Overview

In today’s world, we know how challenging it can be for homeowners to finance property upgrades. That’s why exploring the benefits of fixed HELOC rates can be a game-changer. These rates offer predictable monthly payments, which can help you plan your budget with confidence. Imagine knowing exactly what to expect each month, allowing you to focus on what truly matters—your home and your family.

Additionally, fixed HELOC rates often come with lower interest rates compared to traditional loans. This advantage can lead to significant savings over time, giving you more freedom to invest in the improvements your home needs. Plus, with protection against future rate increases, you can rest easy knowing your financial plan is secure.

Ultimately, these features contribute to better financial management and ease of budgeting for your home improvements. We’re here to support you every step of the way as you navigate this important decision. By considering a fixed HELOC, you can empower yourself to make the upgrades that will enhance your living space and overall quality of life.

Introduction

Fixed-rate HELOCs have become a popular financing solution for homeowners looking to improve their properties without the worry of fluctuating interest rates. These loans not only ensure predictable monthly payments, making budgeting easier, but they also present significant benefits over traditional home equity loans, such as lower interest rates and reduced fees.

However, with so many options available, how can homeowners determine if a fixed-rate HELOC is truly the best choice for their renovation plans? In this article, we will explore ten compelling benefits of fixed HELOC rates, shedding light on why they may be the perfect financial tool for your home upgrades.

We know how challenging this decision can be, and we’re here to support you every step of the way.

F5 Mortgage: Competitive Fixed-Rate HELOC Options for Homeowners

At F5 Mortgage LLC, we understand how important it is for homeowners to finance upgrades to their properties. That’s why we offer a variety of competitive fixed heloc rates specifically tailored for families like yours. By collaborating with over two dozen top lenders, we ensure you have access to the most favorable rates and terms available in the market. Our independent brokerage is committed to your satisfaction, positioning ourselves as a trustworthy partner as you navigate your financial solutions for property enhancements.

Fixed heloc rates provide the stability of consistent monthly payments, which makes budgeting much simpler. As of 2025, the interest percentage for fixed heloc rates averages approximately 7.89%. This indicates a positive environment for those looking to tap into their property equity for renovations or expansions.

Recent trends reveal a growing preference among property owners for fixed heloc rates. These choices offer protection against fluctuating interest rates, which can be a source of concern. Experts agree that utilizing fixed heloc rates can be a strategic decision for funding your property improvements. This allows you to enhance your living spaces while maintaining control over your finances.

In the words of satisfied clients, “F5 Mortgage made the process smooth and clear, assisting us in obtaining the best deal for our renovations.” With our dedication to personalized service and extensive lender collaborations, we are here to help you securely and effectively.

Predictable Monthly Payments: A Key Benefit of Fixed-Rate HELOCs

One of the standout advantages of fixed heloc rates is the predictability they provide in monthly payments. This feature enables residents to budget effectively, alleviating the anxiety that often accompanies fluctuating interest rates. We understand how important stability is, especially for families planning significant home upgrades. It not only facilitates better financial planning but also fosters peace of mind.

Additionally, property owners have the option to change the duration of their loans through refinancing. This can lead to reduced monthly payments or even the removal of private mortgage insurance (PMI) if they have gained sufficient equity. Statistics show that property owners who utilize fixed heloc rates report a higher level of satisfaction with their budgeting processes. This satisfaction allows families to allocate funds more efficiently for renovations and improvements.

Financial advisors often recommend these options for their ability to simplify financial management. We know how challenging this can be, and these solutions ensure that families can focus on enhancing their living spaces without the stress of unexpected payment changes. We’re here to support you every step of the way as you .

Lower Interest Rates Compared to Traditional Home Equity Loans

We understand how challenging it can be to navigate home financing, especially when considering improvements to your property. Homeowners like you often find that fixed HELOC rates provide reduced interest levels compared to conventional equity loans, making them an appealing choice. This cost advantage allows you to access the necessary funds without the burden of high-interest debt, paving the way for your home improvement dreams.

By choosing fixed HELOC rates, you can achieve substantial savings on interest payments throughout the loan’s duration. For instance, recent data reveals that the average home equity loan percentage was 8.28 percent, while fixed HELOC rates can provide considerably lower rates than this threshold. Furthermore, HELOC interest levels concluded 2024 nearly a full percentage point lower than the prior year, making fixed HELOC rates even more attractive as alternatives.

Imagine the peace of mind that comes with consistent monthly payments, as demonstrated by case studies of property owners who have utilized fixed HELOC rates for their renovations. They not only benefit from stable payments but also avoid the unpredictability associated with fixed HELOC rates. Additionally, specialists predict a possible decrease in HELOC costs by 0.25% or greater in 2025. This creates a favorable moment for you to consider utilizing your equity for home enhancements.

