Overview

Understanding the world of conventional loans can be overwhelming, especially when it comes to credit scores. The minimum required score is typically 620, but many lenders prefer scores of 680 or higher for more favorable terms. We know how challenging this can be.

Maintaining a strong credit profile is crucial. Higher scores can lead to significantly lower interest rates and better mortgage conditions. This not only eases the financial burden but also opens doors to opportunities that might seem out of reach.

We’re here to support you every step of the way. By understanding and improving your creditworthiness, you can take control of your financial future. Remember, small steps can lead to big changes!

Introduction

Navigating the complexities of securing a conventional loan can feel overwhelming, especially when it comes to the crucial role of credit scores. We understand how challenging this can be. With a minimum requirement often set at 620, potential borrowers may find themselves wondering how their financial ratings influence not only their eligibility but also the terms they can secure.

This article explores ten key insights that shed light on the importance of credit scores in the mortgage landscape. We aim to reveal strategies for improvement while addressing common misconceptions. As the stakes rise, we’re here to support you every step of the way. How can you best position yourself to achieve your homeownership dreams amidst evolving lending standards?

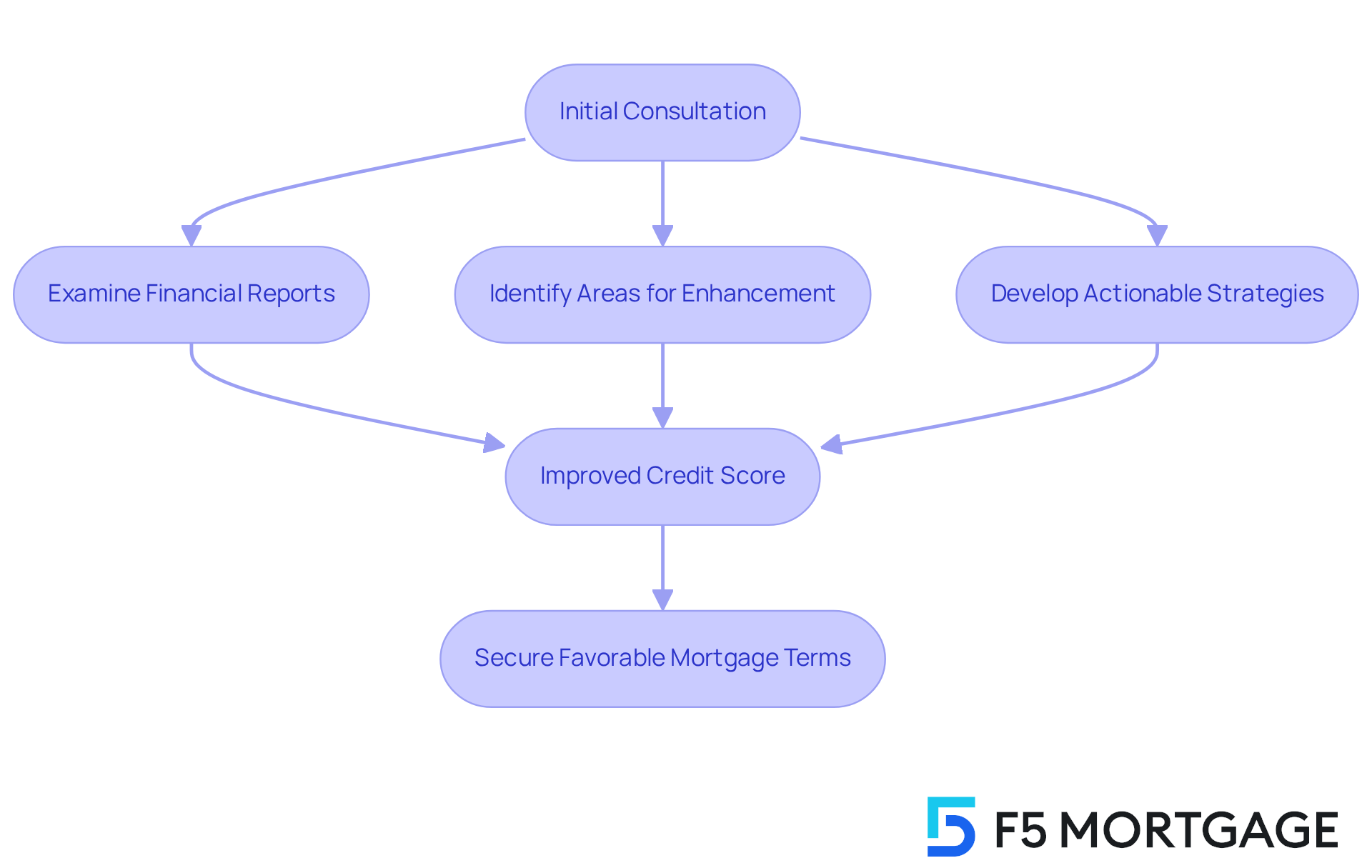

F5 Mortgage: Personalized Mortgage Consultations for Credit Score Guidance

At F5 Mortgage, we understand how challenging navigating the mortgage process can be. That’s why our customized mortgage consultations are designed to assist you in grasping the intricacies of financial ratings, particularly the minimum credit score for conventional loan, and how they impact your mortgage choices. Our skilled brokers work closely with families like yours, examining financial reports, identifying areas for enhancement, and developing actionable strategies to improve creditworthiness. This personalized approach not only empowers you to make informed financial decisions but also increases your chances of securing favorable mortgage terms by understanding the minimum credit score for conventional loan.

Statistics reveal that roughly 70% of clients see improvements in their financial ratings after these consultations, highlighting the effectiveness of our tailored advice. For instance, families who initially faced low scores have successfully transitioned to better mortgage alternatives by receiving focused guidance on the minimum credit score for conventional loan. Many have raised their scores from 580 to 640, allowing them to meet the minimum credit score for conventional loan and qualify for standard financing.

Client testimonials reflect the exceptional service we provide at F5 Mortgage. Many clients praise our friendly and patient approach. One client shared, “Alyssa and Jorge were both very patient with me & got me secured at rates I couldn’t believe,” showcasing our commitment to your satisfaction. Additionally, we offer competitive rates and fast service, ensuring you receive the best possible options. By utilizing a vast network of lenders, our brokers can provide insights into financing products tailored to your financial profile, streamlining the mortgage process for first-time homebuyers and those looking to refinance.

As industry specialists point out, ‘Enhancing your rating before you apply can truly benefit you,’ highlighting the importance of meeting the minimum credit score for conventional loan applications. Our dedication to personalized service positions F5 Mortgage as your trusted partner in achieving your homeownership dreams. We’re here to support you every step of the way.

