Overview

The article highlights the many benefits of fixed-rate equity loans for families eager to upgrade their homes. We understand how challenging this journey can be, and that’s why it’s important to explore options like predictable payments, lower interest rates, and potential tax benefits.

These advantages not only provide financial stability but also simplify budgeting. Imagine being able to make meaningful improvements to your living space without the stress of fluctuating costs. With fixed-rate loans, families can confidently plan their upgrades, knowing exactly what to expect each month.

We’re here to support you every step of the way as you consider these options. Fixed-rate equity loans can empower you to create the home you’ve always dreamed of, while also ensuring your financial well-being. Take the first step towards a brighter future by exploring these opportunities today.

Introduction

As more homeowners look to enhance their living spaces, the appeal of fixed rate equity loans continues to grow. We understand how important it is for families to have the financial means to fund renovations and improvements. These loans not only provide that support but also come with a range of benefits that can significantly ease your financial burden.

Imagine having predictable payments and lower interest rates, along with potential tax deductions. These advantages can simplify your journey toward homeownership. However, with so many options available, it’s natural to wonder: how can families ensure they are making the best choice for their unique financial situations? We’re here to support you every step of the way.

F5 Mortgage: Competitive Fixed Rate Equity Loan Options

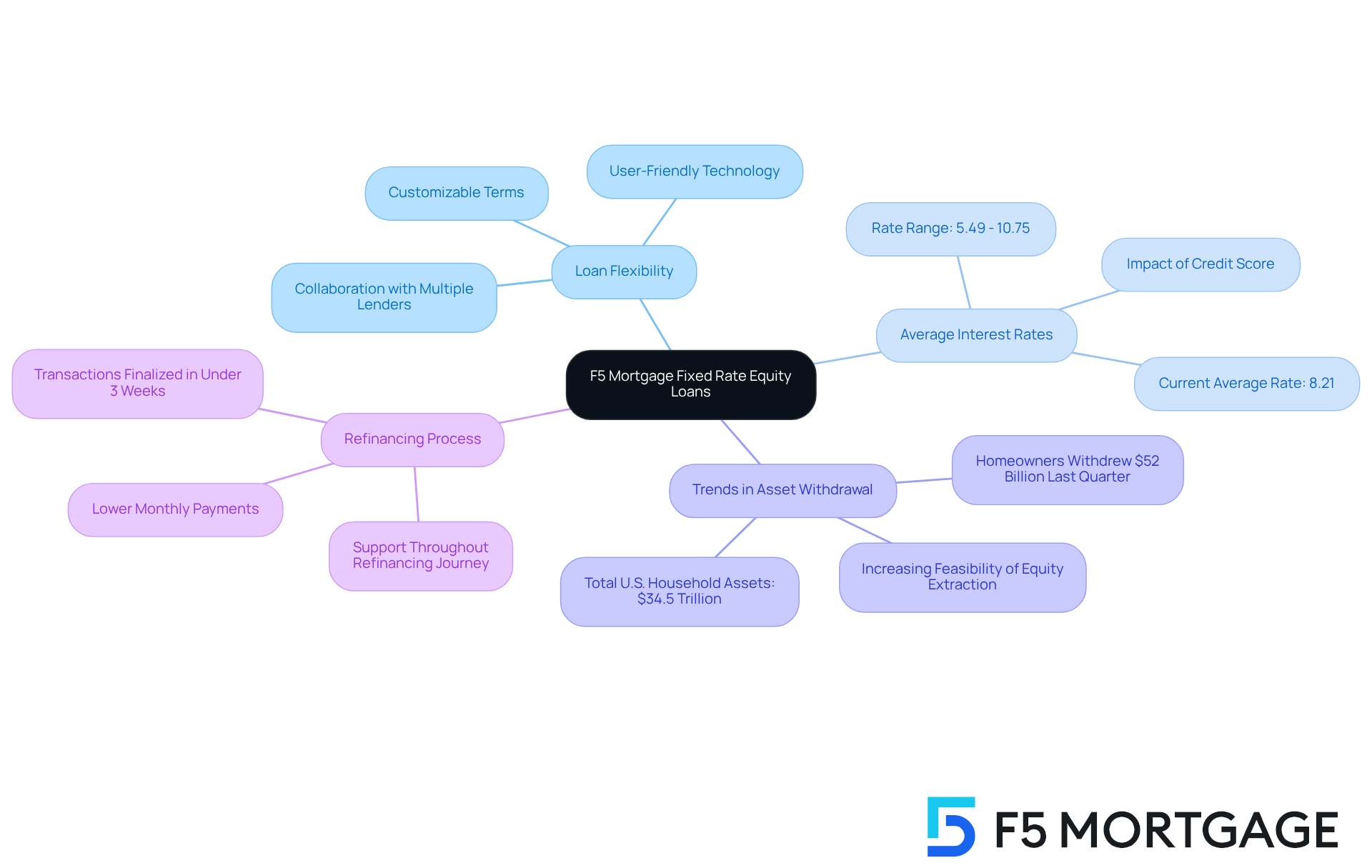

At F5 Mortgage, we understand how challenging it can be to find the right financing for your home improvements. That’s why we offer a range of attractive fixed rate equity loan options tailored to the unique needs of families like yours. By leveraging user-friendly technology and collaborating with multiple lenders, we provide access to a variety of customizable terms and conditions designed to fit your financial situation.

