Overview

We understand how challenging navigating the housing market can be, especially for families looking to secure their dream home. The recent increase in the 2024 conforming loan limits to $806,500 for single-family homes is a significant development that can make a real difference for homebuyers. This change is designed to make conventional financing more accessible and affordable, which is especially beneficial for first-time buyers and those in high-cost areas.

With these new limits, you can secure loans with lower down payments and interest rates. This means that purchasing a home in today’s competitive market is not just a dream but a tangible possibility. We’re here to support you every step of the way as you explore your options and take action toward homeownership.

Consider how this increase can empower you to make informed decisions. By understanding your financing options, you can enhance your ability to purchase a home that meets your family’s needs. We know how important it is to feel supported during this journey, and we encourage you to reach out for guidance tailored to your unique situation.

Introduction

Navigating the complex world of home financing can be daunting, and understanding the dynamics of conforming loan limits is essential. These limits not only set the stage for your borrowing potential but also influence the terms of your mortgage, playing a pivotal role in determining what you can afford. With the recent adjustments for 2024, many families are left wondering: how do these changes impact your ability to secure a mortgage in an increasingly competitive market?

We know how challenging this can be, and that’s why it’s important to delve into the significance of conforming loan limits. Recent increases have implications that could affect your homeownership journey. By leveraging this knowledge, you can take empowered steps toward unlocking your dreams of owning a home. We’re here to support you every step of the way.

