Overview

Home equity loans offer a valuable opportunity for homeowners to tap into the equity of their property. Imagine receiving a lump sum at a fixed interest rate that can pave the way for various enhancements, like upgrading your home. We understand how significant these decisions are for families, and knowing the ins and outs of home equity loans is essential. These loans typically come with lower interest rates compared to unsecured options, making them an attractive choice for improving your living conditions and achieving your financial goals.

We know how challenging this can be, and we’re here to support you every step of the way. By understanding home equity loans, you can make informed decisions that positively impact your family’s future. Take the time to explore your options, and consider how this financial tool can empower you to create the home you’ve always wanted.

Introduction

Understanding the nuances of home equity loans is essential for families eager to enhance their living spaces or manage financial needs effectively. We know how challenging this can be. These loans provide a unique opportunity to tap into the value of a home, often at lower interest rates than traditional unsecured loans. This makes them a practical choice for funding renovations or consolidating debt.

However, the benefits come with challenges. Homeowners must navigate potential risks and repayment obligations. It’s important to approach this financial tool with care. How can families leverage this opportunity to maximize their home’s value while ensuring responsible borrowing? We’re here to support you every step of the way.

Define Home Equity Loan: Key Concepts and Terminology

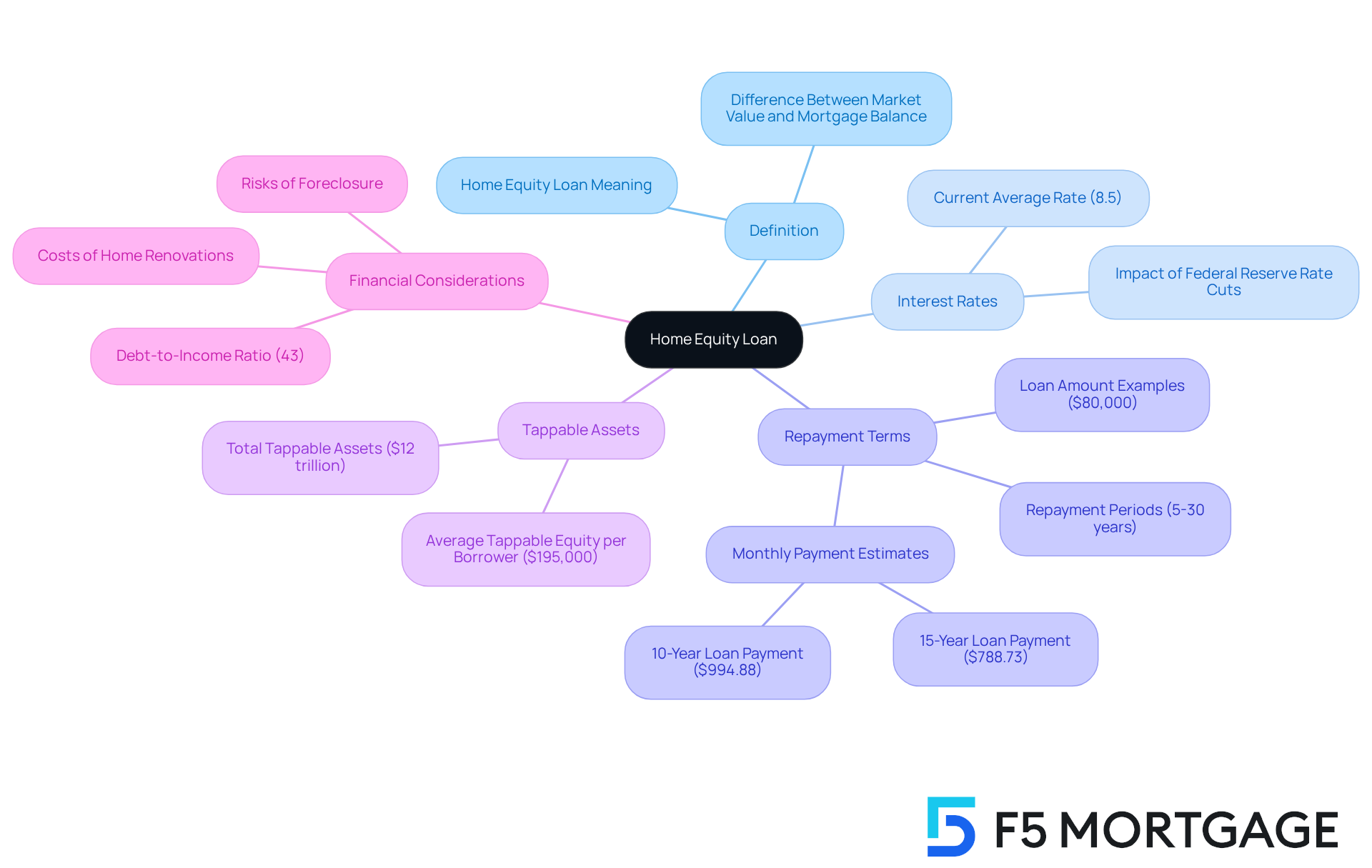

