Introduction

Navigating the complexities of VA home loans can feel overwhelming for many families. We understand how challenging this can be, especially when it comes to grasping the specific credit requirements needed to secure financing. Surprisingly, many veterans are unaware of their eligibility for no down payment options. This presents a significant opportunity to empower these individuals and their families.

So, how can veterans and active-duty service members fully leverage their benefits while avoiding common pitfalls in the mortgage process? This article will explore the essential credit requirements for VA home loans, offering insights that can truly transform the homeownership journey for military families. We’re here to support you every step of the way.

F5 Mortgage: Personalized VA Loan Solutions for Veterans

F5 Mortgage understands how challenging navigating the mortgage process can be for service members and their families. That’s why we excel in providing customized VA financing solutions tailored to your unique needs. With competitive rates and exceptional service, we’re here to empower you with the guidance necessary to simplify homeownership.

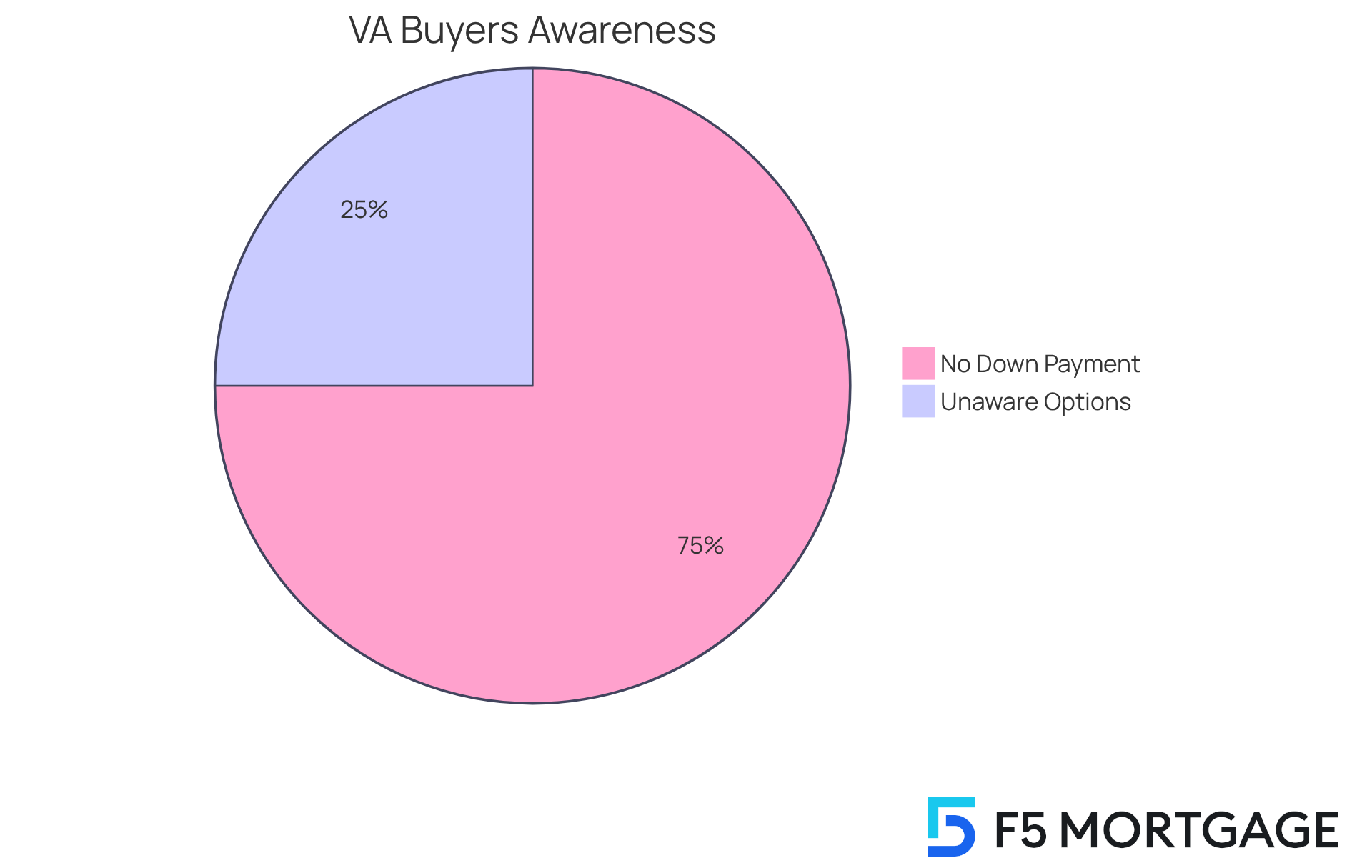

Did you know that approximately 75% of VA buyers purchase homes with no down payment? At F5 Mortgage, we leverage our expertise to help those who have served achieve their homeownership dreams. Our knowledgeable team is well-versed in the intricacies of VA financing, ensuring you receive personalized assistance that enhances your home-buying experience.

However, we recognize that many veterans and active-duty service members may not be aware of their eligibility for no-money-down options. In fact, only one-third of them do. With an average VA financing utilization rate of just 15 per 1,000 military households, there’s significant potential for growth in this area. By partnering with specialized lenders and providing comprehensive education, we aim to help families like yours navigate these opportunities more effectively.

Our financing officers are dedicated to offering a personal touch, combining excellent communication with problem-solving skills to address the unique challenges you may face during the mortgage process. Clients consistently commend F5 Mortgage for our outstanding customer support and tailored mortgage solutions, highlighting the hassle-free experience and quick closing times we reliably provide.

We know how important it is to feel supported every step of the way. Let us help you turn your homeownership dreams into reality.

