Overview

We understand that navigating home equity loans can feel overwhelming for families. Current interest rates are influenced by factors such as credit scores, loan-to-value ratios, and broader economic conditions. Despite recent increases, rates remain competitive, which is a silver lining.

It’s essential to recognize how these elements impact your options. By improving your credit score and shopping around for offers, you can secure more favorable loan terms. We know how challenging this can be, but taking these strategic steps can make a significant difference.

Remember, you’re not alone in this journey. We’re here to support you every step of the way as you explore the best options for your family’s financial future.

Introduction

Home equity loans offer families a valuable opportunity to tap into the worth of their homes, serving as a financial lifeline for significant expenses like renovations or education. We know how challenging it can be to navigate these options, especially with current interest rates remaining competitive. By understanding the nuances of these loans, homeowners can feel empowered to make informed decisions that align with their financial goals.

However, as economic factors fluctuate, families may find themselves grappling with the challenge of securing the best possible rates. What strategies can you employ to navigate this complex landscape and ensure you maximize your home equity potential? We’re here to support you every step of the way.

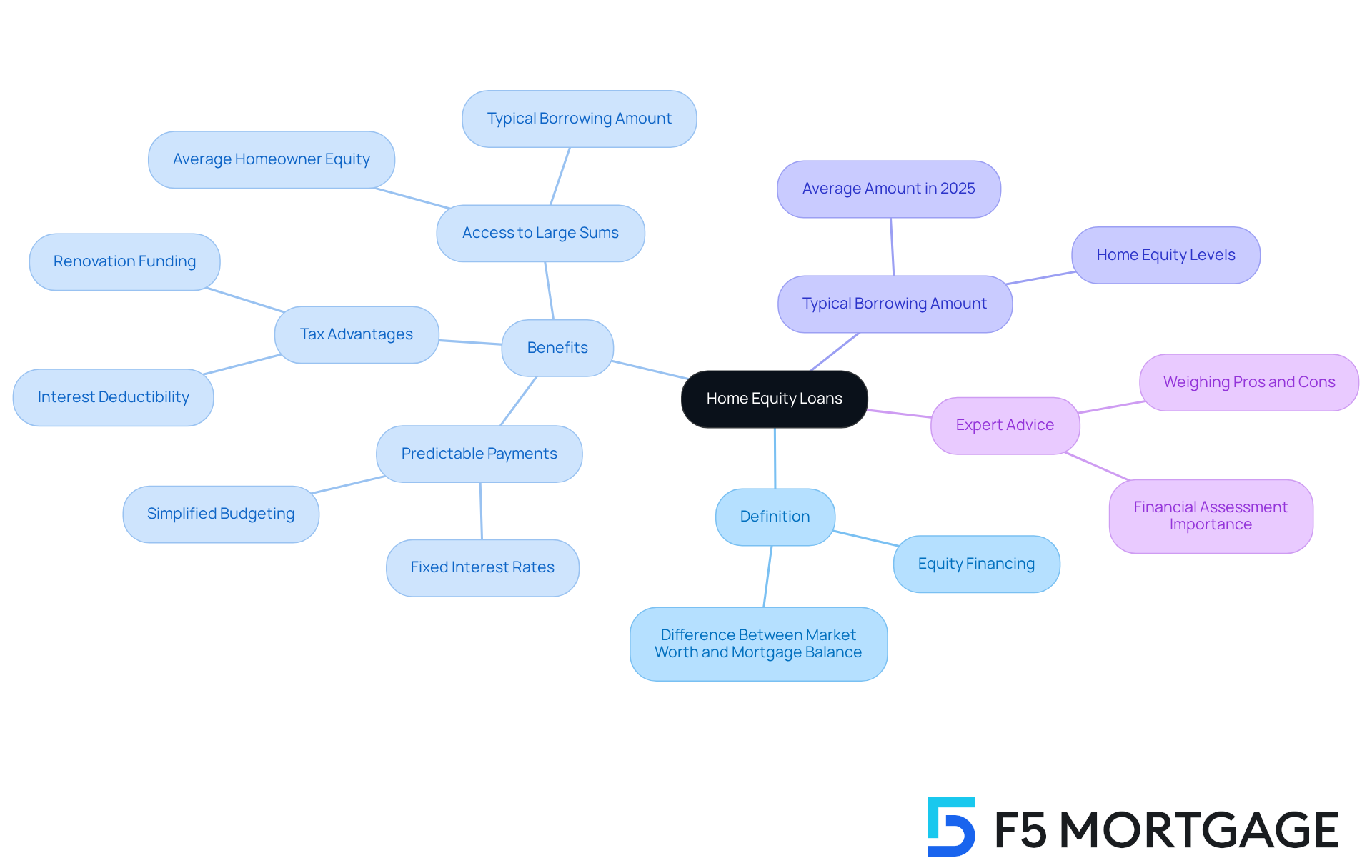

Define Home Equity Loans and Their Purpose

Equity financing offers a valuable opportunity for property owners to tap into the value accumulated in their assets. This value is determined by the difference between the current market worth and the outstanding mortgage balance. For families, these funds can be especially beneficial for significant expenditures such as renovations, educational expenses, or debt consolidation. By leveraging their property’s worth, families can often secure funds at lower current interest rates on home equity loans compared to unsecured borrowing, making this a compelling option for financing important projects.

In 2025, the typical residential borrowing amount is around $46,700, highlighting a steady demand for this financial solution. Families can find several key benefits in home equity loans:

- Predictable Payments: Home equity loans usually feature fixed interest rates, which allow for consistent monthly payments that simplify budgeting.

- Tax Advantages: The interest paid on these loans may be tax-deductible if the funds are used for property renovations, provided the borrower itemizes deductions.

- Access to Large Sums: With the average homeowner having at least $100,000 in accessible capital, these financial products can provide significant resources for major expenses.

Real-world examples illustrate the practical use of residential financing. Many families utilize these funds to finance renovations that not only improve their living spaces but also enhance property value. This strategic approach to homeownership can lead to long-term financial benefits, especially when renovations are thoughtfully planned.

Financial consultants emphasize the importance of carefully weighing the advantages and disadvantages of property financing. As one expert noted, “A property value borrowing might be a suitable choice if you wish to fund a singular fixed cost, are assured you can handle the payments, and possess a financial buffer that can provide you with some flexibility in your budget if you face an unforeseen financial challenge.” This perspective underscores the need for families to assess their financial situation and ensure that borrowing against home assets aligns with their overall financial goals. We know how challenging this can be, and we’re here to support you every step of the way.

