Overview

Upgrading your home can be an exciting yet challenging journey for families. We know how overwhelming the mortgage process can feel, which is why using a house loan broker can be a game-changer. Here are ten benefits that can truly make a difference.

-

A house loan broker offers personalized service tailored to your unique needs. They take the time to understand your financial situation and help you navigate the options available. This means you’re not just another application; you’re a valued client with specific goals.

-

Brokers provide access to multiple lenders, giving you a wider range of choices. This can lead to better terms and rates that suit your budget. Imagine having the power to compare different offers without the stress of contacting each lender individually.

-

Expert guidance is another significant advantage. Brokers are well-versed in the mortgage landscape and can simplify the loan experience for you. They help demystify the process, ensuring you feel informed and confident every step of the way.

-

Their negotiation skills can lead to more favorable terms. They advocate on your behalf, striving for the best possible deal. This can result in substantial cost savings over the life of your loan.

-

Brokers provide customized solutions that cater specifically to your family’s financial situation. Whether you’re a first-time homebuyer or looking to refinance, they’re here to support you every step of the way, ensuring a smoother and more efficient home financing journey.

In conclusion, partnering with a house loan broker not only alleviates the stress of securing a mortgage but also empowers you to make informed decisions that align with your family’s needs. Take the first step towards your dream home today.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially for families looking to enhance their living situations. We understand how challenging this can be. House loan brokers are here to help, playing a crucial role in this journey by offering tailored solutions that meet your unique financial needs.

By leveraging their expertise and connections with multiple lenders, these professionals simplify the mortgage process for you. They unlock significant savings and opportunities that can make a real difference for families like yours. However, with so many options available, you might wonder: what specific advantages do house loan brokers provide that can truly transform your home buying experience? We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Solutions Tailored to Your Needs

At F5 Mortgage, we understand that every household has unique financial circumstances. That’s why we focus on developing customized loan solutions with a house loan broker tailored to your specific needs. By utilizing user-friendly technology, we streamline the loan process and provide dedicated assistance every step of the way.

Our diverse range of loan options—fixed-rate loans, FHA loans, VA loans, and jumbo loans—ensures that, as your house loan broker, we can offer financing that aligns with your home upgrade goals. This personalized approach empowers families like yours to make informed decisions about their financial futures by consulting a house loan broker, ensuring you receive the most suitable financing available.

Key Features:

- Personalized Consultations: We engage in tailored discussions to understand your needs, providing no-pressure guidance throughout the process.

- Diverse Loan Programs: Access various loan types designed to fit different financial situations, including strategic refinancing opportunities that unlock lower rates and flexible terms.

- User-Friendly Tools: Utilize instruments like loan calculators to assist in your decision-making, simplifying the refinancing process to the greatest extent.

We know how challenging this can be, and we’re here to support you every step of the way. Let’s work together to find the right solution for your family.

