Overview

Amortized loans can provide families with predictable monthly payments and the opportunity to build equity over time, making them an appealing choice for homeownership. However, we understand that these loans also come with some challenges.

- Higher initial payments

- Long-term commitments

These factors can strain budgets and reduce flexibility. It’s essential to consider these factors carefully. We know how challenging this can be, and we’re here to support you every step of the way. Take the time to weigh your options and ensure that this path aligns with your family’s needs.

Introduction

Navigating the complexities of amortized loans can feel overwhelming for families seeking home financing. We understand how challenging this can be, but these loans offer a structured repayment plan that can empower you to manage your finances effectively. However, it’s important to recognize that they also come with challenges that may affect your long-term financial stability.

As you weigh the benefits of predictable payments and the opportunity to build equity against potential drawbacks like higher initial costs and long-term commitments, a critical question arises: how can you balance the advantages of amortized loans with the risks they entail? This article delves into the multifaceted nature of amortized loans, providing insights that can help you make informed decisions aligned with your financial goals.

We’re here to support you every step of the way as you explore your options and find the best path forward for your family.

Define Amortization and Its Importance in Loan Management

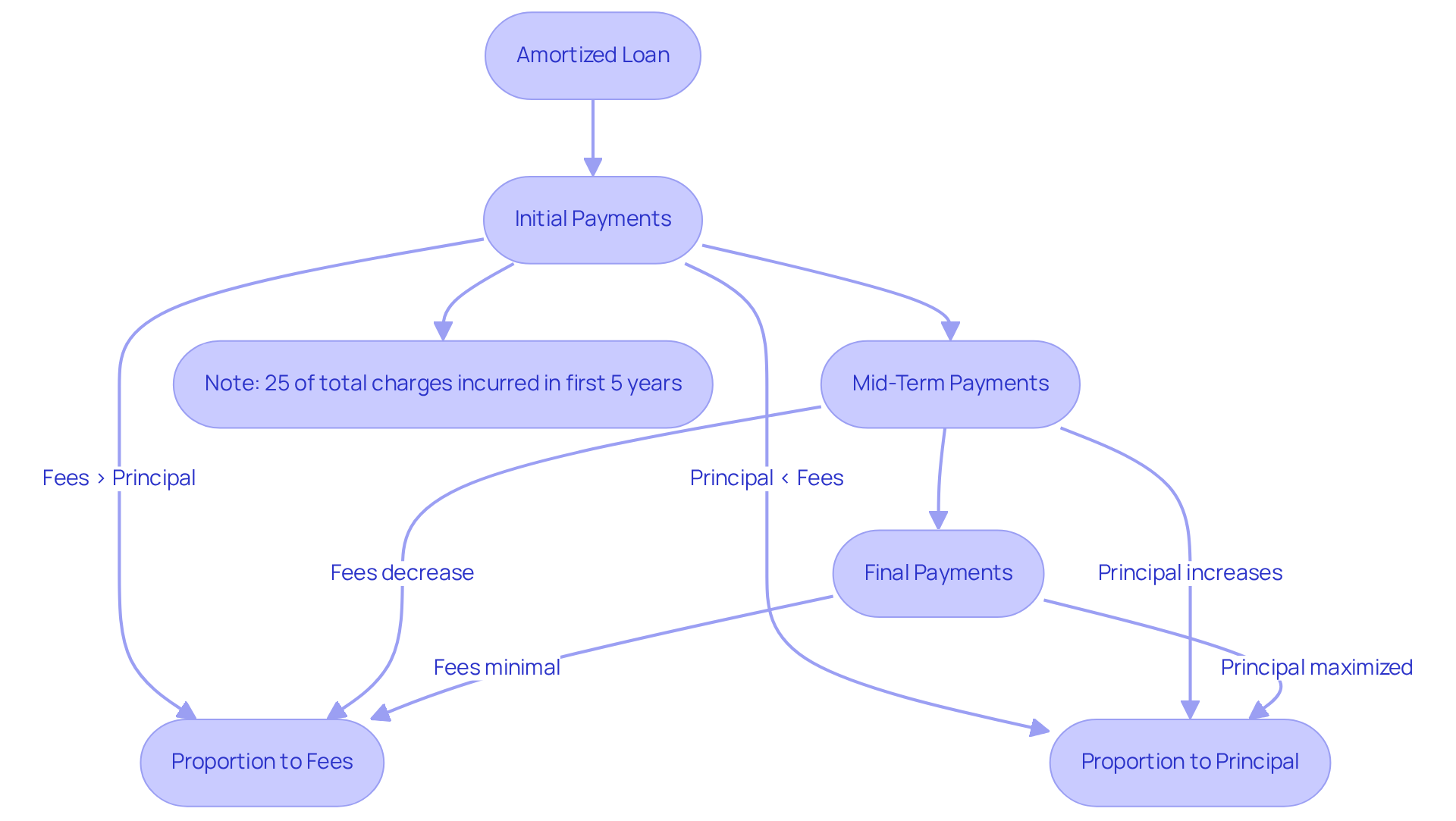

