Overview

This article explores a vital question for many veterans: can you successfully refinance a VA loan? We understand how overwhelming this process can feel, but there are several options available to help you navigate it. One popular choice is the Interest Rate Reduction Refinance Loan (IRRRL), which can significantly lower your monthly payments. Another option is cash-out refinancing, allowing you to access the equity in your home.

Refinancing is indeed feasible for many veterans, especially when considering the eligibility criteria and benefits. Imagine being able to secure a lower interest rate or even eliminating the need for a down payment—these advantages can truly enhance your financial situation. We know how challenging this can be, but we’re here to support you every step of the way.

If you’re considering refinancing, take a moment to evaluate your current financial standing and how these options could work for you. With the right guidance and resources, you can make informed decisions that benefit your family’s future.

Introduction

Navigating the complexities of refinancing a VA loan can feel overwhelming for many veterans. We understand how challenging this can be. However, the potential to lower monthly payments and access home equity makes it essential to grasp the ins and outs of this financial opportunity. This article explores key insights and strategies designed to empower veterans as they navigate the refinancing process.

But what specific challenges and considerations might impact your ability to secure favorable terms? We’re here to support you every step of the way.

F5 Mortgage: Personalized Guidance for VA Loan Refinancing

At F5 Mortgage, we understand how challenging it can be when you ask, can you refinance a VA loan. That’s why we excel in offering tailored consultations designed to empower our clients. By thoroughly evaluating each family’s unique economic situation, we can suggest the most suitable funding options customized to their specific needs.

This personalized approach not only streamlines the refinancing process but also addresses the question of how can you refinance a VA loan, significantly boosting client confidence in their financial decisions. One client shared their experience, stating, “Alyssa and Jorge were both very patient with me & got me secured at rates I couldn’t believe.” Such testimonials highlight our commitment to treating clients as valued individuals rather than just numbers, fostering trust and satisfaction throughout the mortgage journey.

With most agreements finalized in under three weeks, we prioritize a no-pressure approach, allowing you to choose what feels right for you. This commitment enhances your confidence in the decisions you make, ensuring you feel supported every step of the way.

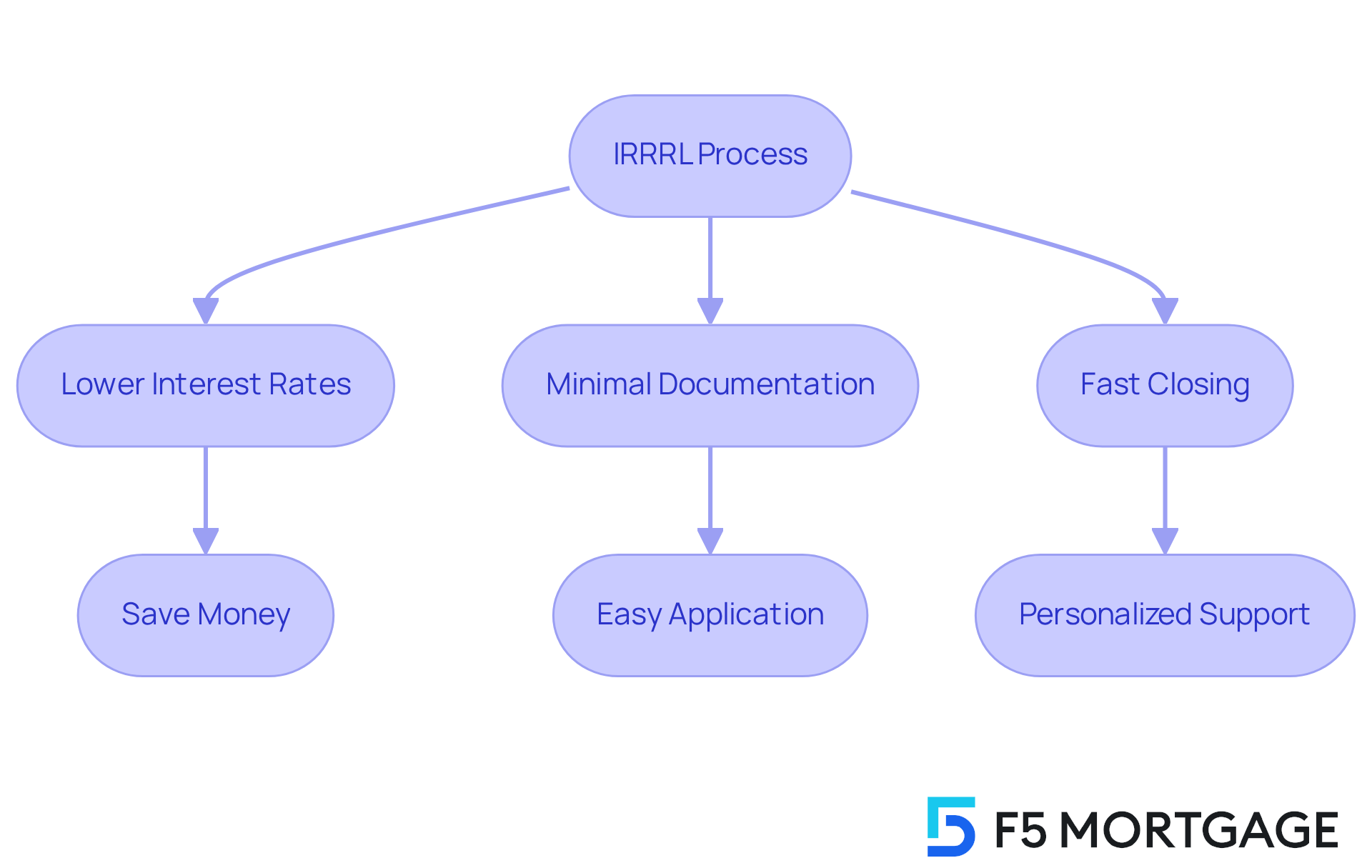

Interest Rate Reduction Refinance Loan (IRRRL): Lower Your Payments

The Interest Rate Reduction Refinance Loan (IRRRL) is designed with former service members in mind, helping you lower your interest rates. We understand how challenging this can be, and we want to make the refinancing process as smooth as possible for you, especially if you are wondering can you refinance a VA loan. This streamlined option requires minimal documentation and often doesn’t need an appraisal, allowing you to focus on what truly matters.

By utilizing the IRRRL, veterans like you can significantly reduce monthly payments and save money over the life of your mortgage. It’s a compelling choice for many homeowners looking to ease their financial burden. At F5 Mortgage, we’re here to support you every step of the way. You can receive a free quote with no hidden costs, take advantage of competitive rates, and enjoy user-friendly technology that simplifies the process; especially if you are wondering, can you refinance a VA loan?

