Introduction

Navigating the complexities of rural land loans can feel overwhelming for families dreaming of owning a piece of the countryside. We understand how challenging this can be, especially with unique hurdles like varying down payment requirements and eligibility criteria. That’s why grasping the landscape of rural financing is so important.

In this article, we’ll explore ten essential insights designed to empower families like yours. These insights will help you make informed decisions, streamline your loan application process, and ultimately secure the property of your dreams. What key factors should you consider to ensure you’re well-prepared for the journey ahead? Let’s dive in together.

F5 Mortgage: Personalized Mortgage Consultations for Rural Land Loans

At F5 Mortgage, we understand how challenging it can be to secure a rural land loan for your dream property located in the countryside. Families often face unique hurdles, and that’s why we focus on customized mortgage consultations tailored just for you.

By taking the time to thoroughly assess your individual financial circumstances and aspirations, we can recommend the loan products that best fit your needs. This personalized approach not only simplifies the mortgage process but also empowers you to make informed decisions. You deserve to obtain the best terms for your investments in a rural land loan, and we’re here to help you achieve that.

Imagine feeling supported and assured throughout your mortgage journey. Our commitment to personalized guidance greatly enhances client satisfaction, ensuring that you never feel alone in this process. We’re here to support you every step of the way, making your experience as smooth and rewarding as possible.

Texas Farm Credit: Tailored Loan Products for Rural Real Estate

At Texas Farm Credit, we understand how challenging it can be to navigate the world of countryside real estate. That’s why we excel in providing tailored financing options, such as rural land loans, specifically designed for properties like farmland, ranches, and recreational spaces. With competitive interest rates – averaging around [insert specific average interest rate from external sources] – and flexible terms, our loans are particularly appealing for families eager to invest in their dream properties.

We understand that every family has unique needs, and that’s why we prioritize the distinct circumstances of rural buyers looking for a rural land loan. Our financing solutions are not just accessible; they’re crafted to fit your individual situation. Take Mark C., for example. His positive experience with our timely communication and thorough explanations during his land purchase truly highlights the effectiveness of our approach.

But don’t just take our word for it. Testimonials from clients like Jose G. emphasize the reliability of our loan officers, showcasing our commitment to understanding and addressing the specific challenges faced by countryside buyers. We’re here to support you every step of the way, whether it’s through our refinancing options or community programs like the Passion Forward initiative.

Texas Farm Credit is a reliable ally in your pursuit of a rural land loan for landownership. Let us help you turn your aspirations into reality.

AgCarolina Farm Credit: Financing Options for Rural Land Purchases

At AgCarolina Farm Credit, we understand how challenging it can be to secure a rural land loan for acquiring land. That’s why we offer a wide range of solutions tailored to meet the unique needs of families looking to invest in agricultural, residential, or recreational properties, such as a rural land loan. In North Carolina, our typical borrowing amounts reflect the local market conditions, allowing households to access attractive rates that support their dreams of country living.

We know how important competitive rates are for making countryside investments viable, especially when traditional lenders might overlook rural land loan opportunities. Take the Farmers from Louisburg, North Carolina, for example. They turned to AgCarolina financing to enhance their agricultural activities, showcasing the potential for growth and sustainability in rural enterprises.

Our commitment to understanding local markets means that you’ll receive personalized guidance for your rural land loan every step of the way. This tailored approach not only simplifies the financing process but also empowers families to make informed decisions about their rural land loan investments in the countryside. We’re here to support you, ensuring that your journey toward achieving your property goals is as smooth as possible.

