Overview

Mortgage payments can be a source of stress for many families, especially when they are considered late. Payments are typically regarded as late if they are not made within a grace period of 10 to 15 days after the due date. It’s crucial to understand these timelines to avoid late fees and potential damage to your credit score.

We know how challenging this can be, and it’s important to communicate with your lender if you miss a payment. Exploring options together can provide you with the support you need during tough times. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Introduction

Understanding the intricacies of mortgage payments can feel overwhelming, especially for families striving to maintain financial stability. We know how challenging this can be. With varying due dates and grace periods, it’s essential to understand when a mortgage payment is officially considered late and the potential repercussions of missing a payment. What happens if a payment slips through the cracks?

This article delves into the timelines, grace periods, and crucial steps families can take to navigate the complexities of mortgage payments. We’re here to support you every step of the way, ensuring you stay informed and proactive in managing your financial health.

Understand Mortgage Payment Timelines

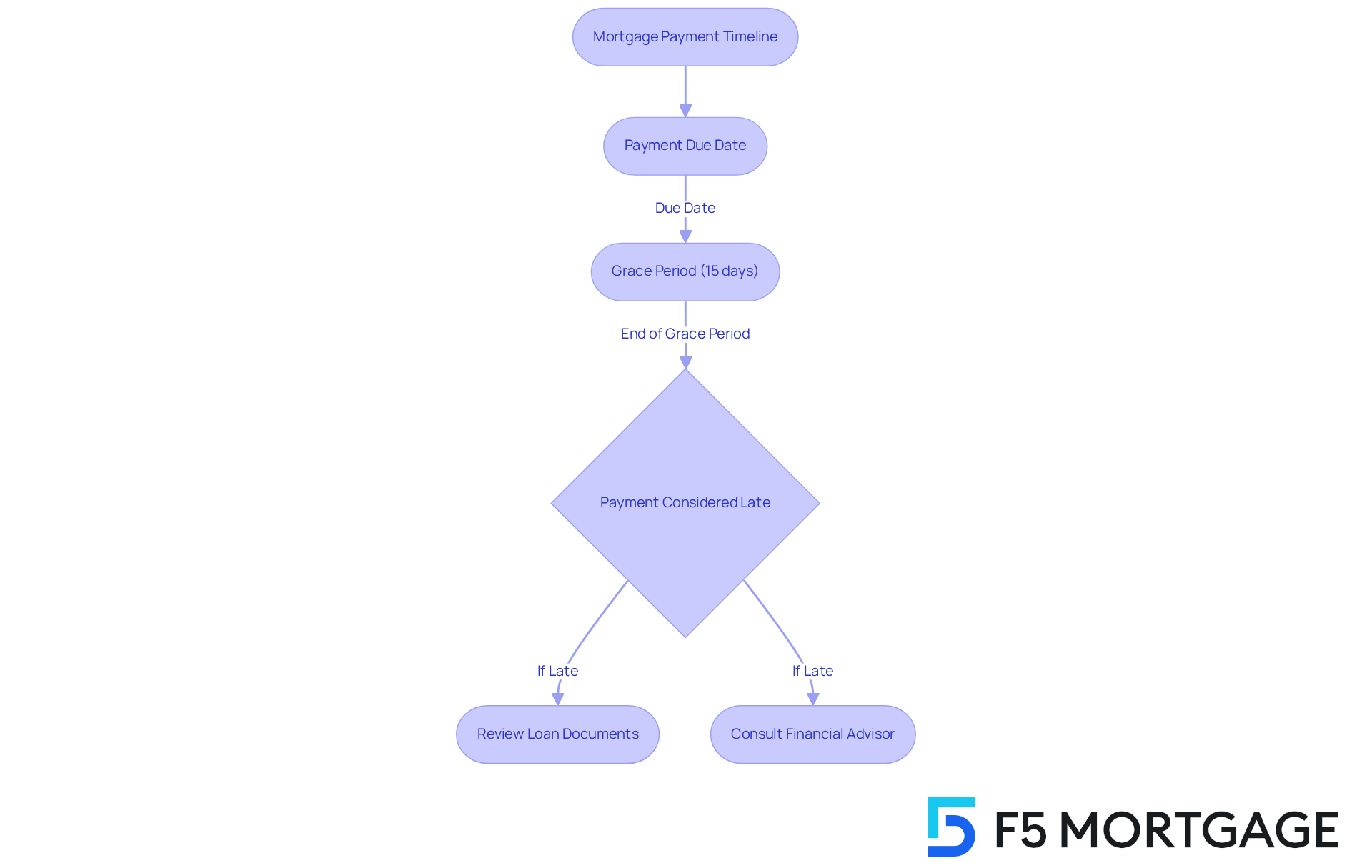

Understanding housing costs can be overwhelming, especially when payments are due on the first day of each month. It’s crucial for families to be aware of their specific due dates, which can vary depending on the provider and loan terms. Most creditors send monthly statements that clearly outline the due date and amount owed, helping families to plan their finances effectively. This way, they can ensure they have the necessary funds for timely payments.

In 2025, when is a mortgage payment considered late, considering the average grace period for loan installments is about 15 days? This grace period offers some flexibility before addressing when a mortgage payment is considered late. However, it’s important to note that this can differ among lenders. Some may even offer alternative schedules, like bi-weekly installments, which can positively impact the overall repayment timeline. For instance, families might find that bi-weekly payments help reduce the interest they pay over time.

We understand how challenging it can be to keep track of these details. That’s why it’s recommended for families to carefully review their loan documents or reach out to their loan broker. This ensures clarity on their specific repayment timeline and any associated grace periods. Financial advisors emphasize the significance of grasping these timelines to understand when a mortgage payment is considered late, in order to avoid late fees and maintain a healthy credit profile. Remember, we’re here to support you every step of the way.

