Introduction

Homeowners often find themselves navigating the complexities of leveraging their property’s value. We know how challenging this can be, and that’s where home equity lines of credit (HELOCs) come into play. This financial tool offers a way to access funds based on the equity you’ve built in your home, providing flexibility and potentially lower interest rates compared to traditional loans.

However, it’s important to consider the other side of the coin. What happens when the allure of easy access to cash meets the risks of fluctuating payments and potential foreclosure? Understanding the pros and cons of HELOCs is essential. We’re here to support you every step of the way, helping you make informed financial choices that align with your long-term goals.

Defining Home Equity Line of Credit (HELOC)

Homeowners should consider the pros and cons of home equity line of credit, as it can be a valuable resource. It’s a revolving line of credit backed by the equity in your home, allowing you to borrow against your property’s value. Think of it like a credit card, where you can access funds whenever you need them.

The borrowing limit is based on the equity you’ve built up, which is the difference between your home’s current market value and what you still owe on your mortgage. This means that as your home appreciates, so does your potential borrowing power.

Typically, a HELOC has a draw period where you can withdraw funds, followed by a repayment period where you’ll need to pay back what you borrowed, plus interest. As we look ahead to 2025, many homeowners are turning to HELOCs to meet their financial needs. This trend shows how families are finding ways to leverage their home equity for support.

We know how challenging financial decisions can be, but a HELOC might just be the solution you’re looking for. It’s important to consider the pros and cons of home equity line of credit when looking for tools to help you manage expenses or invest in opportunities that matter to you. Remember, we’re here to support you every step of the way.

