Overview

The article titled “10 Essential HELOC Pros and Cons for Homeowners” is designed to help you navigate the important advantages and disadvantages of Home Equity Lines of Credit (HELOCs). We know how challenging financial decisions can be, and this overview highlights key factors that matter to you.

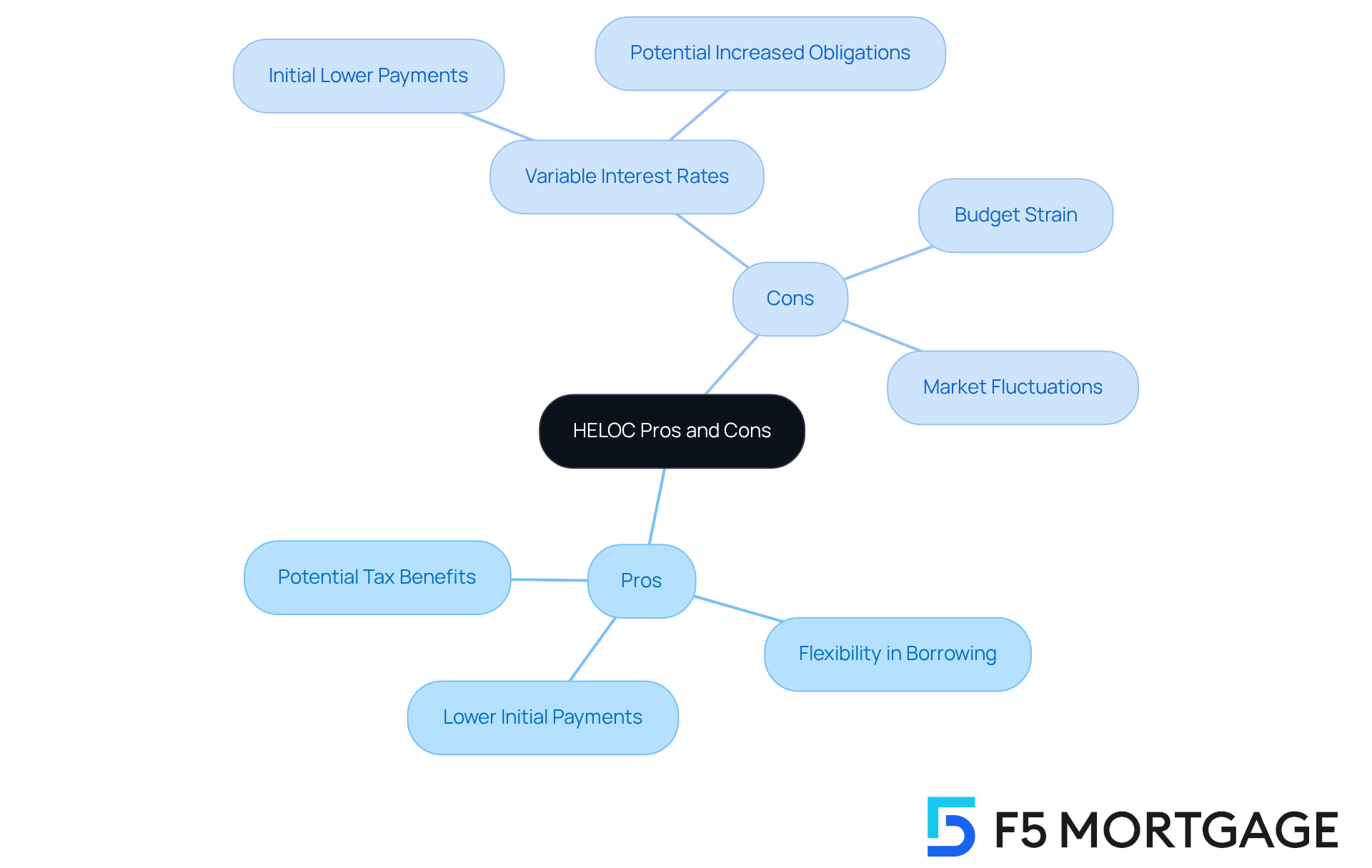

Firstly, let’s talk about the flexibility in borrowing that HELOCs offer. This can be a valuable resource for homeowners looking to manage their finances more effectively. Additionally, potential tax deductions can provide significant benefits, making HELOCs an attractive option.

However, it’s crucial to be aware of the risks involved. Variable interest rates can lead to unexpected costs, and the threat of foreclosure is a serious consideration. Understanding these aspects is essential for making informed financial decisions that best suit your needs.

By recognizing both the pros and cons, you can feel empowered to take the next steps in your financial journey. We’re here to support you every step of the way as you explore your options.

Introduction

Navigating the world of Home Equity Lines of Credit (HELOCs) can feel overwhelming for homeowners. We understand how challenging this can be, especially with the many options and potential pitfalls involved. This financial tool offers a unique opportunity to leverage home equity, providing flexible borrowing solutions for everything from renovations to debt consolidation. However, it’s important to consider the significant factors at play, such as variable interest rates and the risk of foreclosure.

So, what are the true advantages and disadvantages of using a HELOC? How can homeowners make informed decisions that align with their financial goals? We’re here to support you every step of the way, helping you navigate these important choices with confidence.

