Overview

Navigating the question of what house you or your family can afford can feel overwhelming. We understand how challenging this can be, and it’s crucial to align your household income with various housing costs. Remember, housing expenses should ideally not exceed 30% of your gross income.

To help you in this journey, we’ll explore key factors that play a role in your decision-making process:

- Consider your income

- Current mortgage rates

- Property prices

- Debt-to-income ratios

- Down payment options

These elements are vital in assessing your financial situation.

We’re here to support you every step of the way. Alongside this information, we provide tools and resources designed to help potential buyers like you make informed decisions. In today’s challenging housing market, having the right guidance can empower you to find a home that fits your needs and budget.

Introduction

Understanding the complexities of home affordability is crucial in a market where rising property prices and fluctuating mortgage rates can leave potential buyers feeling overwhelmed. We know how challenging this can be. This article delves into the essential factors that influence what house one can afford, offering insights into:

- Income

- Debt-to-income ratios

- The impact of credit scores

As families grapple with the reality of homeownership, the pressing question remains: how can they navigate these financial challenges to secure their dream home without sacrificing their financial stability? We’re here to support you every step of the way.

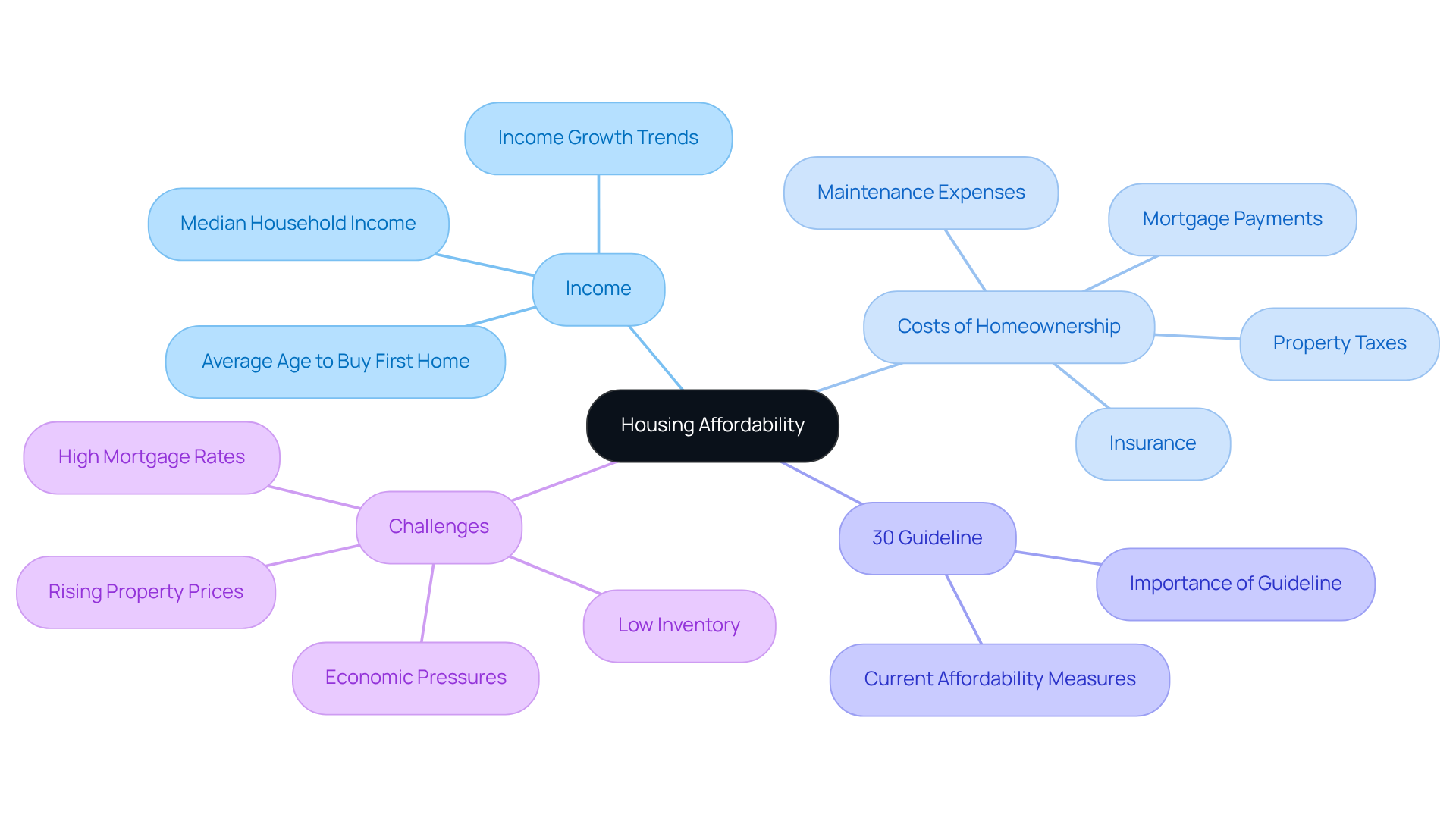

Define Home Affordability

Housing affordability is more than just a number; it reflects the ability of individuals and families to secure a home without compromising their financial health. We understand how overwhelming this can be, as it involves figuring out what house can I afford by carefully assessing how a household’s income aligns with the many costs of homeownership—mortgage payments, property taxes, insurance, and maintenance expenses. A common guideline suggests that when determining what house can I afford, housing costs should ideally not exceed 30% of a household’s gross income. This benchmark is crucial, as it helps families determine what house can I afford, ensuring they can maintain a comfortable lifestyle while meeting their housing obligations.

As we look ahead to 2025, the reality is that many families struggle to adhere to this guideline. With rising property prices and mortgage rates, it’s becoming increasingly challenging to figure out what house can I afford. Real-life stories illustrate this challenge; families often calculate their total monthly housing expenses against their income, seeking advice from financial advisors. These experts emphasize the importance of a balanced budget to alleviate financial stress. Remember, we’re here to support you every step of the way as you navigate these challenges.

