Overview

In this article, we explore the differences between VA loans and conventional loans, particularly focusing on how VA loans can be a wonderful option for veterans and active-duty service members. We understand how challenging it can be to navigate the mortgage landscape, which is why it’s important to highlight the unique benefits of VA loans.

One of the most significant advantages is the absence of down payment requirements, allowing those with limited savings to move forward with confidence. Additionally, VA loans exempt borrowers from private mortgage insurance (PMI), further reducing financial burdens.

The article delves into the financial advantages of VA loans, showcasing their potential for lower long-term costs and customized refinancing options. This tailored approach makes them especially appealing for individuals facing credit challenges.

We know that every family’s situation is different, and having a loan that accommodates your specific needs can make all the difference. By understanding these benefits, you can make informed decisions that empower you on your homeownership journey.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially for families like yours, who are weighing the options between VA loans and conventional loans. We understand how challenging this can be.

VA loans, backed by the U.S. Department of Veterans Affairs, offer unique advantages, including:

- No down payment

- No private mortgage insurance

This makes them particularly appealing for veterans and active-duty service members.

On the other hand, conventional loans present their own set of benefits, such as:

- Greater flexibility in property types

- Eligibility criteria

With so much at stake, how can families determine which loan type aligns best with their financial goals and circumstances? We’re here to support you every step of the way as you explore your options.