This financial strategy is particularly beneficial in today’s mortgage market. We encourage you to explore how you can for various financial needs while maintaining control over your borrowing costs. Remember, we’re here to support you every step of the way.

Rate Locking: Protect Against Future Interest Rate Increases

Fixed heloc rates provide property owners a valuable advantage by enabling them to secure their interest rates, thus protecting them from potential future increases. This feature is especially beneficial in a turbulent market, where interest rates can fluctuate unexpectedly. With a stable rate, homeowners can confidently plan for their home improvements, alleviating the stress associated with rising costs. We understand how challenging this can be, and this stability enables families to focus on their renovation goals without the worry of escalating expenses.

Many lenders now offer fixed heloc rates, which makes them particularly appealing in today’s economic climate. With the for fixed heloc rates hovering around 8.47% as of early October 2025, locking in a rate can safeguard against possible hikes, ensuring that homeowners maintain control over their financial commitments. Additionally, the ability to use fixed heloc rates on a portion of the HELOC balance allows for strategic financial planning, further enhancing the attractiveness of this borrowing option. We’re here to support you every step of the way as you navigate these decisions.

Flexibility in Accessing Funds for Home Improvements

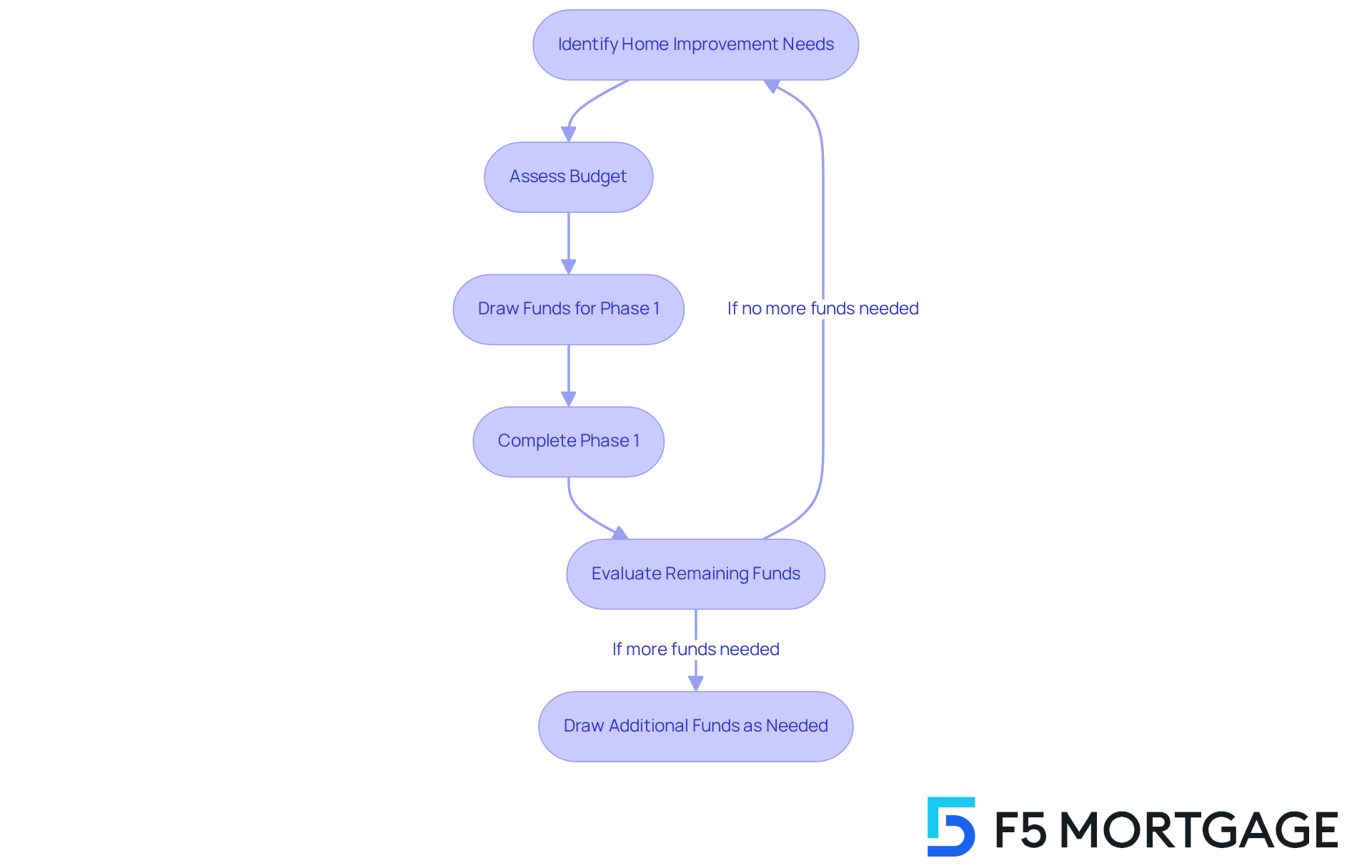

Fixed heloc rates offer a nurturing way for property owners to access funds incrementally for ongoing home improvement projects. This approach offers a significant advantage over traditional loans that deliver a lump sum, especially in terms of fixed heloc rates. By allowing clients to withdraw only what they need, this structure promotes better management of renovation costs. For example, property owners can draw funds as specific project phases are completed, which aids in budgeting and minimizes the risk of overspending.

