Overview

Navigating the world of mortgages can be challenging, especially when considering a balloon payment mortgage. This article aims to shed light on this financing option, focusing on the benefits and risks involved. We understand how important it is for borrowers to feel informed and supported in their decisions.

Balloon mortgages can offer enticing advantages, such as lower initial costs and flexibility for those planning short-term ownership. However, it’s crucial to recognize the potential pitfalls. The substantial final payment can be daunting, and without proactive financial planning, borrowers may face the risk of foreclosure.

We want to empower you with knowledge. Engaging in thoughtful financial planning is essential to navigate the complexities of a balloon payment mortgage. By understanding both sides of this option, you can make informed decisions that align with your financial goals. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Introduction

Navigating the complexities of balloon payment mortgages can feel overwhelming for many borrowers. We understand how challenging this can be. These unique financing options involve a substantial lump-sum payment at the end of the loan term, presenting both opportunities and challenges that can significantly impact your financial planning.

As you weigh the benefits of lower initial costs against the risks of potential foreclosure, it’s essential to grasp the nuances of balloon payments. What strategies can you employ to ensure you’re prepared for that large final installment? We’re here to support you every step of the way, helping you leverage personalized mortgage solutions to mitigate risks.

By understanding these aspects, you can take proactive steps to navigate this financial journey with confidence.

F5 Mortgage: Personalized Solutions for Balloon Payment Mortgages

At F5 Mortgage, we understand how challenging the mortgage process can be, particularly for borrowers taking a balloon payment mortgage most likely when they are considering large final installment options. That’s why we focus on offering customized loan solutions tailored to your unique needs. Our dedicated loan specialists, who possess significant experience and a genuine passion for helping clients, ensure you receive the red carpet treatment every step of the way.

By leveraging a network of over two dozen top lenders, we guarantee loan options that align with your financial situation. This client-centered approach not only simplifies the mortgage process but also empowers you to make informed decisions about your financing alternatives. We understand that borrowers taking a balloon payment mortgage most likely find it crucial to navigate the intricacies of large final amounts, and we’re here to support you.

With our commitment to providing a stress-free experience, we aim for fast loan closings in under three weeks. You can feel confident knowing that we are with you, ensuring you feel supported and informed throughout your journey.

