Overview

This article addresses the current rates of Home Equity Lines of Credit (HELOC) and their implications for homeowners who are considering financing upgrades. We understand how challenging navigating these financial decisions can be, especially when it comes to understanding rates influenced by economic conditions and Federal Reserve policies.

It’s crucial to grasp these rates, as they can significantly impact your financial well-being. We’re here to support you every step of the way, providing insights into strategies for securing favorable terms. For instance, improving your credit score and comparing offers from multiple lenders can make a meaningful difference in your financing options.

By taking these steps, you can empower yourself to make informed decisions that align with your family’s needs and aspirations. Remember, you are not alone in this process; many families face similar challenges, and together we can navigate these waters with confidence.

Introduction

Current fluctuations in HELOC rates present a unique opportunity for homeowners looking to enhance their living spaces or consolidate debt. We know how challenging it can be to navigate financial decisions, especially with the national average hovering around 7.84%. Understanding how these rates are shaped by economic conditions and personal financial factors can empower you to make informed choices. Yet, as rates shift and market dynamics evolve, the question remains: how can you effectively navigate this landscape to secure the best possible terms for your home equity needs? We’re here to support you every step of the way.

F5 Mortgage: Personalized Solutions for Navigating HELOC Rates

At F5 Mortgage, we understand how challenging it can be to navigate the complexities of home equity line of credit costs. That’s why we offer tailored consultations designed to help you manage these intricacies with ease. By carefully assessing your unique financial situation, our brokerage crafts customized loan options that align with your specific goals. This personalized approach not only simplifies your decision-making process but also ensures that you are well-informed about your home equity choices.

Our commitment to your satisfaction is at the heart of what we do. We have successfully assisted many families in obtaining advantageous home equity lines of credit, reinforcing the significance of customized solutions in achieving financial aspirations. Clients often share their gratitude for our exceptional service, with testimonials highlighting the smooth and stress-free experience provided by our knowledgeable loan officers, like Jeff and Alyssa.

We’re here to support you every step of the way, ensuring that you feel confident and empowered in your financial journey.

Bankrate: Average HELOC Rates and Best Practices for Borrowers

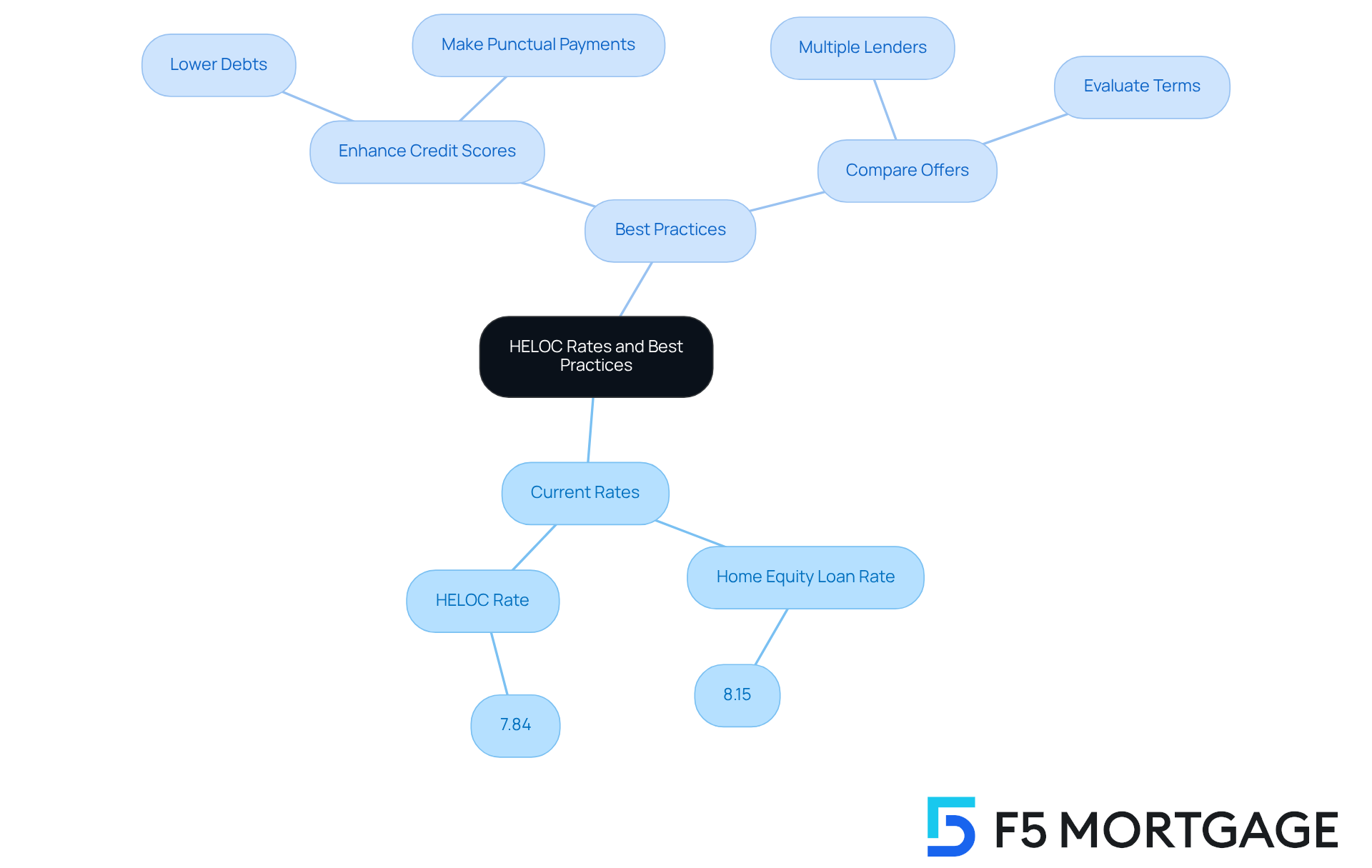

As of October 8, 2025, the HELOC current rates for the national average interest percentage stand at 7.84%. This reflects a slight increase in borrowing costs, which can be concerning. We understand how important it is for you to secure the best possible terms for your financial future. To help, consider adopting some best practices, such as:

- Enhancing your credit scores

- Diligently comparing offers from multiple lenders

Improving your credit score can significantly influence the interest options available to you. For instance, homeowners who work to lower their debts and make punctual payments often qualify for more favorable terms. This proactive approach can make a real difference in your borrowing experience.

In light of the current economic situation, it’s wise to utilize your property equity now before potential market changes affect your borrowing choices. Historical patterns show that the HELOC current rates and the costs associated with home equity lines of credit can vary based on Federal Reserve decisions. This makes it essential for you to stay informed about price changes that may impact your options.