We know how challenging it can be to manage home improvements, and statistics reveal that property owners are currently utilizing about 37% of their HELOC lines of credit. This indicates a growing trend towards strategic, incremental withdrawals rather than one-time large sums. Financial advisors emphasize that this thoughtful approach not only helps in managing expenses but also provides the flexibility to adjust plans based on project developments or unexpected costs, much like how fixed heloc rates offer stability.

Success stories abound, with many homeowners leveraging HELOCs to finance renovations that enhance property value and comfort. Picture a family starting with a kitchen remodel, drawing funds as needed for materials and labor, and later using additional funds for landscaping or bathroom upgrades. This method of financing allows for a customized approach to property enhancements, aligning expenditures with actual project requirements and schedules. We’re here to in your home improvement journey.

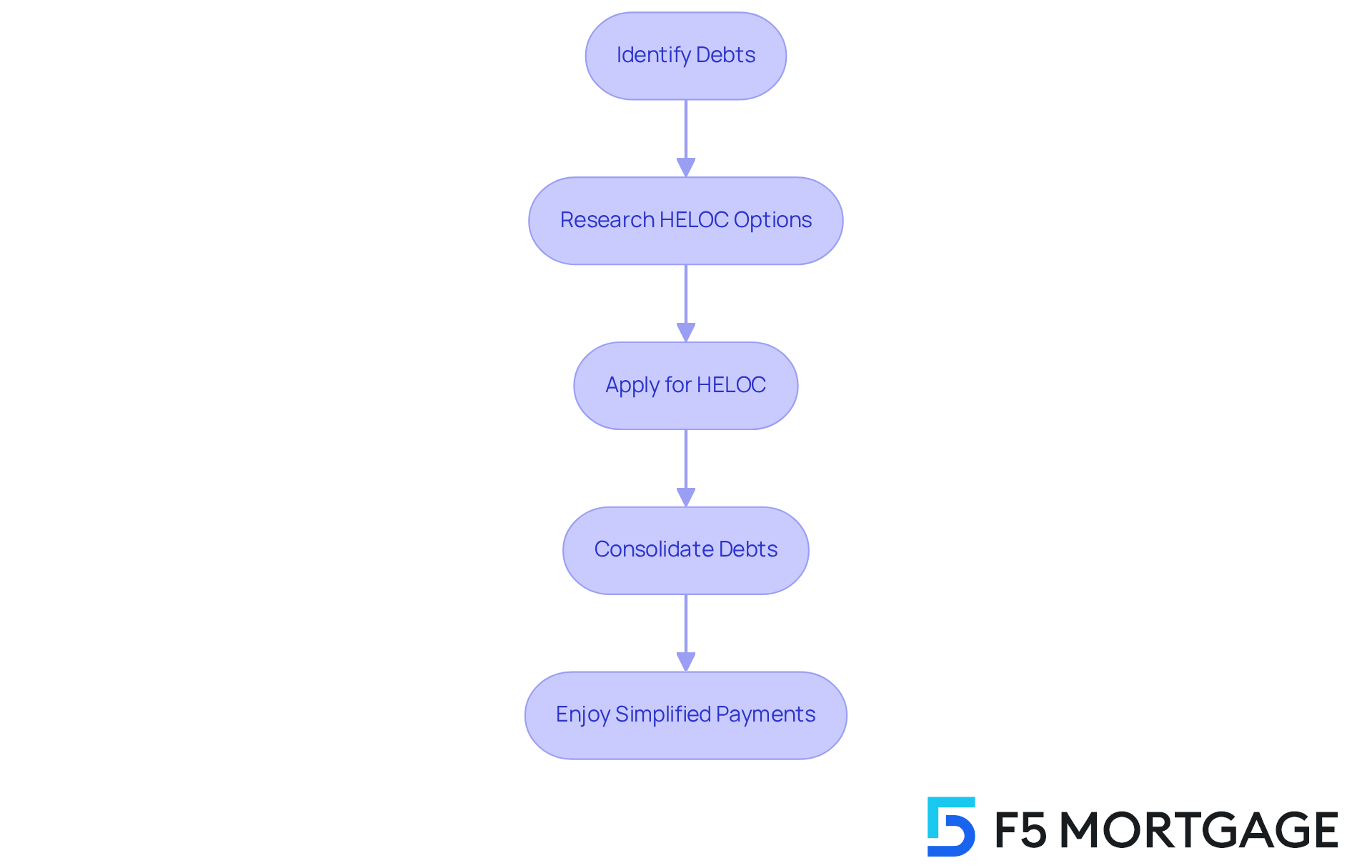

Debt Consolidation Potential: Simplify Finances with Fixed-Rate HELOCs