Eligibility Criteria for VA Home Loans

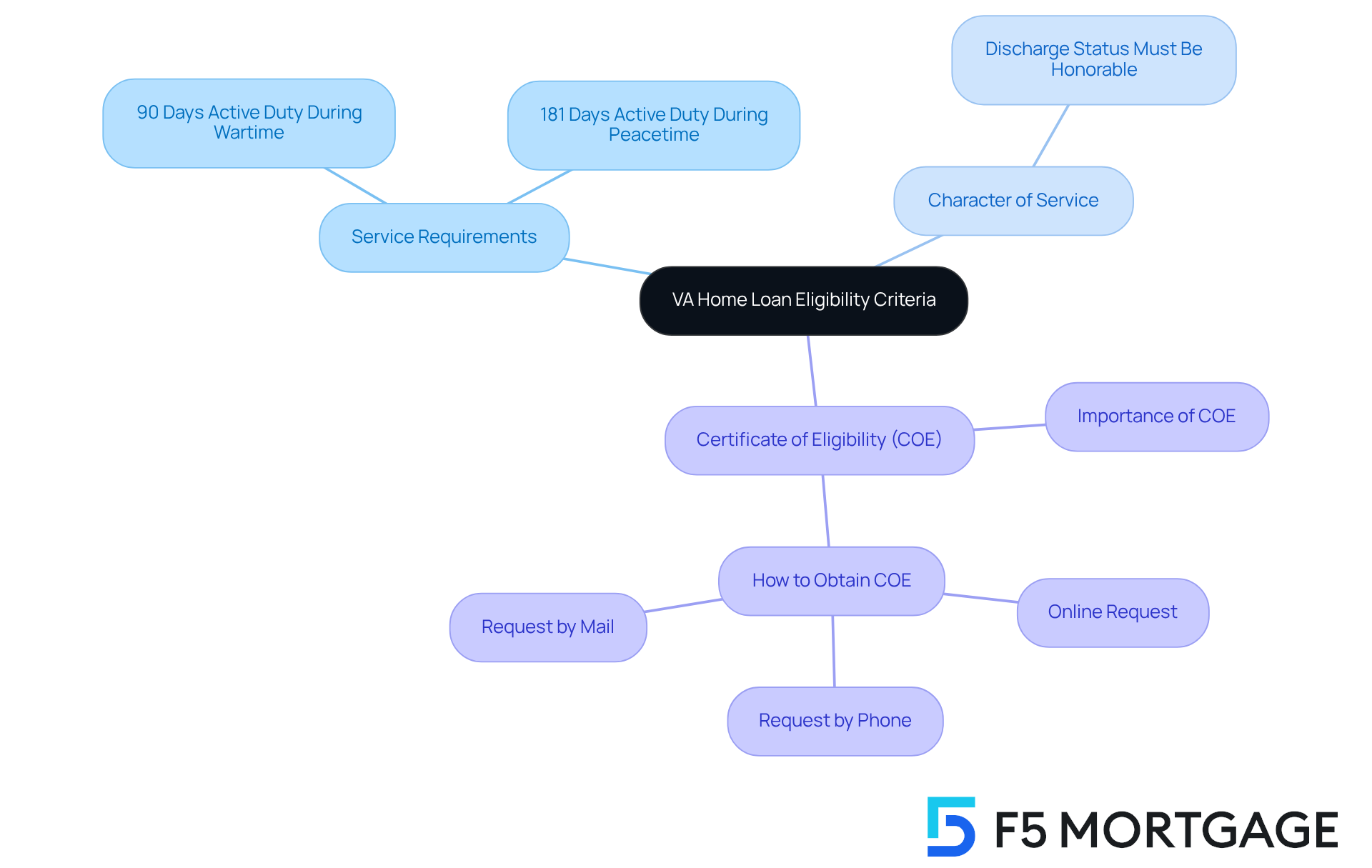

Navigating the VA home loan process can feel overwhelming, but we’re here to support you every step of the way. To qualify for a VA home loan, applicants must meet specific eligibility criteria:

- Service Requirements: Veterans need to have served at least 90 days of active duty during wartime or 181 days during peacetime. This ensures that those who have made significant sacrifices for our nation can access the benefits of VA financing.

- Character of Service: It’s crucial that the discharge status is under conditions other than dishonorable. This requirement reflects the commitment of former service members and their eligibility for VA assistance.

- Certificate of Eligibility (COE): The COE is a vital document that confirms a service member’s eligibility for a VA mortgage. You can obtain it through the VA or a lender, and if your lender has access to the VA’s system, they may be able to issue it instantly.

Recent changes in the VA home loan credit requirements have made it easier for former military personnel to access these benefits. For instance, those with service-related disabilities might qualify for additional assistance, including waivers from certain fees. Despite the fact that around 80% of former military personnel are homeowners, only 13% have utilized their VA benefits. This highlights the importance of raising awareness and understanding of these options.

Real-life stories show how veterans have successfully navigated these requirements. Many have shared their journeys of obtaining their COE and securing favorable financing terms. Their experiences underscore the value of working with knowledgeable lenders who specialize in VA financing. These insights not only clarify the process but also inspire other veterans to explore their eligibility for VA home financing.

