Overview

This article highlights the essential steps for effectively using a PMI removal calculator, a valuable tool for homeowners eager to understand when they can eliminate Private Mortgage Insurance (PMI) from their monthly payments. We know how challenging this process can be, and gathering the necessary information is the first step. By inputting data into the calculator, you can begin to see the potential for significant monthly savings.

Analyzing the results is crucial, as it helps you understand your financial situation better. Planning your next steps is equally important, as it empowers you to take control of your finances. This process not only leads to improved financial flexibility but also provides peace of mind. Remember, we’re here to support you every step of the way as you navigate this journey.

Introduction

Understanding the complexities of Private Mortgage Insurance (PMI) can feel overwhelming for homeowners seeking financial relief. We know how challenging this can be. PMI, often seen as an unwelcome addition to monthly payments, can significantly impact your budget, especially if your down payment is less than 20%.

This article explores the effective use of a PMI removal calculator, a powerful tool designed to help you assess your equity and determine the right time to eliminate this cost. Imagine being able to navigate the intricacies of PMI removal with confidence. What steps can you take to ensure you’re making the most informed decisions in an ever-changing housing market? We’re here to support you every step of the way.

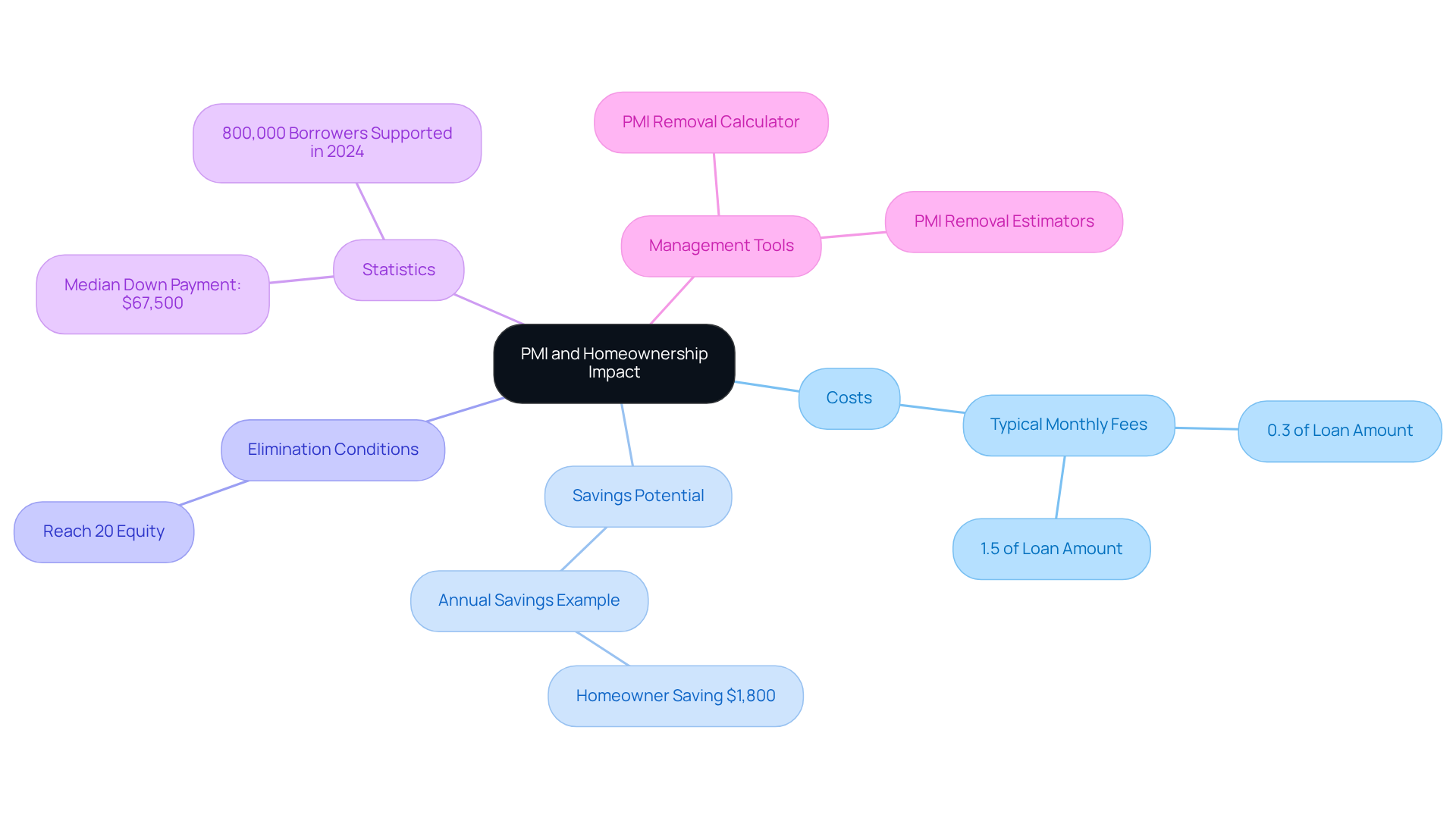

Understand PMI and Its Impact on Homeownership

Private Mortgage Insurance (PMI) can often feel like an extra burden, especially when lenders require it for on a home. While PMI is designed to protect lenders in case of default, it can also add to the . Understanding how PMI works is crucial, as it can significantly . For example, the typical monthly payment for homeowners with PMI may include an additional fee ranging from 0.3% to 1.5% of the original loan amount annually, depending on the down payment size and loan type.

each month, allowing towards other important financial goals, such as saving for the future or making home improvements. For instance, a homeowner with a $300,000 mortgage who pays $150 monthly for PMI could potentially save $1,800 each year by removing this cost. Typically, PMI can be eliminated once homeowners reach a certain level of equity, often around 20%. This is where a serves as an invaluable resource, and determining the optimal time to request PMI cancellation.

Recent statistics show that private loan insurers supported over 800,000 borrowers in 2024, highlighting the role of PMI in facilitating homeownership in the face of market challenges. As the housing market evolves, is essential for homeowners looking to manage their budgets effectively. By utilizing tools like PMI removal estimators, families can make informed decisions that positively impact their financial health. We’re here to support you every step of the way as you navigate these important choices.

