Overview

This article highlights ten essential refinancing options, designed specifically for families eager to enhance their homes. We understand how important it is to navigate financial decisions, and each option—like cash-out refinancing and rate-and-term refinancing—is explained with care. These options can empower families to manage their finances better, improve cash flow, and reduce overall debt. Our goal is to support you in making informed choices about your home financing, ensuring you feel confident every step of the way.

Introduction

Navigating the world of home financing can feel overwhelming, especially for families looking to upgrade their living spaces. We know how challenging this can be. With a myriad of refinancing options available, homeowners have the opportunity to not only improve their financial situation but also enhance their homes. However, with so many choices, how can families determine which refinancing strategy is best suited to their unique needs?

This article delves into ten essential refinancing options that can empower families to make informed decisions, streamline their finances, and ultimately transform their homes into the spaces they’ve always envisioned. We’re here to support you every step of the way.

F5 Mortgage: Personalized Refinancing Solutions for Homeowners

At F5 Mortgage, we understand how challenging the lending process can be for families. That’s why we set ourselves apart by offering customized loan solutions tailored to meet your unique needs. Our commitment to your satisfaction is unwavering, and we provide consultations designed to help you navigate the often complex landscape of refinancing options.

Imagine being able to get pre-qualified for a loan in just 10 minutes. This quick start can set you on a positive financial journey. By partnering with over two dozen top lenders, we give you access to a wide range of loan programs, making it easier for you to find the most advantageous options for your situation.

Our personalized approach simplifies the loan restructuring process, empowering you to make informed choices about your mortgage options. With a of 94% and an impressive 4.9 rating based on over 300 reviews, families can upgrade their homes with confidence and ease.

Our dedicated loan officers are here for you, known for their exceptional communication skills and personal touch. They provide no-pressure guidance and manage the entire loan process, ensuring you feel supported every step of the way. We encourage homeowners to consult with a loan officer to set rate alerts for favorable refinancing options, further enhancing your refinancing experience. We’re here to support you on this journey.

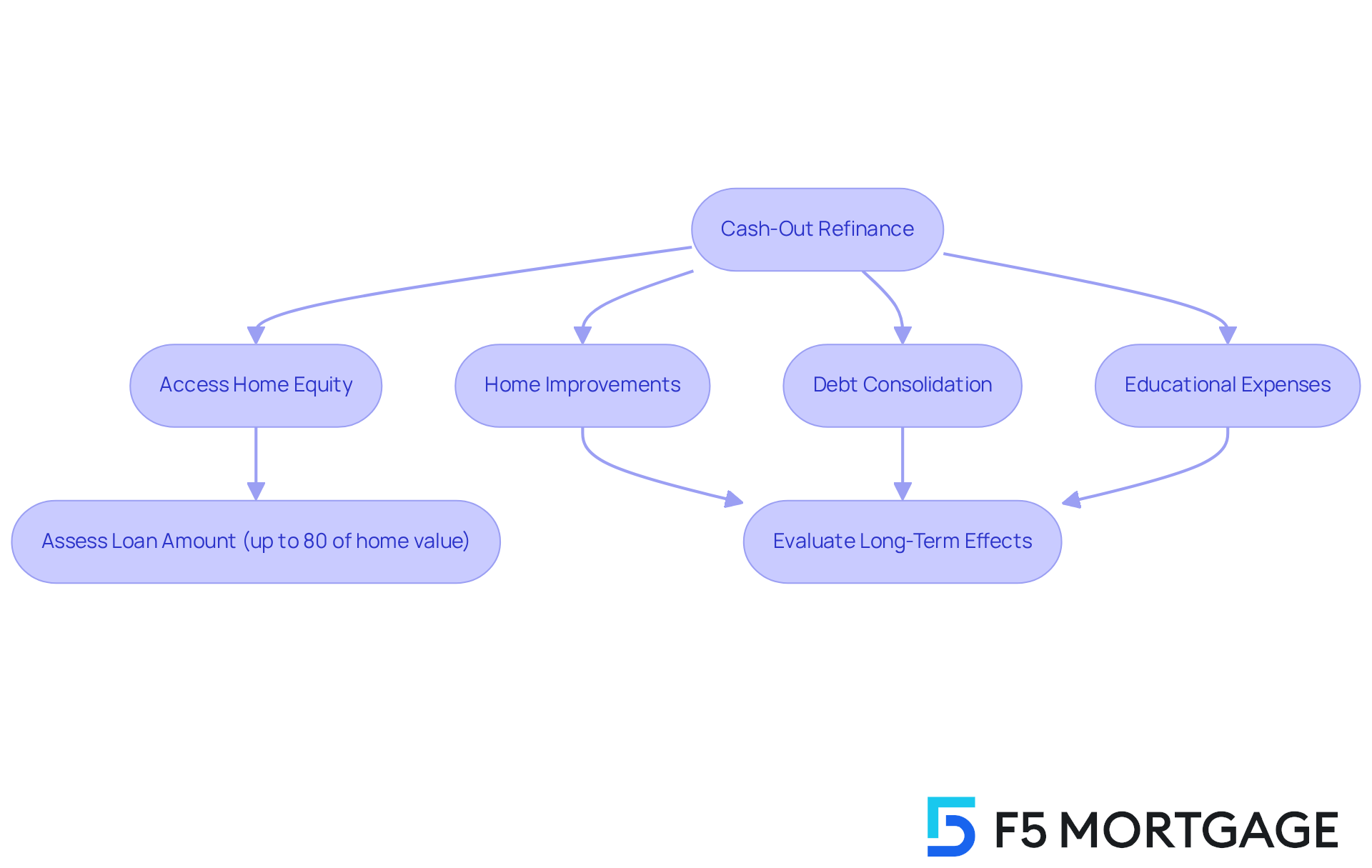

Cash-Out Refinance: Access Home Equity for Cash Needs

A cash-out refinance allows homeowners to tap into the equity built in their properties by replacing their existing mortgage with a larger loan. This financial strategy offers families access to cash for various purposes, such as home improvements, consolidating high-interest debt, or funding educational expenses. Typically, homeowners can borrow up to 80% of their home’s value, making this a versatile option for those looking to .