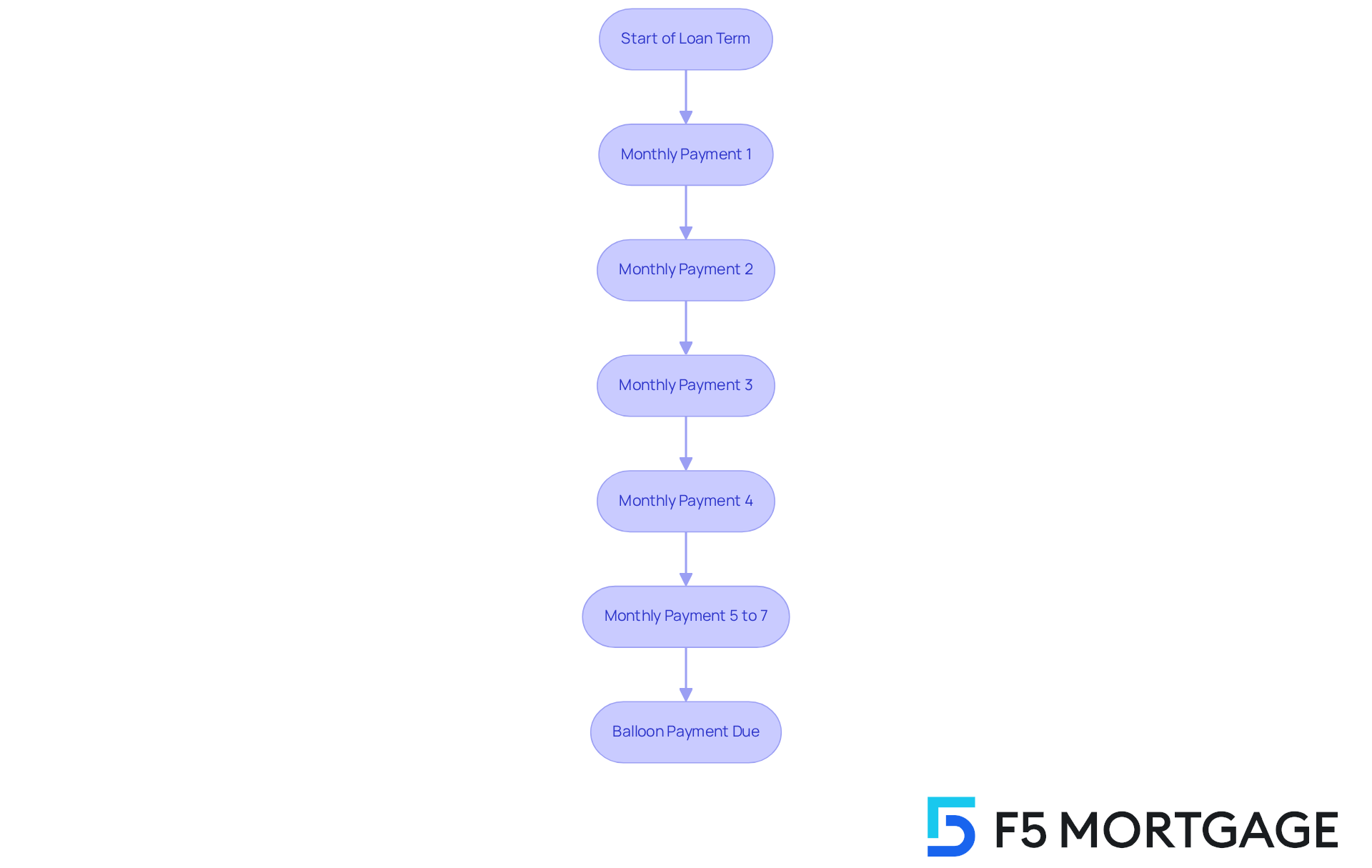

Understanding Balloon Payments: Definition and Functionality

A balloon settlement can feel overwhelming. It represents a substantial, lump-sum amount due at the end of a loan term, following a series of smaller monthly contributions. Typically, these loans span shorter durations, often five to seven years, where borrowers make reduced monthly payments. At the end of the term, however, the outstanding balance is required in full, which can be significantly larger than earlier payments.

This structure might appeal to those who anticipate a financial gain or plan to refinance before that large sum comes due. We understand how challenging this can be, and it’s essential to recognize that as a broker, F5 Mortgage does not manage loans. Instead, borrowers will remit funds directly to the lender associated with their loan.

Comprehending this transaction process is vital for managing expectations. By understanding how it works, you can strategize effectively for that large sum, feeling more empowered and prepared for the journey ahead. We’re here to support you every step of the way.

Typical Borrower Profile: Renting Out Properties with Balloon Mortgages

We understand that borrowers often face the challenge of managing large final installment loans, particularly real estate investors and those looking to lease properties. These individuals can benefit from reduced initial costs, allowing them to focus their resources on property improvements or other investments. Borrowers taking a balloon payment mortgage most likely plan to sell the property or refinance before the large payment is due, making this financing a strategic choice for managing cash flow.

By refinancing with F5 Mortgage, you can take advantage of competitive interest rates and customizable loan terms. This not only enhances your financial strategy but also provides the flexibility you need to navigate your unique situation. We’re here to support you every step of the way, ensuring that you feel confident and empowered in your financial decisions.