This flexibility allows you to secure financing that aligns with your specific goals, whether you’re considering renovations, expansions, or other enhancements. We know that every family’s dreams are different, and our refinancing services are here to help you discover some of the lowest rates available. Our aim is to ensure you can lower your monthly payments and save money.

As of October 2025, the average interest rate for a fixed rate equity loan is 8.21%, based on a borrower with a credit score of 700 or higher and a combined value-to-value ratio of 80%. With U.S. household assets totaling $34.5 trillion, property owners withdrew $52 billion in assets last quarter. This trend shows that leveraging your property’s value for upgrades is becoming an increasingly feasible way to enhance your home’s worth and overall living space.

At F5 Mortgage, we pride ourselves on finalizing most transactions in under 3 weeks. We’re here to support you every step of the way throughout the refinancing journey, ensuring you can tap into your home value effectively. Let us help you turn your vision into reality.

Predictable Payments: Stability for Your Budget

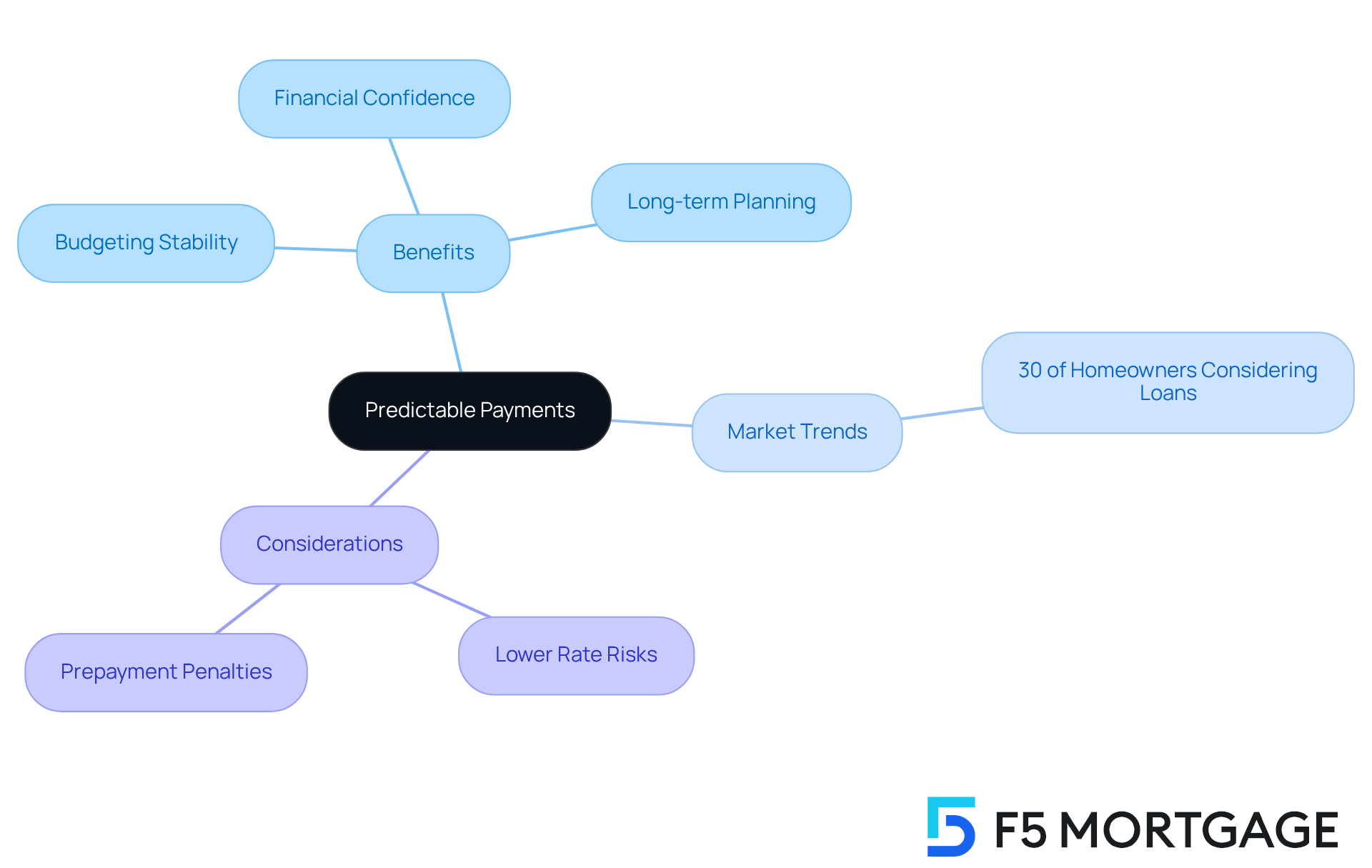

One of the key benefits of a fixed rate equity loan is its ability to provide consistent monthly payments, which can significantly help households with budgeting. With a fixed-rate mortgage, families can manage their finances with confidence, knowing that their mortgage payment will remain stable throughout the term. This predictability not only simplifies financial planning but also reduces the anxiety that comes with potential payment fluctuations. For instance, households can allocate their funds more effectively for other essential expenses, such as education or home improvements, without worrying about unexpected increases in their mortgage costs.

Additionally, financial advisors often recommend fixed-rate financing due to its reliability, especially in a fluctuating interest rate environment. As of September 2025, the average interest rate for fixed-rate lines of credit (HELOCs) is approximately 8.10%. This makes them an attractive option for families looking to tap into their property’s value. By securing a fixed-rate mortgage through F5 Mortgage, households can lock in their interest rate, ensuring stable monthly payments that facilitate easier budgeting and financial planning.

Recent market trends indicate that nearly 30% of U.S. homeowners are considering leveraging their home value in the upcoming year. This highlights the significance of a fixed rate equity loan as a financing option for families. Real-life experiences show that households using a fixed rate equity loan often report a greater sense of confidence in their financial choices, allowing them to manage their budgets more effectively. This predictability empowers families to make informed decisions about their spending and savings, ultimately contributing to a more stable financial future.

However, it is important to weigh potential drawbacks, such as the risk of missing out on lower rates when they drop or facing early prepayment penalties for refinancing. As Bankrate.com points out, fixed-rate HELOCs can offer peace of mind with steady monthly payments, making budgeting easier for families. To make the most informed decision, we encourage households to consult with a mortgage broker or financial advisor, like those at F5 Mortgage, to explore their options and align their financial goals. We’re here to support you every step of the way.