Required Documents for VA Loan Applications

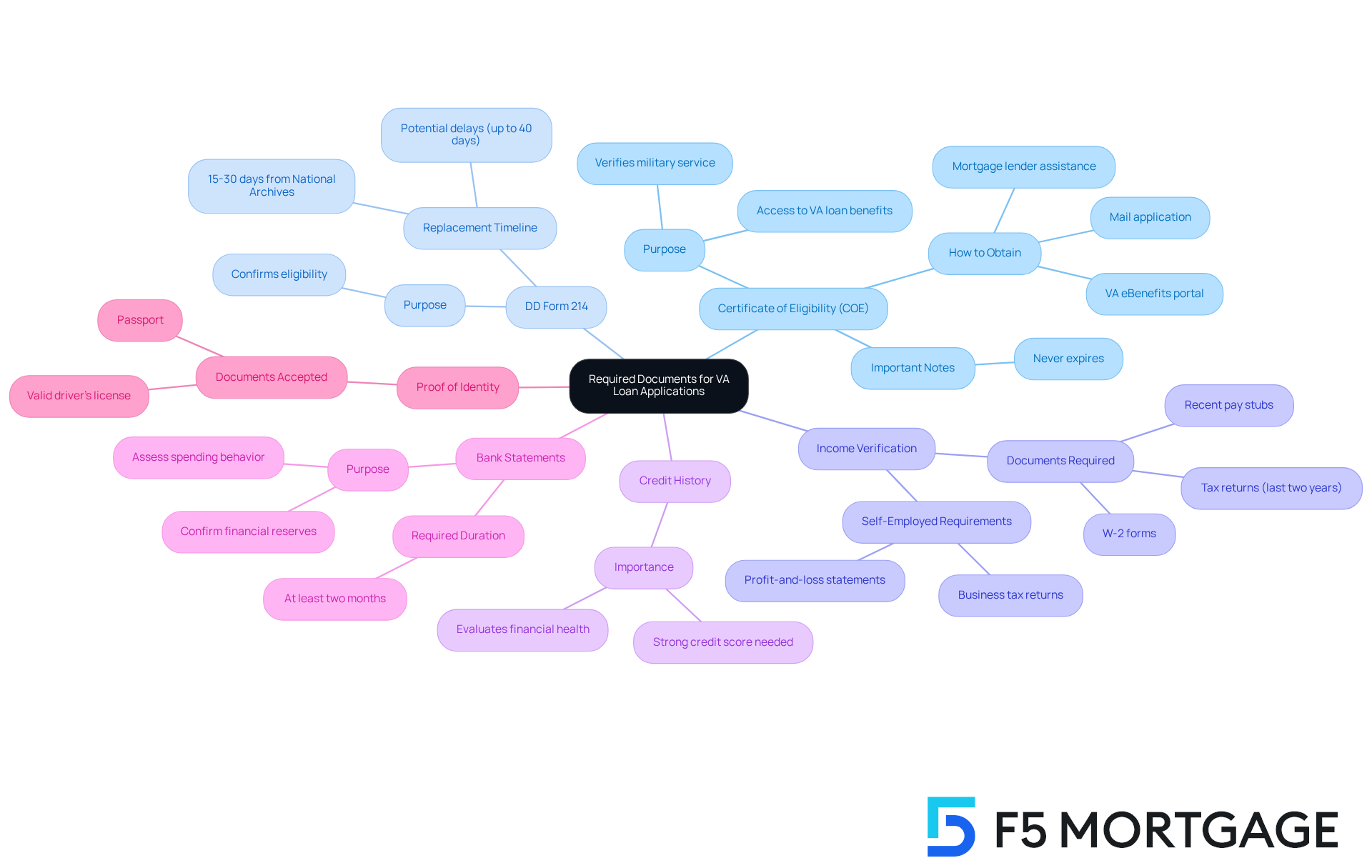

Applying for a VA mortgage can feel overwhelming, but we’re here to support you every step of the way. To ensure a smooth application process, it’s essential to gather several key documents. Here’s what you need:

- Certificate of Eligibility (COE): This vital document verifies your military service and is crucial for accessing VA loan benefits. You can obtain it through the VA eBenefits portal, a mortgage lender, or by mail. Online applications are the quickest option. Remember, a VA certificate of eligibility never expires, so you can access your benefits whenever you need them.

- DD Form 214: This form provides a comprehensive account of your service, which is necessary for confirming your eligibility. If you’ve misplaced it, getting a replacement from the National Archives can take 15-30 days, potentially affecting your borrowing timeline. In fact, one individual recently took 40 days to replace a lost DD-214.

- Income Verification: Lenders will ask for recent pay stubs, W-2 forms, and tax returns from the last two years to assess your income stability. If you’re self-employed, you’ll also need to provide business tax returns and profit-and-loss statements. It’s important to have the most recent month of pay stubs ready to verify consistent income.

- Credit History: Lenders will review your credit reports to evaluate your financial health. A strong credit score is crucial, as fluctuations in income or credit issues can result in failure to meet VA home loan credit requirements.

- Bank Statements: You’ll need at least two months of bank statements to confirm your financial reserves and spending behavior.

- Proof of Identity: A valid driver’s license or passport is required for all credit applications.

Did you know that around 43% of veteran homebuyers utilize VA financing? This highlights the importance of understanding the documentation process. Common issues, like misplaced DD-214s or missing tax returns, can delay your application. Financial advisors emphasize that obtaining the COE is a critical step; it verifies your eligibility for the VA home loan credit requirements but doesn’t guarantee approval.

Successful applicants often stress the importance of early preparation and organization of documents. By ensuring all necessary paperwork is in order, you can navigate the VA financing application with greater confidence and efficiency.

Key Benefits of VA Home Loans

VA home loans offer a range of significant benefits that can truly help families achieve their dream of homeownership:

No Down Payment: One of the most remarkable features of VA loans is that most don’t require a down payment. This means families can buy homes without the burden of saving for a hefty initial expense, making homeownership feel much more attainable.

No Private Mortgage Insurance (PMI): Unlike traditional financing, VA mortgages eliminate the need for PMI, which can add $150 to $300 to monthly payments. This reduction in costs makes homeownership even more affordable, allowing families to manage their budgets more effectively.

Competitive Interest Rates: VA mortgages typically offer interest rates about 0.25% lower than traditional financing. This difference can lead to significant savings over the life of the mortgage, making it easier for families to manage their payments.