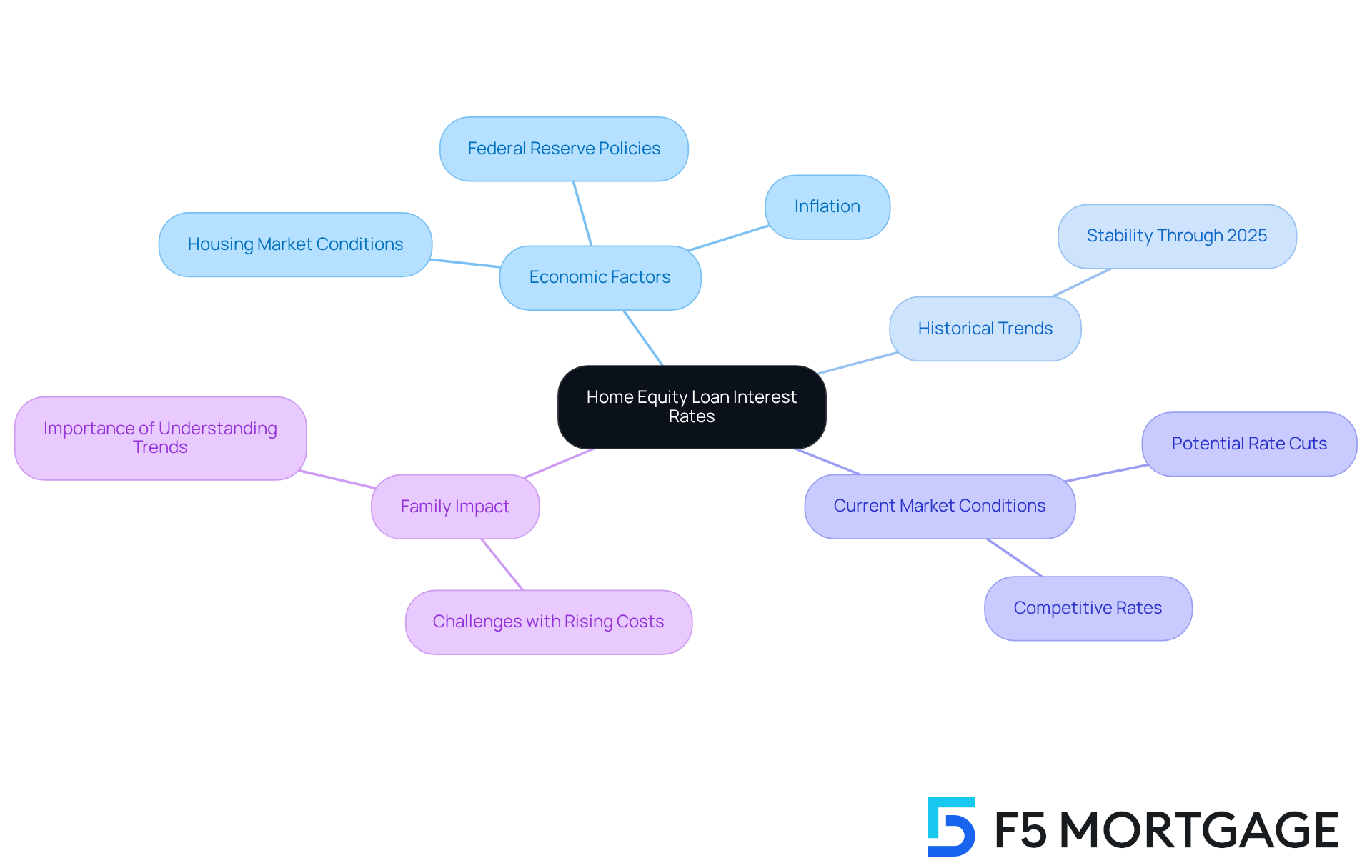

Analyze Current Trends in Home Equity Loan Interest Rates

A range of economic factors, including inflation, Federal Reserve policies, and existing housing market conditions, currently influence the current interest rates on home equity loans. While these figures may be higher than the historical lows we’ve seen in recent years, the current interest rates on home equity loans still remain competitive when compared to other borrowing options. We know how challenging this can be for families, so it’s important to stay attentive to these trends, as numbers can vary greatly in response to economic indicators. For example, if the Federal Reserve decides to increase interest levels to combat inflation, residential mortgage costs are likely to reflect this change. Keeping track of these advancements is essential for families seeking the best possible terms when applying for financing.

Historically, the current interest rates on home equity loans have experienced substantial variations, frequently influenced by the Federal Reserve’s monetary policy. In recent years, the Fed’s cautious strategy has created a relatively stable environment for current interest rates on home equity loans, with expectations that prices will remain consistent through 2025. However, possible reductions in the current interest rates on home equity loans could occur later this year, depending on market conditions. Families should also consider how their credit scores and debt-to-income ratios can significantly impact the terms they receive.

Real-life examples highlight the effects of rising residential financing costs on families. Many property owners are currently facing challenges due to increased borrowing expenses, which can limit their ability to tap into the equity built in their homes. As costs rise, households may find it more difficult to fund necessary upgrades or consolidate debt. This underscores the importance of understanding the broader economic context when considering property-backed financing. We’re here to support you every step of the way as you navigate these decisions.