By following these strategies, you can maximize your borrowing capacity and reduce expenses related to renovations. Remember, we’re here to support you every step of the way as you navigate this process.

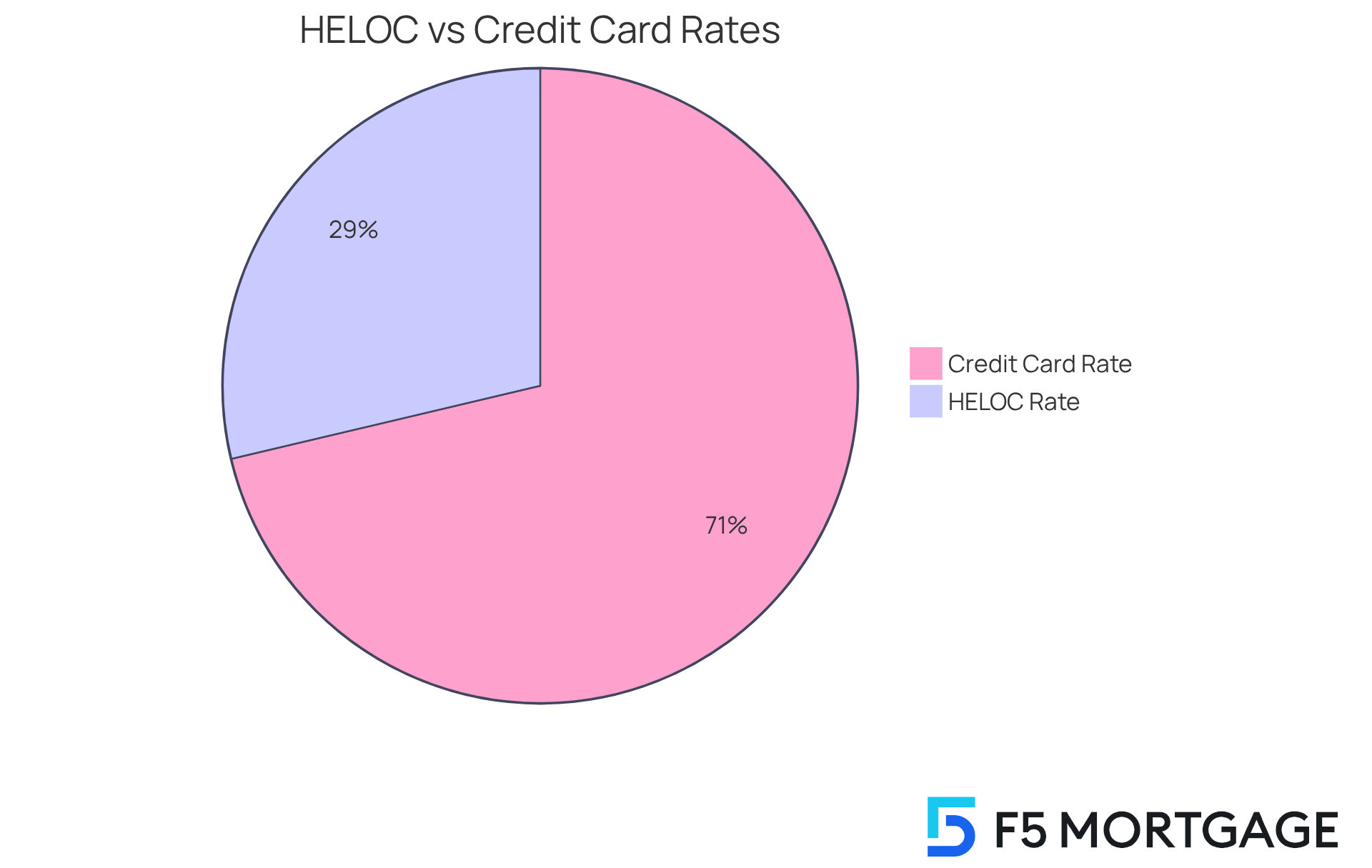

CBS News: Impact of Falling HELOC Rates on Homeowners

Recent trends indicate a decrease in HELOC current rates, providing homeowners with a valuable opportunity to secure funds at lower costs. This shift is primarily influenced by the Federal Reserve’s recent reductions, making the HELOC current rates for borrowing against property equity more appealing. Many property owners are increasingly taking advantage of these lower costs for projects like renovations and debt consolidation, leveraging the significant equity they have built in their homes. For instance, the typical home equity line of credit interest, reflecting the HELOC current rates, currently sits at 8.05 percent, which is considerably less than the average credit card interest exceeding 20 percent. This cost-effectiveness makes HELOCs a preferred choice for managing financial needs.

However, we know how challenging it can be to navigate these changes. It’s important to note that home equity borrowing costs are still significantly higher than they were just a few years ago, reflecting the evolving economic landscape. Economists emphasize that the Federal Reserve’s actions directly impact HELOC current rates, with reductions leading to more favorable borrowing conditions. As Mark Hamrick, Senior Economic Analyst, states, “The recent reductions have opened opportunities for property owners to utilize their equity more effectively, but they must stay alert to possible changes in values.”

Understanding home appraisals is crucial, as they determine property value and equity, which directly influence your borrowing capacity. As you navigate these changes, remember that while current values may be beneficial, they can fluctuate in response to upcoming Fed decisions. This dynamic environment underscores the importance of closely monitoring HELOC current rates to secure the best offers.