In addition to these advantages, families can explore down payment assistance programs available through F5 Mortgage. For example, California’s MyHome Assistance Program provides up to 3% of the home’s purchase price, while Texas’s My Choice Texas Home program offers up to 5% for down payment and closing assistance. In Florida, programs like the Florida Assist Second Mortgage Program can provide up to $10,000 for upfront costs. These assistance options enhance the benefits of VA financing, making homeownership even more accessible for families.

Real-life stories highlight the impact of these advantages: families using VA financing have reported significant financial relief, with many saving hundreds of dollars each month due to the absence of a down payment and PMI. For instance, a family purchasing a $300,000 home with a VA mortgage could save around $675 each month compared to traditional financing options. This clearly demonstrates the tangible benefits of this program. Additionally, choosing a lower-rate borrowing option could save families between $300 and $500 each month on a $300,000 mortgage, further showcasing the affordability of VA loans.

In summary, the VA home loan credit requirements, which include no down payment, no PMI, and competitive interest rates, make VA financing a powerful tool for families looking to secure their dream homes while maintaining financial stability. As Tim Lucas, Editor of The Mortgage Reports, wisely notes, “Utilizing a VA mortgage saves you money upfront and greatly enhances your purchasing power.” We know how challenging this journey can be, and we’re here to support you every step of the way.

VA Loan Borrowing Limits Explained

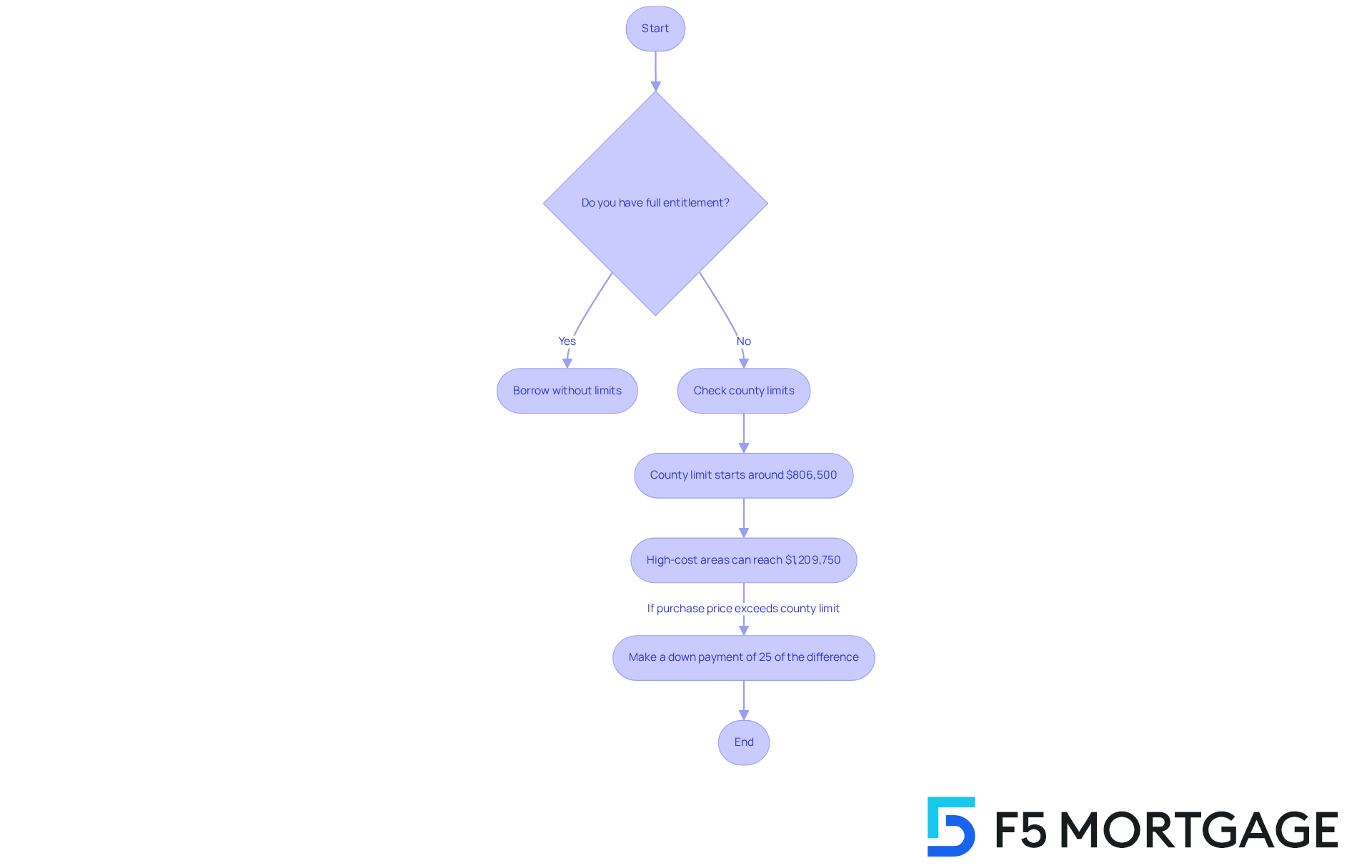

As of 2025, veterans with full entitlement can borrow without any VA-imposed limits, as long as they can show they have the financial means to manage the loan. This flexibility opens doors for qualified former service members to pursue homes that might exceed conventional borrowing limits.

However, if you have partial entitlement, it’s important to be aware of specific county limits, which typically start around $806,500. In high-cost areas, these limits can increase significantly, reaching up to $1,209,750. We know how challenging navigating these numbers can be, so it’s crucial to verify your county’s limits. These figures directly impact your borrowing potential and down payment requirements.

For instance, if your purchase price exceeds the county limit, you may need to make a down payment of about 25% of the difference to meet the total guaranty coverage expectations. Understanding the VA home loan credit requirements is essential for veterans like you to effectively plan your home purchases. We’re here to support you every step of the way, ensuring you make informed financial decisions.