Explore Key Factors Affecting Affordability

Several key factors significantly influence home affordability:

- Income: We understand that a household’s total income is the primary determinant of how much you can afford to spend on housing. Generally, greater incomes allow for larger mortgage amounts, boosting your purchasing power.

- Mortgage Interest Rates: The expense of borrowing directly affects your monthly costs. Currently, mortgage costs range from 6.5% to 7%, which can significantly influence affordability. For instance, a one percentage point rise on a $420,000 property can elevate monthly payments by hundreds of dollars. It’s essential to consider how changing interest levels impact your budget. Locking in your mortgage rates with F5 Mortgage once your application is approved can protect you from market fluctuations during the processing period.

- Property Prices: The overall market cost of residences in your area plays a critical role in affordability. With home prices anticipated to increase by approximately 4% on average in 2025, many buyers may find it increasingly difficult to enter the market, especially as prices exceed income growth.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly obligations to your gross monthly income. Lenders generally prefer a DTI of 36% or less, which can limit your borrowing capacity, particularly in a market where prices are high.

- Down Payment: The initial sum you can provide greatly impacts your loan amount and monthly installments. F5 Mortgage offers various down payment assistance programs, including the MyHome Assistance Program in California, which supplies up to 3% of the property’s purchase price, and the My Choice Texas Home program, offering up to 5% for down payment and closing support. Additionally, Florida programs can provide up to $10,000 in upfront costs. A larger down payment reduces your overall loan amount, thereby lowering monthly mortgage costs and improving affordability.

Understanding these elements is crucial for navigating the current housing market and determining what house can I afford, as elevated interest rates and increasing property costs present significant challenges for many potential buyers. Importantly, 86 percent of Americans who were renting expressed a desire to purchase their own home but found it unaffordable. We know how challenging this can be, and we’re here to support you every step of the way.

