Overview

Home equity is the difference between the current market value of your property and the outstanding mortgage balance. It represents the portion of your home that you truly own. We understand how important this concept is for your financial planning. By leveraging your equity, you can explore options like cash-out refinancing or home equity loans to meet various financial needs. This can ultimately enhance your wealth and provide greater financial flexibility.

We know how challenging this can be, and we’re here to support you every step of the way. Understanding your home equity allows you to make informed decisions that can positively impact your financial future. Take the time to consider how these options might work for you, and feel empowered to take action towards achieving your financial goals.

Introduction

Understanding home equity is not just a financial concept; it’s a vital aspect of financial literacy that can profoundly impact your personal wealth. We know how challenging navigating financial matters can be, and home equity—defined as the difference between a property’s market value and the outstanding mortgage balance—serves as a crucial resource for homeowners like you.

As property values rise and mortgage payments are made, the potential to leverage this equity for investments, renovations, or debt consolidation becomes increasingly relevant. Imagine using your home equity to create the financial opportunities you’ve always dreamed of. However, the challenge lies in navigating the various options and understanding the implications of accessing this valuable asset.

So, how can you effectively utilize your home equity to enhance your financial stability and future opportunities? We’re here to support you every step of the way, guiding you through this important journey.

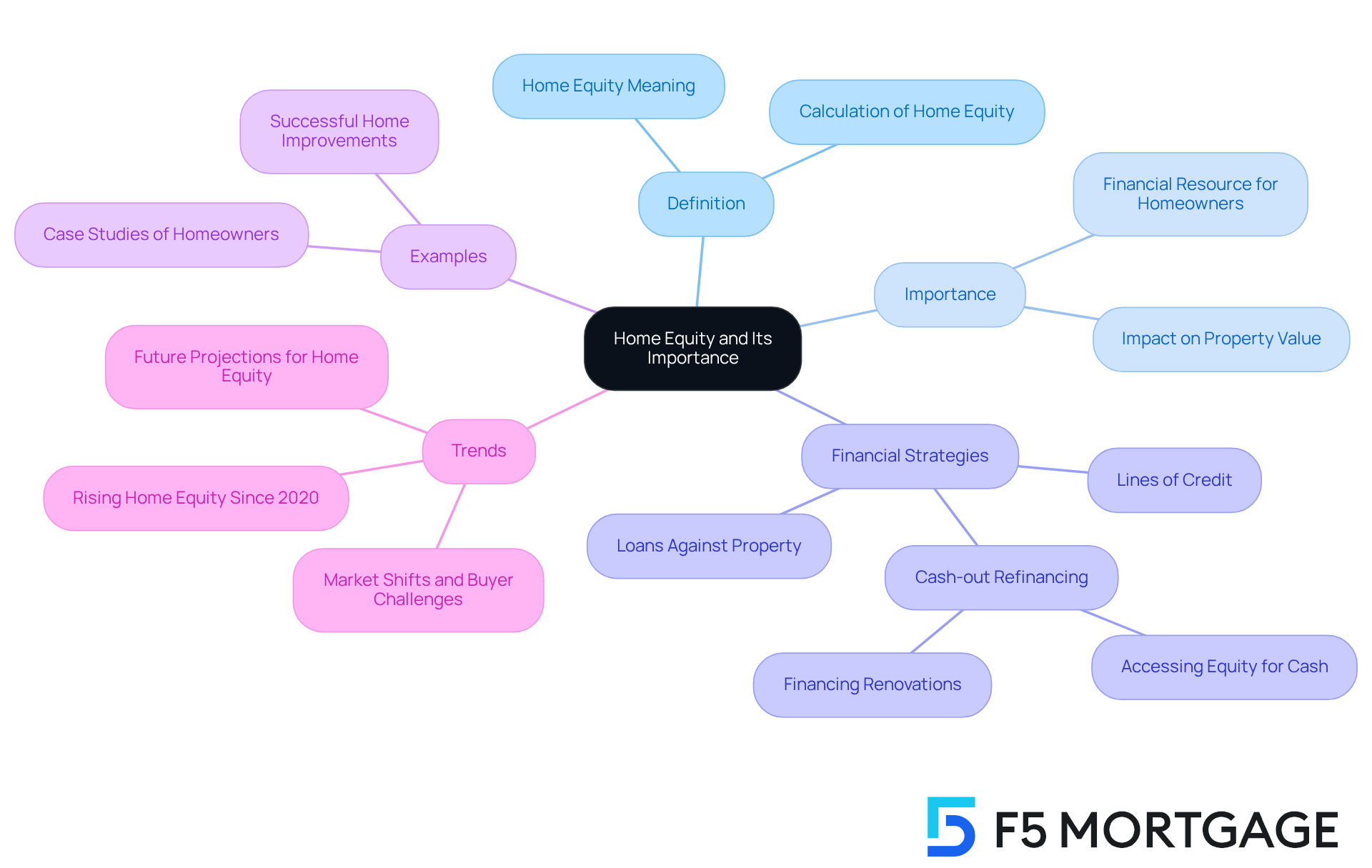

Define Home Equity and Its Importance

Understanding residential ownership can feel overwhelming, but it’s crucial for your financial well-being. The home equity meaning can be understood as the difference between the current market value of your property and the remaining balance on any mortgages or liens against it. This figure represents the portion of your home that you truly possess. For instance, if your residence is appraised at $300,000 and the mortgage balance is $200,000, you hold $100,000 in value. Recognizing the home equity meaning is essential, as it serves as an important monetary resource for homeowners like you.

We know how challenging it can be to navigate these financial waters, but understanding home equity meaning can help leverage it to open doors to new opportunities. In California, for example, cash-out refinancing is a strategic method to access your equity. This process involves refinancing your existing mortgage for a higher amount than what you currently owe, allowing you to receive the difference in cash. This can be particularly advantageous for financing property enhancements, consolidating debt, or making significant purchases, especially when the new interest rate is lower than your existing mortgage rate.