An amortized loan is a structured method for repaying debt through planned installments over a specified duration. Each installment consists of both principal and fees, with the proportion of each changing as the financing progresses. We understand how essential it is for households to grasp the ; it illustrates how monthly payments are allocated and how the remaining loan balance diminishes over time. This insight empowers borrowers to manage their finances more effectively, plan for future expenses, and understand the long-term implications of their mortgage decisions.

For instance, families can benefit from recognizing that in the early years of a mortgage, a significant portion of their payments goes toward fees rather than the principal. This understanding allows them to develop strategies to minimize overall costs, such as making extra payments toward the principal whenever possible.

Statistics indicate that in a standard 30-year fixed-rate mortgage:

- Borrowers pay more in fees than principal for the first 18.5 years.

- 25% of total charges are incurred in the first five years alone.

This underscores the importance of securing a lower interest rate; even a small reduction can lead to substantial savings over the life of the loan. Additionally, understanding the costs associated with refinancing, such as closing costs, is crucial for households considering this option. For example, if refinancing costs are $4,000 and monthly savings amount to $100, the break-even point would be 40 months. This highlights the need to remain in the home long enough to recover these expenses.

Recent discussions in the mortgage industry stress that households who actively engage with their amortized loan schedules can profoundly influence their financial well-being. By comprehending the amortization process of an amortized loan and utilizing refinancing options—including the potential removal of PMI through refinancing based on increased home value—individuals can make informed decisions that align with their financial goals. Ultimately, this leads to a more secure and manageable mortgage experience. We’re here to support you every step of the way.