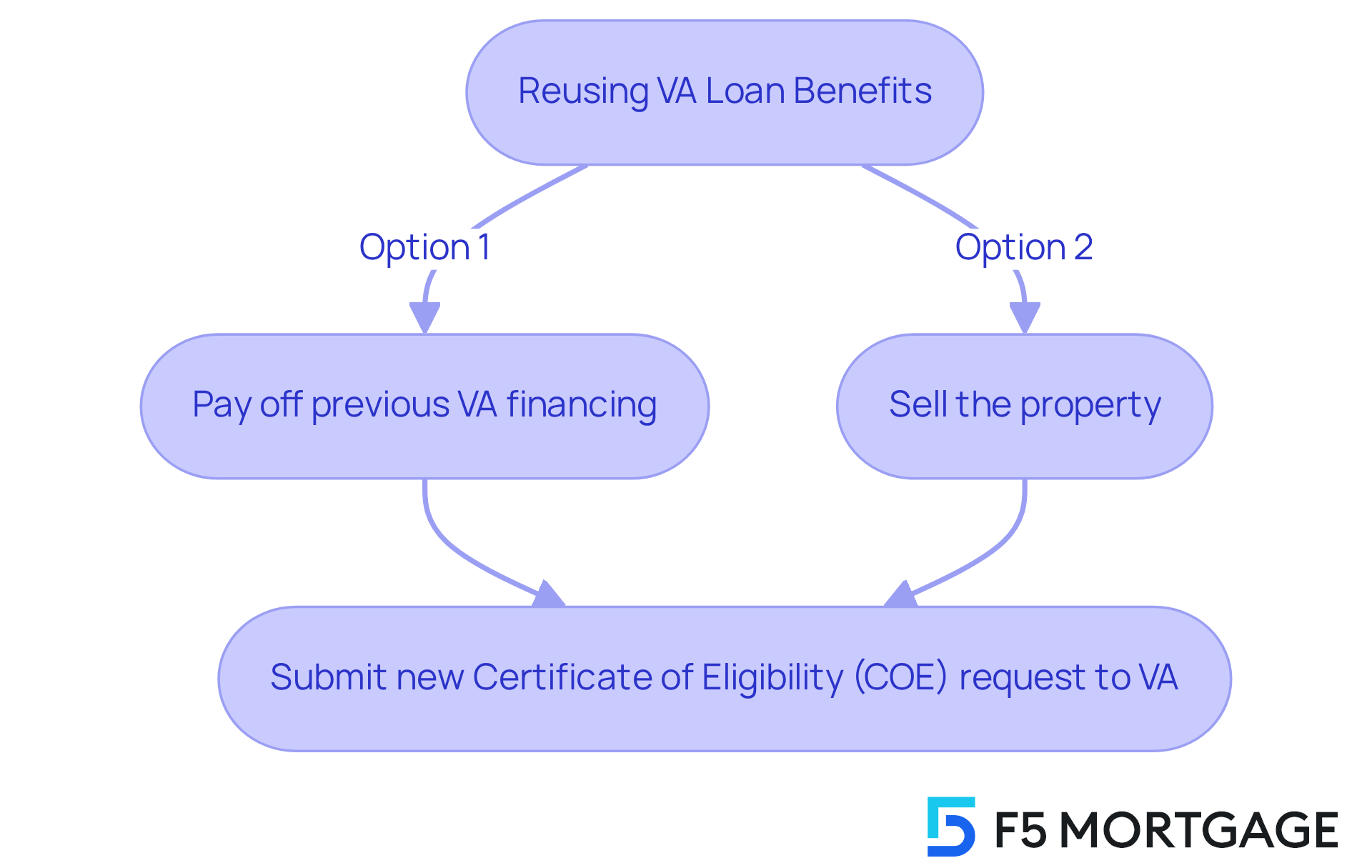

Reusing Your VA Loan Benefits: What You Need to Know

Veterans, we understand how important your VA financing privileges are to you. You can actually utilize these benefits multiple times throughout your life, which is a fantastic opportunity. However, to keep enjoying this valuable resource, it’s essential to reinstate your entitlement after each use.

So, how do you do this? It’s simple! You can either:

- Pay off your previous VA financing

- Sell the property

Once that’s done, you’ll need to submit a new Certificate of Eligibility (COE) request to the VA. This process ensures that you can continue to take advantage of the benefits you’ve earned through your service.

We know how challenging navigating these steps can be, but remember, you’re not alone. We’re here to support you every step of the way, helping you make the most of your VA benefits.