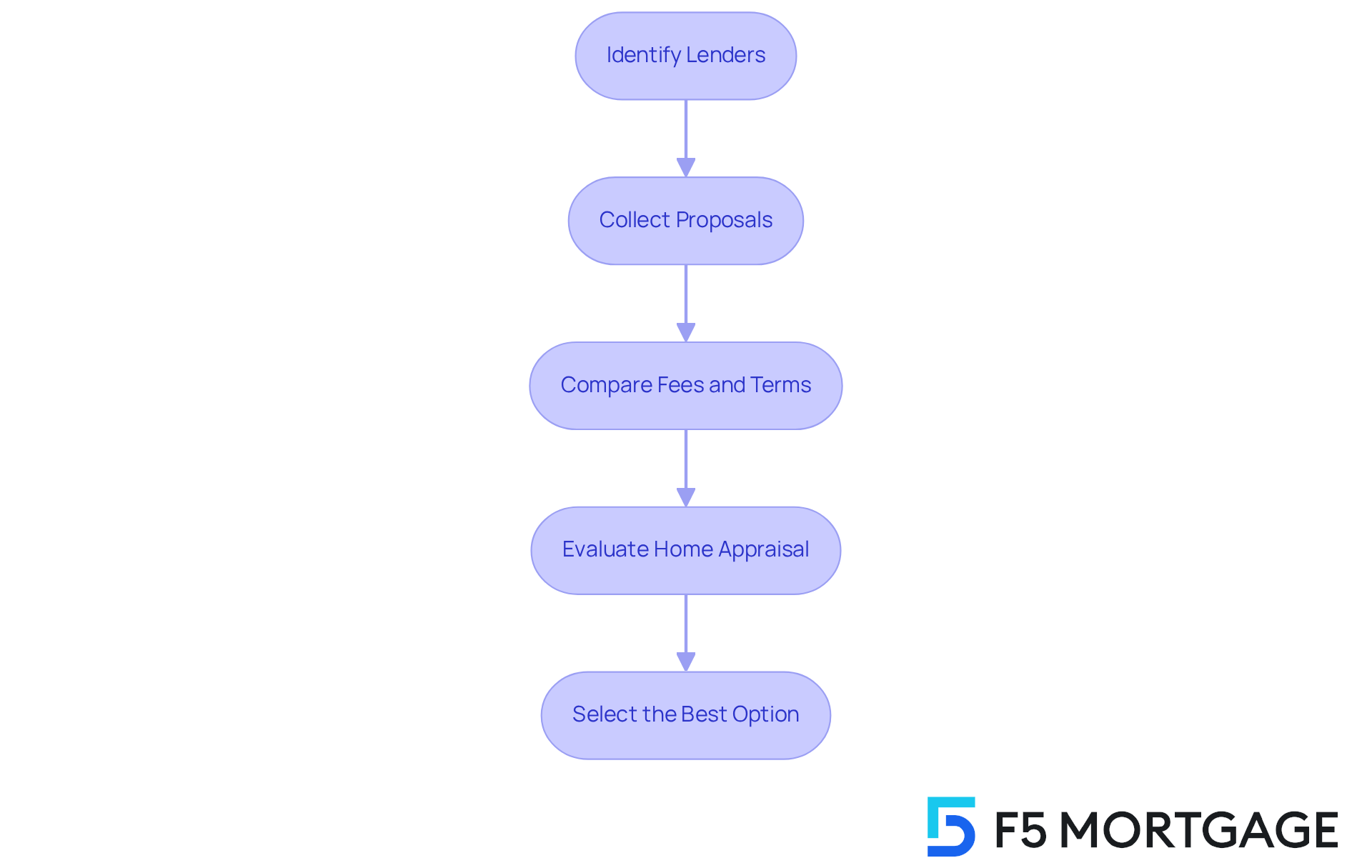

Furthermore, it’s essential to review the fine print of home equity line agreements. This helps you comprehend the conditions and avoid hidden charges. By strategically leveraging your home equity, you can not only enhance your living spaces but also consolidate higher-interest debts, ultimately improving your financial health. To prepare for seeking a home equity line of credit, consider evaluating proposals from various lenders, such as F5 Mortgage, known for its competitive rates and personalized assistance, while staying informed about market developments.

NerdWallet: Compare HELOC Rates from Top Lenders

At NerdWallet, we understand how challenging it can be for borrowers to navigate the world of home equity lines of credit (HELOCs). That’s why it’s so important to compare fees, expenses, and conditions among different lenders to find the best options for your unique financial situation. By taking the time to assess various proposals, property owners can uncover favorable prices and terms that truly fit their needs.

Imagine a homeowner who actively evaluates costs—this simple step can lead to significant savings. In fact, some families have reported saving hundreds of dollars each year just by choosing the right lender. Additionally, recognizing the role of home appraisals in determining property value and equity is vital for making informed choices.

Financial specialists consistently recommend that you invest time in evaluating different home equity line of credit proposals. This effort can lead to better borrowing conditions and lower interest charges. As one advisor wisely noted, ‘The interest-rate differential can translate into substantial savings.’ By adopting this strategic approach, you not only enhance your financial flexibility but also empower yourself to make informed decisions that align with your long-term goals.

We know how important it is to feel confident in your financial choices, and we’re here to support you every step of the way.

