Overview

An origination fee is a charge that lenders impose to cover the administrative costs associated with processing a loan. This fee typically ranges from 0.5% to 1% of the total loan amount. We know how challenging this can be, and understanding this fee is crucial for borrowers. It significantly impacts overall loan costs and can vary based on factors like loan amount and credit score. Ultimately, this fee influences your financial decisions in the mortgage process.

As you navigate these complexities, remember that you’re not alone. We’re here to support you every step of the way. By being informed about origination fees, you can make empowered choices that align with your financial goals. Take the time to ask questions and seek guidance, ensuring that you fully understand how these fees affect your mortgage journey.

Introduction

Navigating the intricacies of mortgage financing can often feel like wandering through a labyrinth, especially when hidden costs, such as origination fees, come into play. We know how challenging this can be. These fees, typically ranging from 0.5% to 1% of the total loan amount, are essential for covering the administrative tasks required by lenders. However, understanding how these fees impact overall loan costs and your financial decisions is crucial.

What strategies can you, as a borrower, employ to minimize these fees while securing the best interest rates? We’re here to support you every step of the way as you explore your options and make informed choices.

Define Origination Fee

For anyone navigating the mortgage process, understanding what an origination fee is crucial. These preliminary costs, levied by lenders, can feel overwhelming. What is an origination fee typically expressed as? It is usually a fraction of the total borrowing amount and ranges from 0.5% to 1%. To understand what an origination fee is, it’s important to note that this fee helps lenders cover essential administrative tasks, such as assessing your creditworthiness and preparing necessary documents.

We know how challenging this can be, especially when you’re trying to manage your finances. For instance, if you secure a $250,000 mortgage with a 1% processing fee, you would encounter an upfront cost of $2,500. This amount contributes to your initial expenses, making it vital to understand what an origination fee fully is.

While these fees can sometimes be , it’s important to recognize that reducing them may lead to higher interest rates over the life of the loan. Therefore, as you evaluate credit proposals, consider these initial costs carefully. Communicating openly about these expenses with lenders, like F5 Mortgage, who offer competitive rates and personalized service, is essential. Together, we can ensure you receive the most advantageous arrangement for your financial future.

Contextualize Origination Fees in Loan Costs

Understanding what is an origination fee is essential as it is a crucial aspect of the overall expense of credit, which also includes interest rates, closing costs, and other charges. When evaluating credit offers, it’s important to understand what is an in addition to the annual percentage rate (APR), which encompasses all costs associated with the financing. For instance, a lower interest rate might be offset by a higher setup fee. This makes it crucial for borrowers to assess the total financial impact of their financing decisions. Understanding these factors can empower families to make informed choices when selecting a mortgage lender, such as F5 Mortgage, which is recognized for its competitive rates and personalized service.

In 2022, the average closing costs for home purchase loans rose to around $5,954, marking a significant increase from prior years. This rise underscores the importance of examining all related charges, including what is an origination fee, since these costs can greatly affect the overall affordability of a mortgage. Additionally, with 59% of mortgage purchasers opting to pay discount points last year—up from 31% in 2021—it’s clear that customers are becoming more aware of how upfront costs can shape their long-term financial commitments.

Experts recommend that borrowers carefully evaluate financing proposals by considering what is an origination fee, along with both the initial charges and the APR. This approach ensures that they are not just searching for the lowest interest rate but also understanding how these fees influence the total cost of the financing. As the mortgage landscape continues to evolve, particularly in 2025, awareness of initial costs and their effects on mortgage decisions is vital for achieving favorable financing outcomes. By partnering with F5 Mortgage, families can navigate these complexities with confidence, ensuring they secure the best possible terms for their home upgrade.