Advantages of Home Equity Lines of Credit

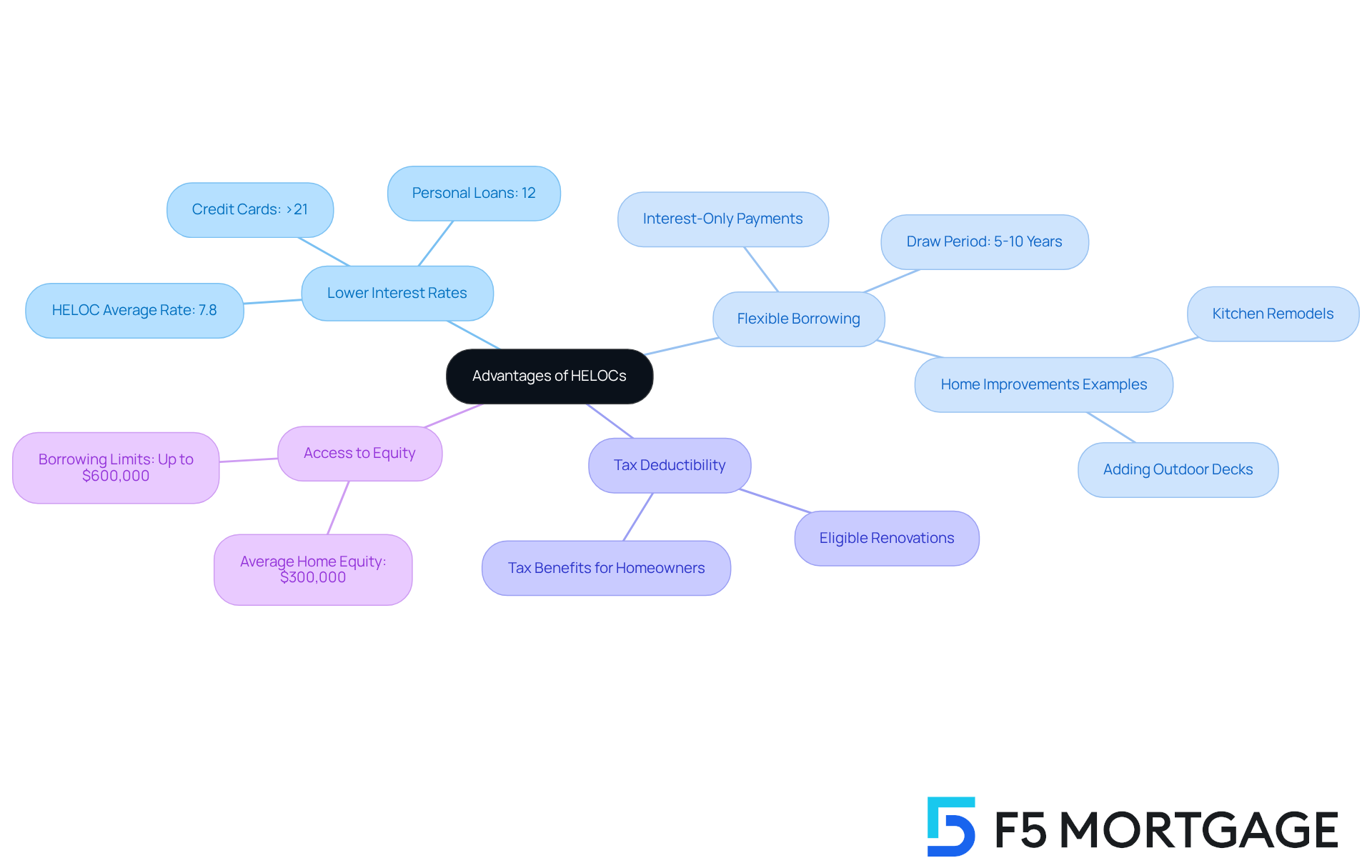

Home Equity Lines of Credit (HELOCs) can be a real lifeline for property owners, especially in 2025. One of the most significant advantages is their lower interest rates compared to unsecured loans. With current HELOC rates averaging around 7.8%, they stand out as a cost-effective borrowing option. In contrast, personal loans hover around 12%, and credit cards can exceed 21%. This affordability allows homeowners to access funds flexibly, borrowing only what they need during the draw period, which typically lasts 5 to 10 years.

During this draw period, many HELOCs offer interest-only payment options, which can make cash flow management much simpler for property owners. This feature is particularly beneficial for those embarking on improvement projects, as it helps them keep track of costs without the pressure of fixed monthly payments. For example, homeowners can use HELOCs to finance renovations that not only enhance their living space but also boost their property value, like kitchen remodels or adding outdoor decks.

Moreover, the interest paid on a HELOC might be tax-deductible if the funds are used for qualifying renovations. This adds an extra layer of financial incentive. However, homeowners should remember that to qualify for these tax benefits, the funds must be used to buy, build, or substantially improve the residence securing the loan. This tax advantage can significantly lower the overall cost of borrowing, making HELOCs an appealing choice for those looking to invest in their homes.

In 2025, many property owners find themselves sitting on considerable equity-averaging around $300,000. HELOCs can serve as a valuable financial tool. They not only provide a safety net for unexpected expenses but also allow homeowners to tap into their equity without the hassle of traditional loan applications. As you navigate your financial needs, understanding the pros and cons of home equity line of credit can empower you to make informed choices that align with your long-term goals. We’re here to support you every step of the way.

