Overview

In Florida, HELOC rates can feel overwhelming, but understanding the factors at play can empower you as a homeowner. Rates are influenced by your credit scores, loan-to-value ratios, market conditions, and property locations, with current averages hovering around 8.27%.

We know how challenging it can be to navigate these variables. By improving your creditworthiness and taking the time to shop around for competitive offers, you can secure more favorable terms. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Take a moment to explore your options. Understanding these aspects can make a significant difference in your financial future.

Introduction

Navigating the financial landscape can be overwhelming, especially when it comes to understanding Home Equity Lines of Credit (HELOCs). We know how challenging this can be, but grasping the intricacies of HELOCs can truly be a game-changer for homeowners like you. With average HELOC rates in Florida hovering around 8.27%, this flexible borrowing option opens the door to tapping into your home equity for various needs—whether it’s for renovations or debt consolidation.

However, the journey doesn’t come without its challenges. Deciphering the factors that influence these rates, such as credit scores and market conditions, can feel daunting. But don’t worry; we’re here to support you every step of the way. What strategies can you employ to secure the most competitive rates and make informed financial decisions? Let’s explore this together.

Define Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Financing is a revolving line of borrowing secured by the equity in your residence, allowing homeowners like you to borrow against your property’s value. This financial product offers you flexibility, enabling access to funds as needed, which can be especially helpful during uncertain times. Unlike conventional home equity loans that provide a one-time payment, a home equity line allows you to withdraw from a financing source multiple times throughout a defined draw period, typically lasting between 5 to 10 years. You only pay interest on the drawn amount, making it a versatile option for various expenses, including home renovations, education, or even debt consolidation.