Our goal is to guide you through every step, ensuring a positive experience that can often lead to closing in less than three weeks. Don’t hesitate to reach out to us today for your personalized quote! We’re here to help you with your refinancing journey and answer the question: can you refinance a VA loan?

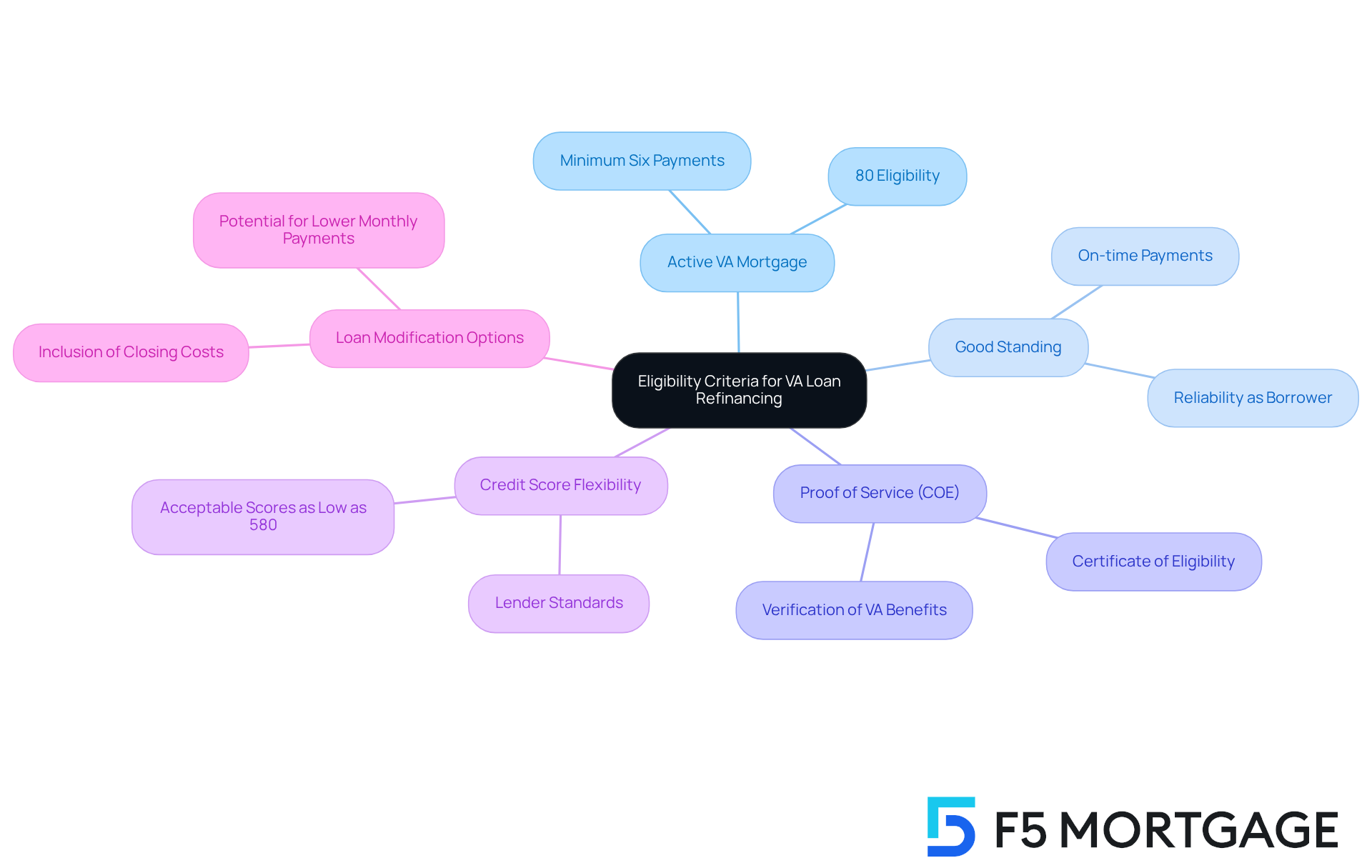

Eligibility Criteria: Who Can Refinance a VA Loan?

Refinancing a VA mortgage can feel overwhelming, but we’re here to help you understand the key eligibility criteria. First and foremost, you need to have an active VA mortgage and stay in good standing with your payment obligations. This means that completing a minimum of six consecutive payments on your current debt is essential, demonstrating your reliability as a borrower. In fact, around 80% of veterans meet the basic eligibility criteria for VA mortgage restructuring, making this a viable option for many.

Additionally, veterans must provide proof of service, typically through a Certificate of Eligibility (COE), which confirms your entitlement to VA loan benefits. While the VA doesn’t set a minimum credit score requirement, many lenders may have their own standards, often accepting scores as low as 580. This flexibility opens up financial alternatives for a broader range of former service members.

It’s important to recognize that loan restructuring can be especially beneficial for veterans looking to lower their monthly expenses or secure a more favorable interest rate. As one VA loan specialist puts it, “Maintaining good standing in mortgage payments is crucial; it not only affects eligibility but also enhances the chances of securing better loan terms.”

Looking ahead to 2025, former service members who have lived in their homes for at least one year may also qualify for loan modification, even if the property is currently an investment. This provision allows you to make the most of your home equity. Moreover, you can incorporate closing costs into the new balance, making refinancing more economical over time. Remember, the VA funding charge for Interest Rate Reduction Refinance Loans (IRRRLs) is just 0.5% of the amount, an important detail that can influence your decision to refinance.

In summary, understanding these criteria and maintaining a solid payment record can significantly enhance your ability to answer the question, can you refinance a VA loan effectively. This can lead to the many benefits of homeownership. For Colorado residents, F5 Mortgage offers tailored loan modification options that can assist veterans in navigating these processes with confidence.