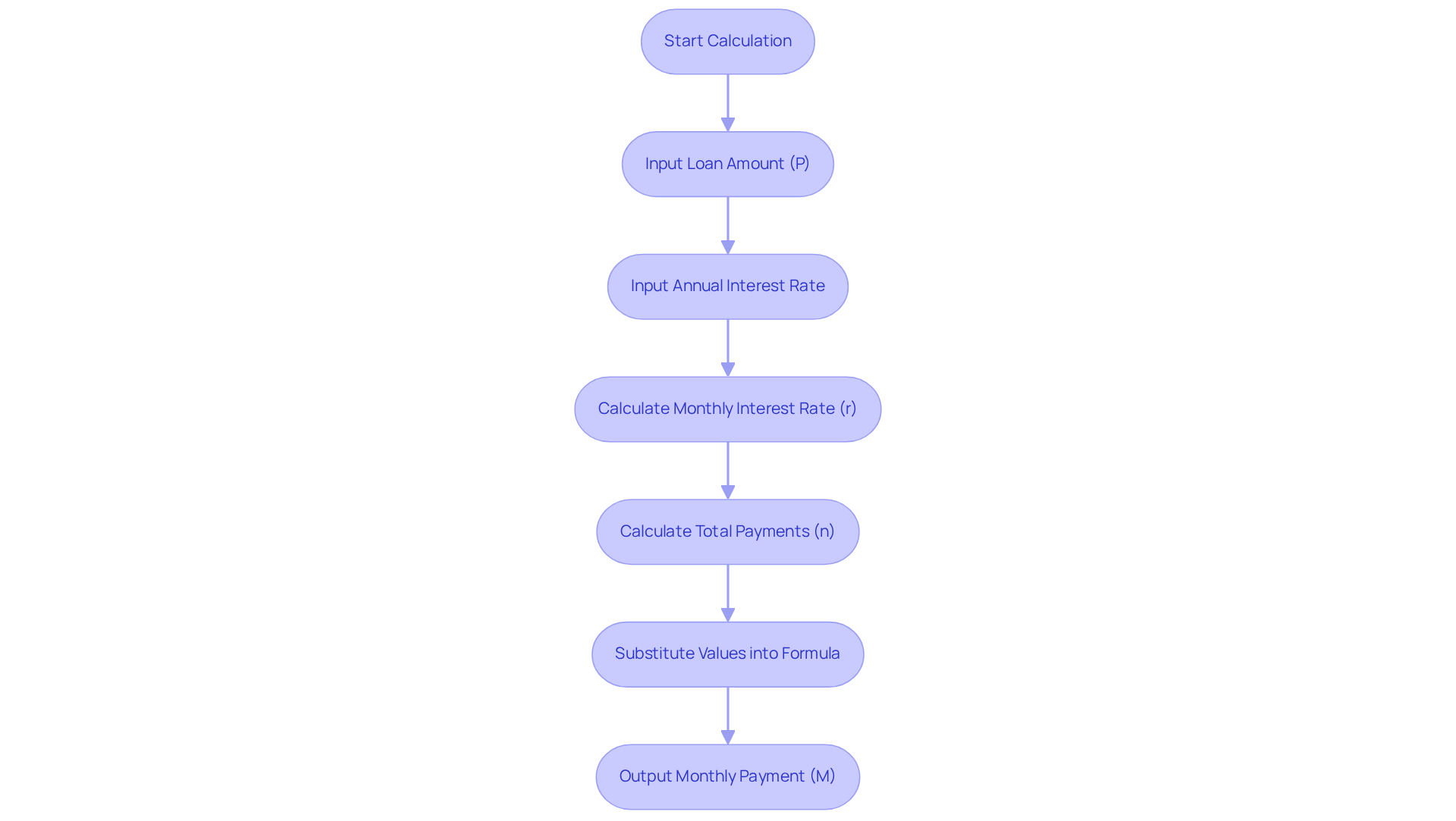

Explain How Amortized Loans Function and Calculate Payments

An amortized loan provides a way to manage the repayment of both principal and charges over a specified term, typically spanning 15 to 30 years. We understand how daunting this process can feel, but can be straightforward with the right approach. You can use the following formula:

M = P * (r(1 + r)^n) / ((1 + r)^n – 1), where:

- M = monthly payment

- P = loan principal (the amount borrowed)

- r = monthly interest rate (annual rate divided by 12)

- n = total number of payments (loan term in months)

For example, let’s say a family borrows $200,000 at an annual interest rate of 4% for 30 years. Here’s how the calculation unfolds:

- Convert the annual interest rate to a monthly rate: 4% / 12 = 0.3333% or 0.003333.

- Calculate the total number of payments: 30 years x 12 months = 360 payments.

- Substitute these values into the formula to find the monthly amount.

This knowledge empowers families to assess different credit offers thoughtfully, ensuring they select the option that best fits their financial situation. Understanding amortization is crucial; while longer durations of an amortized loan typically lower monthly payments, they also increase the total financing costs over the life of the amortized loan. For instance, a $250,000 mortgage at a 4.4% interest rate results in a monthly payment of about $1,250. In contrast, a shorter term would raise monthly payments but reduce the overall interest paid.

By grasping these concepts, households can make informed decisions that align with their homeownership aspirations. We know how challenging this can be, but we’re here to support you every step of the way.