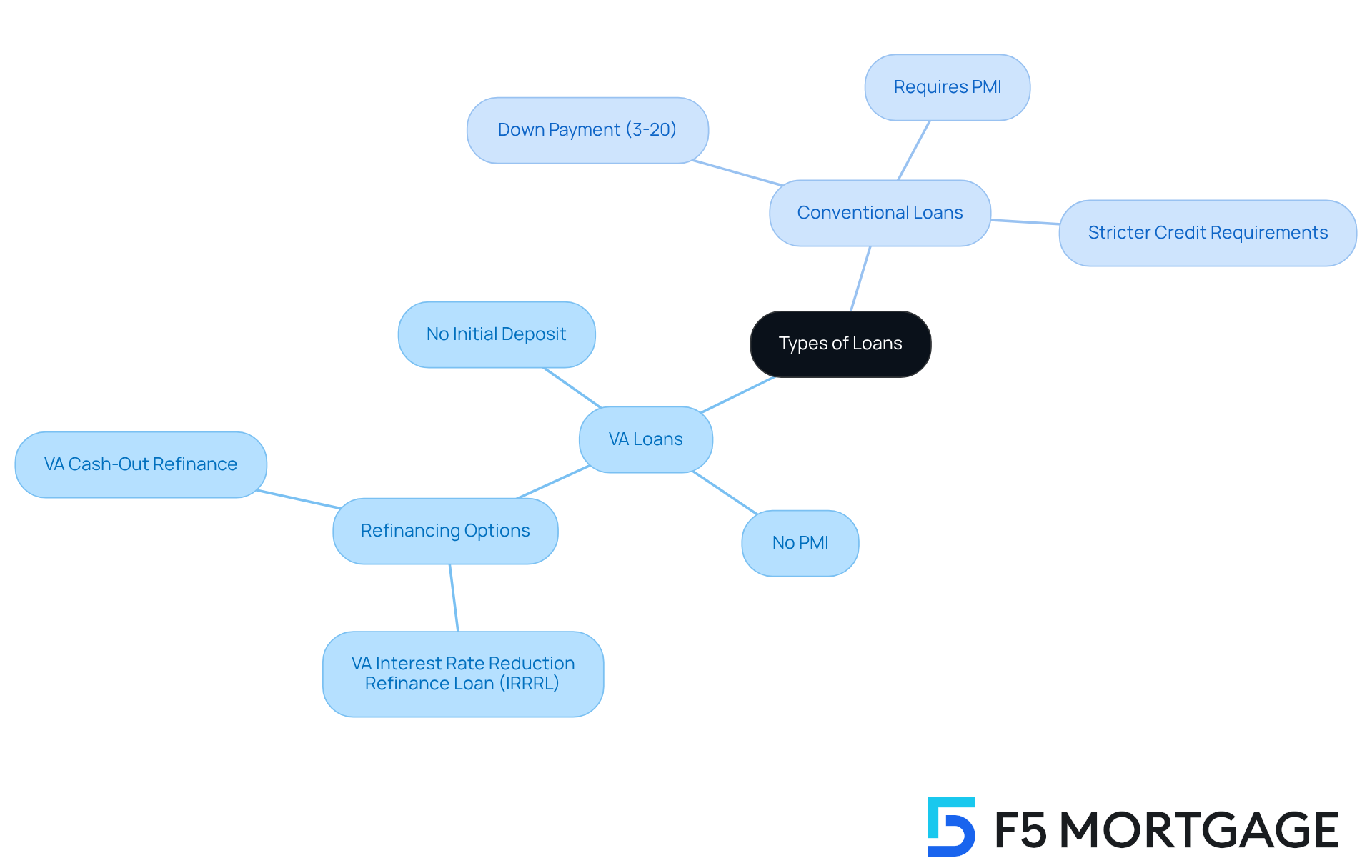

Understanding VA Loans and Conventional Loans

VA mortgages are special financial products backed by the U.S. Department of Veterans Affairs, created to help veterans, active-duty service members, and certain members of the National Guard and Reserves buy homes. We understand how overwhelming the home-buying process can feel, and one of the most significant advantages of VA financing is that it often requires no initial deposit. This means qualified individuals can purchase a home without the upfront costs typically associated with traditional financing.

Additionally, VA financing does not require private mortgage insurance (PMI), which can lead to substantial savings over the life of the loan. In contrast, when considering a VA loan vs conventional loan, traditional financing options, which are not insured by the government, usually necessitate a down payment ranging from 3% to 20%, depending on the lender and the individual’s credit profile. While these standard options may offer more flexibility in terms of eligibility, they often come with stricter credit requirements and higher costs if the down payment is less than 20% due to PMI rules.

Once you’ve built equity in your home, there are refinancing options available, such as the VA Interest Rate Reduction Refinance Loan (IRRRL) or a VA cash-out refinance through F5 Mortgage. These tailored solutions are designed to meet diverse financial needs, and we’re here to support you every step of the way as you navigate this journey.

