Introduction

Navigating the mortgage landscape can feel overwhelming, especially for families looking to secure a significant $400,000 loan. We understand how challenging this can be. It’s essential to grasp the intricacies of budgeting, eligibility requirements, and lender options. This knowledge is crucial for making informed decisions that align with your long-term financial goals.

As families embark on this journey, they often grapple with balancing their current financial situation and the dream of homeownership. What steps can you take to simplify this process? How can you ensure you secure the best mortgage terms available? By addressing these questions, we can help you feel more confident and prepared.

We’re here to support you every step of the way. Let’s explore the options together, so you can navigate this path with clarity and peace of mind.

Understand Your Mortgage Budget and Options

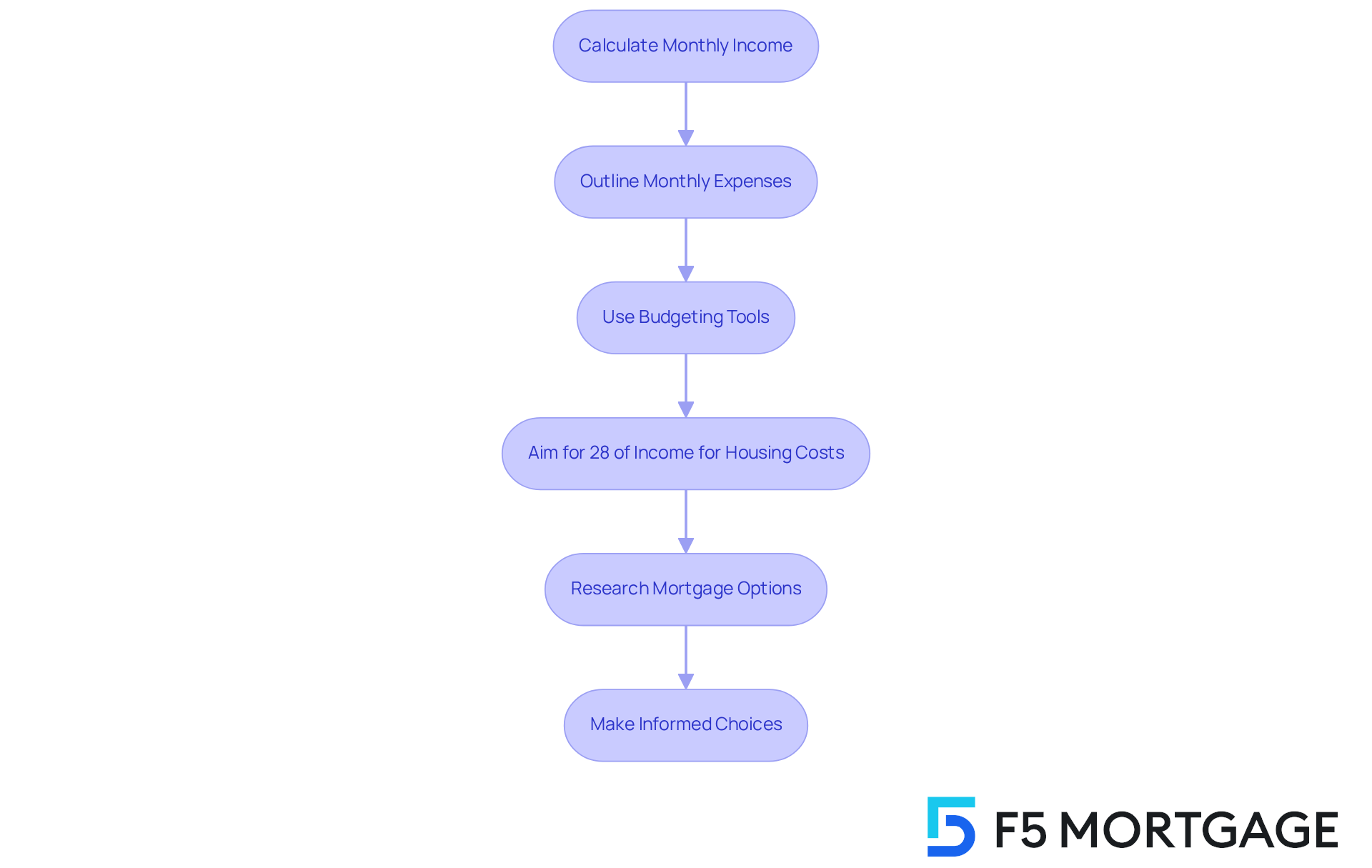

Calculating your total monthly income is a great first step. This should include your salaries, bonuses, and any other income sources you might have. Next, let’s outline your monthly expenses—think utilities, groceries, and any existing debts. Using a budgeting tool or calculator can really help you visualize your financial situation more clearly. Aim to keep your housing expenses, including your loan payment, property taxes, and insurance, to no more than 28% of your gross monthly income. Don’t forget to factor in other homeownership costs, like maintenance and repairs.

In 2025, financial advisors recommend that families adopt effective mortgage budgeting strategies. This means researching different mortgage options—like fixed-rate, adjustable-rate, FHA, and VA loans—to find what best suits your financial situation and long-term goals. It’s worth noting that American families typically allocate around 30% of their income to housing costs. This highlights just how important careful planning is.

To make this process easier, consider using budgeting tools like the Freddie Mac budgeting guide. It offers valuable insights into creating a comprehensive homebuying budget. By understanding your financial situation and the expenses tied to homeownership, you can make informed choices that truly align with your family’s needs. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Prepare Your Financial Documents and Assess Eligibility