Identify the Grace Period for Mortgage Payments

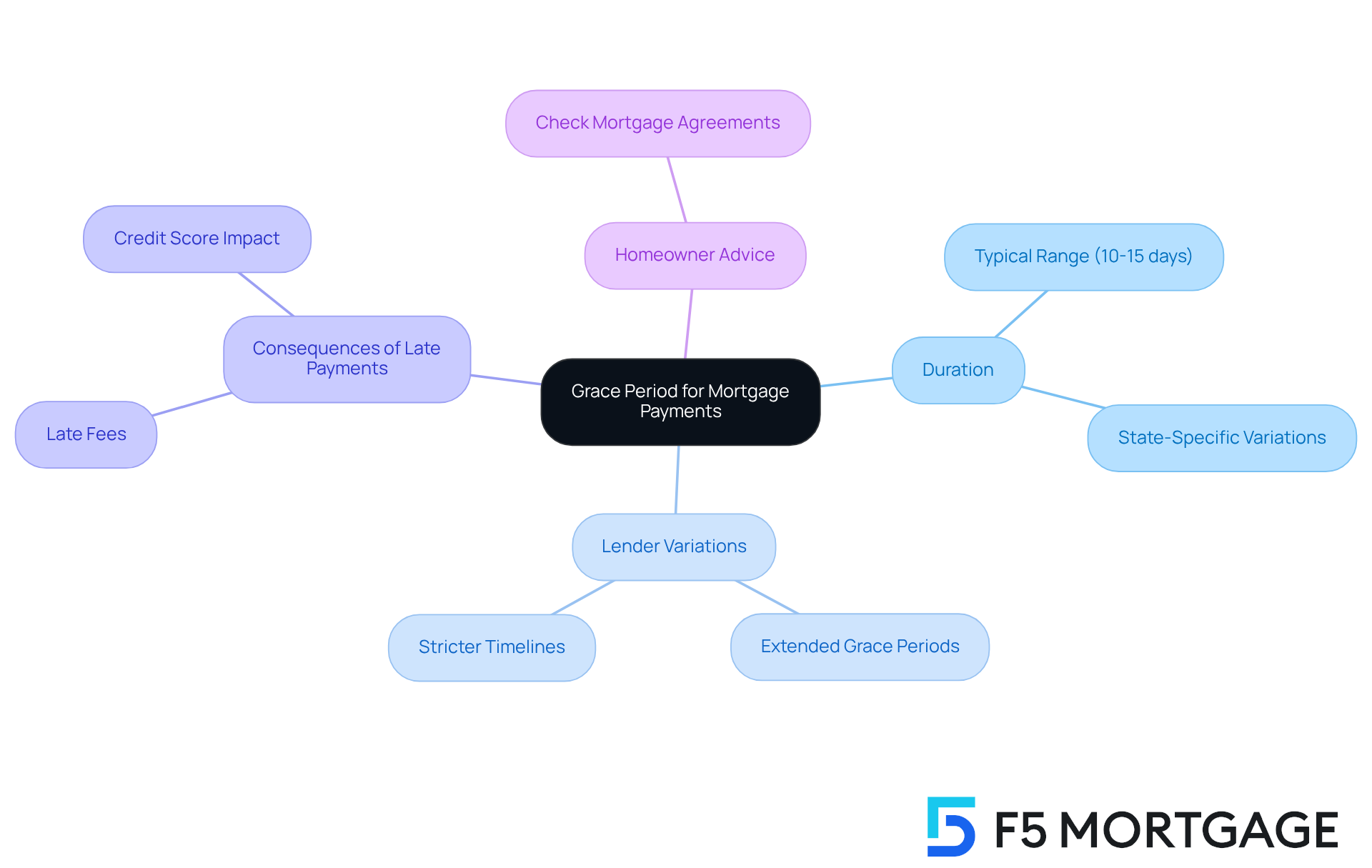

Most loan contracts include a grace period, typically spanning from 10 to 15 days following the due date, which raises the question of when a mortgage payment is considered late. During this time, families can complete their transactions without incurring late fees, providing crucial relief during financial strains. We know how challenging this can be, so it’s important to check the specific terms of your mortgage agreement. Some lenders may offer extended grace periods, while others may have stricter timelines. For instance, in Texas, 4.5 percent of homeowners were reported to be late on dues, emphasizing the significance of understanding these conditions.

If a transaction is completed within this timeframe, it will not be reported as late to credit bureaus. As Maya Dollarhide, a writer and journalist on home financing, observes, “One missed loan installment — even a few days beyond the grace period — will not damage your credit score.” However, if the fee is not settled by the end of the grace period, households may need to understand when a mortgage payment is considered late, as late charges can accumulate significantly and influence overall financial well-being. By comprehending these grace intervals, families can manage their housing costs efficiently, ensuring they stay on course even in tough situations. We’re here to support you every step of the way.