A property value advance, often referred to as a second mortgage, illustrates the home equity loan meaning, serving as a valuable resource for homeowners looking to tap into the equity they’ve built in their homes. The home equity loan meaning refers to the difference between your property’s current market value and the outstanding mortgage balance. Typically, property value financing offers a lump sum at a fixed interest rate, which you can repay over a period of five to thirty years. It’s important to remember that this credit is secured by your property, so failing to repay could lead to foreclosure—a concern we understand deeply.

As we look ahead to 2025, average interest rates for residential property financing hover around 8.5%. This reflects the current economic climate. For instance, if you were to secure an $80,000 property loan at this rate, your monthly payments would be approximately $994.88 over ten years. This financial tool can be particularly helpful for families wanting to finance home upgrades by understanding the home equity loan meaning. The beauty of renovations is that they can increase your home’s value, benefiting you directly, without lenders sharing in that appreciation.

It is essential to understand the home equity loan meaning. ‘Tappable assets’ refers to the total assets available for borrowing, which has seen significant growth, nearing $12 trillion by early 2025. Additionally, it’s wise to keep an eye on your debt-to-income ratio, which ideally should not exceed 43% for loan approval.

Financial consultants emphasize the importance of evaluating the costs associated with residential capital borrowing. As Susan Allen from Experian wisely points out, “Homeowners accustomed to a fixed-rate first mortgage should be aware of the variable rates common with HELOCs, which can lead to unpredictable payments over time.” This insight underscores the need for careful consideration when exploring home financing options for renovations or other financial needs. We’re here to support you every step of the way as you navigate these decisions.