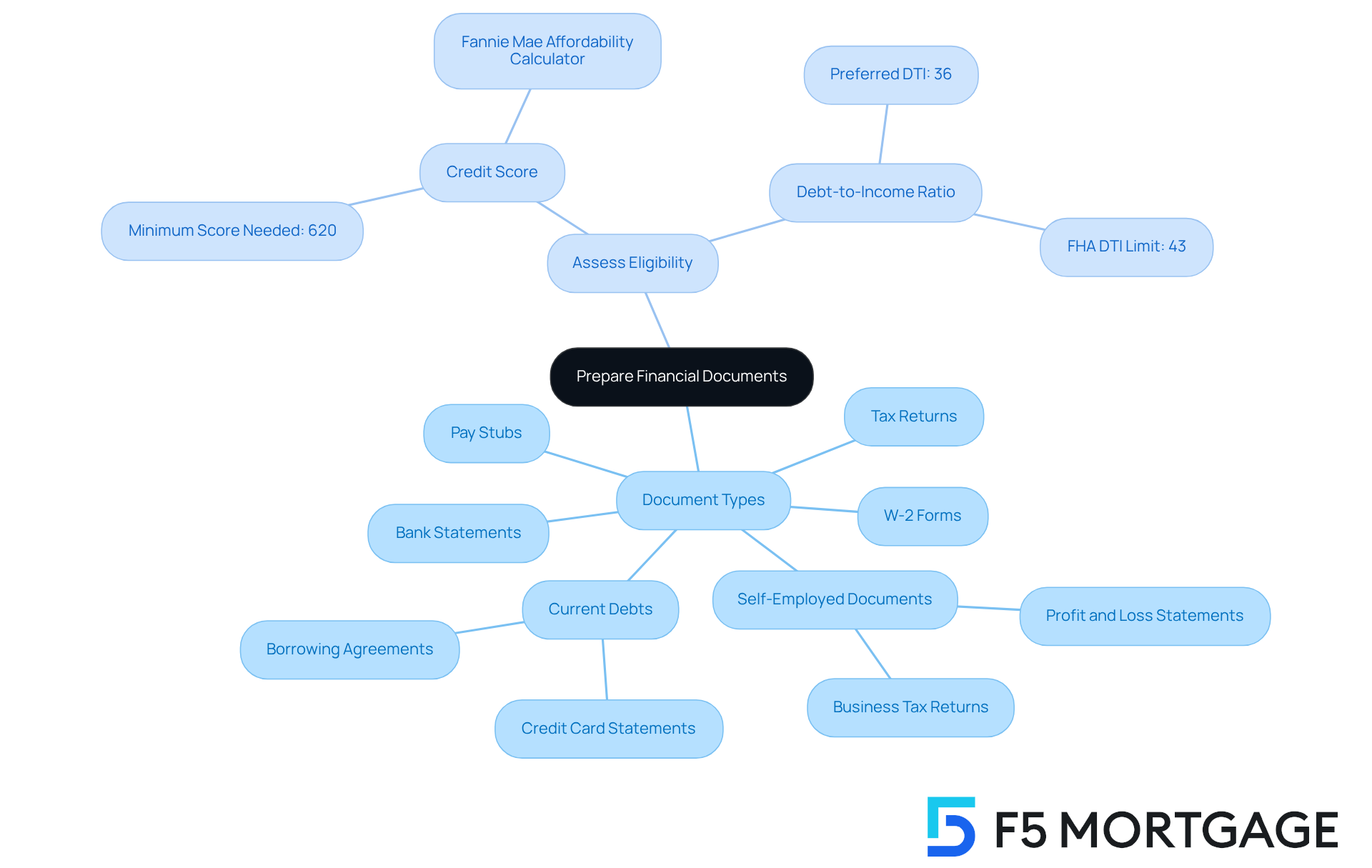

We know how challenging it can be to prepare for a mortgage, but taking the right steps can make a world of difference. Start by gathering essential financial documents. This includes:

- Your last two years of tax returns

- W-2 forms

- Recent pay stubs

- Bank statements

If you’re self-employed, don’t forget to include:

- Profit and loss statements

- Business tax returns

It’s also important to collect documentation for any current debts, like credit card statements and borrowing agreements.

Evaluating your credit score is crucial, as it significantly impacts your loan eligibility. Aim for a minimum score of 620 for standard loans, though some programs may accept lower scores. Tools like the Fannie Mae affordability calculator can help you assess your eligibility based on your income and debts. This thorough preparation not only clarifies your financial situation but also positions you as a more appealing applicant to creditors.

With around 15% of loan applications in 2025 coming from self-employed individuals, understanding how to effectively showcase your financial situation is vital for securing a loan. Remember, we’re here to support you every step of the way.