Minimum Credit Score Requirement for Conventional Loans: What You Need to Know

To qualify for a traditional mortgage, borrowers generally need to meet the minimum credit score for a conventional loan of 620. We understand how crucial this benchmark is, as it significantly affects eligibility for various credit products. However, many lenders favor ratings of 680 or above, which can lead to more advantageous terms and reduced interest rates. For instance, borrowers with a rating of 740 or higher often enjoy lower down payment options and improved interest rates. As the mortgage landscape evolves, understanding these borrowing standards is essential for setting realistic expectations and preparing effectively for mortgage applications.

At F5 Mortgage, we emphasize the importance of maintaining a strong financial profile to enhance mortgage eligibility and secure favorable financing terms. Recent trends indicate that a growing percentage of lenders are tightening their credit evaluation criteria, reflecting an increasing focus on financial discipline and management. This shift underscores the necessity for borrowers to aim for a rating above the minimum credit score for a conventional loan to avoid elevated interest rates, which can significantly impact overall borrowing costs.

When preparing your refinancing application with F5 Mortgage, it’s crucial to gather essential documentation such as Social Security numbers, bank statements, tax returns, and pay stubs. A step-by-step approach can simplify this process:

- Collect all necessary documents

- Ensure they are current

- Submit them with your application

This thorough preparation not only streamlines the application process but also ensures compliance with underwriting standards, ultimately contributing to your success in securing a loan. As you explore your options, remember to compare rates, costs, and terms to find the best fit for your needs. At F5 Mortgage, we offer competitive rates and personalized service, and we’re here to support you every step of the way.

Impact of Credit Scores on Mortgage Rates: Understanding the Financial Consequences

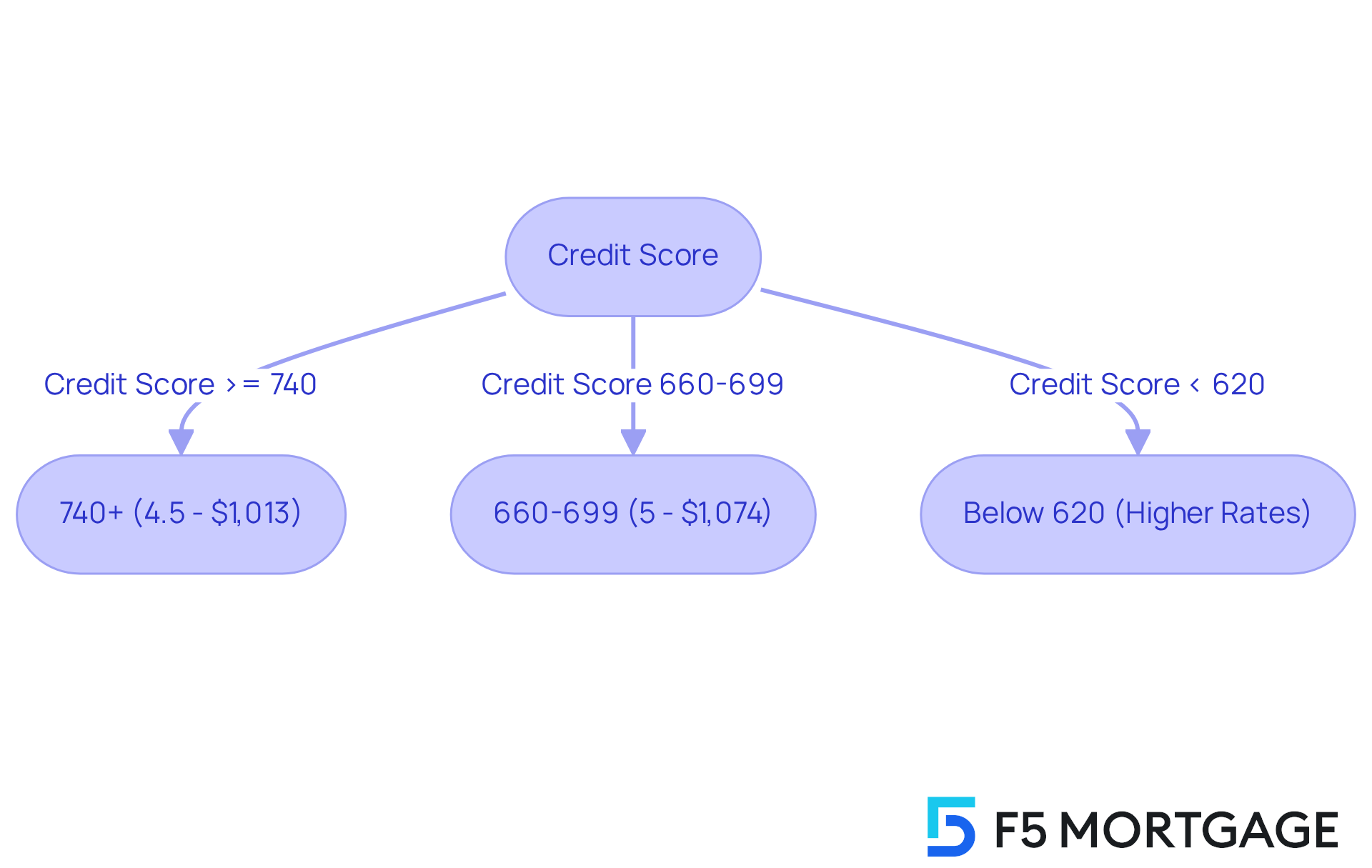

Understanding credit ratings can feel overwhelming, but they play a crucial role in determining your mortgage rates. Typically, higher ratings lead to lower interest rates, which is great news for borrowers. For example, if your rating is above 740, you could qualify for the most favorable rates. On the other hand, if your rating falls below the minimum credit score for a conventional loan of 620, you may encounter significantly higher rates or even denial of your application.

Imagine this: a borrower with a rating of 740 or higher might secure a monthly payment of $1,013 at a 4.5% interest rate. In contrast, someone with a rating between 660 and 699 could see their monthly payment rise to $1,074 at a 5% rate. This difference highlights how much your borrowing rating can impact your finances. Even a small change in interest rates can lead to substantial savings over the life of your mortgage.

In fact, improving your credit history can lower your mortgage rates by nearly 0.75 percentage points. This could translate into savings of over $55,000 in interest on a $300,000 mortgage! We know how challenging navigating these numbers can be, but understanding this relationship is essential for optimizing your mortgage terms and enhancing your overall financial health. We’re here to support you every step of the way.