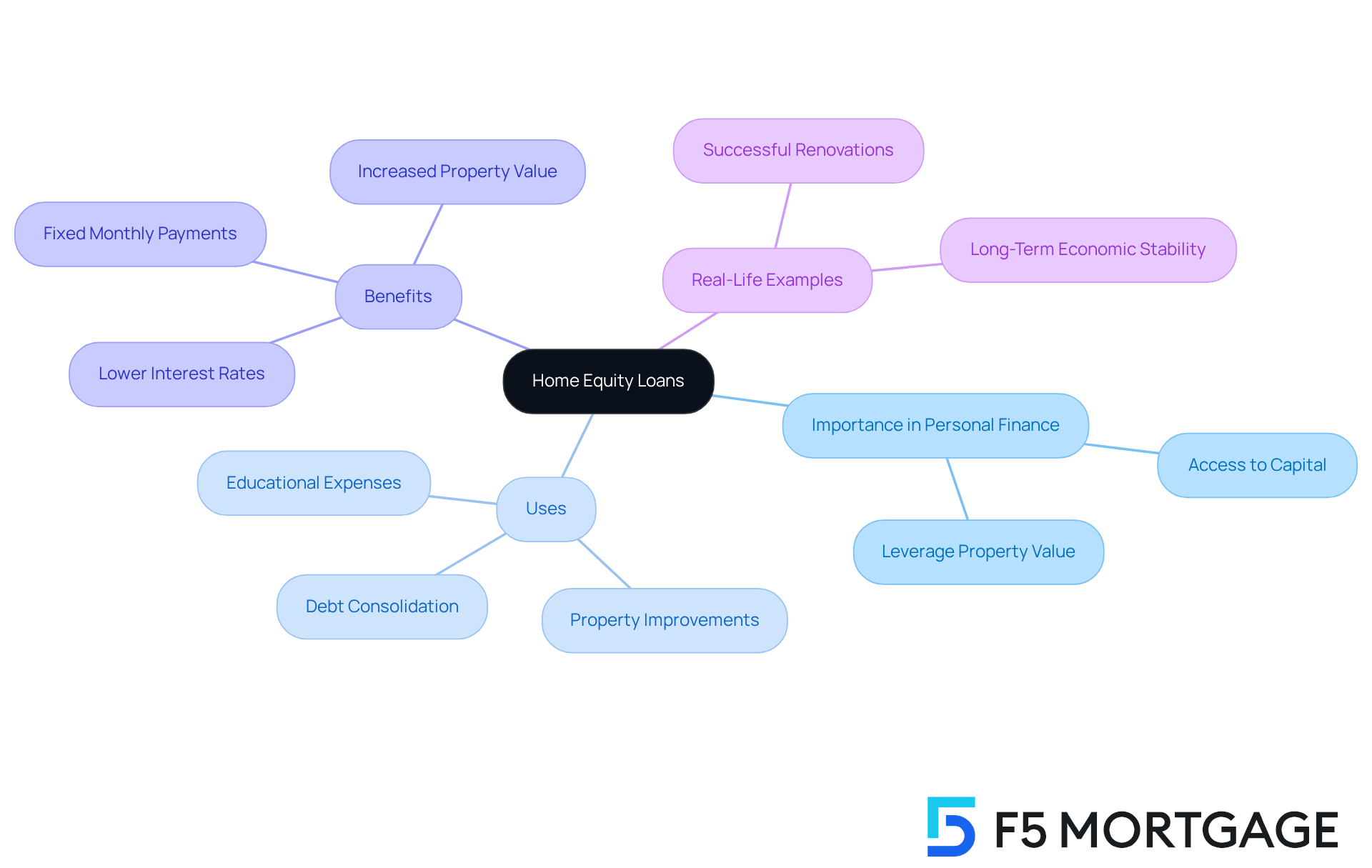

Context and Importance of Home Equity Loans in Personal Finance

Understanding the home equity loan meaning is crucial, as home value borrowing options serve as essential resources in personal finance, particularly for property owners eager to tap into their asset’s worth for various financial needs. We understand how challenging it can be to navigate these options, and many homeowners are discovering the home equity loan meaning, which allows them to obtain significant capital through these financial products, often at lower interest rates than unsecured alternatives. This makes residential financing especially appealing for families looking to fund property improvements, consolidate debts, or manage educational expenses. In fact, a substantial percentage of homeowners utilize these financial options specifically for renovations, showcasing their practicality in enhancing property value.

Financial advisors frequently suggest that understanding the home equity loan meaning can help in leveraging property value for renovations, as it can lead to increased property worth and improved living conditions. The predictability of fixed monthly payments associated with property-backed financing supports better budgeting and financial planning, making them a favored choice among property owners. For instance, consider an $80,000 property financing option at an interest rate of 8.31% over 15 years, resulting in a manageable monthly payment of $778.91. This enables families to organize their finances effectively.

Real-life examples illustrate the flexibility of residential financing options. Families have successfully used these credits to support crucial property upgrades, not only enhancing their living spaces but also contributing to long-term economic stability. As property owners navigate their financial journeys, understanding the home equity loan meaning and its implications and benefits becomes essential for making informed decisions that align with their overall fiscal goals. We’re here to support you every step of the way.