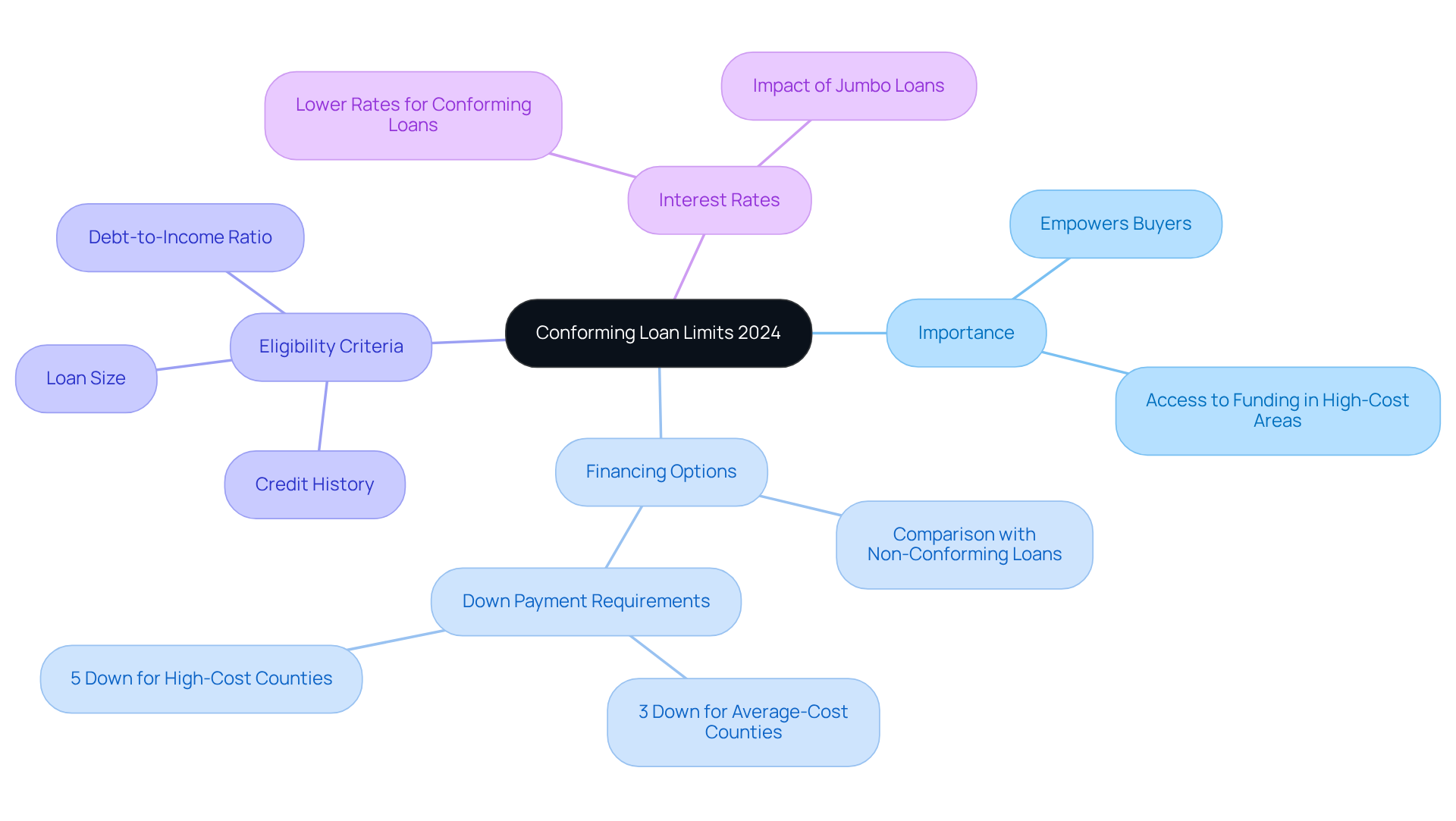

Define Conforming Loan Limits and Their Importance

The conforming loan limits 2024 represent the maximum amounts that Fannie Mae and Freddie Mac are willing to buy or guarantee, as determined annually by the Federal Housing Finance Agency (FHFA). The conforming loan limits 2024 are crucial for homebuyers, as they shape the financing options available, influencing both eligibility criteria and interest rates. Typically, financing options that fall within the conforming loan limits 2024 offer easier qualification processes and lower interest rates compared to non-conforming options, like jumbo mortgages, which often require stricter qualifications and larger down payments.

For instance, in 2025, the baseline conforming loan limits 2024 for one-unit properties have increased to $806,500, up from $766,550. This change allows first-time homebuyers in average-cost counties to borrow more with just a 3% down payment, making homeownership more attainable. In high-cost regions, buyers may only need 5% down, significantly lowering the financial barrier to entry.

The importance of conforming loan limits 2024 cannot be overstated; they empower buyers to secure funding for homes in pricier areas without resorting to jumbo financing, which can involve higher interest rates and more stringent qualification standards. With the median home price projected to rise to $410,700 in 2025, understanding conforming borrowing thresholds is essential for effectively navigating the mortgage landscape. By leveraging the conforming loan limits 2024, homebuyers can enhance their borrowing potential and make informed decisions regarding their financing options.

Additionally, obtaining mortgage approval is a vital step in this journey. An approval signifies that a lender has reviewed your financial information and considers you a suitable candidate for a mortgage. This approval typically includes an estimate of your borrowing amount, interest rate, and potential monthly payments, all of which can significantly impact your decision-making process. For those considering adjustable-rate mortgages (ARMs), it’s important to understand that these products often start with lower initial rates, making monthly payments more manageable. With caps in place to limit how much interest rates can rise, ARMs can be a strategic choice for families planning to relocate or refinance before the adjustment period begins. By grasping both conforming borrowing thresholds and the nuances of mortgage approvals, homebuyers can make informed choices that align with their financial goals.

Take the first step toward the right mortgage. Apply online or over the phone. Our team at F5 Mortgage is here to support you every step of the way! Apply For Your Adjustable Rate Loan Today!