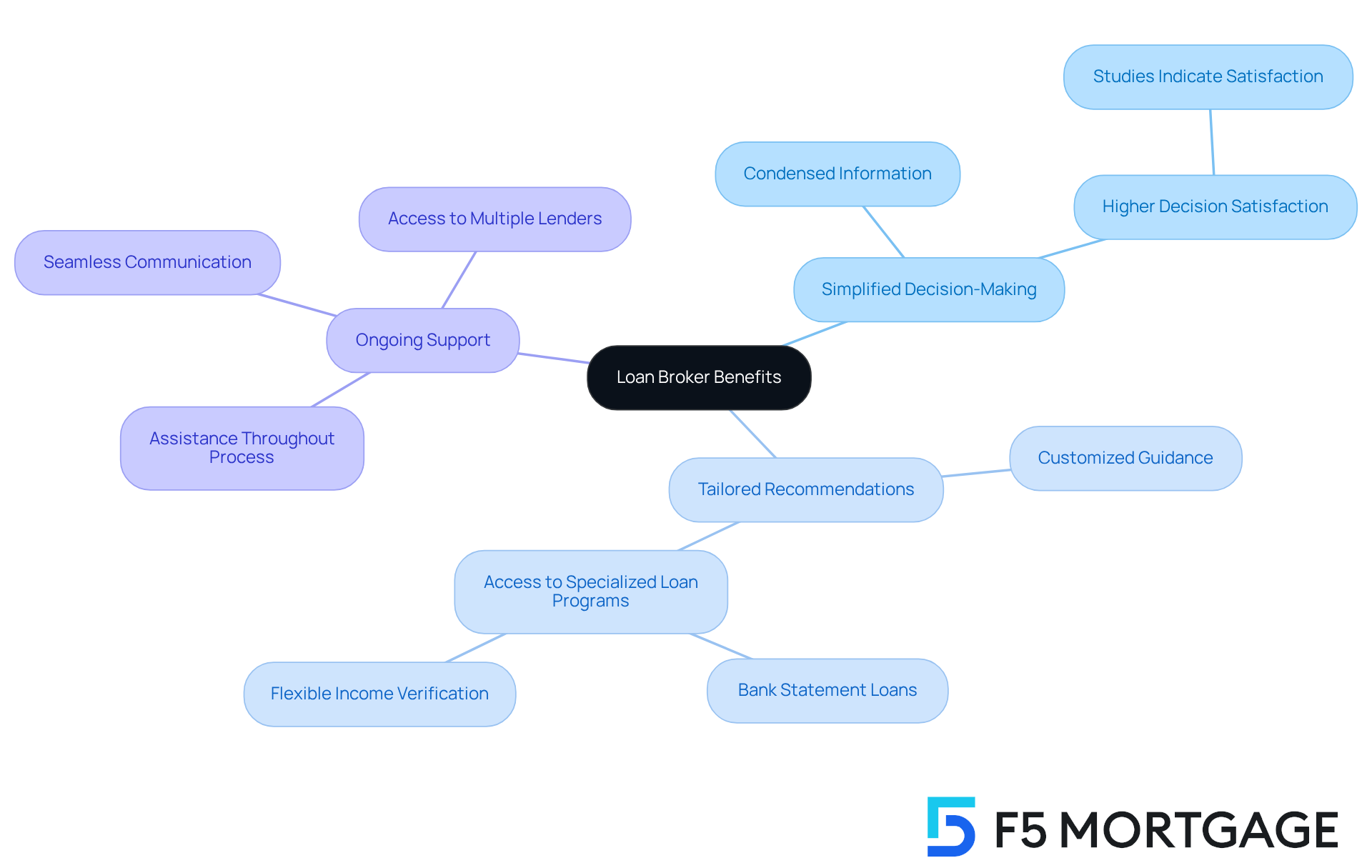

Expert Guidance: Navigating Complex Loan Options with a Broker

Navigating the financial loan landscape can feel overwhelming, especially with so many options available. We understand how challenging this can be. That’s where a knowledgeable house loan broker, such as those at F5 Mortgage, steps in to provide essential guidance. Brokers clarify the nuances of various loan types, interest rates, and repayment terms, ensuring you can make informed decisions that align with your financial goals.

- Simplified Decision-Making: We know that complex information can be daunting. Brokers condense it into manageable insights, making it easier for you to understand your options. Studies indicate that borrowers who use intermediaries report higher decision satisfaction and confidence after securing a loan.

- Tailored Recommendations: At F5 Mortgage, our advisors offer customized guidance based on your unique financial situation. This is especially important for families facing distinct circumstances, such as self-employment or credit challenges. Our expertise allows us to connect you with specialized loan programs, including bank statement loans with flexible income verification, which may not be available through traditional lenders.

- Ongoing Support: From the initial application to closing, our representatives at F5 Mortgage provide continuous assistance throughout the mortgage process. This practical support is crucial, particularly for families navigating intricate loan situations. Our agents handle the application and processing tasks, ensuring seamless communication and updates. As an independent agent with access to over two dozen lenders, F5 Mortgage can obtain competitive rates and terms tailored to your household’s needs.

In a rapidly changing housing finance market, where digital tools are becoming more prevalent, a house loan broker remains a critical resource for families looking to upgrade their homes. Their ability to evaluate rates from various lenders and secure competitive options can lead to substantial savings, making the financing process less intimidating and more beneficial. As Colin Robertson aptly states, “In a sense, they can be compared to financial advisors for the lending sector.