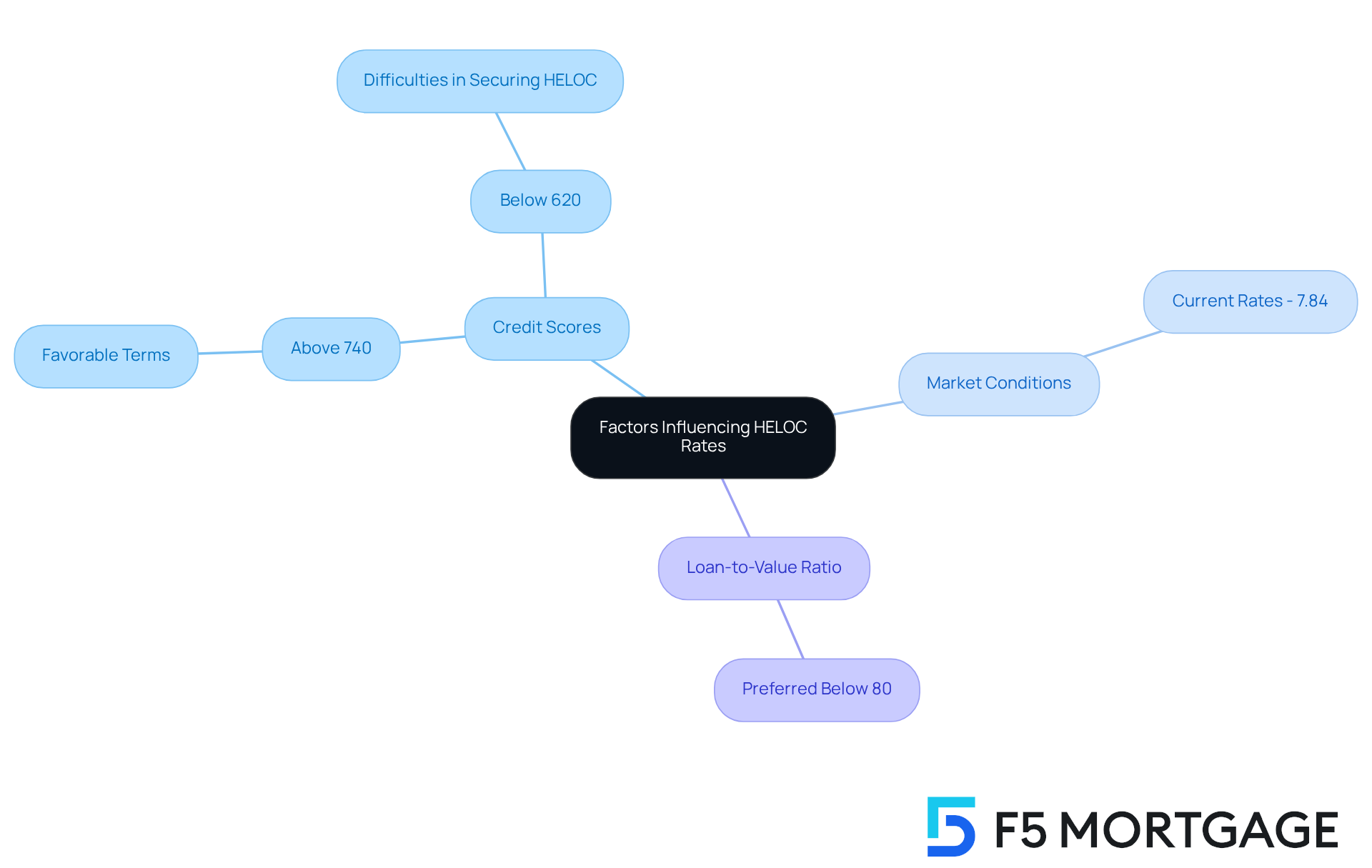

Experian: Key Factors Influencing HELOC Rates

Credit scores play a crucial role in determining HELOC pricing, significantly impacting both eligibility and the conditions presented to borrowers. We know how challenging it can be to navigate these waters, but understanding this connection is essential. Typically, individuals with elevated credit scores—usually above 740—are able to obtain lower borrowing costs, as lenders perceive them as less risky. For instance, those with outstanding credit may secure terms that are significantly more favorable than those offered to individuals with average or poor credit scores.

The relationship between credit scores and home equity line of credit terms is underscored by the fact that lenders often require a minimum credit score for approval. If your score falls below 620, you may face difficulties in securing a home equity line of credit, while those in the 700s can look forward to more advantageous conditions. Moreover, a strong credit profile enhances your bargaining power, allowing you to explore various options for the best possible terms.

Market conditions also play a role in how credit scores influence home equity line of credit terms. As of September 2025, the HELOC current rates have decreased to approximately 7.84%, indicating a broader trend of lowering borrowing costs. This presents a wonderful opportunity for property owners with strong credit histories to tap into their equity at HELOC current rates.

Additionally, the loan-to-value (LTV) ratio is another critical factor. Lenders typically prefer borrowers with LTV ratios below 80%, as this suggests a lower risk of default. Therefore, maintaining a good credit score alongside a favorable LTV can significantly enhance your chances of obtaining a home equity line of credit with appealing conditions.

In summary, if you’re a property owner looking to access your home equity through a home equity line of credit, prioritizing the enhancement of your credit score is vital. Understanding how these scores affect your borrowing choices empowers you to make informed decisions. With the right financial strategies, you can position yourself to benefit from the current favorable lending landscape. We’re here to support you every step of the way.

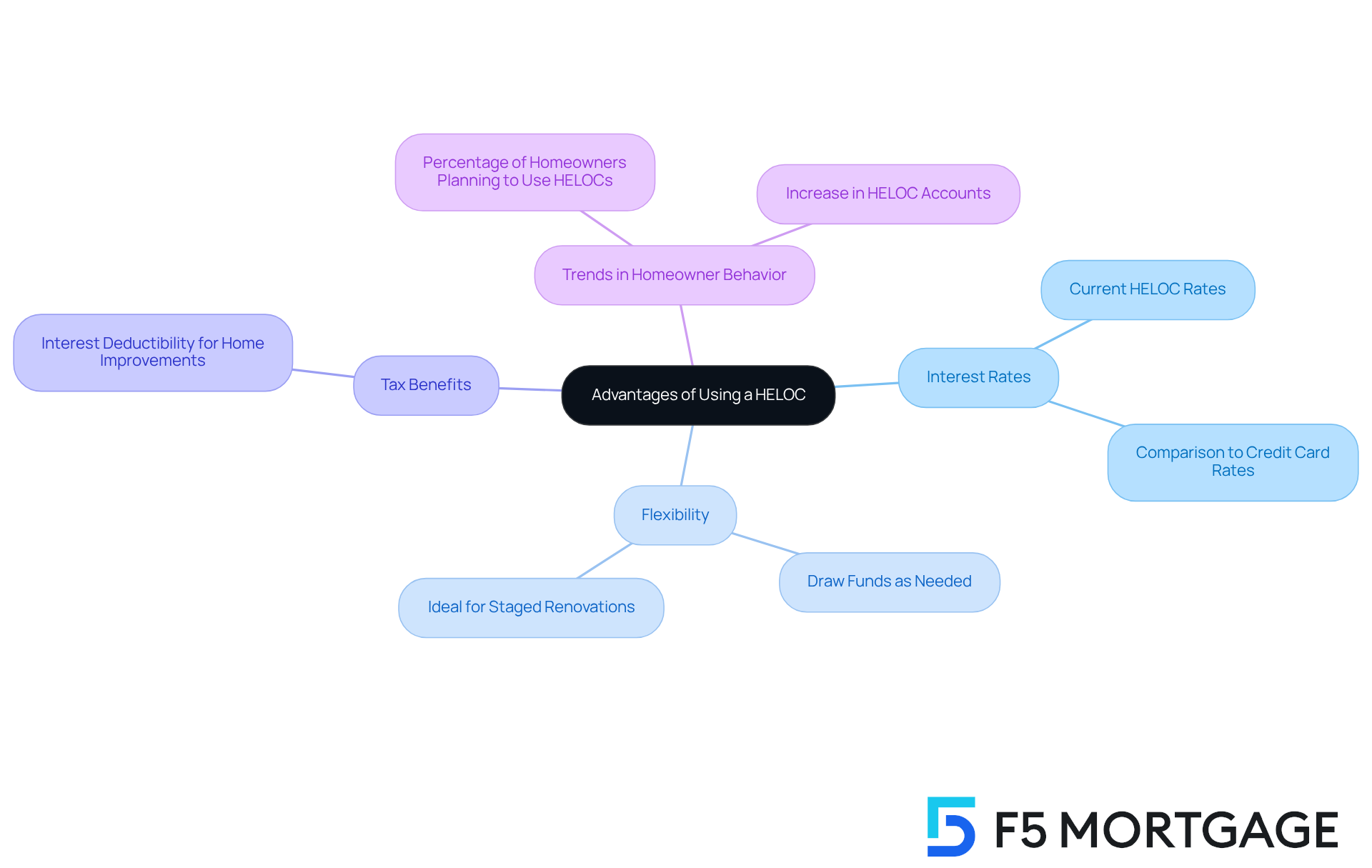

Rate.com: Advantages of Using a HELOC in Today’s Market

In today’s financial environment, we understand how overwhelming it can be to navigate your options. Using a Home Equity Line of Credit (HELOC) offers numerous benefits for homeowners like you. The average HELOC current rates are around 7.8%, which remain significantly lower than the average credit card rate of over 22%. This stark contrast makes HELOCs an appealing choice for those seeking to finance property enhancements, consolidate debt, or address other financial requirements.

