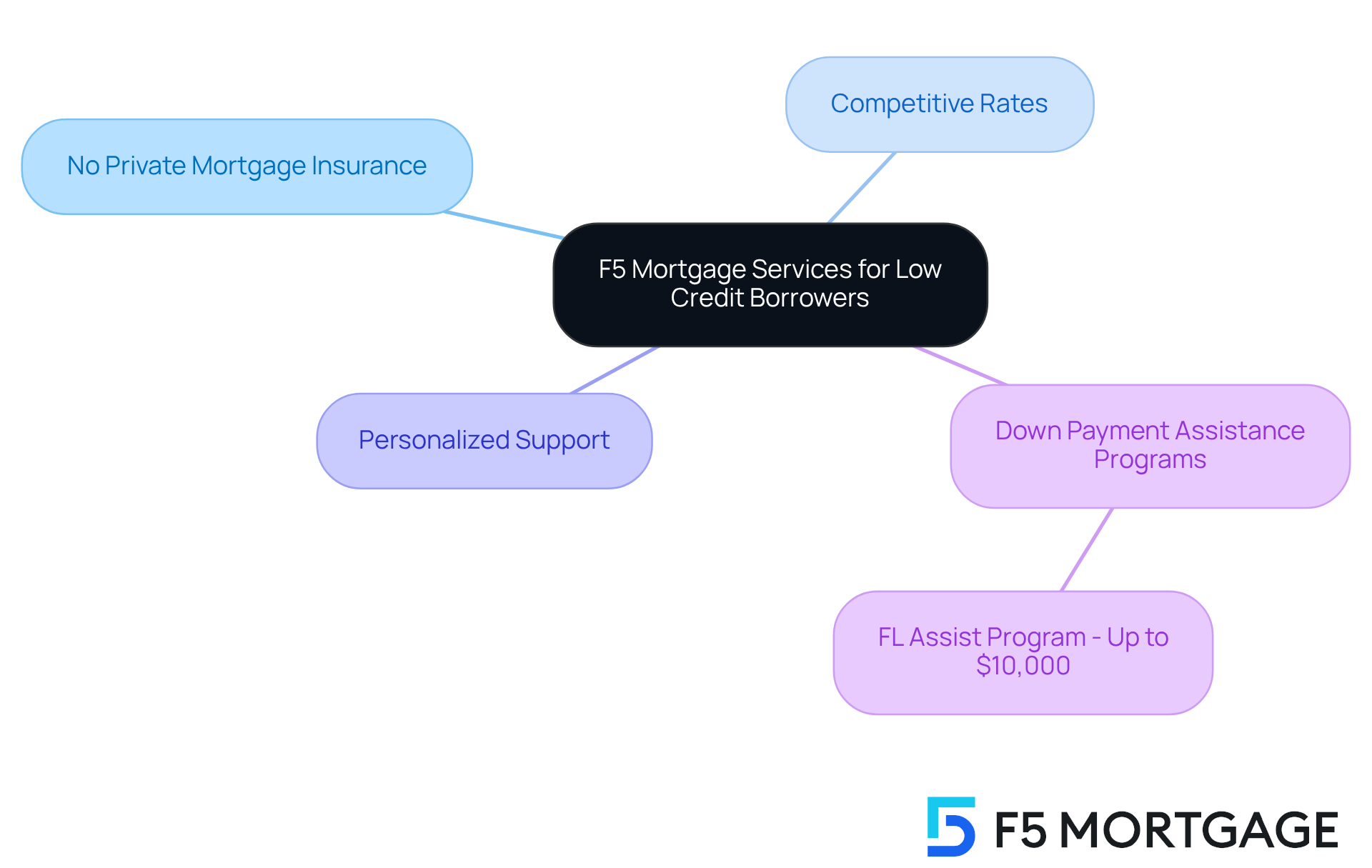

Citibank: No Private Mortgage Insurance for Low Credit Loans

At F5, we understand how challenging it can be for borrowers with low credit scores to secure loans from . That’s why we offer an excellent option that enables you to access without the burden of . This thoughtful approach can lead to significant savings over the life of your loan, making for families like yours.

Our clients often commend us for our . One satisfied client shared, “Everything went very smoothly!” We pride ourselves on our commitment to , guiding you through your options to ensure you find the best solutions tailored to your unique needs.

Additionally, we provide various , such as the FL Assist program, which offers up to $10,000 for qualified borrowers. This can greatly improve your purchasing opportunities, especially if you’re looking to upgrade your residence. Remember, at F5, we’re here to support you every step of the way.

CrossCountry Mortgage: Quick Closing for Low Credit Borrowers

At F5 Finance, we understand how challenging it can be for households, especially those with poor credit, to enhance their residences with the help of . That’s why we excel in offering extensive assistance tailored to your unique needs. Our dedicated team is here to , ensuring a seamless experience that prioritizes your individual circumstances.