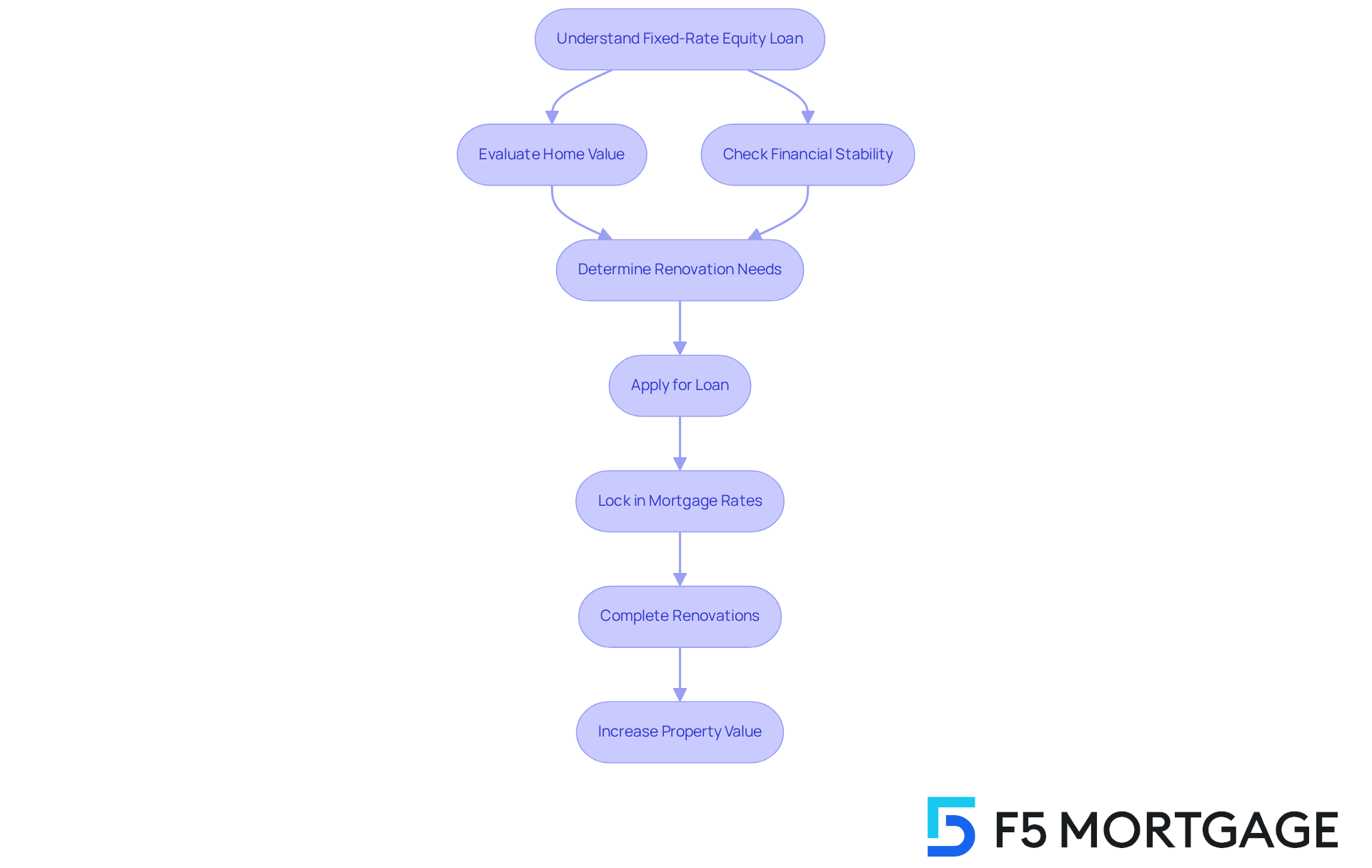

Home Improvement Financing: Enhance Your Living Space

Fixed-rate funds serve as a valuable resource for families eager to improve their living spaces. These financial products empower property owners to tap into their home’s value, providing the necessary funds for meaningful upgrades like kitchen renovations, bathroom enhancements, or even adding extra rooms. On average, homeowners can expect to invest around $46,700 in mortgage financing, reflecting the typical costs associated with significant property improvements, as noted in June 2024.

By choosing a fixed rate equity loan, families not only elevate their quality of life but also enhance their property’s overall value. Successful renovations funded by these loans often lead to increased property equity, transforming them into a wise investment. For instance, green remodeling initiatives have shown to boost sustainability while significantly increasing property value, showcasing the dual benefits of such improvements.

Experts in residential renovation funding emphasize the importance of understanding the terms and requirements of a fixed rate equity loan. They suggest that these financial products provide stability in budgeting, as homeowners benefit from consistent monthly payments. This predictability allows families to plan their renovations without the stress of fluctuating interest rates, making a fixed rate equity loan an attractive choice for those looking to improve their homes.

Furthermore, once your application is approved, it’s essential to lock in your mortgage rates with F5 Mortgage to shield yourself from market fluctuations during the processing period. Understanding property value criteria, such as maintaining an 80% value-to-price ratio and a maximum 43% debt-to-income ratio, is vital for securing competitive mortgage options.

In conclusion, a fixed rate equity loan not only facilitates necessary property improvements but also contributes to long-term financial security and increased property value, making it an ideal choice for families eager to enhance their living environments.

Interest Rate Security: Protect Against Future Increases

A fixed rate equity loan provides essential protection against rising interest rates, enabling households to secure a stable rate and shield themselves from future increases in borrowing costs. This stability is particularly valuable in a volatile market, where variable rates can lead to unexpected financial pressures. For instance, since early 2021, as mortgage interest rates have surged, families with fixed-rate agreements have managed to maintain their monthly payments. They have avoided the substantial $1,265 increase in principal and interest payments that many have faced on a $400,000 mortgage due to fluctuating rates.

By choosing a fixed rate equity loan, households can enjoy peace of mind, knowing their interest expenses will remain consistent throughout the financing period. This predictability enables better budgeting and financial planning. It is especially advantageous for military families, who often deal with frequent relocations and varying income levels. The use of a fixed rate equity loan simplifies their financial management, providing stability amidst changing circumstances. We understand how challenging this can be, and we’re here to support you every step of the way.