Discuss the Benefits of Amortized Loans for Borrowers

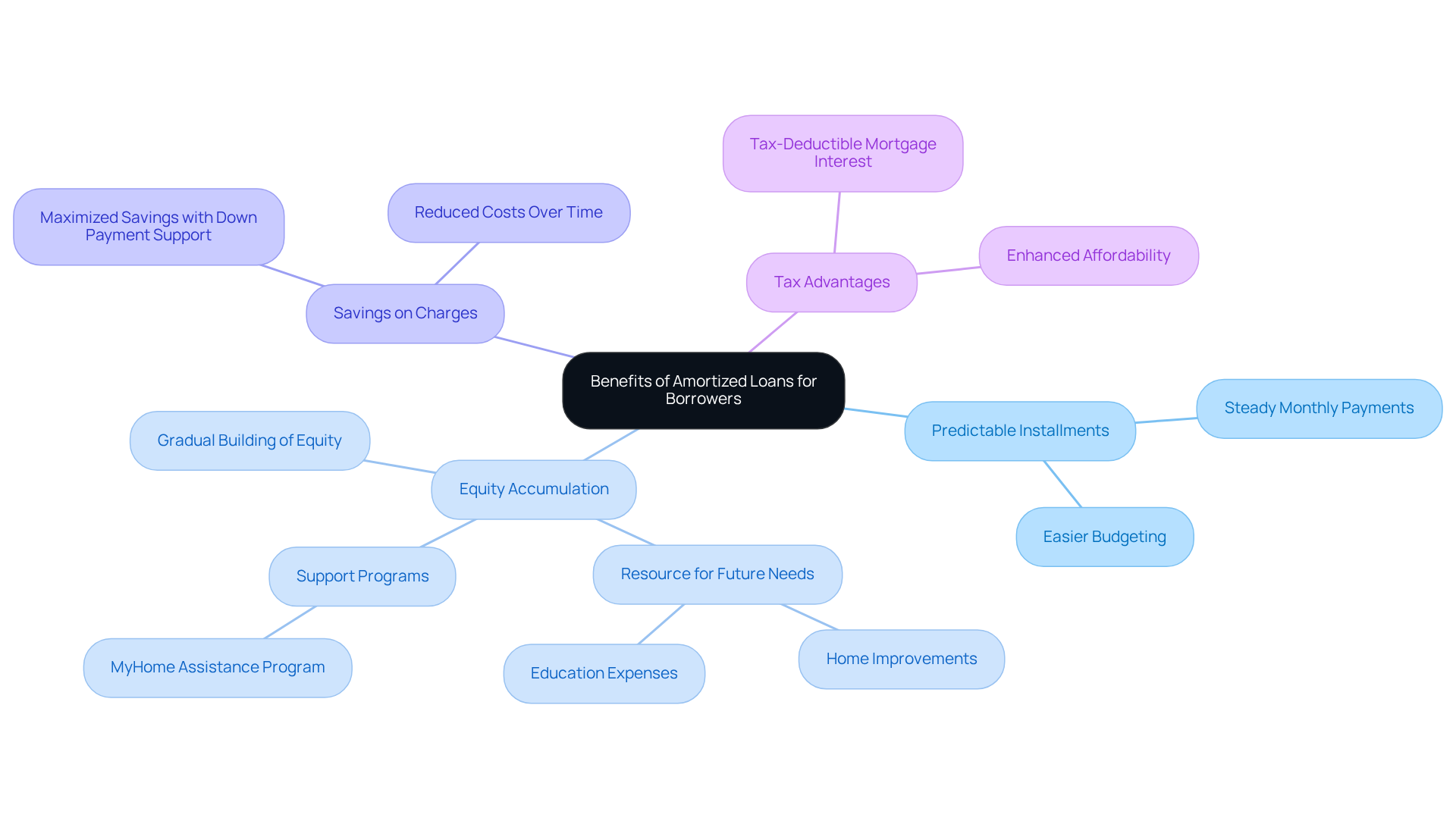

We understand how important this decision is for you, and amortized loans offer several advantages for families looking to purchase or refinance a home.

- Predictable Installments: One of the key benefits is the steady monthly installments throughout the loan period. This consistency makes budgeting easier, allowing you to plan your finances with confidence and stability.

- Equity Accumulation: As you make your monthly payments, you gradually build equity in your home. This equity can be a valuable resource for future needs, such as home improvements or education expenses. Programs like can support you by providing extra funds for deposits, making your offers more competitive.

- Savings on Charges: Over time, you can benefit from reduced costs as the principal balance decreases. For example, if you have a 30-year fixed-rate mortgage of $300,000 at a 4% rate, your monthly payment of approximately $954.83 will gradually shift, allowing more of your payment to contribute to equity rather than costs. Additionally, using down payment support can further minimize the initial amount borrowed, maximizing your savings.

- Tax Advantages: Another significant benefit is that mortgage interest payments may be tax-deductible, providing extra financial relief for your household. This can greatly enhance the overall affordability of homeownership.

Structured repayment through an amortized loan provides families with a clear repayment schedule that helps them stay on track with their financial goals. As you pay down the principal, you not only reduce your debt but also increase your stake in the property, which is crucial for long-term wealth accumulation.