Common Questions About Rural Land Loans: Essential Insights

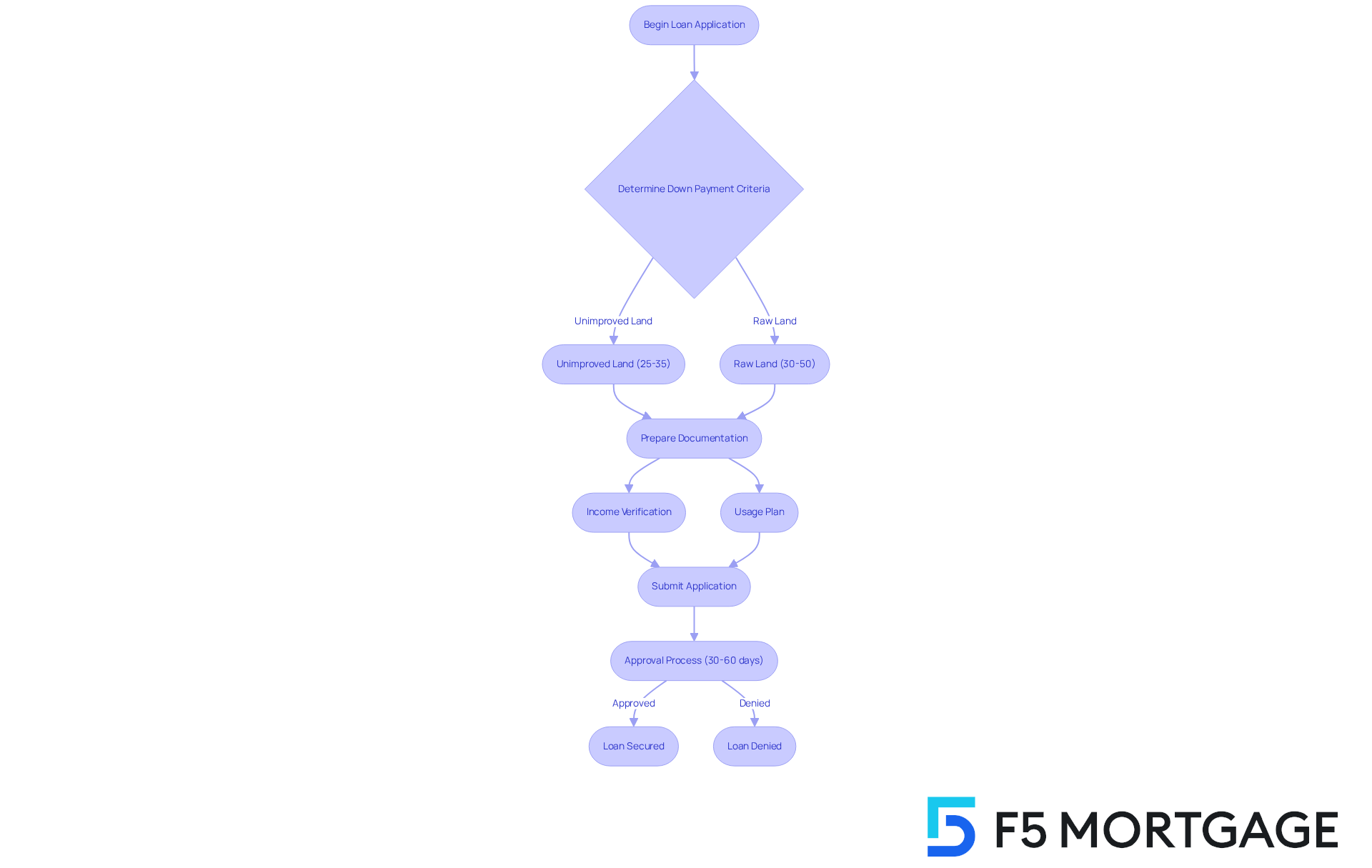

When it comes to securing a rural land loan for agricultural property financing, we understand how challenging it can be to navigate the process. Prospective clients often have important questions about:

- Down payment criteria

- The approval process

- Property eligibility

Generally, down payments for a rural land loan range from 20% to 50%, depending on the type of terrain and its development condition. For example, unimproved land financing typically requires down payments of 25-35%, while raw land financing may necessitate 30-50%. Understanding these requirements is crucial for families looking to secure a rural land loan.

The financing approval process can vary significantly, often taking between 30 to 60 days to finalize. This timeline can be influenced by factors such as the lender’s requirements and the complexity of the loan application. Families should be prepared to provide comprehensive documentation, including income verification and a clear usage plan, to help promote a smoother approval process.

Moreover, properties that meet the criteria for a rural land loan usually include those with established road access and utilities. This can improve the likelihood of approval by about 30%. As Sarah Li Cain wisely notes, “As long as you can meet the eligibility requirements – you know, location and income – you should be good to go.”

By consulting with an experienced mortgage broker, families can clarify these points and ensure they are well-prepared for the application process. We’re here to support you every step of the way, easing the anxiety that often comes with obtaining a rural land loan.