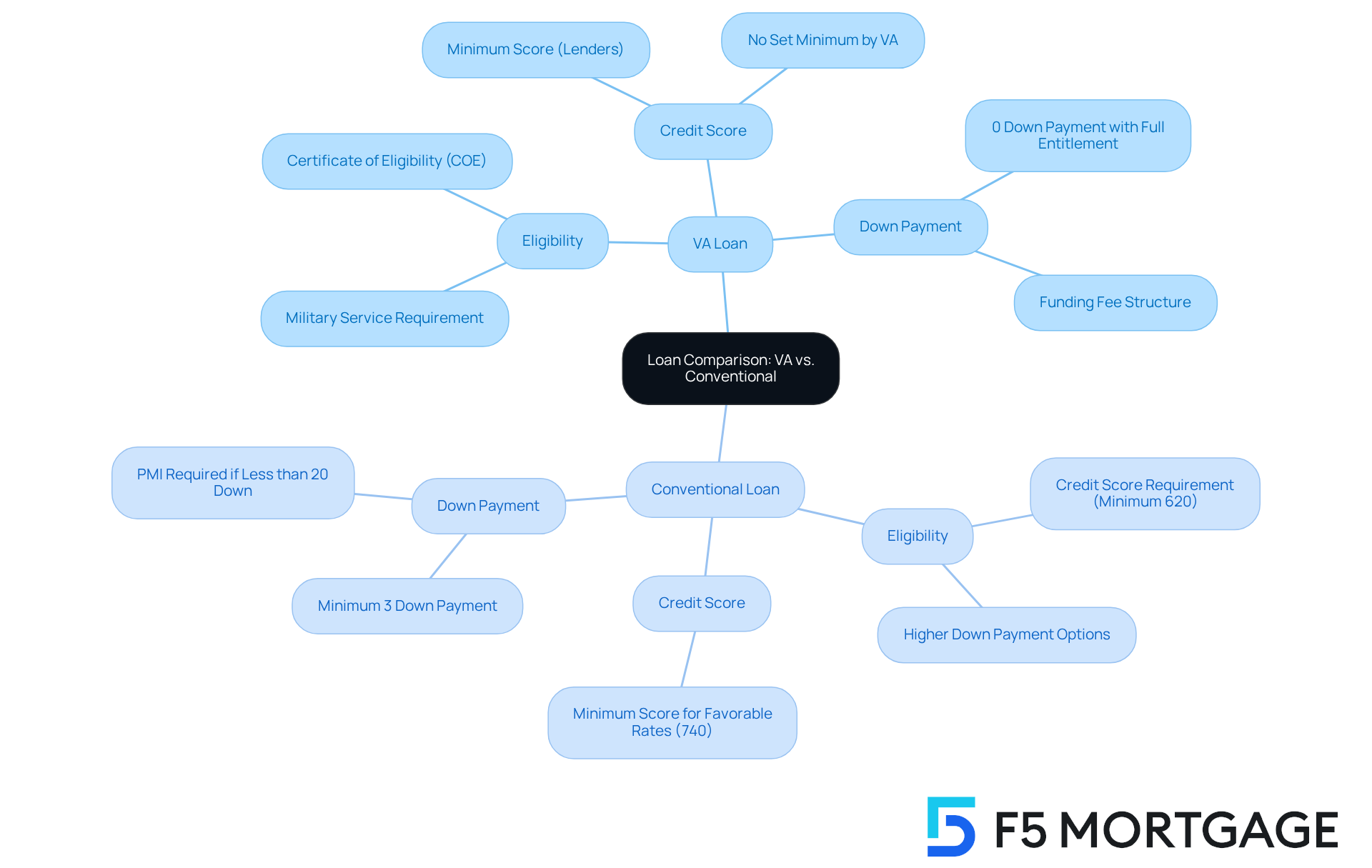

Key Differences: Eligibility, Credit, and Down Payment Requirements

Navigating the world of VA financing can feel overwhelming, especially for those who have served our country. Qualification hinges on military service, requiring individuals to obtain a Certificate of Eligibility (COE). While the VA does not set a minimum credit score, many lenders typically prefer a score of at least 620. In comparison between a VA loan vs conventional loan, traditional financing often necessitates a minimum credit score of 620, with more favorable rates available for scores exceeding 740.

One of the most appealing aspects of VA programs is the possibility of 100% financing. This means qualified individuals can purchase a home without an initial deposit, alleviating some of the financial burdens. In contrast, when comparing a VA loan vs conventional loan, traditional financing usually requires a minimum deposit of 3%, and individuals can avoid private mortgage insurance (PMI) if they contribute 20% or more.

It’s important to note that VA financing might involve a funding charge that varies based on the down payment and whether it is the individual’s first VA loan. Additionally, the ability to refinance VA mortgages through options like the VA Interest Rate Reduction Refinance Program (IRRRL) or VA cash-out refinance adds to their attractiveness.

These differences in initial deposit requirements and overall costs in a VA loan vs conventional loan can significantly impact starting expenses for individuals. For those who meet the criteria, VA financing can be an especially appealing option. We understand how challenging this can be, and we’re here to support you every step of the way.