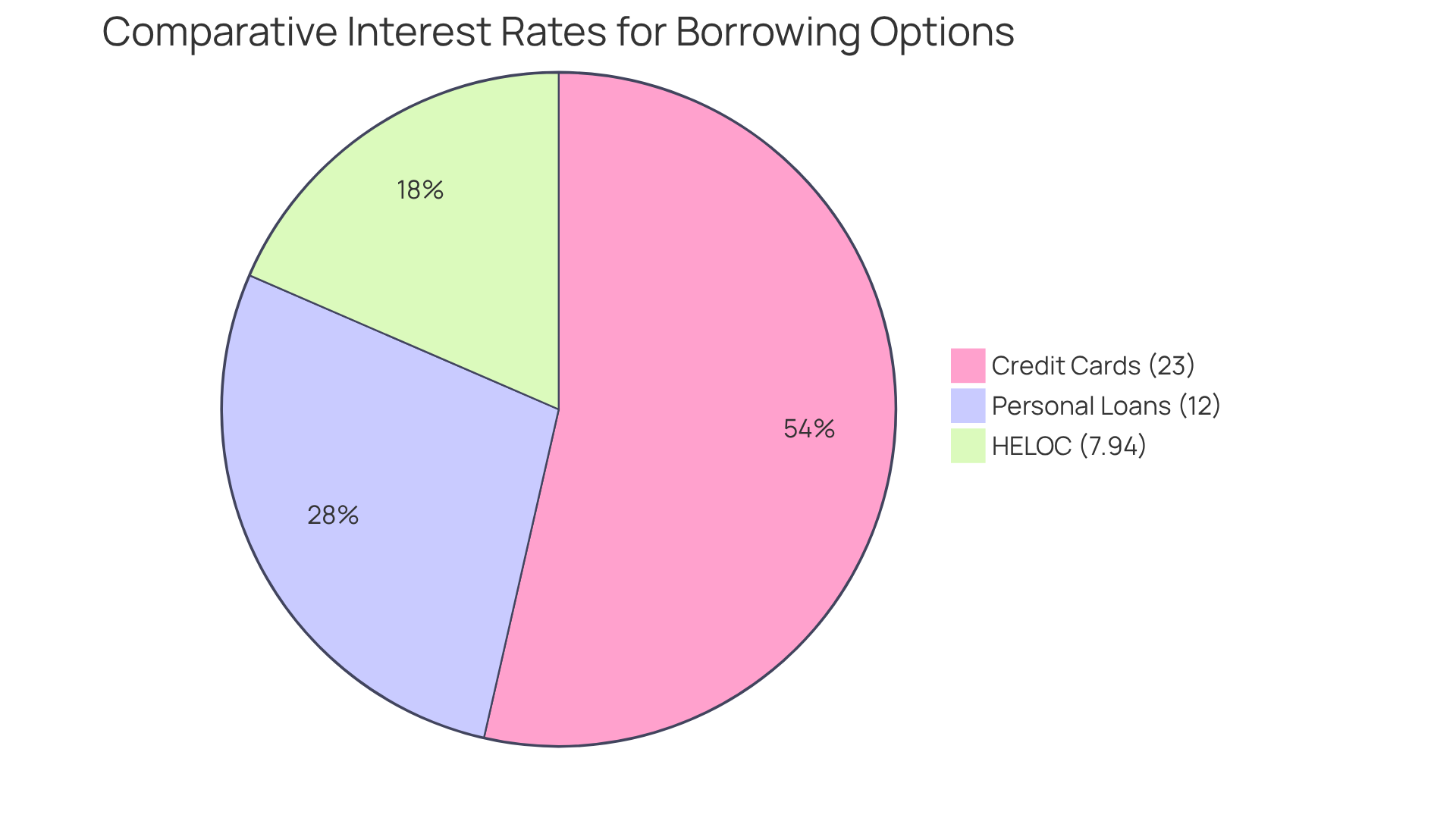

However, we understand that with this opportunity comes responsibility. Since a home equity line of credit is secured by your house, it’s crucial to recognize that failure to repay could lead to foreclosure. As of early 2025, the HELOC rates in Florida average 7.94%, which is considerably lower than other lending alternatives like personal loans and credit cards, which hover around 12% and 23%, respectively. Additionally, the cost of refinancing in California typically ranges from 2% to 5% of the loan amount, an important consideration for homeowners weighing their options.

This affordability, combined with the ability to tap into approximately $11.5 trillion of accessible home equity, makes HELOCs an appealing choice for many families. We know how challenging financial decisions can be, and we’re here to support you every step of the way as you explore your options.