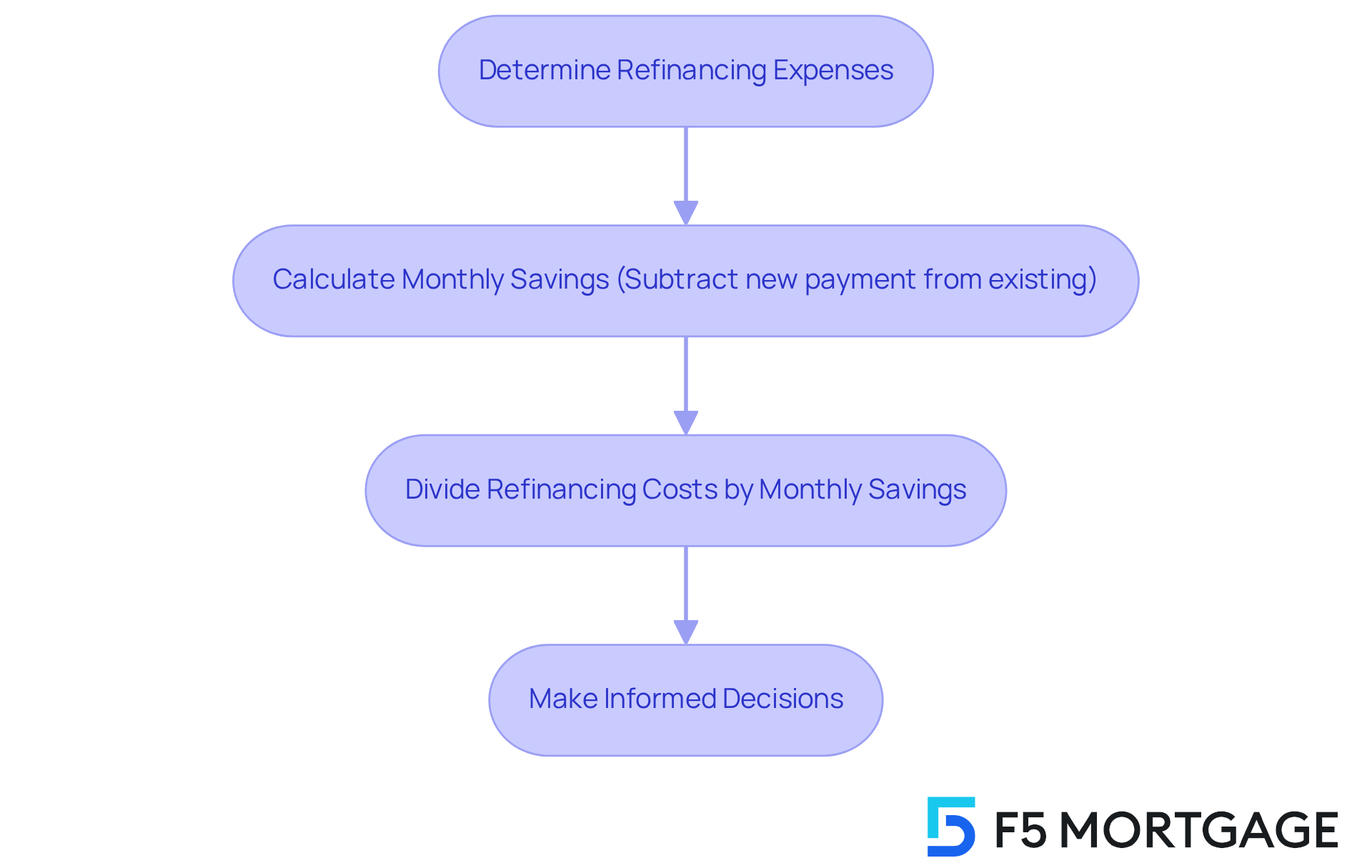

A crucial part of our process is helping you understand and calculate the break-even point for refinancing. To do this, follow these steps:

- Determine your .

- by subtracting your new monthly payment from your existing one.

- Divide your refinancing costs by your monthly savings.

This simple approach empowers you to with low credit mortgage lenders.

Moreover, we provide valuable insights into , which can significantly improve your purchasing opportunities. With a strong emphasis on , . Families appreciate our commitment to , and we are proud to be part of your journey.

Navy Federal Credit Union: Tailored Mortgages for Veterans

At F5, we understand how challenging it can be for families looking to enhance their homes. That’s why we provide that cater to your specific needs, including options from for those with low credit ratings. Our commitment to making the is reflected in our user-friendly technology, designed to simplify the process for you.

We prioritize guiding you without pressure, allowing you to choose what feels right for your family. Many of our clients have shared their satisfaction with our service. One happy client remarked, ‘I enjoyed getting help with my loan through . Highly recommend to anyone who is looking for true experts.’

Additionally, we offer access to various , such as FL Assist and the MI Loan program, which can significantly improve your purchasing opportunities. Our dedicated team guarantees , ensuring your transition to your new residence is as seamless as possible. We’re here to .