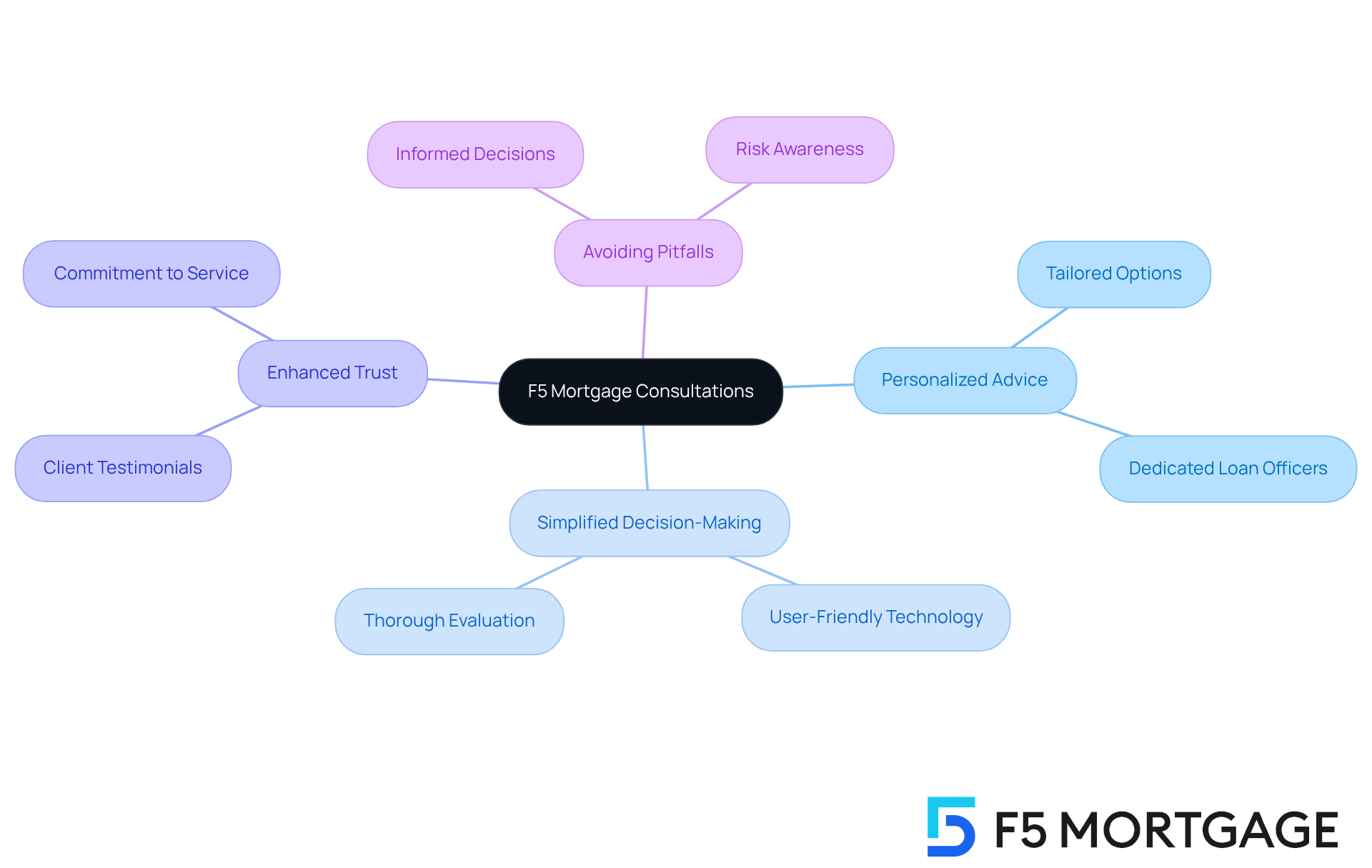

F5 Mortgage: Personalized Mortgage Consultations for HELOC Insights

At F5 Mortgage, we understand how challenging navigating the complexities of can be. That’s why we offer designed to empower homeowners like you. Our , take the time to thoroughly evaluate your unique financial situation. This allows us to provide tailored advice on the various available to you.

This personalized approach simplifies your decision-making process and significantly enhances your trust in your financial choices. We know that is crucial. It ensures that you select a line of credit that aligns with your specific needs and goals.

Our customized guidance is vital in helping you avoid that can lead to successful financial outcomes. Many of our clients consistently highlight the and attention to detail they receive from us. This reinforces our commitment to providing a stress-free mortgage process, supported by user-friendly technology and no-pressure guidance.

We’re here to support you every step of the way, ensuring you feel .

Home Equity Line of Credit (HELOC): Flexible Borrowing Against Home Equity

A Line of Credit () offers a wonderful opportunity for property owners to tap into the equity of their homes, providing a when you need it most. Unlike traditional loans, HELOCs operate much like credit cards, allowing you to withdraw funds as necessary, up to a set limit. This flexibility demonstrates the HELOC pros and cons, making HELOCs an appealing option for homeowners looking to fund renovations, consolidate debt, or manage unexpected expenses.

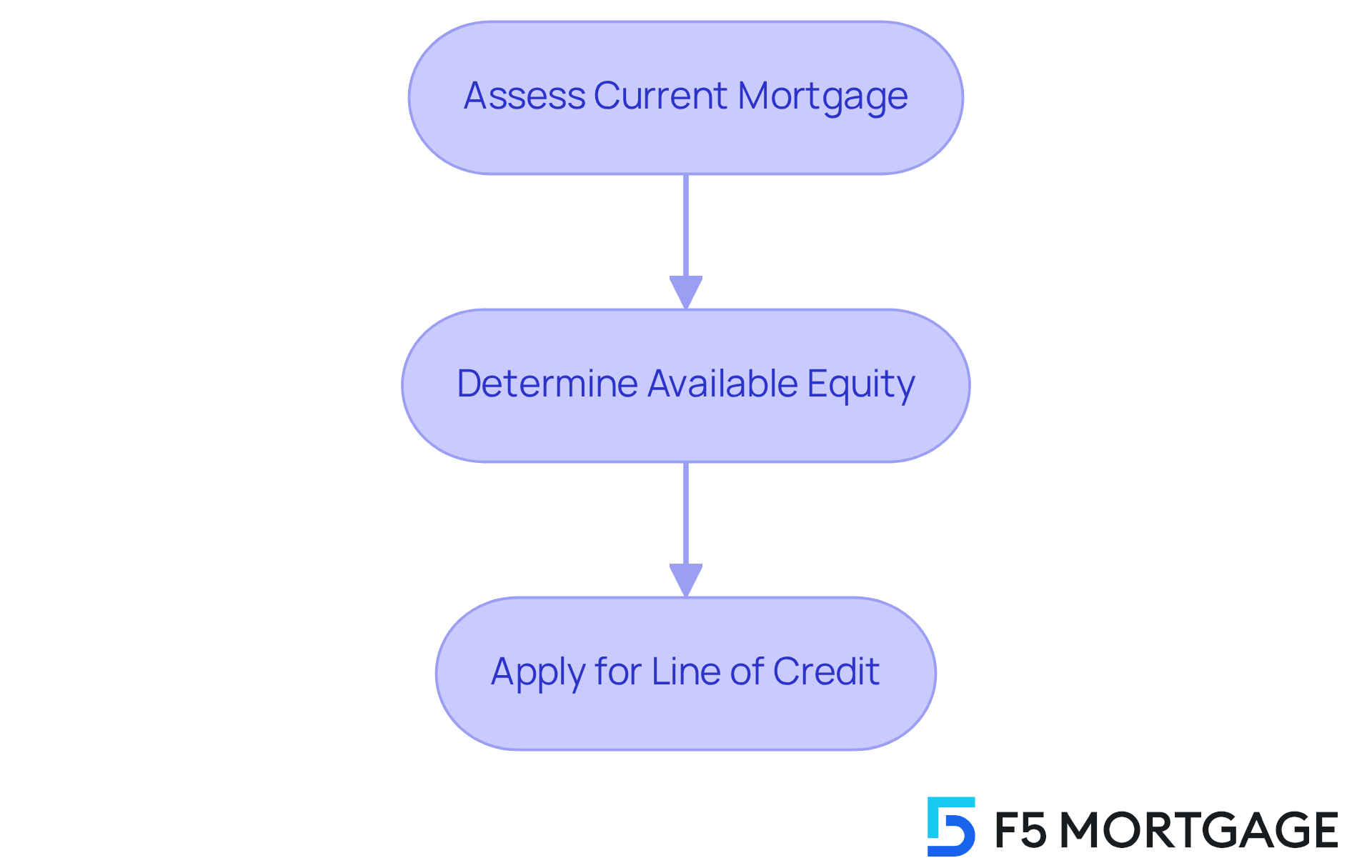

We understand that navigating financial options can be overwhelming. To secure a HELOC in California, homeowners typically engage in a straightforward refinancing process. This involves:

- Assessing your current mortgage

- Determining the equity available

- Applying for the line of credit

With F5 Mortgage’s , you can access some of the , ensuring you maximize your borrowing potential.

