Overview

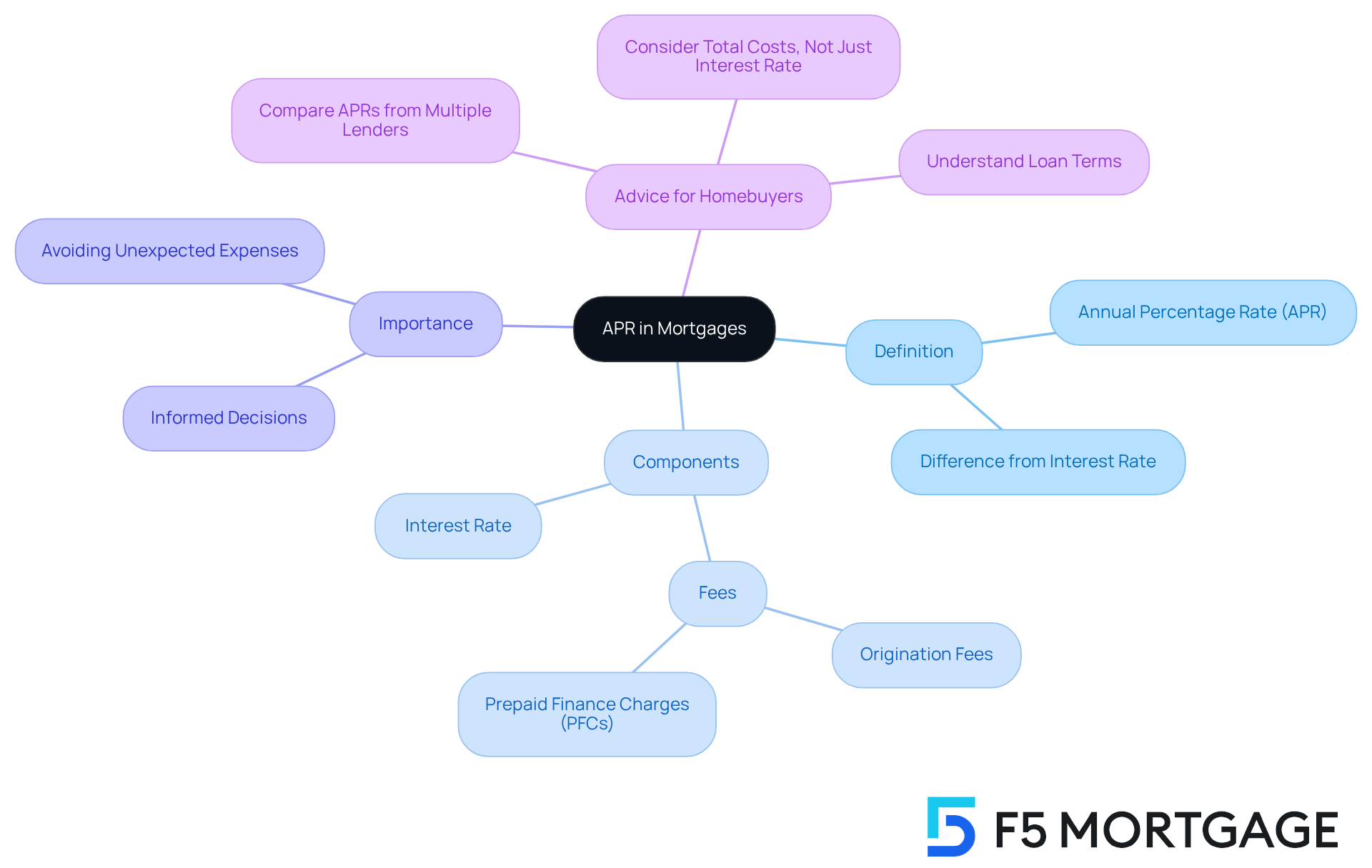

Understanding the Annual Percentage Rate (APR) is essential for anyone navigating the mortgage process. We know how challenging this can be, and that’s why it’s important to grasp what APR truly represents. It’s not just a number; it encompasses the total annual cost of borrowing, including the interest rate and any additional fees related to obtaining a loan.