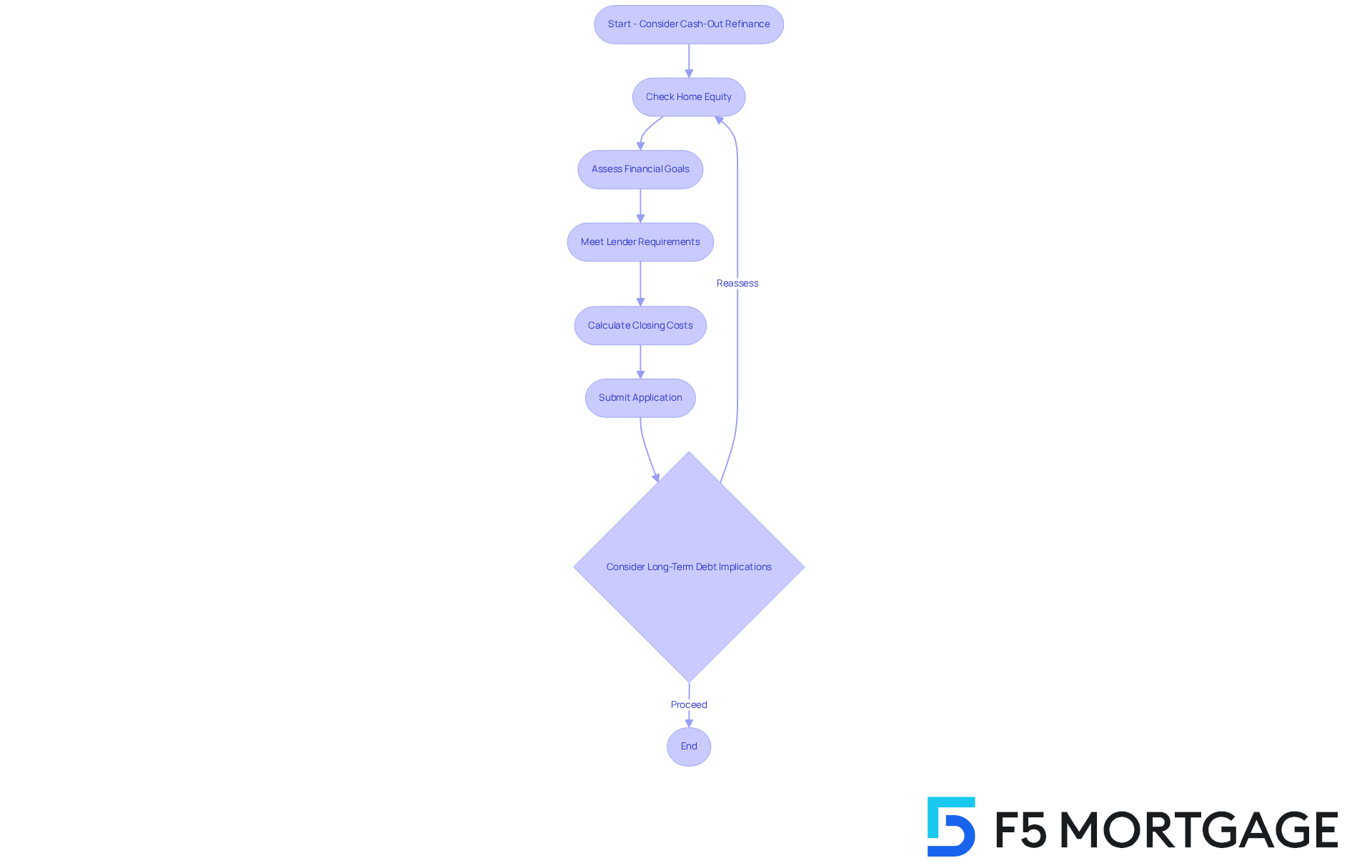

Cash-Out Refinance: Access Your Home Equity

A cash-out refinance offers homeowners a way to tap into the equity they’ve built in their properties, serving as a valuable resource for a variety of needs, such as home improvements, debt consolidation, or unexpected expenses. By securing a loan that exceeds the current mortgage balance, borrowers can receive the difference in cash—potentially a significant amount, depending on their available equity. For example, many homeowners can access tens or even hundreds of thousands of dollars based on their home equity and existing mortgage balance.

However, it’s important to consider the long-term implications of increasing your mortgage balance. While cash-out refinancing can alleviate short-term financial pressures, it may also extend the repayment period and increase your overall debt. As one expert wisely noted, “If you utilize your cash-out refinance to undertake home enhancements, you could qualify for specific tax benefits,” highlighting the potential perks of thoughtful financial planning.

In recent years, cash-out refinancing has gained traction, with homeowners tapping into an average of $55,000 in equity as property values have risen. This trend reflects a broader shift in which homeowners are leveraging their growing equity to achieve their financial goals. For instance, a homeowner who refinanced to access $50,000 in cash used those funds for necessary renovations, ultimately boosting their home’s value and enhancing their living space.

To qualify for a cash-out refinance, homeowners typically need to maintain at least 20% equity in their home and meet specific lender requirements, including a minimum credit score of 620. Additionally, closing costs for cash-out refinancing usually range from 2% to 6% of the total loan amount. This process not only provides immediate cash flow but also aligns with long-term financial strategies, making it an appealing option for many homeowners looking to improve their economic situation.

Moreover, understanding and calculating your break-even point for mortgage restructuring is essential, as it helps you assess the financial viability of this option. F5 Mortgage offers a comprehensive step-by-step guide to navigate the loan modification process, ensuring that homeowners can make informed decisions tailored to their needs. We know how challenging this can be, and we’re here to support you every step of the way.