Factors Influencing Your Credit Score: Key Elements to Consider

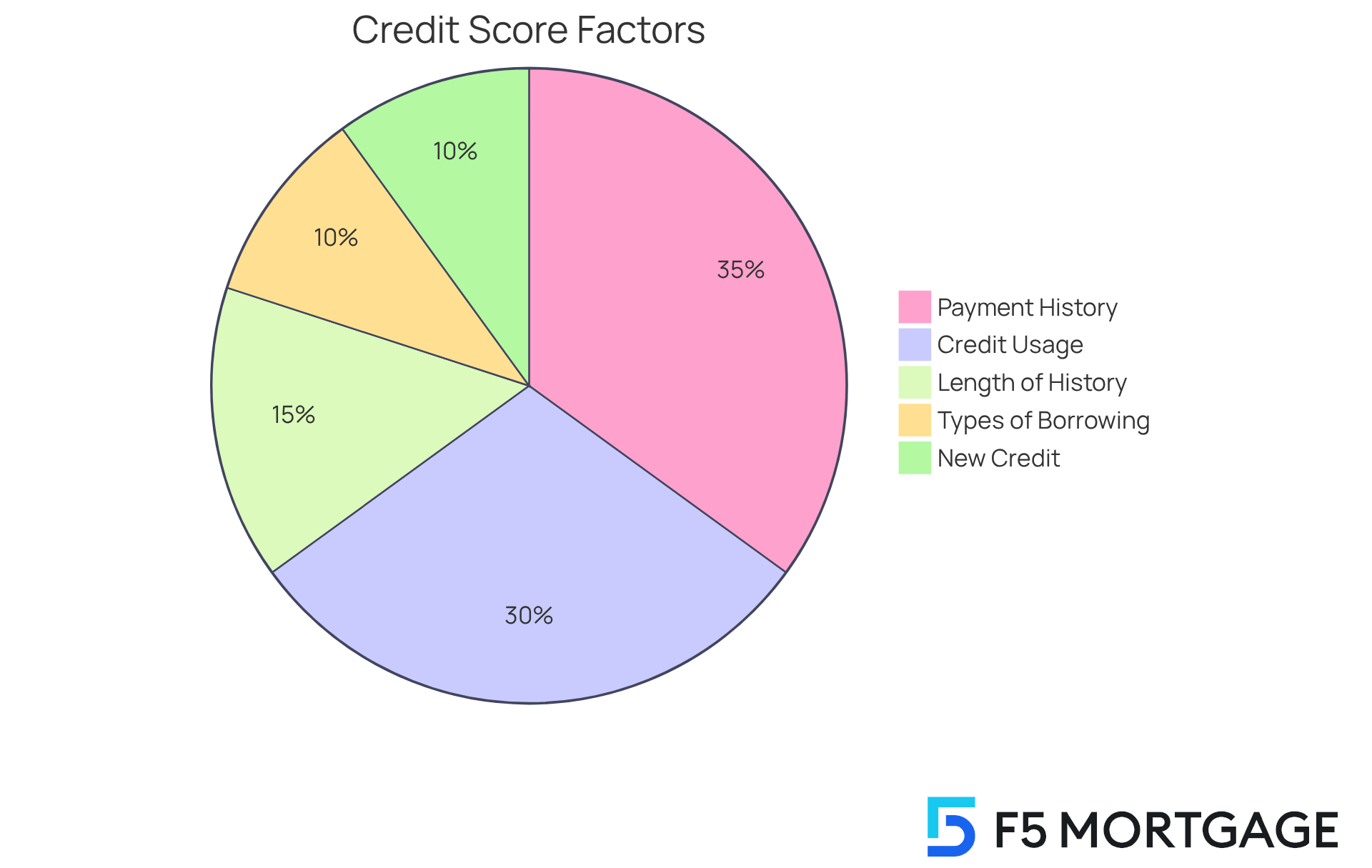

Several key factors significantly influence credit scores, which are essential for securing favorable mortgage terms:

-

Payment History (35%): We know how challenging it can be to keep track of payments. Timely payments on loans and credit cards are paramount, as they constitute the largest portion of your credit score. Late payments can have a substantial negative impact, making it crucial to prioritize on-time payments, even if only the minimum amount is paid. Remember, after closing your loan with a lender, you will make payments to them, not to F5 Mortgage, as we are a broker. If you have any questions post-closing, we’re here to support you every step of the way. Feel free to reach out to us at 1-888-459-0483 or email info@f5mortgage.com for assistance.

-

Credit Usage (30%): Keeping low card balances in relation to your limits is essential. A reduced utilization ratio shows responsible management of finances and can positively influence your rating. We understand that managing expenses can be tough, but every little bit helps!

-

Length of Credit History (15%): A longer financial history can enhance your score, as it provides lenders with a more comprehensive view of your behavior over time. It’s about building trust, and we’re here to help you navigate this journey.

-

Types of Borrowing (10%): A diverse mix of borrowing types, including revolving accounts (such as credit cards) and installment loans (like mortgages), can enhance your financial credibility. Lenders prefer borrowers with diverse financial experiences, and we can assist you in understanding how to achieve this balance.

-

New Credit (10%): Opening several new accounts in a brief period can adversely affect your rating. Each application prompts a hard inquiry, which can temporarily reduce your rating. We recognize that life changes can lead to new credit needs, and we’re here to guide you through those decisions.

Understanding these elements allows clients to focus on enhancing their financial profiles, which ultimately improves their eligibility for mortgage financing, including meeting the minimum credit score for conventional loan. For instance, clients who regularly make prompt payments and handle their utilization efficiently have observed substantial enhancements in their scores, making them more appealing to lenders. Remember, every step you take brings you closer to your goals!