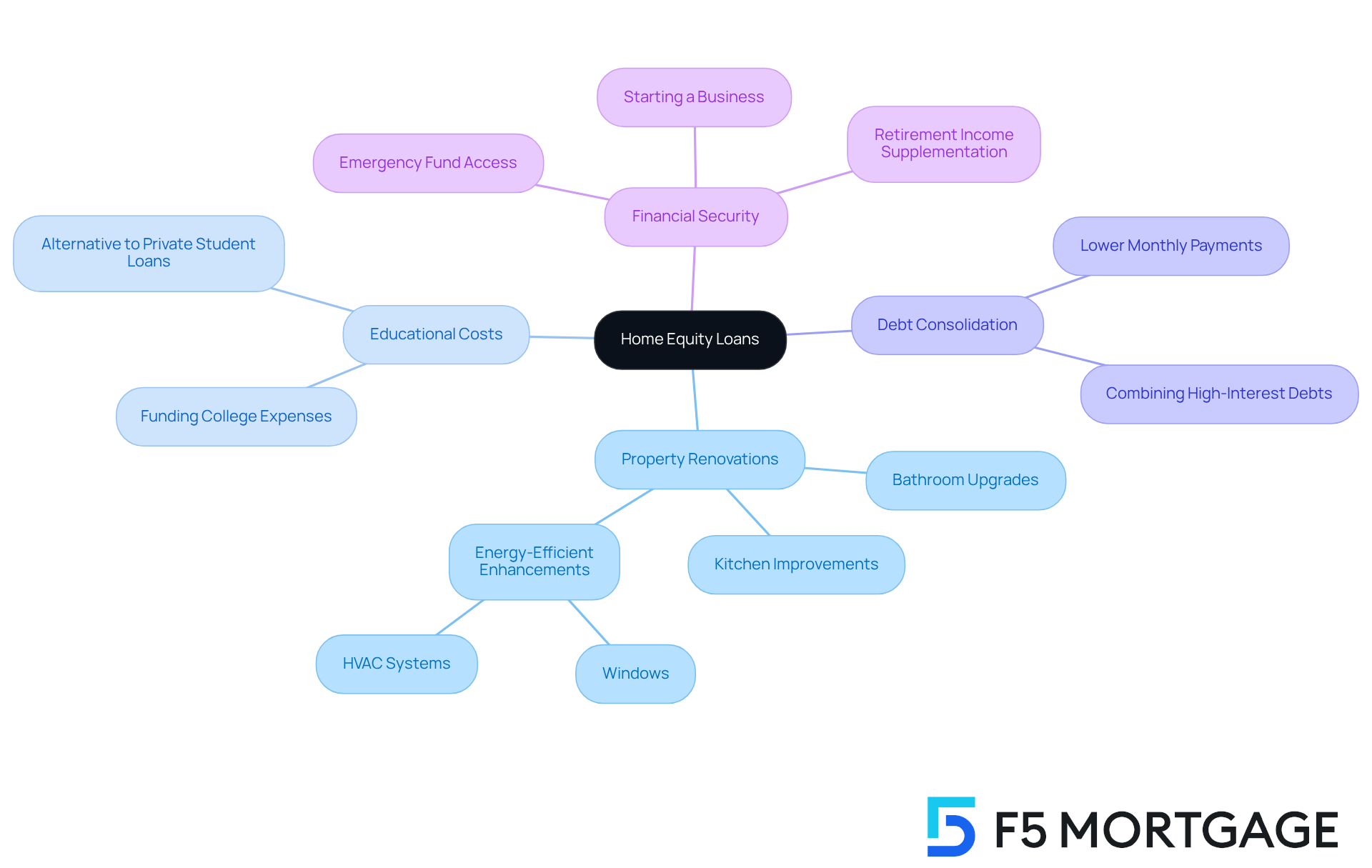

Common Uses of Home Equity Loans: Enhancing Family Living Conditions

Home financing options, including the home equity loan meaning, serve as a flexible financial resource for families looking to enhance their living situations. Many families find these financial aids particularly useful for property renovations, such as kitchen and bathroom improvements. Not only do these upgrades improve quality of life, but they can also significantly boost a property’s market value. For example, energy-efficient enhancements can elevate property value by 5% to 10%.

Families often turn to borrowing against their property value, which aligns with the home equity loan meaning, to cover educational costs, providing a practical alternative to private student loans, especially when interest rates are lower. However, we encourage families to explore federal financial aid options before considering property value for college expenses. Additionally, understanding the home equity loan meaning can help families use these financial products for debt consolidation, allowing them to combine high-interest debts into a single, manageable payment, typically at a lower interest rate compared to credit cards, which can exceed 20% annually.

The home equity loan meaning typically refers to residential value borrowing, which allows access to 80% to 90% of a property’s worth. The home equity loan meaning allows families to secure up to 85% of their home’s current market value through these options, making it a viable choice for larger projects. On average, property owners have about $207,000 in accessible value per borrower, providing substantial financial strength for families contemplating property-based borrowing. Experts emphasize the home equity loan meaning and the benefits that utilizing property loans can bring to family living. When used responsibly, understanding the home equity loan meaning can support significant financial goals while maintaining lower monthly payments compared to unsecured loans.