Financial Considerations: Insurance, Fees, and Long-Term Costs

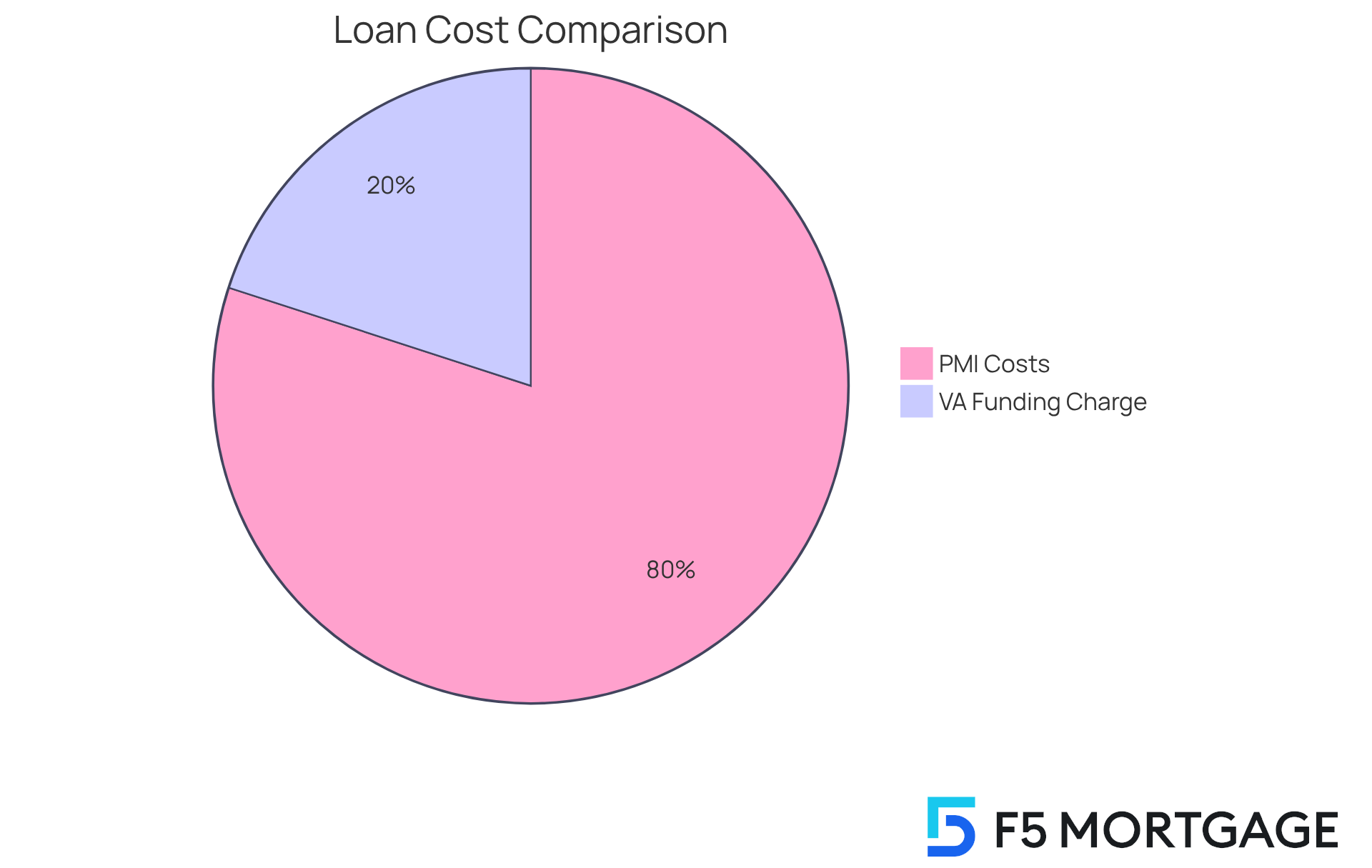

VA loans offer a significant advantage by eliminating the need for private mortgage insurance (PMI). This can save individuals thousands of dollars over the life of the loan, which is a relief for many families. Instead of PMI, borrowers pay a one-time VA funding charge. This fee varies based on military category, down payment, and whether it’s their first use of the benefit. Fortunately, this charge can be included in the total loan amount, making it easier for veterans to manage initial costs.

In contrast, traditional financing requires PMI if the down payment is less than 20%. This can add to the monthly payment and significantly increase overall borrowing costs. For instance, PMI for a typical mortgage can range from 0.46% to 1.50% of the initial mortgage amount annually, which translates to an additional monthly cost of about $115 to $375 for a $300,000 home. Understanding the differences between a VA loan vs conventional loan is crucial.

Moreover, VA mortgages typically come with lower interest rates compared to standard financing options, leading to substantial long-term savings. However, when evaluating a VA loan vs conventional loan, traditional financing may provide greater flexibility regarding loan amounts and property types, which can be a viable option for some families. We know how challenging this decision can be, and understanding these financial considerations is essential for families evaluating their mortgage options. We’re here to support you every step of the way.