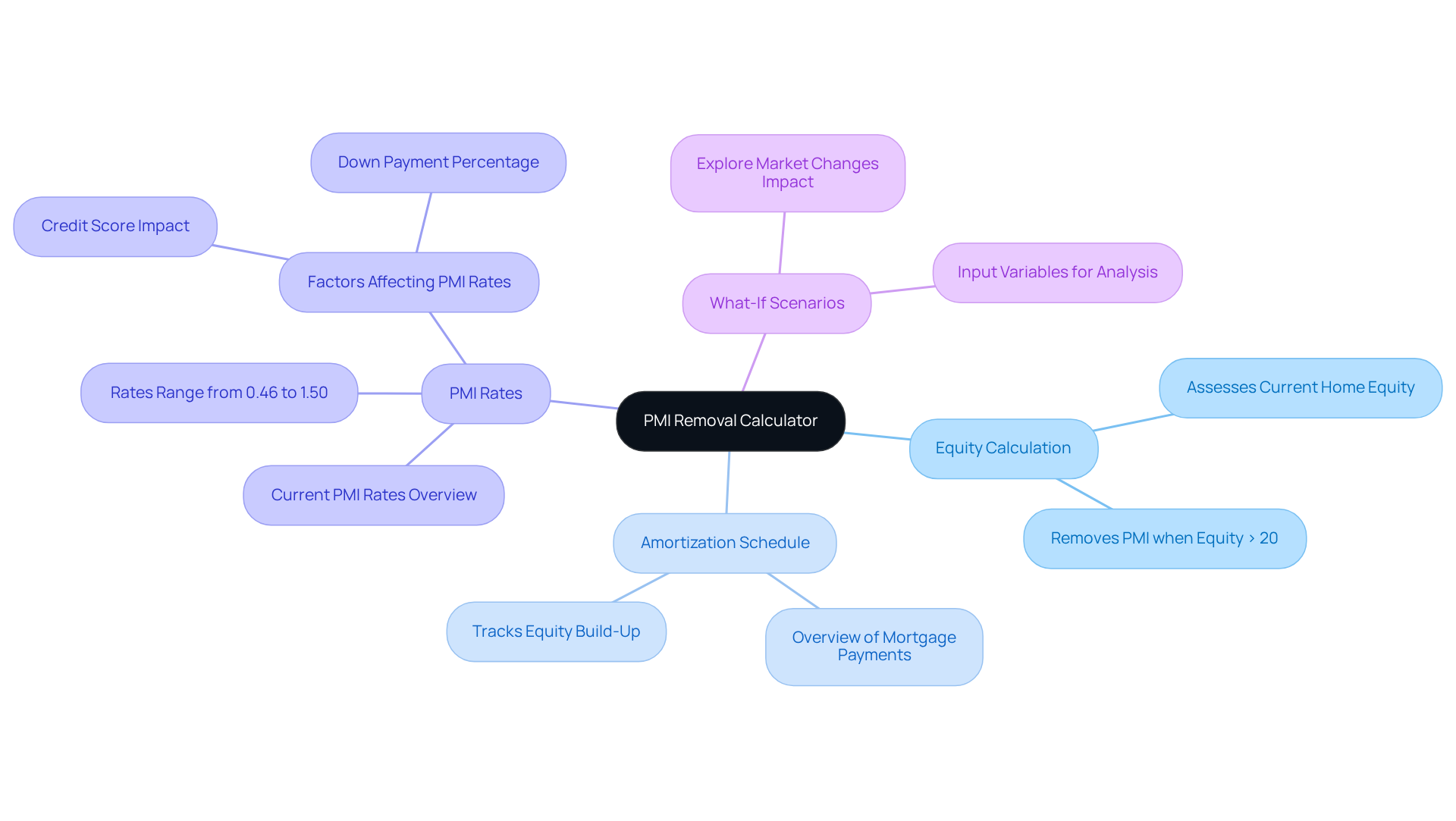

Explore the Features of a PMI Removal Calculator

A tool is an invaluable resource for homeowners who are navigating the complexities of . We understand how challenging this can be, and knowing when you can from your payment obligations is crucial. Here are some key features of a that can help you on this journey:

- : This feature assesses your current by comparing the market value of your home to your remaining mortgage balance. Understanding your equity is essential, as PMI can typically be removed once your equity exceeds 20%.

- : The tool provides a comprehensive overview of your over time, showing how equity builds with each payment. This insight empowers property owners to use the [PMI removal calculator](https://f5mortgage.com/9-essential-features-of-a-florida-mortgage-calculator) to monitor their progress toward PMI removal.

- : Many calculators include current PMI rates, allowing you to see your ongoing costs. For instance, PMI premiums can range from 0.46% to 1.50% of the original loan amount annually, depending on various factors such as credit score and down payment.

- : You can input different variables, such as home values, payment amounts, and interest rates, to explore how these factors influence the timing of PMI removal. This feature enables you to strategize effectively based on potential market changes.

By utilizing these features, you can make informed choices regarding your financing strategy with the help of a PMI removal calculator. Remember, we’re here to support you every step of the way, ultimately leading to significant savings.