Explore Factors Affecting HELOC Rates in Florida

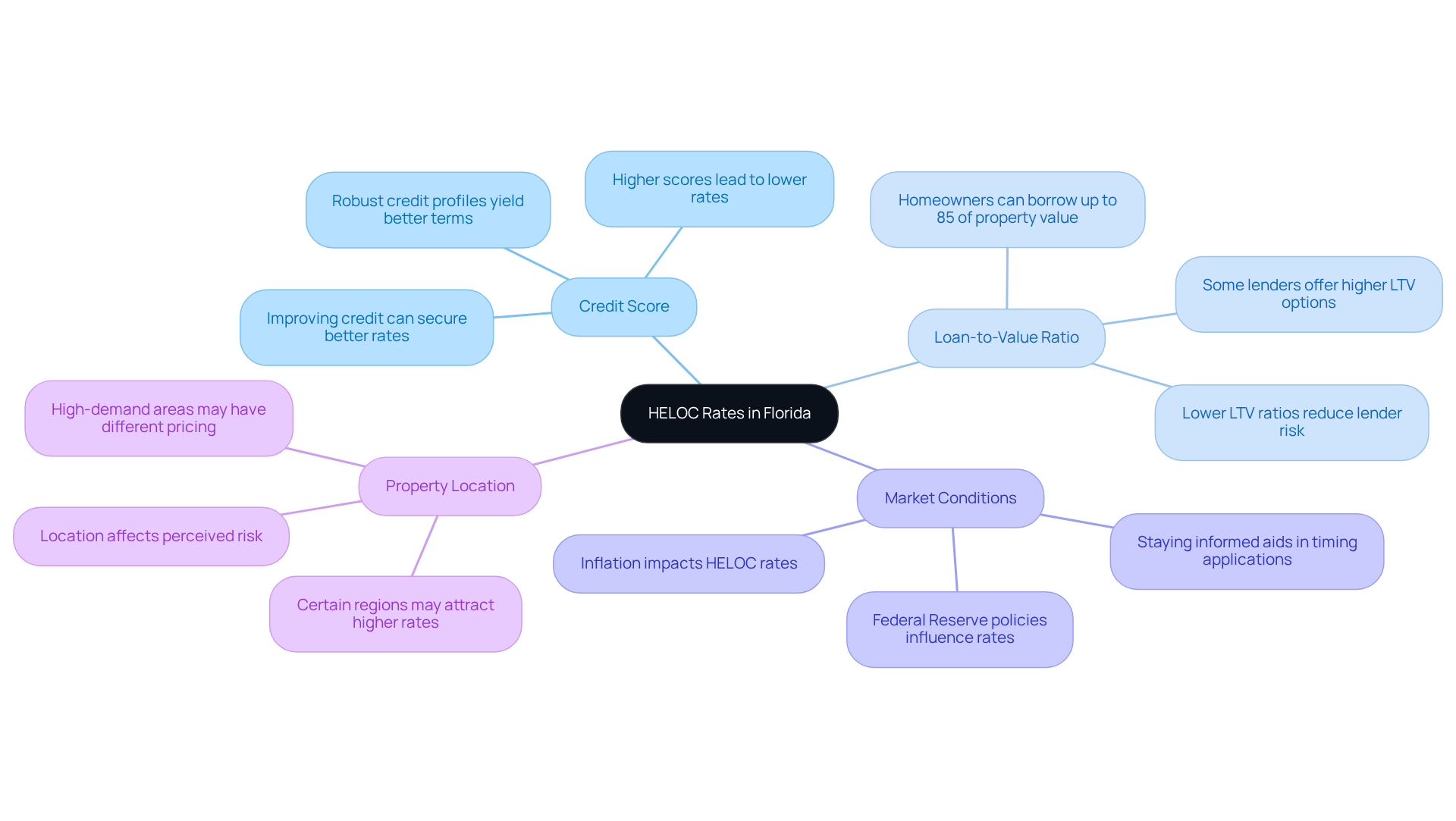

Several key factors influence HELOC rates in Florida, and understanding these factors can empower you in your decision-making process.

-

Credit Score: We know how challenging it can be to manage your credit score. A higher credit score typically results in lower interest rates, signaling to lenders that you are a lower risk. Borrowers with robust credit profiles often enjoy significantly better terms. This is crucial, as lenders may offer reduced rates to those with higher scores due to the perceived diminished risk involved.

-

Loan-to-Value (LTV) Ratio: This ratio compares the loan amount to your home’s appraised value. In Florida, homeowners can usually borrow up to 85% of their property’s worth, with some lenders offering even more favorable LTV options. A lower LTV ratio can lead to better terms, as it reduces the lender’s risk.

-

Market Conditions: We understand that keeping up with economic factors like inflation and the Federal Reserve’s interest policies can feel overwhelming. These elements significantly impact HELOC rates in Florida. Staying informed about current market conditions can help you time your application for the most favorable terms. For example, as inflation rises, financial institutions might maintain higher rates to mitigate risk.

Competition among providers indicates that the number of lenders offering HELOC rates in Florida can create opportunities for you to find lower costs. As these institutions compete for your business, it’s beneficial to explore and compare rates from various lenders to uncover the most competitive deals.

- Property Location: The location of your property also plays a role in determining rates, as certain areas may experience higher demand or risk factors. For instance, homes in high-demand neighborhoods may attract different pricing compared to those in less sought-after regions.

Comprehending these factors can enable you to make informed choices about your home equity line of credit options. We’re here to support you every step of the way, ultimately leading to more favorable loan conditions.

