Overview

Navigating the world of rural development loans can feel overwhelming for families, but understanding the essential requirements can make a significant difference. Key criteria such as income limits, property location, and credit score considerations are vital to grasp. We know how challenging this can be, and that’s why we’re here to support you every step of the way.

By familiarizing yourself with these requirements, you can successfully navigate the loan application process. This knowledge empowers you to secure financing, ultimately promoting homeownership in rural areas. Remember, you are not alone in this journey, and there are resources available to guide you.

Take the time to explore these criteria, and don’t hesitate to reach out for help. Together, we can turn your dreams of homeownership into reality.

Introduction

Navigating the complexities of rural development loans can feel overwhelming for families aspiring to homeownership. We understand how challenging this can be. Recognizing the essential requirements is crucial, as it not only opens doors to financing options but also empowers families to make informed decisions.

What are the key criteria that can unlock the dream of owning a home in rural America? How can personalized guidance streamline this process?

This article delves into the ten fundamental requirements for rural development loans, offering insights and practical advice to help families successfully navigate the journey toward homeownership. We’re here to support you every step of the way.

F5 Mortgage: Personalized Consultations for Rural Development Loans

At F5 Mortgage, we understand how challenging it can be to meet the rural development loan requirements when securing financing. That’s why we offer tailored consultations designed to help households navigate their options with confidence. By evaluating your personal financial situation and homeownership goals, our dedicated mortgage specialists provide customized guidance that meets your family’s unique needs. This client-focused approach not only simplifies the financing process but also empowers you to make informed choices about your mortgage options, ensuring a hassle-free experience.

- Tailored Advice: Each consultation is crafted to address your family’s specific circumstances, ensuring that you receive exceptional service that aligns with your individual needs.

- Expert Guidance: Our knowledgeable team is here to support you through the complexities of rural development loan requirements and financing eligibility criteria, making the mortgage process easier for you.

- Streamlined Process: Our consultations help households navigate the application process more efficiently, focusing on quick financing closure—often in under three weeks—so you can move forward with your homeownership dreams.

In 2023, lenders approved 85.76% of purchase mortgage applications, highlighting the vital role of tailored advice in achieving positive outcomes. Many families have successfully utilized personalized mortgage consultations to secure government-backed financing, benefiting from options like zero down payments and favorable interest rates. This approach not only creates a smoother experience but also enhances customer satisfaction, evidenced by the growing trend of lenders prioritizing personalized solutions to meet borrower needs. We’re here to support you every step of the way.

USDA Loan Eligibility: Key Criteria for Applicants

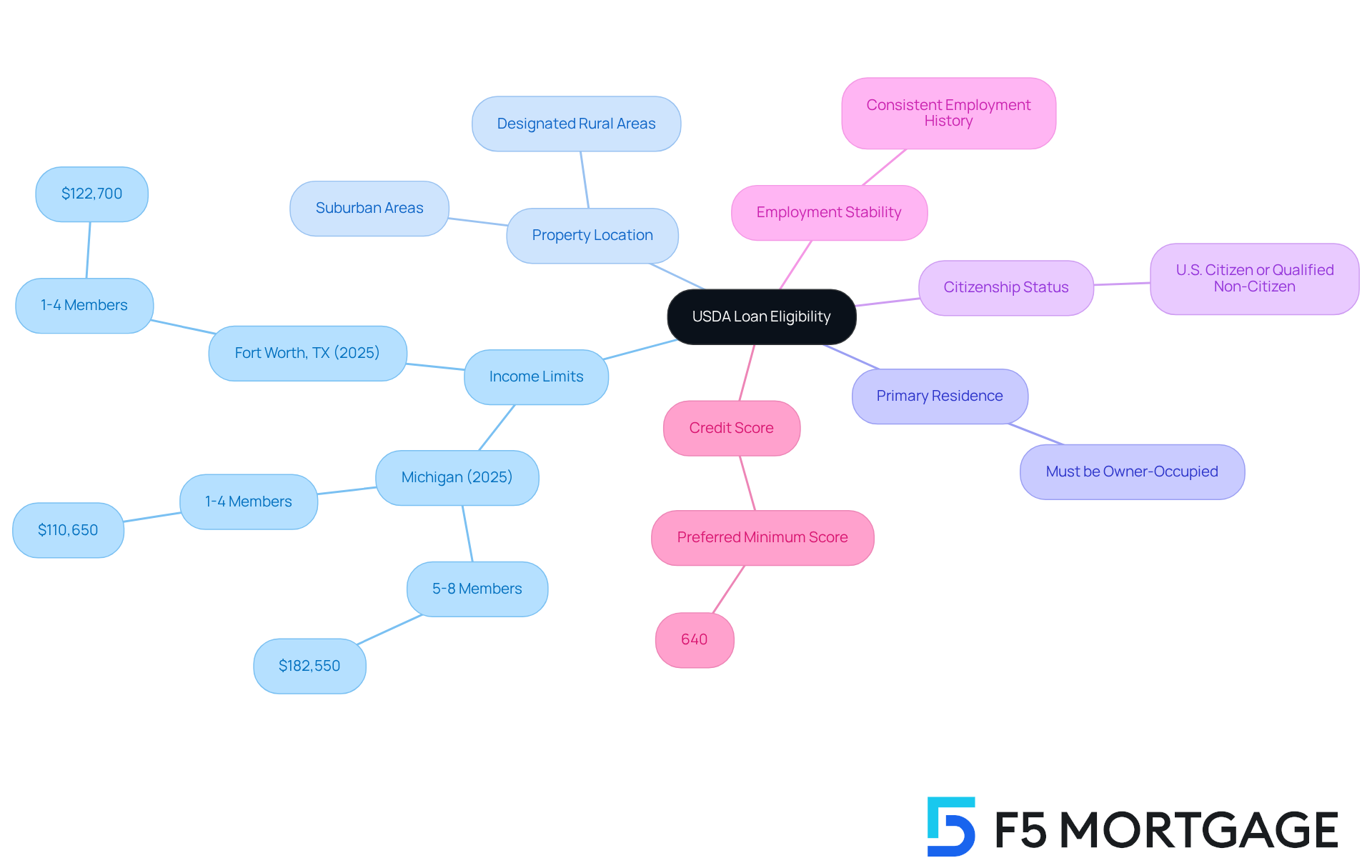

To qualify for a USDA loan, we understand that applicants must meet the rural development loan requirements. This can feel overwhelming, but we’re here to support you every step of the way. Here are the key requirements:

Income Limits: Your household income must not exceed 115% of the median income for your area. This ensures that assistance is directed toward families in need. For example, in 2025, the income limit for a household of four in Michigan is set at $110,650, while in Fort Worth, Texas, it is $122,700.