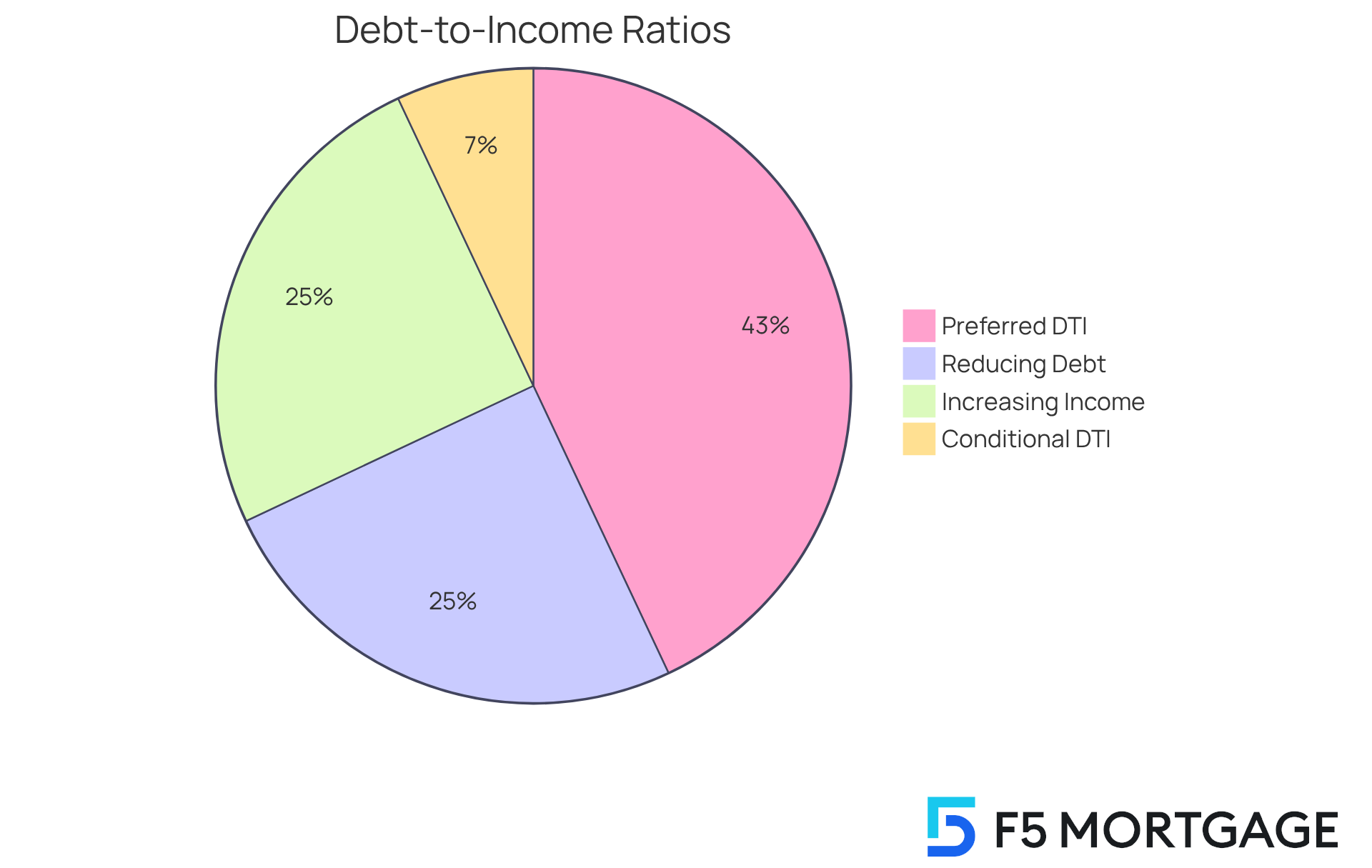

Debt-to-Income Ratio: Its Role in Securing a Conventional Loan

Understanding the debt-to-income (DTI) ratio is crucial when it comes to securing a conventional loan. This ratio serves as a key indicator of your financial health, evaluating how much of your monthly earnings go towards debt repayments, including mortgages, credit cards, and other obligations. Most lenders prefer a DTI ratio of 43% or less, though some may accept higher ratios based on factors like your credit score and overall financial stability. For instance, if you have a strong credit history, you might find that some lenders allow DTI ratios up to 50% under certain conditions.

At F5 Mortgage, we recognize that self-employed individuals often face unique challenges, especially with complex tax returns. That’s why we offer customized bank statement financing, which allows for income assessment based on 12 or 24 months of bank statements. This flexible solution is designed for those who may not fit into conventional criteria. To qualify for these financial products, you’ll need:

- A minimum credit score for conventional loan of 680

- A down payment of at least 10%

A lower DTI ratio not only reflects better financial management but also significantly increases your chances of loan approval. Lenders generally view lower DTI ratios as a sign of your ability to manage additional financial responsibilities, which can lead to more favorable mortgage terms.

If you’re looking to enhance your DTI ratio, consider focusing on:

- Reducing your current debt

- Increasing your income through side jobs or projects

Research shows that maintaining a DTI ratio within preferred limits can open doors to better loan options and lower interest rates. For example, many individuals who successfully lowered their DTI ratios from 45% to 35% found themselves qualifying for more competitive mortgage products. Additionally, lenders typically have maximum DTI limits ranging from 43% to 50%, which can serve as a helpful benchmark as you navigate your loan options.

By actively managing your debt and income, you can not only secure financing but also foster long-term financial stability. We know how challenging this can be, but remember, you’re not alone in this journey. We’re here to support you every step of the way.