Many families have successfully used cash-out loans to enhance their living spaces. In fact, data indicates that around 40% of homeowners who chose this option in 2025 allocated the funds for home enhancements. It’s important to remember that assessing the long-term effects of rising loan balances is crucial. Financial consultants emphasize ensuring that the benefits—like reduced monthly payments compared to credit card debt—outweigh the associated costs.

We recommend engaging with a loan broker to evaluate your unique financial situation and determine if cash-out restructuring aligns with your broader economic goals. This approach not only simplifies budgeting by consolidating debts but can also potentially improve credit scores by reducing high-interest liabilities. As you explore refinancing options for loan restructuring, understanding the intricacies of cash-out loan adjustments can empower you to make informed decisions that enhance your financial wellness.

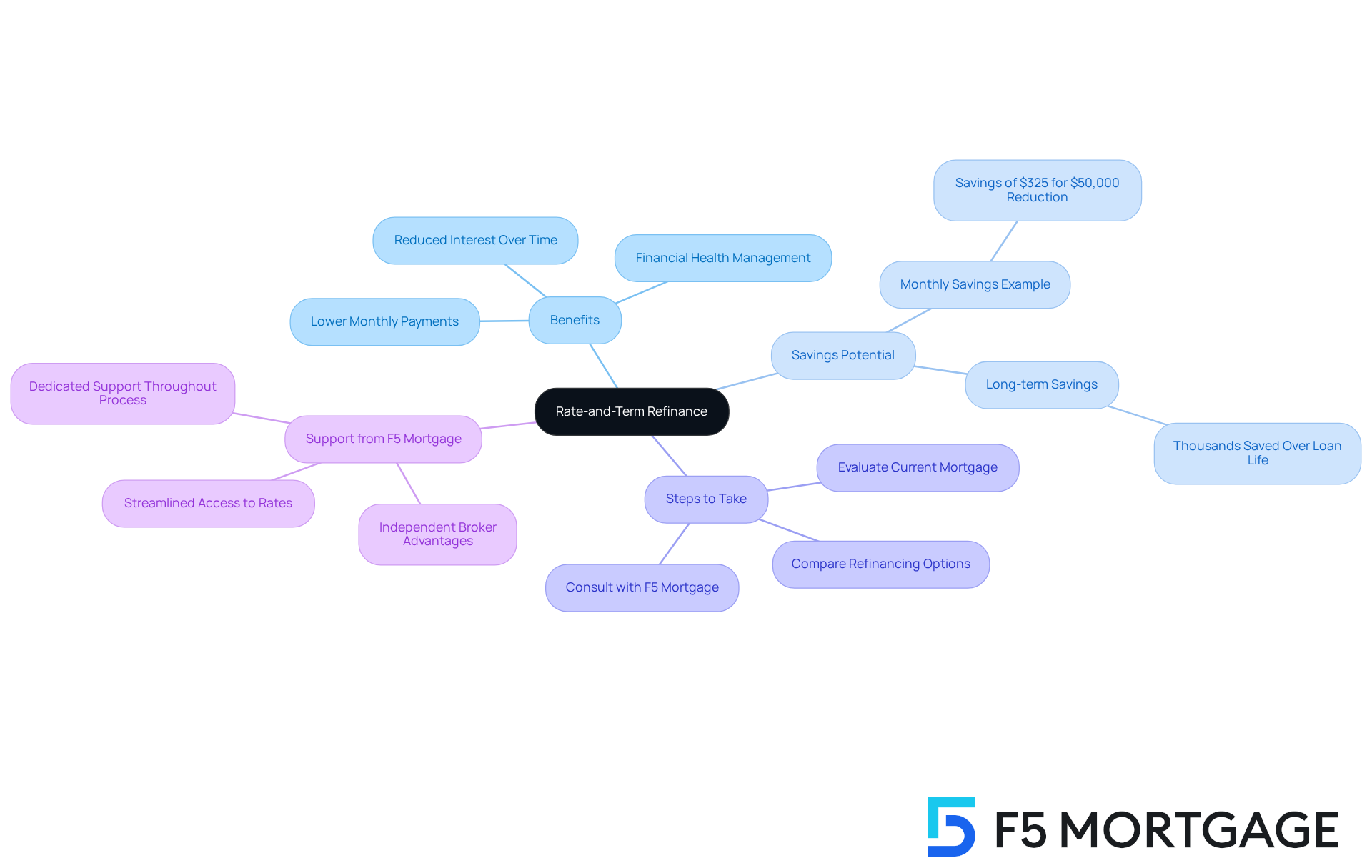

Rate-and-Term Refinance: Adjust Your Mortgage Terms for Better Rates

Rate-and-term restructuring is a thoughtful approach that allows homeowners to adjust their mortgage interest rate and loan duration without altering the loan amount. We understand how important it is for families to lower their monthly payments or reduce the total interest paid over the life of the loan. By restructuring to a lower interest rate, families can potentially save hundreds of dollars each month, freeing up funds for other important priorities, such as education or home improvements.

With F5 Mortgage, California homeowners have the advantage of working with an who is dedicated to their needs, rather than those of the lenders. This means streamlined access to the lowest refinance rates available, thanks to a caring team that simplifies the process. We encourage homeowners to evaluate their current mortgage conditions and compare them with available refinancing options to uncover potential savings. For instance, if a family can adjust from a rate above 7% to around 6.5%, they could experience significant monthly savings, especially if the new rate is at least 0.75% to 1% lower than their current one. Statistics reveal that households transitioning to reduced interest rates can save thousands over the life of their loans, making this an appealing choice for many.

Moreover, many families have reported substantial financial relief through rate-and-term restructuring, with some experiencing monthly payment reductions of about $325 for a $50,000 decrease in their mortgage balance. This strategy not only enhances cash flow but also empowers families to manage their overall financial health more effectively. To maximize these benefits, we recommend that families reach out to F5 Mortgage to explore their extensive network of lenders and receive dedicated support throughout the loan modification journey.