When to Choose a VA Loan vs. a Conventional Loan

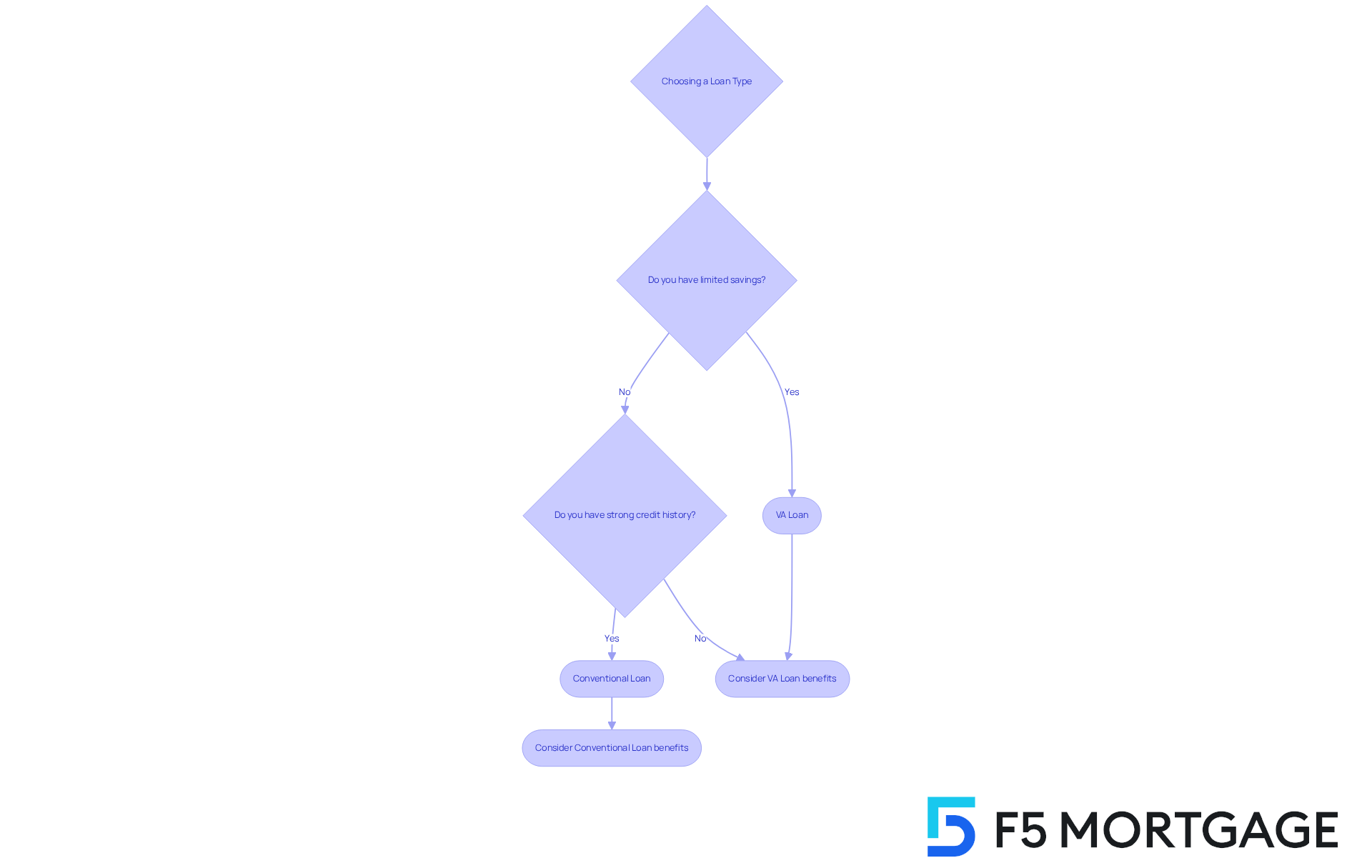

Choosing between a VA loan vs conventional loan can feel overwhelming. We understand that your financial situation and eligibility requirements play a crucial role in this decision. VA financing stands out as a compelling choice for veterans and active-duty personnel, offering significant benefits such as no upfront costs and exemption from private mortgage insurance (PMI). These features make VA financing particularly advantageous for those with limited savings or who may struggle to meet the credit criteria of traditional financing.

