Overview

We understand how challenging it can be to navigate the refinancing process, especially for homeowners with existing FHA loans. That’s why FHA streamline refinance rates are designed to simplify this journey for you. This option allows you to reduce your monthly payments or secure better interest rates without the burden of extensive documentation.

Imagine being able to breathe a little easier each month. With minimal eligibility requirements and no need for an appraisal, this refinancing choice offers the potential for significant savings. It’s a truly attractive option for financially responsible homeowners who want to make the most of their investments.

We’re here to support you every step of the way. If you’re looking for a way to improve your financial situation and ease your worries, consider exploring FHA streamline refinancing. It could be the solution you’ve been waiting for.

Introduction

Homeownership can often bring its own set of financial challenges, especially when it comes to managing mortgage payments. We know how challenging this can be, particularly for those with FHA loans. The FHA streamline refinance offers a unique opportunity to alleviate some of this burden. This refinancing option not only simplifies the process by reducing paperwork and eliminating the need for an appraisal, but it also provides the potential for significant savings on monthly payments.

However, with fluctuating rates and varying lender requirements, how can you effectively navigate this landscape to maximize your financial benefits? We’re here to support you every step of the way.

Define FHA Streamline Refinance and Its Purpose

If you’re a homeowner with an existing FHA loan, the FHA streamline refinance rates could be the perfect solution for you. We understand how overwhelming the refinancing process can be, and this option is designed to simplify it. By allowing you to reduce your monthly mortgage payments or secure a better interest rate, FHA streamline refinance rates alleviate some of the financial burdens without the stress of extensive documentation or credit checks.

To qualify, you simply need to be current on your payments. This makes it especially beneficial for those who have consistently made timely payments on their FHA loan. The process of FHA streamline refinance rates minimizes paperwork and speeds up approval, making it an appealing choice for families looking to improve their financial situation.

One of the standout features of this option is that it does not require an appraisal, which not only accelerates the process but also cuts down on costs for borrowers. Plus, FHA loan insurance can be more affordable than traditional private loan insurance (PMI), providing you with additional financial relief.

As you prepare to apply, it’s helpful to have specific documents ready, such as:

- Recent pay stubs

- Bank statements

- W2s

- Tax returns

- A photo ID

We know how challenging this can be, but having these documents at hand can make the process smoother.

With over 1,000 families supported and a remarkable customer satisfaction level of 94%, F5 Mortgage exemplifies how effective this refinancing solution can be. They are dedicated to helping clients navigate the complexities of mortgage financing through personalized consultations and educational resources. We’re here to support you every step of the way as you explore this opportunity to enhance your financial future.

