Overview

When it comes to FHA inspections, certain issues can prevent your home from passing. These include:

- Significant structural problems

- Safety hazards

- Plumbing and electrical issues

- Environmental concerns like mold or lead-based paint

We understand how challenging this can be, and it’s important to address these key failures before the evaluation. By doing so, families can secure financing and avoid delays in their home purchasing journey. We’re here to support you every step of the way.

Introduction

Navigating the home buying process can feel overwhelming, especially for families relying on FHA loans that come with specific inspection requirements. We know how challenging this can be. Understanding what can lead to a failed FHA inspection is crucial, as it impacts not only your ability to secure financing but also the safety and livability of your potential home. What if the very issues that could derail your dream of homeownership are lurking unnoticed? This article delves into the common pitfalls of FHA inspections, offering insights and strategies to help you avoid costly mistakes and ensure a smoother path to your new home. We’re here to support you every step of the way.

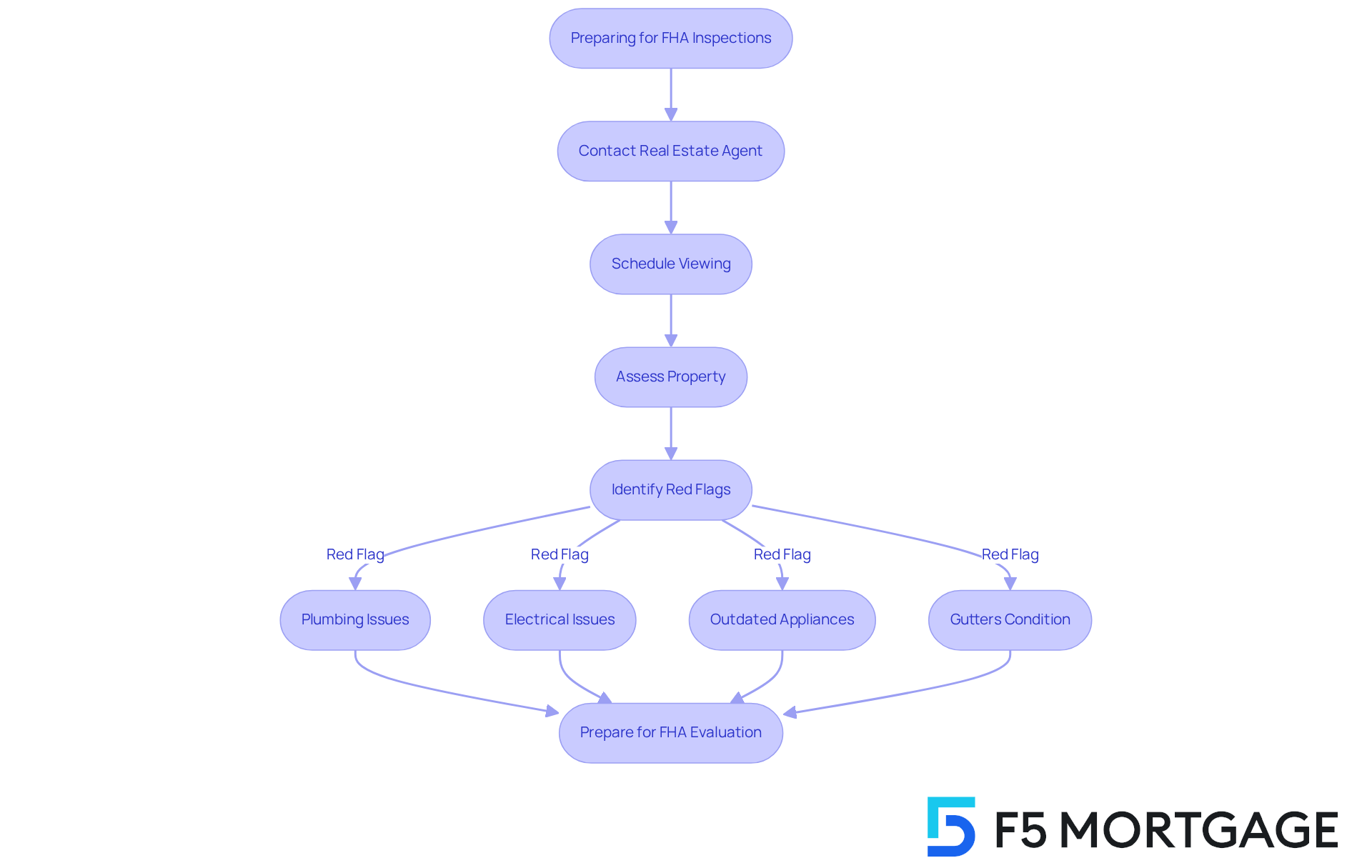

Clarify the Purpose of FHA Inspections

FHA evaluations are a vital part of the home purchasing journey, especially for families seeking FHA loans. We understand how important it is for you to ensure that the property meets the minimum safety, security, and soundness standards set by the Federal Housing Administration (FHA). This involves assessing the home’s structural integrity, safety features, and overall livability.