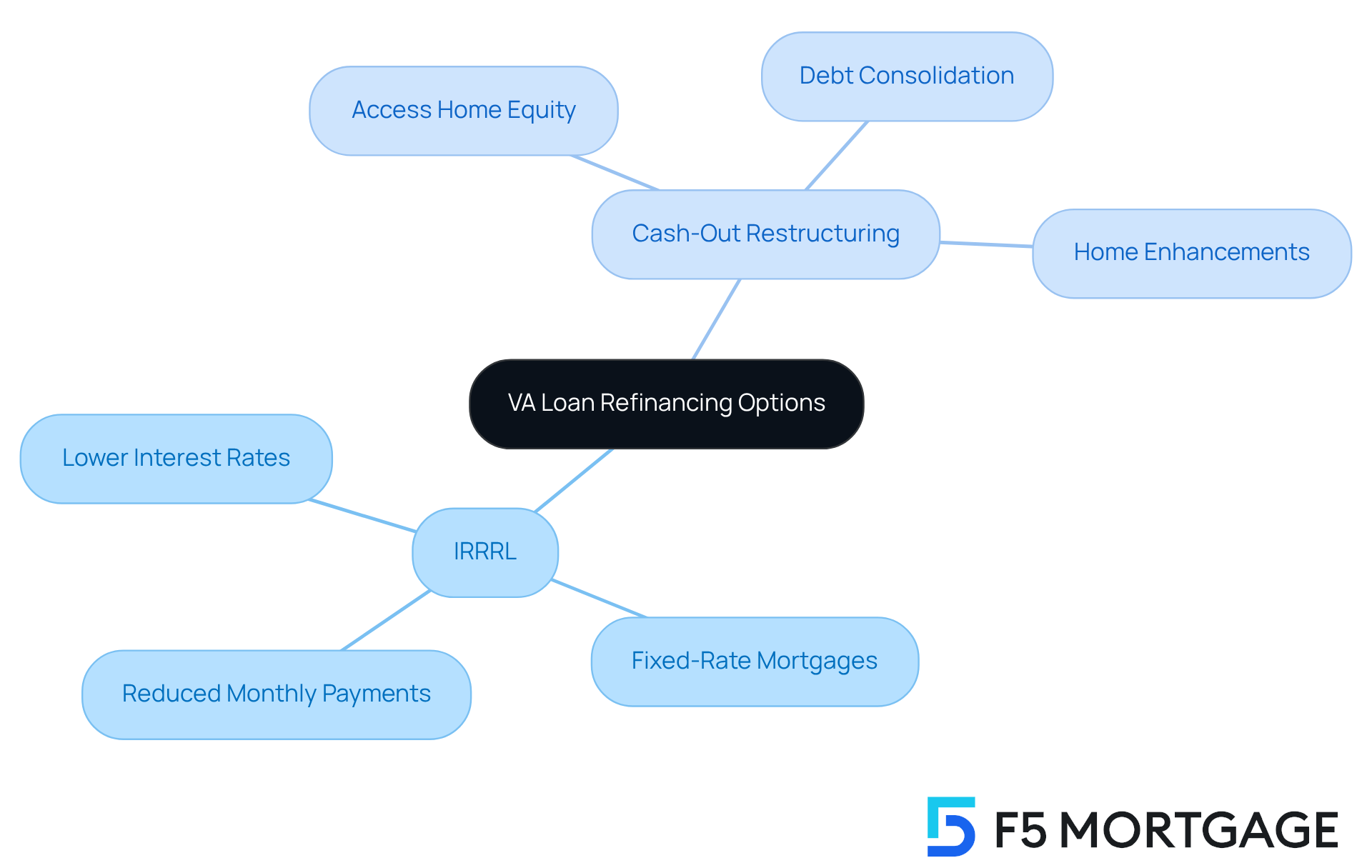

Types of VA Loan Refinancing: Explore Your Options

Navigating the world of VA loan restructuring can feel overwhelming, but understanding how you can refinance a VA loan with two main alternatives, the Interest Rate Reduction Refinance Loan (IRRRL) and cash-out restructuring, can help you. The IRRRL is a wonderful option for those looking to lower their interest rates or switch from an adjustable-rate mortgage to a fixed-rate mortgage. This choice is particularly beneficial for anyone focused on reducing monthly payments and easing financial stress.

On the other hand, cash-out loan modifications allow homeowners to tap into their home equity. This can be a valuable resource for various needs, such as debt consolidation or home enhancements. We know how important it is to access funds when you need them, and cash-out refinancing offers that flexibility.

Current trends indicate that with decreasing interest rates in 2025, many former service members are asking, ‘Can you refinance a VA loan?’ to maximize their savings. Mortgage experts emphasize that the IRRRL shines when rates drop significantly, making it easier to understand how you can refinance a VA loan while typically involving lower costs. For example, a veteran aiming to reduce a $2,800 monthly mortgage payment to $2,400 would find the IRRRL to be a beneficial choice.

Conversely, if you’re in need of funds for specific financial strategies, cash-out loan restructuring might be the right path for you. Imagine a borrower looking to eliminate $40,000 in credit card debt while also funding a bathroom remodel. The flexibility of a cash-out refinance can make this possible, allowing access to up to 100% of the home’s assessed value. This option can be a powerful financial tool when used wisely.

Ultimately, the decision on which option you choose, whether it be IRRRL or cash-out loan restructuring, depends on whether you can refinance a VA loan to meet your personal economic goals. We encourage veterans to reflect on their current mortgage situation, consider the purpose of refinancing, and consult with a qualified mortgage professional. Together, you can determine the best option to meet your needs and move towards a more secure financial future.