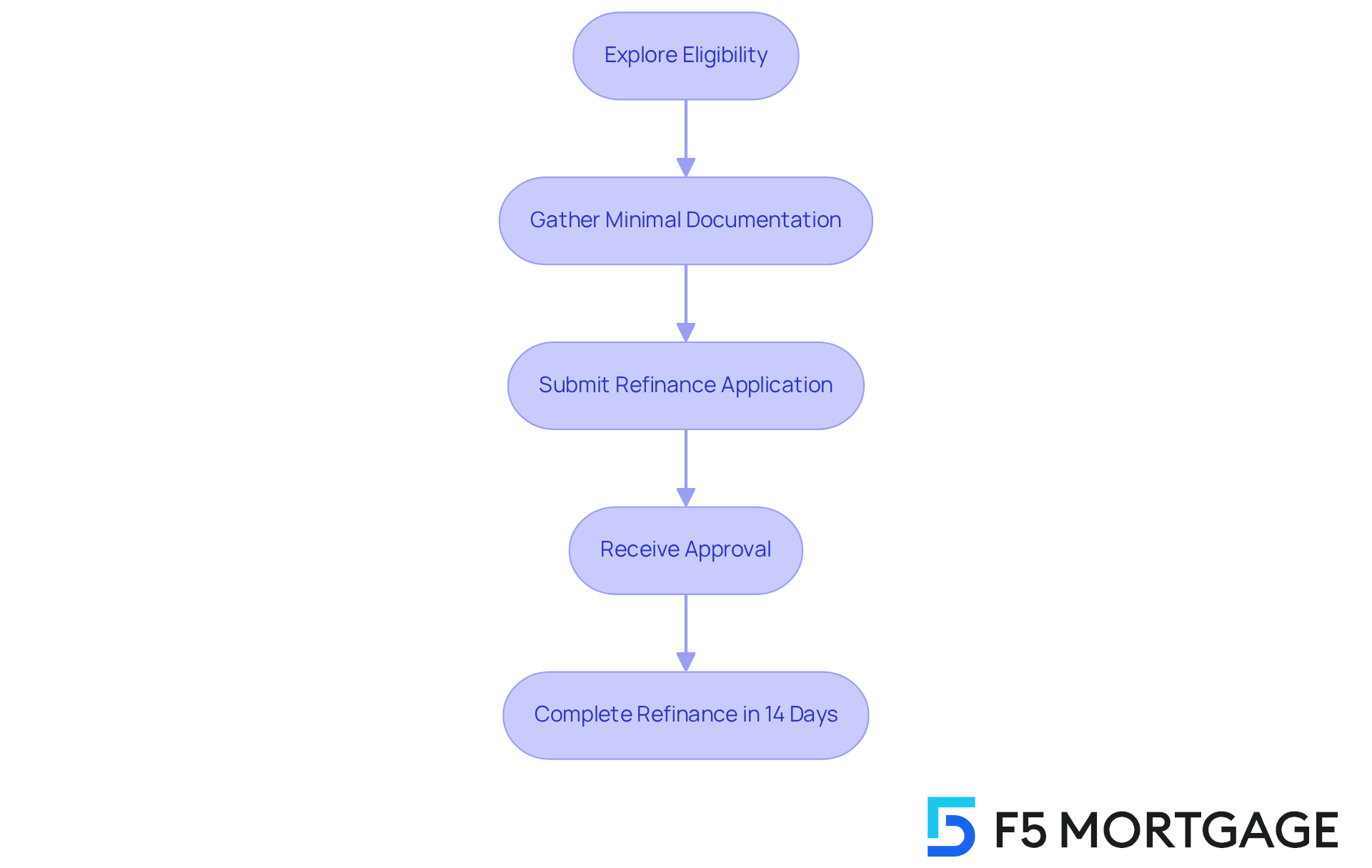

Streamline Refinance: Simplified Options for FHA and VA Loans

We know how challenging managing a mortgage can be, especially for FHA and VA mortgage holders. Streamline loan restructuring offers straightforward refinancing options that allow you to refinance with minimal documentation and without the need for a home appraisal. This method is designed to simplify the loan modification process, often resulting in lower interest rates and reduced monthly payments.

For eligible homeowners, this can be a quick way to improve mortgage terms using refinancing options without the complexities of traditional refinancing. We encourage families to explore their eligibility for these refinancing options, as the benefits can significantly enhance their economic situation.

With F5 Mortgage, many households have , often completing refinances in as little as 14 days by exploring various refinancing options. This swift turnaround enables families to quickly explore refinancing options to secure better rates and alleviate financial pressures. The simplicity of streamline refinancing options not only makes the journey to homeownership more manageable but also empowers households to make informed financial decisions, leading to substantial savings over time.