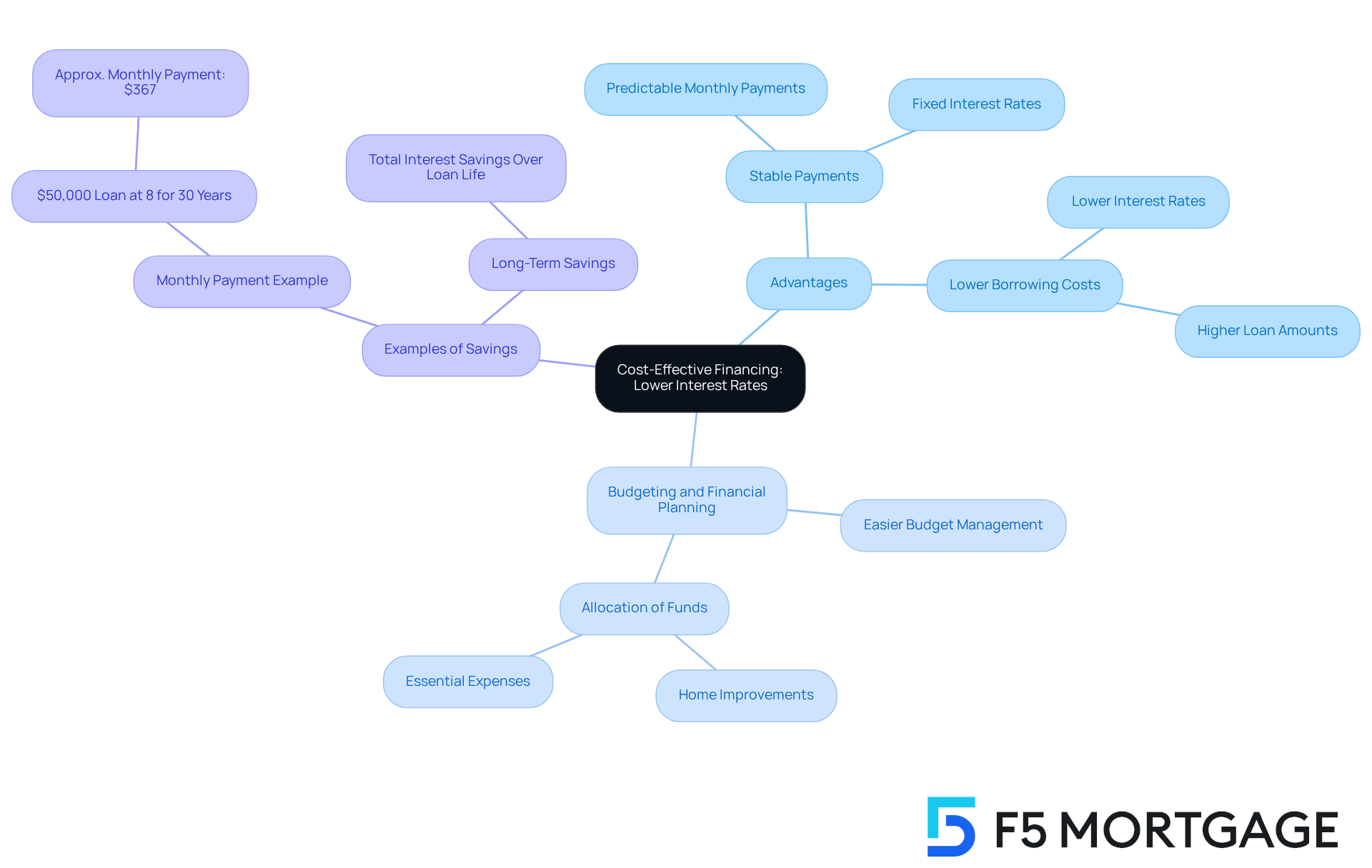

Cost-Effective Financing: Lower Interest Rates

A fixed rate equity loan often offers lower interest rates compared to other funding options, making it a financially sound choice for families. By securing financing at a favorable rate, households can save significantly over the life of the loan. For instance, with a typical interest rate of about 8.21% for a 5-year loan, families can expect stable monthly payments. This predictability is helpful for budgeting and financial planning, allowing them to allocate funds toward other essential expenses or investments that enhance their overall financial well-being.

Moreover, families utilizing fixed-rate mortgages for home improvements can experience substantial savings. Consider a $50,000 property financing plan at an 8% interest rate, which results in a monthly payment of roughly $367. This payment is often more manageable than options with higher rates. Experts suggest that lower interest rates not only reduce borrowing costs but also empower families to take on larger projects without the worry of escalating payments. This financial advantage positions a fixed rate equity loan as an attractive option for families looking to enhance their homes while maintaining control over their budgets.

Debt Consolidation: Simplify Your Financial Management

Families often face the challenge of managing multiple debts, and we understand how overwhelming that can be. A fixed rate equity loan can be a lifeline, allowing families to consolidate high-interest debts into a single, more manageable financial agreement with a lower fixed rate. By doing so, many households experience an average decrease in monthly payments, often saving between $130 to $150 each month. This not only simplifies budgeting but also helps families regain control over their finances, enabling them to focus on home improvements and other essential goals.

Financial advisors emphasize the stability that fixed-rate mortgages provide, allowing families to organize their budgets without the worry of fluctuating interest rates. Imagine the relief of merging your debts; households that have taken this step often report a clearer financial situation. They can concentrate on their property enhancement projects rather than juggling multiple payments. The benefits of merging debt with home values extend beyond mere convenience; they can lead to substantial savings on interest expenses, making this a strategic choice for families looking to enhance their financial health.

We know how challenging this can be, but remember, you don’t have to navigate this journey alone. We’re here to support you every step of the way as you explore your options for a brighter financial future.

Longer Repayment Terms: Manageable Monthly Payments

Fixed-rate equity financing offers extended repayment periods, which can significantly ease the monthly financial burden for families. By lengthening the repayment timeline, households can spread out payments in a way that feels manageable, reducing their monthly commitments. For instance, borrowing $30,000 at an 8.21% interest rate over 15 years results in a monthly payment of approximately $258. This flexibility is especially valuable for families with fluctuating incomes or those trying to balance their lifestyle while enhancing their homes.