Before you schedule a viewing, consider reaching out to your real estate agent or the seller’s agent. This will help arrange a time that allows for a thorough assessment of the property without distractions. During the viewing, pay close attention to potential red flags such as:

- Plumbing and electrical issues

- Outdated appliances

- Conditions that won’t pass FHA inspection, like the condition of gutters

These factors can significantly impact what won’t pass FHA inspection.

By clarifying the purpose of these evaluations and understanding key considerations, families can better prepare for what to expect. Recognizing the importance of addressing any potential issues before the evaluation takes place is essential. Ultimately, a successful FHA evaluation is crucial for securing funding and ensuring a safe living environment for your family. We’re here to support you every step of the way.

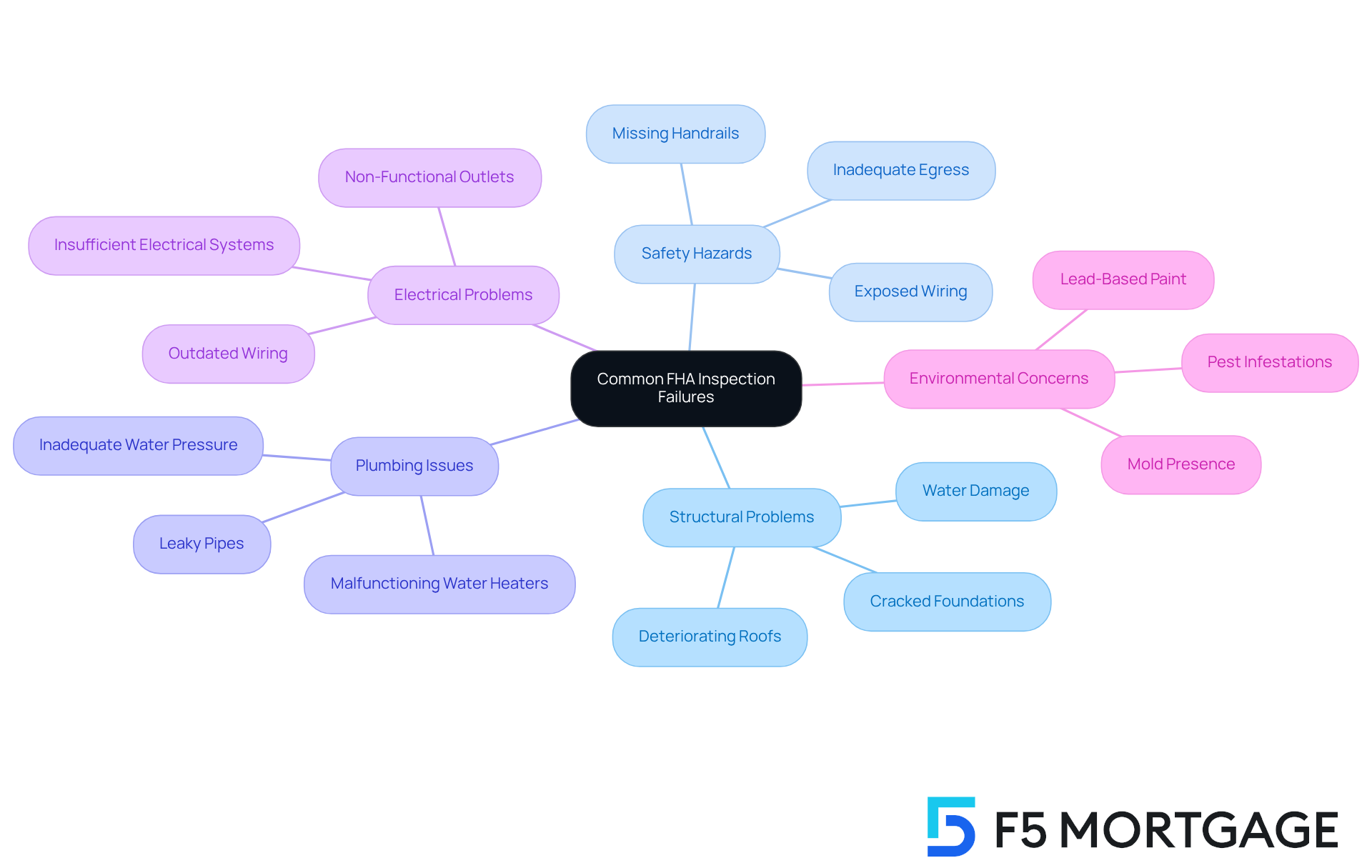

Identify Common FHA Inspection Failures

Common FHA evaluation failures can significantly obstruct a family’s ability to secure financing. We understand how challenging this can be. Key issues that frequently lead to failed inspections include:

- Structural Problems: Major structural damage, such as cracked foundations or sagging roofs, is a primary concern. Properties with these issues often face delays in financing or may not qualify for FHA loans due to what won’t pass FHA inspection, necessitating repairs before approval.

- Safety Hazards: To meet FHA standards, it is essential to address critical safety concerns, including what won’t pass FHA inspection, such as missing handrails, exposed wiring, and inadequate egress from bedrooms. These risks can endanger funding and must be corrected before assessment.

- Plumbing Issues: Problems like leaky pipes, inadequate water pressure, and malfunctioning water heaters are all examples of what won’t pass FHA inspection. Making certain that all plumbing systems are operational is crucial for passing the FHA evaluation.

- Electrical Problems: Outdated wiring, non-functional outlets, and insufficient electrical systems are all examples of what won’t pass FHA inspection due to their significant safety risks. FHA evaluations necessitate that all electrical systems meet standards and function properly to prevent disqualification.

- Environmental Concerns: The presence of mold, pest infestations, or lead-based paint in homes constructed prior to 1978 are clear examples of what won’t pass FHA inspection. FHA-approved appraisers are especially attentive to these concerns, as they can pose health risks.

Grasping what won’t pass FHA inspection enables households to take preventive actions to address concerns prior to the evaluation, facilitating a more seamless home purchasing experience. For instance, properties with structural problems like crumbling foundations or deteriorating roofs must be addressed to avoid financing delays. Moreover, a considerable proportion of residences do not pass FHA evaluations because of what won’t pass FHA inspection, highlighting the necessity of comprehensive pre-evaluation assessments. By addressing these concerns early, families can enhance their chances of securing financing and achieving their homeownership goals. We’re here to support you every step of the way.