The property you’re considering must be located in a designated rural area to meet the rural development loan requirements defined by the USDA. This includes certain suburban areas, making it accessible for families wanting to establish themselves beyond busy metropolitan hubs.

To fulfill the rural development loan requirements, the home must serve as your primary residence. This requirement reinforces the program’s goal of promoting homeownership and stability.

One of the rural development loan requirements is that you must be a U.S. citizen or a qualified non-citizen to access these benefits, ensuring that the program supports eligible residents.

Additionally, there are a few more considerations:

Employment Stability: Lenders often look for a consistent employment history to demonstrate your ability to repay the loan. This is crucial for assessing risk.

While there are no strict minimum credit score requirements, most lenders prefer a score of at least 640 when evaluating rural development loan requirements. This reflects a borrower’s credit reliability and helps in the loan approval process.

Real-life examples show how families can qualify for USDA loans based on these income limits. For instance, a household with a combined income of $60,000 may qualify after accounting for deductions, such as childcare expenses necessary for employment. This flexibility in income evaluation allows many families to access home financing that might otherwise be out of reach.

By understanding these essential criteria, you can navigate the government-backed financing process more effectively. This empowers you to take advantage of the benefits it offers, such as no initial cost and attractive interest rates. Remember, we know how challenging this can be, and we’re here to help you achieve your homeownership dreams.

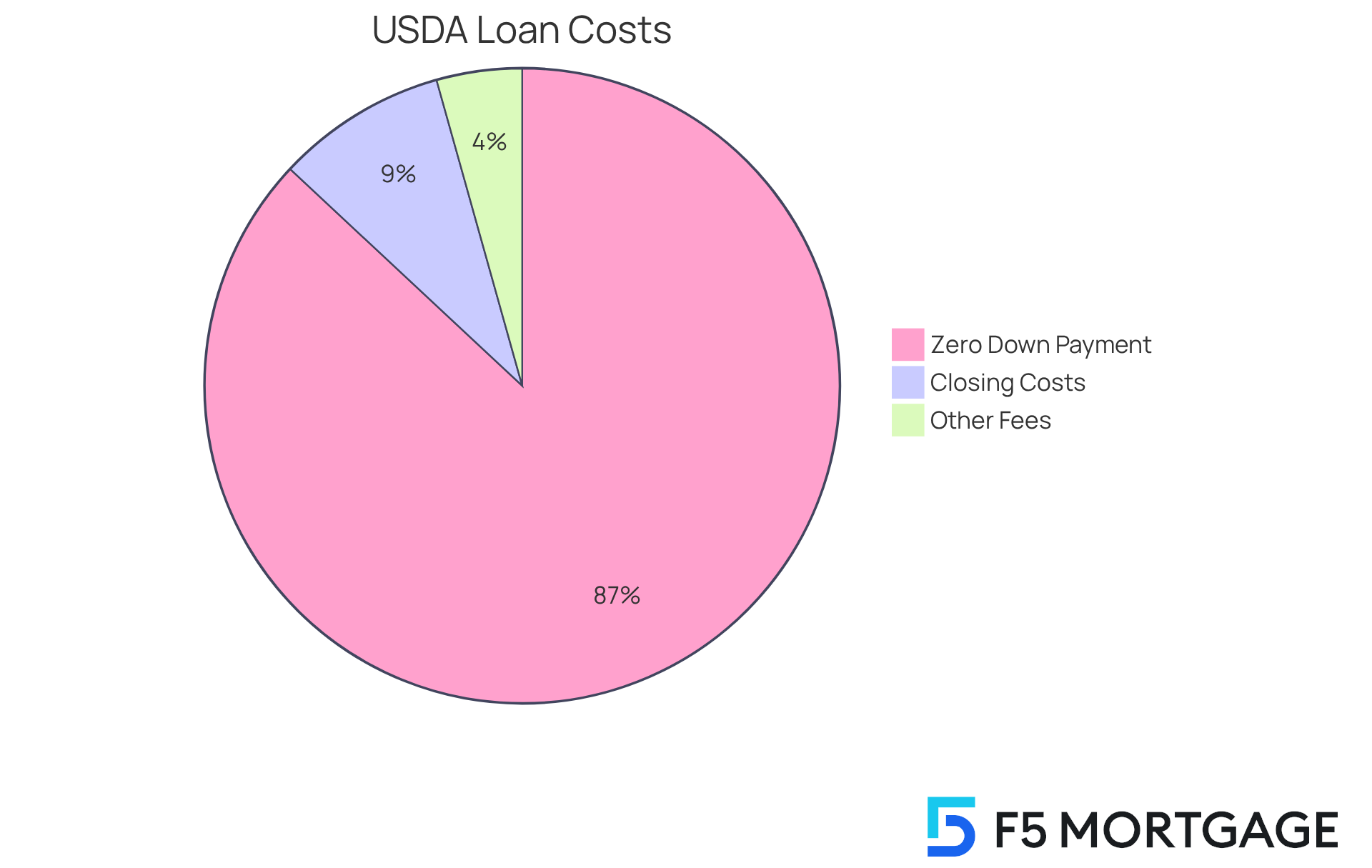

USDA Loan Down Payment Requirements: What You Need to Know

USDA financing stands out for its appealing feature of requiring no initial cost, allowing eligible borrowers to cover 100% of the home’s purchase price. This accessibility is especially beneficial for families with limited savings, turning homeownership into a realistic goal. While applicants can choose to make a deposit, which can significantly reduce monthly mortgage payments and lower the total amount borrowed—ultimately saving on interest—it’s vital to consider the overall picture.

Although the absence of an initial deposit is a considerable advantage, it’s essential for borrowers to budget for closing expenses, which typically range from 2% to 5% of the loan amount. For example, on a $300,000 home, closing costs could total between $6,000 and $15,000. Understanding these expenses is crucial for families to plan effectively and avoid unexpected challenges during the mortgage process. By weighing the benefits of a zero down payment against the potential savings from making a down payment, families can make informed decisions that align with their financial aspirations.

Additionally, families should be aware of specific costs related to mortgage refinancing, such as application fees, origination fees, and appraisal costs. This awareness ensures they are fully prepared for the financial responsibilities involved. We know how challenging this can be, and we’re here to support you every step of the way.