Moreover, households can benefit from the cost-effectiveness of property improvements through these extended financing options. Imagine a family wanting to renovate their kitchen; they can finance the project with a fixed rate equity loan, which allows them to maintain their lifestyle without the anxiety of high monthly payments. This strategy not only supports essential upgrades but also boosts the overall value of their home.

Mortgage specialists emphasize that longer repayment periods can help families manage their finances more effectively. By selecting a credit option with a longer duration, families can allocate resources to other necessary expenses, fostering a more stable financial environment. This thoughtful approach to financial planning can lead to a better quality of life while still working towards homeownership goals.

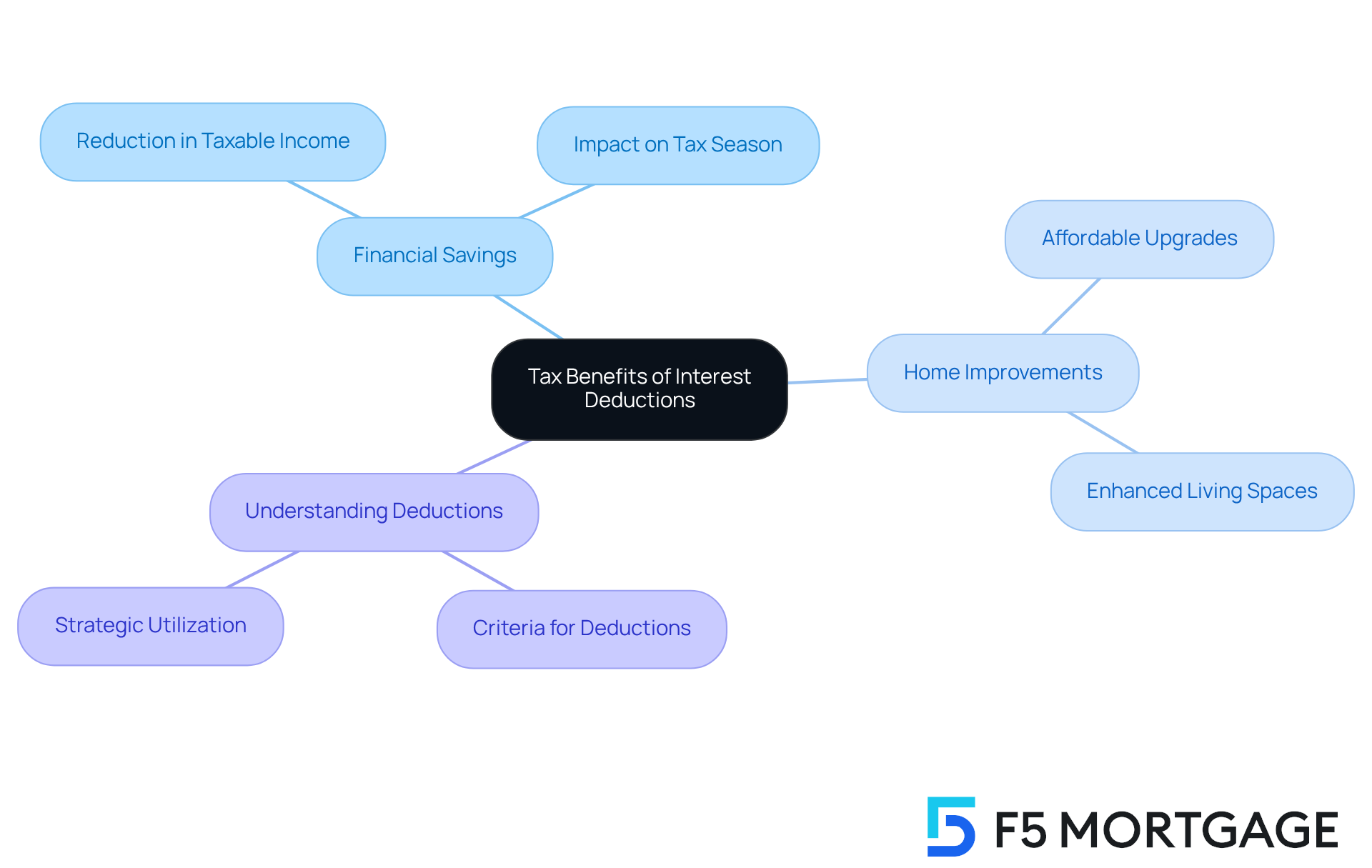

Tax Benefits: Potential Deductions on Interest Payments

One significant yet often overlooked advantage of a fixed rate equity loan is the potential for tax deductions on interest payments. We know how challenging financial decisions can be, and understanding this benefit can make a real difference for families. By deducting the interest paid on their mortgage from taxable income, families can experience substantial savings during tax season. This financial relief not only eases the burden of higher interest rates but also enhances the overall affordability of home upgrades.