Homeowners, we understand how overwhelming managing multiple debts can feel. Fixed HELOC rates provide a compassionate solution for debt consolidation, enabling you to merge your various debts into a single, manageable payment. This approach not only simplifies your finances but can also lead to , which may ease your financial burden.

Imagine being able to focus on your home upgrades without the stress of high-interest debt weighing you down. By consolidating your debts through a HELOC, you can pave the way toward greater financial stability and peace of mind.

We’re here to support you every step of the way as you explore this option. Take the first step toward a more manageable financial future today.

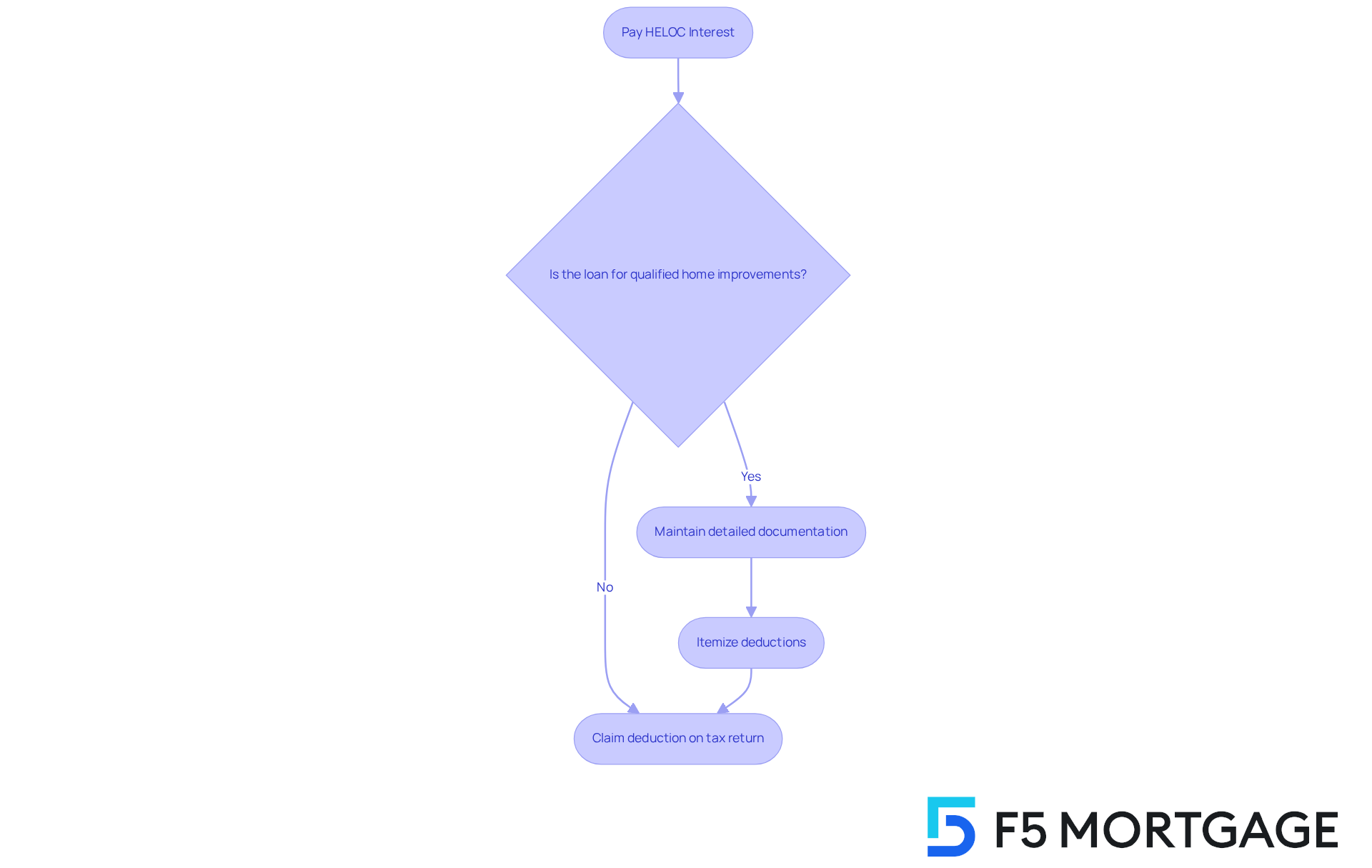

Tax Deduction Benefits: Save on Interest Payments

Interest payments on fixed HELOC rates can be tax-deductible, providing property owners with a valuable opportunity to reduce their overall borrowing expenses. By using these loans for qualified home improvements—like kitchen remodels or roof replacements—homeowners may significantly lower their taxable income.