We’re here to . Our user-friendly technology simplifies the process, allowing you to explore your options with ease. Plus, we close most loans in less than three weeks, making it easier than ever to access your home equity when you need it. Remember, we know how challenging this can be, and we are committed to helping you find the best solution for your needs.

Variable Interest Rates: A Key Con of HELOCs

We understand that navigating a home equity line of credit involves considering the , which can feel daunting, especially with the variable interest rates that fluctuate based on market conditions. While these rates might lead to lower initial payments, it’s crucial to , particularly the possibility of increased if interest rates rise. This unpredictability can put a strain on your budget, which is why it’s essential to evaluate the [HELOC pros and cons](https://f5mortgage.com/7-heloc-without-appraisal-options-for-quick-financing) in relation to your before making such a commitment.

Once you’ve taken the step to apply, consider locking in your mortgage rates with . This can provide you with protection against during the processing period, adding an extra layer of financial security. Remember, we’re here to support you every step of the way, ensuring you make informed decisions that align with your family’s needs.

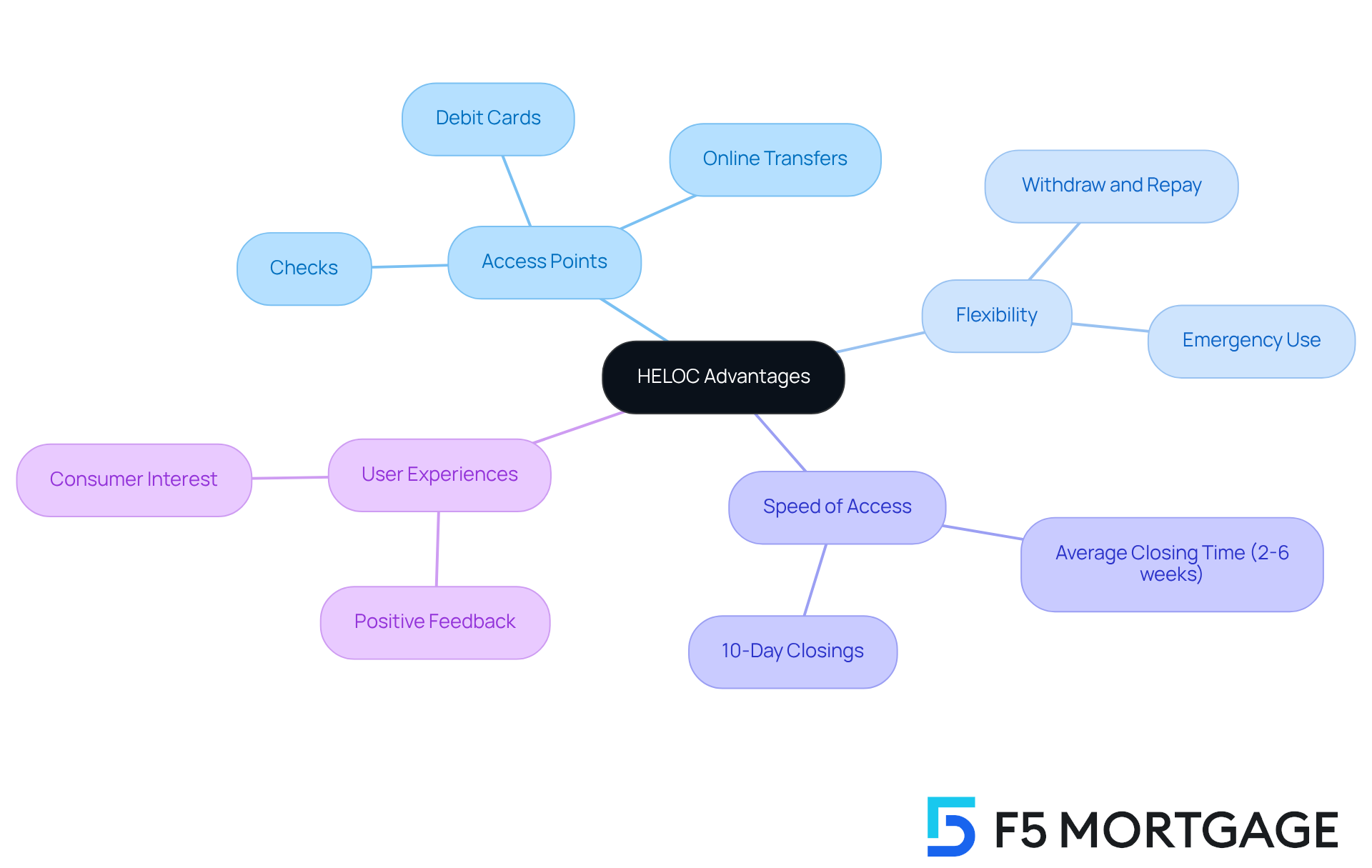

Multiple Access Points: The Advantage of HELOCs

Homeowners often face challenges when it comes to , which is why understanding the can be beneficial. With multiple access points, such as checks, online transfers, or debit cards linked to their HELOC accounts, borrowers can quickly tap into their . This convenience is vital for various needs, whether it’s for or unexpected emergencies.

The flexibility to withdraw and repay funds as necessary showcases the [HELOC pros and cons](https://f5mortgage.com/understanding-current-heloc-interest-rates-and-their-impact), distinguishing HELOCs from traditional loans and providing a safety net that can be essential in times of need. Many property owners have shared their positive experiences, especially during urgent situations. Joe Mellman highlights that consumer interest in remains high, reflecting the growing recognition of their value.

On average, property owners can expect to access their within two to six weeks. However, some lenders even promote 10-day HELOC closings, which can significantly alleviate . By gathering necessary documents in advance, well-prepared borrowers may achieve , which highlights the HELOC pros and cons for managing finances effectively. We know how challenging this can be, and we’re here to support you every step of the way.