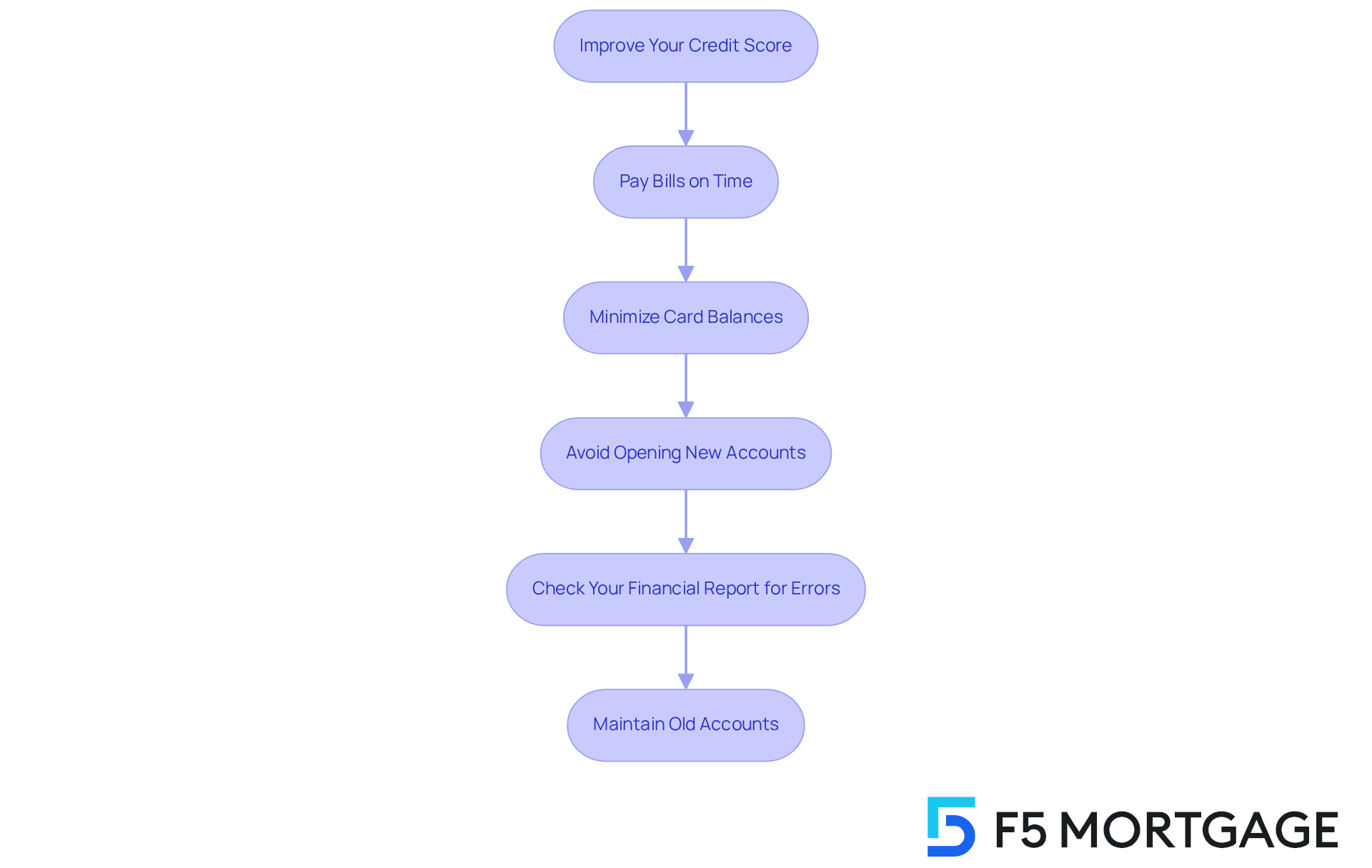

Steps to Improve Your Credit Score: Boosting Your Loan Eligibility

To enhance your credit score and improve your chances of securing a loan, we know how challenging this can be. Consider these effective strategies that can truly make a difference:

-

Pay Bills on Time: Prompt payments are crucial, as they represent 35% of your rating. Consistent on-time payments can significantly boost your creditworthiness. As Steven Millstein, a certified financial advisor, highlights, “The most effective method to enhance your rating is to reduce your revolving debt.”

-

Minimize Card Balances: Strive to maintain your utilization ratio under 30% of your overall limit. Reducing your balances can result in a rapid enhancement in your rating, as this ratio makes up 30% of your financial evaluation. A case study on the ‘Impact of Decreasing Borrowing Utilization’ indicates that individuals who lowered their card balances frequently saw a swift rise in their ratings.

-

Avoid Opening New Accounts: Each new financial inquiry can temporarily lower your score. It’s advisable to limit new loan applications before applying for a mortgage to maintain a stable financial profile.

-

Check Your Financial Report for Errors: Regularly review your financial report for inaccuracies and dispute any mistakes. Fixing errors can result in a quick rise in your rating, occasionally in just a few days.

-

Maintain Old Accounts: Keeping older financial accounts open helps enhance the duration of your history, which is advantageous for your overall rating.

By applying these strategies, you can observe considerable enhancements in your financial rating, which will help you meet the minimum credit score for conventional loan qualification and facilitate easier access to advantageous mortgage conditions. For example, clients who concentrated on lowering their card balances and guaranteeing prompt payments frequently reported a rise in their ratings within a few months, improving their qualifications for superior financing options. We’re here to support you every step of the way.

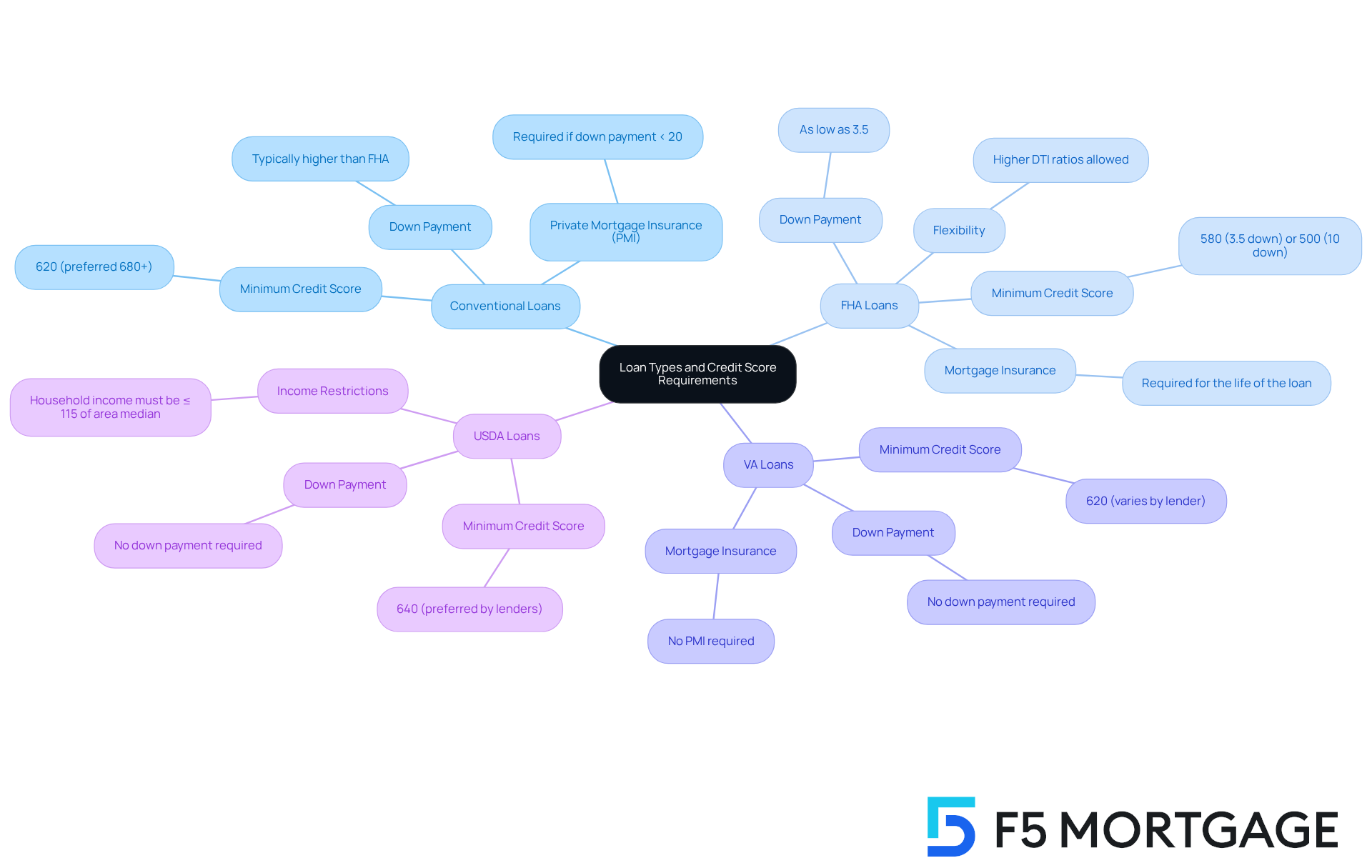

Conventional Loans vs. Government-Backed Loans: A Credit Score Comparison

When evaluating the differences between conventional loans and government-backed loans such as FHA, VA, and USDA loans, we know how challenging it can be to navigate the credit score requirements. Here’s a closer look:

- Conventional Loans: Generally require a minimum credit score of 620, with many lenders favoring scores of 680 or higher to secure favorable terms. This can feel daunting for many.