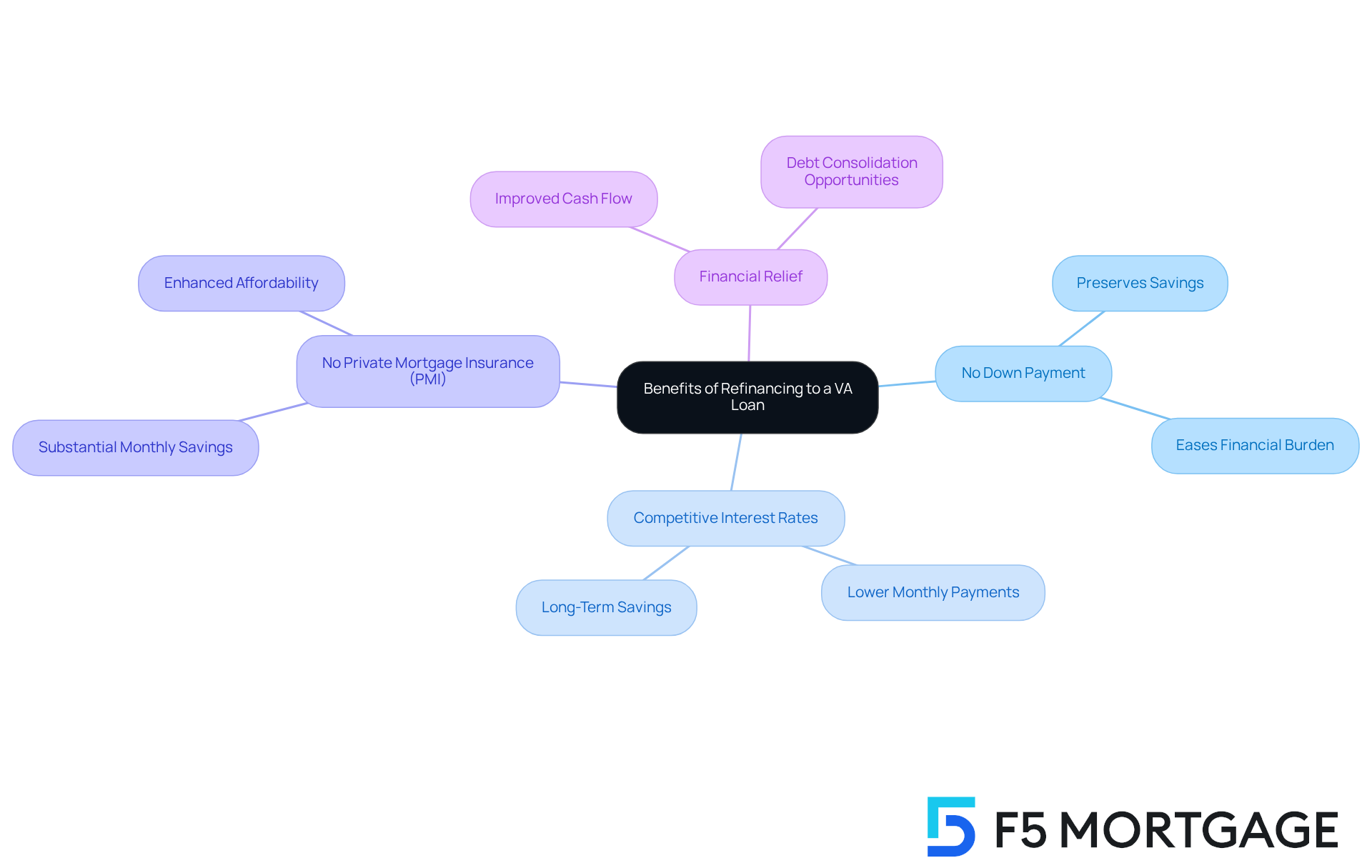

Benefits of Refinancing to a VA Loan: Why It Matters

Many qualified military personnel and service members wonder, can you refinance a VA loan, which offers numerous advantages that can greatly improve their financial health. One of the most compelling benefits is the absence of a down payment. This feature allows veterans to preserve their savings for other essential expenses, easing some of the financial burdens they may face.

Additionally, VA financing provides competitive interest rates, often lower than traditional options, making monthly payments more feasible for families. In Colorado, VA financing options stand out as they eliminate the need for private mortgage insurance (PMI), a cost typically associated with conventional mortgages. This financial relief can be pivotal, especially for those managing tight budgets. In fact, many veterans experience substantial savings when transitioning to a VA mortgage, with some reporting hundreds of dollars saved each month.

It’s also important to consider other refinancing alternatives available in Colorado, such as conventional and FHA financing, and to ask, can you refinance a VA loan, which may offer advantageous terms as well. For instance, FHA mortgages cater to homeowners with lower credit scores, while conventional options can present competitive rates for those with good credit. Moreover, the streamlined refinance option allows current FHA borrowers to quickly and easily reduce their interest rates.

Real-world examples highlight these benefits beautifully. Veterans who have switched to VA financing often share stories of enhanced cash flow, enabling them to allocate resources toward other priorities like home improvements or debt consolidation. Insights from mortgage industry specialists further affirm that the combination of no down payment and competitive interest rates positions VA products as a premier choice for those who ask, can you refinance a VA loan in 2025. By leveraging these advantages, veterans can not only enhance their financial stability but also unlock opportunities for a more secure future. We know how challenging this can be, and we’re here to support you every step of the way.

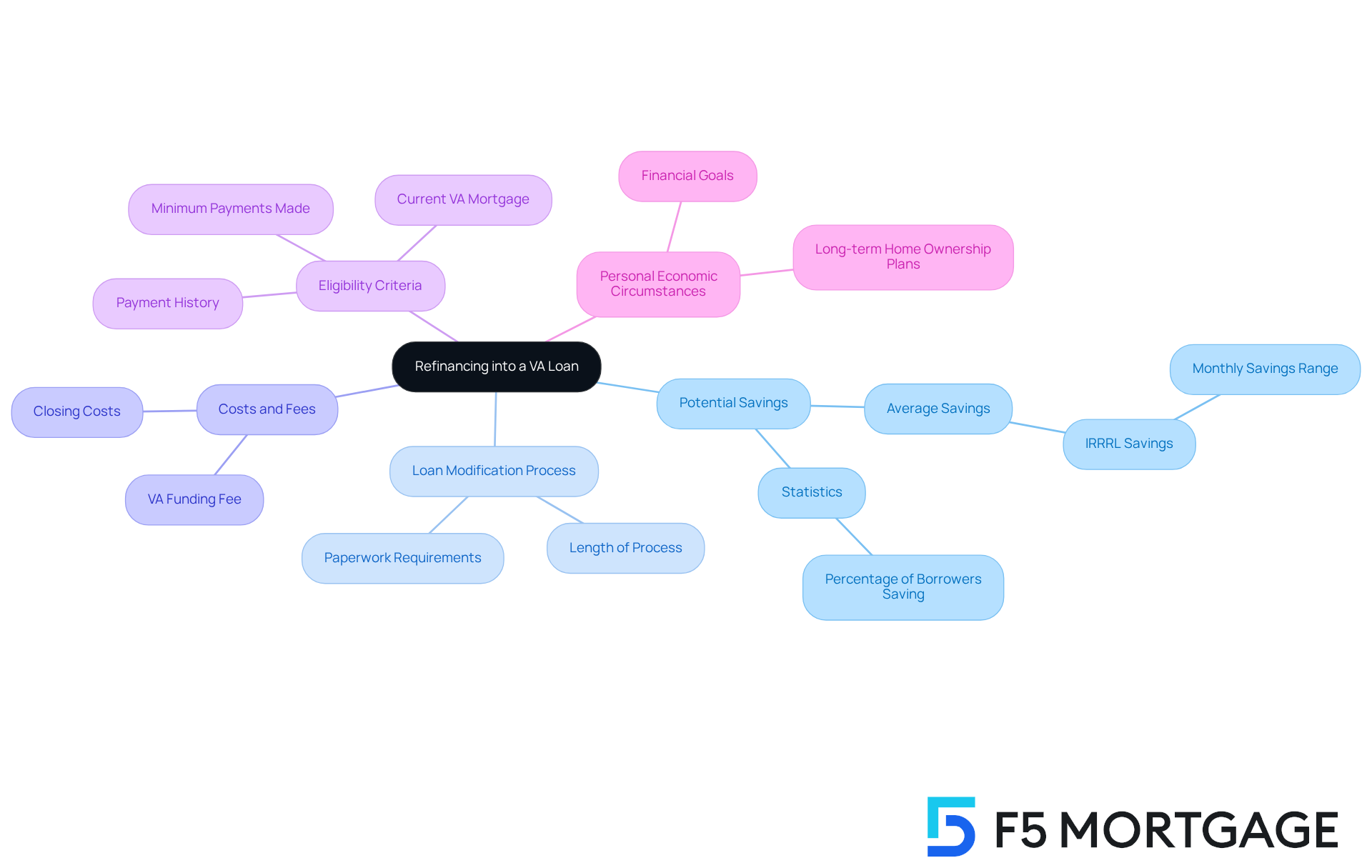

Common Questions: Should You Refinance into a VA Loan?