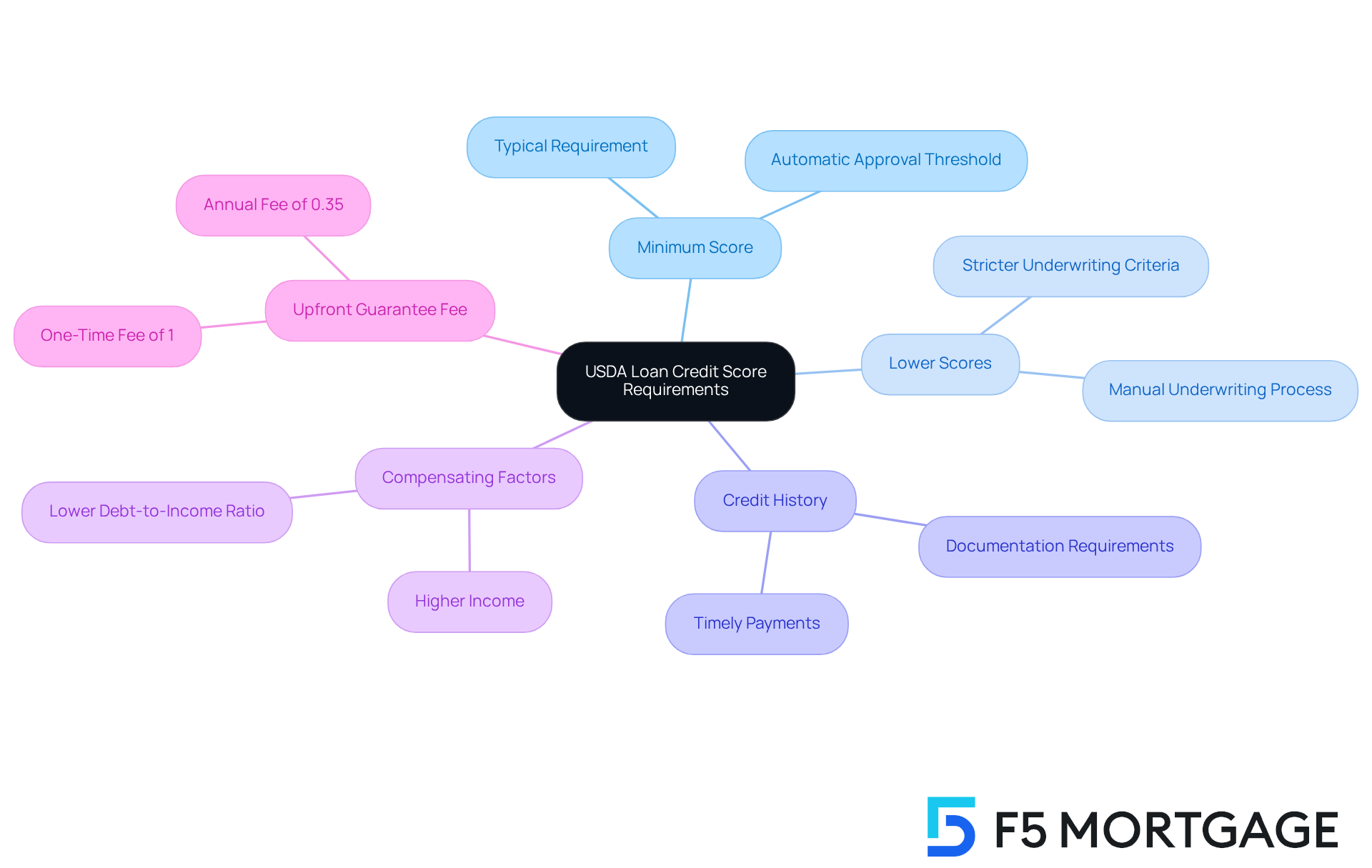

USDA Loan Credit Score Requirements: Minimum Standards Explained

USDA loans offer a unique opportunity for families, as they do not impose a fixed minimum credit score requirement. However, many private USDA lenders typically look for a score of at least 640 for automatic approval through the USDA Guaranteed Underwriting System (GUS). This flexibility allows families with diverse credit histories to pursue their dream of homeownership.

- Lower Scores: We understand that some lenders may consider lower scores, but this often means stricter underwriting criteria, which can complicate the approval process.

- Credit History: A strong credit history that showcases timely payments can significantly enhance your chances of approval, even if your score is lower.

- Compensating Factors: Factors like a higher income or a lower debt-to-income ratio can help mitigate the impact of a lower credit score, increasing your likelihood of securing financing.

In 2025, households with varying credit ratings successfully acquired government-backed financing, demonstrating the program’s accessibility. For example, individuals with scores below 640 have qualified through manual underwriting by providing essential documentation, such as stable employment history and cash reserves. This flexibility underscores our commitment to helping low- to moderate-income families achieve their homeownership goals.

It’s also important to be aware that agricultural development loans require a one-time upfront guarantee fee of 1% of the amount borrowed. Understanding this financial factor is crucial for prospective borrowers, and we’re here to support you every step of the way.

