Introduction

Navigating the world of real estate can feel overwhelming, especially for homebuyers. We know how challenging this can be, and understanding the intricacies of escrow is essential to making your journey smoother. This financial mechanism not only safeguards your earnest money deposits but also plays a vital role in managing ongoing expenses like property taxes and insurance premiums.

Yet, many buyers remain unaware of how escrow arrangements function. This lack of understanding can lead to potential pitfalls in your home buying journey. So, what are the key elements and benefits of escrow that every prospective homeowner should grasp? By familiarizing yourself with these concepts, you can ensure a smooth and secure transaction, paving the way for a successful homeownership experience.

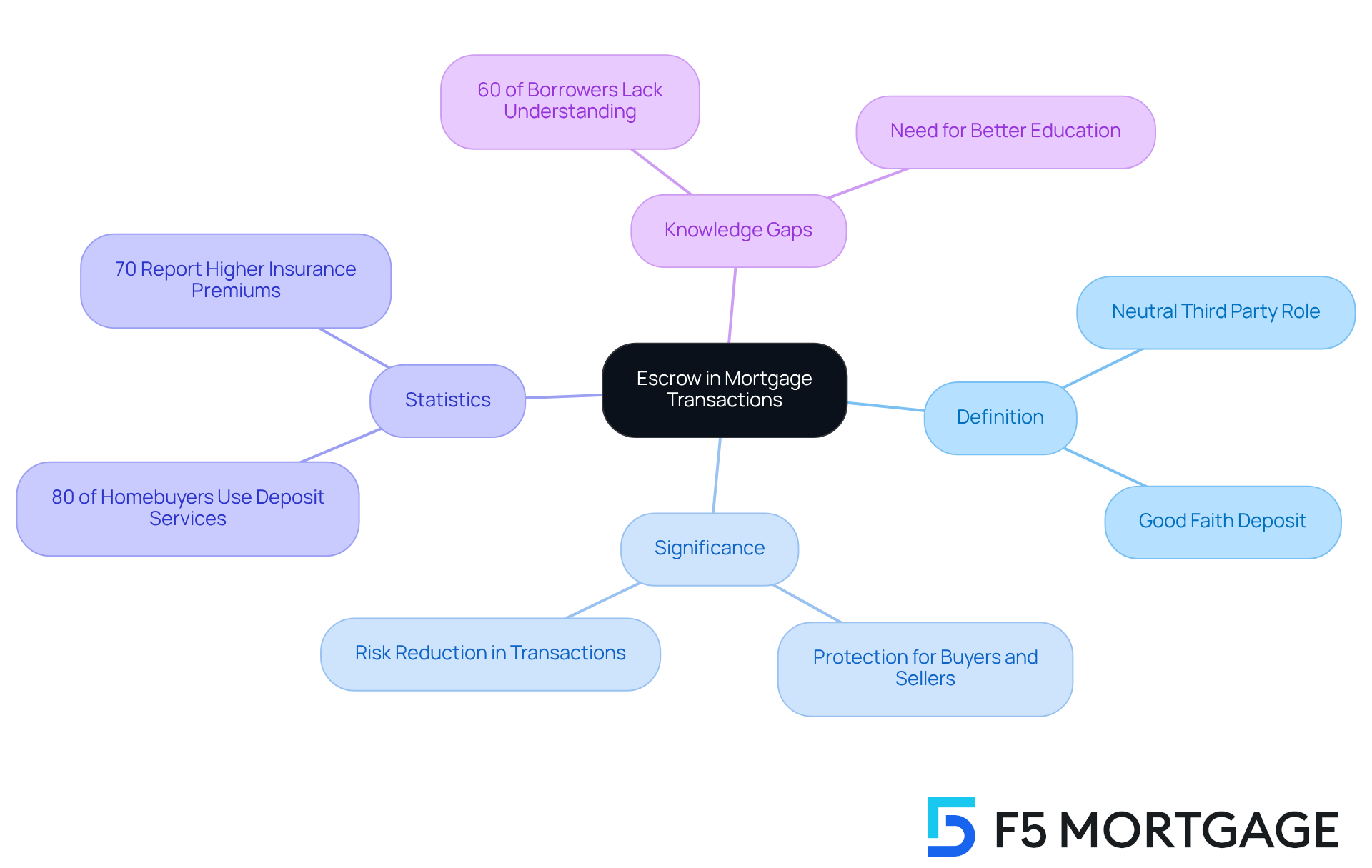

Defining Escrow in Mortgage Transactions

The escrow mortgage meaning involves a financial arrangement in mortgage deals where a neutral third party holds funds or documents for both the purchaser and seller until specific conditions are met. We know how crucial this system is for protecting both parties during the home buying process. For instance, when a purchaser makes a good faith deposit, it goes into a trust account, ensuring the funds remain secure until the deal is finalized. This mechanism not only reduces risks related to real estate transactions but also helps convey the escrow mortgage meaning, providing peace of mind to both buyers and sellers.