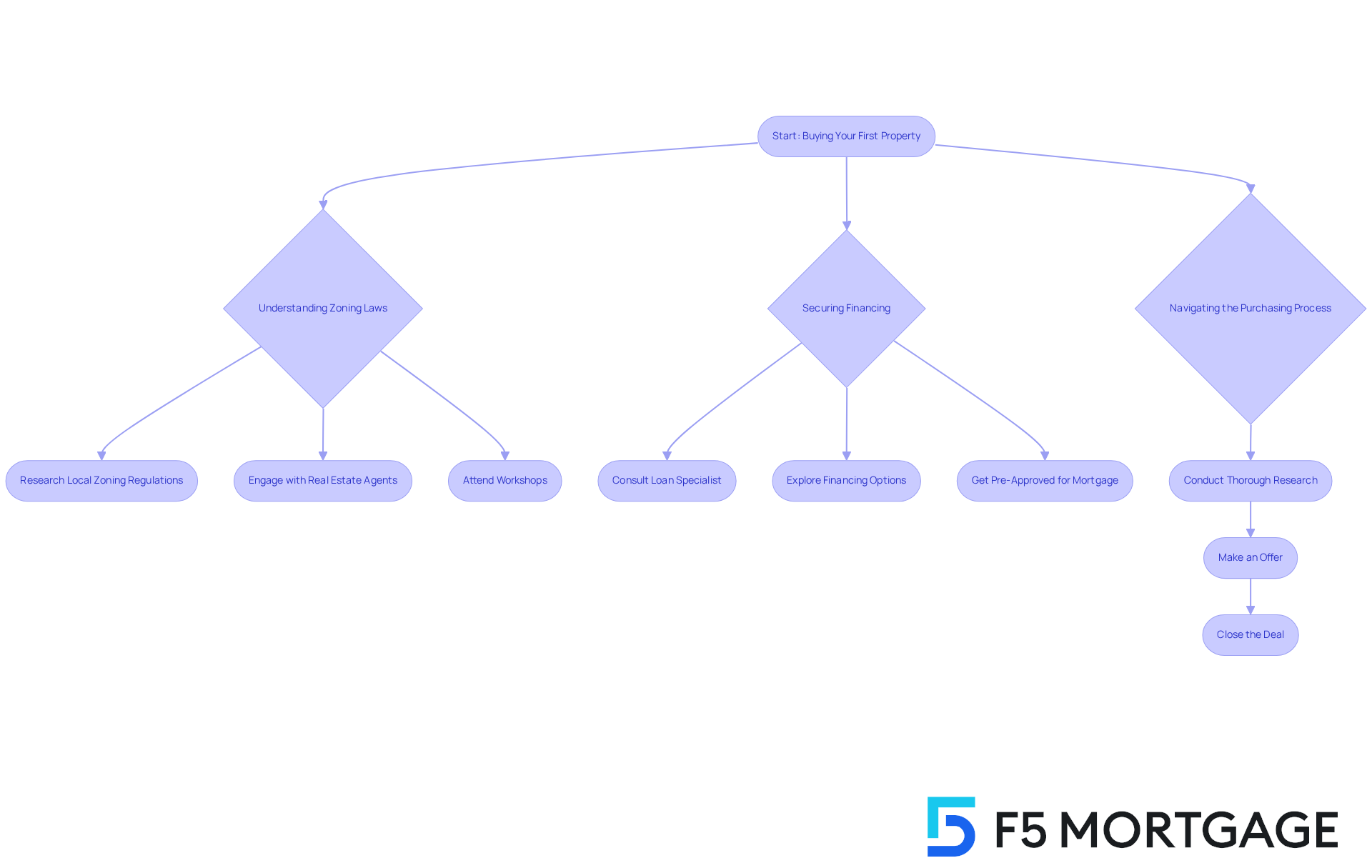

Support for First-Time Land Buyers: Overcoming Common Challenges

Buying your first property can feel overwhelming. Many first-time buyers encounter hurdles like understanding zoning laws, securing financing, and navigating the purchasing process, particularly when applying for a rural land loan. We know how challenging this can be, but conducting thorough research on your desired area is a crucial first step. Engaging with knowledgeable professionals, such as real estate agents and mortgage brokers, can provide invaluable insights that make this journey smoother.

Understanding local zoning regulations is essential when applying for a rural land loan. These laws dictate what you can do with a property and can significantly impact its value. As one specialist wisely noted, “Navigating zoning regulations is essential for ensuring your property meets your intended use, whether for residential, agricultural, or commercial purposes.”

Additionally, we encourage first-time buyers to leverage resources like comprehensive buyer’s guides and local workshops. These tools can offer essential education on the purchasing process. Many states even provide down payment assistance programs and workshops specifically designed for first-time buyers, helping you understand financing options, such as rural land loans, and the importance of pre-approval.

There are many success stories of buyers who have navigated these challenges. For instance, a family in Tennessee attended local workshops to learn about zoning regulations and secured financing through a specialized mortgage broker. They ultimately found a countryside property that perfectly suited their needs. By being proactive and informed, first-time property buyers can confidently navigate the complexities of purchasing a home.