Recognize the Formal Notice Process

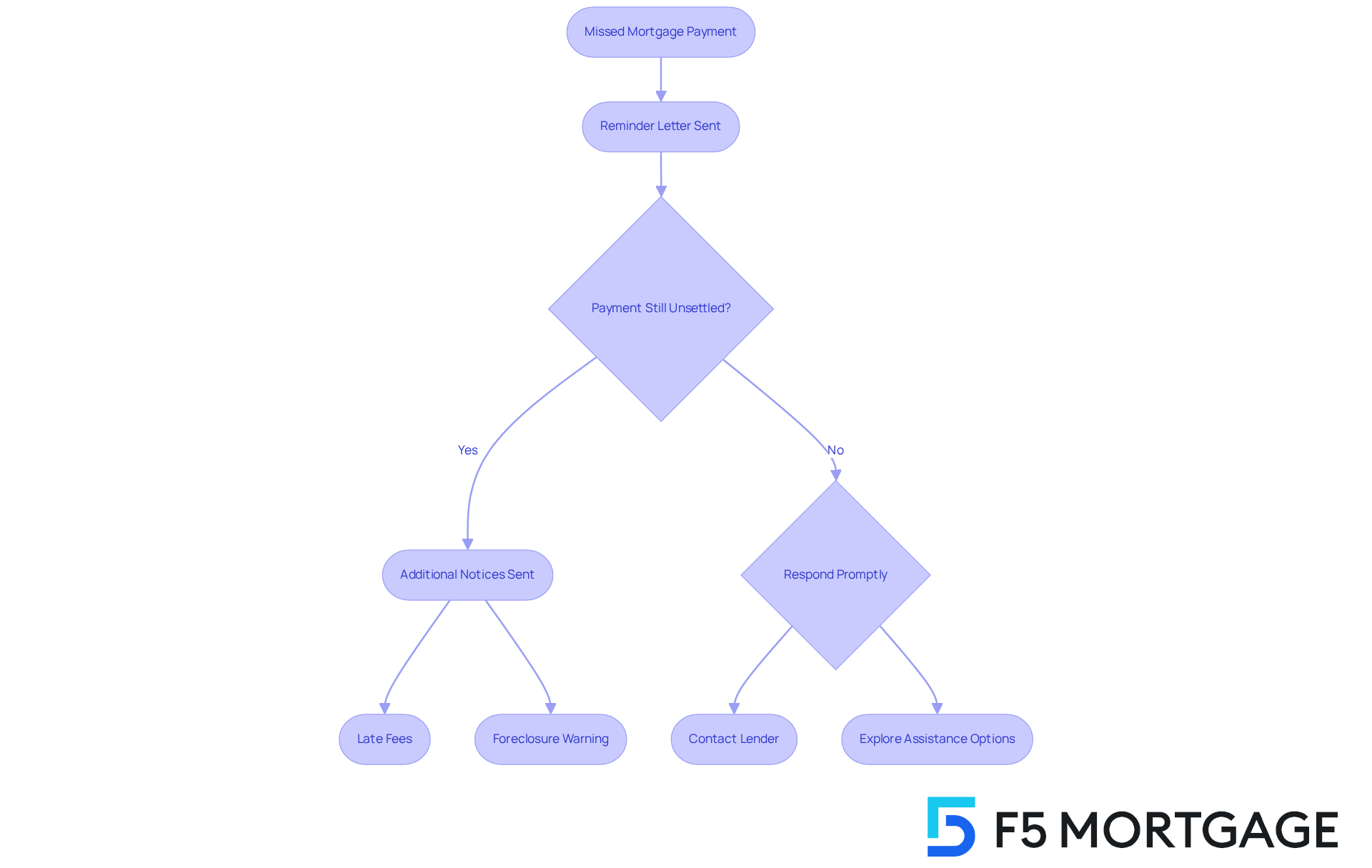

For families, missing a mortgage installment can lead to stress as they wonder when is a mortgage payment considered late. If a payment is missed, lenders typically initiate a formal notice process to address the question of when is a mortgage payment considered late. This often begins with a reminder letter sent shortly after the due date, informing the borrower when a mortgage payment is considered late due to the missed installment.

If the payment remains unsettled, additional notices may follow, especially when is a mortgage payment considered late, growing in urgency. These communications may include important information about late fees, the potential for foreclosure, and options for assistance. We know how challenging this can be, and it’s crucial for families to respond promptly to these notices. Ignoring them can lead to more severe consequences.

Maintaining open channels of communication with your lender can frequently lead to solutions. By reaching out, you may discover options such as installment arrangements or loan modifications that can help ease your financial burden. Remember, we’re here to support you every step of the way.