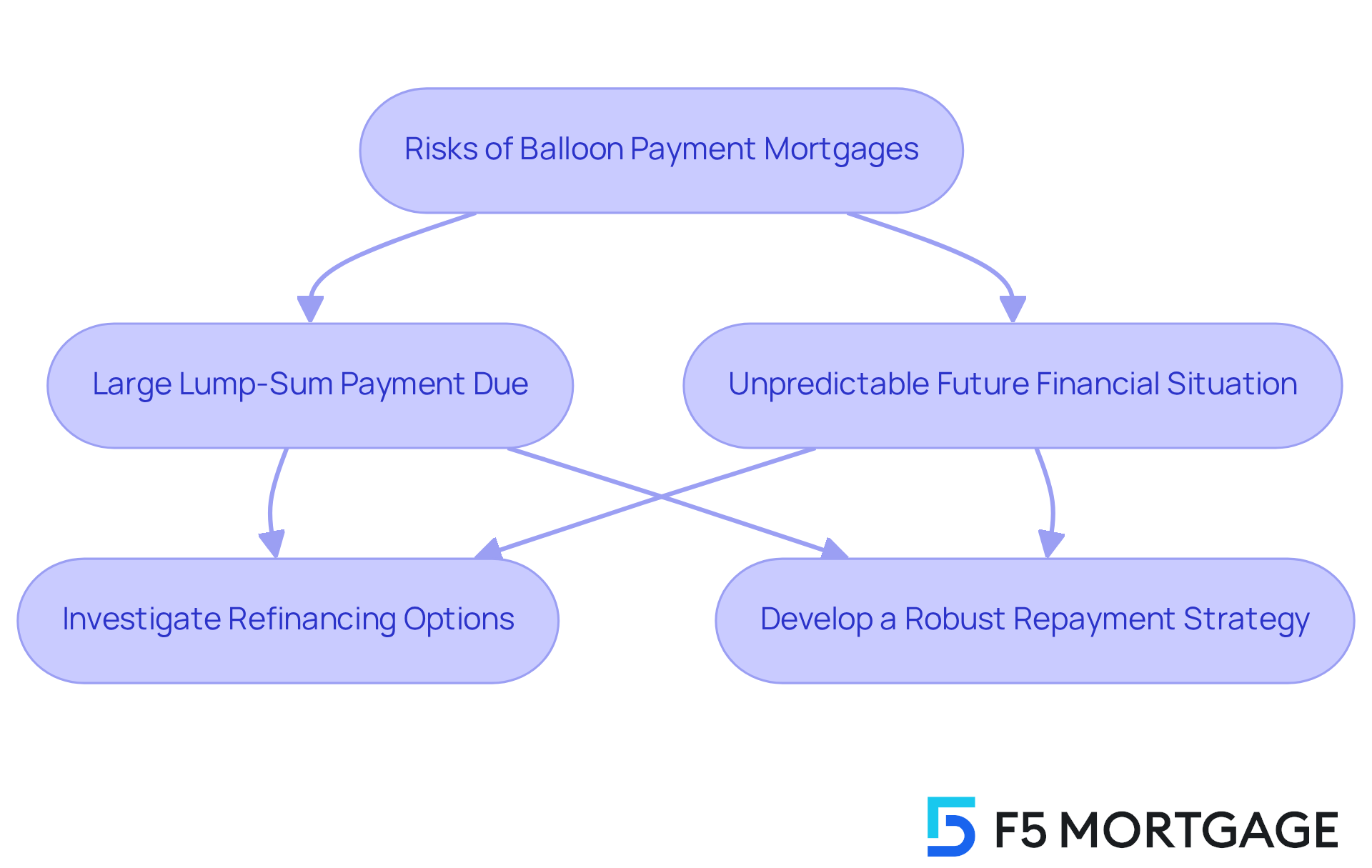

Risks of Balloon Payment Mortgages: What Borrowers Should Know

While balloon financing options can offer reduced initial costs, we understand that they also carry significant risks. One of the most pressing concerns is the large lump-sum amount due at the end of the loan term. If individuals taking out loans are unable to refinance or sell the property before this due amount, they may face the distressing possibility of foreclosure.

Moreover, relying on future financial situations can lead to unpredictability. This is why it’s essential for individuals to have a robust repayment strategy in place. We know how challenging this can be, but investigating refinancing alternatives can be a strategic way to mitigate these risks. By exploring these options, individuals may find opportunities to obtain better terms or extend their repayment schedule, providing a sense of relief and empowerment.

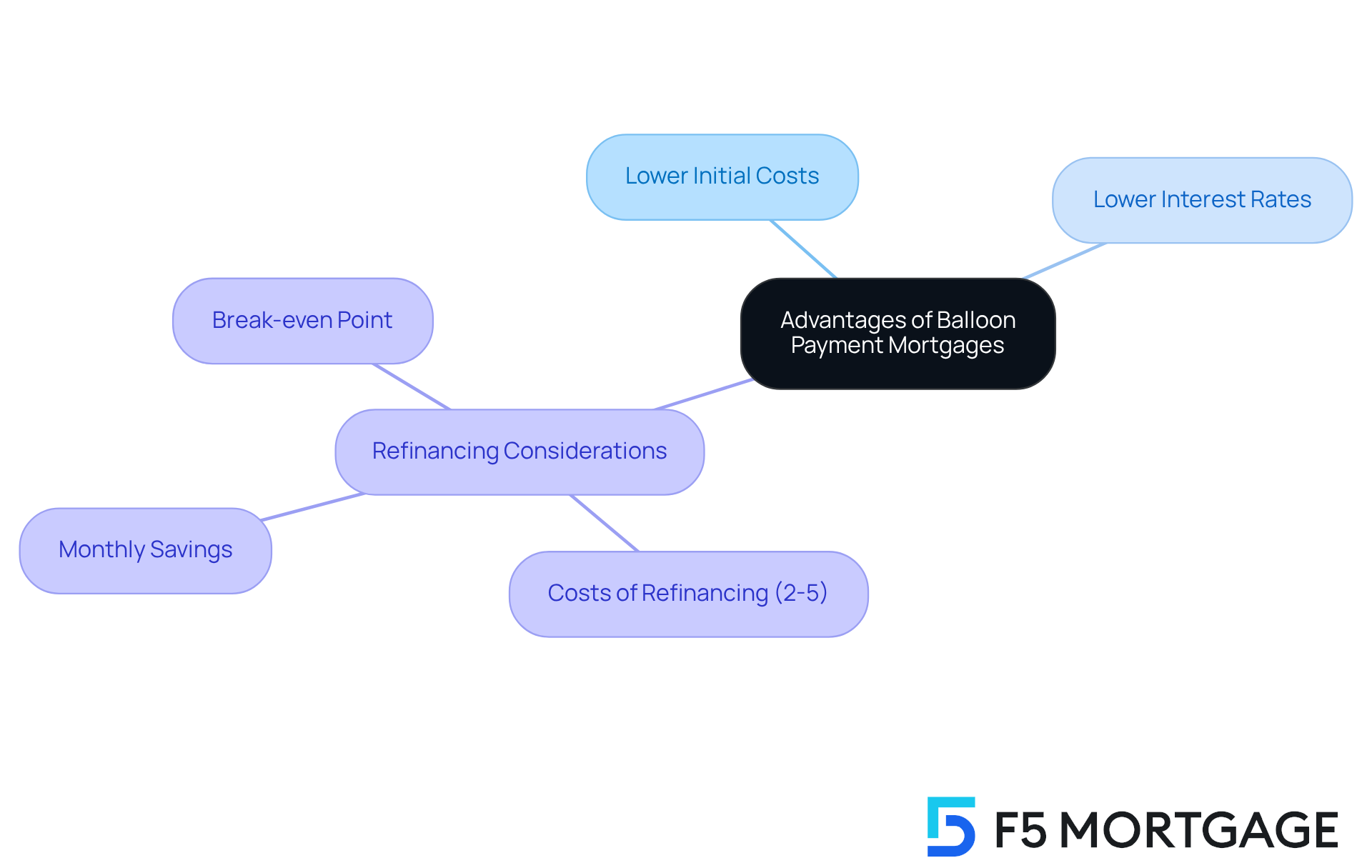

Advantages of Balloon Payment Mortgages: Benefits for Borrowers

Balloon financing options offer several advantages, particularly for those seeking lower initial costs. We understand how important it is to make homeownership more accessible, especially for borrowers taking a balloon payment mortgage most likely who plan to sell or refinance before the balloon payment comes due. Additionally, these loans often feature lower interest rates compared to traditional fixed-rate home loans, allowing individuals to save on interest during the early years.