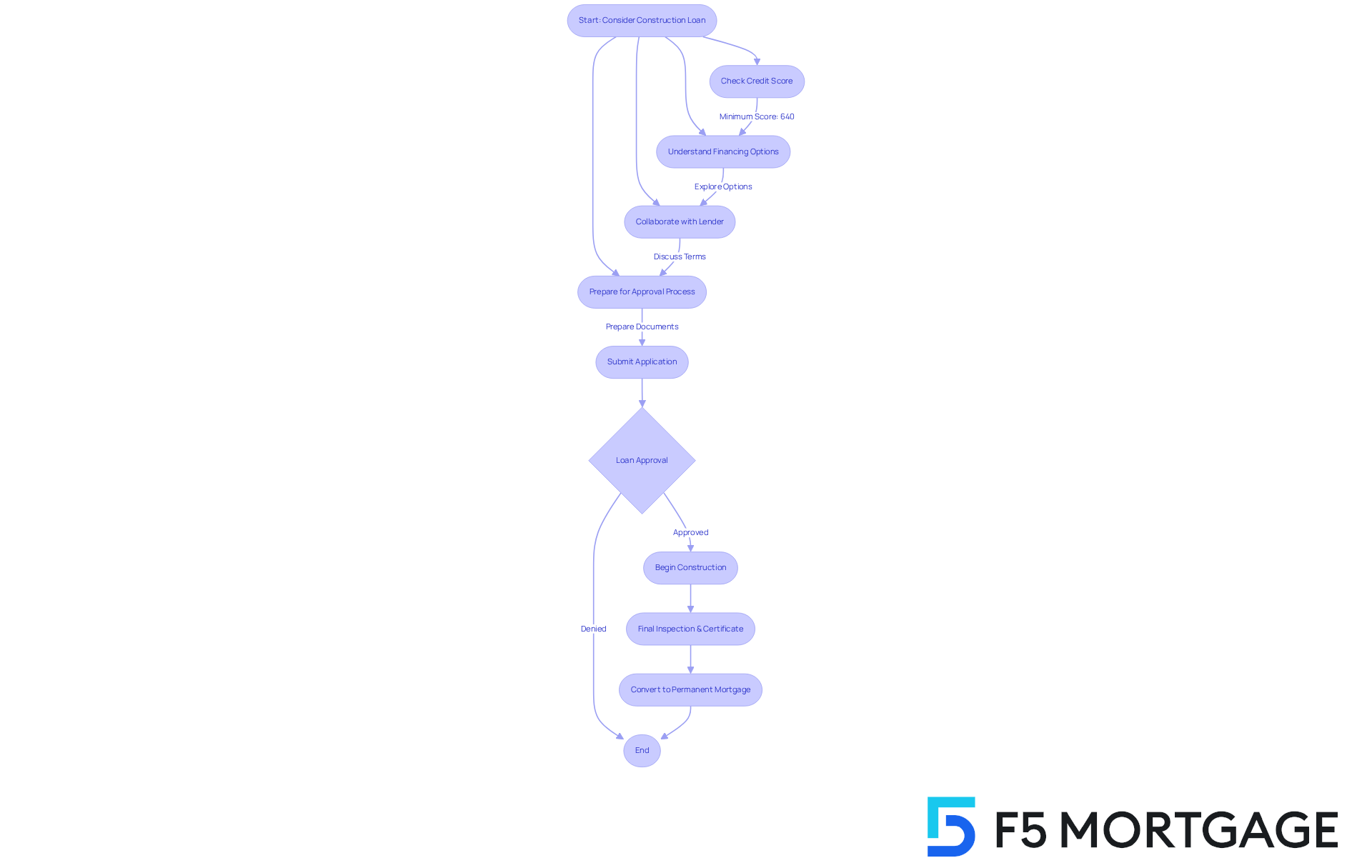

Understanding Construction Loans for Rural Land Development

Financing options for a rural land loan are tailored to support families in building homes or other structures on their acquired plots. These resources cover essential expenses like land acquisition, construction materials, and labor. We know how challenging this can be, especially when traditional mortgages often require a higher down payment-typically around 20%. However, USDA construction financing offers a silver lining: qualified borrowers can benefit from no down payment at all.

It’s important for families to understand that credit score criteria can be more stringent. Most lenders look for a minimum score of 640 for USDA financing, though some may accept scores in the 500s under certain conditions. This can feel daunting, but knowing the requirements can help you prepare.

To navigate the complexities of construction financing, collaborating closely with your lender is essential. This partnership ensures you fully understand the specific terms and conditions related to your credit, including any applicable fees, which can range from 3% to 5% of the total mortgage balance. Be ready for a potentially longer approval process; USDA construction financing can take time, with some borrowers waiting up to a year due to strict eligibility criteria.

Successful financing stories highlight the advantages of USDA construction loans. Not only do they provide 100% financing, but they also convert into a permanent 30-year mortgage once construction is complete. This efficient process can significantly ease the financial burden for low- to moderate-income households looking to secure a rural land loan to build in rural areas. By understanding these requirements and utilizing available resources, families can confidently embark on their journey to homeownership in the countryside.