This comprehensive view of APR empowers homebuyers to make informed comparisons between various loan products. By recognizing all the costs involved, families can avoid unexpected expenses that may arise later. Ultimately, this knowledge guides you toward better financial decisions, ensuring you feel confident and secure in your choices.

As you embark on this journey, remember that you’re not alone. We’re here to support you every step of the way, helping you navigate the complexities of mortgages with empathy and understanding.

Introduction

Understanding the intricacies of mortgage financing can indeed feel overwhelming. We know how challenging this can be, especially when it comes to deciphering the Annual Percentage Rate (APR). This crucial metric not only reflects the interest charged on a loan but also encompasses additional costs that can significantly influence the total amount borrowed.

For homebuyers, grasping the nuances of APR is essential for making informed financial decisions. Yet, many find themselves confused by the differences between APR and the nominal interest rate. How can prospective homeowners navigate these complexities?

By taking the time to understand APR, you can ensure that you are choosing the most economical loan option available. We’re here to support you every step of the way as you embark on this important journey.

Define APR in Mortgages: Understanding the Basics

Understanding what is apr mortgage, or Annual Percentage Rate, is vital for anyone considering a loan. This measure represents the total annual cost of borrowing, expressed as a percentage. It goes beyond just the interest charged; it also includes any additional fees or expenses related to obtaining financing. By grasping this comprehensive measure, you can truly understand the cost of a loan over its duration, which is essential for making informed home financing decisions.

For example, imagine a loan with a nominal interest rate of 3.5%. You might think that’s a great deal, but if there are substantial fees involved, the APR could be much higher. This means the overall cost of the loan is greater than what the interest rate suggests. We know how challenging this can be, especially for first-time homebuyers. Understanding what is apr mortgage is essential for comparing different loan products and choosing the one that best fits your financial situation.

Financial specialists emphasize that having a clear understanding of APR can help you avoid unexpected expenses. This knowledge can ultimately guide you toward better loan options, ensuring you feel confident in your choices. Remember, we’re here to support you every step of the way.