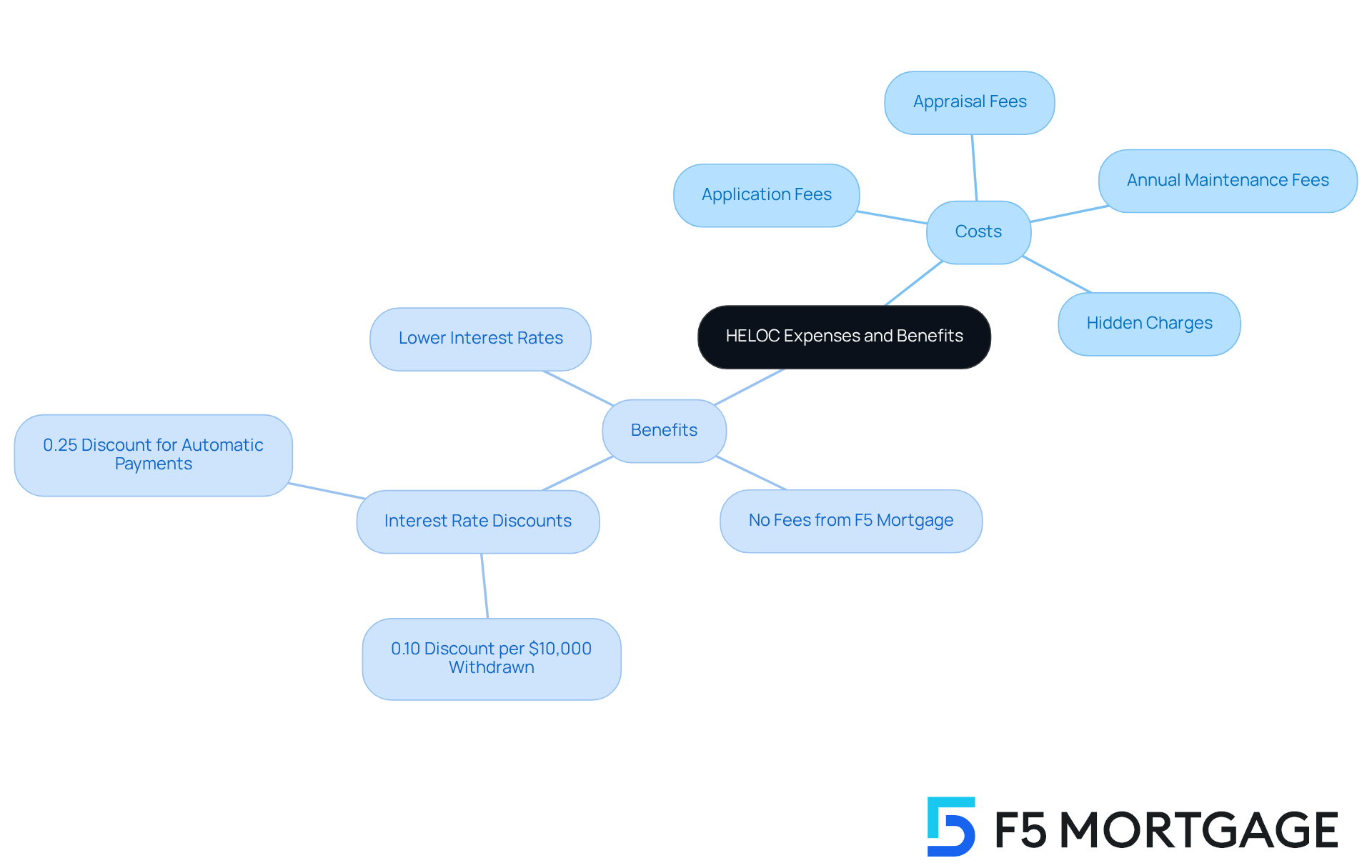

Fees and Costs: Understanding HELOC Expenses

When evaluating the , it’s clear that (HELOCs) can be an appealing option for families seeking borrowing solutions, primarily due to their typically . However, we know how challenging it can be to navigate the various fees associated with these financial products. Common costs, such as application fees, appraisal fees, and , can quickly add up, impacting overall affordability.

For instance, while many lenders impose these fees, stands out by offering HELOCs with , closing costs, or annual fees for amounts up to $1,000,000. This makes their offerings particularly competitive and worth considering. Budget advisors stress the importance of carefully assessing these costs, as .

It’s also essential to keep in mind that while an initial withdrawal of $10,000 may come with a 0.10% interest rate discount, additional fees could offset these potential savings. On a positive note, setting up can provide a 0.25% interest rate discount, which is a practical way to manage costs effectively.

Understanding the HELOC pros and cons is crucial for making informed decisions and ensuring that the benefits of utilizing do not come with unforeseen complications. To effectively budget for these costs, we encourage property owners to take the time to review all potential fees and consider their overall financial strategy. can help ensure you find the best rates and personalized service tailored to your needs.

Foreclosure Risk: A Serious Concern with HELOCs

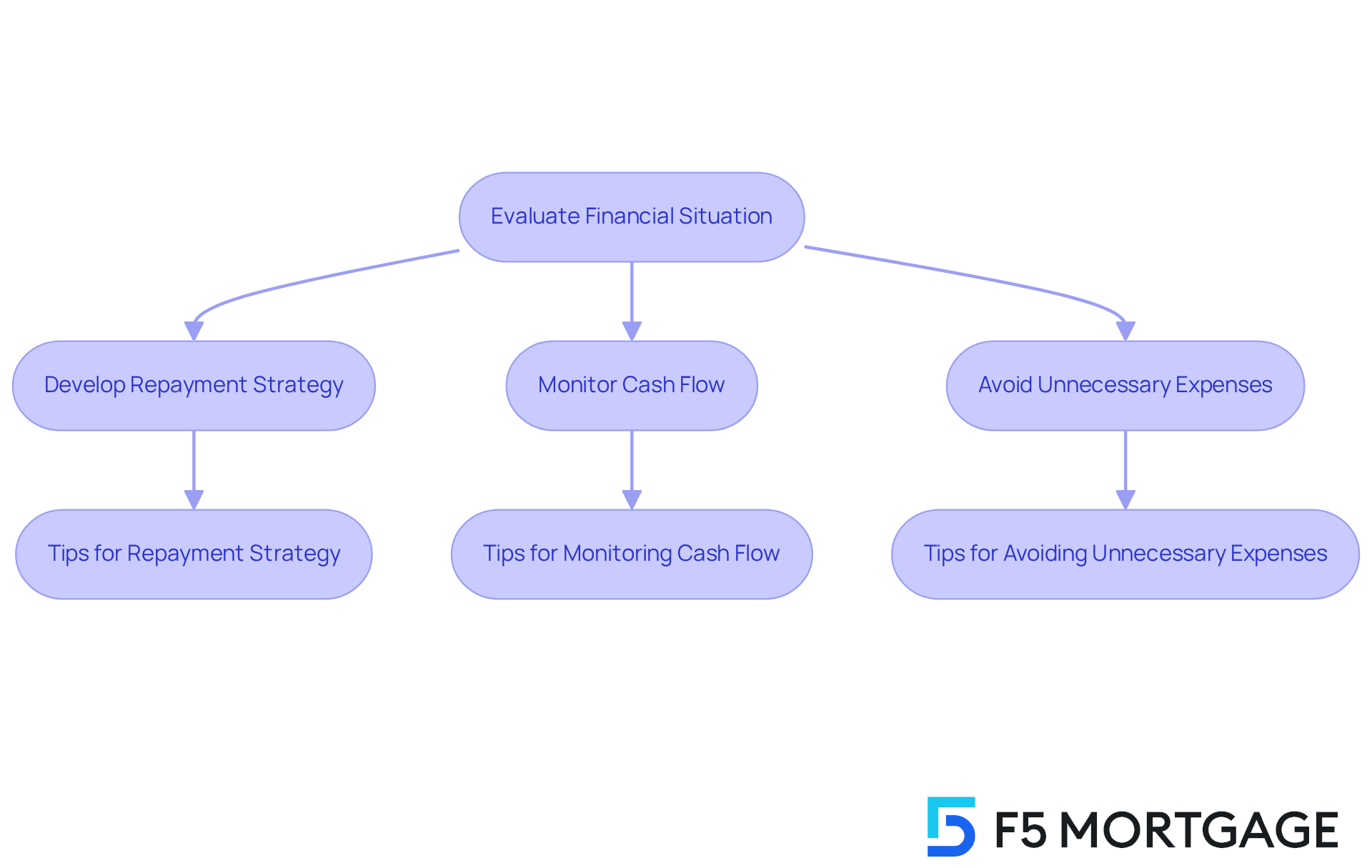

is a significant concern for property owners when evaluating the . Given the HELOC pros and cons, it’s important to note that since a HELOC is secured by the equity in your home, failing to make timely payments can lead to foreclosure actions initiated by the lender. We understand how challenging this can be, so it’s essential to develop a strong that aligns with your financial situation. Experts highlight the importance of budgeting and to ensure that payments remain manageable. For instance, it’s wise to avoid using HELOC funds for unnecessary expenses, as this could create additional financial pressure.