Explore FHA Streamline Refinance Rates and Trends

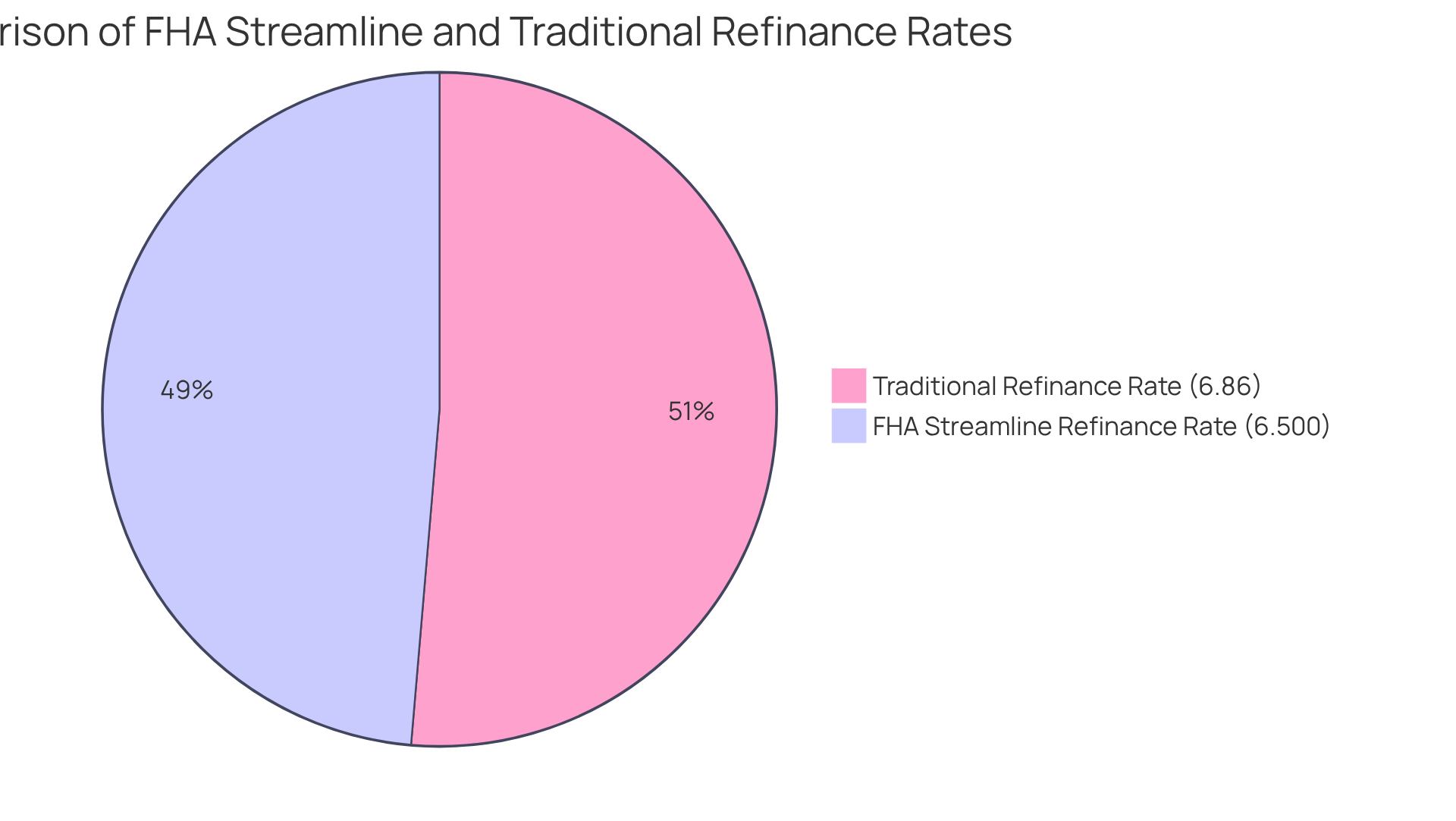

FHA Streamline Refinance rates are influenced by various factors, including market conditions, lender policies, and the borrower’s financial profile. Typically, FHA Streamline Refinance rates are more favorable than those for traditional refinancing due to the lower risk associated with FHA loans. As we look towards mid-2025, the FHA Streamline Refinance rates for the average 30-year loan stand at 6.500%, with an APR of 7.379%. In contrast, the current average refinance rate for a 30-year fixed-rate home loan is 6.86% as of July 25, 2025. This competitive positioning is often shaped by broader economic indicators, such as inflation and the Federal Reserve’s monetary policy decisions, which can influence FHA Streamline Refinance rates.

We know how challenging it can be to navigate these numbers, but homeowners should actively monitor them. Even a modest decline in FHA Streamline Refinance rates can result in significant savings over the life of the loan. For instance, homeowners can save hundreds of dollars each month by refinancing to FHA Streamline Refinance rates, especially if the new rate is at least one percentage point lower than their current one. Furthermore, it’s wise to compare offers from multiple lenders, as FHA Streamline Refinance rates can vary substantially. Most FHA loans require a minimum credit score of 640 for refinancing at U.S. Bank, making it essential for homeowners to assess their financial situation before proceeding.

Instruments like loan calculators can be invaluable for estimating potential savings and determining the best timing for refinancing. We’re here to support you every step of the way, ensuring you make informed financial choices. Utilizing these tools can help homeowners understand the financial implications of refinancing and identify the best opportunities available.