LendingTree: Compare Lenders for Low Credit Mortgages

At , we understand how challenging it can be to navigate the . That’s why we’re dedicated to supporting you in finding the tailored to your unique financial situation. We can connect you with leading realtors in your area, ensuring you receive the proper guidance throughout the property purchasing process.

We also recognize that can significantly improve your chances of homeownership. Programs like FL Assist, for example, provide up to $10,000 as a deferred second mortgage for eligible borrowers. Additionally, the MI Home Loan program offers $10,000 loans for . These options make for families looking to renovate their residences.

Our goal is to empower you with the information and resources you need to make informed decisions. We’re here to support you every step of the way, helping you secure the .

Better.com: Streamlined Digital Mortgages for Low Credit

At F5 Lending, we understand how challenging it can be for households looking to enhance their residences. That’s why we are committed to being your ally, offering a simplified tailored to meet the needs of borrowers who are seeking assistance from .

The in California typically involves several key steps:

- Assessing your current mortgage

- Determining your refinancing goals

- Gathering necessary documentation

- Submitting your application

We know that this can feel overwhelming, but our user-friendly platform is designed to simplify your experience, ensuring transparency with no hidden fees.

We offer and a swift application procedure, making it easier for families to obtain financing promptly and effectively. Our clients consistently express their satisfaction, with testimonials highlighting our expert support and smooth processes.

At F5, we are dedicated to improving property purchasing opportunities. We also provide access to that can greatly assist households aiming to upgrade their residences. Remember, we’re here to support you every step of the way.

SoFi: Mortgage Solutions for Self-Employed Borrowers with Low Credit

F5 understands the challenges families face when enhancing their homes, especially for those struggling with . That’s why they provide tailored to your needs. With fast and , F5 makes the smoother, helping you achieve .

At F5 Financing, exceptional service is a priority. Their personalized support empowers you throughout your journey, ensuring you feel understood and cared for. The efficient application procedure and attractive rates simplify obtaining financing, even in difficult situations.

Success stories highlight how families with low credit have secured loans through low credit mortgage lenders, showcasing the effectiveness of their . For example, clients like Alley Cohen have shared their appreciation for the team’s smooth process and unwavering support.

Moreover, F5 Mortgage offers valuable , such as the FL Assist initiative, which provides up to $10,000 for qualified borrowers. This enhances property purchasing opportunities for those who may need a little extra help. the importance of these programs, noting that they can significantly improve your chances of securing a mortgage when looking to upgrade your home.

We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Navigating the mortgage landscape can be particularly daunting for families with low credit scores, but it’s important to remember that homeownership is still within reach. This article highlights ten low credit mortgage lenders who understand the unique challenges faced by these borrowers and offer tailored solutions to meet their needs. From personalized consultations to specialized loan programs, these lenders are committed to helping families secure the financing they require to upgrade their homes.

Key insights revealed include various loan types available, such as FHA and VA loans, which come with lower credit score requirements and down payment assistance programs. Lenders like F5 Mortgage, Rocket Mortgage, and Guild Mortgage stand out for their dedication to client satisfaction, quick loan processing, and innovative approaches to lending. Each lender offers distinct advantages, from no private mortgage insurance options to flexible underwriting criteria, ensuring that families can find a solution that aligns with their financial situation.

As families explore these mortgage options, it is essential to take action and seek out the best resources available. Whether through down payment assistance programs or personalized loan consultations, support is available for those ready to embark on their journey to homeownership. Embracing these opportunities can make a significant difference, turning the dream of owning a home into a tangible reality, even for those with low credit scores.

Frequently Asked Questions

What services does F5 Mortgage offer for low credit borrowers?

F5 Mortgage specializes in providing customized loan consultations for families with low credit ratings. They leverage a wide range of loan programs, including FHA and VA loans, to offer competitive rates and terms tailored to individual needs.

How does F5 Mortgage simplify the mortgage process?

F5 Mortgage uses user-friendly technology to simplify the mortgage journey, allowing families to make informed decisions about their financing options without feeling pressured.

What are the benefits of FHA loans offered by F5 Financing?

FHA loans from F5 Financing have a minimum credit score requirement of just 580 and allow for down payments as low as 3.5%. This makes it easier for families with less-than-perfect credit to purchase a home with competitive interest rates.

Are there assistance programs available for down payments through F5 Financing?

Yes, F5 Financing provides access to various down payment assistance programs, which can significantly improve the chances of homeownership for families.

What makes Guild Mortgage a good option for no credit borrowers?

Guild Mortgage offers quick and adaptable options for individuals with no credit, providing tailored assistance and guidance throughout the financing process to help them achieve homeownership.

How do clients feel about the services provided by F5 Financing?

Clients have expressed satisfaction with F5 Financing’s services, highlighting the seamless process and the care and compassion shown by the skilled team during their home buying journey.