Additionally, grasping the is crucial. Typically, these plans include a draw period of 10 years followed by a repayment phase. During the draw period, homeowners can access funds, but it’s vital to prepare for the transition to repayment, which may significantly increase monthly obligations. If adjustments aren’t made, this can lead to economic distress and, ultimately, foreclosure.

Real-world examples illustrate the consequences of mishandling HELOC payments. Homeowners who depended heavily on their HELOCs for daily expenses or luxury purchases often found it difficult to meet repayment demands, leading to foreclosure. To safeguard against such outcomes, we recommend and that prioritizes timely repayments, taking into account the HELOC pros and cons. By taking these proactive measures, you can protect your investment and maintain your .

Moreover, it’s important to note that by $6 billion in Q1 2025, totaling $402 billion. This trend indicates a growing reliance on these credit lines. Homeowners typically use just over one-third (37 percent) of their available credit lines, emphasizing the need for careful management. As advisor Steven Sexton points out, having a is essential to avoid cash-flow issues. By understanding these dynamics and implementing a solid financial strategy, you can navigate the complexities of HELOCs more effectively. We’re here to support you every step of the way.

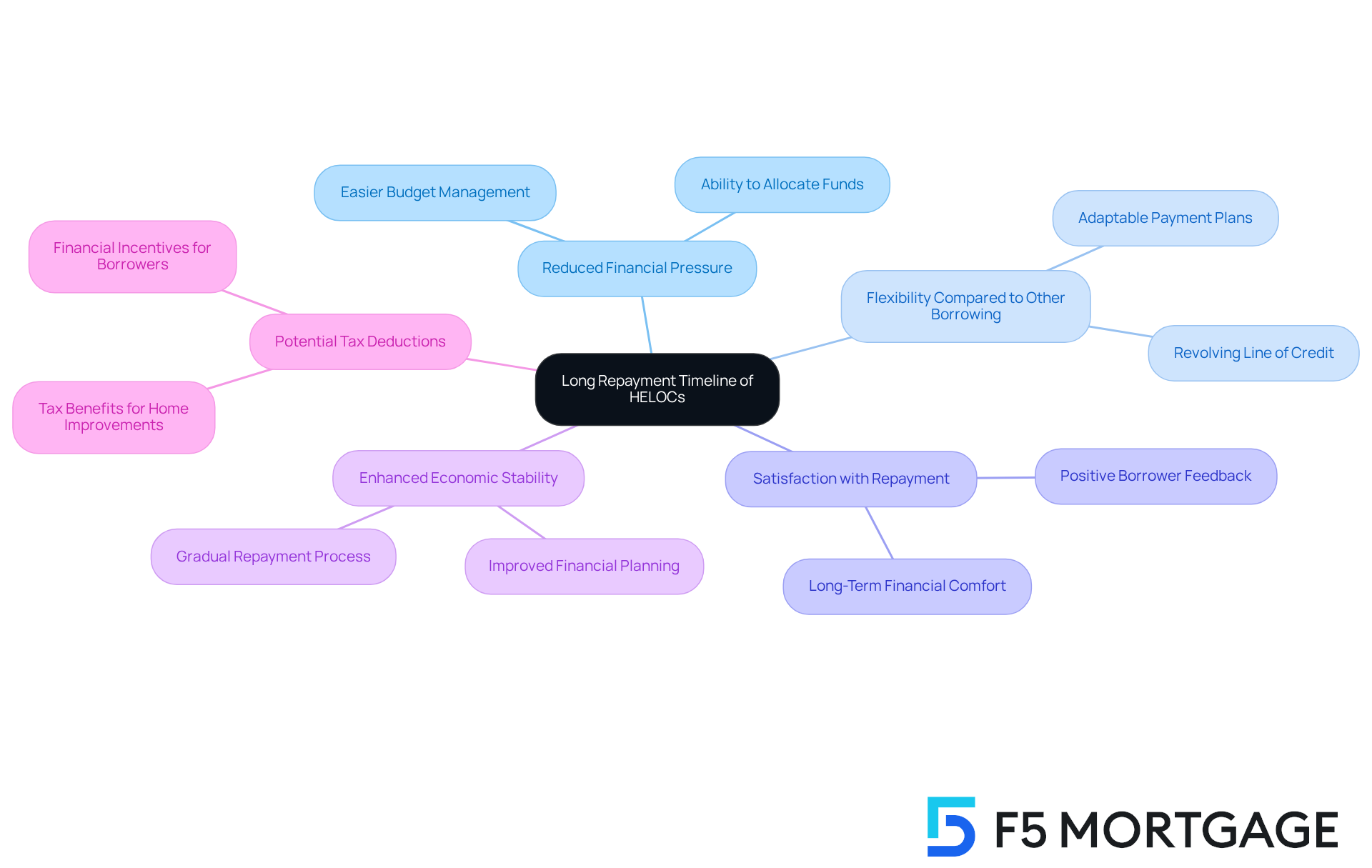

Long Repayment Timeline: A Benefit of HELOCs

Home equity lines of credit (HELOCs) typically offer a , often extending up to 20 years. This extended period can be a real lifeline for property owners, allowing them to more easily, especially when they’re using the funds for significant costs like home improvements or . When considering the , the flexibility of an extended repayment period makes a HELOC a more manageable choice compared to other types of borrowing that require faster repayment.

We understand how overwhelming can be. Investment consultants emphasize that this adaptability is among the HELOC , as it enables property owners to spread out payments over time, alleviating monetary pressure. Statistics show that many borrowers express satisfaction with their repayment conditions, appreciating the ability to allocate funds toward other necessary expenses without feeling burdened.

For instance, property owners who have taken advantage of prolonged repayment periods have reported enhanced economic stability. The gradual repayment process allows them to more effectively. Additionally, the interest paid on equity loans for may even be tax-deductible, which is one of the HELOC pros and cons that makes HELOCs even more appealing.

To make the most of a , we encourage property owners to consult with a and explore the best terms available. Remember, we’re here to support you every step of the way as you navigate these important financial choices.