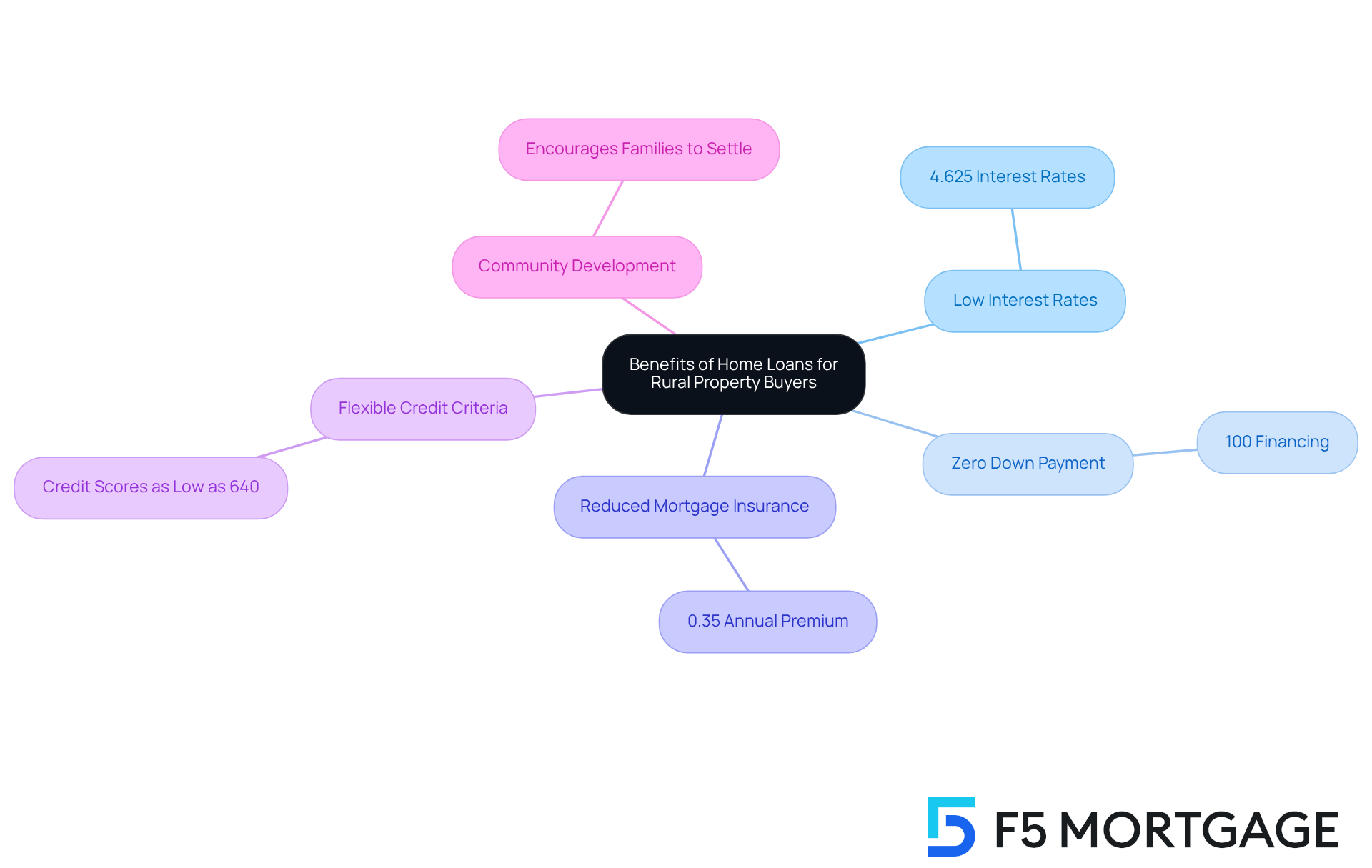

Benefits of Home Loans for Rural Property Buyers

Are you dreaming of owning a home in the countryside? Home mortgages for countryside property purchasers provide incredible benefits, especially when obtaining a rural land loan through USDA financing. With interest rates as low as 4.625%, these options often surpass those of conventional financing, making them a fantastic choice for families looking to settle down.

One of the most appealing aspects of USDA financing is the zero down payment requirement. This means eligible buyers can use a rural land loan to finance 100% of their home’s purchase price, significantly easing the path to homeownership in rural areas. We know how challenging it can be to save for a down payment, and this feature truly opens doors for many families.

Additionally, USDA financing comes with reduced mortgage insurance costs. With an annual premium of just 0.35% of the remaining balance, it’s among the lowest in the market. This further alleviates financial strain, making homeownership more achievable for households.

Families have successfully used a rural land loan through USDA financing to secure their dream homes in rural areas. The program’s flexible credit criteria allow for credit scores as low as 640, which is a game-changer for many. As mortgage experts at F5 Mortgage observe, the rural land loan not only facilitates home acquisitions but also encourages community development by helping families establish roots in less populated regions.

When considering USDA loans, it’s important to note that closing costs typically range from 2% to 5% of the home’s price. Applicants must also demonstrate stable income for at least 24 months to qualify. We’re here to support you every step of the way in navigating these requirements.

At F5 Mortgage, we’re committed to providing quick and adaptable mortgage solutions tailored to your needs. Exploring these options can help families align their financial goals with their homeownership dreams. Let us assist you on this journey to finding your perfect home.