Imagine a homeowner who utilizes these deductions—effectively reducing their taxable income. This makes it easier for them to invest in improvements that elevate their living spaces, creating a more comfortable home for their loved ones. Recent data shows that a significant percentage of households take advantage of mortgage interest deductions, highlighting the importance of understanding these tax benefits.

Tax experts emphasize that knowing the criteria for these deductions can greatly enhance a household’s opportunities to maximize their savings, especially during tax season. By strategically utilizing a fixed rate equity loan, families can not only improve their residences but also benefit from the financial relief that comes with effective tax planning. We’re here to support you every step of the way as you navigate these options for a brighter financial future.

Personalized Service: Tailored Support from F5 Mortgage

At F5 Mortgage, we understand how challenging the mortgage journey can be for families. That’s why we are dedicated to providing tailored service to support you every step of the way. With over 10 years of experience, our loan officer, Jeff Bozimowski, specializes in crafting mortgage solutions that fit your unique needs, especially for self-employed individuals and those in unique financial situations.

Our team is committed to fostering an environment where families feel confident and informed as they explore their mortgage options. This individualized approach enhances decision-making and significantly contributes to successful home upgrades. Clients often report a remarkable 94% satisfaction rate after engaging in personalized consultations, highlighting the positive impact of our guidance.

Testimonials from pleased clients illustrate how Jeff and his team simplify the process and eliminate concerns. We turn the intimidating task of obtaining financing into a cooperative experience. By prioritizing personalized service, F5 Mortgage ensures that you are equipped to make informed choices, paving the way for your homeownership dreams.