Examine Factors Influencing Home Equity Loan Rates

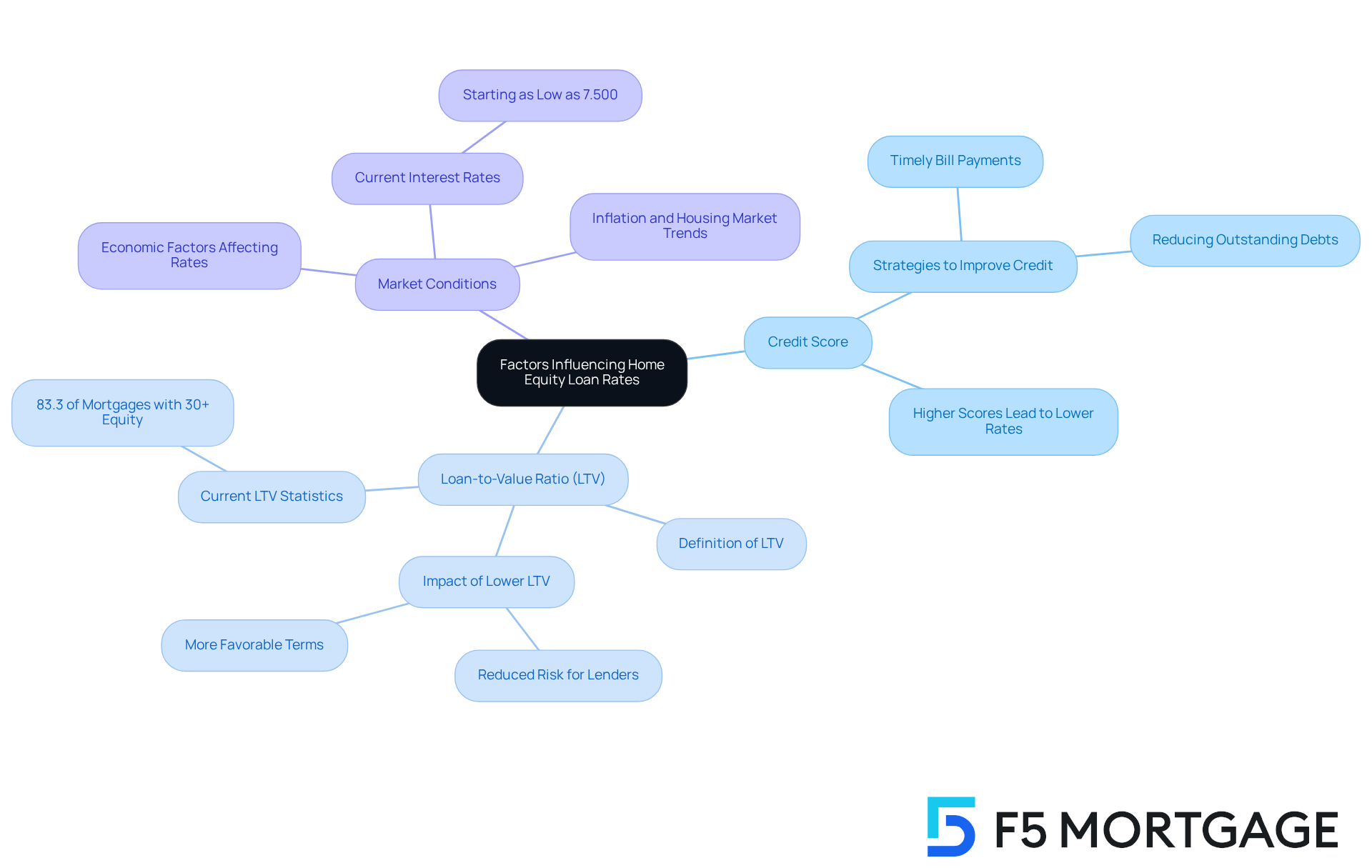

Understanding home equity loan rates can feel overwhelming, but several key factors can significantly influence your experience:

-

Credit Score: We know how challenging it can be to manage finances, but a higher credit score generally leads to lower interest rates. Lenders view borrowers with strong credit histories as less risky. Families should prioritize enhancing their credit scores before seeking a financial advance. Approaches like prompt bill payments and lowering outstanding debts can improve creditworthiness, ultimately leading to more favorable borrowing conditions.

-

Loan-to-Value Ratio (LTV): This ratio measures the loan amount against the appraised value of your home. A lower LTV indicates reduced risk for lenders, often resulting in more advantageous terms. As of Q1 2023, 83.3% of mortgages had an equity stake of 30% or more, reflecting a strong position for many homeowners.