VA Loan Eligibility for Military Spouses

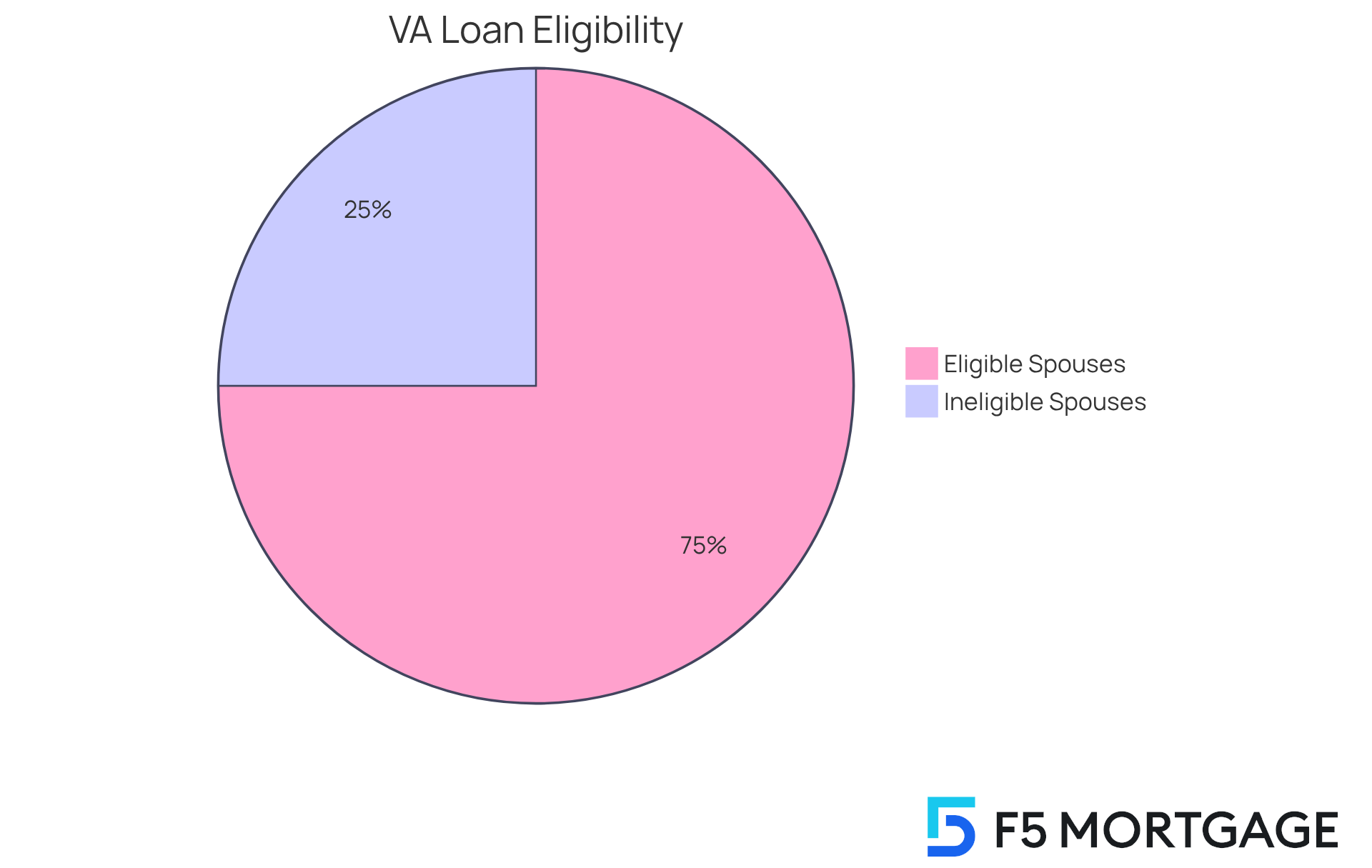

Military spouses face unique challenges, but they can qualify for VA benefits under specific conditions, opening doors to valuable opportunities for homeownership. If a service member is missing in action, a prisoner of war, or has died in service, their spouse is eligible to apply for a VA benefit. Additionally, partners of veterans with service-related disabilities may also find themselves eligible for these advantages. To confirm eligibility, it’s crucial for spouses to obtain a Certificate of Eligibility (COE), which serves as proof of their entitlement.

We know how important it is for military families to have access to resources. Recent updates show that a significant percentage of military spouses are eligible for VA financing, reflecting the program’s commitment to supporting service members’ families. For instance, in 2015, over 3,000 surviving spouses accessed their VA resources to secure homes, often with zero down payment and no mortgage insurance. This highlights the program’s accessibility and dedication to helping families thrive.

Veterans have shared heartfelt experiences regarding the advantages of VA financing for spouses. One veteran expressed, ‘There’s no way to repay the spouse of a fallen hero, but this benefit surely helps them move forward after tragedy.’ This sentiment underscores the importance of VA financing in providing stability and assistance to military families during their most challenging times.

Overall, the VA financing program not only facilitates homeownership for military spouses but also empowers them to navigate the complexities of the mortgage process while understanding the VA home loan credit requirements with confidence and ease. We’re here to support you every step of the way.