When considering refinancing options, it’s crucial to evaluate the costs associated with refinancing, which typically range from 2% to 5% of the loan amount. We know how challenging this can be, but understanding these expenses can help you determine if restructuring your large final installment loan is a smart choice. If you can achieve significant monthly savings, you may reach your break-even point more efficiently, empowering you on your financial journey.

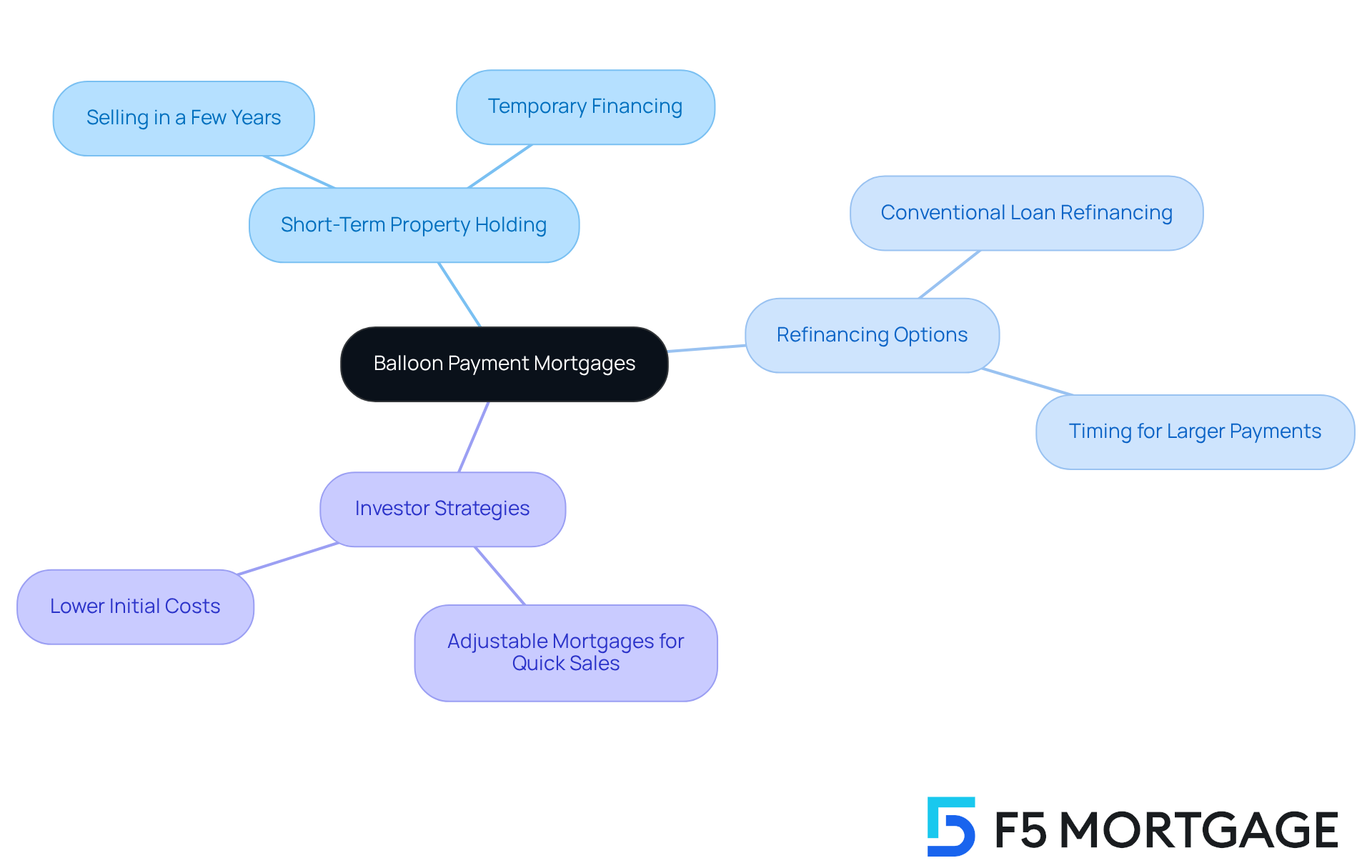

Common Uses of Balloon Payment Mortgages: When to Consider Them

For borrowers taking a balloon payment mortgage, balloon financing arrangements can be a helpful option if they expect to hold onto a property for a short time. For instance, if you’re planning to buy a house with the intention of selling it in a few years, this type of financing might suit your needs. Similarly, if you’re looking to refinance into a conventional loan before a larger payment is due, balloon financing could be beneficial.

We understand that real estate investors often face unique challenges. Many choose adjustable mortgages to fund properties they plan to renovate and sell quickly. This approach allows them to take advantage of lower initial costs, making it easier to manage their investments.