- FHA Loans: Provide greater flexibility, accepting financial ratings as low as 580 with a 3.5% down payment, or even 500 with a 10% down payment. This makes them attainable for numerous first-time homebuyers, offering a glimmer of hope.

- VA Loans: Generally do not set a minimum financial assessment requirement, although individual lenders may establish their own criteria. This can be a relief for veterans seeking options.

- USDA Loans: Typically necessitate a minimum rating of 640, which can restrict choices for certain individuals.

This comparison highlights that individuals with reduced financial ratings often find more flexible choices through government-supported financing. For those with elevated ratings, traditional financing might offer potentially reduced expenses. As highlighted by industry specialists, government-supported financing can provide crucial pathways to homeownership for individuals facing financial difficulties. We’re here to support you every step of the way in exploring these options.

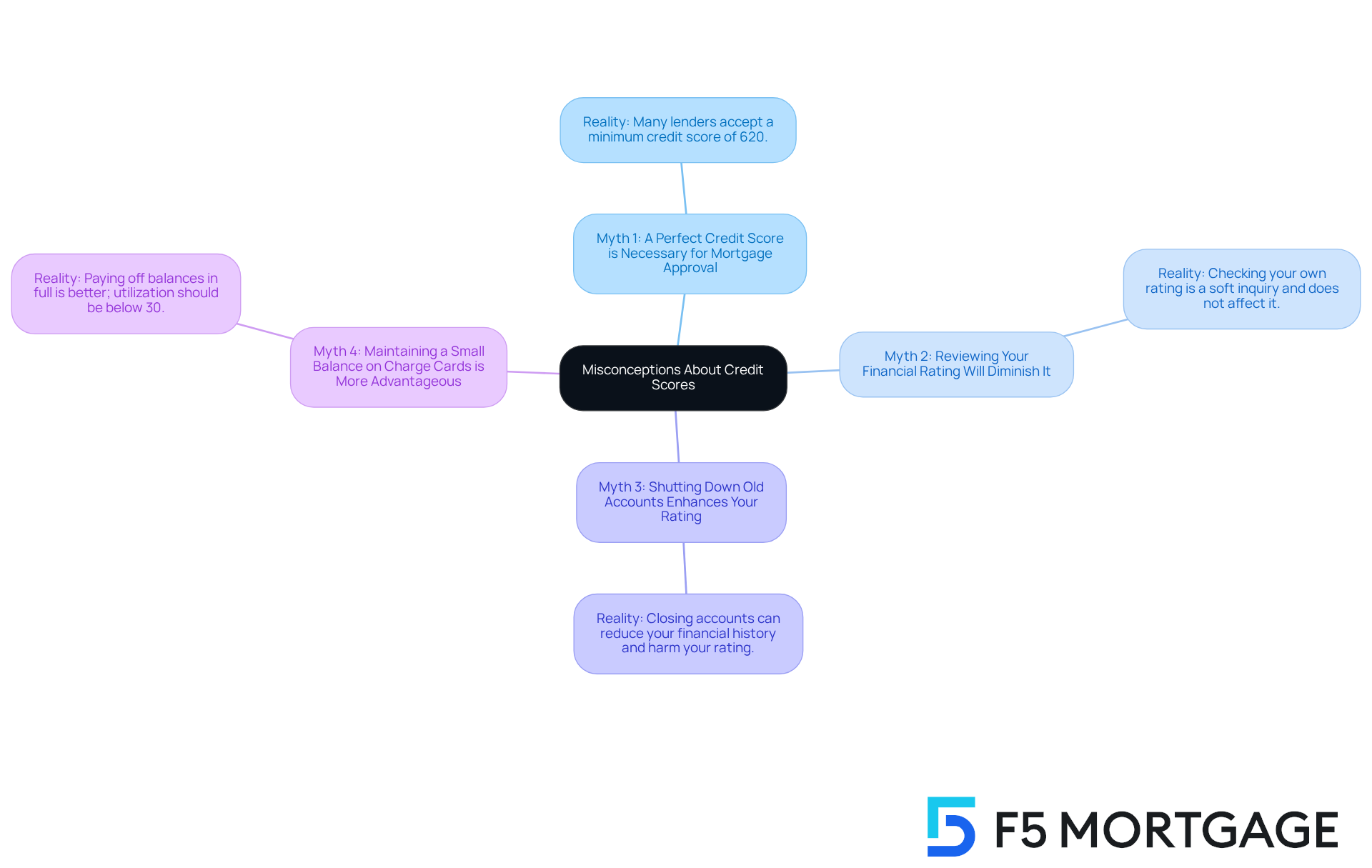

Common Misconceptions About Credit Scores and Loan Approvals: What Borrowers Should Know

Many misunderstandings regarding financial ratings and approvals can obstruct potential applicants from pursuing their dreams of homeownership. We know how challenging this can be, so let’s address some prevalent myths and the realities behind them:

-

Myth 1: A perfect credit score is necessary for mortgage approval.

Reality: Many lenders accept a minimum credit score for conventional loan as low as 620, which allows a broader range of borrowers to qualify. In fact, a considerable portion of prospective home purchasers wrongly assume they need a perfect financial rating, which can discourage them from applying. According to recent statistics, 18% of Americans mistakenly believe that their financial ratings cannot decrease when a lender performs a check, further complicating their understanding of mortgage eligibility. -

Myth 2: Reviewing your financial rating will diminish it.

Reality: Checking your own financial rating is categorized as a soft inquiry and does not affect your rating. In fact, consistently reviewing your financial standing can help you spot mistakes and understand your eligibility for loans. As financial educator Cynthia Chen wisely points out, ‘You can check your financial rating ten times a day and it’s not going to change because you check it.’ -

Myth 3: Shutting down old accounts enhances your rating.

Fact: Closing accounts can reduce your financial history, which may adversely impact your rating. Keeping older accounts can actually enhance your financial profile. -

Myth 4: Maintaining a small balance on charge cards is more advantageous for your rating.

Reality: Holding a small balance does not improve your rating compared to paying it off in full. In fact, maintaining utilization below 30% is advised for optimal ratings. Interestingly, 49% of Americans who keep a balance on at least one card believe that maintaining a small balance is more beneficial for their ratings, which is a widespread misunderstanding.