However, it’s crucial for families to be cautious about borrowing too much against their property value, as understanding the home equity loan meaning could help prevent financial strain. Understanding the home equity loan meaning and confirming repayment ability before borrowing against property value is essential. Real-life examples illustrate how families have successfully improved their living conditions through property financing—whether by creating dream kitchens, expanding living spaces, or investing in necessary repairs. This strategic use of residential assets helps families understand home equity loan meaning, which not only enhances daily life but also sets them on a path toward long-term financial security.

Home Equity Loans vs. Other Financing Options: A Comparative Analysis

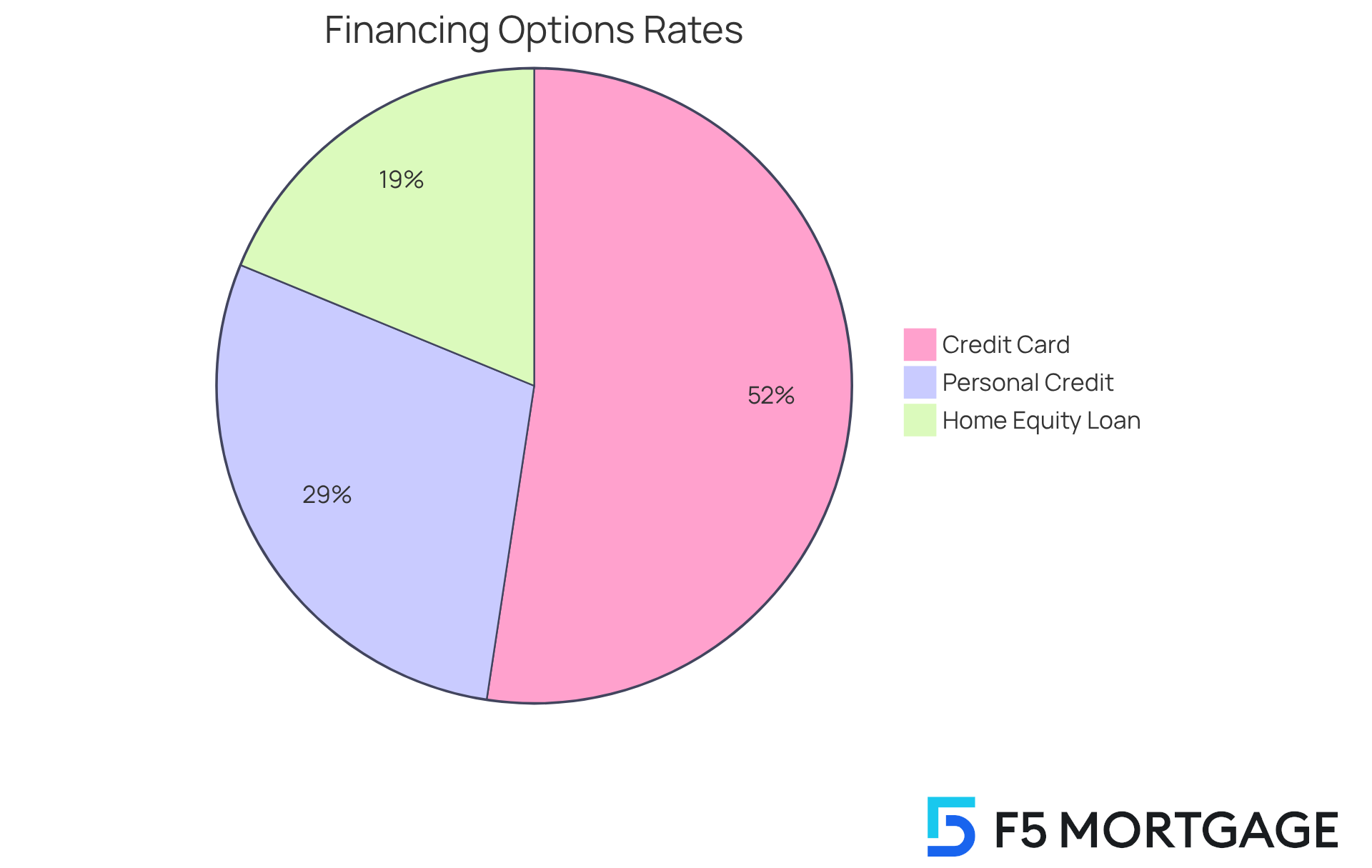

When considering funding alternatives like property-backed borrowing, personal credit, and charge cards, it’s important to understand the home equity loan meaning and recognize some key differences that can impact your financial well-being. We understand how challenging it can be to navigate these options, and we want to help you make informed choices.