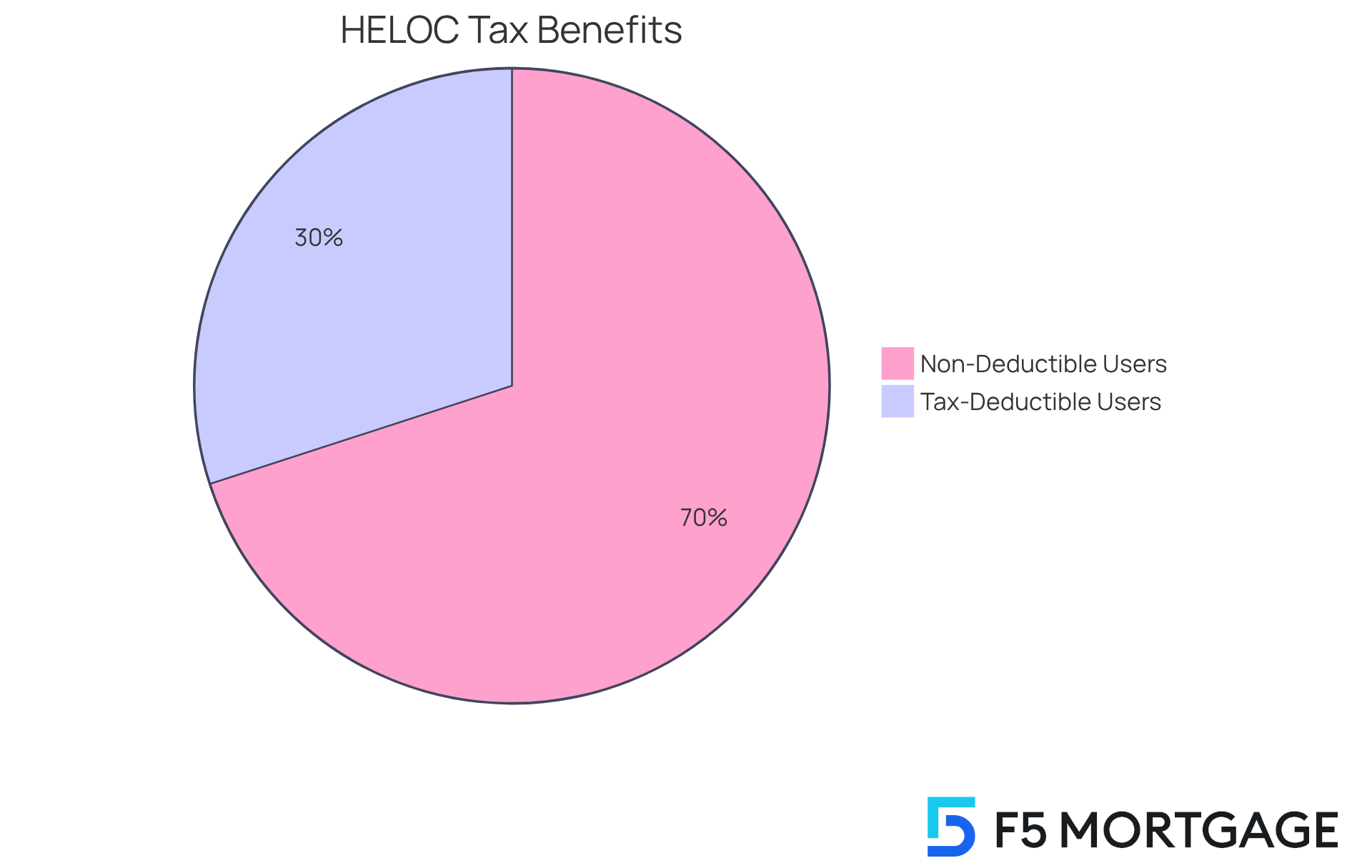

Tax Deductions: A Financial Benefit of HELOCs

We understand how challenging it can be to navigate financial decisions, particularly when evaluating the for home improvements. Interest paid on a may be tax-deductible, particularly when the funds are used for renovations or other qualifying expenses. This potential tax advantage can significantly reduce the overall cost of borrowing, which is one of the HELOC pros and cons, making HELOCs an appealing option for homeowners looking to or consolidate debt.

In fact, approximately 30% of property owners utilize HELOCs specifically for , highlighting their . Tax professionals often encourage homeowners to explore these deductions, as they can lead to . As one tax expert wisely noted, “Utilizing your property equity can be a beneficial choice for funding renovations, particularly when considering the possible .”

Homeowners who have tapped into their home equity for renovations have reported not only an but also the ability to deduct interest payments, which showcases the HELOC pros and cons that can further improve their financial situation. For example, a homeowner who funded a kitchen renovation with a HELOC was able to boost its value by 20% while enjoying tax-deductible interest payments.

Consulting with a tax expert is crucial to understanding the specific deductions available and maximizing the benefits of a line of credit secured by equity, which includes evaluating the HELOC pros and cons. We’re here to support you every step of the way, ensuring you are also mindful of the against your property equity.