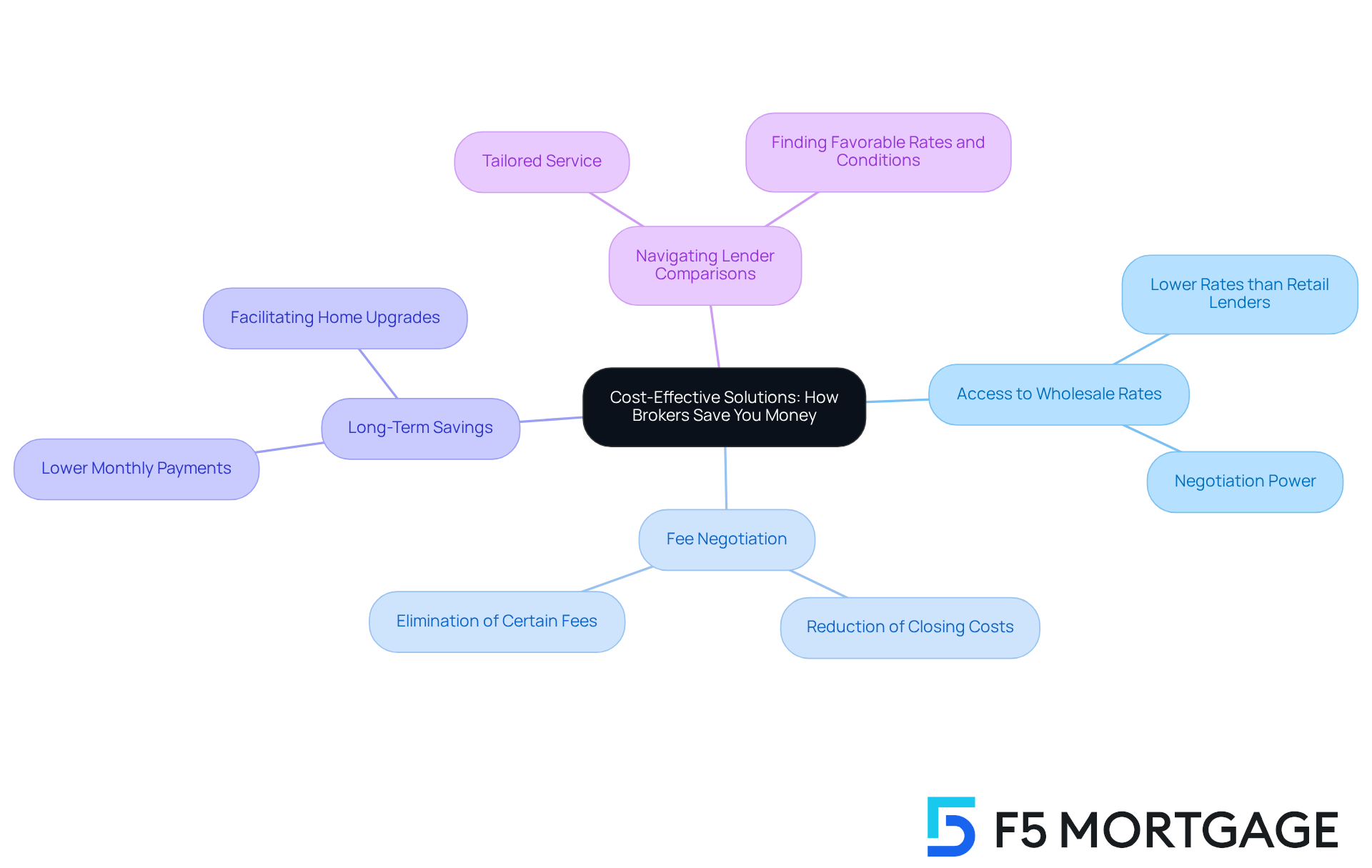

Cost-Effective Solutions: How Brokers Can Save You Money

One of the main benefits of collaborating with a loan broker, like F5 Mortgage, is the possibility of substantial cost reductions. We understand how overwhelming this process can be, and brokers have access to a wide range of lenders, allowing them to negotiate better rates and terms on your behalf. This can lead to lower interest rates, decreased fees, and overall savings on the total expense of your loan, especially when refinancing.

In Colorado, refinancing a loan typically incurs up-front expenses averaging between 2% and 5% of the total amount. For instance, refinancing a home in Denver valued at $500,000 could result in closing costs of up to $25,000. However, we’re here to support you every step of the way. F5 Mortgage works with top lenders to help you compare rates and find the most affordable refinance options. This could potentially reduce these costs through down payment assistance programs, significantly alleviating your upfront expenses.

How Brokers Save You Money:

- Access to Wholesale Rates: Brokers can often secure lower rates than retail lenders, which is crucial when refinancing.

- Fee Negotiation: They can negotiate to reduce or eliminate certain fees associated with the mortgage, further lowering the overall cost.

- Long-Term Savings: Reduced rates can result in significant savings throughout the duration of the loan, facilitating home upgrades for your family.

- Navigating Lender Comparisons: A house loan broker, such as F5 Mortgage, offers tailored service to assist you in exploring different lender choices, guaranteeing you discover the most favorable rates and conditions available.