For example, if a property owner pays $3,000 in HELOC interest and qualifies for the deduction, they can subtract that amount from their taxable income, leading to substantial savings. However, it’s important to keep in mind that the IRS caps the mortgage debt qualifying for interest deductions at $750,000 for loans made after December 15, 2017.

Additionally, property owners must itemize their deductions to claim the HELOC interest deduction, so maintaining detailed documentation of qualified improvements is crucial. We know how challenging this can be, and consulting with a tax professional is essential to navigate the complexities of these deductions. This way, homeowners can maximize their financial benefits.

This strategic approach not only enhances the value of their properties but also provides a path to more manageable interest payments. We’re here to in making informed financial decisions.

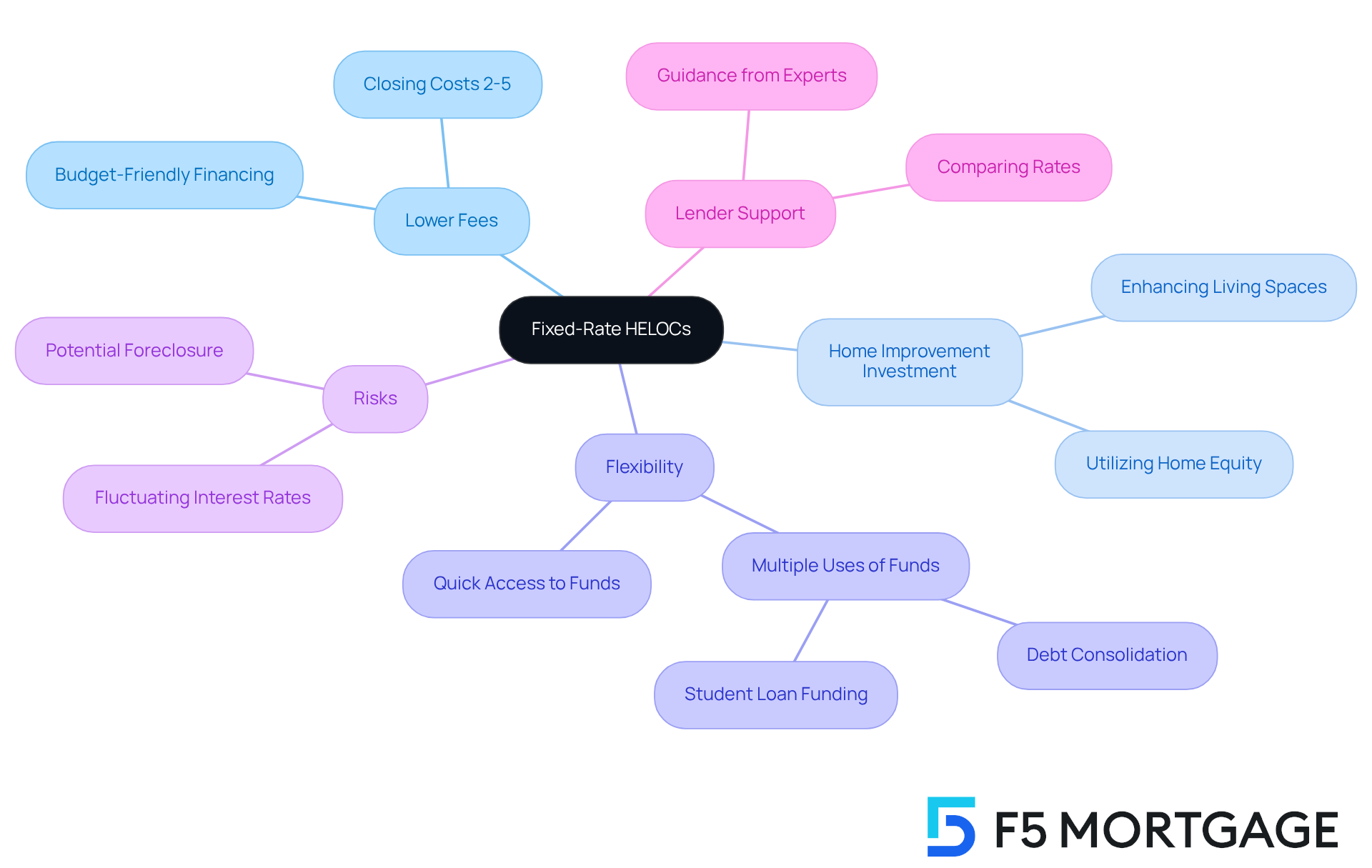

Lower Fees: Cost-Effective Financing with Fixed-Rate HELOCs

Fixed HELOC rates provide a wonderful opportunity for homeowners, presenting reduced fees compared to traditional equity loans. With typically ranging from 2% to 5% of the total loan amount, this budget-friendly financing option can significantly lower initial expenses. This makes it easier for families to invest in essential home improvements. For instance, refinancing a home in Colorado can lead to substantial savings, as the average cost to refinance also falls between 2% and 5% of the overall loan sum. By choosing fixed HELOC rates, homeowners can enhance their budget for necessary upgrades while minimizing unnecessary costs.

As financial analyst Stephen Kates from Bankrate notes, “The HELOC enables property owners to utilize this equity for home enhancement, debt consolidation, student loan funding, or other financial matters without affecting their current mortgage.” This flexibility is vital, especially considering that American homeowners currently possess over $200,000 in tappable equity on average. By leveraging fixed HELOC rates, individuals can make significant improvements to their living spaces without the stress of high expenses.

However, it’s essential to weigh potential risks, such as fluctuating interest rates and the possibility of foreclosure if payments are missed. These factors should be carefully considered in your decision-making process. We’re here to support you every step of the way. Additionally, F5 Mortgage partners with leading lenders to help homeowners compare rates and discover the most economical refinancing options, further empowering your financial decisions.