USDA Loan Debt-to-Income Ratio Requirements: Understanding Limits

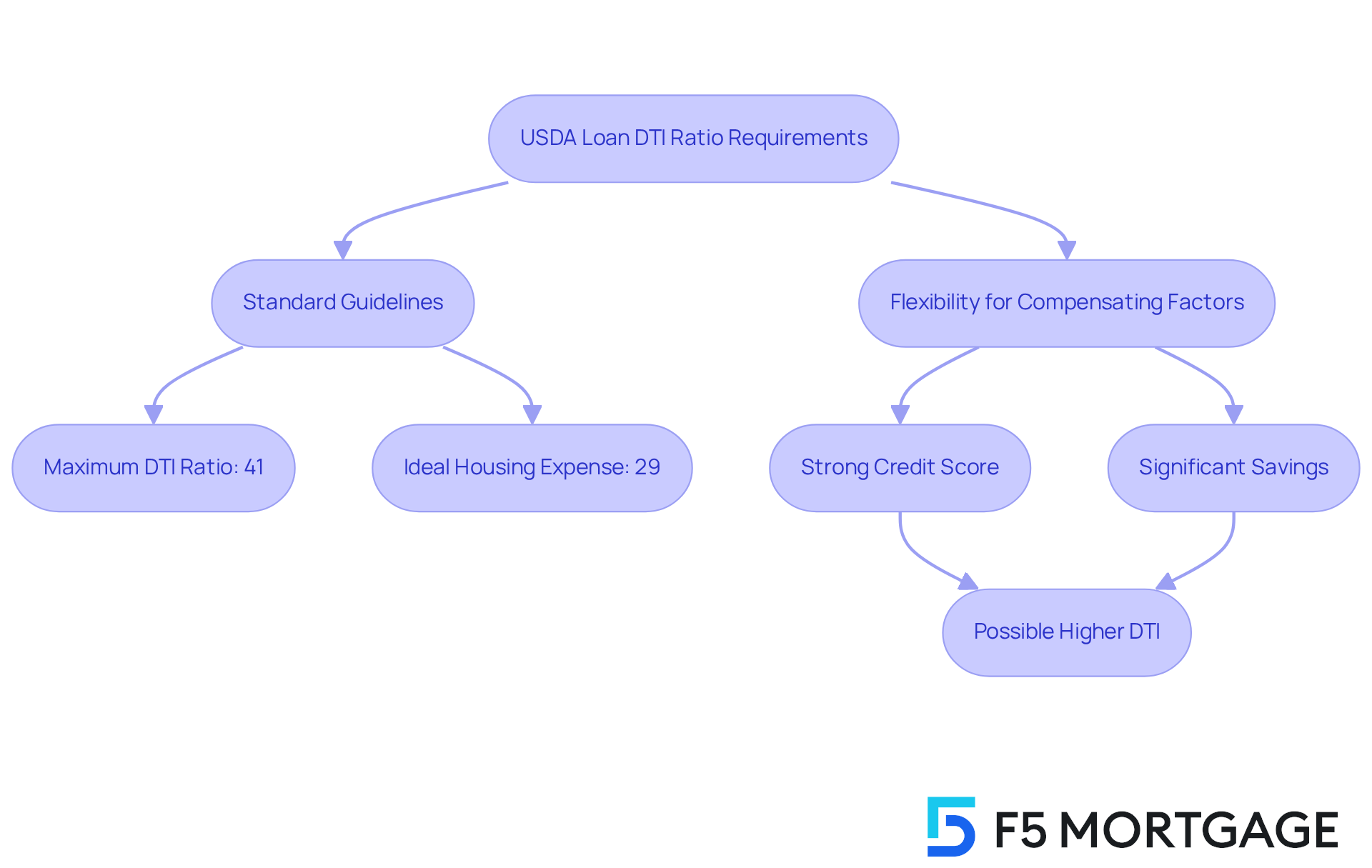

Navigating government-backed mortgages can feel overwhelming, especially when it comes to understanding debt-to-income (DTI) ratios. Typically, these mortgages set a maximum DTI ratio of 41%. This means that no more than 41% of your gross monthly earnings should be allocated for debt repayments, including your mortgage. Ideally, housing expenses should not exceed 29% of your gross income.

Yet, it’s important to know that there’s some flexibility within these guidelines. Lenders may allow higher DTI ratios if you have compensating factors, such as a strong credit score or significant savings. For example, families with a DTI ratio close to the maximum might still qualify for a USDA mortgage if they demonstrate financial stability through other means.

Maintaining a low DTI ratio is crucial for securing approval and can lead to more favorable interest rates. Financial experts emphasize that a lower DTI increases your chances of mortgage approval and can enhance your credit conditions. Consider this: a household with a monthly income of $6,000 and total monthly debt obligations of $2,400 would have a DTI ratio of 40%, which aligns with the rural development loan requirements for acceptable financing.

Real-life examples show how families successfully manage their DTI ratios. By prioritizing debt repayment and avoiding new credit commitments, many borrowers have effectively lowered their DTI ratios to meet government-backed mortgage criteria. This proactive approach not only aids in securing financing but also fosters long-term financial well-being. We know how challenging this can be, but remember, we’re here to support you every step of the way.

Eligible Properties for USDA Loans: Criteria and Guidelines

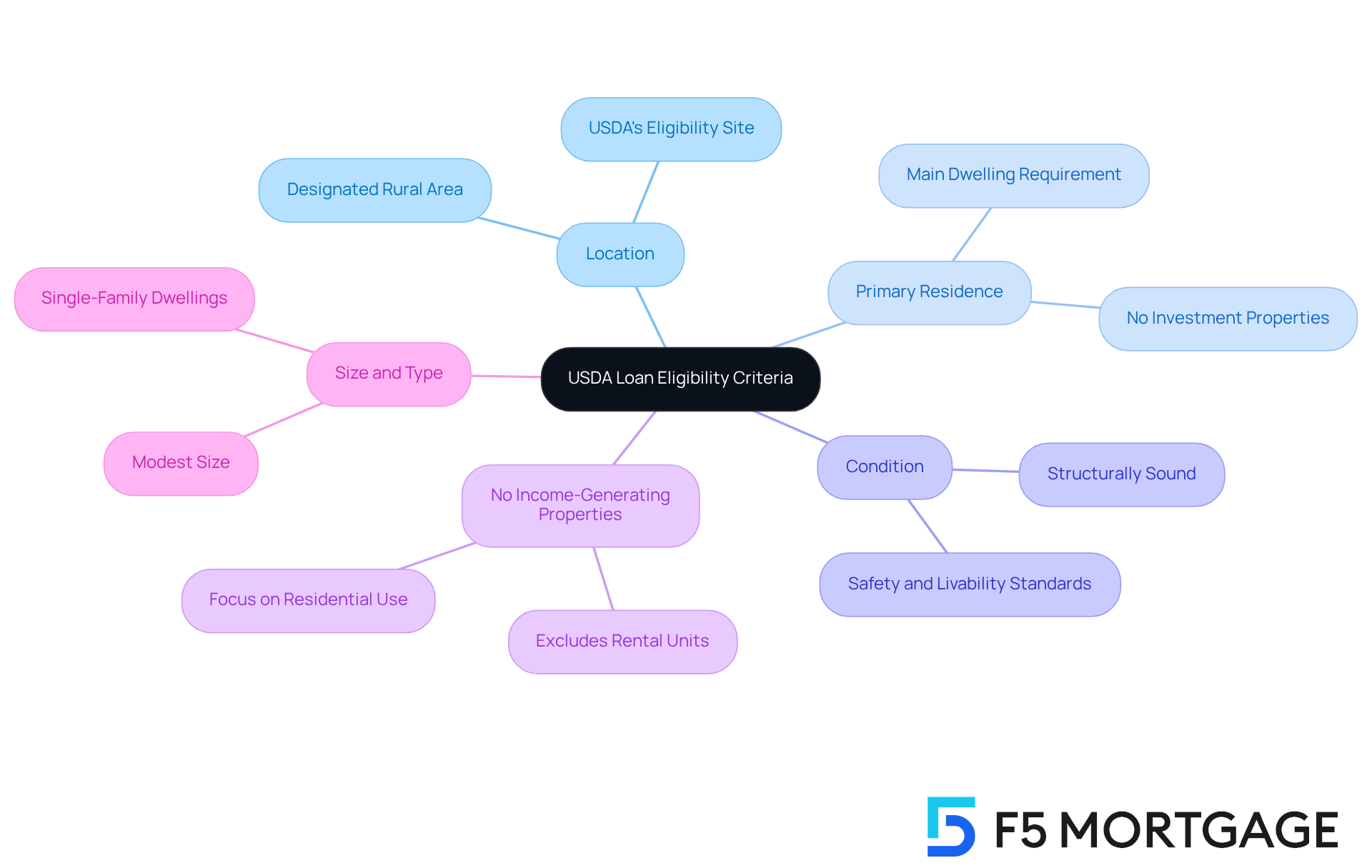

To qualify for a USDA loan, properties must meet the rural development loan requirements that are designed to promote affordable homeownership in rural areas. We understand how important it is to find the right home, and we’re here to support you every step of the way:

- Location: The home must be located in a designated rural area as defined by the USDA. You can easily verify this using the USDA’s Eligibility Site, which helps potential borrowers determine if a specific address qualifies.