-

Market Conditions: We understand that economic factors, including inflation and variations in the housing market, can influence interest levels. For instance, the current interest rates on home equity loans for borrowings currently begin as low as 7.500%. Staying alert regarding these conditions can help families strategically time their applications for the most favorable terms.

By comprehending these elements, families can make knowledgeable choices concerning their property financing. This understanding can lead to considerable savings and improved financial results, empowering you every step of the way.

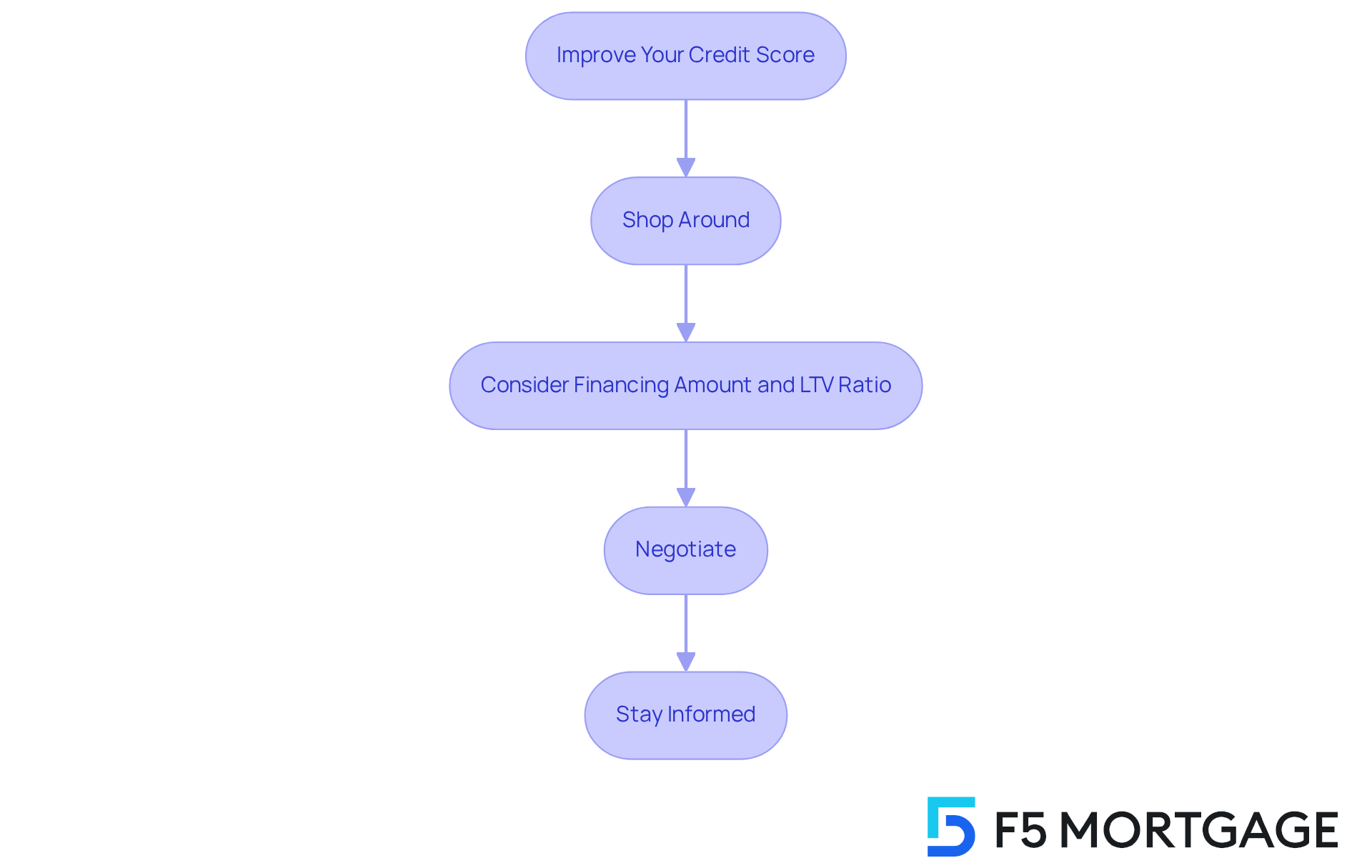

Guide to Securing Competitive Home Equity Loan Rates

Securing competitive current interest rates on home equity loans can feel overwhelming, but by following these essential steps, families can navigate the process with confidence and ease.