Conversion Options: Switch from Variable to Fixed Rates for Security

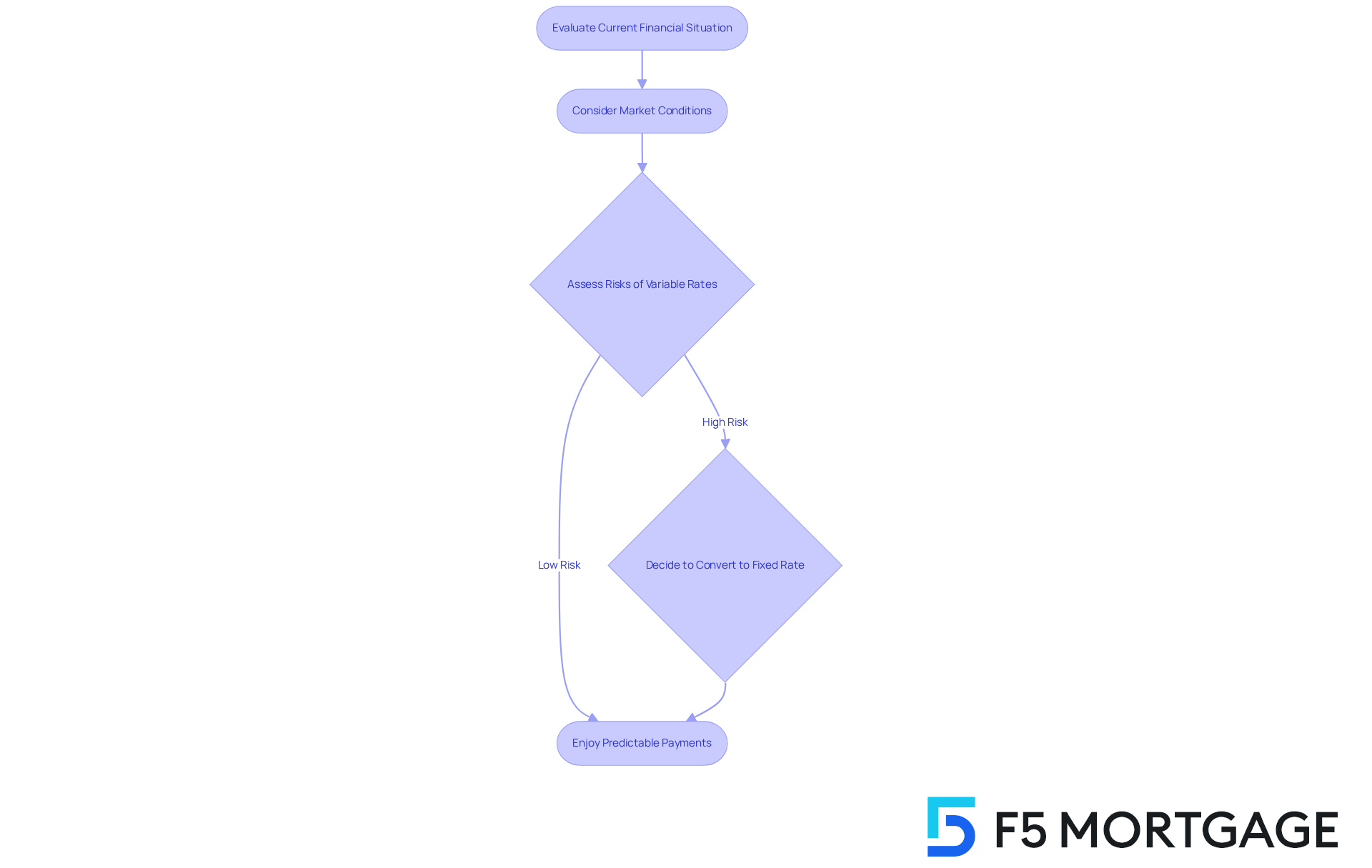

Many fixed heloc rates allow property owners to have the flexibility to switch from variable to fixed terms. This feature becomes especially beneficial when market conditions shift. The choice to convert offers a vital layer of protection, allowing clients to stabilize their payments even as interest rates rise. By having the ability to switch, property owners can enhance their financial planning, ensuring predictable monthly expenses that support budgeting and long-term stability.

For instance, transitioning to a fixed rate can help mitigate the risks associated with fluctuating interest levels, which can lead to unexpected payment increases. Homeowners who purchased their properties with traditional loans and contributed less than 20% may find refinancing advantageous to eliminate private mortgage insurance (PMI), especially given the significant home appreciation in California.

As industry leaders emphasize, a fixed payment structure, such as fixed heloc rates, is essential for effective financial management, particularly in uncertain economic climates. Louis DeNicola notes, “with interest rates starting to come down—but mortgage rates lagging behind—homeowners may continue turning to HELOCs in 2025.” Case studies show that homeowners who proactively convert their HELOCs to fixed heloc rates often enjoy greater peace of mind, knowing their payments will remain consistent despite market volatility.

This strategic approach not only safeguards their economic future but also empowers them to make informed decisions about home improvements and other major investments. We understand how challenging this can be, so homeowners should consider to evaluate their current financial situation and explore conversion options. We’re here to support you every step of the way.