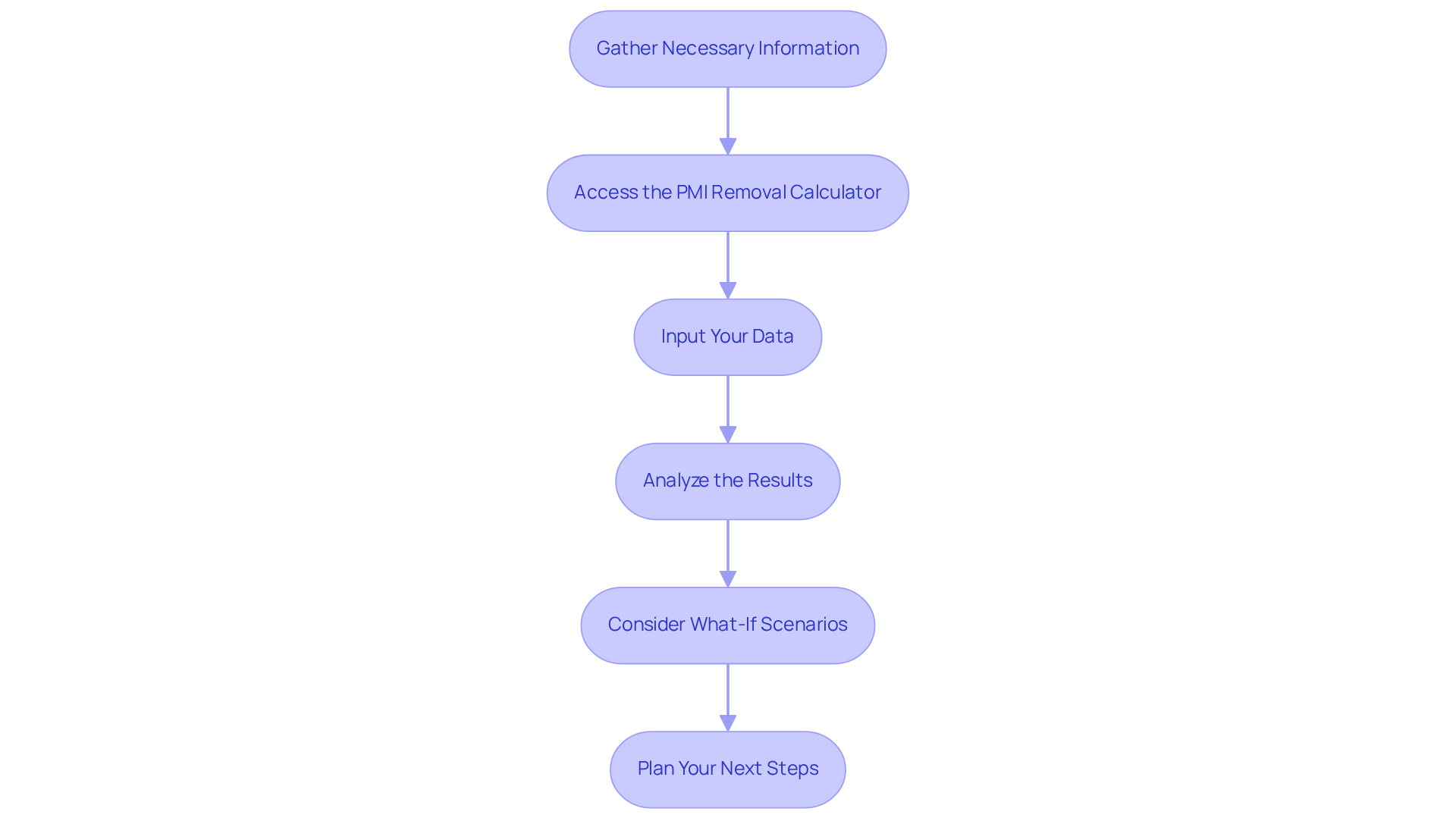

Follow Steps to Use the PMI Removal Calculator

To effectively use a , follow these supportive steps:

- Gather Necessary Information: First, collect your , the original purchase price of your home, and its current market value. This information is crucial for accurate calculations and will help you understand your financial position better.

- Access the PMI removal calculator: Next, find a reliable tool online. Many loan websites, including those of brokers like , offer these tools at no cost, making it easier for you to get started.