Many potential borrowers find themselves grappling with the decision of whether converting to a VA loan is the right choice. We understand how challenging this can be, and key questions often arise, such as the potential for savings, the length of the loan modification process, and the related fees. Grasping these elements is vital for coordinating loan adjustments with your financial objectives.

In 2025, many former service members are asking, can you refinance a VA loan to lead to considerable savings? Statistics reveal that a substantial percentage of borrowers experience reduced monthly payments. For instance, veterans utilizing the VA Interest Rate Reduction Refinance Loan (IRRRL) save an average of $150 to $300 each month. This streamlined option requires minimal paperwork and typically does not necessitate an appraisal, making it an appealing choice for many.

Mortgage advisors emphasize the importance of assessing personal economic circumstances before moving forward. One consultant shared, “The key takeaway is that while costs can be significant, the VA program provides unique and powerful ways to manage them, putting you in control of your financial journey.” This perspective highlights the necessity for tailored consultations to navigate the intricacies of loan restructuring.

There are numerous examples of borrowers who have successfully evaluated their loan alternatives. For instance, one individual was able to reduce their monthly payments by $300 through an IRRRL, showcasing the tangible benefits of informed decision-making. Furthermore, understanding eligibility criteria—such as having a current VA mortgage and making a minimum of six consecutive payments—enables veterans to assess their readiness for loan modification.

It is also crucial to consider how long you plan to own your home before adjusting your mortgage, as this can significantly impact your overall economic strategy. Generally, it is recommended to own a home for at least five years to ensure it pays off. Moreover, exploring alternative refinancing options available in Colorado, such as traditional mortgages and FHA programs, can provide additional avenues to achieve your financial goals.

Ultimately, the choice to refinance into a VA mortgage should consider whether you can refinance a VA loan based on a comprehensive evaluation of potential savings, expenses, and long-term economic implications. We’re here to support you every step of the way, and interacting with a knowledgeable mortgage specialist at F5 Mortgage can offer clarity, ensuring that veterans make informed decisions aligned with their monetary aspirations.