Personalized Service at F5 Mortgage: Tailored Support for HELOC Clients

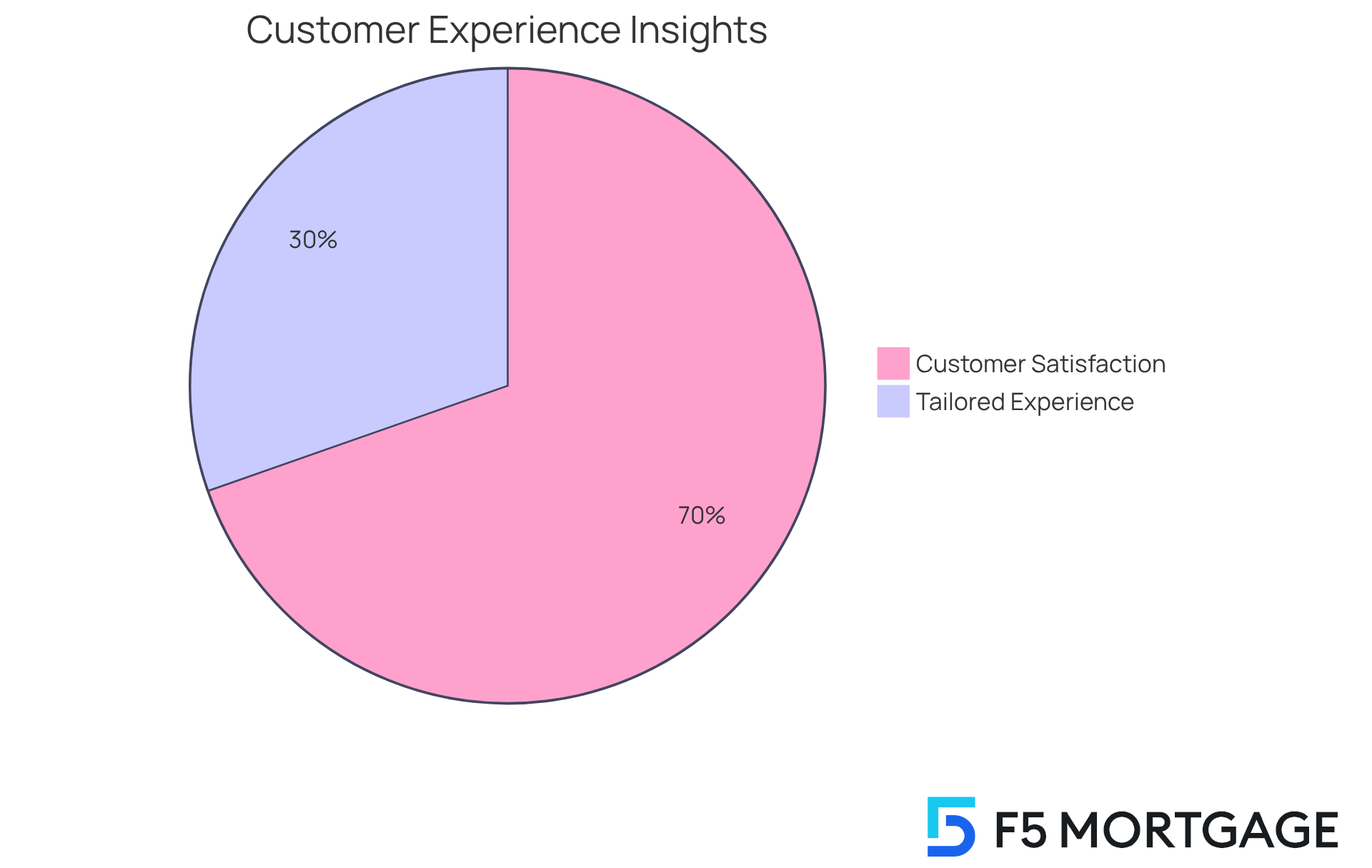

At F5 Mortgage, we understand how challenging the home equity line of credit (HELOC) process can be. That’s why personalized service is integral to your experience with us. Our dedicated team takes the time to understand your unique needs, especially if you find yourself in a distinctive financial situation, such as being self-employed. With over 10 years of experience, our expert loan officer, Jeff Bozimowski, specializes in crafting the tailored just for you.

This comprehensive support not only instills confidence but also empowers you to make informed decisions. In fact, 41% of homeowners emphasize the importance of a seamless, tailored experience when choosing a lender. At F5 Mortgage, we stand out by prioritizing exceptional service to meet your needs. With a customer satisfaction rate of 94%, we have successfully helped over 1,000 families navigate the complexities of home equity lending.

Expert opinions underscore that lenders who adopt an advisory role achieve significantly higher satisfaction scores. This further validates our commitment to personalized service. By fostering strong relationships and providing customized solutions, we ensure that you feel supported and valued throughout your journey with fixed heloc rates. We’re here to support you every step of the way.

Conclusion

Fixed HELOC rates offer homeowners a strategic advantage for financing home upgrades, bringing stability and predictability to what can often feel like an uncertain financial landscape. By choosing these fixed rates, homeowners not only secure lower interest payments but also gain the peace of mind that comes from knowing their monthly expenses will remain consistent. This stability is crucial for effective budgeting and planning, especially when embarking on significant renovations.

Throughout this discussion, we’ve highlighted several key benefits of fixed HELOC rates. From predictable monthly payments and lower interest rates compared to traditional home equity loans to the ability to lock in rates and access funds flexibly, these options empower homeowners to make informed financial decisions. Additionally, the potential for debt consolidation and tax deduction benefits further enhances the appeal of fixed-rate HELOCs, making them a wise choice for those looking to improve their homes while managing their finances effectively.