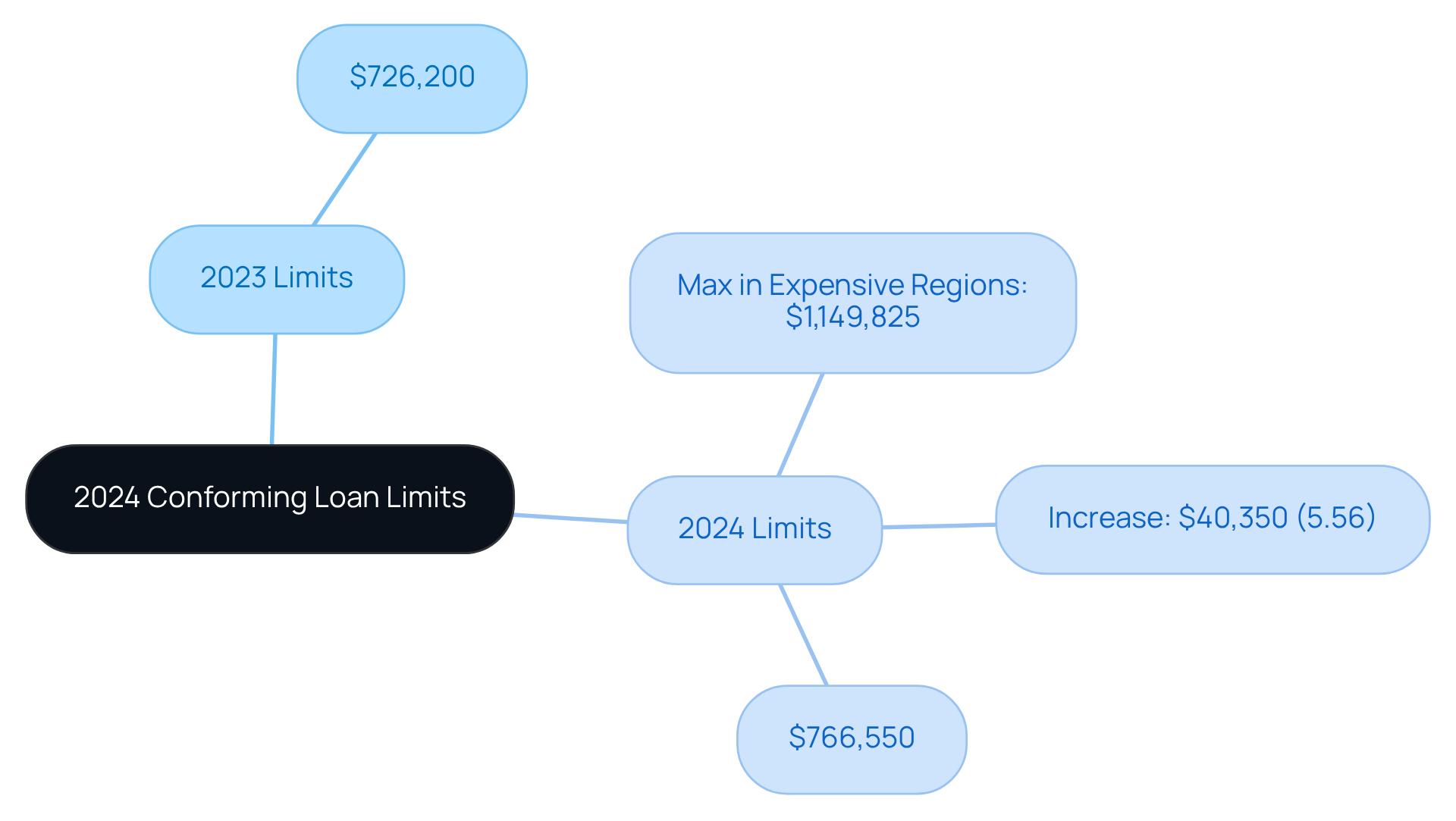

Explore 2024 Conforming Loan Limits: Key Figures and Changes

In 2024, the conforming loan limits for single-family residences have risen to $766,550. This marks a significant rise from the conforming loan limits in 2023, which were $726,200. This $40,350 adjustment reflects the ongoing rise in home prices, which have increased by an average of 5.56% over the past year.

For those purchasing in expensive regions, the maximum borrowing threshold can reach as much as $1,149,825. This figure reflects 150% of the baseline amount. These changes are crucial; they enable buyers to access conventional financing options that align with the conforming loan limits, making it easier to navigate the challenges posed by escalating housing costs.

We know how challenging this can be. Grasping these new restrictions is essential for prospective buyers and real estate experts alike. Understanding these updates greatly affects the accessibility of credit and the overall home purchasing approach. We’re here to support you every step of the way as you navigate this evolving landscape.

Analyze the Impact of Conforming Loan Limits on Homebuyers

The recent rise in conforming loan limits 2024 presents a significant opportunity for homebuyers. With the conforming loan limits 2024 set at $806,500 for 1-unit properties, more individuals can now qualify for conventional financing. This type of financing typically offers lower interest rates and better terms compared to jumbo loans, making it an appealing option. This shift is particularly beneficial for first-time homebuyers and those looking in high-cost areas, as it opens doors to financing for homes that fall within the conforming loan limits 2024, which may have previously felt out of reach.

Imagine a homebuyer considering a property valued at $900,000. In the past, they might have faced the challenge of needing a larger down payment or resorting to a jumbo mortgage. However, with the new qualifying thresholds, they can now secure a standard mortgage with a down payment as low as 3%. This change makes the dream of homeownership more attainable for many.

Moreover, the increase in conforming loan limits 2024 enhances buying capacity in competitive markets. Purchasers can explore properties that align with their financial situation without exceeding the established limits. This not only streamlines the mortgage process but also reduces the likelihood of facing stringent underwriting criteria associated with larger loans. In today’s housing landscape, where affordability is a pressing concern, this accessibility is crucial.