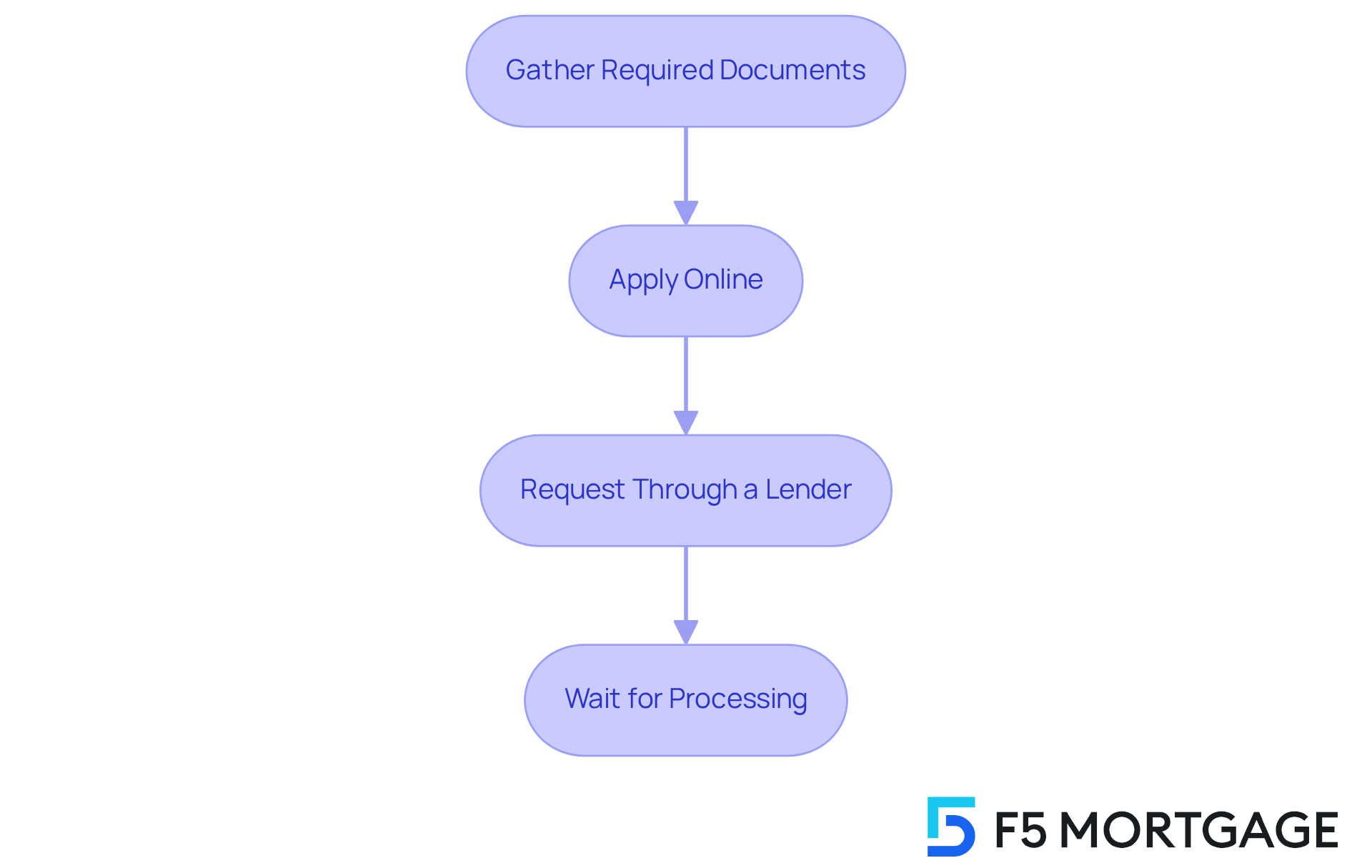

How to Obtain Your VA Loan Certificate of Eligibility

Obtaining a Certificate of Eligibility (COE) for a VA loan can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps:

Gather Required Documents: Start by collecting your DD Form 214, proof of service, and any other documentation needed to verify your eligibility. We know how challenging this can be, but having everything ready will make the process smoother.

Apply Online: Head over to the VA’s eBenefits portal for a streamlined electronic application process. This often leads to instant approval if your service data matches VA records, giving you peace of mind.

Request Through a Lender: Many lenders are ready to assist you in retrieving your COE. This can make the process more efficient and less stressful, allowing you to focus on what matters most.

Wait for Processing: The VA typically evaluates applications and issues COEs within a few days. This ensures you have the necessary documentation to move forward with your financing application.

By following these steps, you’re taking a significant step toward securing your VA loan. Remember, we’re here to help you navigate this journey.