In 2025, around 80% of homebuyers utilized deposit services, underscoring its significance in facilitating smooth and secure transactions. Understanding the purpose of trust funds is essential for homeowners to manage the rising costs of homeownership effectively. The escrow mortgage meaning can vary, but it typically includes provisions for property taxes and insurance premiums, often rolled into monthly mortgage payments. This knowledge is vital, especially as homeowners face increasing financial pressures from rising property taxes and insurance costs, with 70% reporting higher premiums in the past year.

At F5 Mortgage, we’re here to support you every step of the way. We believe that knowledgeable borrowers are content borrowers, and we strive to ensure you understand every stage of the process, including how deposit agreements can differ. Significantly, 60% of borrowers don’t fully grasp how their escrow arrangements work, highlighting a considerable gap in knowledge that needs addressing. By prioritizing transparency and education, F5 Mortgage aims to empower families in their home buying journey.

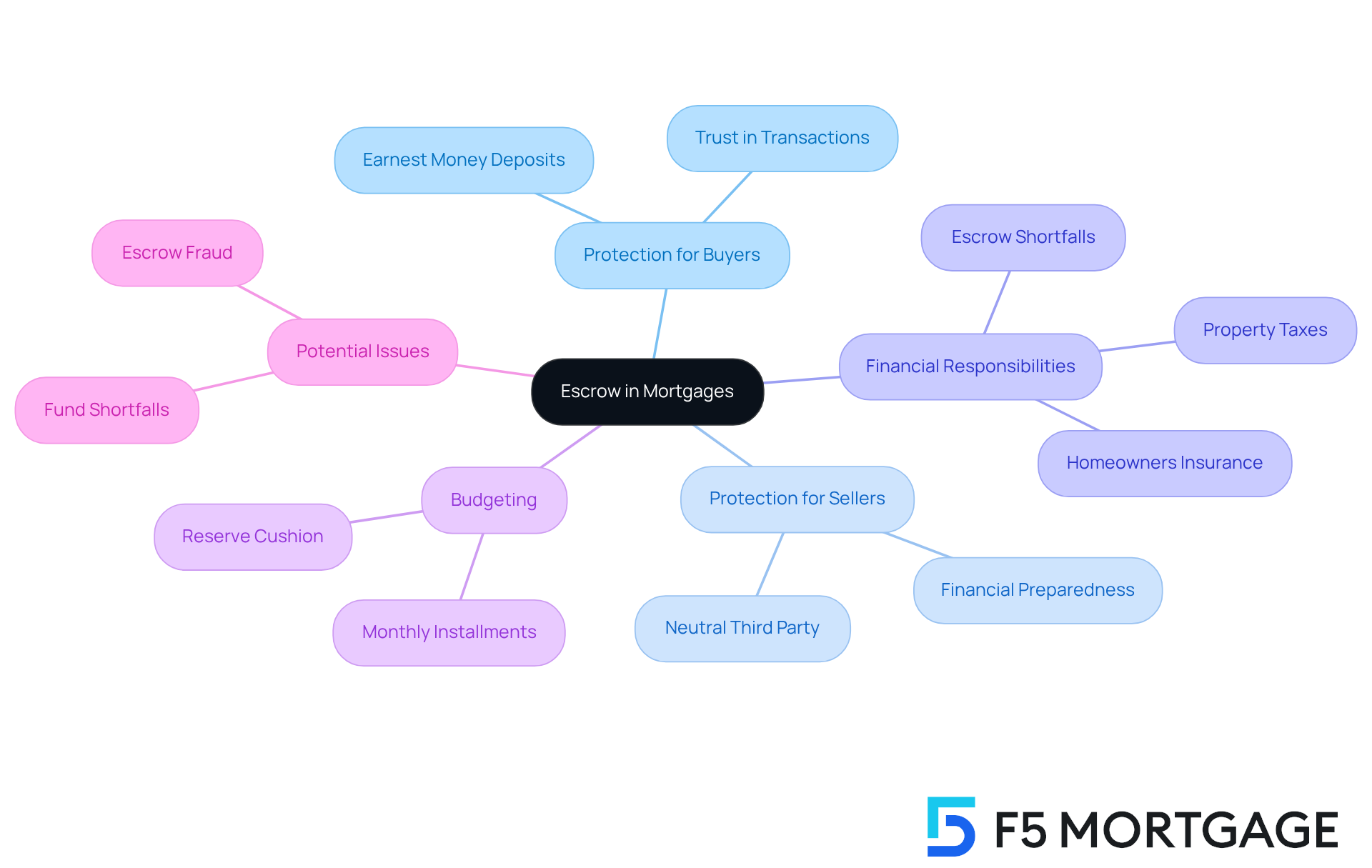

The Role and Importance of Escrow in Mortgages

The escrow mortgage meaning highlights the importance of escrow funds in the mortgage process, serving as a protective shield for both buyers and sellers. For buyers, these accounts safeguard earnest money deposits, ensuring that funds are securely held until all sale conditions – like inspections and financing approvals – are met. This not only protects your investment but also fosters trust in the transaction. For sellers, it provides peace of mind, knowing that the buyer is financially prepared to complete the purchase, as funds are confirmed and held by a neutral third party.