- Input Your Data: Now, enter the required information into the calculator. This usually includes your existing loan balance, , and any additional details the tool requests. Remember, this step is vital for obtaining accurate results.

- : Take a moment to review the output provided by the tool. It will show you your current equity percentage and when you can expect to needed to remove PMI. Understanding this can be empowering.

- Consider What-If Scenarios: Use the tool’s features to explore various scenarios, such as changes in home value or additional payments toward your loan. This will help you grasp how these factors influence the timing of PMI removal.

- Plan Your Next Steps: Based on the results from the tool, decide when to reach out to your lender about . Ensure you have all ready to support your request. We know how challenging this process can be, but being prepared can make a significant difference.

Understanding the average time to reach can also guide your planning. In 2025, homeowners generally reach this milestone within five to seven years, depending on market conditions and loan repayments. By effectively using a PMI removal calculator, you can proactively decrease your monthly loan expenses and enhance your . Remember, we’re here to support you every step of the way.

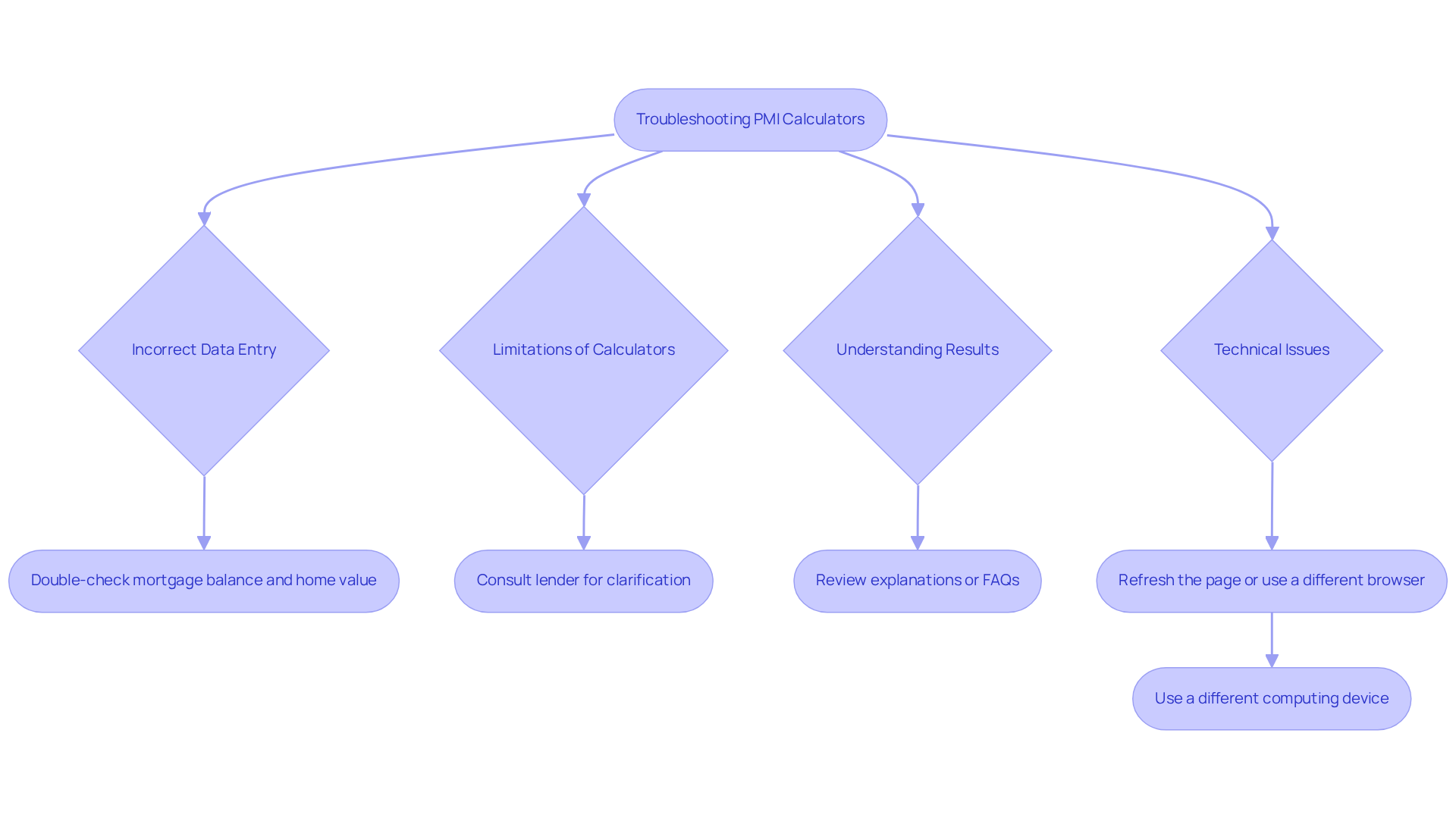

Troubleshoot Common Issues with PMI Calculators

While using a , we understand that you might face some . Here are some to help you navigate through them:

- Incorrect Data Entry: We know how important it is to get the numbers right. Double-check the information you input, ensuring that your mortgage balance and home value are accurate to avoid any misleading results.

- Limitations of Calculators: It’s essential to recognize that some tools may not account for specific lender requirements or local regulations. If the results seem off, don’t hesitate to for clarification.

- Understanding Results: If the output feels confusing, take a moment to review the explanations or FAQs provided by the tool. Many devices offer assistance to help you better.

- : Should the tool not function properly, try refreshing the page or using a different browser. If problems persist, consider utilizing a different computing device from a reputable source.

By being aware of these potential issues and knowing how to address them, you can confidently utilize a . We’re here to support you every step of the way as you make informed decisions about your mortgage.

Conclusion