Land Loan FAQs: Key Information for Borrowers

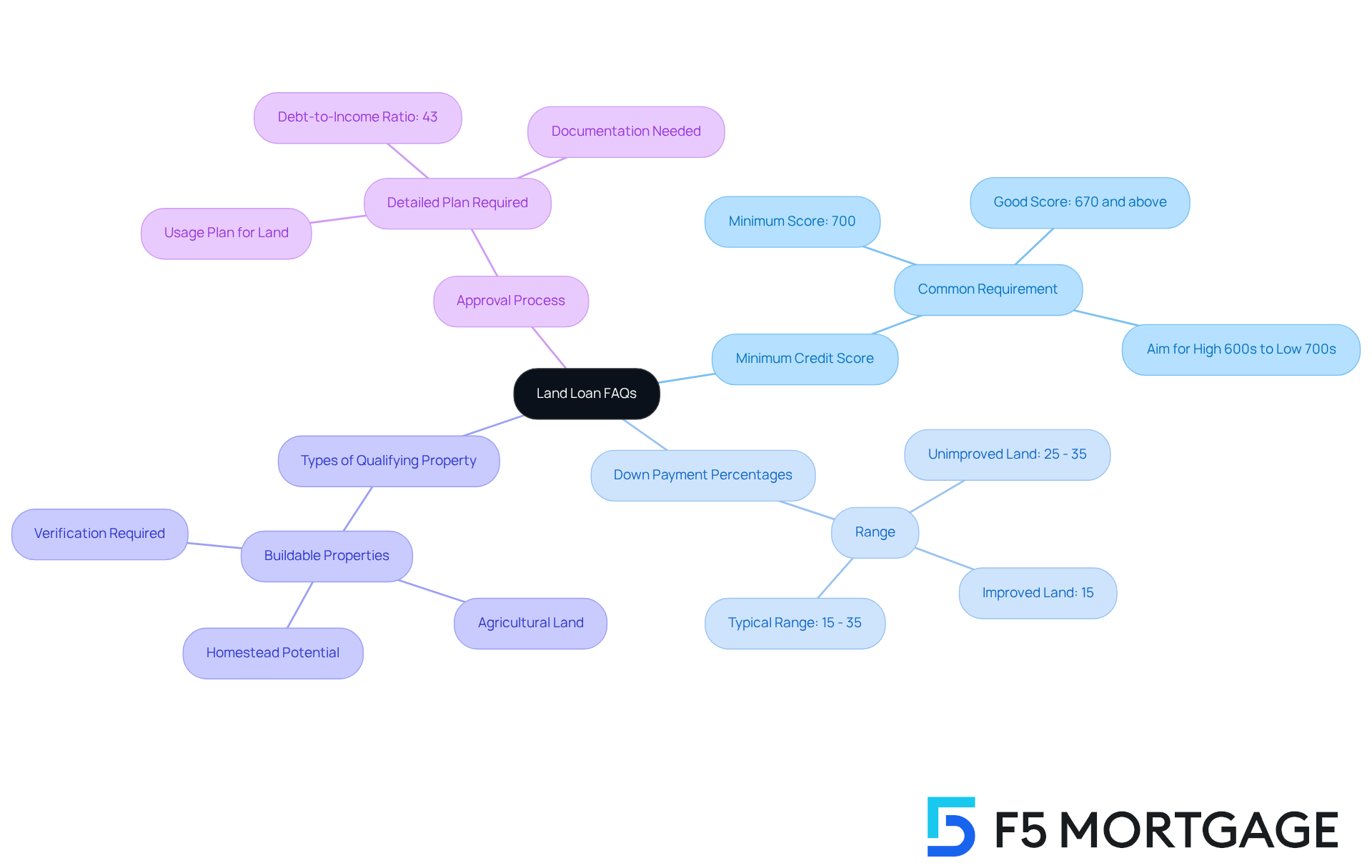

When it comes to property financing, we know how challenging it can be to navigate the details of a rural land loan. Borrowers often seek clarity on eligibility, down payment criteria, and financing terms related to a rural land loan. Here are some essential insights to help you feel more confident:

- Minimum Credit Score: Most lenders require a minimum credit score of 700 for land loans. This reflects the higher risk associated with rural land loans. While a good credit score is typically defined as 670 and above, aiming for a score in the high 600s to low 700s is advisable to improve your chances.

- Down Payment Percentages: Average down payment requirements for property financing can vary significantly, ranging from 15% to 35%, depending on the property type. For unimproved property, the minimum down payment can be as high as 35%, while enhanced property may require as little as 15%.

- Types of Qualifying Property: Not all properties qualify for loans. It’s crucial to ensure that the property is buildable and meets the lender criteria for a rural land loan. For example, agricultural land might be suitable for constructing a homestead, but verifying its development potential with a rural land loan is essential.

- Approval Process: The authorization procedure for property loans can differ, but having a detailed plan for usage can streamline your application. As Lou Jewell, Owner of Land Pro Educational Services, wisely notes, “A lender is going to want to know what you intend to do with the rural land loan property.” Lenders often require paperwork detailing how the property will be utilized, which can assist in obtaining a rural land loan.

Additionally, keep in mind that the maximum debt-to-income (DTI) ratio for property financing is typically 43%. Interest rates for such financing are generally higher than those for conventional mortgages. Consulting with a mortgage broker or lender can provide further insights into specific eligibility criteria and help clarify any uncertainties. Remember, we’re here to support you every step of the way as you embark on your property financing journey.