If you’re considering balloon financing, borrowers taking a balloon payment mortgage most likely should weigh their options carefully. We’re here to support you every step of the way, ensuring you feel confident in your decisions.

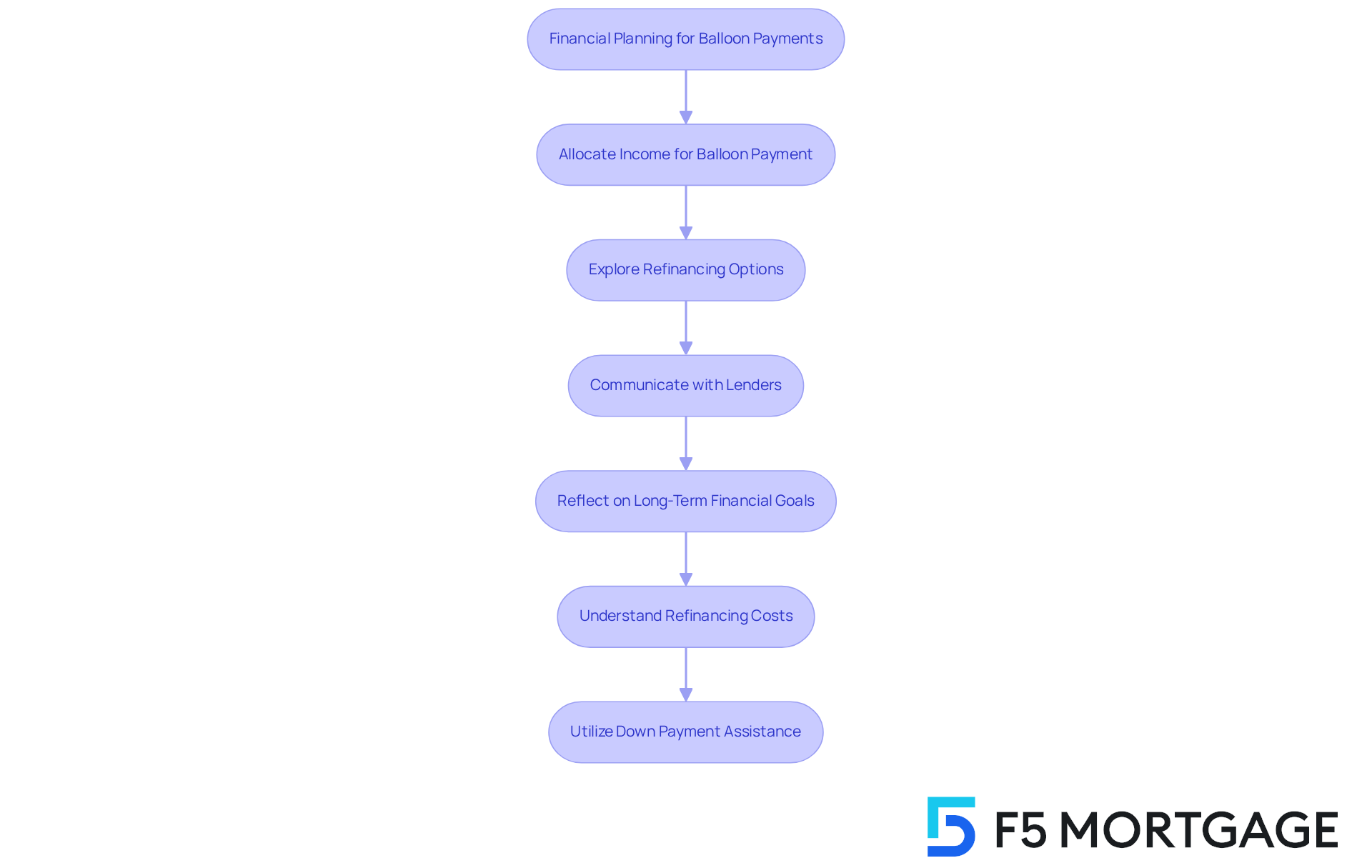

Financial Planning for Balloon Payments: Strategies for Borrowers

We know how challenging managing large final sums can be. To navigate this journey successfully, proactive financial planning is essential. Start by allocating a portion of your income each month specifically for that large final sum. Additionally, consider exploring refinancing options well in advance, and maintain an open dialogue with your lenders about potential strategies that can work for you.

Reflecting on your long-term financial goals is crucial. How does that large final sum fit into your overall financial plan? Understanding the expenses associated with refinancing in Colorado, which typically range from 2% to 5% of the total loan amount, can empower you to make informed decisions.

Moreover, by utilizing down payment assistance programs and comparing rates through F5 Mortgage, you can potentially lower your monthly expenses. This approach not only helps in managing your obligations but also supports your financial well-being. Remember, we’re here to support you every step of the way.