Understanding and managing Private Mortgage Insurance (PMI) can significantly enhance the financial well-being of homeowners. We know how challenging this can be, but by effectively utilizing a PMI removal calculator, you can take control of your mortgage expenses and potentially save thousands each year. This invaluable tool not only helps assess equity but also empowers you to make informed decisions about when to request PMI cancellation.

In this article, we outline essential features of a PMI removal calculator, including:

- Equity calculation

- Amortization schedules

- The ability to explore various scenarios

These elements are crucial for homeowners like you who wish to navigate the complexities of PMI and maximize their financial strategies. It’s important to remember that accurate data entry and understanding the calculator’s limitations can help you avoid common pitfalls.

Ultimately, leveraging a PMI removal calculator is a proactive step towards reducing your monthly expenses and achieving greater financial flexibility. We encourage you to take advantage of these tools, stay informed about your equity position, and engage with your lenders to eliminate unnecessary costs. By doing so, you can pave the way for a more secure and prosperous financial future.

Frequently Asked Questions

What is Private Mortgage Insurance (PMI)?

PMI is insurance that lenders require for borrowers who make down payments of less than 20% on a home. It protects lenders in case of default.

How does PMI affect monthly expenses for homeowners?

PMI adds an additional fee to monthly mortgage payments, typically ranging from 0.3% to 1.5% of the original loan amount annually, depending on the down payment size and loan type.

How can eliminating PMI benefit homeowners financially?

Eliminating PMI can lead to significant monthly savings, allowing homeowners to redirect those funds towards important financial goals, such as saving for the future or making home improvements.

When can homeowners typically eliminate PMI?

Homeowners can usually eliminate PMI once they reach a certain level of equity in their home, often around 20%.

What tools can help homeowners assess their PMI situation?

PMI removal calculators can help homeowners assess their equity position and determine the optimal time to request PMI cancellation.

How many borrowers were supported by private loan insurers in 2024?

Private loan insurers supported over 800,000 borrowers in 2024, demonstrating the role of PMI in facilitating homeownership.

Why is it important to understand how PMI affects monthly loan payments?

Understanding how PMI impacts monthly payments is essential for homeowners to manage their budgets effectively, especially as the housing market evolves.