Analyze HELOC Rates Specific to Florida

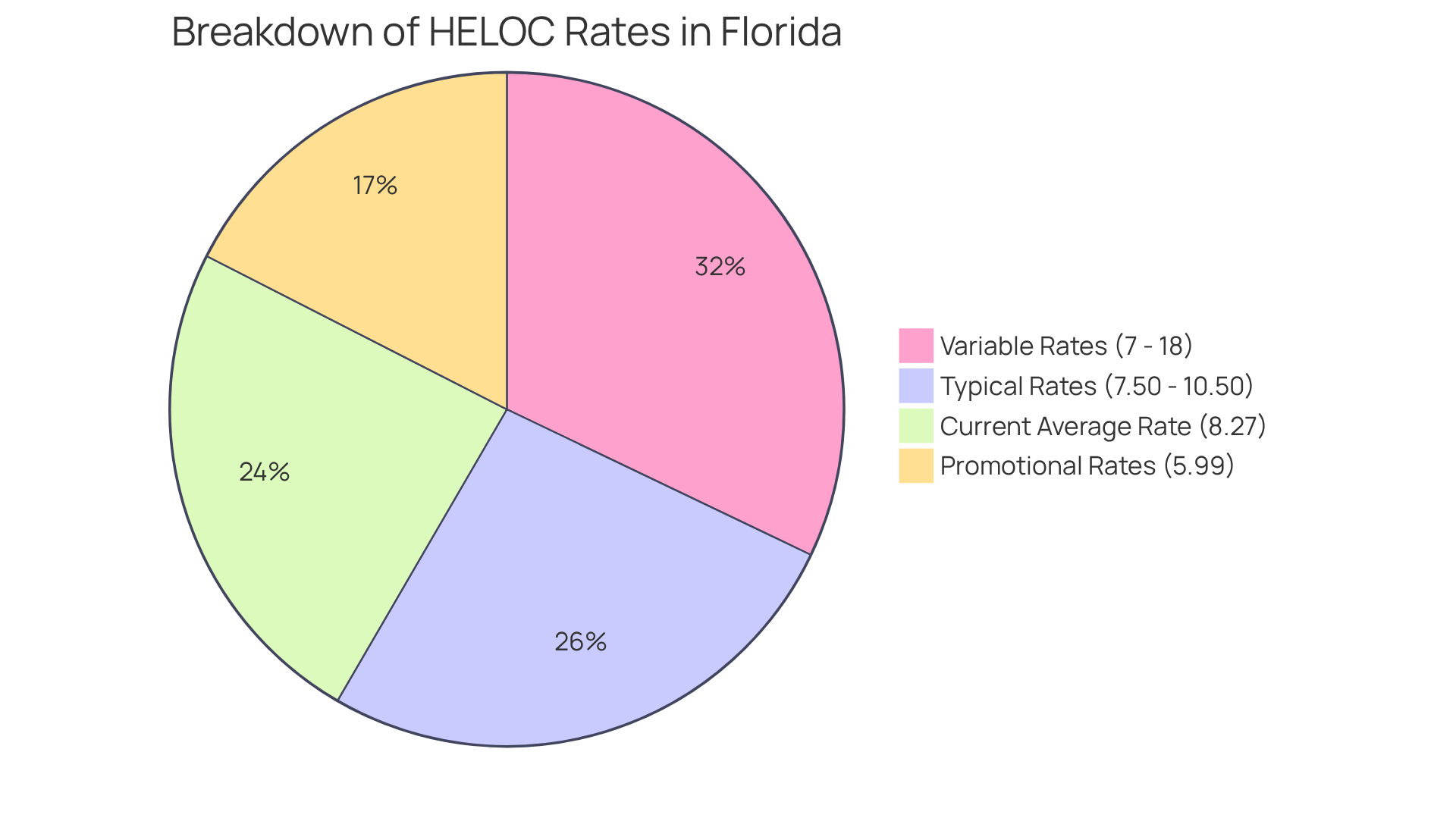

As of July 2025, we understand how important it is to stay informed about HELOC rates Florida for home equity line of credit interest levels. These rates can vary significantly, typically ranging from nearly 7% to as high as 18%. Factors such as creditworthiness and borrowing policies play a crucial role in determining your rate. Currently, most lenders offer percentages between 7.50% and 10.50%, with some promotional rates as low as 5.99% for the first six months. After that, rates adjust based on the prime benchmark.

The current average HELOC rates Florida are approximately 8.27%, reflecting similar trends nationwide, where typical rates hover in the low-8% range as of June. To qualify for this type of credit, borrowers generally need:

- A combined loan-to-value ratio (CLTV) of 85% or less

- A credit score of 620 or higher

- A debt-to-income (DTI) ratio below 43%

We know how challenging this can be, and it’s essential to explore various proposals from different lenders to find the most favorable terms suited to your financial situation.