Examine Factors Influencing Origination Fees

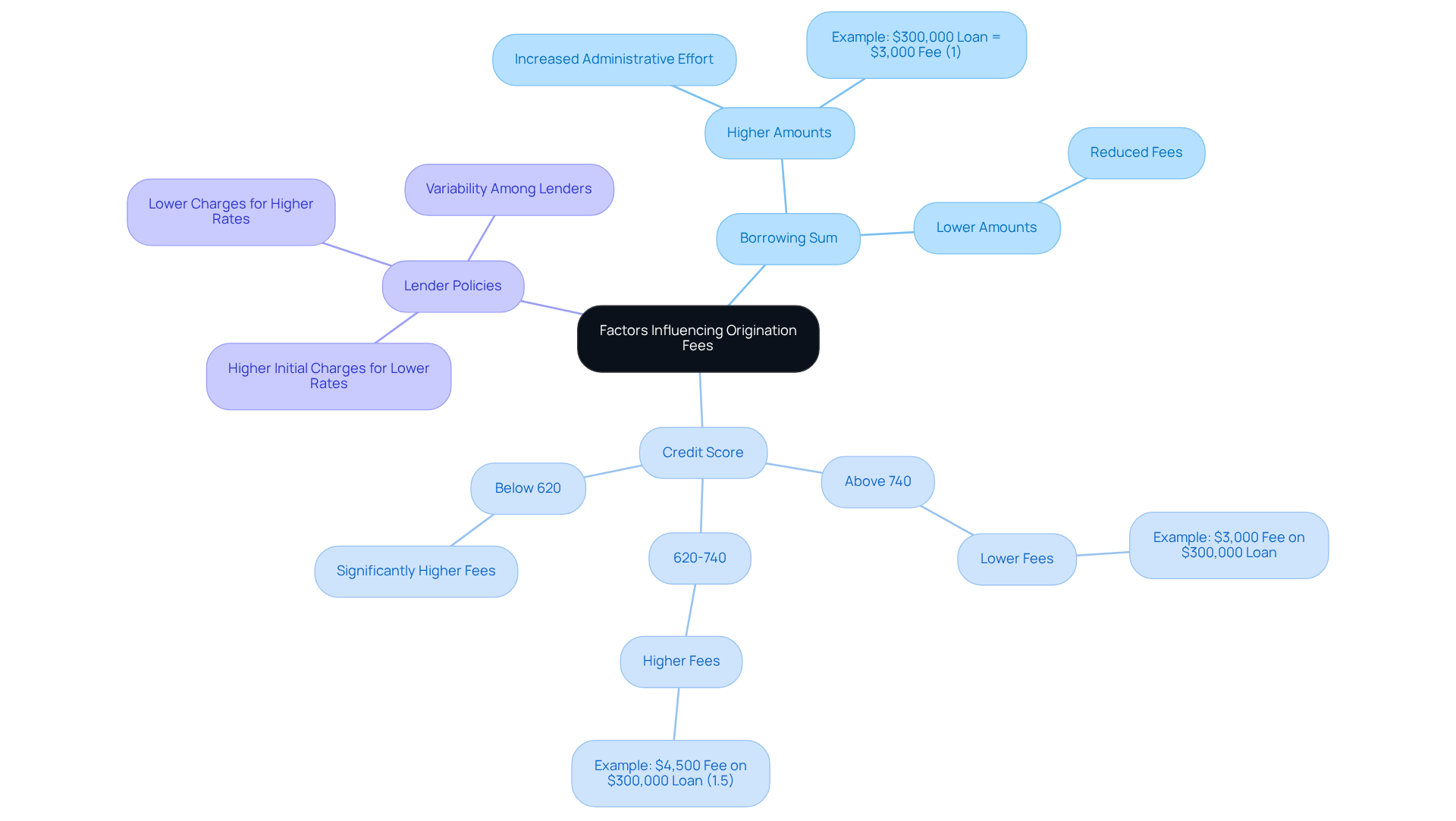

When considering the initial charges that lenders impose, it’s important to understand , as several elements come into play, with the borrowing sum being a significant factor. We understand how daunting this can feel; typically, larger amounts attract greater charges due to the increased administrative effort required for processing them.