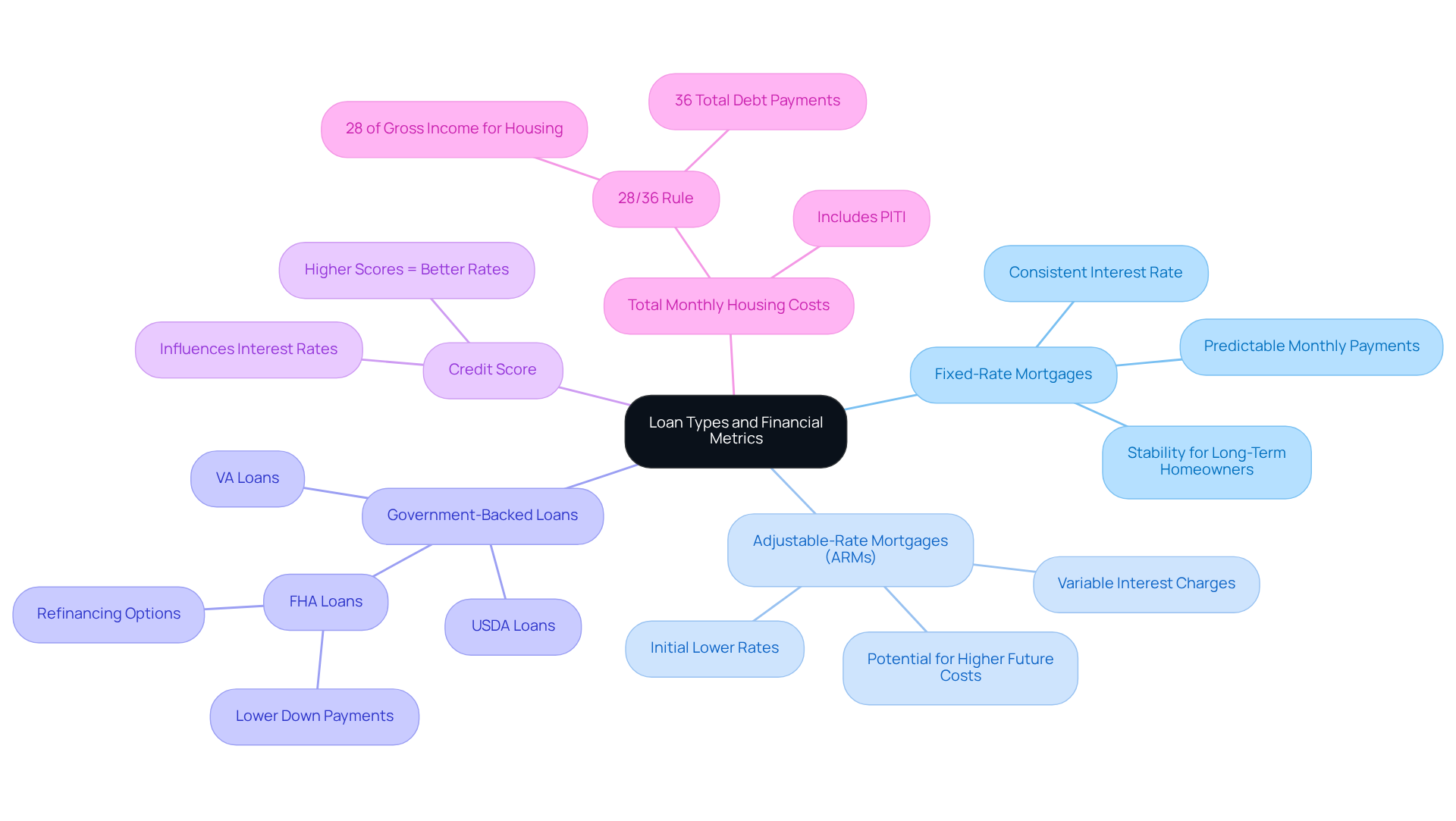

Analyze Loan Types and Financial Metrics

When considering what house can I afford, we understand how challenging this can be. It’s crucial to understand the various loan types and their financial implications:

-

Fixed-Rate Mortgages: These loans maintain a consistent interest rate throughout the loan term, ensuring predictable monthly payments. They are especially appropriate for individuals planning to remain in their residences for an extended period, as they offer stability against changing market values.

-

Adjustable-Rate Mortgages (ARMs): While ARMs often start with lower rates, their interest charges can vary after an initial fixed period. This means that future hikes can lead to considerably larger costs, making them a more hazardous choice for some buyers.

-

Government-Backed Loans: Programs like FHA, VA, and USDA loans cater to specific purchasing demographics, typically requiring lower down payments and offering more lenient credit criteria. These loans can be instrumental in making homeownership accessible to first-time buyers and those with unique financial situations. For instance, FHA loans allow for refinancing options that can help eliminate private mortgage insurance (PMI) and adjust loan terms to better fit a homeowner’s financial goals.