Residential financing options often come with lower interest rates because they are secured by your property, making them a more affordable solution for larger expenses. For instance, the typical home financing rate is around 8.25%, compared to credit card rates that hover around 23%. This means that credit cards can be about 170% more expensive.

Personal credit options provide flexibility, but they are generally unsecured and carry higher interest rates, with a median rate of 12.65%. The home equity loan meaning encompasses loans that offer fixed repayment terms, which can help you budget and plan your finances more effectively. In contrast, personal credit options may have variable rates, and credit card payments can change, potentially leading to financial strain.

For families looking to manage larger costs efficiently, property-backed financing can be particularly advantageous. These loans not only result in lower monthly payments—approximately $109 less each month for a $50,000 credit compared to personal credit—but also allow for repayment terms of up to 30 years, enhancing affordability.

Moreover, utilizing a residential value credit facility to consolidate high-interest credit card debt can lead to substantial savings. Over a period of more than five years, property owners could save approximately $6,540 by opting for a mortgage instead of maintaining credit card debt. This strategic use of residential borrowing aligns with your financial goals, especially in a market where managing debt is increasingly important.

However, it’s crucial to keep in mind that the interest paid on property financing may be tax-deductible if the funds are used for qualifying home improvements or repairs. There is also the risk of losing your home if payments are not made, which underscores the importance of careful financial planning. Additionally, the approval process for a home equity loan meaning can be more complex than for personal loans, often requiring a property appraisal and a minimum borrowing amount of $10,000 or more. Understanding these differences is vital for families to make choices that best suit their financing needs. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the meaning of a home equity loan is vital for families looking to tap into their property’s value for various financial needs. These loans offer homeowners the chance to access significant capital, enabling them to fund home upgrades, consolidate debts, or cover educational expenses. By leveraging their home’s equity, families can improve their living conditions while also increasing their property’s market value, making these loans a truly valuable financial tool.

Throughout this article, we’ve highlighted key insights, such as:

- The benefits of fixed interest rates

- The importance of maintaining a healthy debt-to-income ratio

- The potential risks of borrowing against home equity

Real-life examples illustrate how families have successfully utilized these loans for renovations, showcasing the practicality and effectiveness of home equity financing. Additionally, comparisons with other financing options reveal the advantages of home equity loans, particularly in terms of lower interest rates and fixed repayment terms, making them a more affordable choice for larger expenses.

Ultimately, grasping the meaning of home equity loans empowers families to make informed financial decisions that align with their goals. It’s crucial to approach these loans with caution, ensuring that borrowing does not exceed repayment capabilities. By considering the implications and benefits of home equity loans, families can strategically enhance their living situations while securing their long-term financial stability. Embracing this knowledge can lead to smarter financial planning and a more prosperous future. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan, often referred to as a second mortgage, allows homeowners to borrow against the equity they have built in their homes. It represents the difference between the property’s current market value and the outstanding mortgage balance.

How does a home equity loan work?

A home equity loan typically provides a lump sum at a fixed interest rate, which can be repaid over a period of five to thirty years. The loan is secured by the property, meaning failure to repay could lead to foreclosure.

What are the current average interest rates for home equity loans?

As of 2025, average interest rates for residential property financing are around 8.5%.

How would a home equity loan payment look for an $80,000 loan?

If you secure an $80,000 home equity loan at an 8.5% interest rate, your monthly payments would be approximately $994.88 over ten years.

What are ‘tappable assets’ in the context of home equity loans?

‘Tappable assets’ refer to the total assets available for borrowing against home equity, which has grown to nearly $12 trillion by early 2025.

What is the ideal debt-to-income ratio for loan approval?

The ideal debt-to-income ratio for loan approval should not exceed 43%.

What should homeowners consider when evaluating home equity loans?

Homeowners should evaluate the costs associated with borrowing, be aware of variable rates common with Home Equity Lines of Credit (HELOCs), and understand that these can lead to unpredictable payments over time.