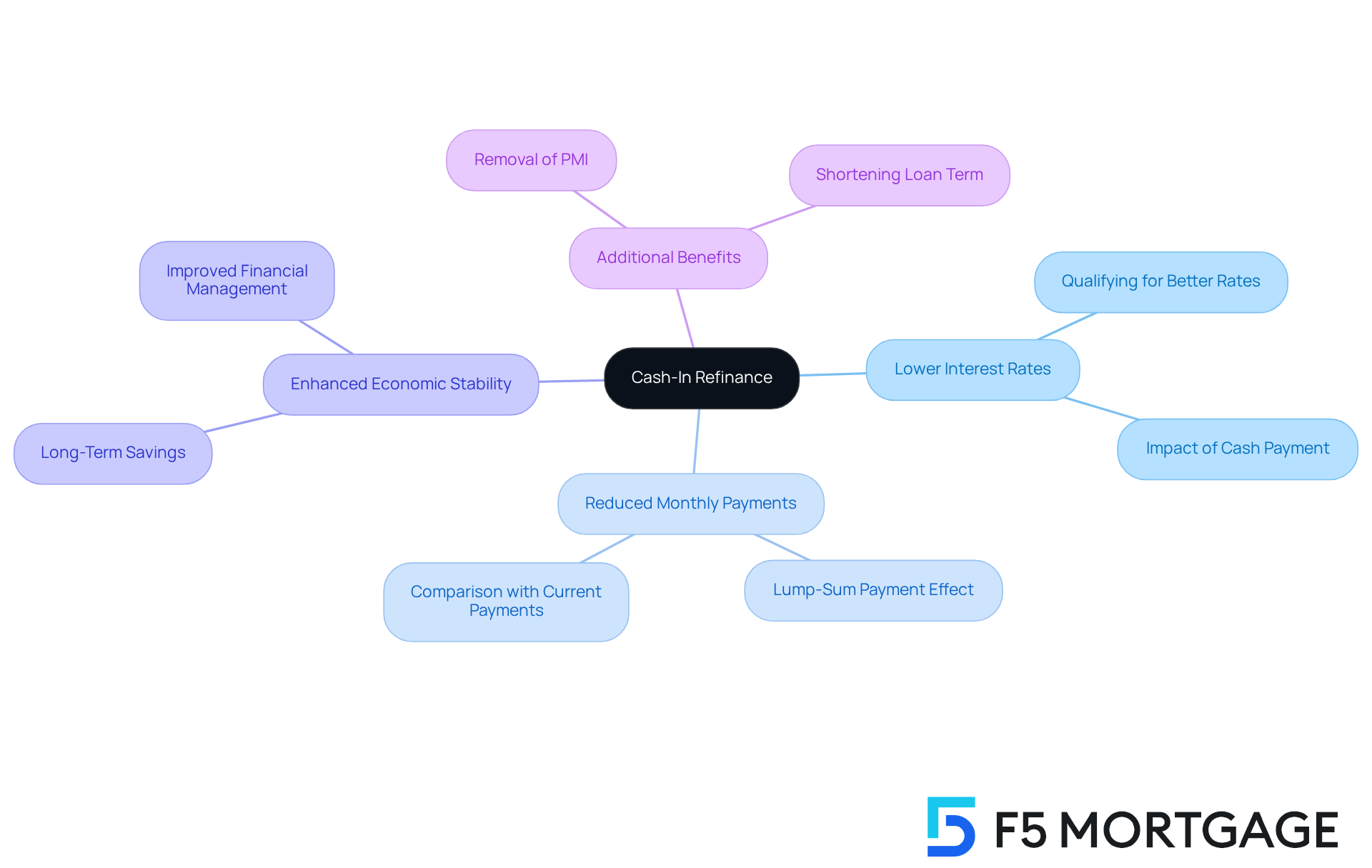

Cash-In Refinance: Reduce Your Mortgage Balance for Better Terms

A cash-in refinance can be a valuable refinancing option for homeowners exploring their refinancing options to improve their financial situation. By paying extra cash at closing, you can effectively reduce your mortgage balance. This strategic approach not only leads to more but can also lower your interest rates, making it especially beneficial if you have built up savings.

Reducing the principal owed may allow you to qualify for a lower interest rate, resulting in significant savings over the life of your loan. Many homeowners who have chosen cash-in refinancing report substantial decreases in their monthly payments, which ultimately enhances their overall economic stability. We know how challenging it can be to manage finances, and this option offers a path toward relief.

Financial advisors frequently promote cash-in refinancing, observing that it not only enhances loan terms but also prepares families for lasting financial well-being. Additionally, making a lump-sum payment at closing can reduce the number of payments left until full repayment. With thoughtful consideration and preparation, numerous families have effectively utilized refinancing options to secure better financing conditions and lower their total borrowing expenses.

If you’re aiming to enhance your residence and improve your financial outlook, cash-in refinancing could be a practical choice. We’re here to support you every step of the way as you explore this opportunity.