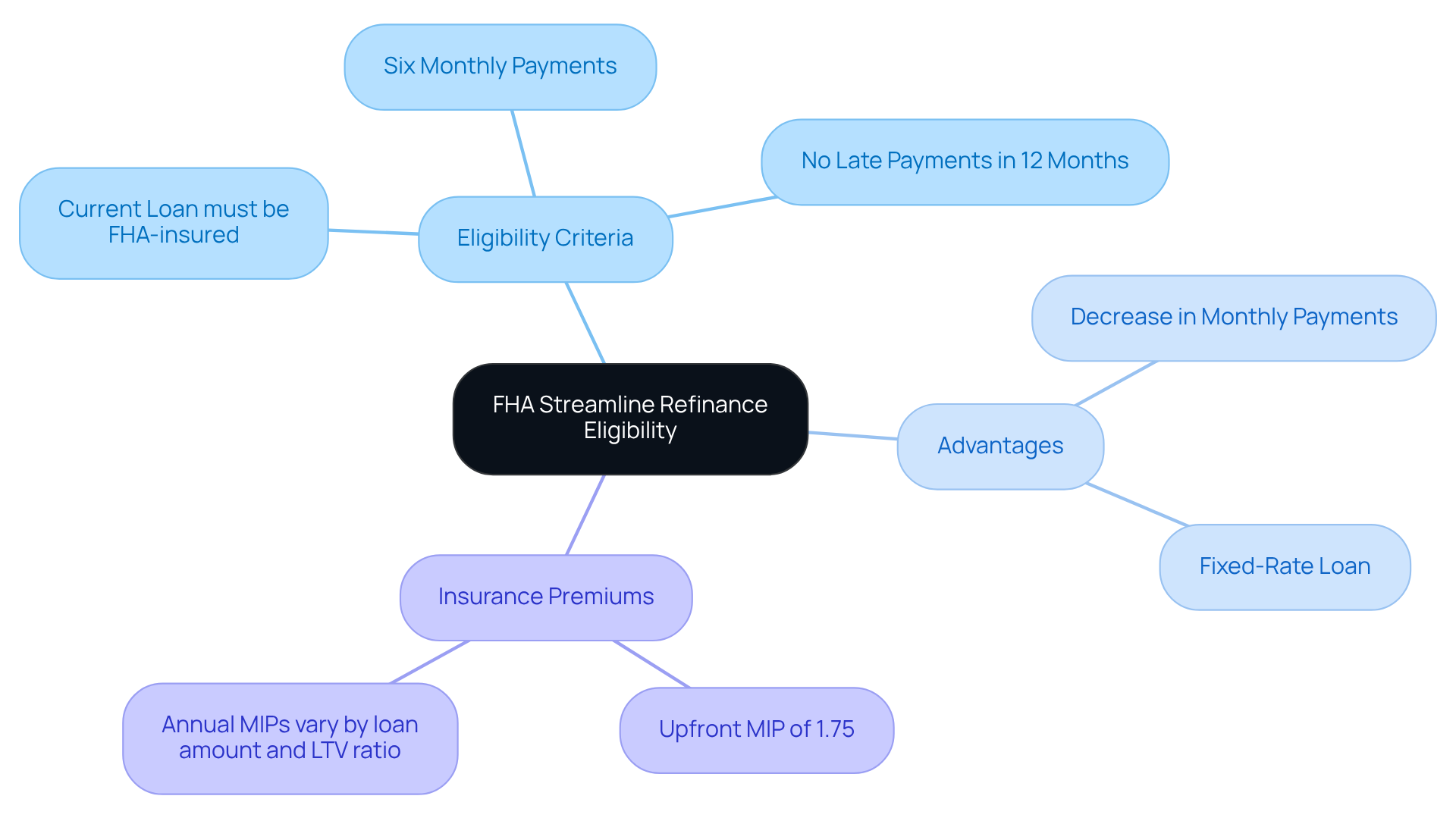

Understand Eligibility Requirements for FHA Streamline Refinance

We know how challenging navigating the refinancing process can be. To qualify for FHA streamline refinance rates, individuals must meet specific eligibility criteria. Firstly, your current loan needs to be FHA-insured. Additionally, you should have made at least six consecutive monthly payments on your current loan and must not have been late on any payments in the last 12 months.