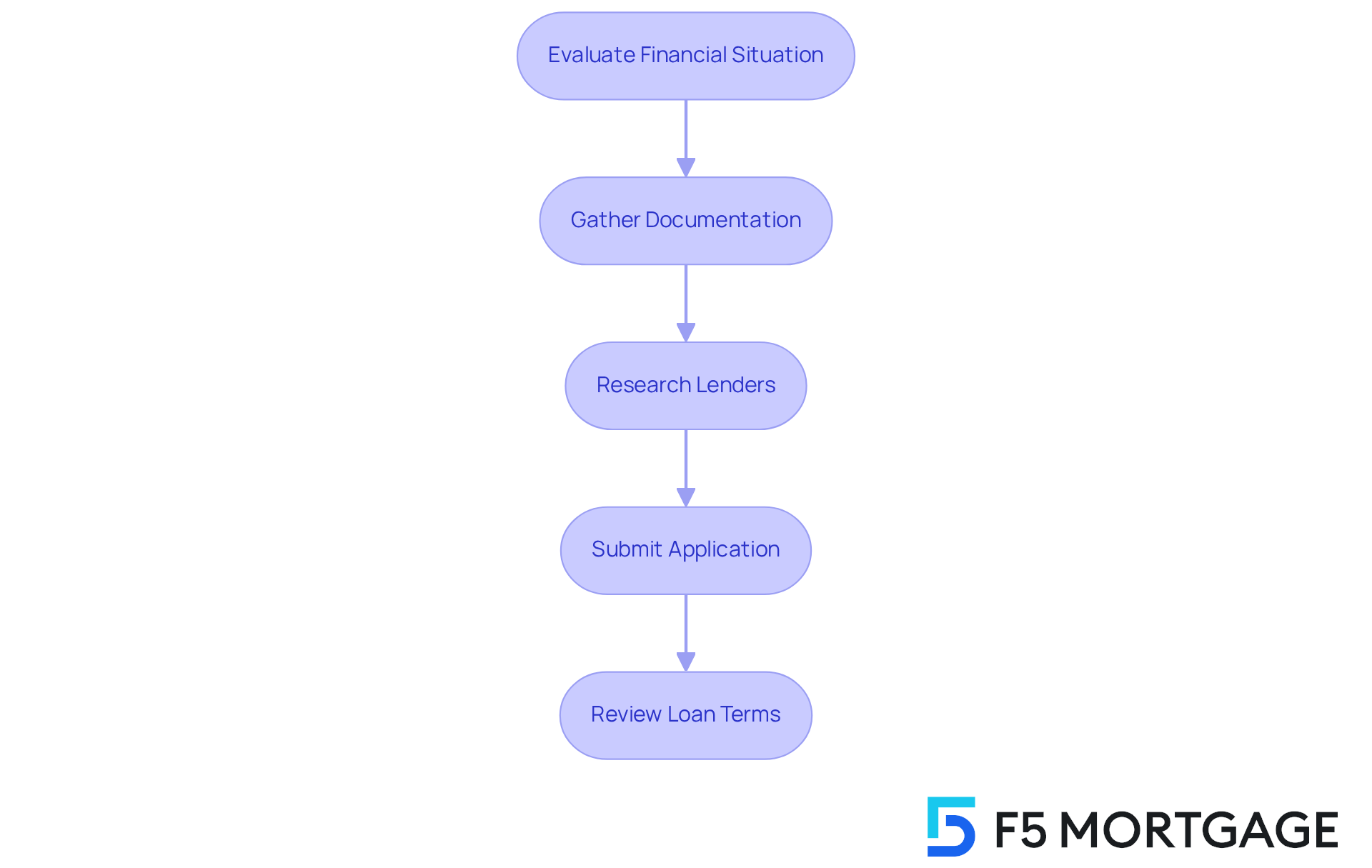

Steps to Refinance into a VA Loan: A Practical Guide

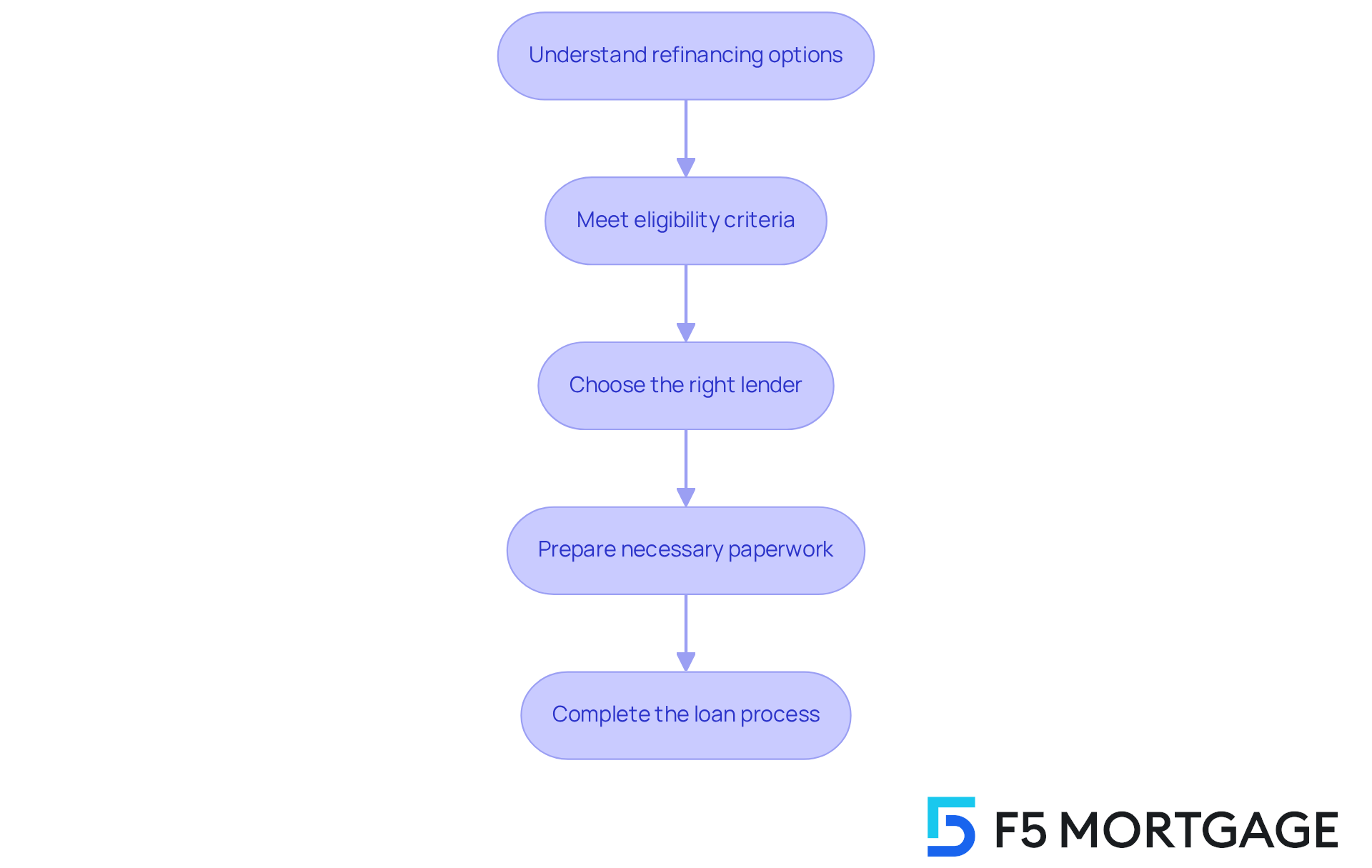

While it may feel overwhelming, we are here to support you every step of the way when asking, can you refinance a VA loan? Here are some steps to help you navigate this process with confidence:

-

Evaluate your current financial situation and determine your goals. Understanding where you stand is the first step toward achieving your dreams.

-

Gather necessary documentation, including proof of income and your Certificate of Eligibility (COE). This step typically takes about one to two weeks, depending on how prepared you are. Being organized can make a big difference.

-

Research various lenders to compare rates and terms, ensuring you find the best fit for your needs. It’s crucial to look closely at qualification requirements, as this can significantly impact your refinancing experience.

-

Submit your application and provide all necessary documentation to expedite approval. This includes information about your property and financial documents, which will be essential during the appraisal process where the lender assesses your property’s current value.

-

Once approved, carefully review the loan terms before proceeding to close the loan. Mortgage brokers emphasize that thorough documentation is crucial, as it can significantly reduce processing time and enhance the likelihood of a successful refinance, particularly when asking, can you refinance a va loan?

Moreover, obtaining a VA IRRRL provides advantages like no down payment or mortgage insurance, and the procedure can conclude in as little as 3-4 weeks. By following these steps, you can simplify the VA loan process and move closer to your financial goals.

It’s also important to consider other financing types available in Colorado, such as conventional mortgages, FHA programs, and streamlined refinance options. This way, you can ensure you’re making the most informed decision possible.