Financing Options for Agricultural Land Purchases

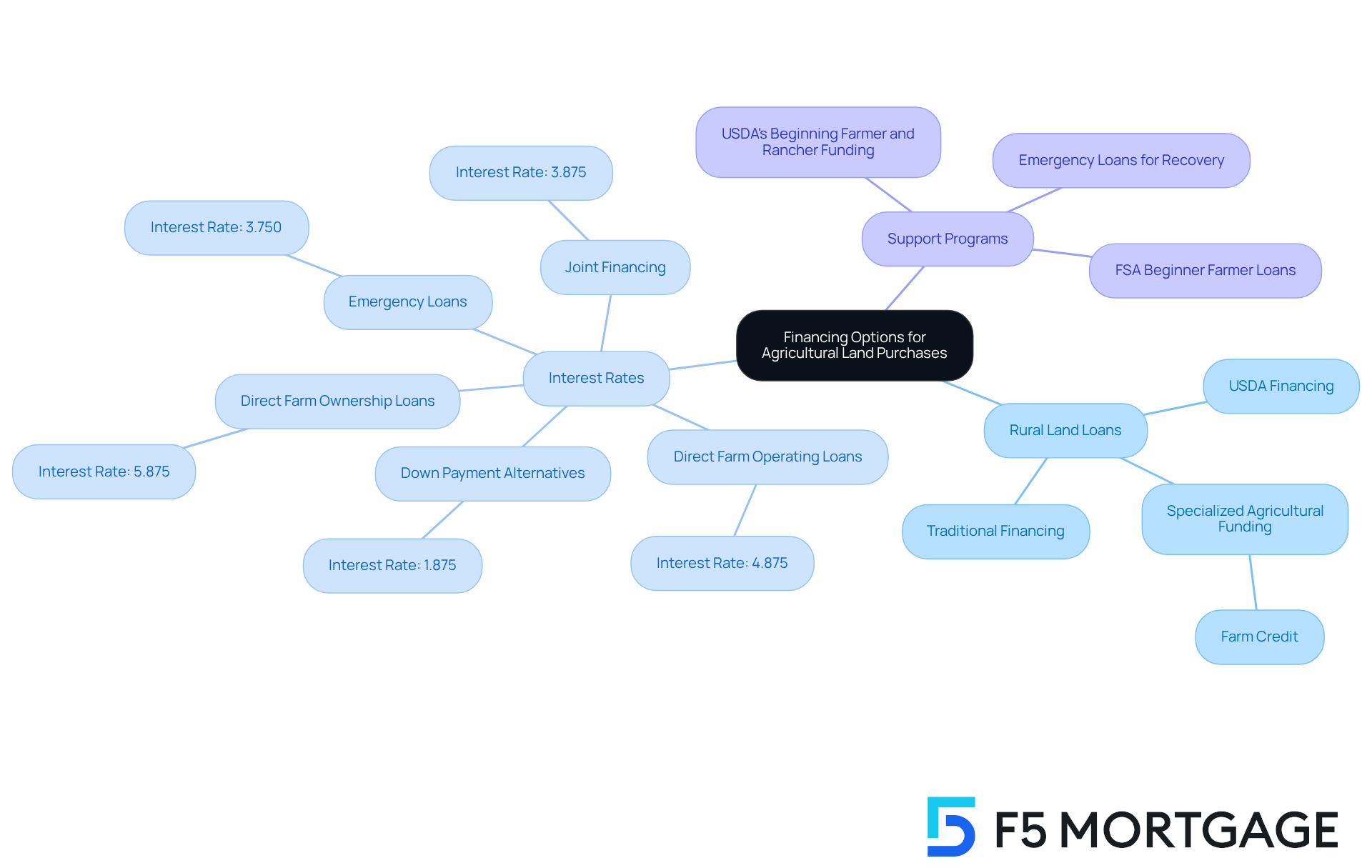

When it comes to acquiring agricultural land, families often face a range of challenges in obtaining a rural land loan. Fortunately, a rural land loan is one of the financing alternatives available that can help ease this journey. Traditional financing, USDA financing, and specialized agricultural funding from organizations like Farm Credit offer favorable terms for a rural land loan, such as lower interest rates and extended repayment periods. This makes it more accessible for families eager to invest in farming or ranching.

Currently, families can find Direct Farm Operating Loans at an interest rate of 4.875%, while Direct Farm Ownership Loans are available at 5.875%. For those considering Joint Financing options, the interest rate is even lower at 3.875%, and Down Payment alternatives can be secured at a remarkably low rate of just 1.875%.

Programs like the USDA’s Beginning Farmer and Rancher funding provide crucial support for first-time buyers of a rural land loan. These programs often include grants or aid to help reduce financial strains. Imagine having financial resources to assist with initial expenses, making it easier for households to embark on their agricultural journeys. Success stories, like that of Jesse and Tracey Paul, illustrate this perfectly. They utilized a Farm Ownership Loan to purchase a farm in Michigan, allowing them to produce pure maple syrup and contribute to local agriculture.

Another inspiring example is Dakota Davidson, a beginning farmer who leveraged an FSA beginner farmer loan to acquire necessary supplies for his first wheat crop. His story showcases how these loans can empower new agricultural ventures. We understand how challenging this can be, and we encourage families to explore rural land loan options for financing. Visiting local FSA Service Centers can provide personalized assistance to help identify the best solutions for your agricultural aspirations.

Additionally, households should be aware of Emergency Loans, which can offer essential assistance in recovering from production and physical losses caused by natural disasters. By understanding and utilizing these resources, families can embark on their farming journeys with confidence, knowing that support is available every step of the way.