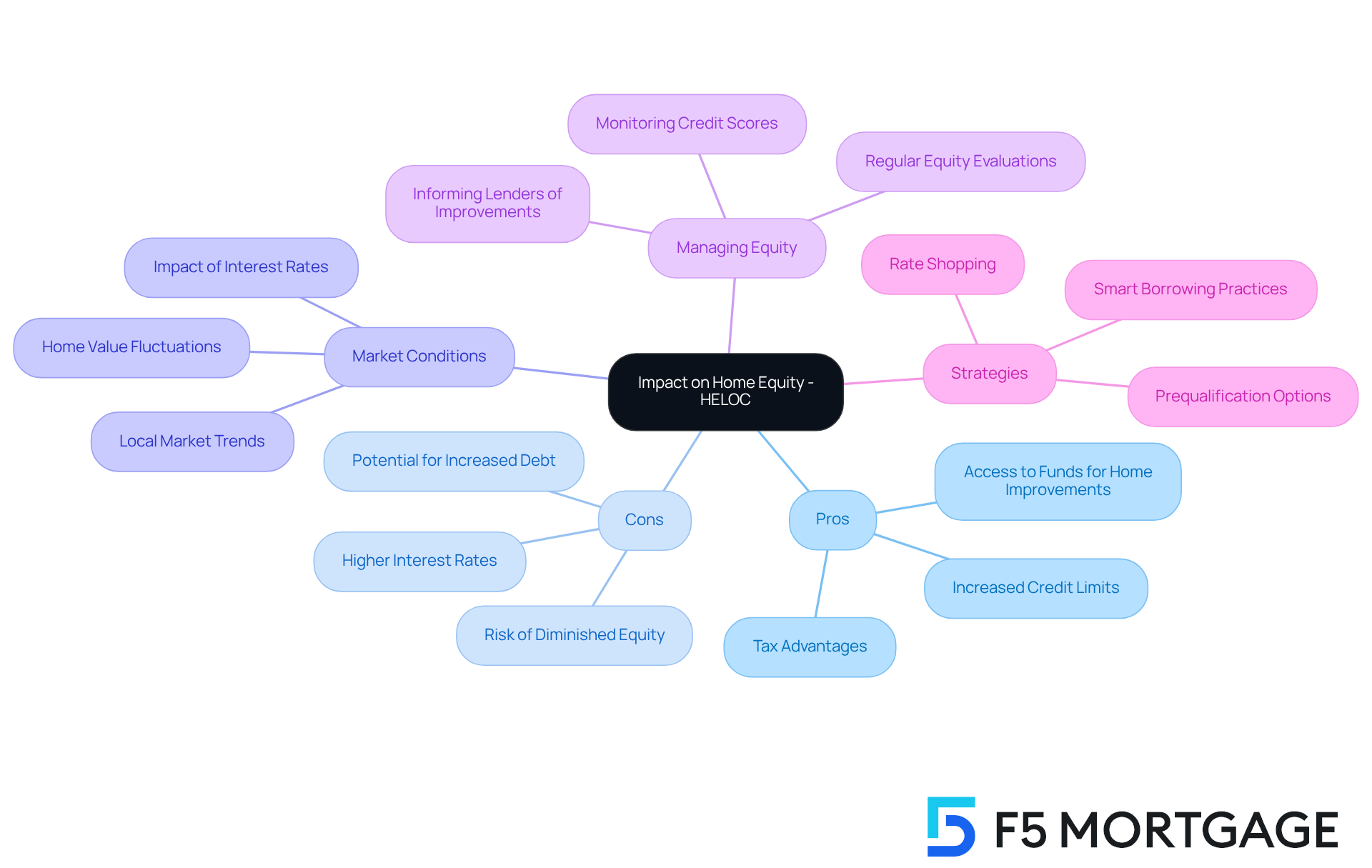

Impact on Home Equity: A Consideration for HELOC Borrowers

When considering through a , it is important to weigh the , as this can significantly impact the total equity available in your home. We know how challenging it can be to , so it’s crucial to exercise caution regarding the amount you borrow. Excessive borrowing can diminish your equity, complicating future sales or refinancing efforts, highlighting the HELOC pros and cons. With approximately 48 million mortgage holders in the U.S. possessing , the average homeowner has around $212,000 available for borrowing. Regularly evaluating your equity levels is essential to maintaining financial health and ensuring that your borrowing remains within prudent limits.

Real estate experts emphasize the importance of managing effectively. For instance, property owners who inform their lenders about recent improvements can potentially raise their credit limits, leveraging the increased worth of their asset. Conversely, if property values decrease, lenders may limit available credit. This highlights the need for .

Furthermore, information suggests that homeowners should weigh the HELOC pros and cons, as they might face a typical reduction in property equity if they fail to handle their borrowing judiciously. Successful instances include property owners who strategically use their HELOCs for home enhancements that while keeping their borrowing within safe limits. By maintaining a healthy balance, you can enjoy the HELOC pros and cons without jeopardizing your economic stability.

Additionally, increasing interest rates can affect home equity line terms and available credit, making it crucial for homeowners to remain alert regarding their borrowing ability. Once your application is approved, with can shield you from market fluctuations during the processing period. This ensures that you secure the best possible terms for your investment. We’re here to support you every step of the way.

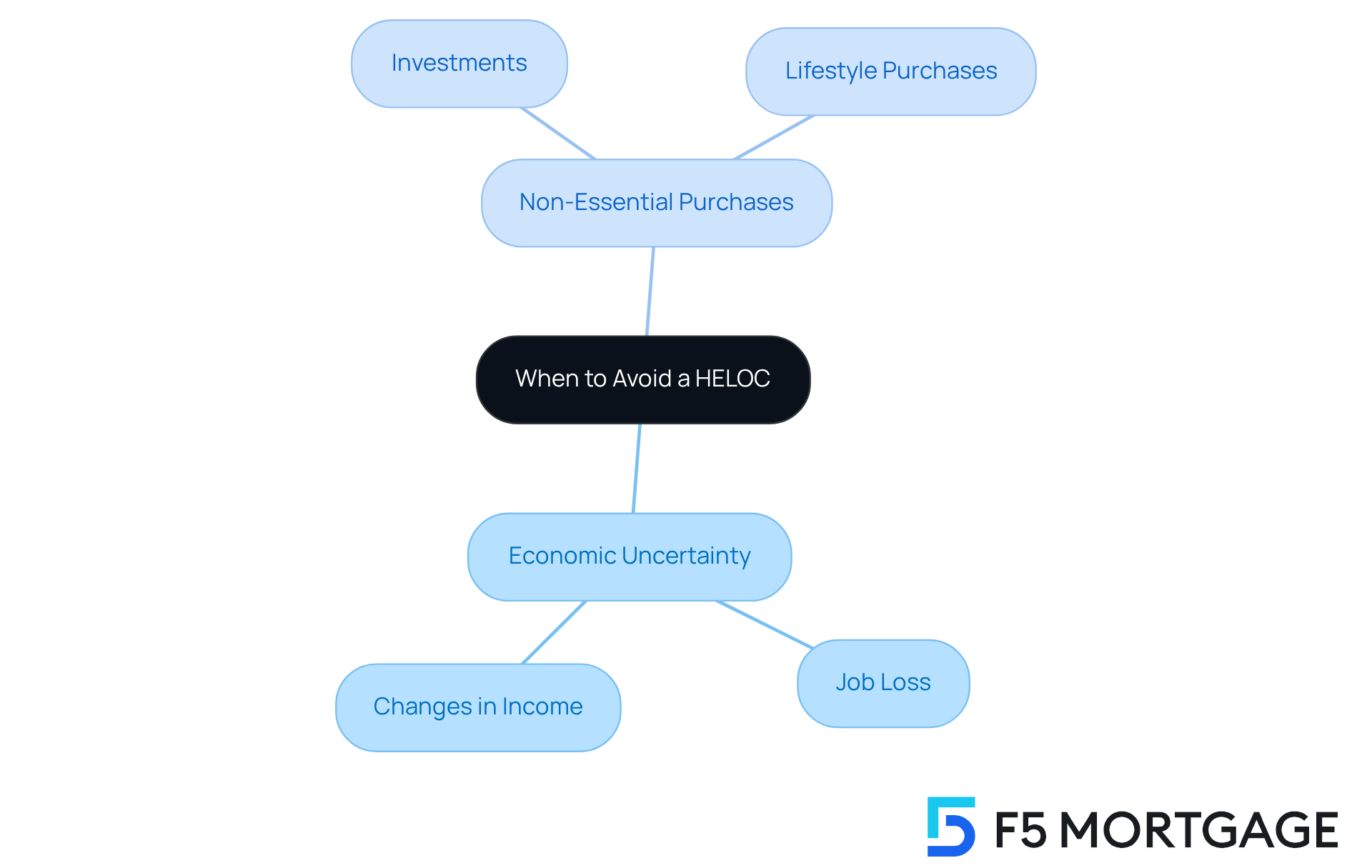

When to Avoid a HELOC: Key Considerations for Borrowers

If you’re a homeowner, it’s important to consider avoiding a , especially if you’re facing economic uncertainty, such as job loss or significant changes in income. We understand how challenging these situations can be. Additionally, if you’re thinking about using these funds for non-essential purchases or investments, it might be wiser to look into other financing options.

Taking the time to understand your and future goals is essential in to determine whether a home equity line of credit is the right choice for you. Remember, we’re here to .