These advantages make an amortized loan an appealing choice for families seeking stability and a path to lasting financial well-being. By understanding the principles of amortization and utilizing down payment assistance programs, you can make informed decisions that align with your financial aspirations. We’re here to support you every step of the way.

Identify Drawbacks and Considerations of Amortized Loans

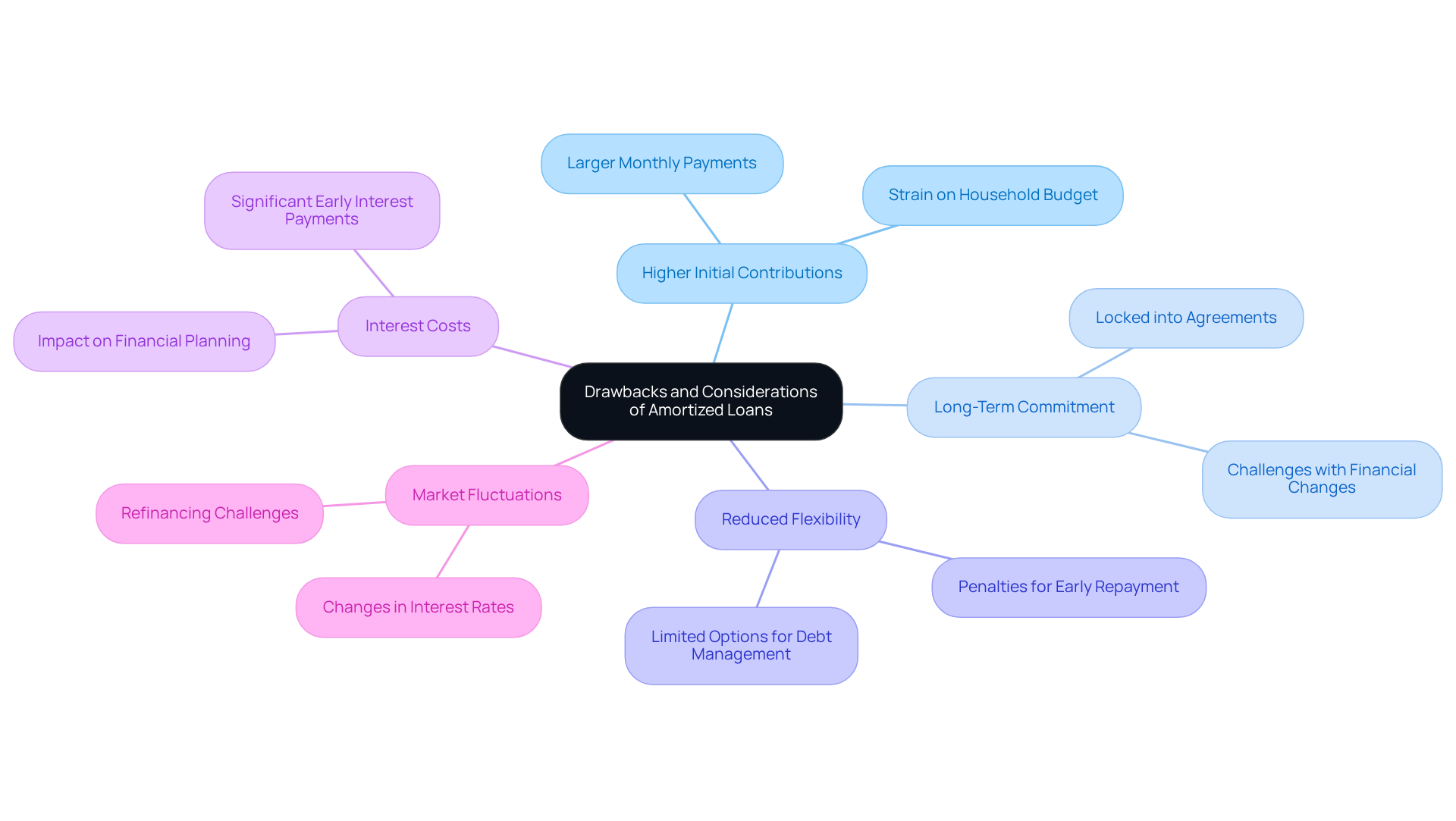

While amortized loans offer several advantages, it’s important for families to also consider potential drawbacks and challenges:

- Higher Initial Contributions: Amortized loans typically involve larger initial monthly payments compared to interest-only options. This can place a strain on a household’s budget. As we know, one of the biggest benefits of an amortized loan is that it has fixed payments that remain constant throughout the duration of the agreement. However, this stability can lead to higher upfront expenses.