Recent trends show that residential value stakes have risen significantly since 2020, with some areas witnessing triple-digit growth. By 2025, the typical property ownership percentage for residents is anticipated to remain appealing. This creates a favorable moment for homeowners to consider the home equity meaning and leverage their assets for various financial needs. For instance, financing renovations can not only improve your living environment but also potentially raise your property value in a competitive market.

Besides cash-out refinancing, it’s important to explore other alternatives for accessing your residential value, such as loans against property and lines of credit. We’re here to support you every step of the way. Tracking property value trends is crucial for identifying both opportunities and risks linked to property ownership. Working with investment consultants can assist you in aligning your borrowing choices with long-term monetary objectives, ensuring you make informed decisions about utilizing your home value.

Contextualize Home Equity in Financial Planning

Understanding home equity meaning is crucial for money management, especially for property owners who are looking to build wealth over time. As mortgage payments are made, property owners gradually enhance their ownership stake, effectively creating a form of enforced savings. This accumulated capital can be utilized for various financial needs, such as:

- Financing property renovations

- Consolidating high-interest debt

- Exploring other investment opportunities

Many property owners view renovations as a strategic investment in their homes, recognizing the potential for increased value.

Moreover, residential value plays a vital role in retirement planning. Property owners can tap into this value through options like:

- Reverse mortgages

- Home equity lines of credit (HELOCs)

These options highlight the home equity meaning by providing a source of income during retirement. With average home equity loan rates currently under 8.50%, these alternatives often prove to be more cost-effective than credit cards or personal loans, making them appealing for those seeking to finance projects or investments.

For property owners considering refinancing in California, understanding the process is essential. The refinancing journey typically involves:

- Assessing your current mortgage

- Comparing rates and terms from various lenders

- Applying for a new loan

- Closing on the new mortgage

By partnering with F5 Mortgage, property owners can discover competitive rates and receive personalized service tailored to their needs. This strategic approach not only maximizes property value but also enhances financial flexibility.

However, it’s important for property owners to manage and leverage their assets with care. Excessive borrowing against residential value can pose significant risks, as understanding home equity meaning is crucial since the property serves as collateral and may lead to foreclosure if payments are not met. Understanding how to navigate these options is vital for long-term financial well-being. By utilizing their property value wisely, homeowners can improve their living spaces and create opportunities for wealth accumulation. As real estate continues to appreciate, the ownership stake in a home can serve as a valuable resource for financial growth, allowing property owners to invest in their future while enjoying the stability that homeownership provides.