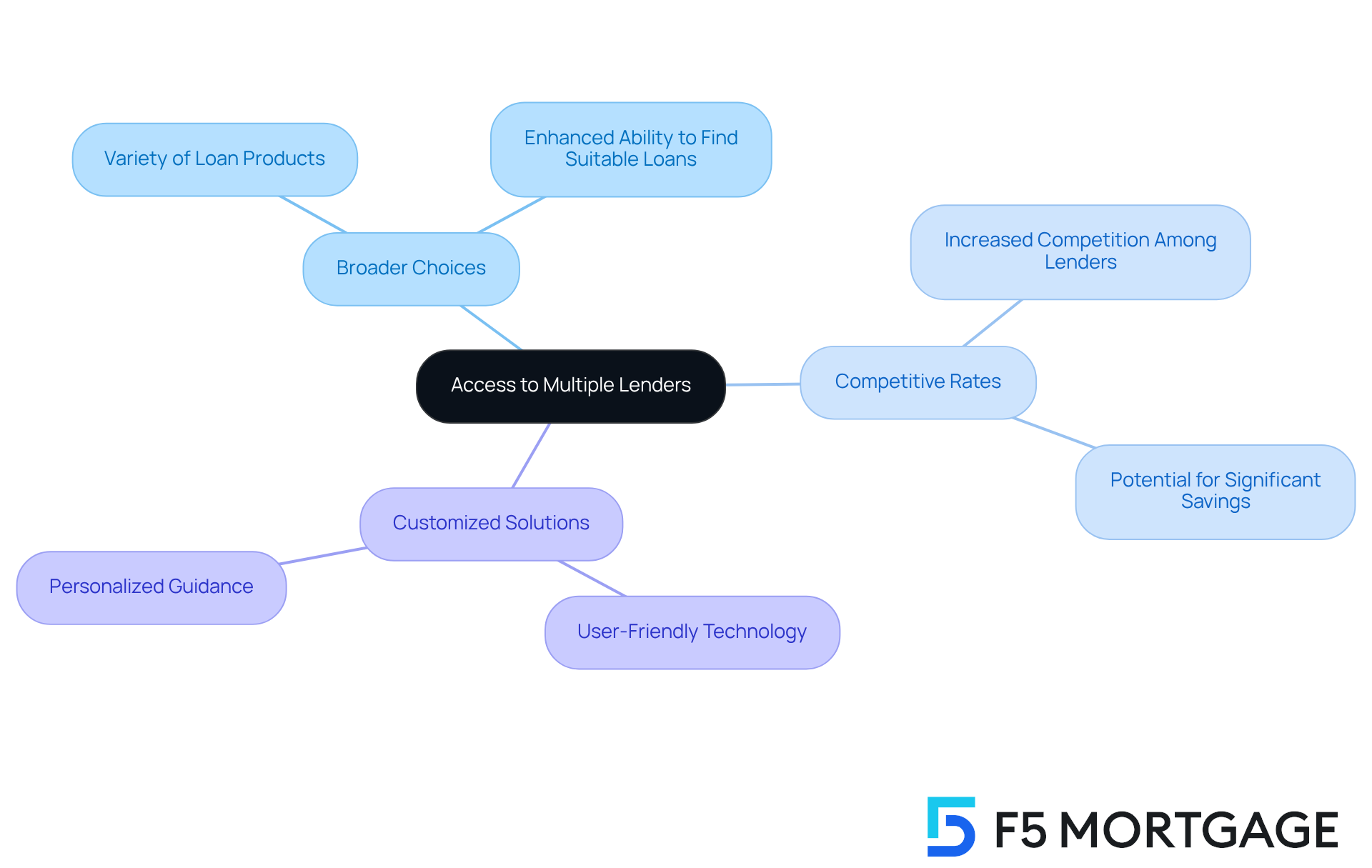

Access to Multiple Lenders: Unlocking Competitive Rates and Terms

House loan brokers are here to assist you in navigating the often overwhelming world of financing. With their extensive connections to lenders, a house loan broker offers a variety of loan choices that can be especially beneficial for families seeking competitive rates and favorable conditions. By facilitating comparisons among different lenders, a house loan broker empowers individuals to discover financing options that are tailored to their unique financial situations.

Why Accessing Multiple Lenders Matters:

- Broader Choices: You gain access to a wide array of loan products and terms, enhancing your ability to find the perfect fit for your needs.

- Competitive Rates: The increased competition among lenders often results in more attractive rates, allowing families to save significantly over the life of their loans.

- Customized Solutions: Brokers, like F5 Mortgage, utilize user-friendly technology to simplify the financing process and provide personalized guidance, ensuring a more tailored experience just for you.

In 2022, the bridging loan market witnessed £4.94 billion lent through completions, highlighting the growing reliance on diverse financing options. This statistic underscores the vital role house loan brokers play in enabling access to beneficial financial products, ultimately assisting families in achieving their homeownership dreams. For instance, a successful South African couple recently expanded their UK real estate investment portfolio by leveraging an expert’s knowledge to navigate competitive loan rates. Additionally, Mrs. A secured authorization for a total liability of around £5 million, showcasing the remarkable potential funding that intermediaries can help clients attain. We understand how challenging this journey can be, and we’re here to support you every step of the way.

Time-Saving Convenience: Streamlining the Mortgage Process

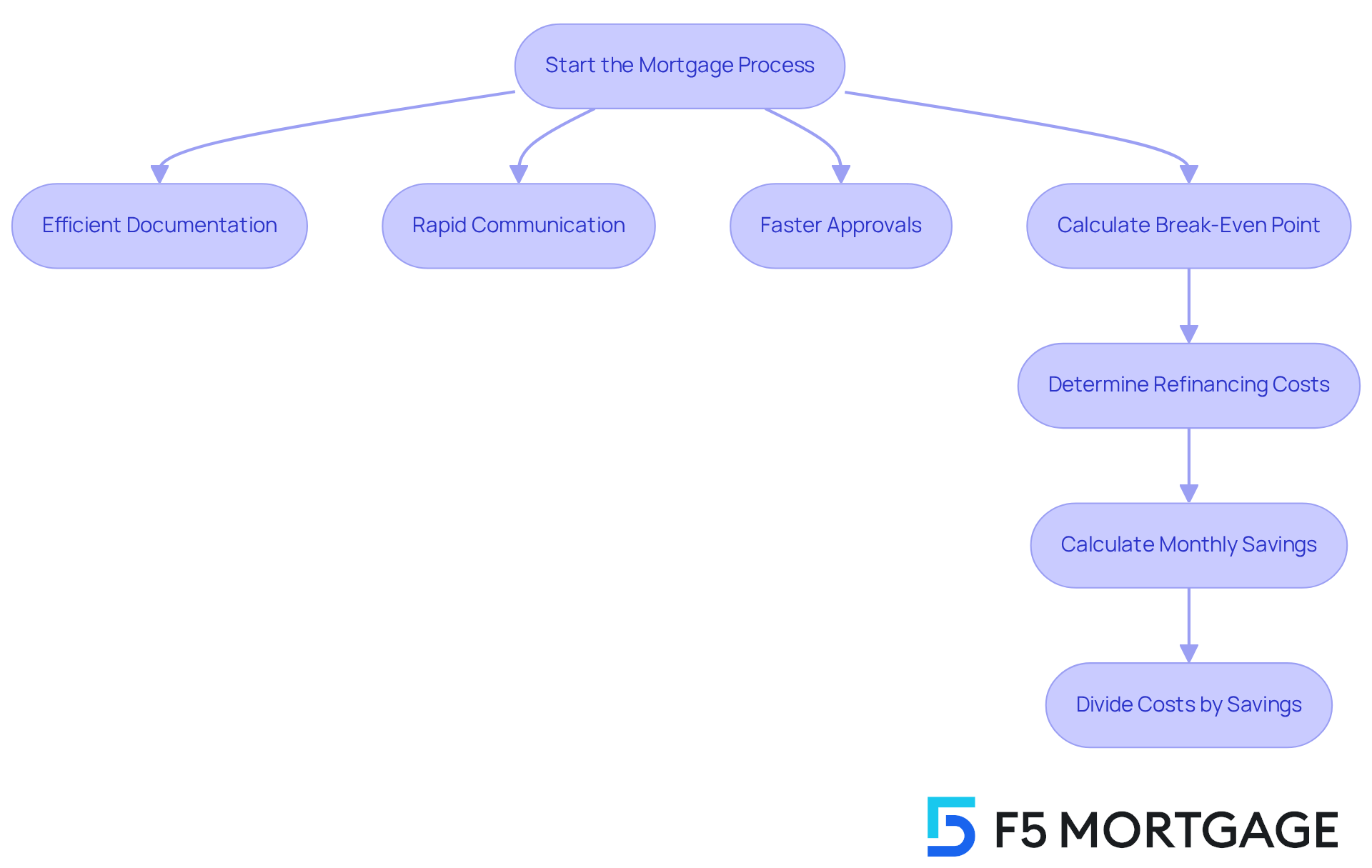

Navigating the mortgage process can often feel overwhelming. With extensive paperwork and multiple communications with lenders, it’s understandable to feel stressed. House loan brokers play an essential role in simplifying this experience, efficiently handling the intricacies on behalf of those they serve. By overseeing the collection of essential documentation and submitting applications, agents not only save households valuable time but also alleviate the stress related to the process.