Differentiate Between APR and Interest Rate: Key Comparisons

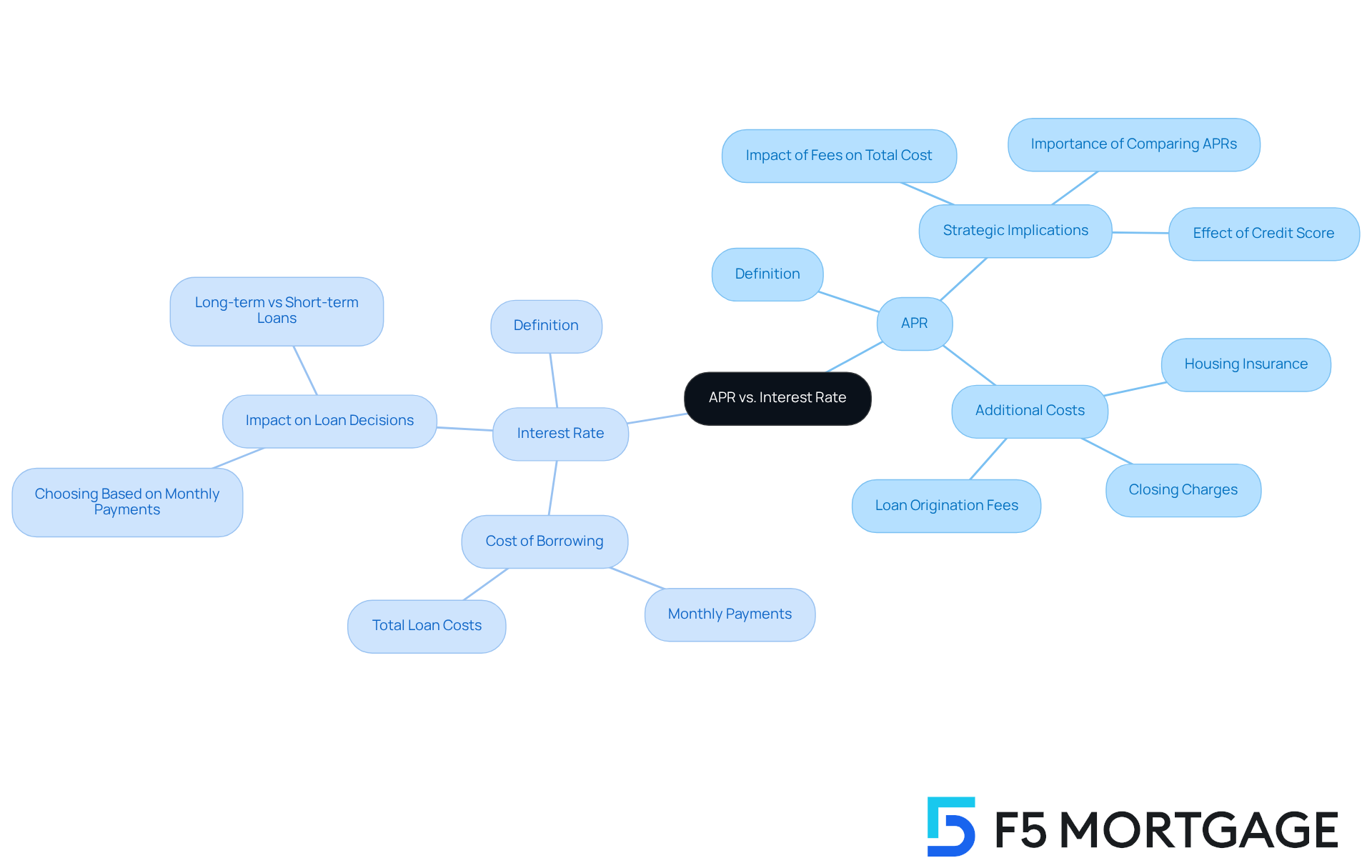

For homebuyers who want to make informed financing decisions, understanding what is APR mortgage and interest charges is essential. We know how challenging this can be, so let’s break it down. The interest figure represents the cost of borrowing the principal amount of the loan, expressed as a percentage. In contrast, what is APR mortgage refers to the Annual Percentage Rate that includes not only the interest percentage but also additional costs such as loan origination fees, housing insurance, and closing charges.

For instance, imagine a loan with a nominal interest rate of 5%. If it includes $5,000 in fees, the APR could be as high as 6.15%. This means that even with a lower interest rate, the total cost of the loan could be significantly higher. This discrepancy highlights the importance of evaluating both figures when comparing financing options. Many borrowers struggle to grasp what is APR mortgage and how it differs from interest charges, which can lead to costly financial mistakes.

By comparing APR and interest quotes from lending specialists, including competitive offerings from F5 Financing, you can navigate your options more effectively and choose the most economical loan for your needs. Additionally, improving your credit score can help secure lower interest rates, providing a practical strategy for you. Understanding what is APR mortgage is crucial, especially as market conditions and lender practices evolve.

It’s also important to note that the APR may not accurately reflect the actual costs of a loan if you refinance or sell your home before the loan term ends. Moreover, the APR is influenced by lender-controlled factors like discount points and broker fees, which can greatly affect your total borrowing costs.

If you’re looking to eliminate private mortgage insurance (PMI), refinancing can be a strategic move, particularly in markets with significant property appreciation, such as California. By leveraging higher home values, you may achieve a lower loan-to-value (LTV) ratio, allowing you to remove PMI and reduce your overall housing expenses.

Working with F5 Mortgage can provide you with access to competitive offers and personalized service, enhancing your refinancing experience. We’re here to support you every step of the way.