Moreover, trust funds are essential for managing ongoing financial responsibilities, such as property taxes and homeowners insurance. Lenders often require these accounts when the down payment is less than 20%, especially for FHA, VA, and USDA loans. By collecting a portion of these costs with each mortgage payment, the fund helps prevent missed payments, ensuring that crucial expenses are settled on time. This proactive approach not only protects your investment but also reduces the risk of tax liens or insurance lapses.

For instance, if your yearly property taxes total $6,000 and homeowners insurance is $1,200, that adds up to $7,200. This amount can be divided into manageable monthly installments of $600, which are then kept in a designated account. This setup simplifies budgeting for homeowners and ensures timely payments, protecting both the lender’s and your interests. It’s important to note that a reserve cushion is typically limited to no more than two months’ worth of payments, which helps in managing the funds effectively.

Experts emphasize the significance of understanding trust accounts, as they help clarify the escrow mortgage meaning, which represents an increasing part of monthly mortgage expenses. Additionally, closing costs often range from 1% to 2% of the property’s purchase price, which is crucial for buyers to consider when planning their budget. By grasping how these accounts function, homebuyers can navigate the complexities of real estate transactions with greater confidence, leading to a smoother homeownership experience. Furthermore, being aware of potential issues, like a fund shortfall – when insufficient money is collected to cover taxes or insurance – can empower buyers to manage their finances more effectively. Ultimately, ensuring clear communication is key to preventing fraud in trust funds, safeguarding the management of these resources.