The refinance should lead to a concrete advantage for you, such as:

- A decrease in monthly payments of at least 0.5 percent

- A shift from an adjustable-rate loan to a fixed-rate loan

Importantly, there is no minimum credit score requirement for FHA Streamline Refinances, but lenders may impose their own standards.

Furthermore, you will need to pay insurance premiums, which include:

- An upfront MIP of 1.75 percent

- Annual MIPs that vary based on loan amount and LTV ratio

Notably, FHA streamline refinance rates do not require a home appraisal, simplifying the process for many homeowners.

Understanding these requirements is crucial for you to navigate the refinancing process effectively. In 2025, a notable proportion of individuals fulfilling these criteria will make the FHA streamline refinance rates an attainable choice for many homeowners aiming to reduce their loan expenses. We’re here to support you every step of the way.

Evaluate the Benefits of FHA Streamline Refinance

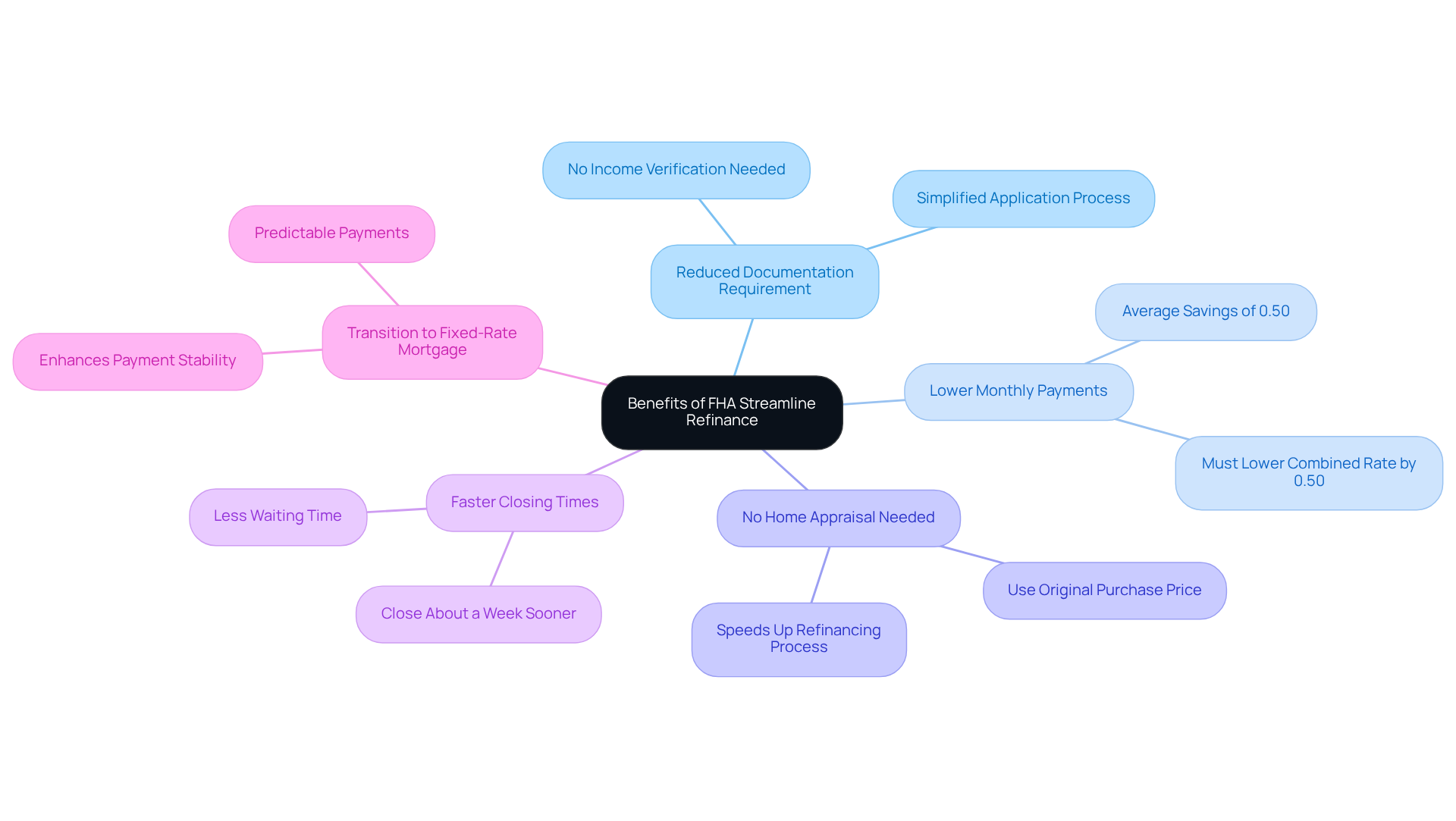

The fha streamline refinance rates offer many advantages that can truly benefit homeowners. One of the key benefits is the significantly reduced documentation requirement, which simplifies the application process. We understand how overwhelming paperwork can be, so this streamlined approach is designed to ease your experience. To qualify, you need to have made three months of on-time mortgage payments and wait 210 days after your last purchase or refinance.

This program allows borrowers to access fha streamline refinance rates, which results in lower monthly payments and substantial overall savings. Importantly, the fha streamline refinance rates must lower the combined interest and insurance rate by at least 0.50% to meet the program criteria. We know how important it is to save money, and this program is crafted to help you do just that.

Moreover, the elimination of the home appraisal requirement speeds up the refinancing process, enabling quicker closings—often about a week sooner than traditional refinancing options. This means less waiting and more peace of mind for you and your family. Additionally, the fha streamline refinance rates allow for a transition from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, enhancing payment stability and predictability.

With the potential for monthly payment reductions averaging around 0.50% or more, this program is tailored to empower homeowners like you who are looking to improve their financial circumstances. We’re here to support you every step of the way as you explore this opportunity.

Conclusion

FHA streamline refinance rates offer a wonderful opportunity for homeowners with existing FHA loans to improve their financial situation with ease. This refinancing option is designed to simplify the process, allowing borrowers to enjoy lower monthly payments and better interest rates without the stress of extensive documentation or credit checks. By focusing on those who have consistently made timely payments, FHA streamline refinancing stands out as a practical solution for many families seeking financial relief.