Moreover, HELOCs provide a flexibility that personal loans often lack. While personal loans typically come with fixed amounts and terms, HELOCs allow you to draw funds as needed. This makes them ideal for staged renovations or unexpected expenses that life may throw your way.

Another important consideration is that the interest paid on a HELOC might be tax-deductible if utilized for significant property enhancements. This offers an extra financial motivation that can make a real difference in your budget. Homeowners are increasingly recognizing the benefits of HELOCs, with nearly 25% planning to tap into their equity in the coming year. This trend underscores the importance of borrowing with intention, as strategic use of home equity can enhance your long-term financial stability.

For those contemplating refinancing options, rate-and-term loans are a popular choice among California homeowners. These loans aim to lower your monthly mortgage payments by substituting current mortgages with new ones that provide improved conditions or varied term lengths. You can switch to a shorter term to pay off your mortgage faster or adjust between variable and fixed-rate mortgages, especially during times of falling interest rates. This flexibility can enhance the use of HELOCs, enabling you to manage your finances more effectively.

For instance, property owners who have chosen HELOCs instead of personal loans have reported considerable savings in interest payments, particularly when handling high-interest debt. By utilizing your property equity, you can access funds at a lower cost, allowing for more effective financial management. As the market evolves, understanding the nuances of HELOCs compared to other borrowing options, including rate-and-term loans, is crucial for making informed decisions. To maximize your financial benefits, we encourage you to consider consulting with a financial advisor. They can help you explore how both HELOCs and rate-and-term loans can work together in your financial strategy.

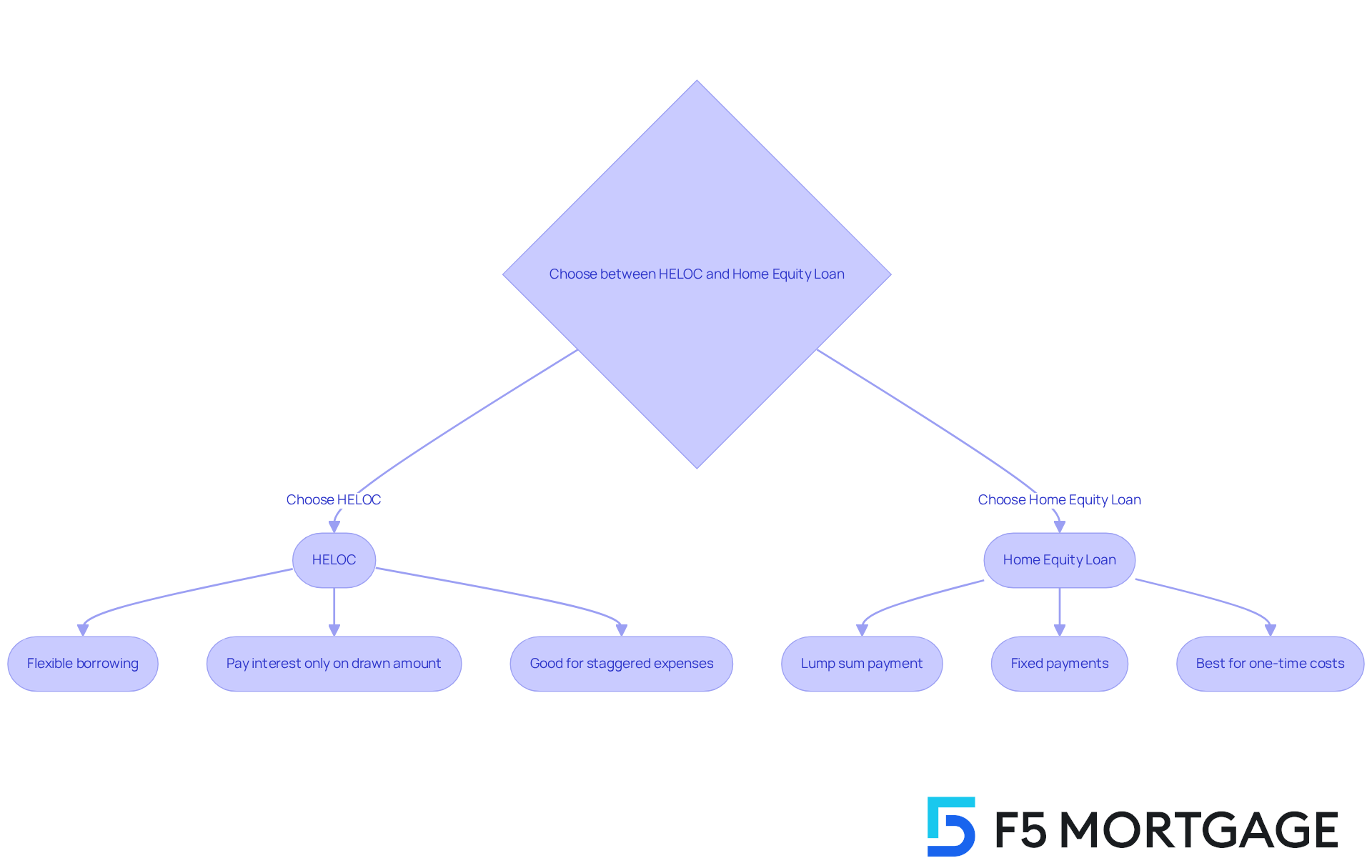

Realtor.com: HELOC vs. Home Equity Loan – Making the Right Choice

When choosing between a HELOC and an equity loan, we understand how crucial it is to align your decision with your financial needs. HELOCs offer remarkable flexibility and variable rates, making them especially beneficial for ongoing expenses. Homeowners can borrow as needed, paying interest only on the amount drawn. This feature makes HELOCs ideal for projects that require staggered funding, like home renovations or education costs. If you foresee multiple expenses over time, a HELOC might be the better option, as it provides revolving access—much like a credit card, but with more favorable terms.