- Efficient Documentation: Brokers meticulously manage and organize all paperwork, ensuring that everything is in order and submitted correctly. This significantly reduces the chances of delays, allowing you to focus on what matters most.

- Rapid Communication: They serve as a link between customers and lenders, enabling prompt communication that speeds up response times. This keeps households informed throughout the process, making it less daunting.

- Faster Approvals: With established relationships with various lenders, brokers can often secure quicker approvals for their clients. This enhances the overall efficiency of the mortgage process, giving you peace of mind.

Furthermore, understanding the financial consequences of refinancing is essential for households seeking to improve their residences. To calculate your break-even point, follow these steps:

- Determine your refinancing costs, including all closing fees and expenses.

- Calculate your monthly savings by subtracting your new monthly payment from your current one.

- Divide your refinancing costs by your monthly savings to find out how many months it will take to break even.

For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months. This understanding is crucial for households to ensure they remain in their homes long enough to benefit from refinancing.

Statistics show that households working with a house loan broker experience a significant decrease in paperwork, with many stating a more streamlined application process. For example, the typical mortgage approval rate for home purchasers is 85.76%, indicating the efficiency of agents in managing the intricacies of mortgage financing. Expert opinions emphasize that a house loan broker not only provides improved offers but also excels in connecting with varied communities, making them essential partners for households looking to upgrade their homes. Real-world examples demonstrate how households have gained from streamlined processes, leading to quicker closings and a more tailored experience. At F5 Mortgage, we utilize accessible technology to streamline the loan process, guaranteeing a hassle-free experience for those we serve. Our commitment to providing no-pressure guidance and fast loan closings in under three weeks has earned us numerous positive testimonials from satisfied customers.

Personalized Service: Tailored Support Throughout Your Mortgage Journey

At F5 Mortgage, we understand how challenging the mortgage process can be. That’s why personalized service is at the heart of what we do. Our dedicated agents take the time to truly comprehend each family’s unique financial situation and goals, providing tailored support throughout the loan journey. This customer-focused approach ensures that you feel valued and supported at every stage, making the experience seamless and effective.

-

Dedicated Brokers: You will be paired with a broker who genuinely understands your specific needs. They are committed to guiding you through the complexities of the mortgage process, ensuring you never feel alone.

-

Regular Updates: We believe in consistent communication. You will receive regular updates about your loan status, keeping you informed and confident in your decisions.

-

Customized Solutions: Our agents craft financing strategies that align with your long-term objectives. This includes refinancing options that can reveal lower rates and flexible terms, specifically designed to benefit California homeowners. We’re here to support you every step of the way.