- Primary Residence: The property must serve as your main dwelling. This ensures that the financing supports homeownership rather than investment properties, which can often complicate financial planning.

- Condition: Homes must be structurally sound and meet basic safety and livability standards. After all, providing a secure environment for your family is paramount.

- No Income-Generating Properties: Properties that produce income, such as rental units or farms, are not eligible for this program. The focus is on residential use, allowing families to thrive in their homes.

- Size and Type: The home should be modest in size, typically classified as a single-family dwelling. This aligns with the program’s aim to assist low- and moderate-income households by fulfilling the rural development loan requirements, ensuring that more families can achieve their dream of homeownership.

In 2025, a significant percentage of homes in rural areas meet these criteria, making USDA loans a viable choice for many households. Imagine the relief of knowing that you can acquire a USDA-eligible home, benefiting from the program’s 100% financing option, which eases the burden of a down payment. This flexibility allows families to invest in their future while contributing to community prosperity and enhancing quality of life.

How to Apply for a USDA Loan: Step-by-Step Guide

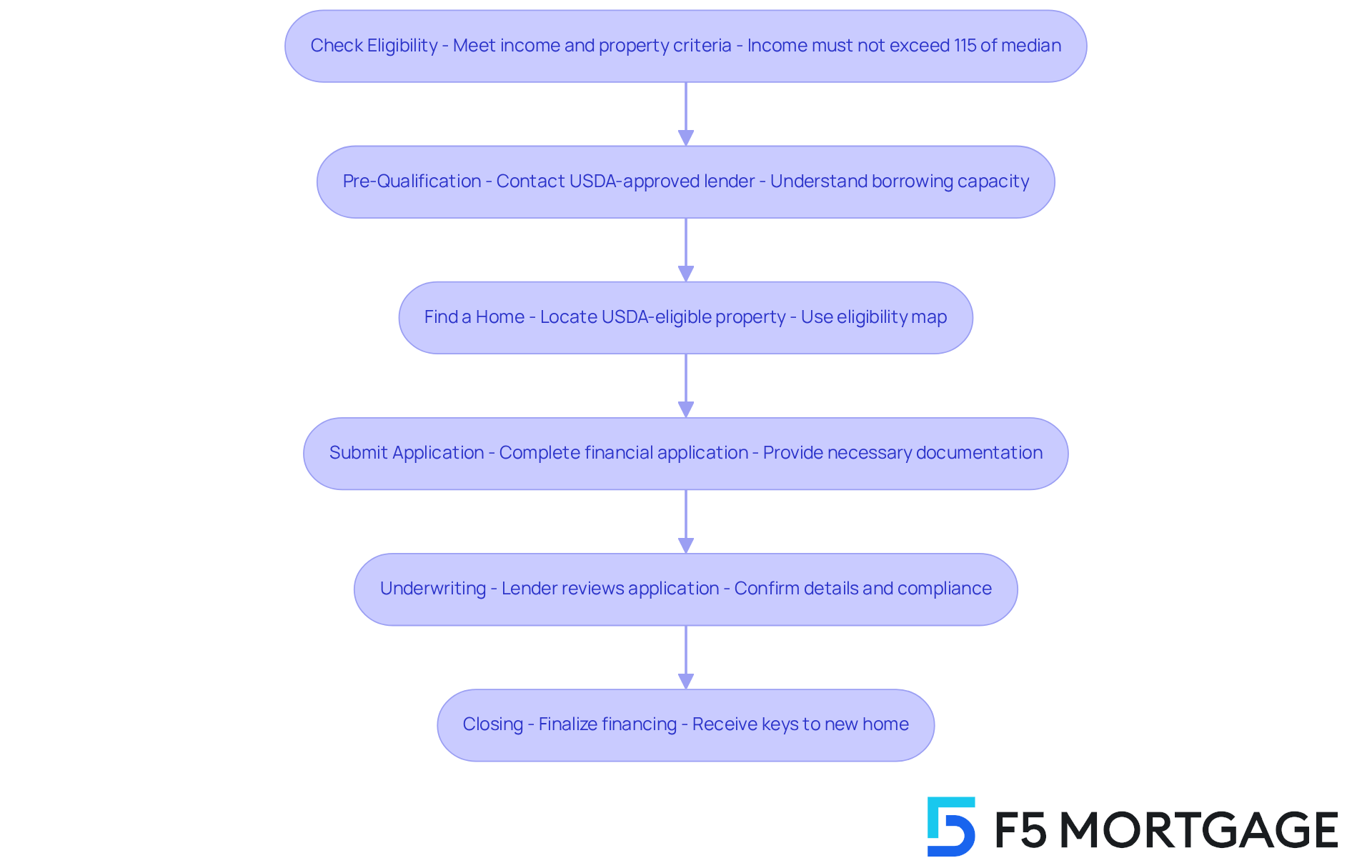

Applying for a USDA loan can feel overwhelming, but by following these key steps, you can move toward successful homeownership with confidence:

Check Eligibility: We understand that knowing where you stand can be crucial. Ensure that you meet the rural development loan requirements, including the income and property qualification criteria essential for obtaining a government-backed mortgage. Your household monthly income must not exceed 115% of the median income for your area.

Pre-Qualification: Reach out to a USDA-approved lender, like F5 Mortgage, to get pre-qualified. This initial step helps you understand your borrowing capacity and sets the stage for the application process. As Tim Lucas highlights, “Prequalification with a lender approved by the Department of Agriculture is a crucial initial step in the approval process timeline for the program.”

Find a Home: Look for a USDA-eligible property that suits your needs. Utilize the USDA property eligibility map to ensure the home is located in a qualifying rural area. At F5 Mortgage, our financing officer and Account Manager will work closely with you and your realtor to assist you in finding your ideal home and securing your offer, preventing any unnecessary delays.