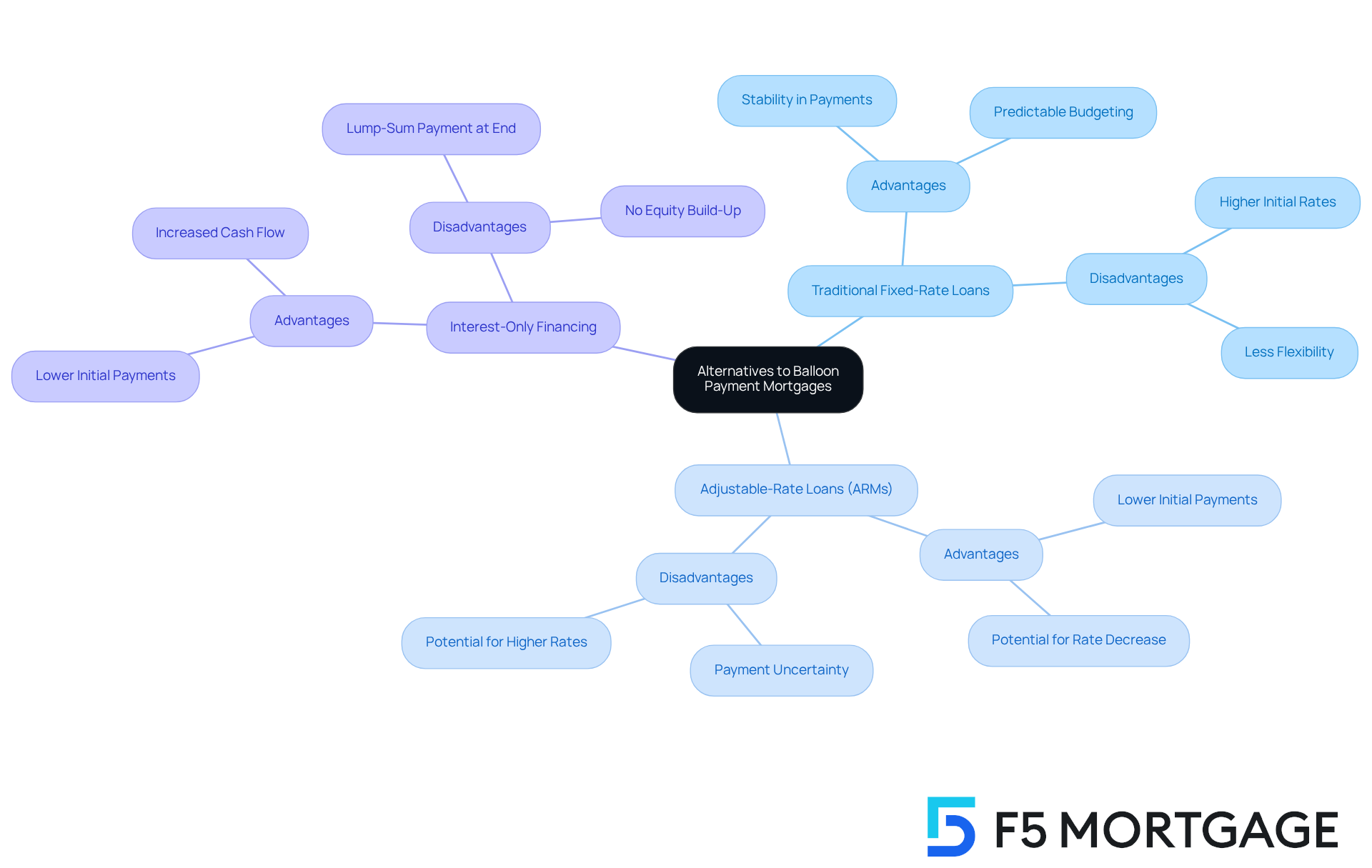

Alternatives to Balloon Payment Mortgages: Exploring Other Options

If you’re considering balloon financing options, we understand how overwhelming it can feel for borrowers taking a balloon payment mortgage most likely. It’s important to explore alternatives such as:

- Traditional fixed-rate loans

- Adjustable-rate loans (ARMs)

- Interest-only financing

These choices may offer you more stability and predictability in your monthly payments, which can help alleviate the worry of a large lump-sum payment at the end of the term.

Understanding loan approval is crucial, as it determines your eligibility for these options and can influence the terms provided by lenders. Each alternative comes with its unique set of advantages and disadvantages. That’s why it’s essential to assess your financial situation and long-term goals carefully.

We know how challenging this can be, but taking the time to evaluate these options can empower you to make the best decision for your family. Remember, we’re here to support you every step of the way.