Explore Consequences of Late Mortgage Payments

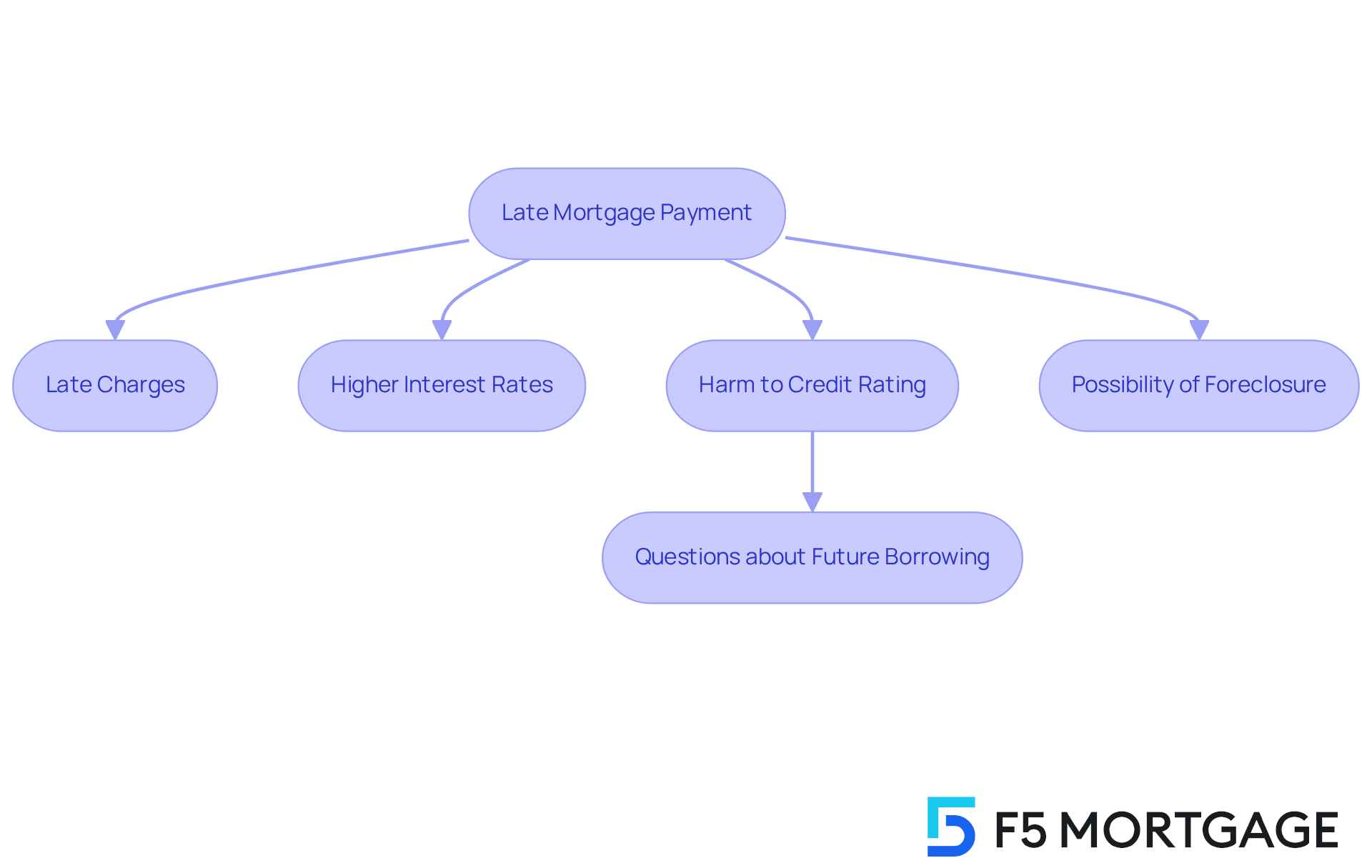

We understand how challenging managing mortgage payments can be, and it’s important to know when a mortgage payment is considered late and the potential consequences of delayed installments. Late payments can lead to various outcomes, including:

- Late charges

- Higher interest rates

- Harm to your credit rating

Just one missed payment can lead to questions about when a mortgage payment is considered late, significantly lowering your credit score and affecting your ability to borrow in the future.