Submit Application: Complete the financial application, ensuring you provide all necessary documentation, including W-2s, pay stubs, and bank statements. We know how challenging this can be, but gathering everything in one go can simplify the process.

Underwriting: The lender will examine your application, confirm your details, and evaluate adherence to the rural development loan requirements. Promptly addressing any requests for additional documentation can facilitate this process and keep things on track.

Closing: Once your application is approved, complete the financing and finalize your new home, marking the culmination of your journey.

Tips for Success:

- Gather Documentation Early: Collect financial documents ahead of time to streamline the application process. This includes recent pay stubs, tax returns, and bank statements. We’re here to support you every step of the way.

- Stay in Communication: Maintain regular contact with your lender, such as F5 Mortgage, throughout the process. This ensures you receive timely updates and guidance, helping to navigate any potential challenges.

Statistics indicate that comprehensive preparation and proactive communication can greatly improve the chances of a successful application for funding. For instance, applicants who gather their documentation early and respond promptly to lender requests often experience smoother processing times. Real-life instances demonstrate that families who collaborated closely with USDA-approved lenders, such as F5 Mortgage, were able to obtain their financing efficiently, benefiting from the program’s 100% funding option and competitive rates. The case study titled ‘Path to Homeownership with Government-Assisted Financing’ highlights the benefits of such financing for prospective homeowners, especially those who might not meet the criteria for FHA financing.

USDA Loan Interest Rates and Payback Periods: What to Expect

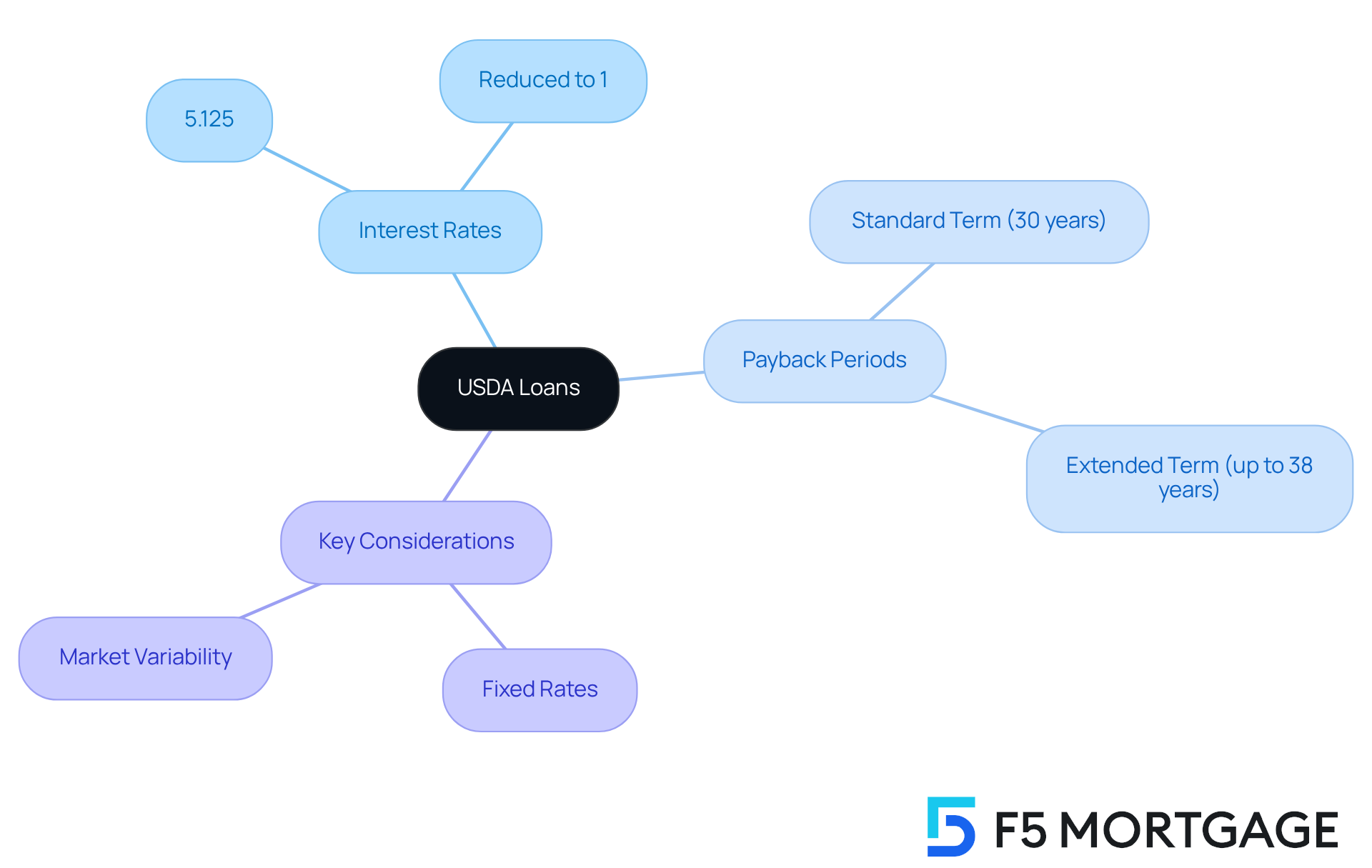

These government-backed mortgages are recognized for their competitive interest rates, often more advantageous than those of traditional financing. As of September 2025, the interest rate for agricultural financing is set at 5.125% for low-income borrowers. Through assistance programs, these rates can be reduced to as low as 1%. This affordability is crucial for families seeking homeownership in rural areas, as it directly relates to the rural development loan requirements.

Payback Periods:

- Standard Term: The standard repayment period for USDA loans is 30 years. This allows borrowers to spread their payments over a significant duration, making it easier to manage.

- Extended Term: Very low-income borrowers may qualify for an extended repayment duration of up to 38 years. This makes monthly installments more manageable and accessible, providing a greater sense of security.

Key Considerations:

- Fixed Rates: USDA loans typically feature fixed interest rates. This ensures stability in monthly payments throughout the loan term, allowing families to plan their budgets effectively.

- Market Variability: While interest rates are generally stable, they can fluctuate based on market conditions. It’s essential for potential borrowers to stay informed about current rates and options available to them.

Families benefiting from government financing often discover that these attractive rates and adaptable repayment terms significantly enhance their capacity to attain homeownership. We know how challenging this can be, and financial analysts emphasize that the affordability of government-backed financing makes it a viable choice for families with constrained financial means. Ultimately, meeting rural development loan requirements fosters prosperity and enhances the quality of life in rural areas. We’re here to support you every step of the way.