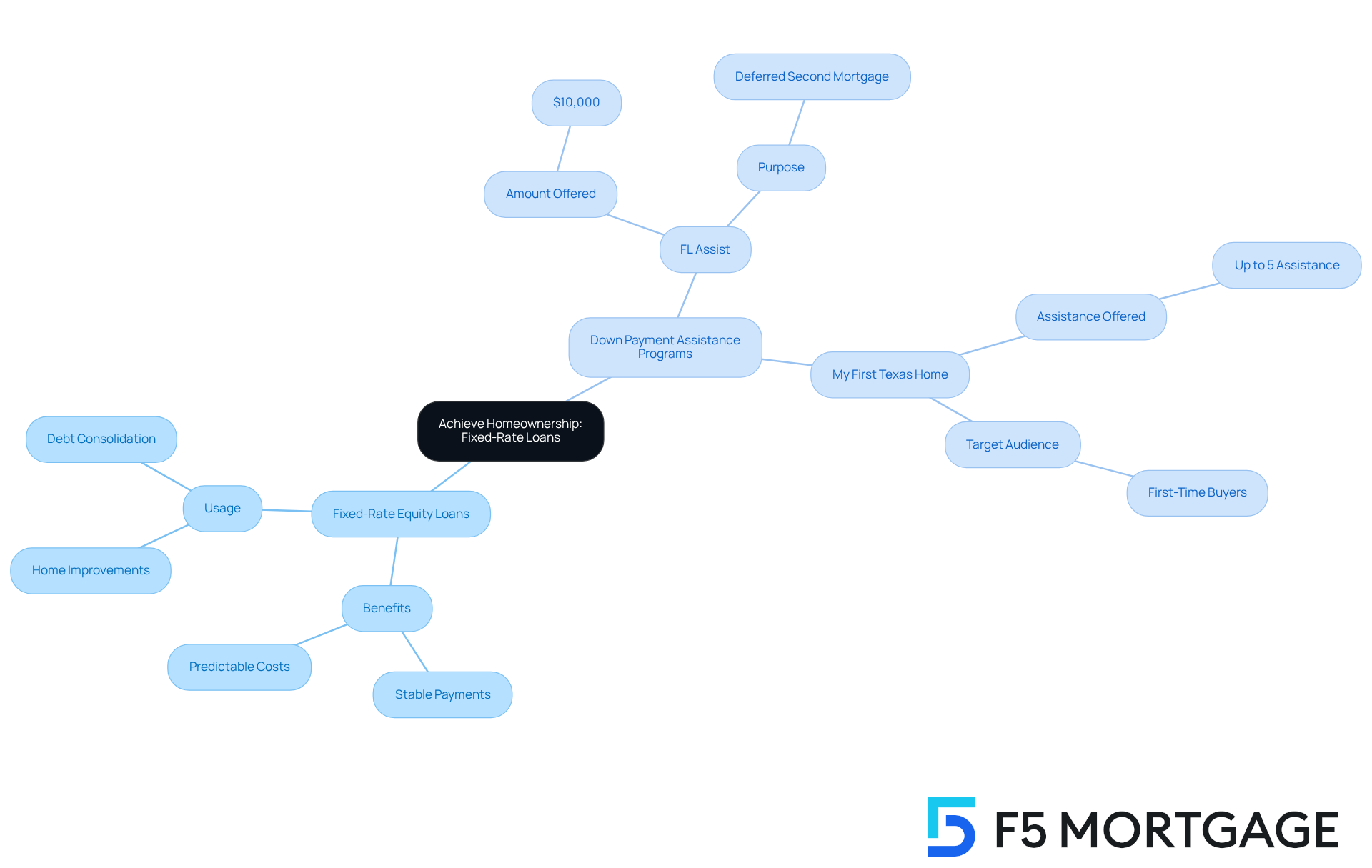

Achieve Homeownership: Funding Your Dreams with Fixed-Rate Loans

A fixed rate equity loan serves as a powerful resource for households striving to achieve homeownership and fulfill their dreams. We understand how challenging this can be, and these loans provide essential funding for home improvements, enabling families to create the living environments they desire.

With the support of F5 Mortgage, which boasts 5-star ratings on platforms like Google and Zillow, individuals can pursue their homeownership goals confidently. Knowing you have a trustworthy ally on your mortgage journey makes all the difference.

F5 Mortgage also offers valuable down payment assistance programs in states like Florida and Texas. For instance:

- FL Assist provides up to $10,000 as a deferred second mortgage

- The My First Texas Home program helps first-time buyers secure low-rate mortgages with up to 5% assistance

This client-centric approach ensures that families receive expert guidance and support throughout the financing process.

To maximize your home buying potential, we’re here to support you every step of the way. Consider reaching out to F5 Mortgage to explore your options today.

Conclusion

A fixed rate equity loan stands out as a strategic financial tool for families looking to enhance their homes and secure their financial future. We know how challenging this can be, and by offering predictable monthly payments along with the ability to leverage home equity, these loans empower homeowners to undertake meaningful renovations while maintaining budget stability. With the backing of F5 Mortgage, families can navigate the complexities of financing with assurance, knowing they have access to competitive rates and personalized support tailored to their unique needs.

The article highlights several key advantages of fixed rate equity loans. These include:

- Their role in facilitating home improvements

- Providing interest rate security

- Simplifying debt management

Families can benefit from lower interest rates, longer repayment terms, and potential tax deductions—all of which contribute to a more manageable financial landscape. Additionally, the expertise and personalized service offered by F5 Mortgage can make the process smoother and more efficient, ensuring that families feel confident in their financial decisions.

Ultimately, embracing a fixed rate equity loan can be a transformative step for families aiming to improve their living spaces and achieve long-term financial stability. By exploring these financing options, homeowners can not only enhance their properties but also take control of their financial futures. It is essential to consider the benefits outlined and consult with professionals to make informed choices that align with personal goals. Together, we can pave the way for a brighter, more secure home environment.