In summary, the increased qualifying borrowing thresholds not only expand opportunities for first-time homebuyers but also provide a strategic advantage in navigating competitive housing markets. This ultimately fosters a more inclusive environment for potential homeowners, and we’re here to support you every step of the way.

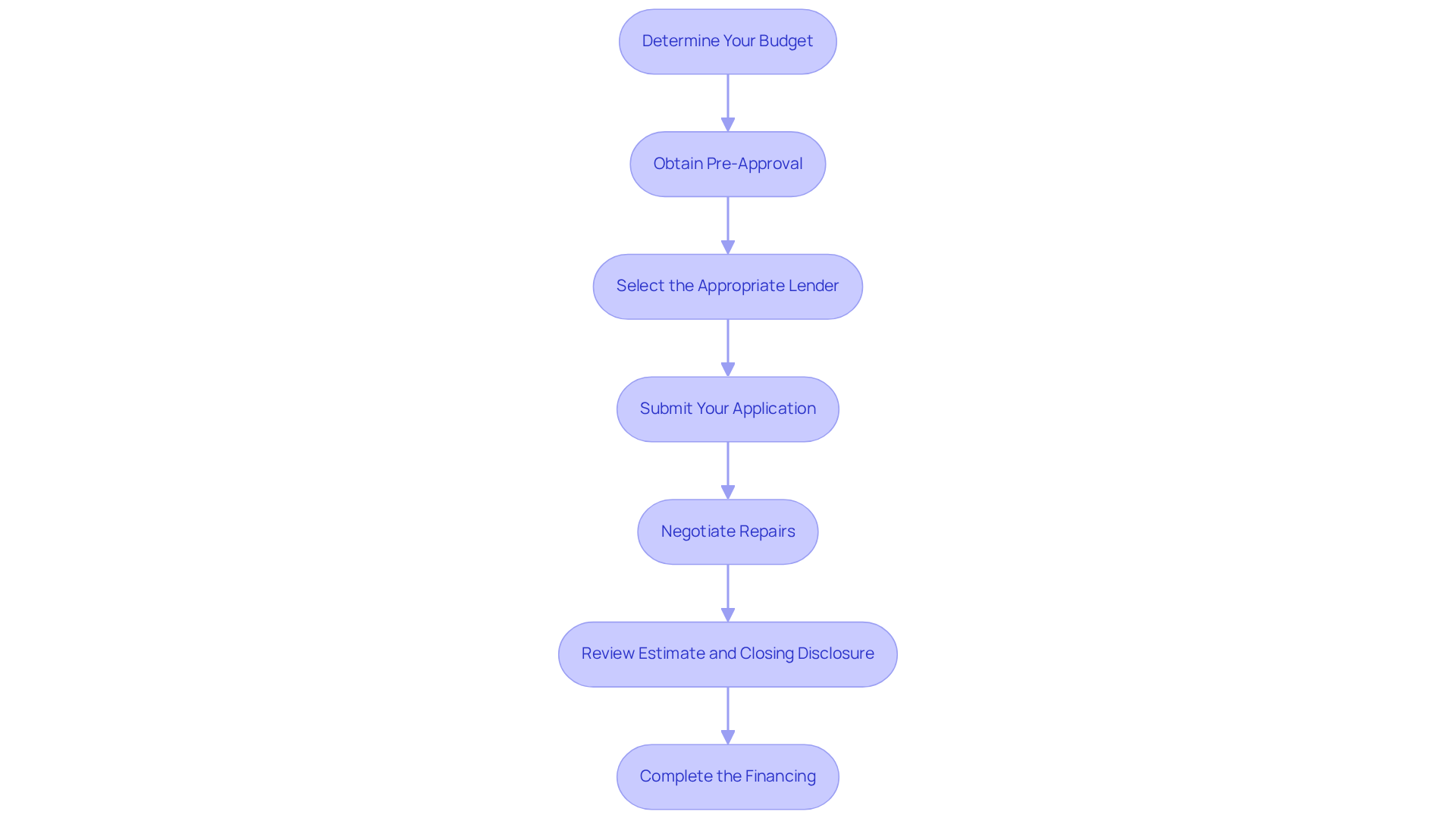

Guide to Navigating the Mortgage Process with Conforming Loan Limits

Navigating the mortgage process with standard borrowing thresholds can feel overwhelming, but with a thoughtful approach, homebuyers can find their way. Here are some essential steps to guide you through this journey:

Determine Your Budget: Begin by assessing your financial situation to understand how much you can afford to borrow within the approved limits. For 2025, these limits can reach up to $806,500 in average-cost counties, which opens up many possibilities.