Break Down APR Components: Fees and Costs Involved

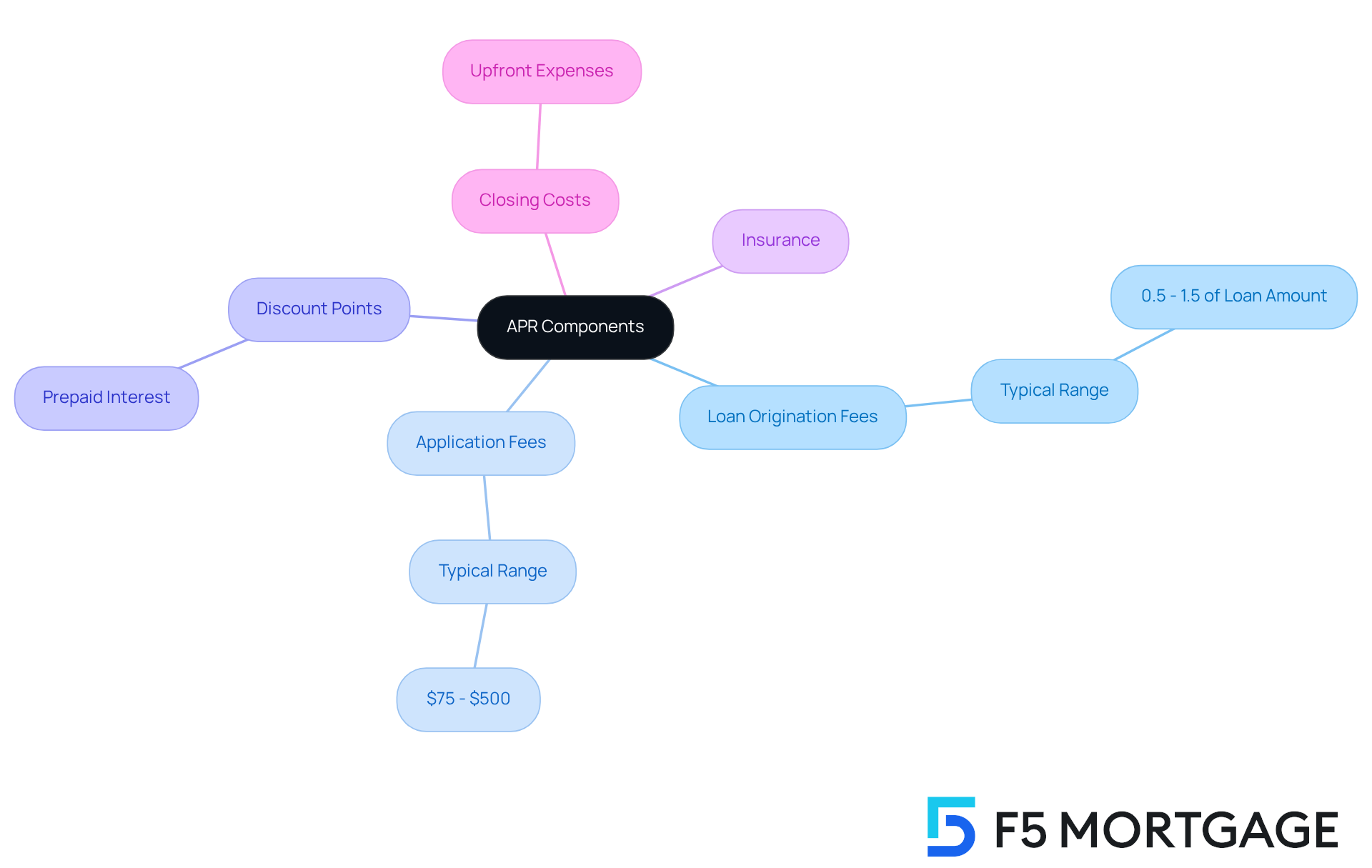

Understanding what is APR mortgage can feel overwhelming, but we’re here to support you every step of the way. What is APR mortgage? It is determined by combining the interest percentage with various charges and expenses related to your loan. Key elements often include:

- Loan origination fees (typically between 0.5% and 1.5% of the loan amount)

- Application fees (ranging from $75 to $500)

- Discount points (which represent prepaid interest)

- Insurance

- Closing costs

Let’s consider a scenario: imagine you’re a borrower who obtains a $200,000 loan at a 3.5% interest rate but incurs $5,000 in fees. In this case, understanding what is APR mortgage will account for these additional costs, providing a clearer picture of the total amount you will pay over the loan’s duration. Grasping these elements helps you understand how each charge affects your total loan costs, empowering you to make better-informed comparisons among various lending proposals.