Finding the Right Lender: Key Considerations for VA Refinancing

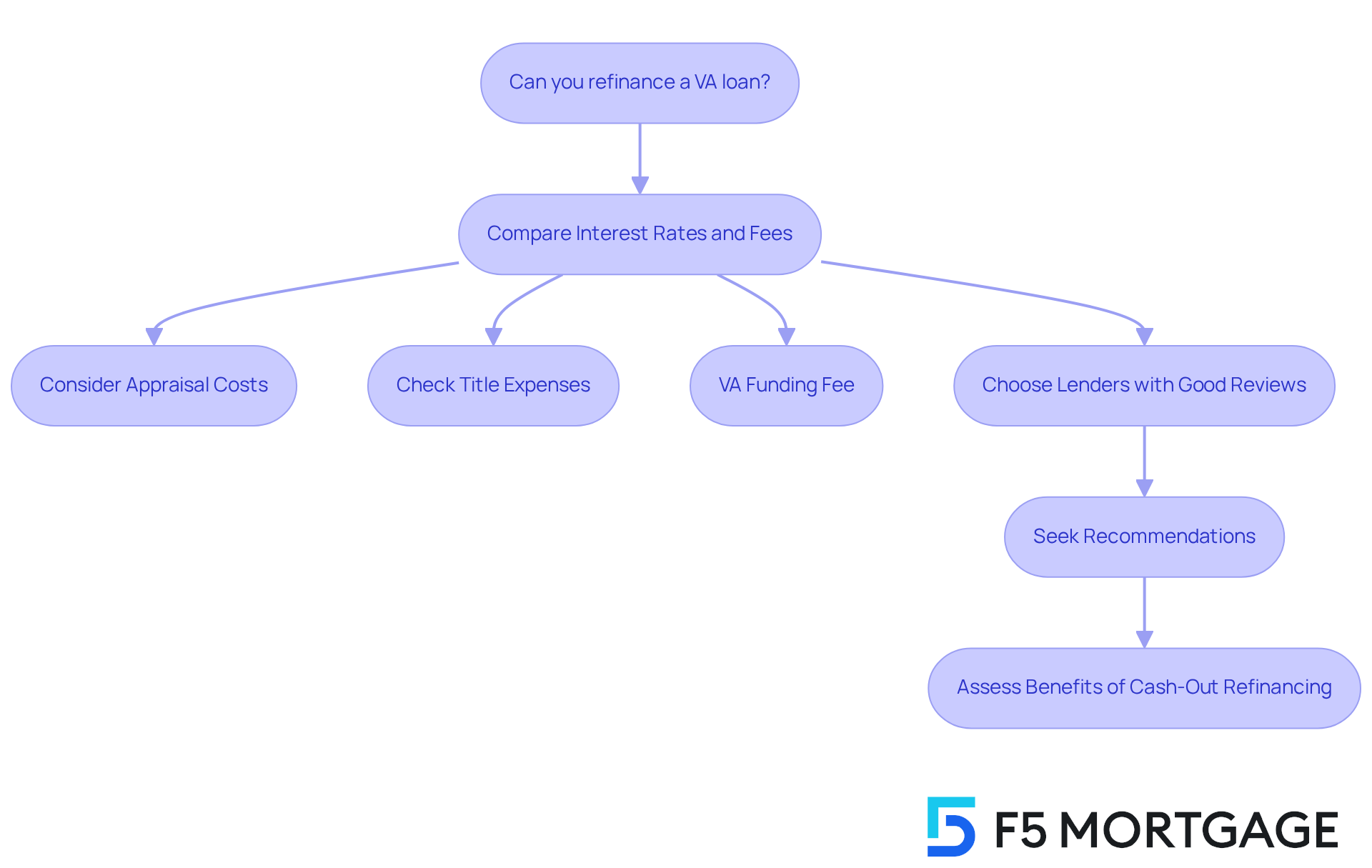

Choosing the right lender when you ask, can you refinance a VA loan for mortgage restructuring can feel overwhelming. We understand how challenging this process can be, and we’re here to support you every step of the way. Start by comparing interest rates and associated fees, as these can significantly impact your overall costs. Currently, average charges related to VA mortgage restructuring typically include:

- Appraisal costs

- Title expenses

- The VA funding fee, which is 2.15% for first-time usage and can be incorporated into the financing.

It’s crucial to select a lender who understands how you can refinance a VA loan effectively. They will be familiar with the unique requirements and benefits of VA financing, providing you with the tailored assistance you deserve during the loan modification process. This personalized support can make a significant difference. Focus on lenders recognized for their outstanding customer service. Reading reviews and seeking recommendations from fellow veterans can further guide your decision-making process.

Additionally, consider the potential advantages of restructuring your mortgage, especially if you are wondering, can you refinance a VA loan? For instance, accessing cash through a VA Cash-Out Refinance can offer you financial flexibility, helping you manage your expenses more effectively. By taking these steps, you can make informed decisions that align with your needs.

Key Takeaways: Successfully Refinancing Your VA Loan

Successfully restructuring a VA mortgage raises the question, can you refinance a VA loan? We know how challenging this can be. It requires understanding your options, meeting eligibility criteria, and selecting the right lender. At F5 Mortgage, we’re here to support you every step of the way. Our clients consistently share their appreciation for the exceptional service and personalized guidance they receive throughout the refinancing process.

Take Ruth Vest, for example. She observed how our team managed her financial needs exceptionally well. We ensured all paperwork was in order and provided a funding package that met her expectations. This is just one of many stories that highlight the advantages of VA financing.

Understanding mortgage approval is crucial. It signifies a lender’s evaluation of your eligibility for credit. Our satisfied clients often experience smooth transactions and outstanding customer satisfaction. Jeff, one of our dedicated loan officers, is frequently commended for making the process easy and worry-free. He walks clients through each step, ensuring they fully understand their options.

With these insights, we empower borrowers to confidently navigate their refinancing journey and ask, can you refinance a VA loan? You can rely on the expert guidance from F5 Mortgage to help you secure the best possible outcomes.

Conclusion

Successfully refinancing a VA loan can feel overwhelming, but understanding the available options and confidently navigating the processes is key. We know how challenging this can be, and that’s why personalized guidance is essential. Experts like F5 Mortgage are here to support veterans and service members in making informed financial decisions.

Consider the benefits of the Interest Rate Reduction Refinance Loan (IRRRL), which can significantly lower your monthly payments. Additionally, cash-out refinancing offers flexibility for accessing home equity, providing you with financial options. Remember, many veterans meet the essential eligibility criteria, making these opportunities even more accessible. Choosing the right lender is crucial; it can make all the difference in ensuring a smooth refinancing experience.

Ultimately, the journey to refinancing a VA loan can lead to significant financial advantages, such as lower interest rates and improved cash flow. We encourage you to reflect on your unique financial situation and explore your options. Consulting with mortgage professionals can empower you to make the best choices for your future. Embracing these strategies not only enhances your financial stability but also opens doors to a more secure and prosperous life.

Frequently Asked Questions

Can I refinance a VA loan?

Yes, you can refinance a VA loan. F5 Mortgage offers personalized consultations to help evaluate your unique economic situation and suggest suitable funding options tailored to your needs.

What is the Interest Rate Reduction Refinance Loan (IRRRL)?

The IRRRL is a refinancing option designed for former service members that helps lower interest rates with minimal documentation requirements, often without needing an appraisal.

How can the IRRRL benefit me?

Utilizing the IRRRL can significantly reduce your monthly payments and save you money over the life of your mortgage, easing your financial burden.

What are the eligibility criteria for refinancing a VA loan?

To refinance a VA loan, you need an active VA mortgage in good standing with at least six consecutive payments completed. You must also provide proof of service, typically a Certificate of Eligibility (COE).

Is there a minimum credit score requirement to refinance a VA loan?

The VA does not set a minimum credit score requirement, but many lenders may accept scores as low as 580, providing flexibility for a broader range of veterans.

How long does the refinancing process typically take?

Most agreements for refinancing can be finalized in under three weeks when working with F5 Mortgage.

What costs are associated with refinancing a VA loan?

The VA funding charge for Interest Rate Reduction Refinance Loans (IRRRLs) is 0.5% of the loan amount, which can influence your decision to refinance.

Can I incorporate closing costs into the new loan balance?

Yes, you can incorporate closing costs into the new balance when refinancing, making it more economical over time.

What support does F5 Mortgage provide during the refinancing process?

F5 Mortgage offers tailored guidance, free quotes with no hidden costs, competitive rates, and user-friendly technology to simplify the refinancing process.