Examine Components and Characteristics of Home Equity

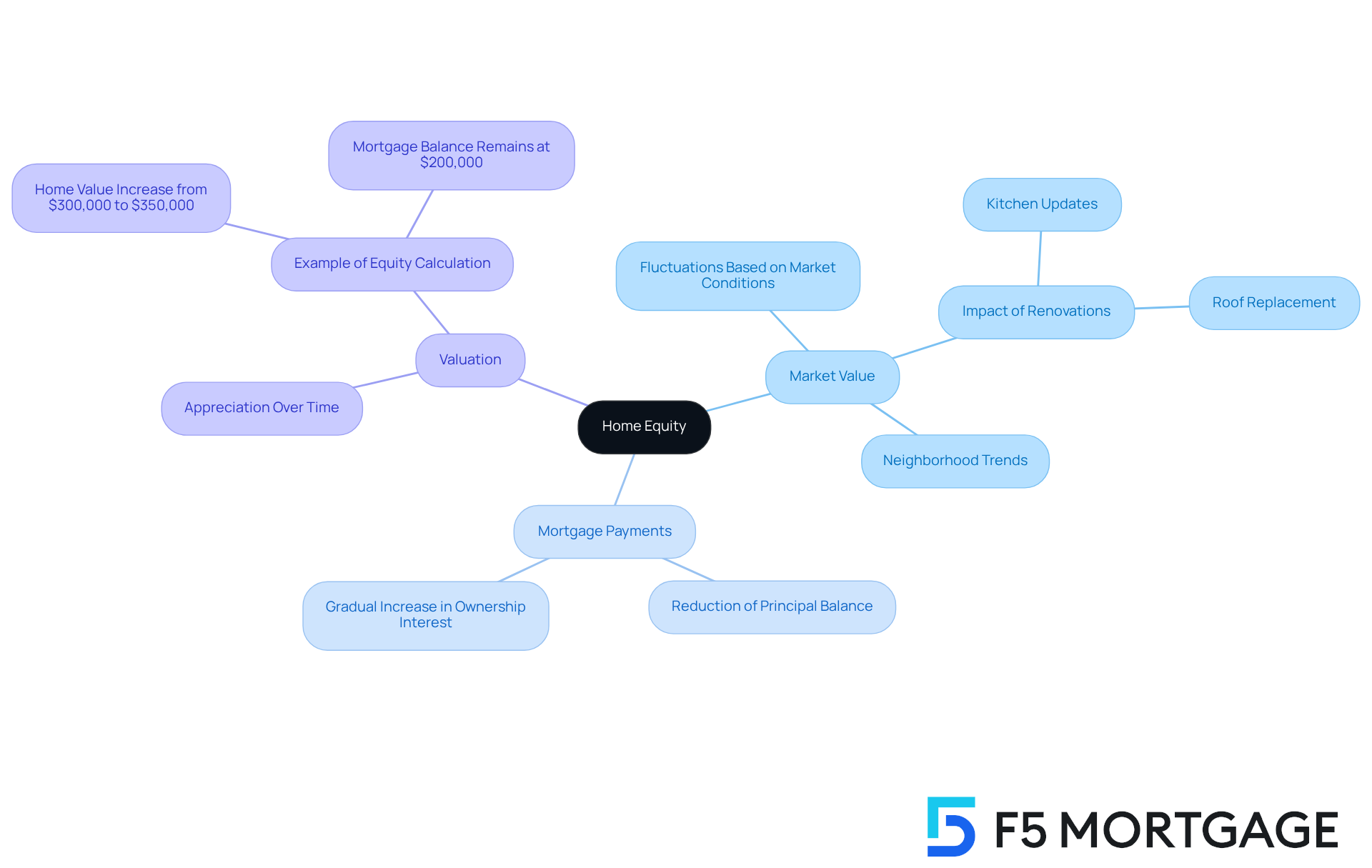

Understanding the home equity meaning is essential, as it is calculated by taking the current market worth of your home and subtracting the remaining mortgage amount. Several key factors play a significant role in this calculation, and we know how challenging this can be.