Other Requirements for USDA Loans: Documentation and Conditions

When considering USDA loans, it’s essential to understand not only the eligibility criteria but also the rural development loan requirements and the specific documentation required to support your application.

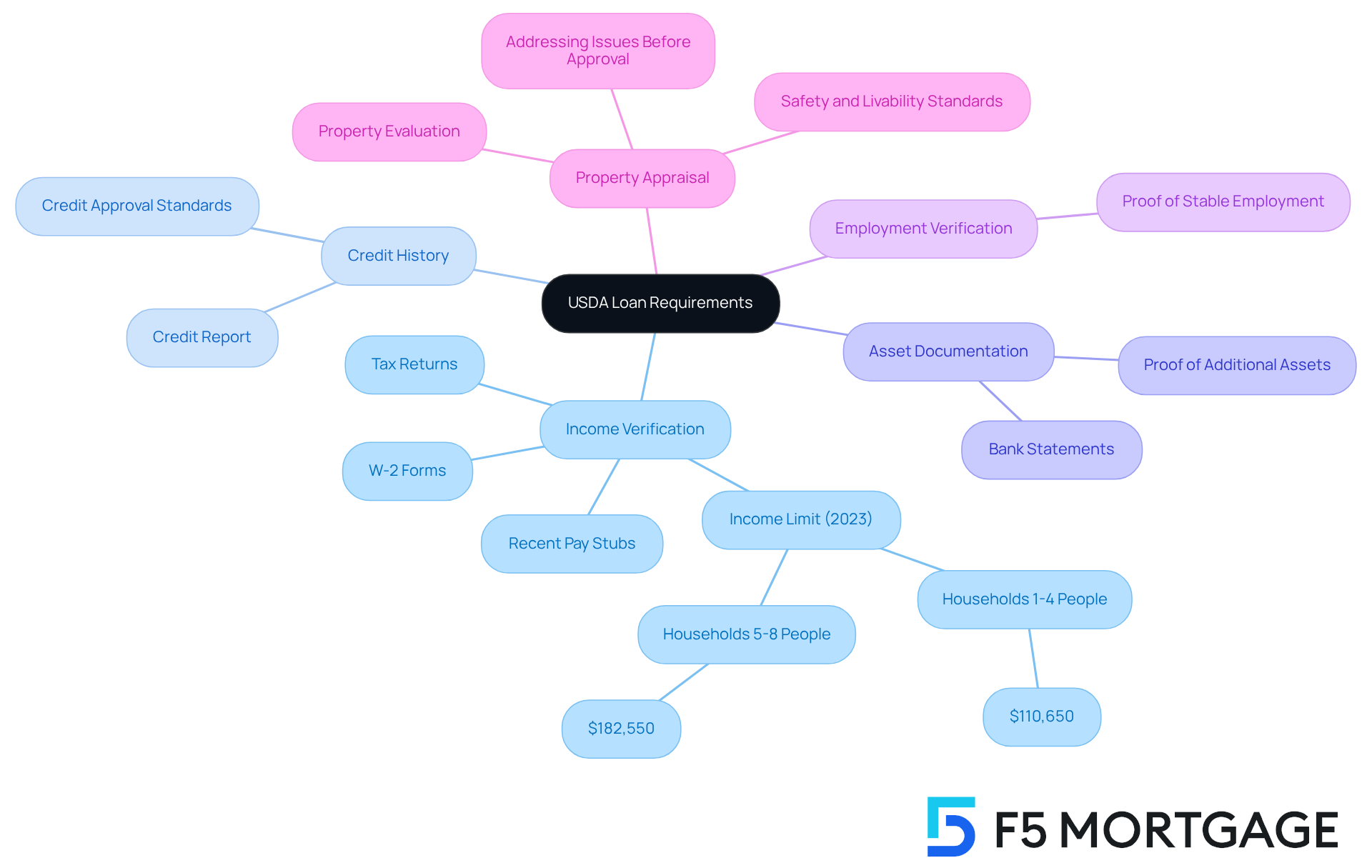

Income Verification: To demonstrate stable income, recent pay stubs, tax returns, and W-2 forms are crucial. For instance, in Michigan, the 2023 income limit for households with 1-4 people is set at $110,650. This highlights the importance of accurate income documentation in your application process.

Credit History: A credit report is necessary to evaluate your creditworthiness. It’s important to note that not all borrowers may meet the criteria for government-backed financing due to credit approval standards.

Asset Documentation: Providing bank statements and proof of any additional assets helps lenders assess your financial stability.

Employment Verification: Lenders typically require proof of stable employment to ensure that you have a reliable source of income.

Property Appraisal: An evaluation of the property is essential to verify its worth and condition, ensuring it meets safety and livability standards. Any issues found must be addressed prior to approval, making this evaluation process vital.

Real-life examples show just how important thorough documentation can be. Families seeking government assistance often compile necessary documents like tax returns and bank statements to demonstrate their eligibility. This proactive approach not only streamlines the application process but also significantly enhances their chances of approval.

By understanding the rural development loan requirements, families can more effectively navigate the complexities of obtaining government financing, empowering them to achieve their homeownership dreams. We know how challenging this can be, and we’re here to support you every step of the way.