Frequently Asked Questions

What financing options does F5 Mortgage offer for home improvements?

F5 Mortgage offers a range of attractive fixed rate equity loan options tailored to the unique needs of families, providing customizable terms and conditions for various home improvement projects.

How quickly can F5 Mortgage finalize transactions?

F5 Mortgage prides itself on finalizing most transactions in under 3 weeks.

What is the average interest rate for fixed rate equity loans as of October 2025?

As of October 2025, the average interest rate for a fixed rate equity loan is 8.21% for borrowers with a credit score of 700 or higher and a combined value-to-value ratio of 80%.

What are the benefits of a fixed rate equity loan?

A fixed rate equity loan provides consistent monthly payments, aiding households in budgeting and financial planning. This predictability reduces anxiety related to potential payment fluctuations.

How can fixed rate equity loans help with home improvements?

Fixed rate equity loans allow property owners to tap into their home’s value, providing necessary funds for significant upgrades such as kitchen or bathroom renovations, which can also enhance the property’s overall value.

What should homeowners consider when applying for a fixed rate equity loan?

Homeowners should understand the terms and requirements, including maintaining an 80% value-to-price ratio and a maximum 43% debt-to-income ratio, to secure competitive mortgage options.

What are the potential drawbacks of fixed rate equity loans?

Potential drawbacks include the risk of missing out on lower rates if interest rates drop and facing early prepayment penalties for refinancing.

Why might financial advisors recommend fixed-rate financing?

Financial advisors often recommend fixed-rate financing due to its reliability in a fluctuating interest rate environment, providing peace of mind with stable monthly payments.

How much do homeowners typically invest in mortgage financing for improvements?

On average, homeowners can expect to invest around $46,700 in mortgage financing for significant property improvements.

What is the significance of recent market trends regarding fixed rate equity loans?

Nearly 30% of U.S. homeowners are considering leveraging their home value in the upcoming year, highlighting the growing importance of fixed rate equity loans as a financing option for families.