Disadvantages of Home Equity Lines of Credit

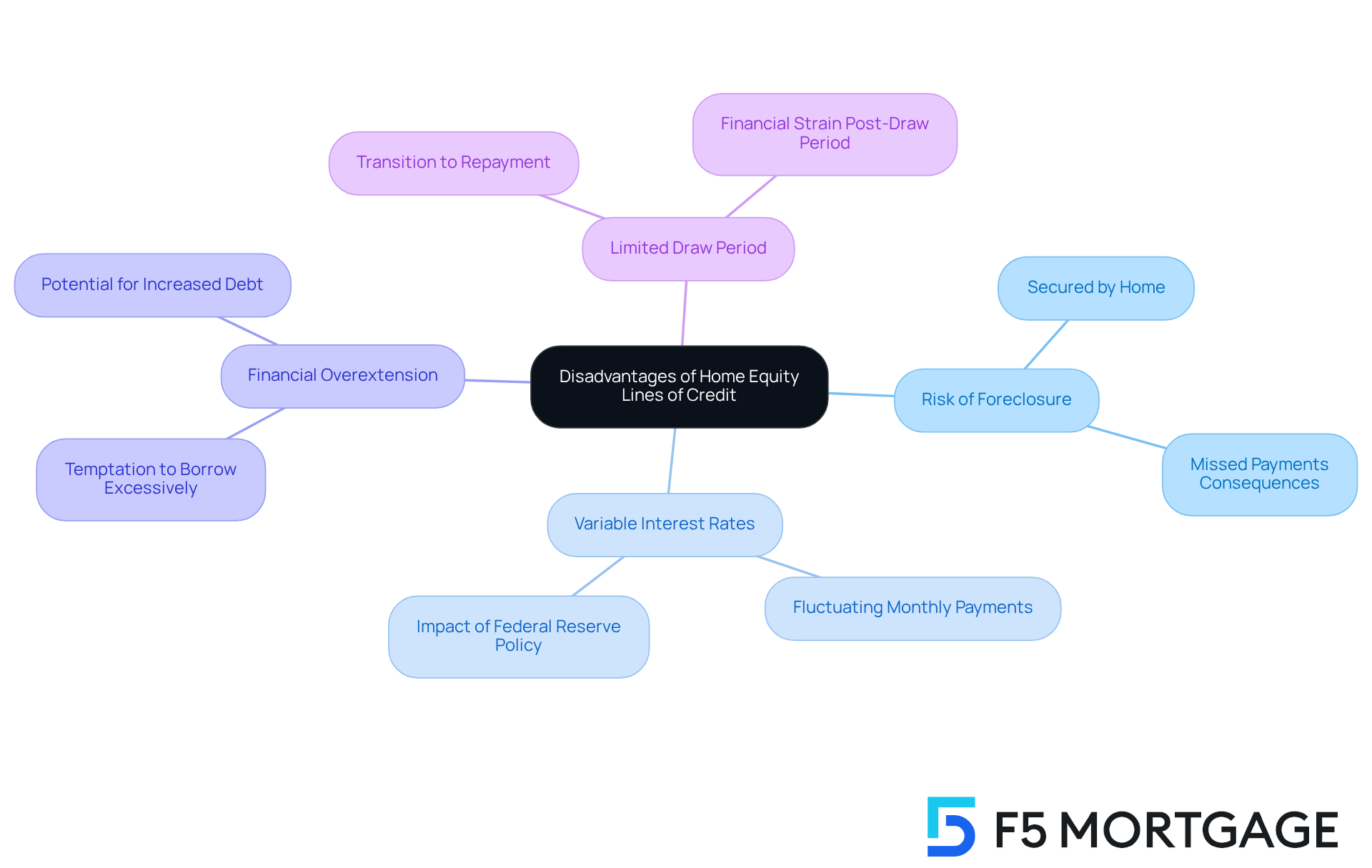

While home equity lines of credit (HELOCs) can offer some advantages, it’s important to be aware of the pros and cons of home equity line of credit that come with them. We know how challenging financial decisions can be, and understanding these risks is crucial for your peace of mind.

One significant concern regarding the pros and cons of home equity line of credit is that they are secured by your home. This means that if you’re unable to repay the loan, you could face foreclosure. It’s a daunting thought, and we’re here to support you every step of the way as you navigate these choices.

Another factor to consider is that HELOCs often come with variable interest rates. This can lead to fluctuating monthly payments, making budgeting a bit tricky. It’s easy to feel overwhelmed, but being aware of this can help you plan more effectively.

Additionally, when evaluating the pros and cons of home equity line of credit, there’s the temptation to overextend yourself financially. It’s understandable to want to make the most of your home’s equity, but excessive debt can create long-term challenges. We encourage you to think carefully about your financial limits.

Lastly, keep in mind that the draw period for HELOCs is usually limited. After this period, you’ll need to start repaying the principal, which can add financial strain if you haven’t planned for it. Taking proactive steps now can help you avoid stress later on.