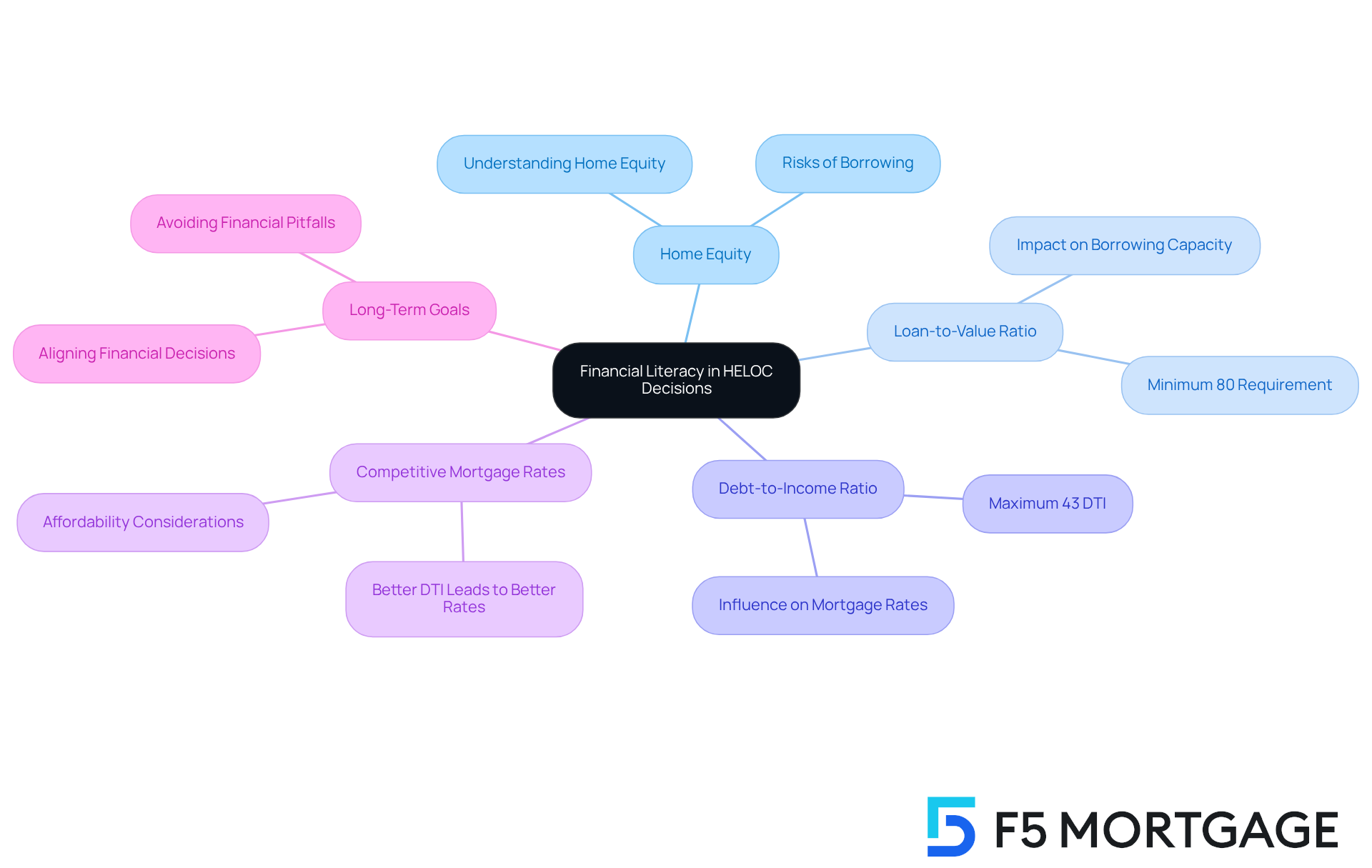

The Importance of Financial Literacy in HELOC Decisions

is essential for making informed decisions about (HELOCs). We understand how challenging this can be, and it’s important for homeowners to educate themselves about the terms, conditions, and against their home equity. For instance, many lenders typically require at least an 80% home-to-value loan ratio and a maximum of a 43% .

A better DTI can lead to more , which significantly impacts the affordability of a HELOC. By grasping these implications, homeowners can make choices that align with their . We’re here to , helping you avoid pitfalls that could jeopardize your financial stability.

Conclusion

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is crucial for homeowners looking to leverage their property equity effectively. We know how challenging this can be, and by weighing the various pros and cons, you can make informed decisions that align with your financial goals. The flexibility of HELOCs, coupled with potential tax benefits and long repayment timelines, offers significant advantages. However, the risks associated with variable interest rates, fees, and the possibility of foreclosure must also be carefully considered.

Throughout this article, we’ve highlighted the importance of financial literacy in navigating HELOC options. Homeowners are encouraged to assess their financial situations thoroughly, understand the costs involved, and develop a solid repayment strategy. The discussions surrounding the impact of HELOC borrowing on home equity, the benefits of personalized mortgage consultations, and the need for prudent financial management serve as vital reminders of the responsibility that comes with accessing home equity.

Ultimately, making the most of a HELOC requires a balanced approach that prioritizes informed decision-making and proactive financial planning. We’re here to support you every step of the way, encouraging you to seek expert advice and remain vigilant about your borrowing practices to safeguard your investments and maintain economic stability. Embracing financial literacy will empower you to harness the full potential of your home equity while minimizing risks, ensuring a more secure financial future.

Frequently Asked Questions

What services does F5 Mortgage offer for Home Equity Lines of Credit (HELOCs)?

F5 Mortgage offers personalized mortgage consultations to help homeowners navigate the complexities of HELOCs. Their dedicated loan officers evaluate each client’s financial situation to provide tailored advice on various HELOC options.

How does a Home Equity Line of Credit (HELOC) work?

A HELOC allows property owners to borrow against the equity in their homes, functioning similarly to a credit card. Homeowners can withdraw funds as needed, up to a set limit, making it a flexible source of funds for renovations, debt consolidation, or unexpected expenses.

What is the process to secure a HELOC in California?

To secure a HELOC in California, homeowners typically go through a straightforward refinancing process that includes assessing the current mortgage, determining available equity, and applying for the line of credit.

What advantages does F5 Mortgage provide in terms of HELOC refinancing?

F5 Mortgage offers some of the lowest rates available for HELOC refinancing, and they close most loans in less than three weeks, making it easier for homeowners to access their home equity quickly.

What are the potential downsides of a HELOC?

One key downside of a HELOC is the variable interest rates, which can fluctuate based on market conditions. While they may lead to lower initial payments, rising rates can increase monthly obligations, potentially straining a homeowner’s budget.

How can homeowners protect themselves against interest rate fluctuations when applying for a HELOC?

Homeowners can consider locking in mortgage rates with F5 Mortgage during the application process to provide protection against market fluctuations, adding an extra layer of financial security.

What do clients say about the service provided by F5 Mortgage?

Many clients highlight the exceptional service and attention to detail provided by F5 Mortgage, reinforcing the company’s commitment to offering a stress-free mortgage process with user-friendly technology and no-pressure guidance.