For instance, veterans with service-related disabilities might be exempt from the VA funding fee, typically 2.15% for first-time applicants with no down payment. This exemption can greatly enhance the affordability of this option. Furthermore, as of August 2025, the average 30-year fixed-rate VA mortgage is 6.18%, which is often lower than conventional mortgage rates that can exceed this by 0.25% to 0.50%. This cost-effectiveness is an essential factor for families considering their financing options.

On the other hand, traditional financing may appeal more to borrowers with strong credit histories who can manage a substantial down payment. These options provide greater flexibility regarding property types and amounts, making them suitable for individuals looking to acquire investment properties or second homes. Financial advisors often recommend that families with solid credit histories and adequate savings explore traditional financing, especially in competitive real estate markets where they might secure more favorable terms.

As Christopher Davis, assistant vice president of residential lending at Navy Federal Credit Union, wisely notes, “For those qualified for a VA mortgage and financially prepared to purchase a home, a VA mortgage is always a choice that should be given high consideration.”

Real-life examples illustrate this dynamic: families with limited financial resources frequently opt for VA financing to boost their purchasing power without the burden of upfront costs. For example, a veteran family may find that using a VA benefit allows them to purchase a home without saving for a down payment, enabling them to settle into a suitable residence sooner. Conversely, families with substantial equity or savings might choose traditional financing to strengthen their financial position and access a broader range of property options.

Ultimately, understanding the nuances of each loan type, including VA loan vs conventional loan, is vital for families navigating their home financing decisions in 2025. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Choosing the right mortgage can significantly impact your family’s financial future. We understand how overwhelming this decision can be, especially when weighing the differences between VA loans and conventional loans. VA loans, backed by the U.S. Department of Veterans Affairs, offer unique advantages like no down payment and exemption from private mortgage insurance. These features make them particularly appealing for veterans and active-duty service members, allowing them to purchase homes without the financial burden that often comes with traditional financing options.

In this article, we’ve explored key differences, including eligibility requirements, credit scores, and long-term costs associated with each loan type. VA loans stand out for their lower interest rates and the absence of PMI, while conventional loans may provide more flexibility regarding property types and amounts. For families with solid credit and significant savings, conventional financing can also be a viable option, particularly in competitive markets.

Ultimately, the decision between a VA loan and a conventional loan should be informed by your individual financial circumstances and eligibility. We encourage you to carefully evaluate your options and consider seeking guidance from financial advisors. By understanding the nuances of each loan type, you can make empowered choices that align with your home-buying goals and financial well-being. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are VA loans?

VA loans are financial products backed by the U.S. Department of Veterans Affairs, designed to help veterans, active-duty service members, and certain members of the National Guard and Reserves buy homes.

What is a key advantage of VA loans compared to conventional loans?

A significant advantage of VA loans is that they often require no initial deposit, allowing qualified individuals to purchase a home without the upfront costs typically associated with traditional financing.

Do VA loans require private mortgage insurance (PMI)?

No, VA loans do not require private mortgage insurance (PMI), which can lead to substantial savings over the life of the loan.

What are the typical down payment requirements for conventional loans?

Conventional loans usually require a down payment ranging from 3% to 20%, depending on the lender and the individual’s credit profile.

How do credit requirements differ between VA loans and conventional loans?

Conventional loans often have stricter credit requirements compared to VA loans, which may have more flexible eligibility criteria.

What refinancing options are available for VA loan borrowers?

VA loan borrowers have refinancing options such as the VA Interest Rate Reduction Refinance Loan (IRRRL) and a VA cash-out refinance.

How can F5 Mortgage assist with VA loans?

F5 Mortgage supports individuals throughout the home-buying process, providing tailored solutions to meet diverse financial needs related to VA loans and refinancing options.