Key Considerations for Choosing a HELOC

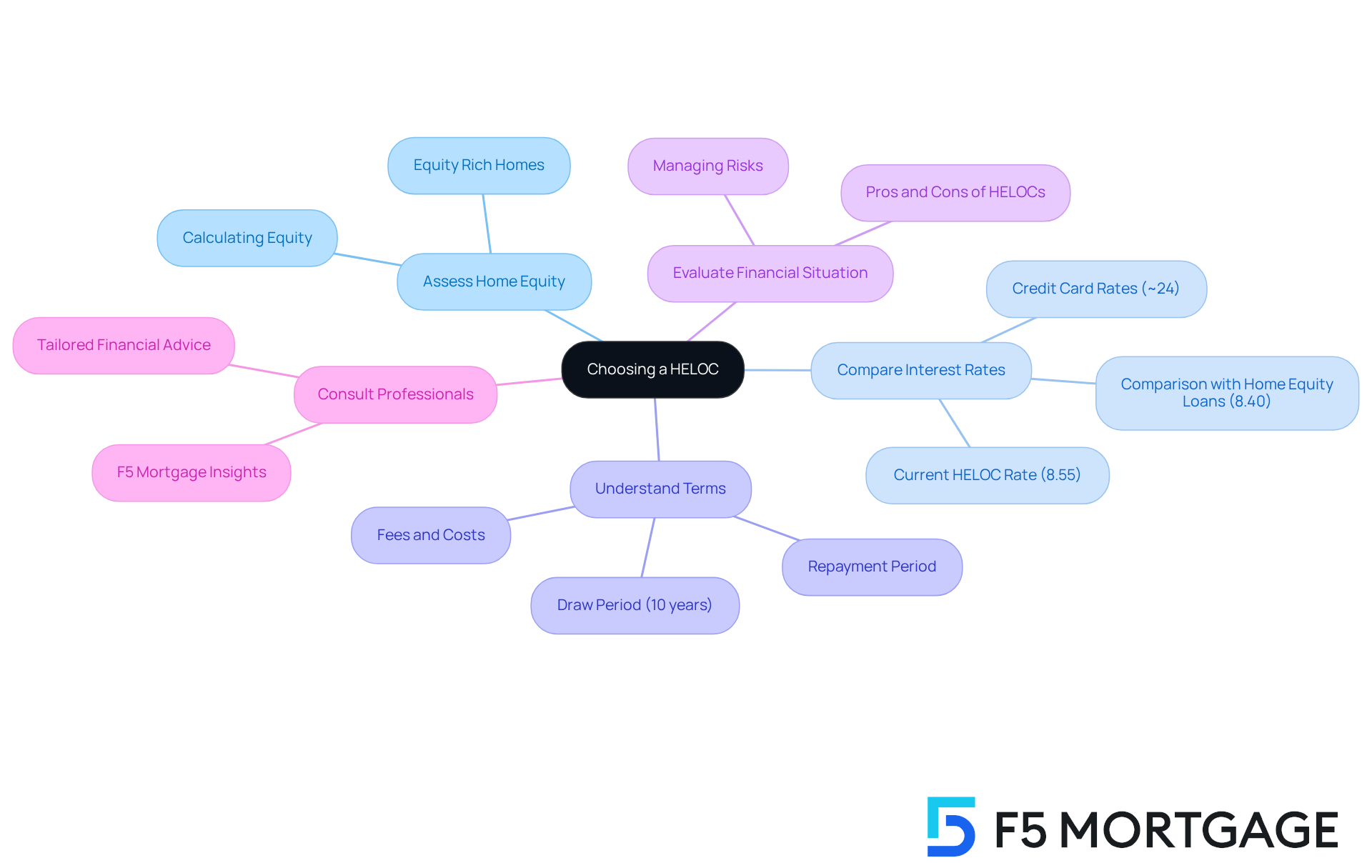

Selecting a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way. Start by assessing the equity in your home, as this will determine your borrowing limit. Did you know that as of early 2025, about 46.2% of mortgaged homes are considered ‘equity rich’? This means their outstanding loan balance is less than half the property’s value, giving you substantial borrowing power.

Interest rates are another crucial factor to consider. They can vary significantly among lenders, so it’s important to compare them. Currently, HELOC rates average around 8.55%, which is slightly higher than the home equity loan rate of 8.40%, but much lower than the nearly 24% average for credit cards. Understanding the terms of the draw and repayment periods is essential, along with any fees that could impact your overall costs. When evaluating lenders, think about partnering with F5 Mortgage, known for competitive rates and personalized service tailored to your financial needs.

Next, take a moment to assess your financial situation. It’s vital to ensure you can manage potential risks, like fluctuating interest rates and the obligation to repay borrowed amounts. Mortgage experts emphasize that the pros and cons of home equity line of credit (HELOCs) should be considered for strategic use. While they’re not meant for everyday expenses, understanding the pros and cons of home equity line of credit can show how they can be great for worthwhile investments, such as home improvements or debt consolidation. As Shi Bradley wisely notes, “Using a HELOC for home projects and renovations can be advantageous, as it may allow homeowners to deduct interest paid from their taxes.”

Finally, consider consulting with a mortgage professional at F5 Mortgage. They can provide tailored insights and help you navigate the complexities of HELOC options, ensuring you make an informed decision that aligns with your financial goals. Remember, we know how challenging this can be, and we’re here to help you find the best path forward.

Conclusion

Home Equity Lines of Credit (HELOCs) can be a wonderful financial opportunity for homeowners. They allow you to tap into your property’s equity for various needs. By understanding what a HELOC is – its revolving credit nature and the potential for lower interest rates – you can make informed decisions that align with your financial goals.

Let’s take a closer look at some essential aspects of HELOCs. They come with advantages, like lower borrowing costs and potential tax benefits. However, it’s crucial to also consider the significant drawbacks, such as the risk of foreclosure and variable interest rates. We know how challenging it can be to navigate these options, so it’s important to carefully assess your financial situation and understand the terms associated with HELOCs, including the draw and repayment periods.

Ultimately, deciding to pursue a HELOC should come from a place of understanding both its benefits and risks. We encourage you to evaluate your financial health, seek professional guidance, and think about how a HELOC can serve as a strategic tool for home improvements or debt consolidation. By approaching this decision thoughtfully, you can harness the potential of your home equity while safeguarding your financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit backed by the equity in your home, allowing you to borrow against your property’s value, similar to how a credit card works.

How is the borrowing limit for a HELOC determined?

The borrowing limit is based on the equity you’ve built up, which is the difference between your home’s current market value and the remaining balance on your mortgage.

What happens to the borrowing power as home values increase?

As your home appreciates in value, your potential borrowing power through a HELOC also increases.

What are the typical phases of a HELOC?

A HELOC typically has a draw period, during which you can withdraw funds, followed by a repayment period, where you must pay back what you borrowed along with interest.

Why are homeowners considering HELOCs in 2025?

Many homeowners are turning to HELOCs to meet their financial needs, indicating a trend of leveraging home equity for financial support.

What should homeowners consider before obtaining a HELOC?

Homeowners should weigh the pros and cons of a HELOC when looking for financial tools to manage expenses or invest in important opportunities.