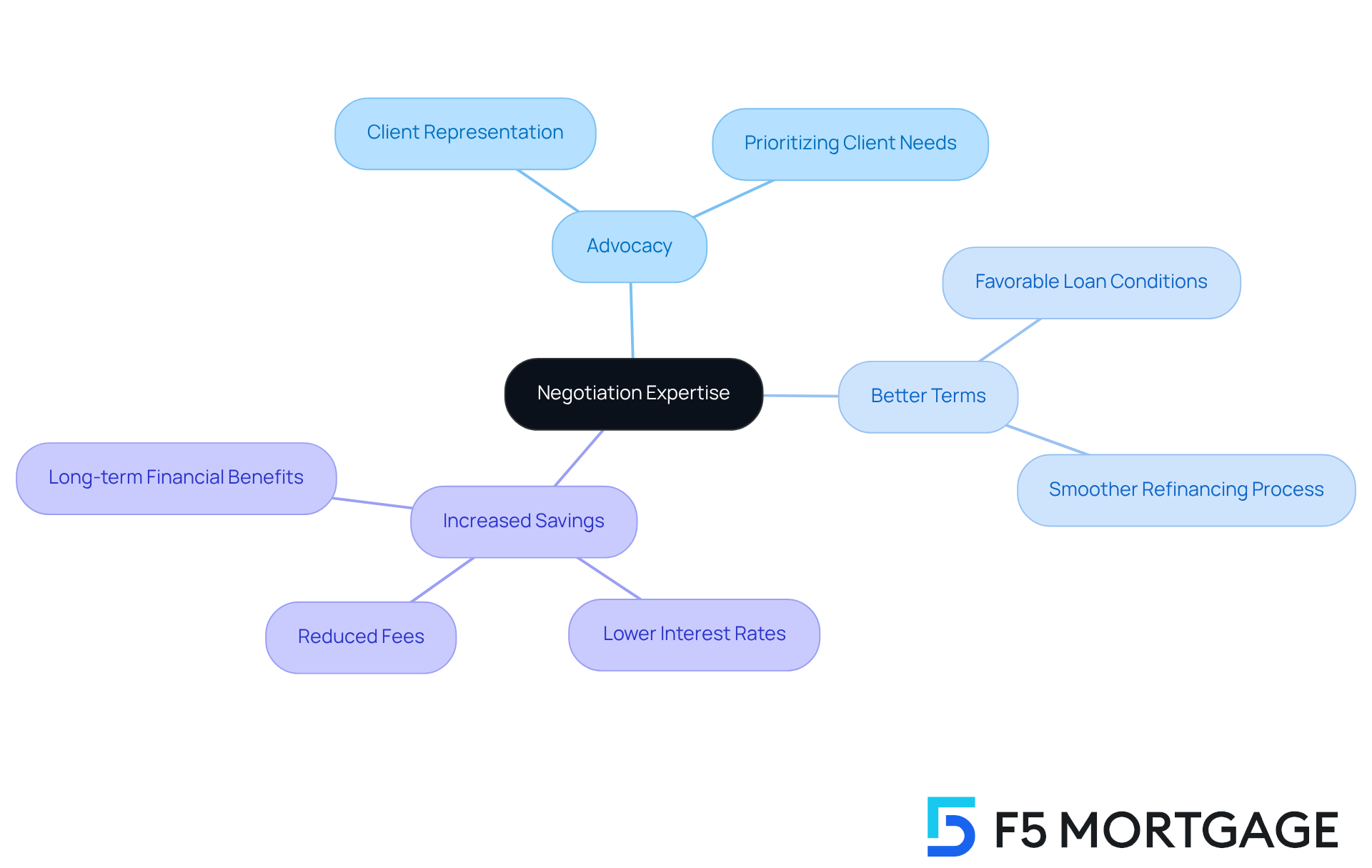

Negotiation Expertise: Securing Better Deals on Your Behalf

House loan brokers possess strong negotiation skills that can significantly benefit customers, especially when working with F5 Mortgage. We understand how challenging this process can be, and our dedication to a hassle-free financing experience is backed by user-friendly technology and individualized support. This guarantees that families obtain the best possible deal. We advocate for those we represent to secure better mortgage terms with the help of a house loan broker, including lower interest rates and reduced fees. This expertise is invaluable in ensuring that customers receive the best possible deal when working with a house loan broker.

Benefits of Negotiation Expertise:

- Advocacy: Brokers represent clients’ interests during negotiations with lenders, ensuring that your needs are prioritized.

- Better Terms: Skilled negotiation can lead to more favorable loan conditions, making the refinancing process smoother and more beneficial.

- Increased Savings: Lower rates and fees translate to substantial savings over time, allowing families to invest more in their new homes.

We’re here to support you every step of the way, ensuring that your journey towards homeownership is as seamless as possible.