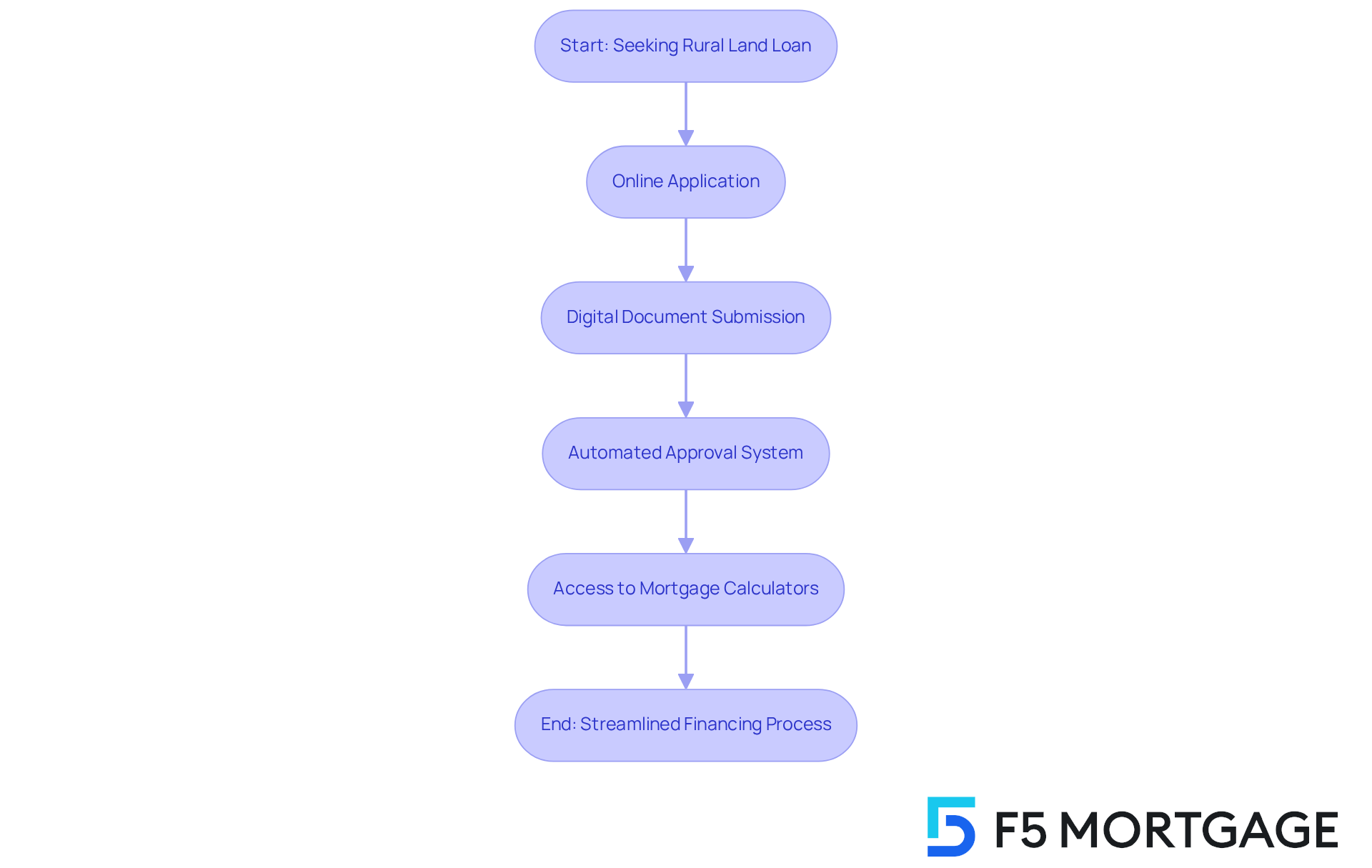

Leveraging Technology to Simplify Rural Land Loan Processes

Technology plays a vital role in simplifying the agricultural property financing process. We know how challenging this can be, but online applications, digital document submissions, and automated approval systems are here to help. These advancements significantly reduce the time and effort needed to secure financing, making it easier for you.

Imagine having access to tools like mortgage calculators and online resources that empower you to understand your options better. At F5 Mortgage, we’re here to support you every step of the way. We guide you through understanding your break-even point for refinancing, helping you determine how long it will take to recoup costs through savings in monthly payments.

By leveraging these technological advancements and our expertise as your personal concierge, families can navigate the complexities of rural land loans with greater efficiency. This ultimately leads to a more streamlined and stress-free experience. Let us help you take the next step toward your dream property.

Conclusion

Navigating the world of rural land loans can feel overwhelming for families, but it also presents a wonderful opportunity to fulfill dreams of owning property in the countryside. We understand how challenging this can be, and this article has highlighted essential insights into securing these loans. Personalized consultations, tailored loan products, and a clear understanding of the specific requirements for rural financing are crucial steps in this journey.

Key insights discussed include:

- The importance of down payment criteria

- The approval process

- The eligibility requirements for various types of properties

We also shed light on the unique challenges faced by first-time buyers, offering practical tips and resources to help them overcome obstacles. Moreover, the advantages of USDA financing and the role of technology in simplifying the loan process were underscored, illustrating how families can harness these tools to their benefit.

Ultimately, the journey to owning rural land is not just about securing financing; it’s about building a future and establishing roots in a community. Families are encouraged to explore the available options and consult with knowledgeable professionals to navigate this process confidently. By taking proactive steps and utilizing the insights shared in this article, families can turn their aspirations into reality and embark on a fulfilling life in the countryside.

Frequently Asked Questions

What services does F5 Mortgage offer for rural land loans?

F5 Mortgage provides personalized mortgage consultations tailored to individual financial circumstances and aspirations, helping clients secure rural land loans for their dream properties.

How does F5 Mortgage ensure client satisfaction during the mortgage process?

F5 Mortgage enhances client satisfaction by offering personalized guidance throughout the mortgage journey, ensuring clients feel supported and informed every step of the way.

What types of loan products does Texas Farm Credit provide?

Texas Farm Credit offers tailored financing options for rural real estate, including rural land loans specifically designed for farmland, ranches, and recreational spaces with competitive interest rates and flexible terms.

How does Texas Farm Credit address the unique needs of families seeking rural land loans?

Texas Farm Credit prioritizes the distinct circumstances of rural buyers by crafting financing solutions that fit individual situations, as demonstrated by positive client testimonials highlighting their effective communication and support.

What is the focus of AgCarolina Farm Credit in terms of rural land financing?

AgCarolina Farm Credit focuses on providing a wide range of financing options tailored to meet the unique needs of families looking to invest in agricultural, residential, or recreational properties.

How does AgCarolina Farm Credit support families in securing rural land loans?

AgCarolina Farm Credit offers personalized guidance throughout the financing process, ensuring families can make informed decisions and access competitive rates that support their countryside investments.

Can you provide an example of a successful client experience with AgCarolina Farm Credit?

An example includes a family from Louisburg, North Carolina, who utilized AgCarolina financing to enhance their agricultural activities, demonstrating the potential for growth and sustainability in rural enterprises.