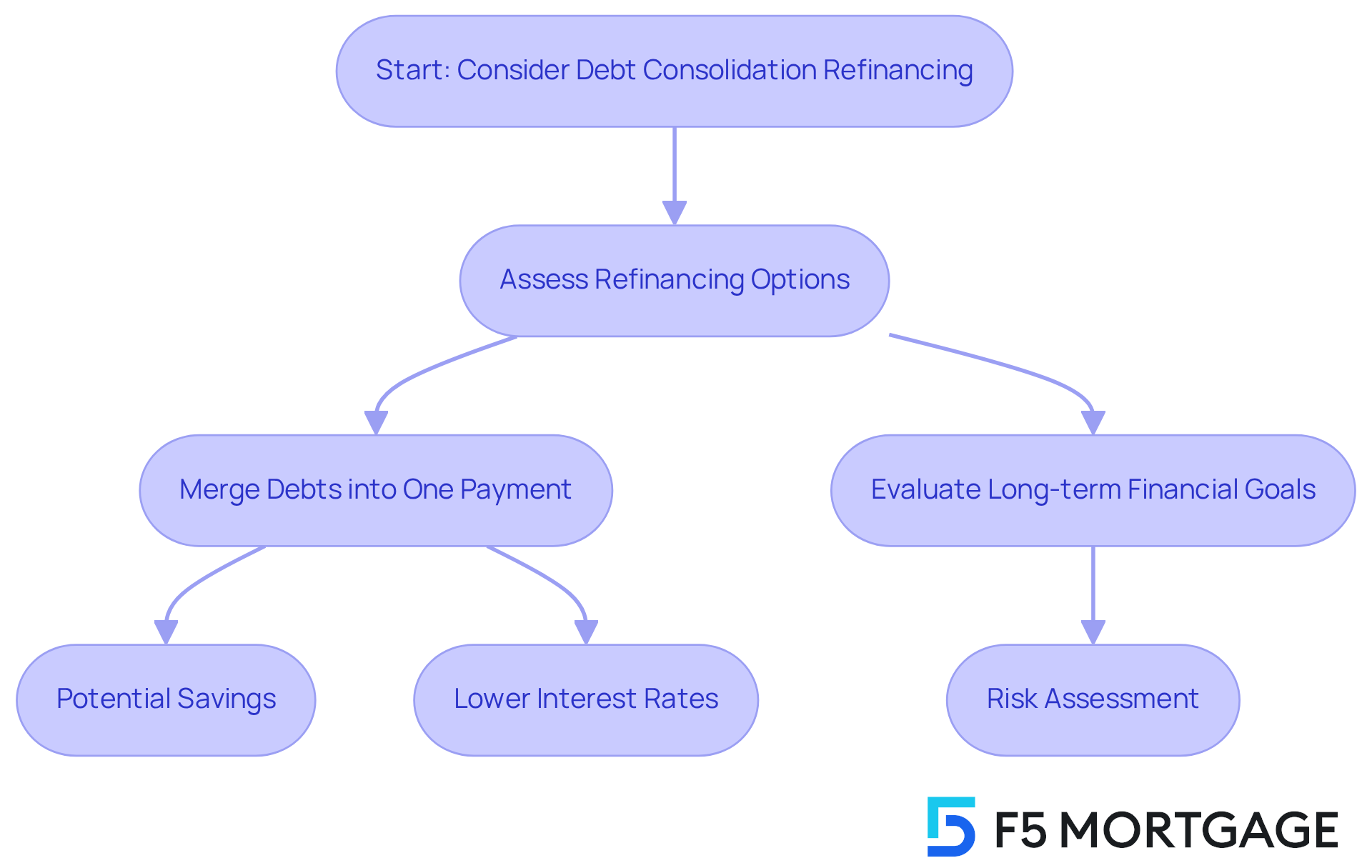

Debt Consolidation Refinance: Combine Debts into One Payment

Debt consolidation refinancing options provide homeowners a valuable opportunity to combine multiple debts into a single mortgage payment, often resulting in a lower interest rate. We know how challenging managing various debts can be, and this strategy not only simplifies financial management by reducing the number of monthly payments but also has the potential to lower overall interest costs. For instance, households can tap into their home equity to pay off high-interest debts, like credit cards, which typically carry average rates around 21%. By consolidating these debts, families can regain control over their finances and improve their cash flow.

Real-life examples truly highlight the effectiveness of this approach. Many households have successfully merged their debts into one manageable payment, allowing them to focus on their home loan while alleviating the stress of juggling multiple obligations. Financial specialists emphasize that utilizing refinancing options to combine high-interest debts into a home loan can lead to significant savings. Homeowners may find that they experience average interest rate reductions of 1.45 percentage points when refinancing, translating into meaningful monthly savings.

However, it’s essential to carefully assess the refinancing options of the new mortgage to ensure they align with your long-term financial goals. As economic experts point out, while merging debt can ease monthly payments, it might also extend the repayment period, which means families could remain in debt longer than anticipated. Therefore, a thorough evaluation of your personal financial situation and risk tolerance is crucial before moving forward with a debt consolidation refinance. We’re here to as you navigate this important decision.

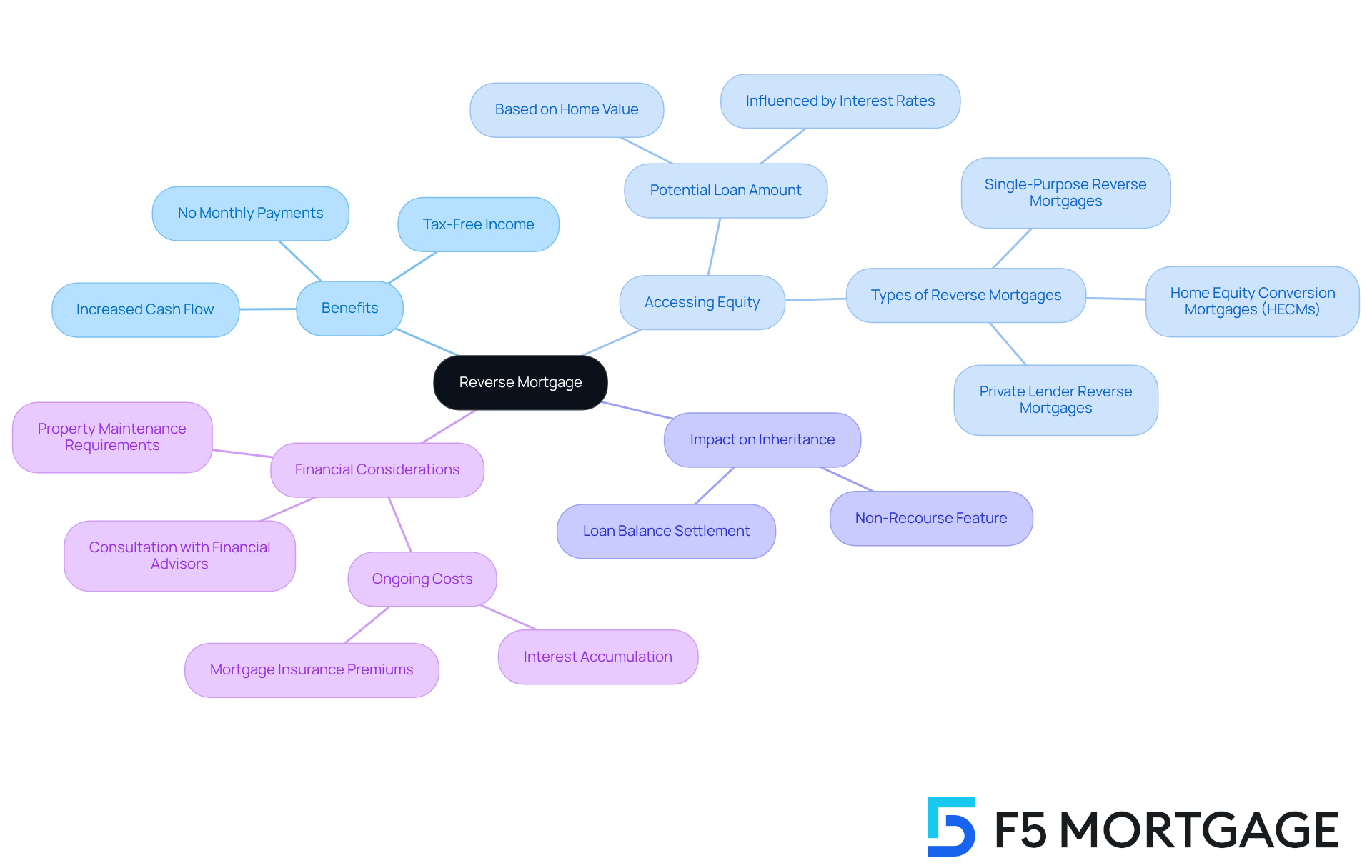

Reverse Mortgage: Access Home Equity Without Monthly Payments

A reverse mortgage offers a valuable opportunity for homeowners aged 62 and older to access their home equity without the stress of monthly mortgage payments. Instead of requiring payments, the loan balance grows over time as interest accumulates. This financial tool can significantly enhance retirees’ cash flow, providing support for living expenses, healthcare costs, or even home improvements. For example, a 72-year-old homeowner with a property valued at $600,000 could potentially access around $300,000, and this amount may increase with lower interest rates, creating a substantial economic cushion.