This thorough approach is crucial, as it clarifies the borrowing process and enables you to explore your financing options effectively. However, it’s important to remain vigilant about potential hidden fees that can impact what is APR mortgage. Comparing loan estimates from different lenders is essential for making informed decisions.

If you’re contemplating variable-interest loans, remember that while they often start with lower introductory rates, fluctuations in terms can lead to higher expenses over time. Be aware of interest adjustment limits that offer some protection against significant increases. Assessing both the advantages and risks associated with Adjustable Rate Mortgages (ARMs) is vital when determining the total expense of borrowing. We know how challenging this can be, but understanding these aspects will help you navigate the mortgage landscape with confidence.

Evaluate APR for Loan Comparisons: Making Informed Choices

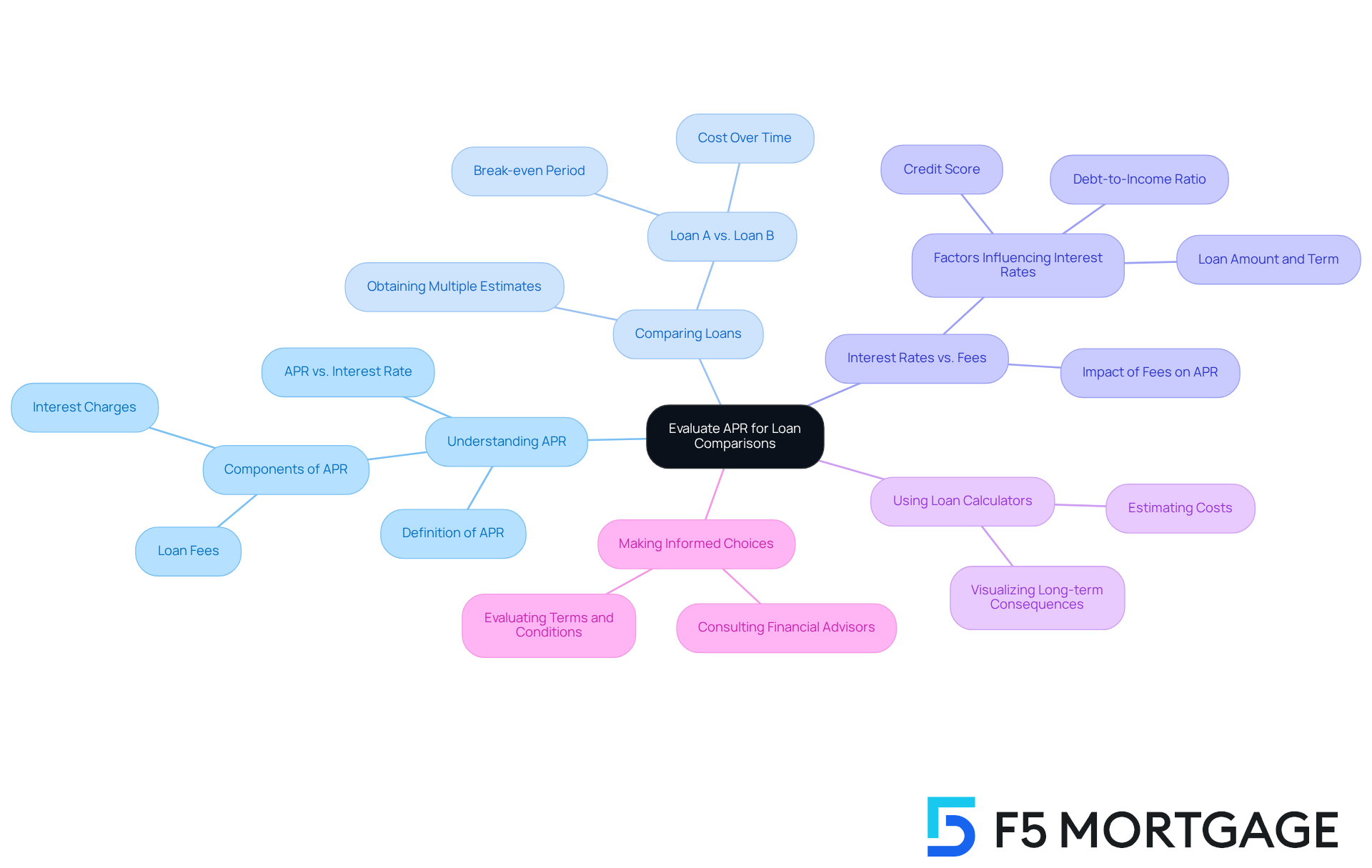

When comparing mortgage offers, it’s essential to evaluate what is APR mortgage in order to find the best financial option for your family. We know how challenging this can be, and it’s important to look beyond just the interest figure. What is APR mortgage is what truly matters when considering the overall expense of the loan. For instance, two loans might have similar interest rates, yet one could carry a significantly higher APR due to additional fees.

By concentrating on what is APR mortgage, you can find out which loan will ultimately require you to pay less over time. Additionally, utilizing tools such as loan calculators can help visualize the long-term financial consequences of various options when considering what is APR mortgage. This empowers you to make decisions that align with your financial objectives.

At F5 Mortgage, we’re here to support you every step of the way. We urge you to evaluate prices, costs, and terms to ensure they meet your needs. Our competitive rates and personalized service can help you navigate these comparisons effectively, ensuring you lock in a mortgage rate that truly works for you.

Conclusion