-

Market Value: The value of your home can fluctuate based on market conditions, neighborhood trends, and any improvements you make. By undertaking renovations, like a kitchen update or a new roof, you can significantly enhance your investment. These changes can lead to a noticeable increase in your home’s market value, ultimately boosting your ownership worth.

-

Mortgage Payments: As you consistently pay down your mortgage, your stake in the property naturally grows. Each payment reduces the principal balance, which directly increases your ownership interest. This gradual buildup of value is a vital aspect of homeownership, and it’s something to celebrate.

-

Valuation: Over time, properties typically appreciate, contributing to your overall asset growth. For example, if your home’s value rises from $300,000 to $350,000 while your mortgage balance remains at $200,000, your ownership stake increases from $100,000 to $150,000. Recognizing this potential highlights the importance of understanding market dynamics and the opportunities for financial growth through homeownership, which ties into home equity meaning.

Identifying these elements is crucial for property owners like you who are looking to maximize your financial potential. We’re here to support you every step of the way in utilizing your property value effectively.

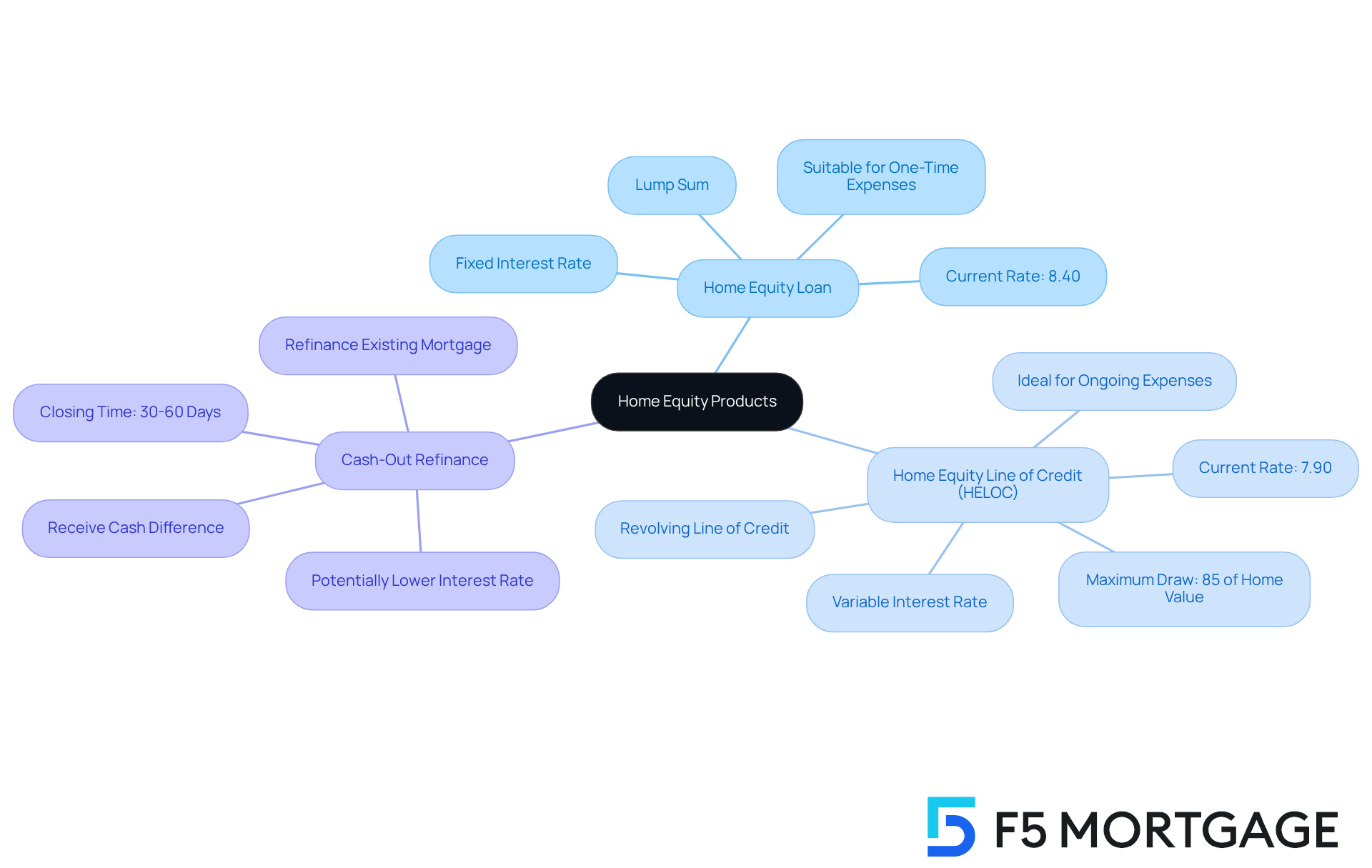

Differentiate Between Home Equity Products

Accessing home equity meaning can be a valuable opportunity for homeowners, but it’s important to understand the options available to you. Each financial product offers unique features and benefits that can help address your specific needs.

-

Home Equity Loan: Often referred to as a second mortgage, this product allows you to borrow a lump sum against your equity, typically at a fixed interest rate. This option is particularly suitable for significant, one-time expenses, like property renovations or debt consolidation. With current home value loan rates hovering around 8.40%, you can secure predictable monthly payments, making budgeting a little easier.

-

Home Equity Line of Credit (HELOC): A HELOC functions like a revolving line of credit, allowing you to borrow against your home’s value as needed, much like a credit card. With variable interest rates currently averaging 7.90% and gradually declining, HELOCs are ideal for ongoing expenses or projects. This means you can enjoy lower initial payments during the draw period, which can be a real relief.

-

Cash-Out Refinance: This option involves refinancing your existing mortgage for more than your current balance, enabling you to receive the difference in cash. It can be beneficial if you’re looking to lower your interest rate while accessing your equity. For instance, if you refinance at a lower rate than your current mortgage, you can reduce your monthly payments while also acquiring cash for urgent needs.