Understanding these myths is essential for individuals seeking loans, particularly first-time homebuyers, as they navigate the mortgage process and the minimum credit score for conventional loan applications. We’re here to support you every step of the way. Financial educators emphasize that while credit scores are important, they are not the sole determinant of mortgage eligibility. Lenders consider various factors, including income stability and debt-to-income ratios, when assessing an individual’s creditworthiness. By debunking these misconceptions, you can approach the mortgage process with greater confidence and clarity.

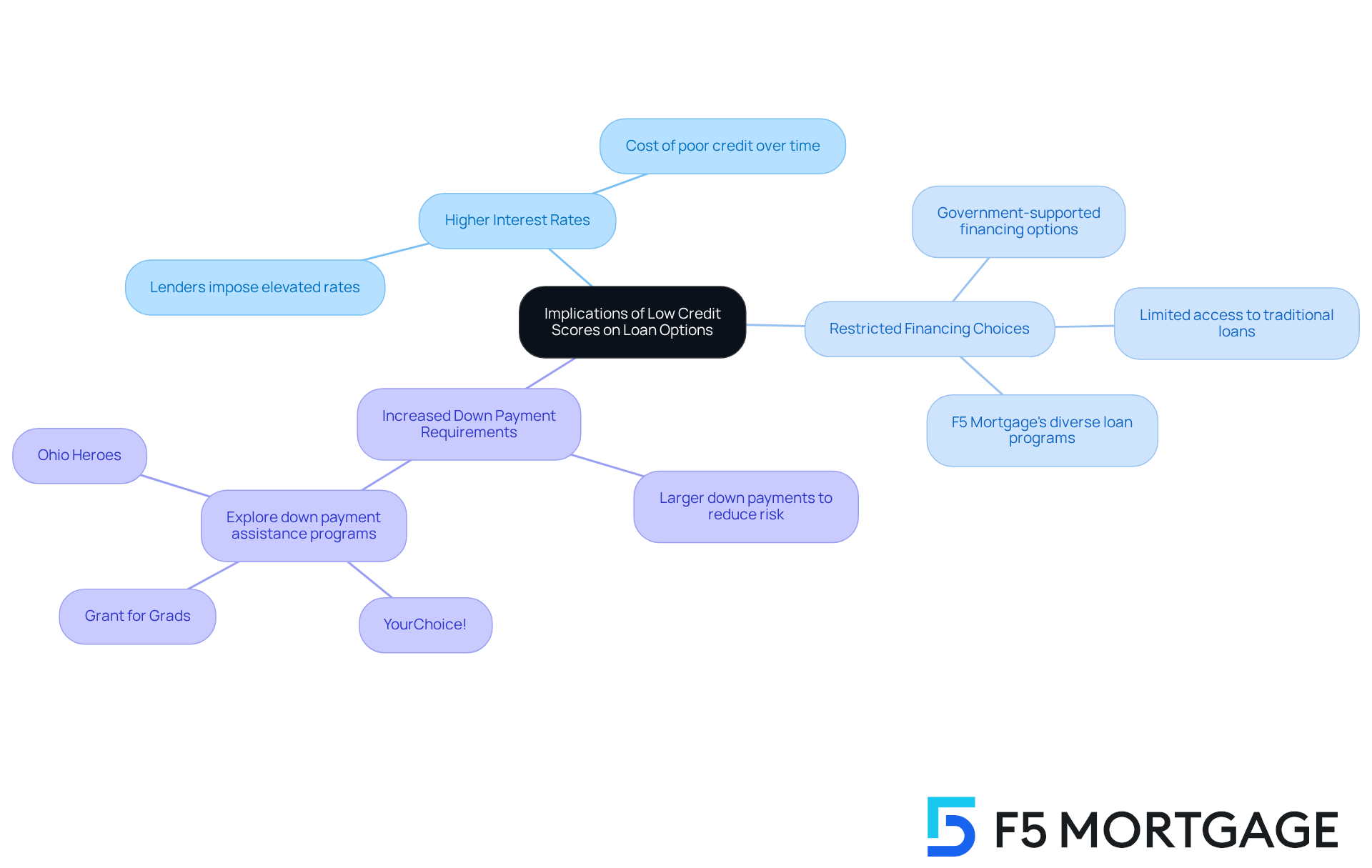

Implications of Low Credit Scores on Loan Options: Understanding Your Choices

A poor rating can significantly limit your mortgage choices and affect the conditions you are offered. We know how challenging this can be. Borrowers with scores below 620 often encounter several hurdles:

- Higher Interest Rates: Lenders typically impose elevated rates to compensate for the increased risk associated with low credit scores. For instance, individuals in this category may see interest rates that are considerably higher than those provided to people with better credit profiles.

- Restricted Financing Choices: Many traditional lenders may deny applications entirely or only offer access to government-supported financing, which often includes more stringent eligibility requirements. This limitation can hinder individuals from securing the most favorable financing. However, F5 Mortgage provides a variety of loan programs, including both conventional and unconventional options, ensuring that even individuals with lower financial ratings can find possible routes to homeownership despite the minimum credit score for conventional loan requirements.

- Increased Down Payment Requirements: To reduce risk, some lenders may require larger down payments from individuals with low financial ratings. This requirement can make it more challenging for individuals to afford a home, as they must save more upfront.

Fortunately, first-time homebuyers in Ohio can explore down payment assistance programs like YourChoice!, Grant for Grads, and Ohio Heroes. These programs can provide financial support and make homeownership more accessible.

Understanding these implications is crucial for borrowers. It opens the door to exploring alternative options, such as enhancing financial scores over time or considering government-backed loans that may provide more lenient terms, alongside the diverse offerings from F5 Mortgage. We’re here to support you every step of the way.