- Long-Term Commitment: Families often find themselves locked into long-term agreements, which can be daunting if their financial circumstances change. Renting can provide the flexibility needed to avoid the complexities of selling a home or securing tenants if a move becomes necessary.

- Reduced Flexibility: Early repayment of an amortized loan may incur penalties, limiting a household’s ability to pay off their debt sooner without facing additional costs. This lack of flexibility can be particularly concerning in the face of unexpected expenses.

- Interest Costs: Although an amortized loan reduces interest over time, borrowers still encounter significant interest payments in the early years of the loan. This reality can impact overall financial planning, especially for families on tight budgets. Before committing to a mortgage, it’s crucial for households to ensure they have a stable income, savings for emergencies, and a clear plan for managing existing debts, including reviewing bank accounts and billing statements.

- Market Fluctuations: Changes in interest rates can affect refinancing options, making it essential for families to stay informed about market trends. At F5 Mortgage, we have assisted over 1,000 households in navigating these challenges by providing guidance on financial readiness. Understanding the implications of an amortized loan is vital.

By recognizing these potential drawbacks and reflecting on insights from the case study titled ‘The Pros and Cons of Amortized Loans,’ families can better evaluate whether an amortized loan aligns with their financial goals and personal circumstances. Additionally, understanding the benefits of renting—such as not being responsible for repairs or property taxes—can empower families to make informed decisions about their housing options before committing to a mortgage.

Conclusion

Understanding the intricacies of amortized loans is crucial for families navigating the complexities of home financing. We know how challenging this can be. These loans offer a structured repayment plan that fosters financial stability, allowing borrowers to manage their monthly budgets effectively while gradually building equity in their homes. This essential knowledge empowers families to make informed decisions that align with their long-term financial goals.

Throughout this exploration, key insights have emerged regarding the benefits and drawbacks of amortized loans. Families can enjoy:

- Predictable monthly payments

- Equity accumulation

- Potential tax advantages

- The ability to reduce overall costs over time

However, it’s equally important to acknowledge the challenges, such as:

- Higher initial payments

- Long-term commitments

- Potential penalties for early repayment

By weighing these factors, families can better assess whether an amortized loan aligns with their unique financial circumstances.

Ultimately, the decision to pursue an amortized loan should be made with careful consideration of both its advantages and potential pitfalls. Staying informed about market trends and understanding personal financial readiness are vital steps in this process. As families embark on their homeownership journey, we’re here to support you every step of the way. Seek guidance and support to navigate these decisions, ensuring a secure and manageable mortgage experience that paves the way for lasting financial well-being.

Frequently Asked Questions

What is amortization in the context of loans?

Amortization is a structured method for repaying debt through planned installments over a specified duration, where each installment consists of both principal and fees, with the proportion of each changing over time.

Why is understanding amortized loans important for borrowers?

Understanding amortized loans helps borrowers grasp how monthly payments are allocated, how the remaining loan balance diminishes over time, and empowers them to manage their finances more effectively and plan for future expenses.

How do payments in an amortized loan change over time?

In the early years of a mortgage, a significant portion of payments goes toward fees rather than the principal, which shifts as the loan progresses.

What statistics illustrate the payment distribution in a standard 30-year fixed-rate mortgage?

Statistics show that borrowers pay more in fees than principal for the first 18.5 years, and 25% of total charges are incurred in the first five years alone.

How can securing a lower interest rate impact loan costs?

Securing a lower interest rate can lead to substantial savings over the life of the loan, making it crucial for borrowers to consider their options.

What should households consider when refinancing their mortgage?

Households should consider the costs associated with refinancing, such as closing costs, and calculate the break-even point to ensure they remain in the home long enough to recover these expenses.

What is the break-even point for refinancing if costs are $4,000 and monthly savings are $100?

The break-even point would be 40 months, meaning the borrower needs to stay in the home for that duration to recover the refinancing costs.

How can engaging with amortized loan schedules benefit households?

Actively engaging with amortized loan schedules allows households to influence their financial well-being by making informed decisions regarding their mortgage and refinancing options, including the potential removal of PMI based on increased home value.