Another crucial aspect is the loan applicant’s credit rating. Individuals with higher credit scores often qualify for reduced initial charges, as they are viewed as lower risk by lenders. For instance, someone with a credit score exceeding 740 may secure a considerably lower charge compared to another individual with a score under 620, who could face costs as high as 1.5% of the borrowed amount.

Lender policies can also vary widely, which adds to the complexity. Some lenders might choose to impose increased initial charges in exchange for lower interest rates, while others may offer lower charges but offset this with higher rates. This dynamic illustrates the importance of thoroughly assessing both what is an origination fee and interest rates when comparing borrowing proposals.

As we move into 2025, setup expenses continue to rise—averaging around $7,472 per loan—making it increasingly essential to comprehend what is an origination fee and how credit scores influence these charges.

Experts agree that improving an individual’s credit score can lead to more favorable loan conditions, including lower initial charges. For example, a person with a credit score of 700 might arrange a 1% charge on a $300,000 mortgage, which equates to $3,000. In contrast, a person with a score of 620 could encounter costs of 1.5%, totaling $4,500. By leveraging their credit ratings, individuals can negotiate better terms and potentially save thousands in initial fees.

Remember, we’re here to support you every step of the way as you navigate this process.

Illustrate Origination Fee Examples

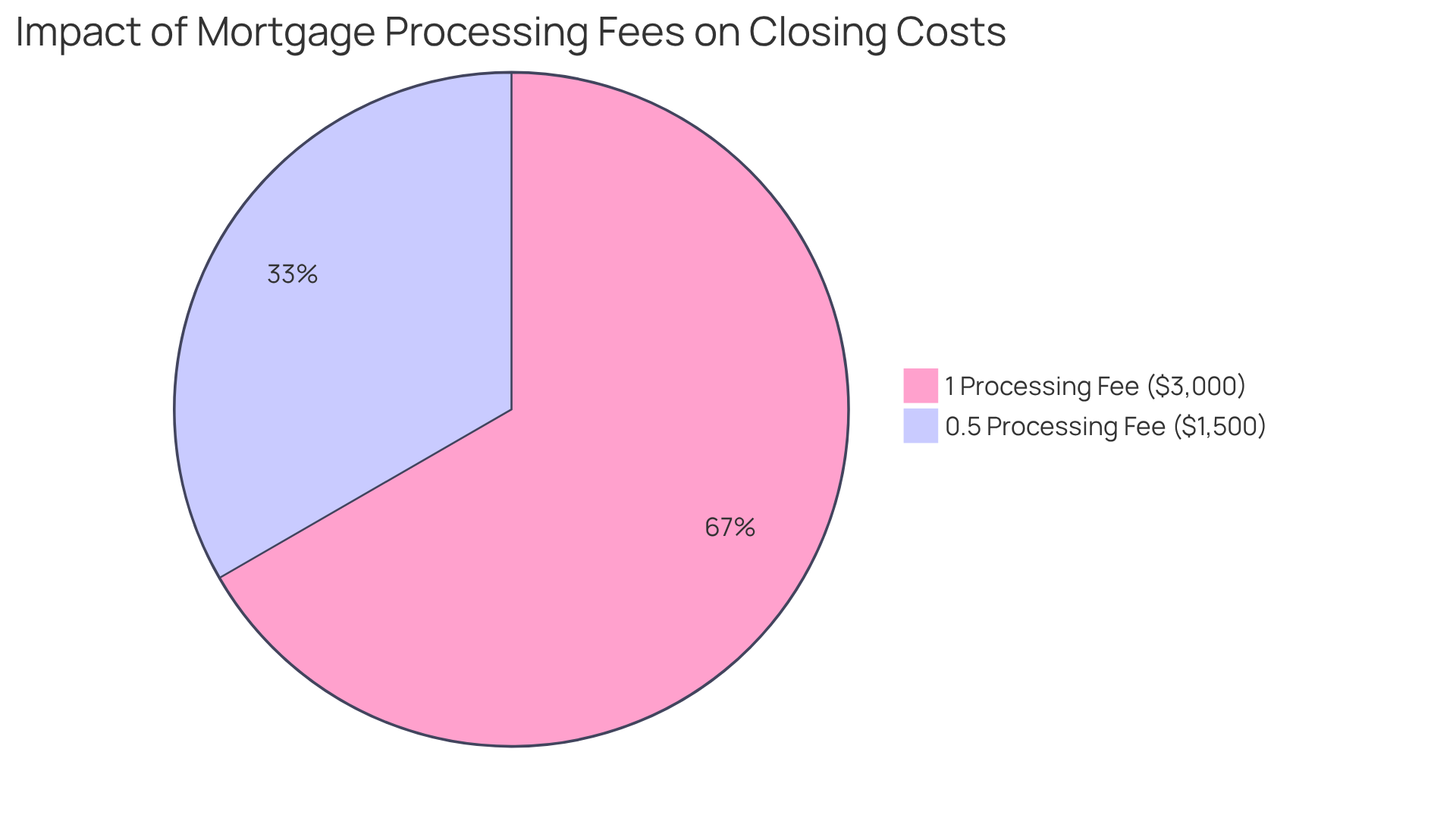

We know how challenging navigating mortgage fees can be. To illustrate the impact of processing fees, let’s consider a scenario: an individual seeking a $300,000 mortgage faces a 1% processing charge. In this case, the upfront cost adds up to $3,000 as part of the closing expenses. Now, imagine if the same individual finds financing with a 0.5% processing fee; the initial expense drops to $1,500. This clear difference underscores how initial charges can vary significantly based on lender practices and personal financial situations.

Understanding what is an origination fee is crucial for anyone taking out a loan, as it directly influences the total cost of the mortgage and the overall planning process. With the average homebuyer facing around $6,000 in in 2022, it is essential to understand what is an origination fee. It empowers borrowers to make strategic financial decisions that can ease their journey toward homeownership. Remember, we’re here to support you every step of the way.