USDA Loans FAQs: Common Questions Answered

USDA Loans FAQs: Common Questions Answered

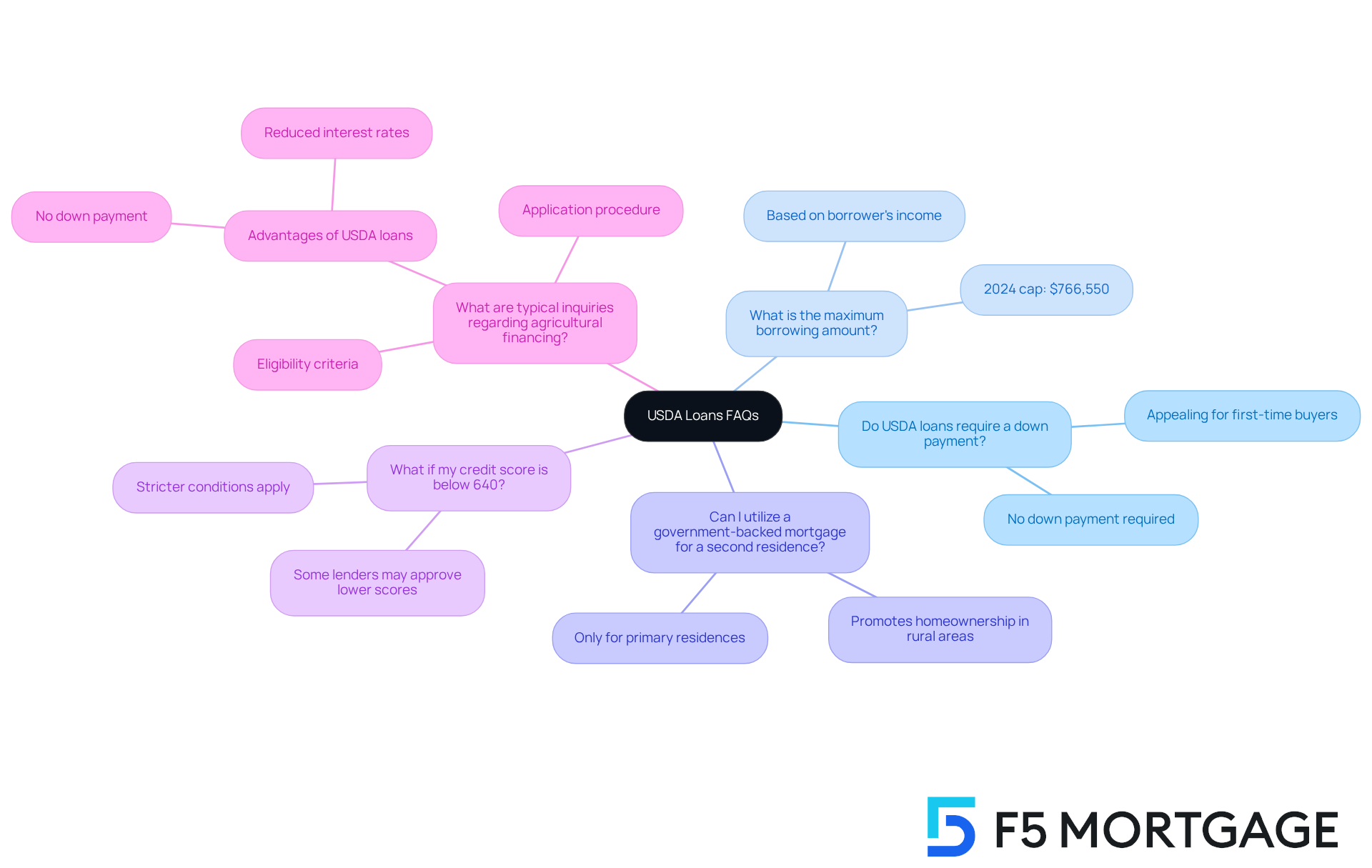

Do USDA loans require a down payment? No, government-backed mortgages usually do not necessitate a down payment. This feature makes them an appealing choice for first-time home purchasers who may feel overwhelmed by upfront costs.

What is the maximum borrowing amount? The highest amount available is based on the borrower’s earnings and capacity to repay. In 2024, caps are established at $766,550 for the continental U.S., allowing families to find a suitable home within their means.

Can I utilize a government-backed mortgage for a second residence? No, these financial programs are solely for main residences. This focus ensures that the initiative promotes homeownership in qualifying rural regions, supporting families in building their futures.

What if my credit score is below 640? While numerous lenders favor a minimum credit score of 640, some may still authorize financing with lower scores, albeit with stricter conditions. In fact, we know that a significant percentage of applicants for government-backed financing have credit scores below this threshold, which highlights the program’s adaptability and commitment to helping families.

What are typical inquiries regarding agricultural financing? Many households navigating the government-backed financial assistance process often ask about the rural development loan requirements, including eligibility criteria, the application procedure, and the advantages of these options, such as no down payment and reduced interest rates. Real-life examples illustrate how families have successfully utilized USDA loans to achieve their homeownership goals, emphasizing the program’s accessibility and support for low- to moderate-income buyers. We’re here to support you every step of the way.

Conclusion

Navigating the landscape of rural development loans can significantly empower families seeking homeownership. We understand how challenging this can be, and knowing the essential requirements and criteria for USDA loans is crucial. This knowledge equips potential borrowers to make informed decisions. By prioritizing personalized consultations, families can receive tailored guidance that simplifies the often complex loan application process, ensuring they are well-prepared to meet the necessary qualifications.

Key points to consider include:

- Income limits

- Property eligibility

- Credit score considerations

Each of these plays a vital role in securing financing. Furthermore, the advantages of zero down payment options and competitive interest rates highlight the accessibility of these loans for families with varying financial backgrounds. Real-life examples demonstrate how understanding these requirements can lead to successful outcomes, ultimately making the dream of homeownership feasible for many.

In conclusion, the significance of rural development loans cannot be overstated. They offer families a pathway to stability and prosperity in their communities. By taking proactive steps—such as consulting with experts and gathering necessary documentation—families can navigate the process with confidence. Embracing the opportunities presented by USDA loans not only fosters individual growth but also contributes to the overall well-being of rural areas. The journey to homeownership is within reach; seize the moment and explore the benefits that await.

Frequently Asked Questions

What services does F5 Mortgage offer for rural development loans?

F5 Mortgage offers personalized consultations to help households navigate rural development loan requirements, providing tailored advice and expert guidance to simplify the financing process.

How does F5 Mortgage tailor its consultations?

Each consultation is crafted to address a family’s specific circumstances, ensuring exceptional service that aligns with individual needs and homeownership goals.

What is the typical timeframe for closing a rural development loan with F5 Mortgage?

F5 Mortgage aims for quick financing closure, often completing the process in under three weeks.

What percentage of purchase mortgage applications were approved in 2023?

In 2023, lenders approved 85.76% of purchase mortgage applications, highlighting the effectiveness of personalized advice in achieving positive outcomes.

What are the key eligibility criteria for a USDA loan?

To qualify for a USDA loan, applicants must meet income limits (not exceeding 115% of the median income for their area), the property must be located in a designated rural area, the home must be the primary residence, and the applicant must be a U.S. citizen or qualified non-citizen.

What are the income limits for USDA loan eligibility?

Income limits vary by area; for example, in 2025, the limit for a household of four in Michigan is $110,650, while in Fort Worth, Texas, it is $122,700.

Is there a minimum credit score requirement for USDA loans?

There are no strict minimum credit score requirements, but most lenders prefer a score of at least 640 when evaluating applicants.

What are the down payment requirements for USDA financing?

USDA financing typically requires no down payment, allowing borrowers to cover 100% of the home’s purchase price, though making a deposit can reduce monthly payments and total interest.

What should borrowers be aware of regarding closing costs?

Borrowers should budget for closing costs, which typically range from 2% to 5% of the loan amount. For example, on a $300,000 home, closing costs could total between $6,000 and $15,000.

What additional costs should families consider when refinancing a mortgage?

Families should be aware of specific costs related to mortgage refinancing, including application fees, origination fees, and appraisal costs.