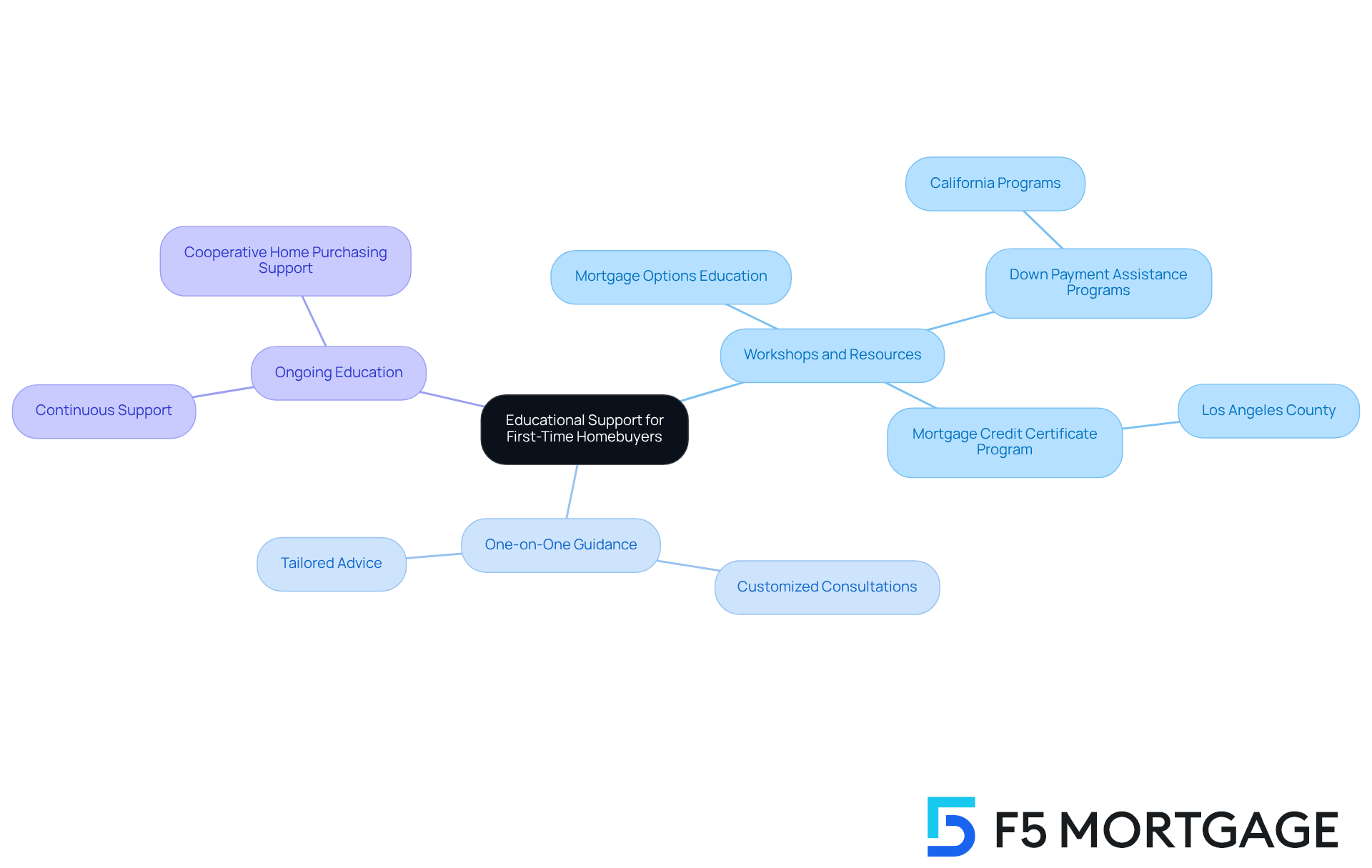

Educational Support: Empowering First-Time Homebuyers with Knowledge

First-time home purchasers often face a steep learning curve when they seek guidance from a house loan broker to navigate the loan process. We know how challenging this can be. At F5 Mortgage, we are here to support you every step of the way by leveraging user-friendly technology to simplify this journey, ensuring a stress-free experience. Our compassionate house loan brokers provide crucial educational assistance, helping you grasp the different elements of home funding. This empowerment allows households to make informed choices and feel assured throughout their process with a house loan broker.

Educational Support Features:

- Workshops and Resources: Our brokers provide workshops and materials designed to educate clients on mortgage options, including down payment assistance programs in California and the Mortgage Credit Certificate Program in Los Angeles County.

- One-on-One Guidance from a House Loan Broker: We offer customized consultations with a house loan broker to address your specific questions and concerns, ensuring that each household receives tailored advice that suits their unique situation.

- Ongoing Education: You will receive ongoing assistance and information throughout the loan process, with an emphasis on cooperative home purchasing support provided by a house loan broker to help you discover and obtain your ideal residence.

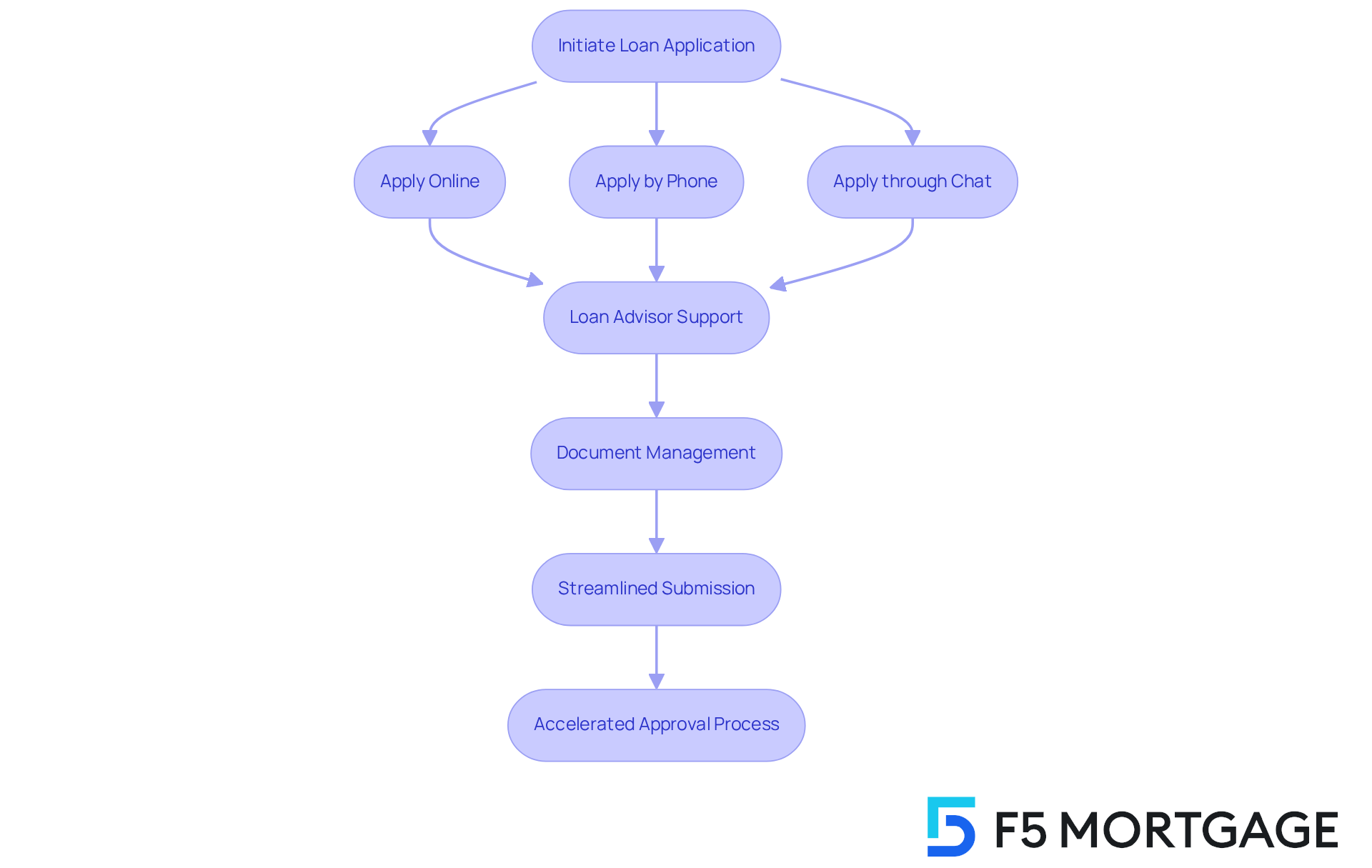

Administrative Assistance: Simplifying Paperwork and Processes

Navigating the loan application process can be overwhelming, especially for families facing a mountain of paperwork. At F5 Mortgage, we understand how challenging this can be, which is why we offer convenient application options—whether online, by phone, or through chat—allowing you to choose the method that suits you best.