If payments continue to be overlooked, creditors may take serious actions, such as initiating foreclosure proceedings, especially when a mortgage payment is considered late, which could result in losing your home. It’s crucial for families to understand when a mortgage payment is considered late, as the longer a bill remains unpaid, the more severe the repercussions can become.

Staying informed about these potential outcomes is vital. We’re here to support you every step of the way, encouraging you to take proactive measures to avoid these issues. Remember, addressing these challenges early can make a significant difference in your financial well-being.

Take Action After Missing a Mortgage Payment

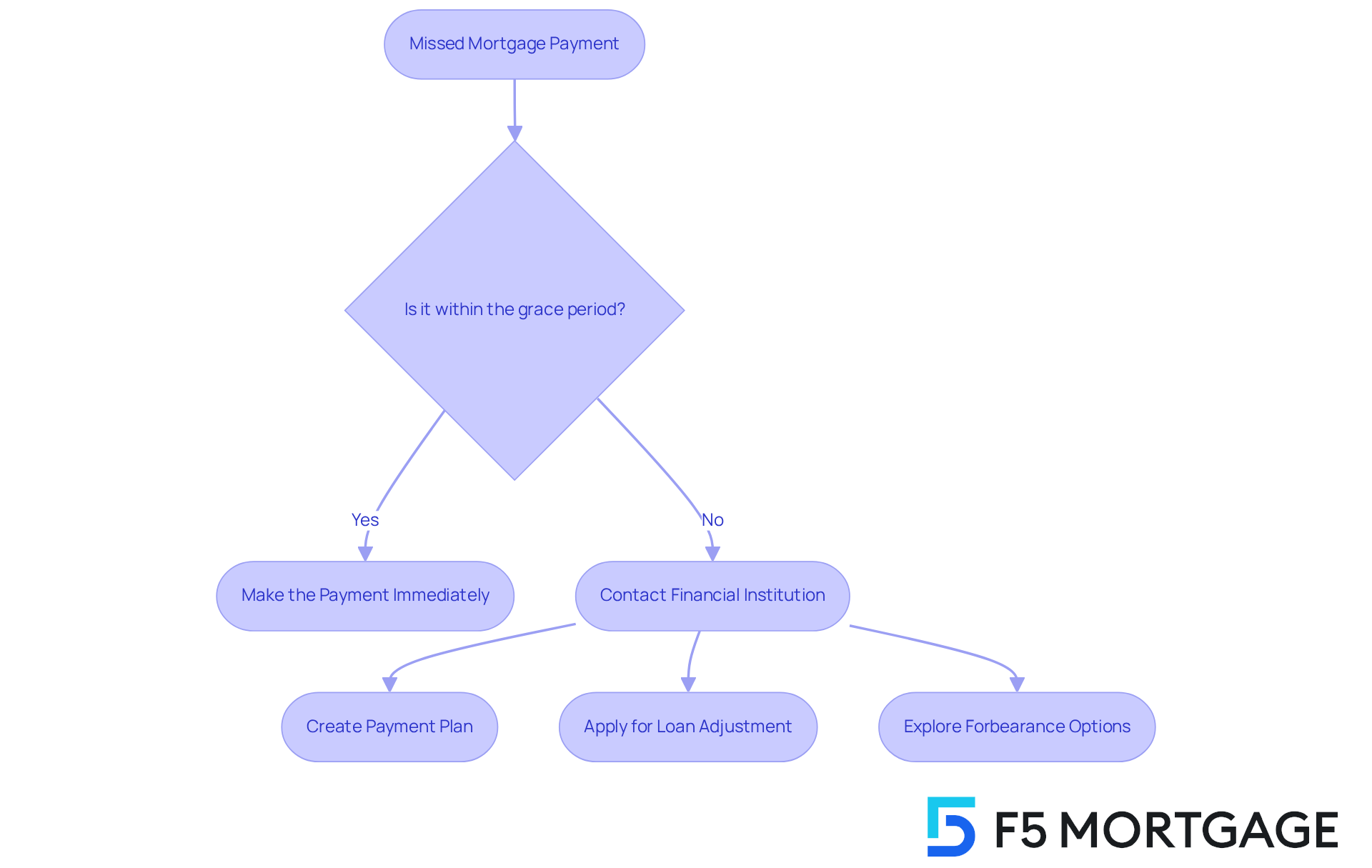

If you’ve realized that a mortgage payment has been missed, it’s important to understand when a mortgage payment is considered late and to act quickly. Ideally, you should make the payment within the grace period to understand when a mortgage payment is considered late. However, if that time has passed, reaching out to your financial institution is crucial to find out when a mortgage payment is considered late. Many lenders are willing to work with borrowers who openly discuss their financial struggles. You might explore options like:

- Creating a payment plan

- Applying for a loan adjustment

- Looking into forbearance options, which can provide temporary relief

Research shows that a significant number of creditors are open to dialogue after missed payments, reflecting a growing understanding of the financial pressures many families face.

For instance, families have successfully communicated with creditors by sharing their situations and demonstrating a commitment to resolving the issue. Financial advisors stress that open communication can lead to beneficial outcomes, such as loan modifications or forbearance agreements. Additionally, it’s wise for families to review their budgets to uncover potential savings that can help ensure timely payments in the future. Consulting with a financial advisor or mortgage broker can also provide valuable strategies for effectively managing your situation, highlighting the importance of proactive engagement with lenders. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding when a mortgage payment is considered late is essential for families striving to maintain financial stability. We know how challenging this can be. By grasping the timelines, grace periods, and potential consequences associated with missed payments, homeowners can navigate their obligations more effectively and avoid unnecessary penalties.