Understanding these products, including the home equity meaning, can empower you to make the right choice based on your financial situation and goals. With the average homeowner holding approximately $320,000 in equity, exploring these options can lead to significant financial benefits. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding home equity is vital for homeowners seeking to enhance their financial well-being. It represents the actual ownership stake in a property, calculated as the difference between the market value of the home and any outstanding mortgage balances. This concept not only serves as a critical asset for financial planning but also opens avenues for leveraging that value through various financial products, such as cash-out refinancing, home equity loans, and HELOCs.

We know how challenging it can be to navigate financial decisions. Throughout the article, key insights were shared regarding the importance of recognizing home equity as a form of enforced savings that builds wealth over time. With rising property values and various strategies to access equity, homeowners can finance renovations, consolidate debt, or invest in further opportunities. Additionally, understanding the components that influence home equity—market value, mortgage payments, and property appreciation—can empower homeowners to make informed decisions that align with their long-term financial goals.

In conclusion, home equity is not just a number; it is a powerful financial tool that can significantly impact personal finance and wealth management. By exploring the different products available and being mindful of the associated risks, homeowners can strategically utilize their equity to foster financial growth and stability. Embracing this knowledge can lead to smarter financial choices and ultimately enhance the quality of life. We’re here to support you every step of the way, making it essential for all homeowners to understand and actively manage their home equity.

Frequently Asked Questions

What is home equity?

Home equity is the difference between the current market value of your property and the remaining balance on any mortgages or liens against it. It represents the portion of your home that you truly own.

Why is understanding home equity important?

Understanding home equity is essential for financial well-being, as it serves as an important monetary resource for homeowners. It can be leveraged to access funds for various financial needs.

How can homeowners access their home equity?

Homeowners can access their home equity through methods such as cash-out refinancing, loans against property, and lines of credit. Cash-out refinancing involves refinancing the existing mortgage for a higher amount and receiving the difference in cash.

What are the benefits of cash-out refinancing?

Cash-out refinancing allows homeowners to access equity for financing property enhancements, consolidating debt, or making significant purchases, especially when the new interest rate is lower than the existing mortgage rate.

How have residential property values changed recently?

Since 2020, residential property values have risen significantly, with some areas experiencing triple-digit growth. This trend creates favorable opportunities for homeowners to leverage their home equity.

What should homeowners consider when accessing their home equity?

Homeowners should track property value trends to identify opportunities and risks. Additionally, working with investment consultants can help align borrowing choices with long-term financial objectives.