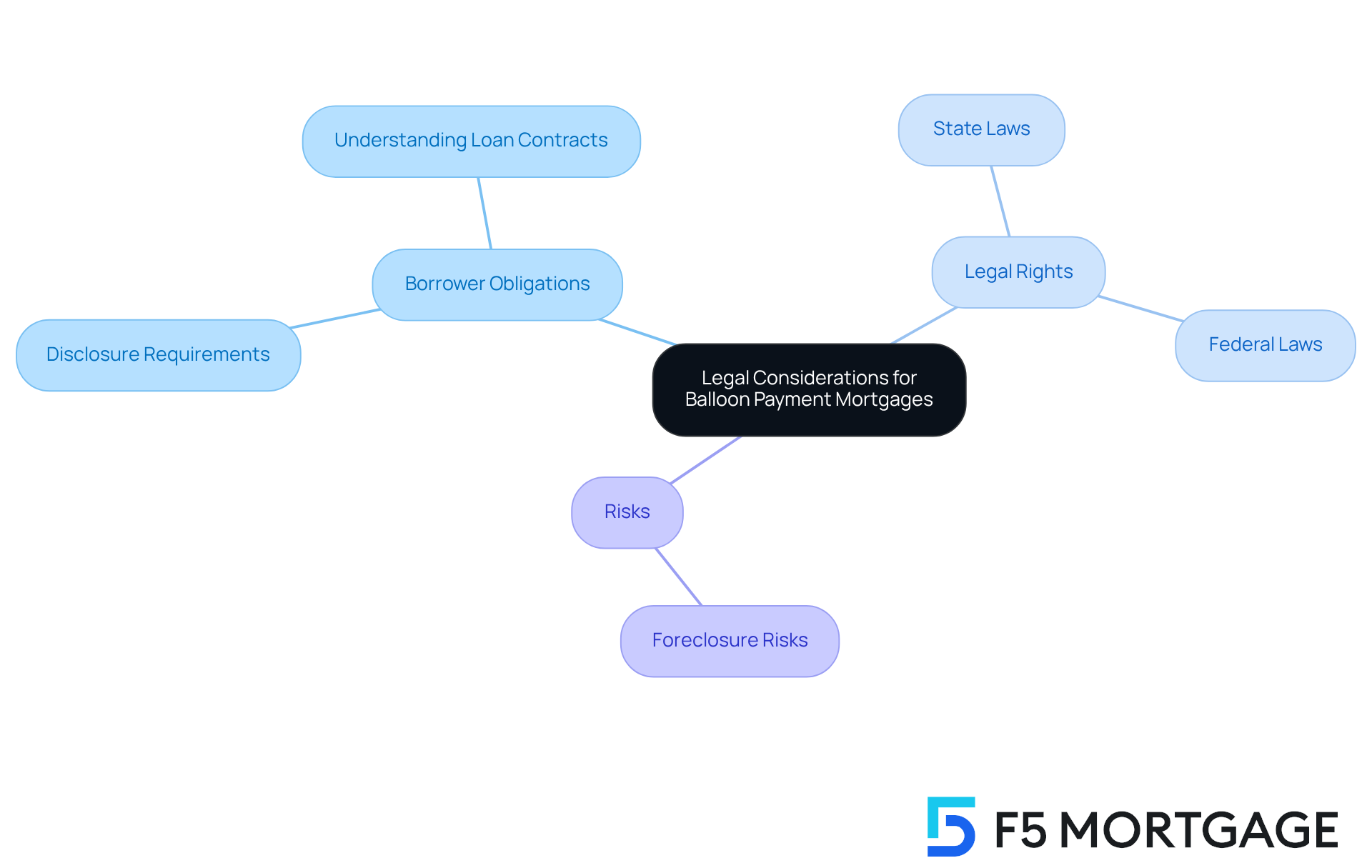

Legal Considerations for Balloon Payment Mortgages: Know Your Rights

We understand how challenging it can be for borrowers taking a balloon payment mortgage most likely to navigate large final installment mortgages. Borrowers taking a balloon payment mortgage most likely need to be mindful of the legal consequences, including obligations for disclosure and the risk of foreclosure if installments are not fulfilled. It’s essential for borrowers taking a balloon payment mortgage most likely to examine the loan contract thoroughly and understand the conditions associated with the final sum.

Additionally, we’re here to support you every step of the way by ensuring you are informed about your rights under state and federal laws. These rights can vary significantly depending on your jurisdiction, and understanding them is crucial for making empowered decisions.