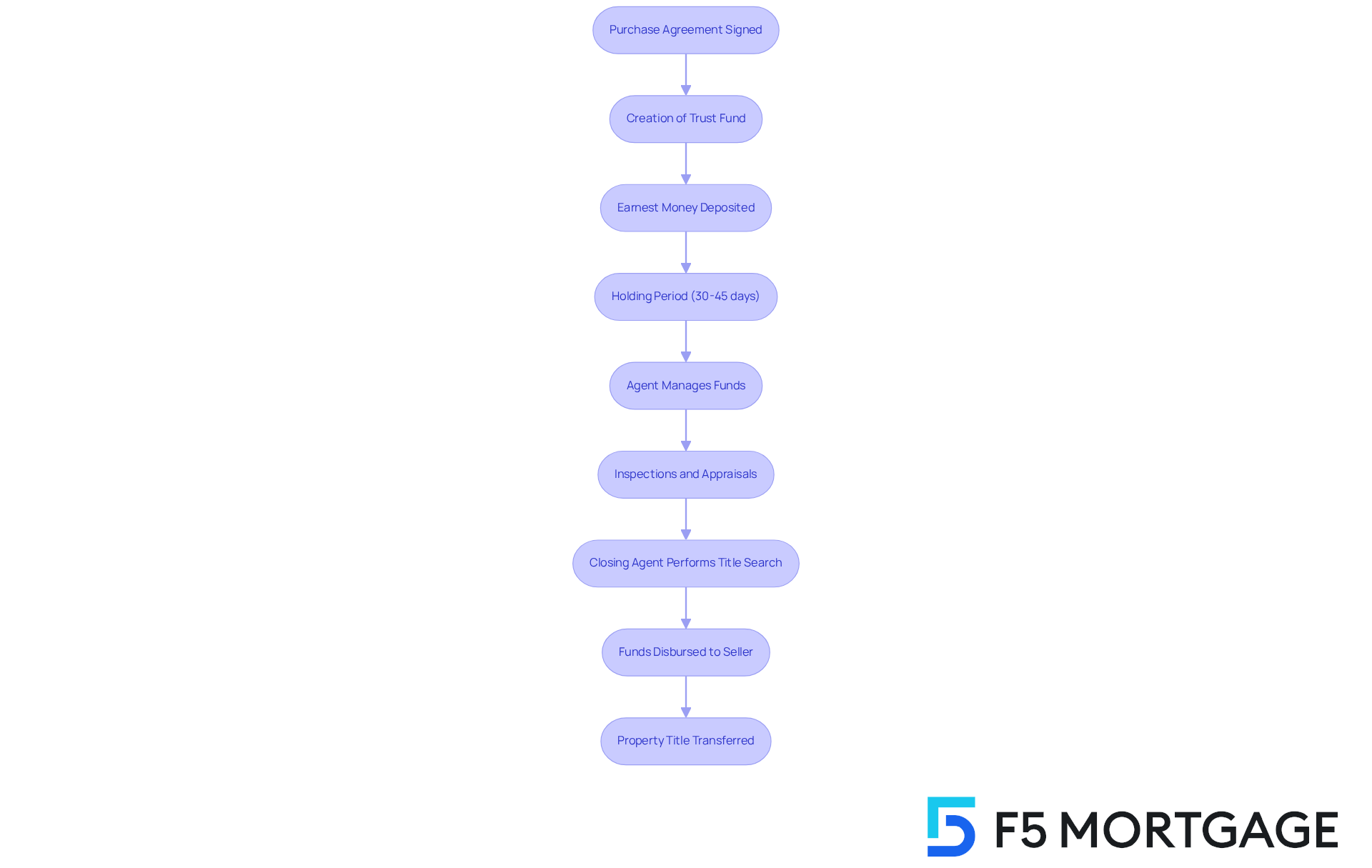

Key Components and Processes of Escrow

Navigating the holding process in real estate can feel overwhelming, but understanding its crucial elements can bring you peace of mind. It all begins with the creation of a trust fund once a purchase agreement is signed. Typically, the purchaser places earnest money into this account, signaling their commitment to the purchase.

During the holding period, which usually lasts from 30 to 45 days, your agent takes the reins, managing the funds and ensuring that all sale conditions are met. This includes coordinating necessary inspections, appraisals, and the final closing process. The closing agent plays a vital role here, performing a title search and securing title insurance for you, ensuring that the seller has clear ownership of the property.

Once everything is in order, the intermediary disburses the funds to the seller and facilitates the transfer of the property title to you. Additionally, trust accounts can be used to gather monthly payments for property taxes and insurance, which are settled on your behalf when due. This systematic approach not only protects the interests of both buyers and sellers but also simplifies the process, enhancing efficiency and security.

By fostering openness and collaboration among all parties, the holding process significantly reduces the risk of deception and miscommunication. This ultimately leads to a smoother closing experience. As noted by PureMotive Realty, the escrow mortgage meaning in your home purchase brings peace of mind and confidence to every stage of the transaction. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding the meaning of escrow mortgages is crucial for homebuyers like you, especially when navigating the complexities of real estate transactions. This financial arrangement acts as a safeguard, allowing both buyers and sellers to move forward with confidence. You can rest easy knowing that your funds and documents are securely held by a neutral third party until all sale conditions are met.

Throughout this article, we’ve explored key insights about escrow. We discussed its vital role in:

- Protecting earnest money deposits

- Managing ongoing financial responsibilities like property taxes and insurance

- Simplifying the overall home buying process

Did you know that many homebuyers are unaware of how their escrow arrangements function? Statistics show that education and transparency in this area are essential.

Ultimately, understanding the nuances of escrow not only enhances your homebuying experience but also empowers you to make informed decisions. As the real estate landscape evolves, grasping the escrow process remains a vital component of achieving successful and secure transactions. We encourage you to seek knowledge and clarity about your escrow agreements, ensuring a smoother journey toward homeownership. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is escrow in mortgage transactions?

Escrow in mortgage transactions refers to a financial arrangement where a neutral third party holds funds or documents for both the purchaser and seller until specific conditions are met, ensuring the security of the transaction.

Why is escrow important in the home buying process?

Escrow is crucial as it protects both parties during the home buying process by securely holding funds, such as good faith deposits, in a trust account until the deal is finalized, reducing risks associated with real estate transactions.

How common is the use of escrow services among homebuyers?

In 2025, around 80% of homebuyers utilized deposit services, highlighting the significance of escrow in facilitating smooth and secure transactions.

What costs are typically included in escrow arrangements?

Escrow arrangements often include provisions for property taxes and insurance premiums, which may be rolled into monthly mortgage payments.

How are homeowners affected by rising costs related to escrow?

Homeowners are facing increasing financial pressures due to rising property taxes and insurance costs, with 70% reporting higher premiums in the past year, making understanding escrow arrangements essential for effective financial management.

What is the level of understanding among borrowers regarding escrow arrangements?

Approximately 60% of borrowers don’t fully understand how their escrow arrangements work, indicating a significant gap in knowledge that needs to be addressed.

How does F5 Mortgage aim to support borrowers in understanding escrow?

F5 Mortgage prioritizes transparency and education to empower families in their home buying journey, ensuring that borrowers understand every stage of the process, including differences in deposit agreements.