Throughout this article, we highlight key insights into the benefits, eligibility requirements, and current trends of FHA streamline refinance rates. The significant reduction in paperwork, the absence of appraisal requirements, and the potential for substantial savings are compelling reasons for homeowners to consider this option. Additionally, understanding the current market conditions and comparing offers from various lenders can further enhance the advantages of refinancing. Remember, even a small decrease in the refinance rate can lead to significant long-term savings.

Ultimately, the FHA streamline refinance program not only simplifies the refinancing journey but also empowers homeowners to take control of their financial futures. By exploring this option, you can potentially lower your monthly mortgage payments and transition to more stable fixed-rate loans. For anyone considering refinancing, staying informed and proactive can truly make a difference in achieving your financial goals. Embracing the FHA streamline refinance could be a pivotal step towards a more secure and manageable financial landscape.

Frequently Asked Questions

What is FHA streamline refinance?

FHA streamline refinance is a refinancing option for homeowners with an existing FHA loan that simplifies the process of reducing monthly mortgage payments or securing a better interest rate without extensive documentation or credit checks.

Who can qualify for FHA streamline refinance?

To qualify for FHA streamline refinance, you must be current on your payments and have consistently made timely payments on your FHA loan.

What are the benefits of FHA streamline refinance?

The benefits include reduced monthly mortgage payments, better interest rates, minimized paperwork, faster approval, no requirement for an appraisal, and potentially more affordable FHA loan insurance compared to traditional private loan insurance (PMI).

What documents are needed to apply for FHA streamline refinance?

You should have recent pay stubs, bank statements, W2s, tax returns, and a photo ID ready to apply for FHA streamline refinance.

How does FHA streamline refinance differ from traditional refinancing?

FHA streamline refinance differs from traditional refinancing by requiring less documentation, not needing an appraisal, and generally providing a quicker and simpler approval process.

How has F5 Mortgage supported families with FHA streamline refinance?

F5 Mortgage has supported over 1,000 families with a customer satisfaction level of 94%, offering personalized consultations and educational resources to help clients navigate mortgage financing complexities.