On the other hand, home equity loans deliver a lump sum with fixed payments, making them perfect for one-time costs such as major home repairs or debt consolidation. With repayment terms ranging from 5 to 30 years, these loans offer stability—a quality many find appealing in today’s fluctuating interest climate. Mortgage professionals often emphasize that locking in a fixed rate can provide peace of mind, especially with uncertainties around future rate increases. Ryan Leahy from Leahy Lending points out that, in the current environment, property equity loans are frequently recommended for clients seeking predictability.

Recent trends indicate a growing preference for equity loans, driven by a significant increase in property values. Homeowners now average about $400,000 in equity, marking a 41% rise since 2020. This shift is also supported by a 10% annual increase in equity loan originations, as many borrowers opt for the security of fixed rates over the unpredictability of equity lines of credit. Notably, nearly half of applications for these loans faced rejection in late 2024, highlighting a trend toward equity loans as a more reliable choice.

Ultimately, the decision between a home equity line of credit and a real estate equity loan should reflect your personal financial situation and intended use of funds. We encourage you to evaluate your overall financial health and consider consulting with mortgage experts who can help you navigate these options effectively. With HELOC current rates for equity loans hovering around 8.25 percent, it’s vital to stay informed about your choices.

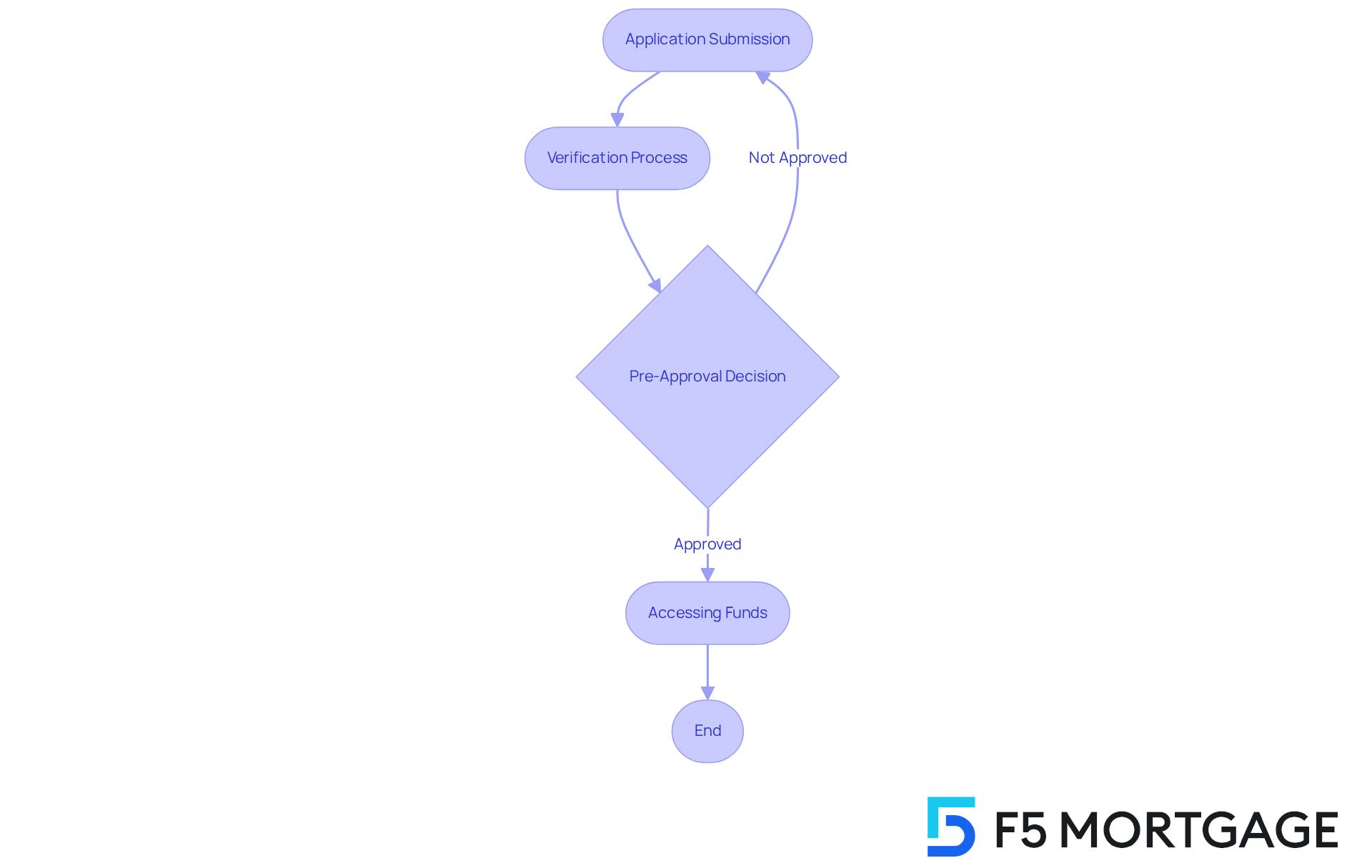

F5 Mortgage: Fast and Efficient HELOC Application Process

At F5 Mortgage, we understand how challenging it can be to navigate the home equity line of credit application process. That’s why we excel in providing a swift and effective experience, often achieving pre-approval in under an hour. This quick turnaround empowers you to access your property equity rapidly, allowing for timely financial decisions that can significantly impact your upgrade plans.

In 2025, we’ve seen a remarkable surge in demand for rapid home equity line of credit pre-approval. Many homeowners are recognizing the advantages of having immediate access to funds for renovations or debt consolidation. For instance, clients have shared their success stories of securing pre-approval within minutes, which has enabled them to act decisively in competitive housing markets.

Mortgage brokers emphasize that quick pre-approval not only streamlines the borrowing process but also enhances your confidence as a borrower. This makes it easier for you to navigate your financial commitments. At F5 Mortgage, our commitment to leveraging advanced technology and efficient processes ensures that you can capitalize on favorable market conditions without unnecessary delays. We’re here to support you every step of the way, reinforcing our reputation as a trusted partner in home financing.