Understanding the implications of a reverse loan is essential for families, especially regarding its impact on inheritance and overall home equity. While it offers immediate financial relief, it can also affect the amount left for heirs, as the loan balance must be settled after the homeowner’s passing. Thankfully, reverse loans are non-recourse financial products, meaning borrowers will not owe more than the home’s value at repayment, easing concerns about inheritance. Financial consultants emphasize that reverse loans should be evaluated carefully, ensuring they align with the property owner’s long-term financial goals. As Paul Scheper highlights, strategically using home equity can be crucial for seniors navigating retirement.

With the around $300,000, reverse loans can be a significant resource for those seeking to boost their retirement income. By providing a steady cash flow, these loans can alleviate financial pressures, allowing retirees to maintain their quality of life while keeping their homes. We encourage families to explore various refinancing options and consult with a financial advisor to make informed decisions. After all, we know how challenging this can be, and we’re here to support you every step of the way.

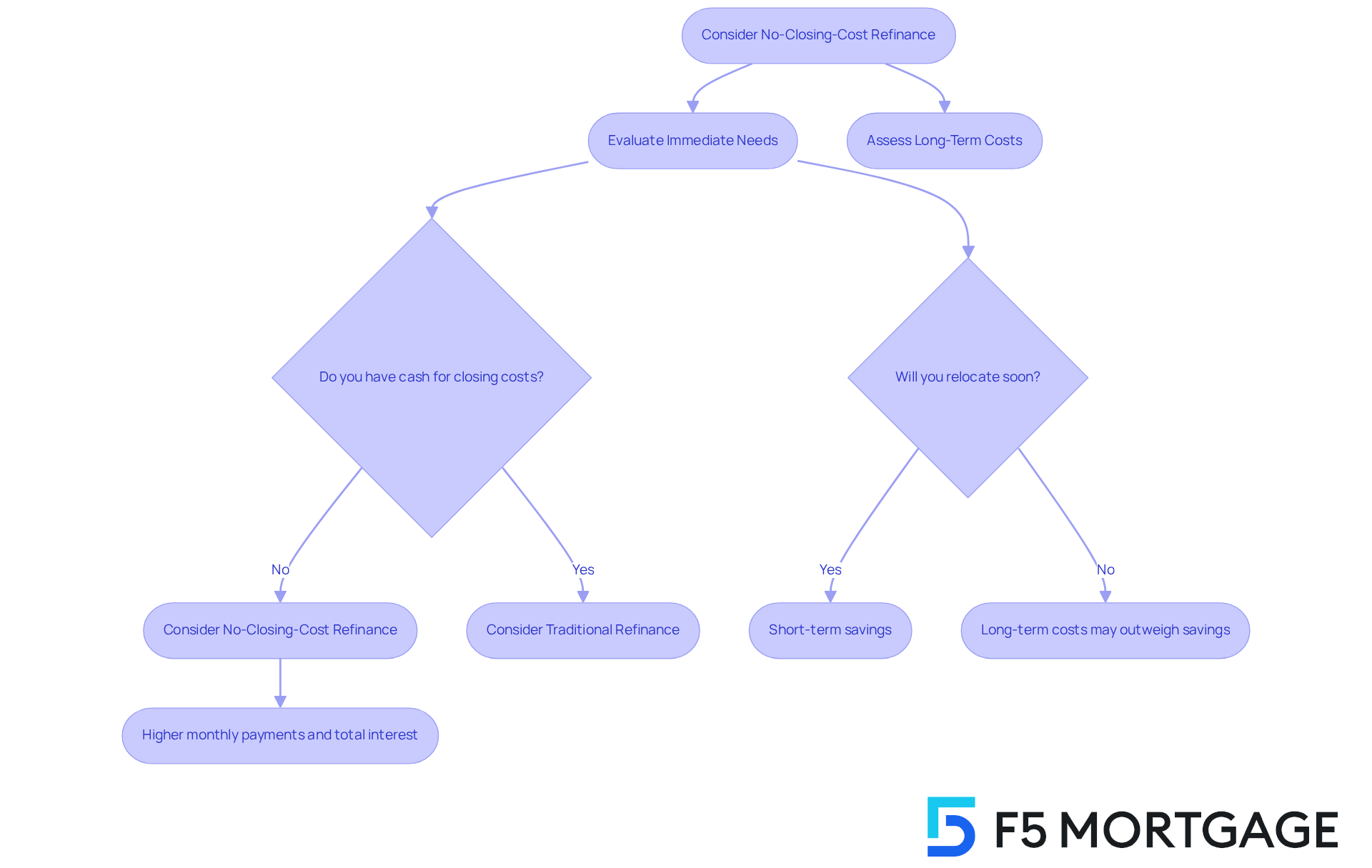

No-Closing-Cost Refinance: Refinance Without Upfront Fees

No-closing-cost mortgage restructuring offers a way for homeowners to adjust their mortgage without the stress of upfront closing expenses. Instead of paying these costs out of pocket, they can be rolled into the loan amount or offset by accepting a slightly higher interest rate. This option is particularly beneficial for families who may not have the funds available for closing costs, making refinancing options a more achievable goal.

However, it’s important to consider the long-term effects of this choice. While it may save you money upfront, it can lead to throughout the duration of the loan. For instance, families who opt for this route should be aware that they might end up paying thousands of dollars in additional interest over the life of the loan due to the increased rate.

Mortgage professionals often encourage borrowers to carefully evaluate their financial situation and future plans before deciding on refinancing options, such as a no-closing-cost refinance. As one expert wisely noted, ‘If you don’t have the cash to pay for closing costs upfront, or you need the money for something else, a no-closing-cost refinance might be your best option.’

Real-life examples show that families planning to relocate within a few years may find this option particularly advantageous. It allows them to avoid immediate costs while still accessing lower rates. Ultimately, it’s essential for families to reflect on their unique circumstances and long-term goals when considering refinancing options for their strategy. We know how challenging this can be, and we’re here to support you every step of the way.