Historical trends indicate that home equity line of credit costs have fluctuated, underscoring the importance of being aware of current market conditions and available lender options. Additionally, understanding potential fees associated with HELOCs and the significance of closing costs is vital as you evaluate your options. Remember, we’re here to support you every step of the way in making informed decisions for your financial future.

Secure Competitive HELOC Rates: Tips and Strategies

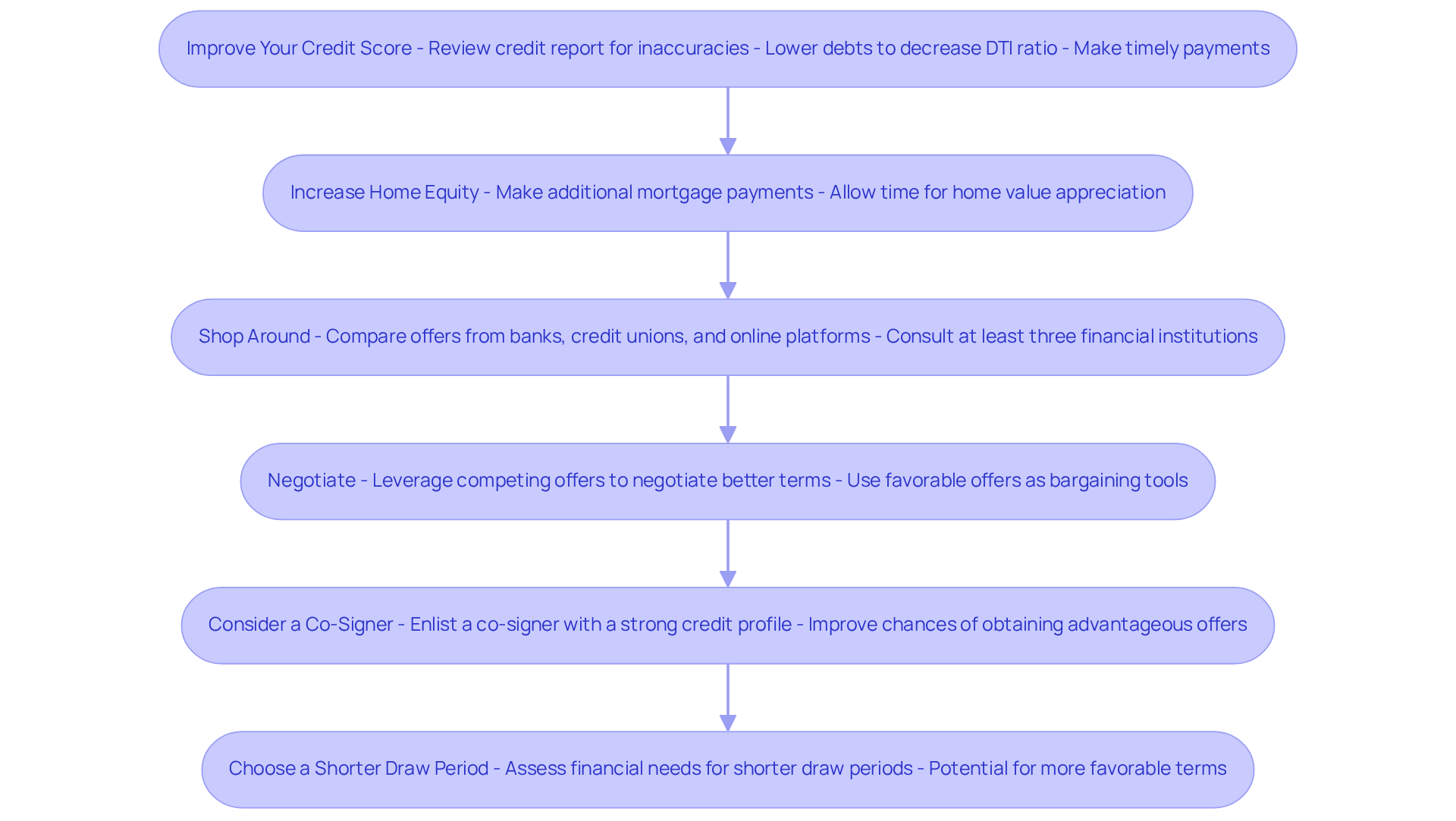

Securing competitive HELOC rates Florida can feel overwhelming, but we’re here to support you every step of the way. Here are some strategies to help you navigate this process with confidence:

-

Improve Your Credit Score: Start by reviewing your credit report for any inaccuracies. Taking proactive steps to enhance your score can make a significant difference. Consider lowering current debts to decrease your debt-to-income (DTI) ratio, ideally below 43% for better terms. Timely payments are crucial. Remember, an improved score can greatly affect the terms presented to you.