In summary, leveraging fixed HELOC rates can truly transform the home improvement experience. They provide a clear path to financial stability and efficiency. We encourage homeowners to explore these options as a means to enhance their living spaces while maintaining control over their financial commitments. Embracing the benefits of fixed HELOC rates not only aids in achieving renovation goals but also fosters a sense of security in navigating the complexities of home financing. We’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage LLC is an independent brokerage that provides competitive fixed-rate Home Equity Lines of Credit (HELOC) tailored for homeowners looking to finance property upgrades. They collaborate with over two dozen top lenders to offer favorable rates and terms.

What are the benefits of fixed-rate HELOCs?

Fixed-rate HELOCs offer predictable monthly payments, which simplify budgeting and reduce anxiety related to fluctuating interest rates. They also allow homeowners to refinance and potentially lower monthly payments or eliminate private mortgage insurance (PMI).

What is the average interest rate for fixed HELOCs as of 2025?

As of 2025, the average interest rate for fixed HELOCs is approximately 7.89%.

How do fixed HELOC rates compare to traditional home equity loans?

Fixed HELOC rates generally offer lower interest rates compared to traditional home equity loans. For instance, the average percentage for home equity loans was 8.28%, while fixed HELOC rates can be significantly lower.

Why are homeowners increasingly choosing fixed-rate HELOCs?

Homeowners prefer fixed-rate HELOCs due to their stability against fluctuating interest rates, which allows for better financial planning and control over renovation financing.

What do clients say about their experience with F5 Mortgage?

Clients have reported a smooth and clear process with F5 Mortgage, highlighting their assistance in obtaining the best deals for renovations.

What potential trends are expected for HELOC rates in 2025?

Specialists predict a possible decrease in HELOC costs by 0.25% or greater in 2025, making it an advantageous time for homeowners to consider utilizing their equity for home enhancements.