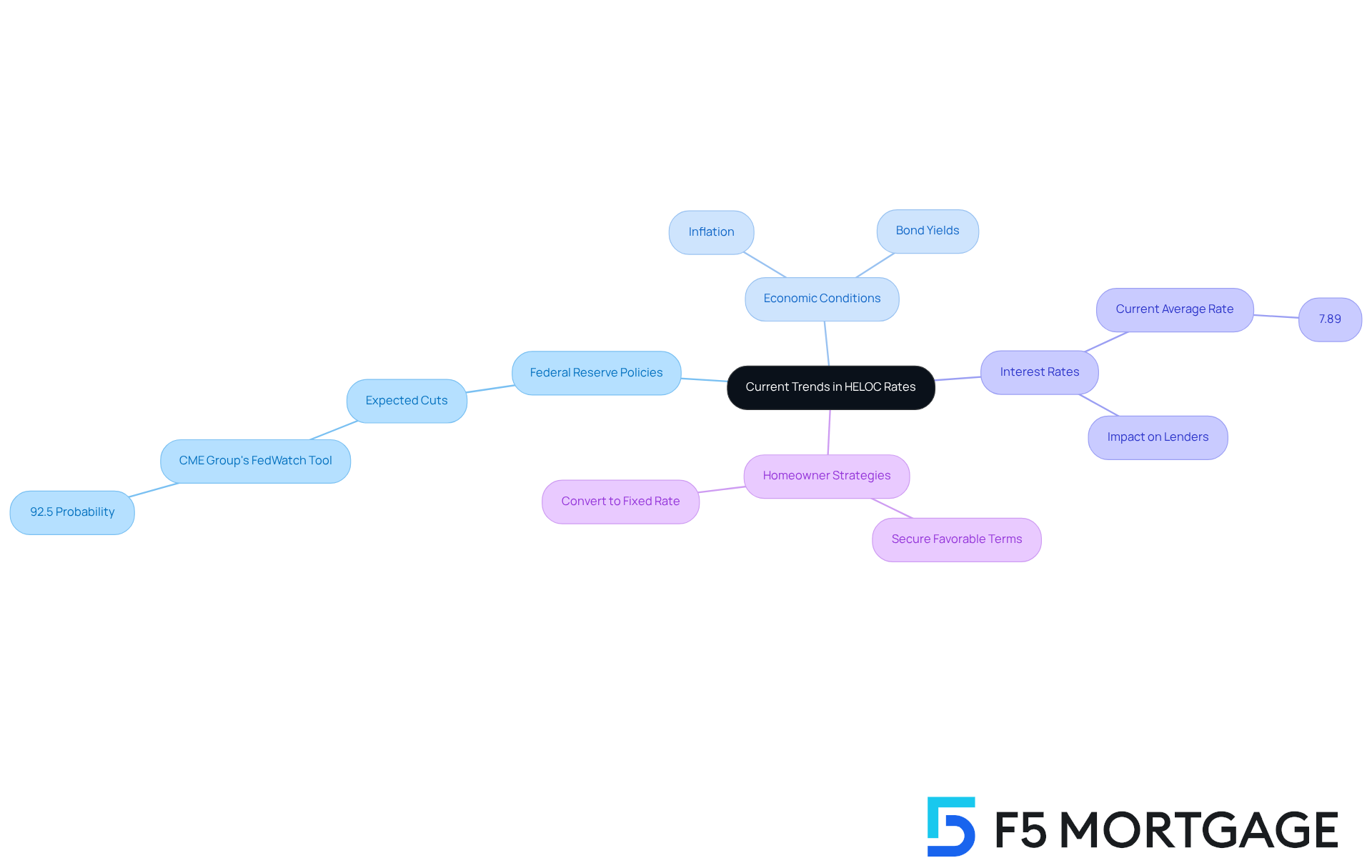

WSJ: Current Trends in HELOC Rates You Should Know

Current trends show that the HELOC current rates are significantly influenced by economic conditions and Federal Reserve policies. We understand that navigating these changes can be challenging, but it’s important to know that as the Federal Reserve adjusts its monetary policy, particularly with expected cuts, there may be opportunities for you to benefit. For instance, the CME Group’s FedWatch tool indicates a strong possibility of a federal funds cut, with a 92.5% probability. This could lead to reduced borrowing costs for homeowners like you.

Economists point out that the prime interest rate, which is typically three percentage points higher than the fed funds rate, directly affects the costs of home equity lines of credit. As the Fed signals potential cuts, lenders are likely to adapt their offerings. This might be the perfect moment for you to secure favorable terms. Recent data shows that the national average interest rate for home equity lines of credit has risen by just one basis point to 7.89%. This rate is still close to its lowest point in over a year and a half, influenced by the Fed’s recent policy adjustments.

Moreover, economic factors such as inflation and bond yields play a crucial role in determining HELOC rates. With inflation easing, as noted by industry experts, the market is responding positively. We encourage you to keep a close eye on these trends. Many property owners are currently facing what we call ‘golden handcuffs’ due to rising real estate values, which enhance their equity positions and borrowing capacity.

Considering these dynamics, if you’re contemplating a HELOC, it’s wise to prepare for potential changes in HELOC current rates following each Federal Reserve decision. Some lenders provide options to convert variable-rate HELOCs into fixed-rate ones for an additional fee, offering you more choices. By staying informed and strategically timing your applications, you can leverage favorable market conditions to secure the best possible rates for your home upgrades. Remember, we’re here to support you every step of the way.