This article delves into critical aspects such as:

- The importance of knowing specific due dates

- Recognizing grace periods

- Understanding the formal notice process initiated by lenders

It highlights how proactive communication with creditors can lead to beneficial outcomes, such as payment plans or loan modifications. We’re here to support you every step of the way, ultimately aiding families in managing their financial responsibilities.

In light of the potential repercussions of late payments, including late fees and damage to credit scores, it is imperative for homeowners to take action promptly when facing difficulties. By staying informed and engaged with lenders, families can explore various options to alleviate financial strain. The path to financial well-being is paved with knowledge and communication, ensuring that homeowners are equipped to handle their mortgage obligations with confidence.

Frequently Asked Questions

When are mortgage payments typically due?

Mortgage payments are usually due on the first day of each month, but specific due dates can vary depending on the provider and loan terms.

How can families keep track of their mortgage payment due dates?

Most creditors send monthly statements that clearly outline the due date and amount owed, helping families to plan their finances effectively.

What is the average grace period for mortgage payments?

The average grace period for loan installments is about 15 days, but this can differ among lenders.

When is a mortgage payment considered late in 2025?

A mortgage payment is considered late if it is not paid by the end of the grace period, which is typically 10 to 15 days after the due date.

Do all lenders have the same grace periods?

No, grace periods can differ among lenders, and some may offer extended grace periods while others have stricter timelines.

What happens if a mortgage payment is made within the grace period?

If a payment is made within the grace period, it will not be reported as late to credit bureaus.

Can missing a mortgage payment affect my credit score?

One missed loan installment, even a few days beyond the grace period, will not damage your credit score as long as it is settled within the grace period.

How can families manage their housing costs effectively?

By understanding their specific repayment timelines and grace periods, families can manage their housing costs efficiently and avoid late fees.