-

Increase Home Equity: The more equity you have in your home, the better your chances of securing a lower rate. You can increase your equity by making additional mortgage payments or simply allowing time for your home’s value to appreciate.

-

Shop Around: It’s essential to compare offers from a variety of providers, including banks, credit unions, and online platforms. We know how challenging this can be, so we suggest consulting with at least three distinct financial institutions to discover the most competitive offers. Each provider may have different fees and conditions, so thorough investigation can lead to improved financial outcomes.

-

Negotiate: Don’t hesitate to leverage competing offers when discussing terms with financial institutions. If you receive a favorable offer from one lender, use it as a bargaining tool to negotiate a better arrangement with another. You deserve the best possible terms.

-

Consider a Co-Signer: If your credit score isn’t where you’d like it to be, enlisting a co-signer with a strong credit profile can significantly enhance your chances of obtaining a more advantageous offer. A strong financial profile can improve your borrowing terms.

-

Choose a Shorter Draw Period: Lenders may offer more favorable terms for shorter draw periods. Take the time to assess your financial needs carefully to determine if this option aligns with your borrowing strategy.

As of July 16, the HELOC rates in Florida averaged 8.27%, compared to the national average HELOC APR of 6.64%. Understanding these benchmarks, along with your DTI and score, can assist you in effectively assessing your options. Additionally, order a copy of your credit report to check for errors or discrepancies, and consider paying down existing debts to further improve your DTI ratio. We’re here to help you make informed decisions.

Conclusion

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) in Florida is essential for homeowners looking to leverage their property’s value. This financial tool offers significant flexibility and competitive rates compared to traditional lending options. However, we know how challenging it can be to navigate this opportunity with caution, as it is secured by your home. Responsible borrowing and repayment are crucial to avoid potential foreclosure.

Key factors influencing HELOC rates in Florida include:

- Credit scores

- Loan-to-value ratios

- Market conditions

- Property location

A strong credit profile can lead to lower interest rates, while understanding the dynamics of the housing market can help you time your applications effectively. Moreover, exploring various lenders and negotiating terms can uncover more favorable options, ultimately leading to better financial outcomes.

As you navigate the landscape of HELOC rates, it is vital to remain informed and proactive. By improving your credit scores, increasing home equity, and comparing offers, you can secure competitive rates that align with your financial goals. Taking these steps not only enhances your borrowing experience but also empowers you to make informed decisions that contribute to your long-term financial health.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a revolving line of borrowing secured by the equity in your residence, allowing homeowners to borrow against their property’s value.

How does a HELOC differ from a conventional home equity loan?

Unlike a conventional home equity loan that provides a one-time payment, a HELOC allows you to withdraw funds multiple times throughout a defined draw period, which typically lasts between 5 to 10 years.

What are the interest payment requirements for a HELOC?

You only pay interest on the amount you have drawn from the HELOC, making it a flexible option for various expenses.

What types of expenses can a HELOC be used for?

A HELOC can be used for various expenses, including home renovations, education, or debt consolidation.

What are the risks associated with a HELOC?

Since a HELOC is secured by your house, failure to repay could lead to foreclosure.

What are the average HELOC rates in Florida as of early 2025?

As of early 2025, the average HELOC rates in Florida are 7.94%.

How do HELOC rates compare to other lending alternatives?

HELOC rates are considerably lower than other lending alternatives, such as personal loans and credit cards, which average around 12% and 23%, respectively.

What is the typical cost of refinancing in California?

The cost of refinancing in California typically ranges from 2% to 5% of the loan amount.

How much home equity is accessible for borrowing?

Approximately $11.5 trillion of home equity is accessible for borrowing through HELOCs.