Obtain Pre-Approval: Seeking pre-approval from a lender specializing in standard mortgages is a crucial step. This not only clarifies your budget but also strengthens your position when making an offer. Sellers often favor pre-approved buyers, making your offer more compelling.

Select the Appropriate Lender: Collaborating with a knowledgeable mortgage broker or lender can ensure you secure competitive rates and favorable terms. Over 60% of mortgage seekers opt for traditional financing options, underscoring their popularity and accessibility. F5 Mortgage can connect you with top realtors in your area, enhancing your chances of finding the right home.

Submit Your Application: Complete the mortgage application process by providing all necessary documentation to support your income and creditworthiness. Generally, a credit score of at least 620 is required for eligibility for a conforming mortgage.

Negotiate Repairs: When making an offer, consider requesting the seller to complete necessary repairs or upgrades. This common practice can help you secure a home that meets your needs without incurring additional costs after purchase.

Review Estimate and Closing Disclosure: After submitting your application, your lender will provide an Estimate detailing the fees and costs associated with your financing. Remember, these numbers can change by up to 10% before closing. Before you finalize, you will receive a Closing Disclosure that outlines your final costs, ensuring you know exactly what you’re paying for.

Complete the Financing: Once approved, take the time to carefully review the closing documents and finalize your financing. Most agreements can be completed in under three weeks, allowing you to transition smoothly to your new home.

By following these steps, you can effectively leverage conforming loan limits 2024 to secure advantageous mortgage financing, making homeownership more attainable in today’s market. We know how challenging this can be, but we’re here to support you every step of the way.

Conclusion

The conforming loan limits for 2024 are crucial in shaping the home financing landscape for prospective buyers. By understanding these limits, homebuyers can access more favorable mortgage options, making homeownership more achievable. This increase in limits reflects rising home prices and enhances borrowing capacity for individuals, especially first-time buyers and those in high-cost areas.

Key insights highlighted in the article include the significant rise in baseline conforming loan limits to $766,550, with maximum thresholds reaching as high as $1,149,825 in expensive regions. This change allows buyers to secure conventional financing with lower down payments, reducing the financial barriers that often accompany home purchases. Additionally, we emphasized the importance of obtaining pre-approval and selecting the right lender, as these steps can streamline the mortgage process and improve the chances of securing a desirable home.

In light of these developments, the message is clear: understanding and leveraging conforming loan limits is essential for navigating the current housing market. We know how challenging this can be, and we encourage homebuyers to assess their financial situation, seek pre-approval, and explore their options within these new limits. By taking these steps, they can unlock opportunities for homeownership that may have previously seemed out of reach, fostering a more inclusive and accessible real estate environment.

Frequently Asked Questions

What are conforming loan limits?

Conforming loan limits are the maximum amounts that Fannie Mae and Freddie Mac are willing to buy or guarantee, as determined annually by the Federal Housing Finance Agency (FHFA).

Why are conforming loan limits important?

They shape the financing options available for homebuyers, influencing eligibility criteria and interest rates. Loans within the conforming limits typically offer easier qualification processes and lower interest rates compared to non-conforming options.

What is the baseline conforming loan limit for 2024?

The baseline conforming loan limit for one-unit properties in 2024 has increased to $806,500, up from $766,550.

How do conforming loan limits affect first-time homebuyers?

The increased conforming loan limits allow first-time homebuyers in average-cost counties to borrow more with just a 3% down payment, making homeownership more attainable.

What are the down payment requirements in high-cost regions?

In high-cost regions, buyers may only need a 5% down payment to qualify for loans within the conforming limits.

What are the benefits of conforming loans compared to jumbo mortgages?

Conforming loans typically have lower interest rates and easier qualification standards than jumbo mortgages, which often require stricter qualifications and larger down payments.

What is the projected median home price for 2025?

The median home price is projected to rise to $410,700 in 2025.

What does mortgage approval signify?

Mortgage approval indicates that a lender has reviewed your financial information and considers you a suitable candidate for a mortgage, typically providing an estimate of your borrowing amount, interest rate, and potential monthly payments.

What are adjustable-rate mortgages (ARMs)?

ARMs are mortgage products that often start with lower initial rates, making monthly payments more manageable. They have caps to limit how much interest rates can rise, making them a strategic choice for families planning to relocate or refinance before the adjustment period begins.

How can homebuyers enhance their borrowing potential?

By understanding and leveraging conforming loan limits, homebuyers can make informed decisions regarding their financing options and enhance their borrowing potential.