-

Improve Your Credit Score: Start by reviewing your credit report for any inaccuracies. We understand how challenging this can be, so take proactive measures to enhance your score. Strategies include paying down existing debts and keeping credit card balances below 30% of their limits. Remember, an elevated credit score can significantly affect the current interest rates on home equity loans that you receive.

-

Shop Around: Don’t settle for the first financing proposal that comes your way. It’s crucial to evaluate prices, expenses, and conditions from various lenders, including banks, credit unions, and independent brokers like F5 Mortgage, known for their competitive pricing and personalized service. Studies show that obtaining multiple estimates can lead to substantial savings over time; for instance, a mere 0.75% variation in costs could save you around $72,000 over thirty years. Aim to get at least three mortgage quotes to understand the range of mortgage costs available to you.

-

Consider the Financing Amount and Loan-to-Value (LTV) Ratio: Strive for a lower financing amount in relation to your home’s value. A favorable LTV ratio can enhance your chances of securing better terms, as lenders tend to view lower-risk borrowers more favorably.

-

Negotiate: Don’t hesitate to negotiate your loan terms with lenders. Many are open to adjusting prices or reducing fees to earn your business, especially if you present competing offers. As Peter Warden wisely advises, “Don’t accept your first mortgage quote.” This negotiation could lead to significant financial benefits for you.

-

Stay Informed: Keep yourself updated on market trends and economic indicators. Timing your application when conditions are favorable can make a notable difference in the terms you receive.

By diligently following these steps and considering F5 Mortgage for your lending needs, families can significantly improve their chances of securing a competitive home equity loan rate in light of the current interest rates on home equity loans. We’re here to support you every step of the way, making your financial journey smoother and more affordable.

Conclusion

Understanding the current landscape of home equity loans is essential for families looking to leverage their property’s value. We know how challenging financial decisions can be, and by tapping into home equity, families can access funds for significant expenses while often benefiting from lower interest rates compared to other borrowing options. This financial strategy not only supports immediate needs but can also enhance long-term financial stability when used wisely.

Throughout the article, we shared key insights regarding:

- The benefits of home equity loans

- The factors influencing interest rates

- Practical steps families can take to secure competitive rates

The importance of credit scores, loan-to-value ratios, and market conditions were highlighted as critical elements that shape the borrowing experience. Moreover, strategies such as shopping around for quotes and negotiating terms can lead to substantial savings.

Ultimately, staying informed about current interest rates and understanding how to navigate the borrowing process can empower families to make sound financial decisions. By being proactive and informed, families can not only meet their immediate financial needs but also set themselves up for future success. Embracing these opportunities with confidence can lead to a more secure financial future and enhance the overall quality of life.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a type of equity financing that allows property owners to borrow against the value accumulated in their assets, calculated as the difference between the current market value of the property and the outstanding mortgage balance.

What are the primary purposes of home equity loans?

Home equity loans are often used for significant expenditures such as home renovations, educational expenses, or debt consolidation, providing families with access to funds at lower interest rates compared to unsecured borrowing.

What are some benefits of home equity loans?

Key benefits include predictable payments due to fixed interest rates, potential tax advantages if the loan is used for property renovations, and access to large sums of money, with the average homeowner having at least $100,000 in accessible capital.

How much do families typically borrow through home equity loans?

In 2025, the typical residential borrowing amount is around $46,700, indicating a steady demand for home equity loans.

How can home equity loans improve property value?

Many families use home equity loans to finance renovations that not only enhance their living spaces but also increase the overall value of their property.

What should families consider before taking out a home equity loan?

Families should carefully weigh the advantages and disadvantages, assess their financial situation, and ensure that borrowing against home assets aligns with their overall financial goals, especially regarding their ability to handle loan payments and unforeseen financial challenges.