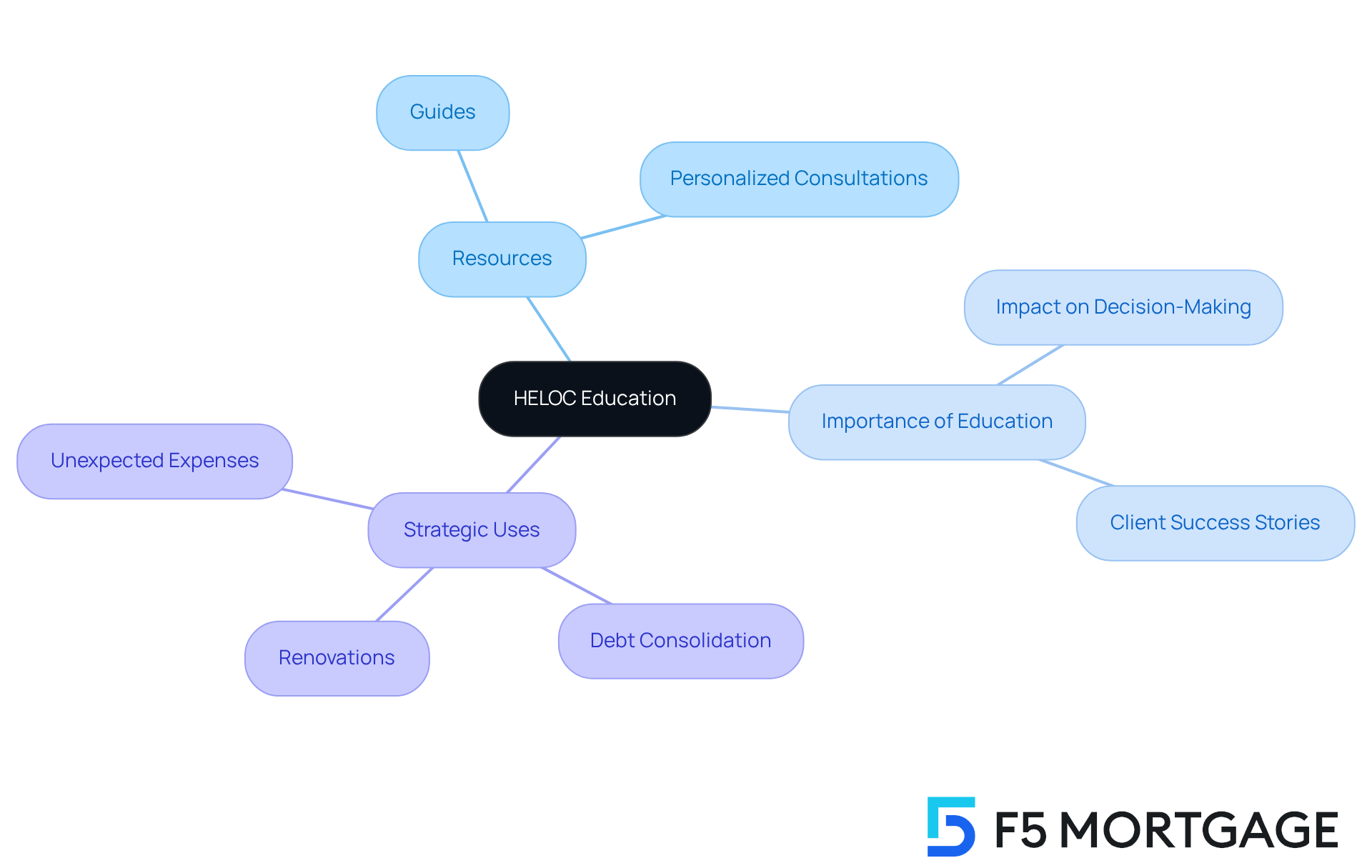

F5 Mortgage: Empowering Clients with HELOC Education and Resources

At F5 Mortgage, we are dedicated to empowering you with the essential knowledge about Home Equity Lines of Credit (HELOCs). We understand how overwhelming financial decisions can be, and that’s why we provide a wealth of resources, including detailed guides and personalized consultations, to help you navigate your options effectively. With the average mortgage-holding property owner possessing approximately $302,000 in equity, it’s crucial to understand how to leverage this asset for informed financial decisions.

Mortgage brokers emphasize the importance of client education in this area. As one specialist pointed out, many lenders allow eligible property owners to access up to 80 percent of their equity. It’s essential for you to understand the implications of such choices. Our educational resources have led to successful outcomes for many clients, with property owners utilizing HELOCs for significant projects like renovations that can enhance property value over time.

In 2025, the importance of client education on HELOC options is greater than ever. With HELOC current rates around 8% APR, we encourage you to explore how HELOCs can serve as a strategic financial tool for:

- Debt consolidation

- Renovations

- Unexpected expenses

By equipping you with the necessary knowledge and resources, we ensure you are well-prepared to make sound financial choices regarding your home equity. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the landscape of Home Equity Lines of Credit (HELOCs) in 2025 presents a wealth of opportunities for homeowners eager to leverage their property equity for upgrades and financial flexibility. We understand how challenging this can be, and knowing the current HELOC rates and their fluctuations based on economic conditions and credit scores is essential for making informed borrowing decisions. With rates hovering around 7.84%, we encourage homeowners to act strategically to secure the best terms available.

Key insights reveal the importance of:

- Enhancing credit scores

- Comparing offers from multiple lenders

- Staying informed about market trends

By adopting best practices—such as understanding the implications of home appraisals and the differences between HELOCs and home equity loans—borrowers can optimize their financial strategies. The recent decline in HELOC rates, influenced by Federal Reserve policies, emphasizes the need for homeowners to seize favorable conditions for funding renovations or consolidating debt.

In this dynamic financial environment, the ability to access funds through a HELOC can significantly impact long-term financial health. We’re here to support you every step of the way. Homeowners are urged to take charge of their financial journeys by utilizing available educational resources and consulting with experts to navigate the complexities of HELOCs. By remaining proactive and informed, individuals can enhance their living spaces, manage expenses, and ultimately achieve their financial aspirations with greater confidence.

Frequently Asked Questions

What is F5 Mortgage’s approach to home equity line of credit (HELOC) solutions?

F5 Mortgage offers personalized consultations to help clients navigate the complexities of HELOC costs. They assess individual financial situations and craft customized loan options that align with specific goals, simplifying the decision-making process.

How does F5 Mortgage ensure client satisfaction?

F5 Mortgage prioritizes client satisfaction by providing tailored solutions and exceptional service. They have successfully assisted many families in obtaining advantageous HELOCs, with clients expressing gratitude for the smooth and stress-free experience facilitated by knowledgeable loan officers.

What are the current average HELOC rates as of October 8, 2025?

The national average HELOC interest rate stands at 7.84% as of October 8, 2025, reflecting a slight increase in borrowing costs.

What best practices can borrowers adopt to secure better HELOC terms?

Borrowers can enhance their credit scores and compare offers from multiple lenders to secure better HELOC terms. Lowering debts and making timely payments can significantly influence the interest options available.

Why is it important to utilize property equity now?

It is wise to utilize property equity now before potential market changes affect borrowing choices. Historical patterns show that HELOC rates can vary based on Federal Reserve decisions, making it essential to stay informed about price changes.

How have recent trends impacted HELOC rates for homeowners?

Recent trends indicate a decrease in HELOC rates, influenced by Federal Reserve reductions. This provides homeowners with the opportunity to secure funds at lower costs for projects like renovations and debt consolidation.

What is the typical interest rate for a home equity line of credit?

The typical interest rate for a home equity line of credit currently sits at 8.05%, which is considerably lower than average credit card interest rates exceeding 20%.

What should homeowners understand about home appraisals and their impact on HELOCs?

Home appraisals determine property value and equity, directly influencing borrowing capacity. Homeowners should monitor these values closely, as they can fluctuate based on Federal Reserve decisions.

What should borrowers do before seeking a home equity line of credit?

Borrowers should evaluate proposals from various lenders, including F5 Mortgage, and stay informed about market developments to secure the best offers and understand the conditions of home equity line agreements.