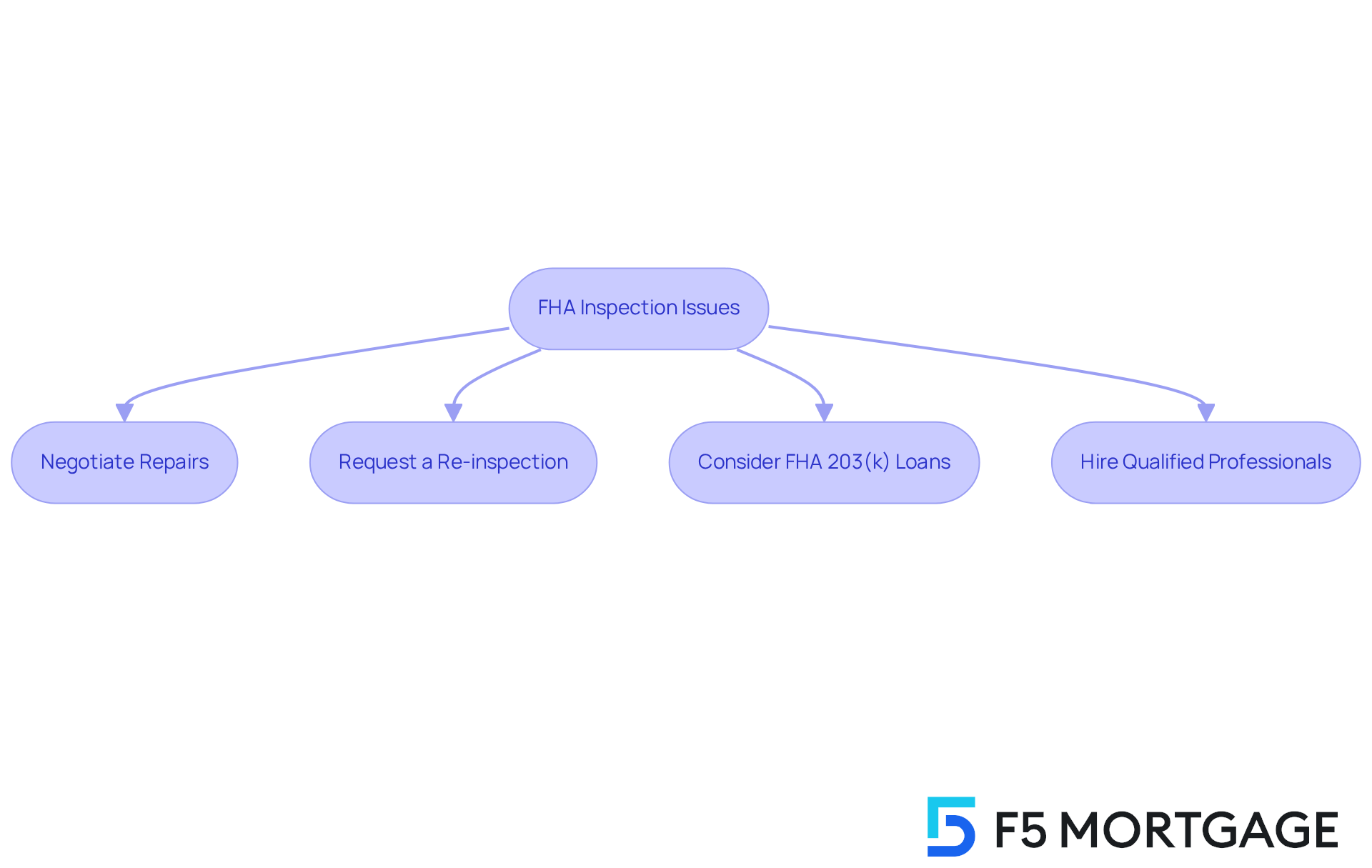

Explore Consequences and Remediation Strategies for FHA Failures

When a home experiences issues related to what won’t pass FHA inspection, it can be a stressful experience for families, leading to delays in closing or the need for costly repairs. But don’t worry—there are specific steps you can take to address these challenges and move forward with confidence.

-

Negotiate Repairs: You can negotiate with the seller to ensure necessary repairs are completed before closing. This can range from fixing plumbing issues to addressing safety hazards, allowing you to feel secure in your new home.

-

Request a Re-inspection: After the repairs are made, you have the option to request a re-inspection. This step is crucial to ensure that the home meets FHA standards and that your investment is protected.

-

Consider FHA 203(k) Loans: If the home requires significant repairs, exploring FHA 203(k) loans might be beneficial. These loans allow you to finance both the purchase and the renovation costs, making your dream home more attainable.

-

Hire Qualified Professionals: Engaging licensed contractors or inspectors can provide peace of mind. They ensure that repairs are done correctly and meet FHA requirements, helping you navigate this process with ease.

By understanding what won’t pass FHA inspection and implementing these strategies, you can more effectively navigate the complexities of the FHA inspection process. Remember, we’re here to support you every step of the way, ultimately leading you toward successful homeownership.

Conclusion

Understanding what won’t pass FHA inspection is crucial for families looking to secure financing for their new home. We know how challenging this can be, and grasping the importance of these evaluations and the standards set by the Federal Housing Administration allows potential homeowners to proactively address issues that could hinder their home purchase journey.

The article highlights key areas that commonly lead to inspection failures, including:

- Structural problems

- Safety hazards

- Plumbing and electrical issues

- Environmental concerns

By being aware of these pitfalls and taking preventive measures, families can significantly increase their chances of passing the FHA evaluation and moving forward with their homeownership dreams.

Ultimately, navigating the FHA inspection process requires diligence and preparation. Families are encouraged to take action by:

- Negotiating repairs

- Considering FHA 203(k) loans

- Hiring qualified professionals to ensure their prospective home meets all necessary standards

By doing so, they can transform potential obstacles into stepping stones toward achieving a safe and secure living environment.

Frequently Asked Questions

What is the purpose of FHA inspections?

FHA inspections are designed to ensure that a property meets the minimum safety, security, and soundness standards set by the Federal Housing Administration (FHA). This includes assessing the home’s structural integrity, safety features, and overall livability.

Why are FHA evaluations important for homebuyers?

FHA evaluations are vital for families seeking FHA loans as they help ensure the property is safe and livable, which is essential for securing funding.

What should I do before scheduling a viewing of a property?

It is advisable to reach out to your real estate agent or the seller’s agent to arrange a viewing time that allows for a thorough assessment of the property without distractions.

What potential red flags should I look for during a property viewing?

During a property viewing, you should pay attention to potential red flags such as plumbing and electrical issues, outdated appliances, and conditions that may not pass FHA inspection, like the state of the gutters.

How can I prepare for an FHA evaluation?

To prepare for an FHA evaluation, it is essential to recognize and address any potential issues with the property before the evaluation takes place, as this can significantly impact the inspection outcome.

What is the ultimate goal of a successful FHA evaluation?

The ultimate goal of a successful FHA evaluation is to secure funding and ensure a safe living environment for your family.