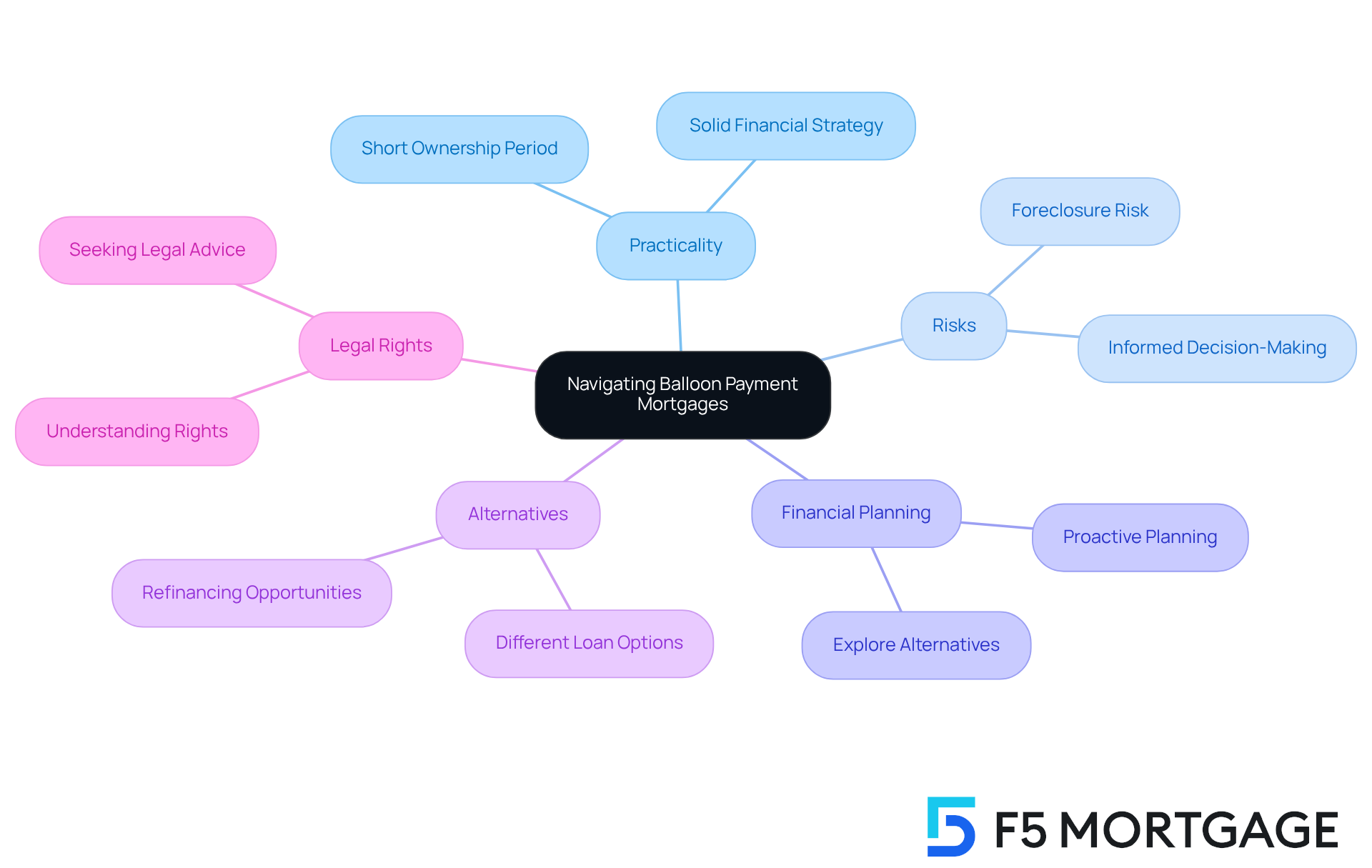

Key Takeaways for Borrowers: Navigating Balloon Payment Mortgages

In conclusion, we understand that large final installment loans can be a practical choice for borrowers taking a balloon payment mortgage most likely, especially those who anticipate brief ownership or have a solid financial strategy in place. However, we know how challenging this can be for borrowers taking a balloon payment mortgage most likely, and it’s important to understand the risks involved. There is a possibility of foreclosure if the large sum cannot be fulfilled, and borrowers taking a balloon payment mortgage most likely need to be aware of this to make informed decisions.

To effectively navigate the complexities of balloon payment mortgages, borrowers taking a balloon payment mortgage most likely should engage in proactive financial planning. Explore your alternatives and be aware of your legal rights. These steps can empower you to approach this financial decision with confidence and clarity. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the complexities of balloon payment mortgages can feel overwhelming for many borrowers. We understand how challenging this can be. These financial arrangements, characterized by smaller monthly payments followed by a substantial final payment, present both opportunities and challenges. It’s crucial to understand the intricacies of this mortgage type to make informed decisions that align with your financial goals.

Throughout our discussion, we’ve highlighted key insights, such as the importance of proactive financial planning and being aware of potential risks like foreclosure. We’ve also explored the advantages of balloon payment mortgages, especially for those who expect to refinance or sell before the large payment is due. Additionally, understanding your legal rights and exploring alternatives can empower you on your financial journey.

Ultimately, the decision to pursue a balloon payment mortgage should be approached with thoughtful consideration and strategic planning. We encourage you to engage with knowledgeable professionals and evaluate all available options. By taking these steps, you can navigate the landscape of balloon payment mortgages effectively, ensuring you are well-prepared for whatever lies ahead. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage’s approach to balloon payment mortgages?

F5 Mortgage focuses on offering personalized loan solutions tailored to the unique needs of borrowers taking balloon payment mortgages. Their dedicated loan specialists provide support throughout the mortgage process, ensuring clients receive customized options that align with their financial situations.

What is a balloon payment mortgage?

A balloon payment mortgage involves a substantial lump-sum amount due at the end of a loan term, following smaller monthly payments. These loans typically last five to seven years, with borrowers making reduced monthly payments before the larger balance is required in full at the end of the term.

Who typically benefits from balloon payment mortgages?

Borrowers such as real estate investors and those looking to lease properties often benefit from balloon payment mortgages. These individuals can manage reduced initial costs and may plan to sell the property or refinance before the large payment is due, making this financing a strategic choice for cash flow management.

How does F5 Mortgage assist borrowers with balloon payment mortgages?

F5 Mortgage assists borrowers by leveraging a network of over two dozen top lenders to provide loan options that fit their financial needs. They aim for fast loan closings in under three weeks and offer support to help borrowers navigate the complexities of balloon payments.

What should borrowers understand about the transaction process with balloon payment mortgages?

Borrowers should recognize that F5 Mortgage acts as a broker and does not manage loans directly. Instead, borrowers will remit funds directly to the lender associated with their loan, making it essential to understand this process for effective financial planning.

How can refinancing with F5 Mortgage benefit borrowers?

By refinancing with F5 Mortgage, borrowers can take advantage of competitive interest rates and customizable loan terms, enhancing their financial strategy and providing the flexibility needed to navigate their unique situations.