Conclusion

Understanding origination fees is vital for anyone seeking a loan. These fees significantly impact the overall cost of borrowing, and we know how challenging this can be. By comprehending the purpose and implications of these charges, borrowers can navigate the complexities of the mortgage landscape with confidence, making informed financial decisions.

Throughout this article, we’ve highlighted key points, including:

- The definition of origination fees and their impact on total loan costs.

- Factors influencing these fees, such as loan amount and credit score.

Real-world examples illustrate how varying origination fees can lead to substantial differences in upfront costs. This emphasizes the importance of careful evaluation when comparing loan offers.

Ultimately, awareness of origination fees and their implications can empower you to negotiate better terms and achieve favorable financing outcomes. As the mortgage market evolves, being informed about these initial costs will not only facilitate a smoother borrowing experience but also contribute to your long-term financial well-being. Taking the time to understand and assess origination fees can lead to significant savings and a more advantageous mortgage journey. We’re here to support you every step of the way.

Frequently Asked Questions

What is an origination fee?

An origination fee is a preliminary cost charged by lenders during the mortgage process, typically expressed as a fraction of the total borrowing amount, ranging from 0.5% to 1%.

What does the origination fee cover?

The origination fee helps lenders cover essential administrative tasks, such as assessing your creditworthiness and preparing necessary documents.

How is the origination fee calculated?

The origination fee is calculated as a percentage of the total loan amount. For example, on a $250,000 mortgage with a 1% origination fee, the upfront cost would be $2,500.

Can origination fees be negotiated?

Yes, origination fees can sometimes be negotiated; however, reducing them may result in higher interest rates over the life of the loan.

Why is it important to understand origination fees?

Understanding origination fees is vital because they contribute to your initial expenses in the mortgage process, impacting your overall financial arrangement.