Understanding the Annual Percentage Rate (APR) in mortgages is crucial for homebuyers like you who are aiming to make informed financial decisions. This comprehensive metric not only reflects the interest rate but also encapsulates all associated fees and costs, providing a clearer picture of the total borrowing expense. By grasping the intricacies of APR, you can navigate the complexities of mortgage financing with greater confidence and clarity.

Throughout this article, we’ve highlighted key insights, including:

- The distinction between APR and nominal interest rates

- The various components that contribute to APR

- The importance of evaluating these figures when comparing loan offers

Remember, a lower interest rate does not always equate to a better deal if the APR is significantly higher due to additional fees. By understanding how to effectively assess APR, you can avoid unexpected costs and make choices that align with your financial goals.

In conclusion, the significance of APR in the mortgage process cannot be overstated. We encourage you to conduct thorough evaluations of APR alongside interest rates, utilizing the tools and resources available to you. By doing so, you can ensure you select the most advantageous loan option, ultimately leading to more sustainable financial outcomes. Taking the time to understand APR will not only enhance your mortgage experience but also pave the way for smarter, more informed decisions in your journey of homeownership.

Frequently Asked Questions

What does APR stand for in the context of mortgages?

APR stands for Annual Percentage Rate, which represents the total annual cost of borrowing expressed as a percentage.

What does APR include besides the nominal interest rate?

APR includes not only the interest charged but also any additional fees or expenses related to obtaining financing.

Why is understanding APR important for homebuyers?

Understanding APR is crucial for comparing different loan products and making informed decisions about home financing, as it reflects the true cost of a loan over its duration.

How can a loan with a low nominal interest rate still have a high APR?

A loan with a nominal interest rate of 3.5% may seem like a good deal, but if there are substantial fees involved, the APR could be much higher, indicating a greater overall cost of the loan.

How can knowledge of APR help borrowers?

Having a clear understanding of APR can help borrowers avoid unexpected expenses and guide them toward better loan options, ensuring confidence in their choices.