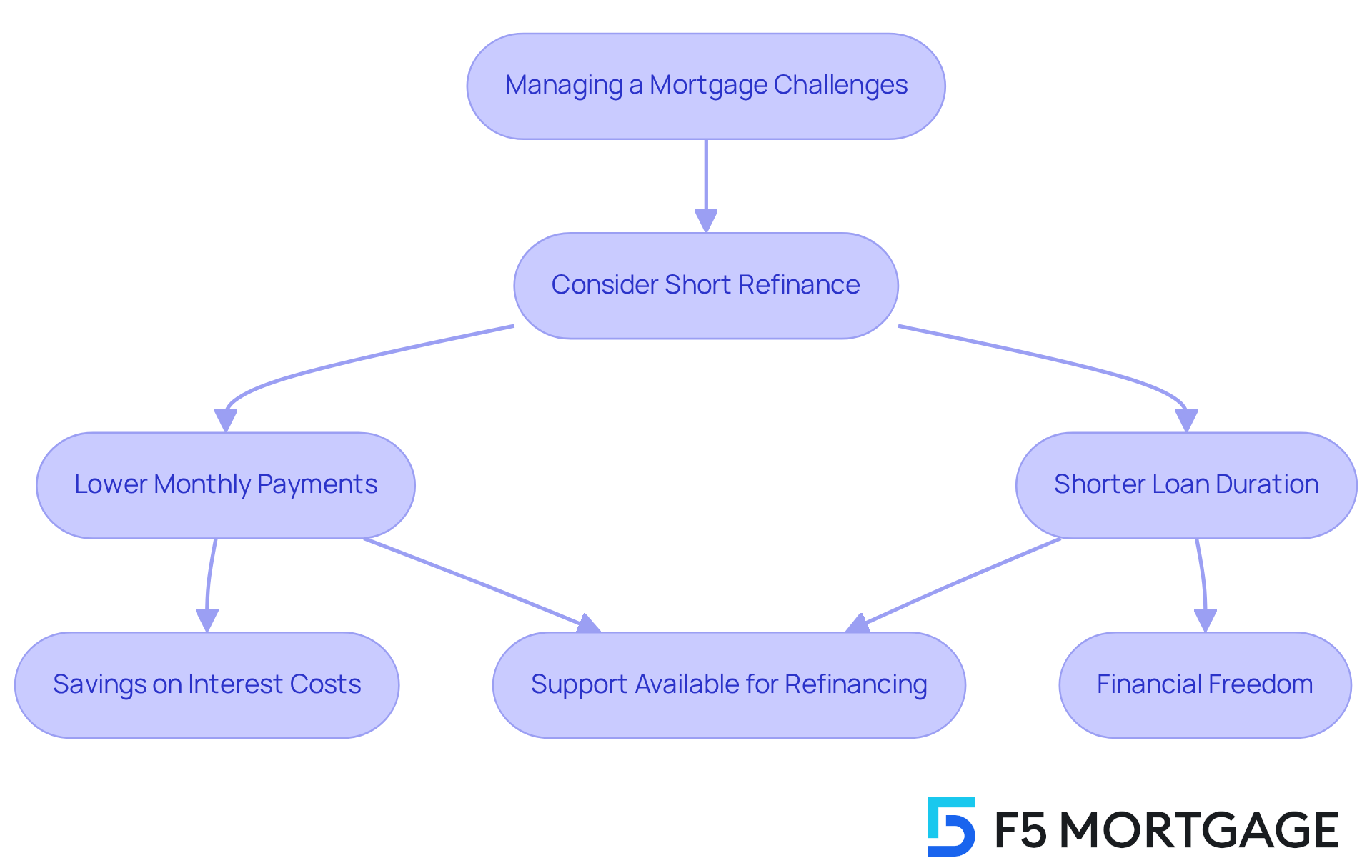

Short Refinance: Pay Off Your Mortgage Faster

We know how challenging managing a mortgage can be. A brief refinance offers homeowners a chance to adjust their loan to an amount lower than their existing balance, effectively reducing their debt. This thoughtful decision can lead to lower monthly payments and a shorter loan duration, allowing families to pay off their home loans more quickly.

By choosing a shorter term, homeowners not only save on interest costs but also speed up their journey toward financial freedom. For instance, families who refinance from a 30-year to a 15-year loan can significantly decrease the total interest paid over the life of the loan, even if their monthly payments are slightly higher.

Financial experts often highlight that even modest improvements in interest rates can create substantial savings, especially for larger loans. Homeowners with strong credit and sufficient equity are in a great position to benefit from these refinancing options. They can secure better rates and avoid private mortgage insurance (PMI).

This approach not only enhances economic stability but also aligns with long-term financial goals. If you’re seeking to improve your home and financial situation, refinancing might be the right step for you. We’re here to support you every step of the way as you .