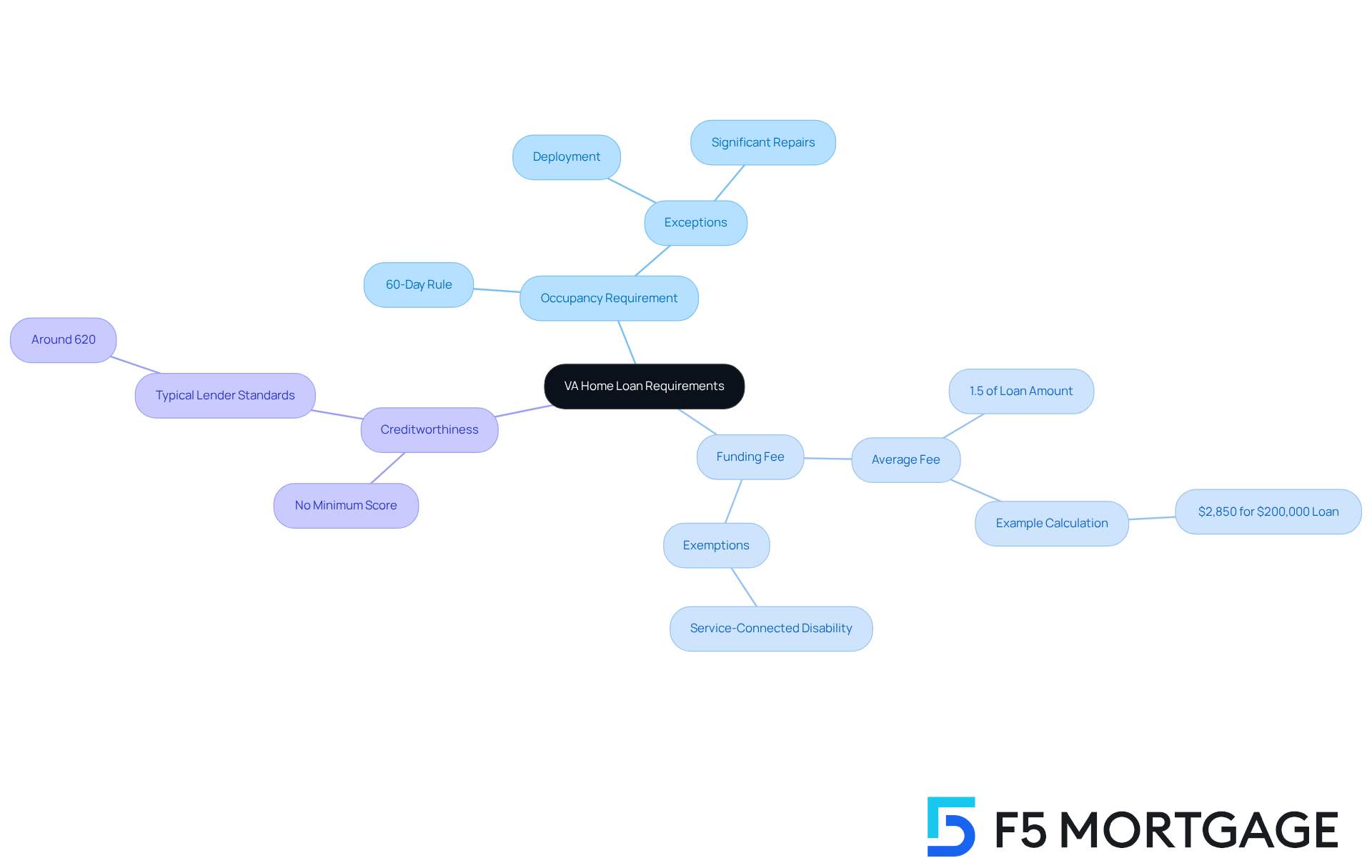

Additional Requirements for VA Home Loans

Navigating the VA home loan process can feel overwhelming, but understanding the specific requirements can make a world of difference for families. Here’s what you need to know:

Occupancy Requirement: It’s essential for borrowers to occupy the home as their primary residence within 60 days of closing. This requirement ensures that the property serves its intended purpose. However, we understand that life can throw curveballs, so exceptions to the VA home loan credit requirements may be granted for documented reasons such as deployment or significant repairs.

Funding Fee: Most VA mortgages come with a funding fee, which can be rolled into the loan amount. As of 2025, the average funding fee for a first-time VA-backed loan is about 1.5% of the loan amount. For example, that translates to roughly $2,850 for a $200,000 loan with a $10,000 down payment. This fee helps cover costs for taxpayers and varies based on service history and how often the benefit is used.

Creditworthiness: While the VA doesn’t set a minimum credit score, lenders often have their own standards, typically around 620. Maintaining a good credit score is crucial, as missed or late payments can affect your eligibility for VA home loan credit requirements.

We know how challenging this can be, but understanding these requirements can empower families. For instance, many households successfully meet the occupancy requirement by carefully planning their move-in dates and ensuring they have the necessary documentation ready for their lenders. Staying informed about these aspects can significantly ease the home-buying process for veterans and their loved ones. Remember, we’re here to support you every step of the way.

Consulting Mortgage Experts for VA Loan Success

Consulting with mortgage specialists who focus on VA financing can truly make a difference in your journey to homeownership. We know how challenging this can be, and at F5 Mortgage, our dedicated professionals are here to support you every step of the way. They understand the nuances of VA financing and provide tailored advice based on your unique situation.

With a commitment to exceptional service, we’ve helped over 1,000 families achieve their dream of homeownership. Our clients have shared their experiences, earning us 5-star reviews on platforms like Google and Lending Tree. We’re proud of the trust families place in us, and we’re eager to help you too.

Our experts can assist you in several key areas:

- Navigating the Application Process: We’ll ensure all necessary documents are in order and submitted correctly, so you can focus on what matters most.

- Understanding Loan Options: Choosing the right loan type and terms can be overwhelming, but we’re here to help you find the best fit for your needs.

- Maximizing Benefits: Let us advise you on how to leverage your VA benefits effectively, ensuring you get the most out of your financial situation.

We’re committed to making this process as smooth as possible for you. Let’s take this journey together!

Conclusion

Navigating the landscape of VA home loans can feel overwhelming, but understanding the essential credit requirements is key for families striving for homeownership. We know how challenging this can be, and that’s why we’ve outlined the crucial aspects of VA home loans, including:

- Eligibility criteria

- Required documentation

- The many benefits available to veterans and their families

By grasping these elements, families can position themselves to seize the opportunities that VA financing offers.

The importance of the Certificate of Eligibility (COE) cannot be overstated. With no down payment and no private mortgage insurance, VA loans provide significant advantages. Specialized lenders like F5 Mortgage play a supportive role in simplifying the process, making it easier for families to navigate. Real-life experiences from veterans and their families highlight the tangible benefits of utilizing VA loans, showcasing the financial relief and stability they can bring.

Ultimately, the message is clear: VA home loans are a powerful resource that can ease the path to homeownership for veterans and their families. By staying informed and seeking guidance from experts in VA financing, families can confidently navigate the complexities of the mortgage process. It’s vital for those eligible to explore these benefits and take proactive steps toward securing their dream homes. After all, the sacrifices made for our nation deserve to be honored with the support they truly need.

Frequently Asked Questions

What is F5 Mortgage’s focus regarding VA loans?

F5 Mortgage specializes in providing personalized VA loan solutions for veterans and their families, aiming to simplify the mortgage process and empower service members with tailored financing options.

What percentage of VA buyers purchase homes with no down payment?

Approximately 75% of VA buyers purchase homes with no down payment.

What are the eligibility criteria for a VA home loan?

To qualify for a VA home loan, applicants must have served at least 90 days of active duty during wartime or 181 days during peacetime, have a discharge status under conditions other than dishonorable, and obtain a Certificate of Eligibility (COE).

How can veterans obtain a Certificate of Eligibility (COE)?

Veterans can obtain a COE through the VA or a lender, and if the lender has access to the VA’s system, they may be able to issue it instantly.

What documents are required for a VA loan application?

Required documents include the Certificate of Eligibility (COE), DD Form 214, income verification (recent pay stubs, W-2 forms, tax returns), credit history, bank statements (at least two months), and proof of identity (valid driver’s license or passport).

What is the significance of the DD Form 214?

The DD Form 214 provides a comprehensive account of a veteran’s service and is necessary for confirming eligibility for a VA mortgage.

What are common issues that can delay a VA loan application?

Common issues include misplaced DD-214 forms, missing tax returns, and not having the necessary documentation organized, which can lead to delays in the application process.

What should veterans do to prepare for the VA loan application process?

Veterans should ensure all necessary paperwork is organized and ready, particularly focusing on obtaining the COE and verifying their income and credit history to navigate the application process more efficiently.