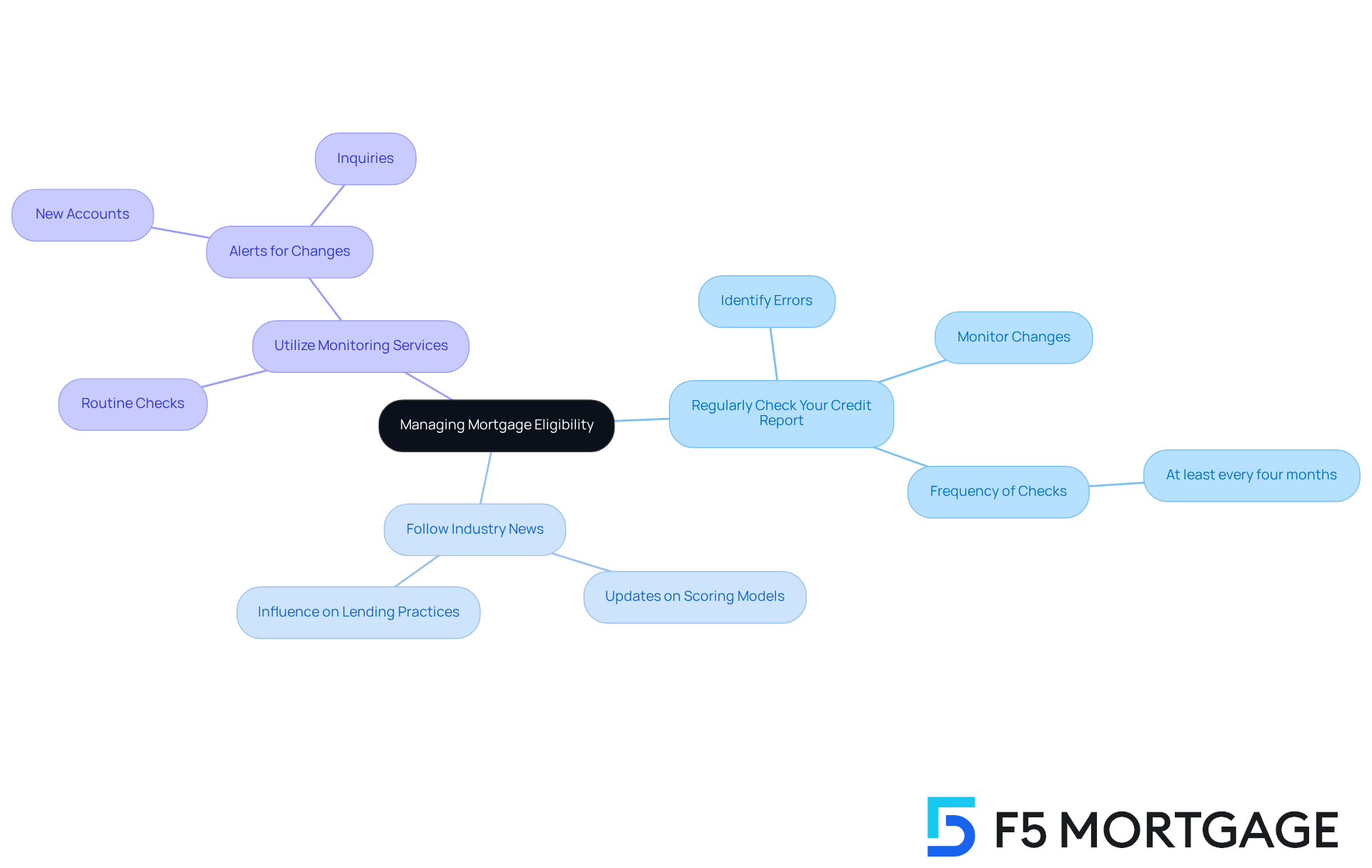

Staying Informed About Credit Score Changes: Managing Your Mortgage Eligibility

Staying knowledgeable about scoring models and reporting practices is essential for managing your mortgage eligibility. We know how challenging this can be, but there are effective strategies to help you stay updated:

- Regularly Check Your Credit Report: Did you know that approximately 30% of borrowers do not check their credit reports regularly? This can lead to missed opportunities for improvement. By monitoring your financial report, you can identify errors and changes that could adversely affect your score.

- Follow Industry News: Staying informed about updates concerning scoring models is crucial. These changes can significantly influence lending practices and your eligibility for loans. Keeping up with the latest news helps you navigate the mortgage landscape more effectively.

- Utilize Monitoring Services: Many monitoring services emphasize the importance of routine checks. Proactive observation can notify you of notable changes in your profile, such as new accounts or inquiries. This can be particularly beneficial for borrowers looking to improve their chances of securing a mortgage.

By actively managing your credit and staying informed about the minimum credit score for conventional loan, you can improve your chances of mortgage approval and secure more favorable terms. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the minimum credit score for conventional loans is crucial for prospective homebuyers who wish to secure favorable mortgage terms. We know how challenging this can be, and it’s important to maintain a strong credit profile. Typically, a score of at least 620 is required, but many lenders prefer scores of 680 or higher to offer better rates. By clarifying common misconceptions and discussing the various factors that influence credit scores, we aim to help you navigate the complexities of mortgage applications with confidence.

Key insights reveal how credit scores impact interest rates, the significance of making timely payments, and the importance of credit utilization. Additionally, understanding the role of the debt-to-income ratio in loan eligibility can empower you in this journey. Comparing conventional loans with government-backed options illustrates the variety of choices available for borrowers with different credit scores. Personalized mortgage consultations, like those offered by F5 Mortgage, can be incredibly effective in helping you improve your creditworthiness and achieve your homeownership dreams.

Ultimately, staying informed about credit score changes and taking proactive steps to enhance your financial profile can greatly influence your mortgage eligibility and terms. By focusing on improving your credit score and understanding the mortgage landscape, you can position yourself for success in securing the best financing options available. Embracing these strategies and seeking expert guidance can pave the way for a smoother path to homeownership. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage provides personalized mortgage consultations to help clients understand financial ratings, particularly the minimum credit score for conventional loans, and how these scores affect mortgage options. Their skilled brokers assist families in examining financial reports and developing strategies to improve creditworthiness.

What is the minimum credit score required for conventional loans?

To qualify for a conventional mortgage, borrowers generally need a minimum credit score of 620. However, many lenders prefer scores of 680 or above for better terms and lower interest rates.

How does credit score impact mortgage rates?

Higher credit scores typically lead to lower interest rates. For example, borrowers with scores above 740 may secure the best rates, while those below the minimum score of 620 may face higher rates or application denial.

What improvements can clients expect after consultations with F5 Mortgage?

Statistics show that approximately 70% of clients see improvements in their financial ratings after consultations. Many clients have successfully raised their scores from 580 to 640, allowing them to qualify for standard financing.

What documentation is needed to prepare for a refinancing application with F5 Mortgage?

Essential documentation includes Social Security numbers, bank statements, tax returns, and pay stubs. It is important to ensure these documents are current and submitted with the application.

How can improving your credit score affect your mortgage costs?

Improving your credit score can lower mortgage rates by nearly 0.75 percentage points, which could result in significant savings over the life of a mortgage—potentially over $55,000 in interest on a $300,000 loan.

What do clients say about the service at F5 Mortgage?

Client testimonials highlight the exceptional service at F5 Mortgage, with many praising the friendly and patient approach of the brokers. Clients have reported being secured at rates they found surprising.

What is the importance of understanding credit ratings before applying for a mortgage?

Understanding credit ratings is crucial as they significantly affect eligibility for various credit products and can influence the terms and interest rates offered by lenders. Enhancing your rating before applying can lead to better financial outcomes.