-

Credit Score: A buyer’s credit score plays a pivotal role in determining the interest percentage they can secure. Generally, higher credit scores correlate with better rates, which can substantially lower overall borrowing costs.

-

Total Monthly Housing Costs: This encompasses principal, interest, property taxes, and insurance (PITI). Lenders often adhere to the 28/36 rule, recommending that no more than 28% of gross monthly income be allocated to housing costs, while total debt payments should not exceed 36%. This guideline helps ensure that buyers maintain a manageable debt load.

For potential homeowners, understanding these elements and the obstacles of elevated interest rates and intricate documentation is crucial in determining what house can I afford. Especially for first-time buyers and families seeking to upgrade or refinance, we’re here to support you every step of the way. Making informed choices can help you effectively manage the intricacies of mortgage financing.

Utilize Tools for Calculating Affordability

Determining how much house you can afford can feel overwhelming, but several online tools and calculators are here to help you make informed decisions:

- Affordability Calculators: Platforms like Zillow, NerdWallet, and Bankrate offer calculators that allow you to input your income, debts, and down payment to estimate affordable home prices. These tools are especially important, as we know that 81 percent of potential buyers consider down costs and closing fees to be major barriers.

- Mortgage Calculators: These tools help you understand possible monthly costs based on various loan amounts, interest rates, and terms. By exploring different scenarios, you can gain clarity on how your choices impact your long-term financial commitments.

- Debt-to-Income Ratio Calculators: Understanding your debt-to-income (DTI) ratio is crucial, as it directly influences your borrowing capacity and overall financial health. These tools assess your DTI, providing insights into how much of your income is allocated to debt payments.

- Budgeting Tools: Using budgeting apps can help you track your expenses and savings, ensuring you are financially prepared for homeownership. With 22 percent of American adults feeling they will never afford their dream home, effective budgeting is more important than ever.

- Consultation with Mortgage Brokers: Engaging with a mortgage broker, like those at F5 Mortgage, offers personalized insights and recommendations tailored to your unique financial situation. This guidance can be invaluable in navigating the complexities of the mortgage market, ensuring you make sound financial decisions. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the complexities of home affordability can feel overwhelming. We understand how challenging this can be, but it’s essential to recognize the multiple factors influencing your ability to purchase a home without compromising your financial stability. The heart of home affordability lies in balancing your income against housing costs, ensuring that you can secure a home while preserving your overall financial health. A helpful guideline is that housing costs should not exceed 30% of your gross income, especially in today’s market where property prices and mortgage rates are on the rise.

Key insights reveal the importance of several elements:

- Your income

- Mortgage interest rates

- Property prices

- Debt-to-income ratios

- Down payments

All play crucial roles in determining home affordability. Additionally, understanding different loan types and utilizing online tools can empower you to make informed decisions. Many families express a strong desire to own homes yet face affordability challenges; thus, being aware of these factors and resources is vital.

Ultimately, the journey toward homeownership requires careful planning and informed choices. By leveraging tools like affordability calculators and consulting with financial experts, you can navigate the housing market more effectively and work towards achieving your dream of owning a home. Remember, the pursuit of a home should not feel out of reach; with the right knowledge and resources, it can become an attainable reality for you and your family.

Frequently Asked Questions

What is home affordability?

Home affordability refers to the ability of individuals and families to secure a home without compromising their financial health, considering various costs associated with homeownership.

What factors are considered when determining home affordability?

Factors include mortgage payments, property taxes, insurance, and maintenance expenses, all of which must be assessed against a household’s income.

What is the common guideline for housing costs in relation to income?

A common guideline suggests that housing costs should ideally not exceed 30% of a household’s gross income.

Why is the 30% guideline important for home affordability?

This benchmark helps families determine what house they can afford while ensuring they can maintain a comfortable lifestyle and meet their housing obligations.

What challenges do families face regarding home affordability as we approach 2025?

Many families struggle to adhere to the 30% guideline due to rising property prices and mortgage rates, making it increasingly difficult to determine affordable housing options.

How do families typically assess their home affordability?

Families often calculate their total monthly housing expenses against their income and seek advice from financial advisors to understand their affordability better.

What role do financial advisors play in determining home affordability?

Financial advisors emphasize the importance of a balanced budget to alleviate financial stress and help families figure out what house they can afford.