Our loan advisors are here to support you every step of the way, providing thorough administrative assistance. They expertly manage the organization and submission of all necessary documents, ensuring that everything is in order and submitted correctly. This meticulous oversight not only streamlines the process but also significantly reduces the likelihood of errors that could delay approval.

The impact of efficient document management by our agents is profound. By handling the administrative tasks, agents accelerate the overall financing process, enabling families to focus on their home-buying journey rather than feeling overwhelmed by paperwork. Many families have reported smoother experiences when brokers take charge of their applications, leading to higher success rates in securing loans.

Moreover, at F5 Mortgage, we leverage user-friendly technology to simplify the process, ensuring a stress-free experience. Our goal is to guide, not to push, empowering you to navigate the complexities of mortgage applications confidently. This approach enhances efficiency and fosters a sense of security for families making significant financial decisions.

A recent case study involving a UK-based couple moving to the Isle of Man illustrated how our personalized assistance and expert advice resulted in a hassle-free experience. This highlights the concrete advantages of collaborating with an experienced professional. Ultimately, partnering with a loan consultant transforms a potentially overwhelming experience into a manageable and successful endeavor.

Long-Term Relationships: Ongoing Support for Future Mortgage Needs

Establishing a long-term relationship with a mortgage professional can provide families with ongoing support for their future mortgage needs. We know how challenging this can be—whether it’s refinancing, purchasing a new home, or navigating changes in financial circumstances. Having a trusted broker by your side can truly make all the difference. At F5 Mortgage, we are committed to nurturing these relationships, ensuring that our clients have access to expert advice and compassionate support whenever they need it.

-

Future Guidance: Our brokers are here to offer insights and recommendations for your future mortgage decisions, helping you feel confident in your choices.

-

Trust and Reliability: As you build an established relationship with your broker, you’ll cultivate trust and confidence in their expertise, knowing they have your best interests at heart.

-

Continued Support: You can rely on your broker for assistance with any mortgage-related inquiries, providing you with peace of mind every step of the way.

Conclusion

Utilizing a house loan broker can significantly enhance the experience of families looking to upgrade their homes. We know how challenging this can be, and by offering personalized, expert guidance throughout the mortgage process, brokers like F5 Mortgage ensure that clients navigate complex loan options with ease and confidence. This tailored approach not only simplifies decision-making but also empowers families to make informed financial choices that align with their unique circumstances.

Key insights from the article highlight the numerous benefits of working with a broker:

- Access to a diverse range of loan products

- Competitive rates

- Ongoing administrative support

- Negotiation expertise

The advantages are clear. Brokers streamline the mortgage process, reduce paperwork, and provide valuable educational resources. They truly become indispensable partners for first-time homebuyers and seasoned investors alike.

In a rapidly evolving housing market, the role of a house loan broker is more crucial than ever. Families are encouraged to leverage these services to unlock better financing options and secure their dream homes. By fostering long-term relationships with brokers, clients can ensure continued support for future mortgage needs. We’re here to support you every step of the way, ultimately paving the path for a more secure financial future. Embracing the expertise of a house loan broker can transform the home-buying journey into a seamless and rewarding experience.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage offers personalized mortgage solutions tailored to individual financial circumstances, including a range of loan options such as fixed-rate loans, FHA loans, VA loans, and jumbo loans.

How does F5 Mortgage personalize its mortgage solutions?

F5 Mortgage engages in tailored consultations to understand each client’s needs and provides no-pressure guidance throughout the loan process, ensuring clients receive the most suitable financing available.

What are some key features of F5 Mortgage?

Key features include personalized consultations, diverse loan programs, and user-friendly tools like loan calculators to assist in decision-making and simplify the refinancing process.

How can a house loan broker help with navigating loan options?

A knowledgeable house loan broker provides essential guidance by clarifying the nuances of various loan types, interest rates, and repayment terms, making it easier for clients to make informed decisions.

What advantages do borrowers have when using a loan broker?

Borrowers who use loan brokers often report higher decision satisfaction and confidence after securing a loan, as brokers condense complex information into manageable insights and offer tailored recommendations based on unique financial situations.

What ongoing support does F5 Mortgage provide during the mortgage process?

F5 Mortgage representatives provide continuous assistance from the initial application to closing, handling application and processing tasks to ensure seamless communication and updates.

How can working with a broker save money on loans?

Brokers like F5 Mortgage can negotiate better rates and terms, potentially leading to lower interest rates, decreased fees, and overall savings on the total expense of the loan.

What are the typical costs associated with refinancing a loan in Colorado?

Refinancing a loan in Colorado typically incurs up-front expenses averaging between 2% and 5% of the total amount, which can be significant, especially for higher-value homes.

How does F5 Mortgage assist clients in reducing refinancing costs?

F5 Mortgage works with top lenders to help clients compare rates and find affordable refinance options, potentially reducing costs through down payment assistance programs.

What specific savings can clients expect from working with a loan broker?

Clients can expect access to wholesale rates, fee negotiation to reduce or eliminate certain mortgage fees, and long-term savings due to reduced rates throughout the duration of the loan.