Home Equity Line of Credit (HELOC): Flexible Access to Home Equity

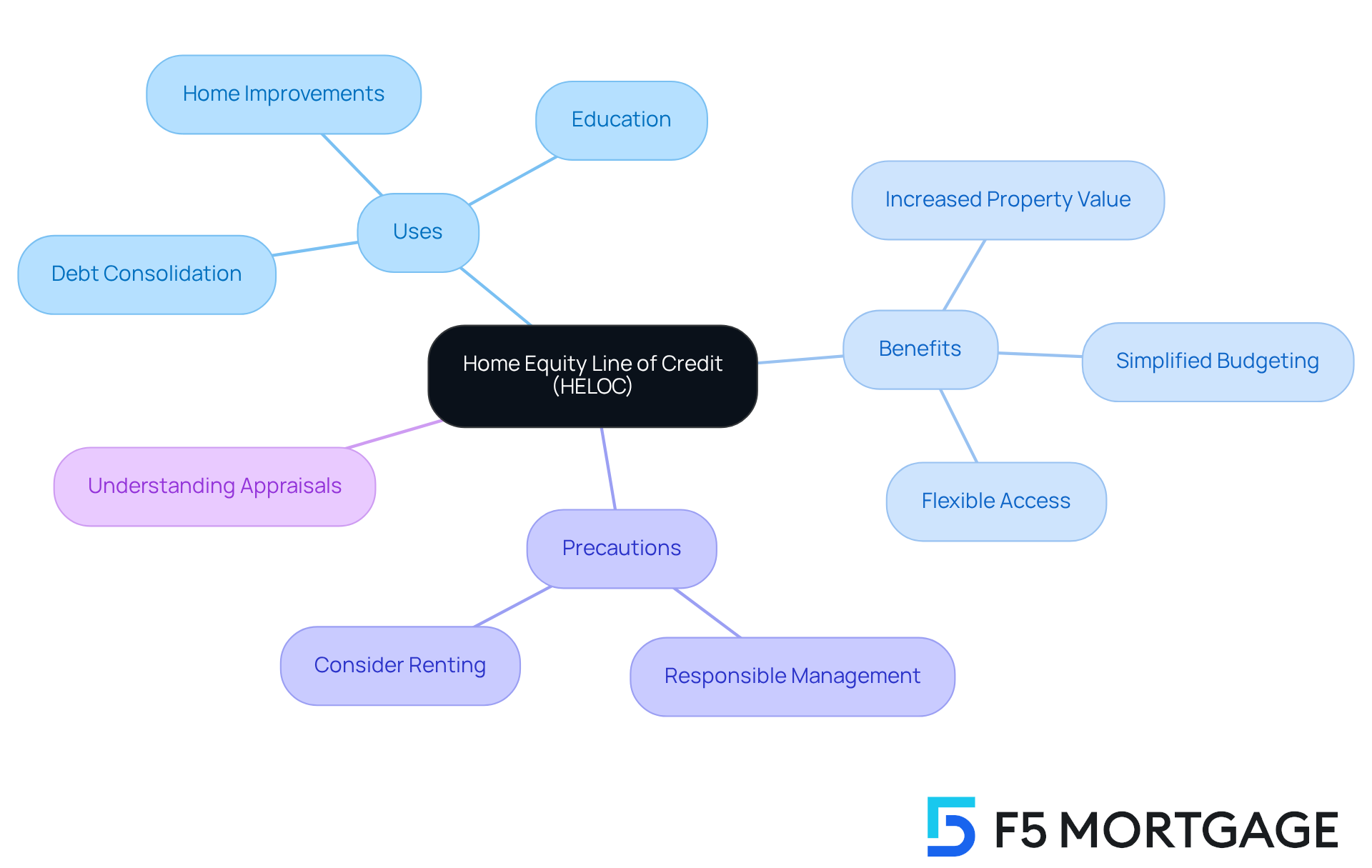

A Home Equity Line of Credit (HELOC) can be a valuable resource for homeowners looking to access their home equity. This flexible financing option allows families to draw funds as needed, whether for home improvements, education, or consolidating debt. Much like a credit card, a HELOC enables you to borrow up to a predetermined limit, with interest only charged on the amount you actually use. This can be particularly beneficial for households aiming to manage their expenses or enhance their living spaces.

We understand how important it is to create a comfortable home. Economic specialists highlight that using a HELOC for home enhancements can significantly increase your property’s value. For instance, many families have successfully remodeled kitchens or added decks, not only improving their enjoyment of their homes but also boosting long-term value. Additionally, merging high-interest debts into a single payment through a HELOC can simplify your budget, making financial management easier.

However, it’s crucial to approach this financing option with care. We know how challenging this can be, and borrowing against your home equity requires thoughtful planning and responsible management. Before deciding on a loan or HELOC, consider the advantages of renting. Renting can help you avoid property taxes and maintenance costs, providing you with financial flexibility.

Understanding home appraisals is also essential. These appraisals determine your property’s current market value and the equity available to you, which can directly impact mortgage rates and your refinancing options. We’re here to support you every step of the way as you .

Conclusion

Exploring refinancing options can significantly enhance the financial well-being of families looking to upgrade their homes. We understand how overwhelming this process can be, but the variety of refinancing strategies available—from cash-out and rate-and-term refinances to HELOCs and reverse mortgages—provides flexible pathways to access equity, lower monthly payments, and consolidate debts. Each option serves a unique purpose, allowing families to tailor their financial strategies to meet specific needs and goals.

Key insights from the article highlight the importance of personalized solutions, as offered by F5 Mortgage. They stand out for their commitment to customer satisfaction and comprehensive support throughout the refinancing process. Families can benefit from various refinancing options, such as:

- Streamline refinances for FHA and VA loans

- Cash-in refinances to reduce mortgage balances

- No-closing-cost refinances that eliminate upfront fees

These strategies not only simplify financial management but also empower families to make informed decisions that align with their long-term financial objectives.

Ultimately, the significance of understanding and utilizing these refinancing options cannot be overstated. As families navigate their financial journeys, engaging with knowledgeable mortgage professionals can provide the guidance needed to choose the best path forward. Embracing the right refinancing strategy can lead to substantial savings and improved financial stability. This makes it an essential consideration for any homeowner looking to enhance their living situation and secure a brighter financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer to homeowners?

F5 Mortgage offers customized loan solutions tailored to individual needs, consultations to navigate refinancing options, and access to a wide range of loan programs through partnerships with over two dozen top lenders.

How quickly can I get pre-qualified for a loan with F5 Mortgage?

You can get pre-qualified for a loan in just 10 minutes.

What is the customer satisfaction rate at F5 Mortgage?

F5 Mortgage has a customer satisfaction rate of 94% and an impressive 4.9 rating based on over 300 reviews.

What is a cash-out refinance?

A cash-out refinance allows homeowners to replace their existing mortgage with a larger loan, tapping into the equity built in their properties to access cash for various needs, such as home improvements or consolidating high-interest debt.

How much equity can homeowners typically borrow through a cash-out refinance?

Homeowners can typically borrow up to 80% of their home’s value through a cash-out refinance.

What are some common uses for cash obtained through a cash-out refinance?

Common uses include home improvements, consolidating high-interest debt, and funding educational expenses.

What is rate-and-term refinancing?

Rate-and-term refinancing allows homeowners to adjust their mortgage interest rate and loan duration without changing the loan amount, potentially leading to lower monthly payments and reduced total interest paid over the loan’s life.

How can rate-and-term refinancing benefit homeowners?

It can save families hundreds of dollars each month and free up funds for other priorities, such as education or home improvements.

What should homeowners consider when evaluating refinancing options?

Homeowners should compare their current mortgage conditions with available refinancing options to uncover potential savings, especially if they can secure a rate at least 0.75% to 1% lower than their current rate.

How can F5 Mortgage assist with the refinancing process?

F5 Mortgage provides dedicated support throughout the loan modification journey and offers access to an extensive network of lenders to help homeowners find the best refinancing options.