Choose the Right Lender and Loan Type for Your Needs

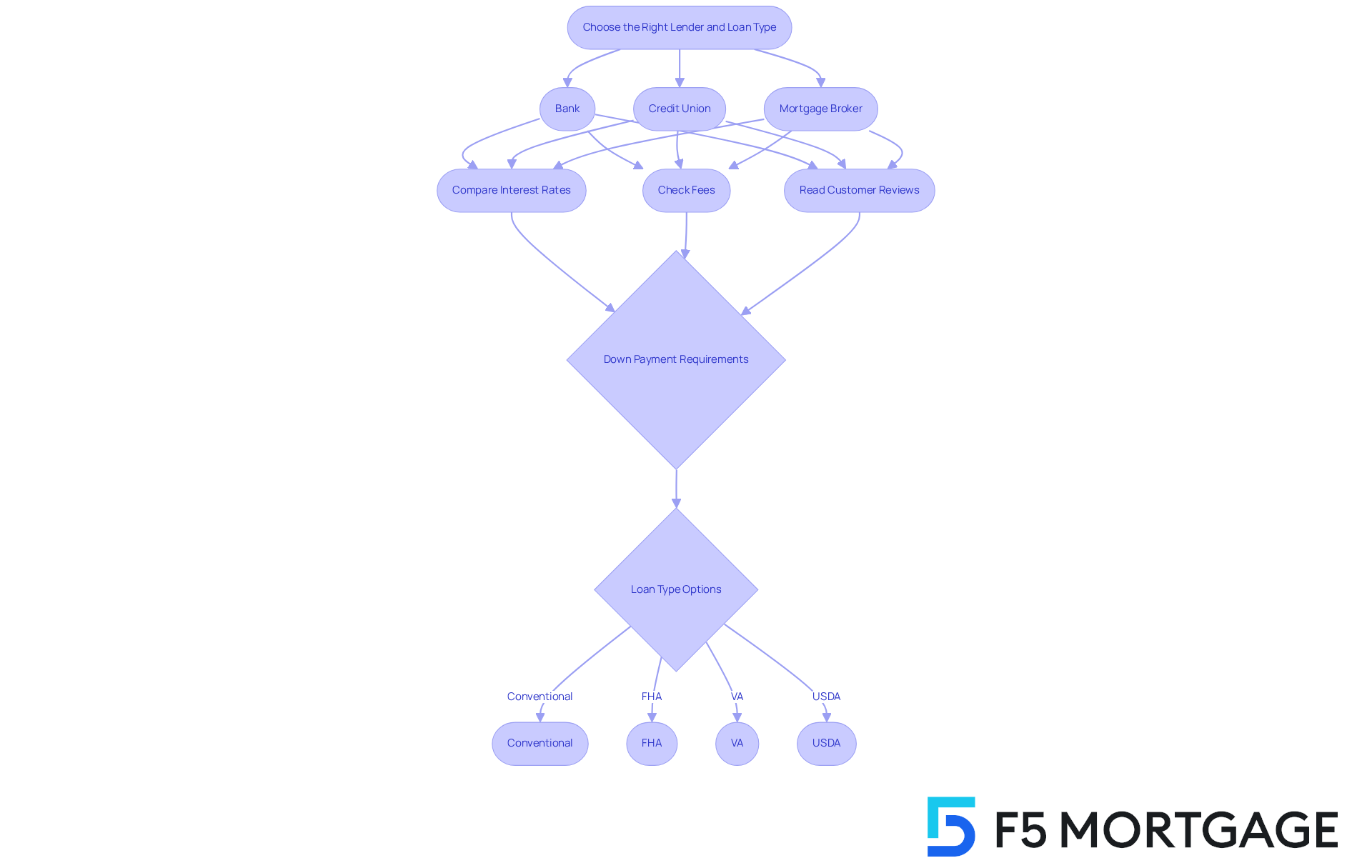

Start by exploring various providers, like banks, credit unions, and independent mortgage brokers. We know how overwhelming this can be, so it’s crucial to compare their interest rates, fees, and customer service reviews. Look for institutions that offer a diverse range of financing options, including conventional, FHA, VA, and USDA products, to find the best fit for your financial situation. Pay close attention to down payment requirements—most conventional loans need at least 3% down, while VA and USDA loans might allow for zero down payment options—and loan limits. Also, check if the financial institution has assistance programs designed for first-time homebuyers, such as Ohio’s YourChoice!, Grant for Grads, and Ohio Heroes programs, which can provide valuable financial support.

F5 Mortgage shines in this arena by offering competitive rates and personalized service. Many satisfied clients have shared their positive experiences, praising the smooth process and expert guidance they received. Once you’ve created a shortlist, reach out to each financial institution for quotes and pre-approval options. This step will help clarify what you can afford and the terms you can expect. Remember, the right lender will not only provide competitive rates but also offer support and guidance throughout the loan process.

As of 2025, loan rates have been fluctuating between 6% and 7%, making it vital to secure favorable terms as you explore your options. By gathering multiple estimates, you could save thousands over the life of your loan, ensuring a more manageable financial commitment as you improve your home. Additionally, consider the impact of discount points, which can reduce your interest rate in exchange for an upfront cost, further boosting your long-term savings. F5 Mortgage also provides insights into down payment assistance programs, making your journey to homeownership even more attainable.

Navigate the Application Process and Secure Approval

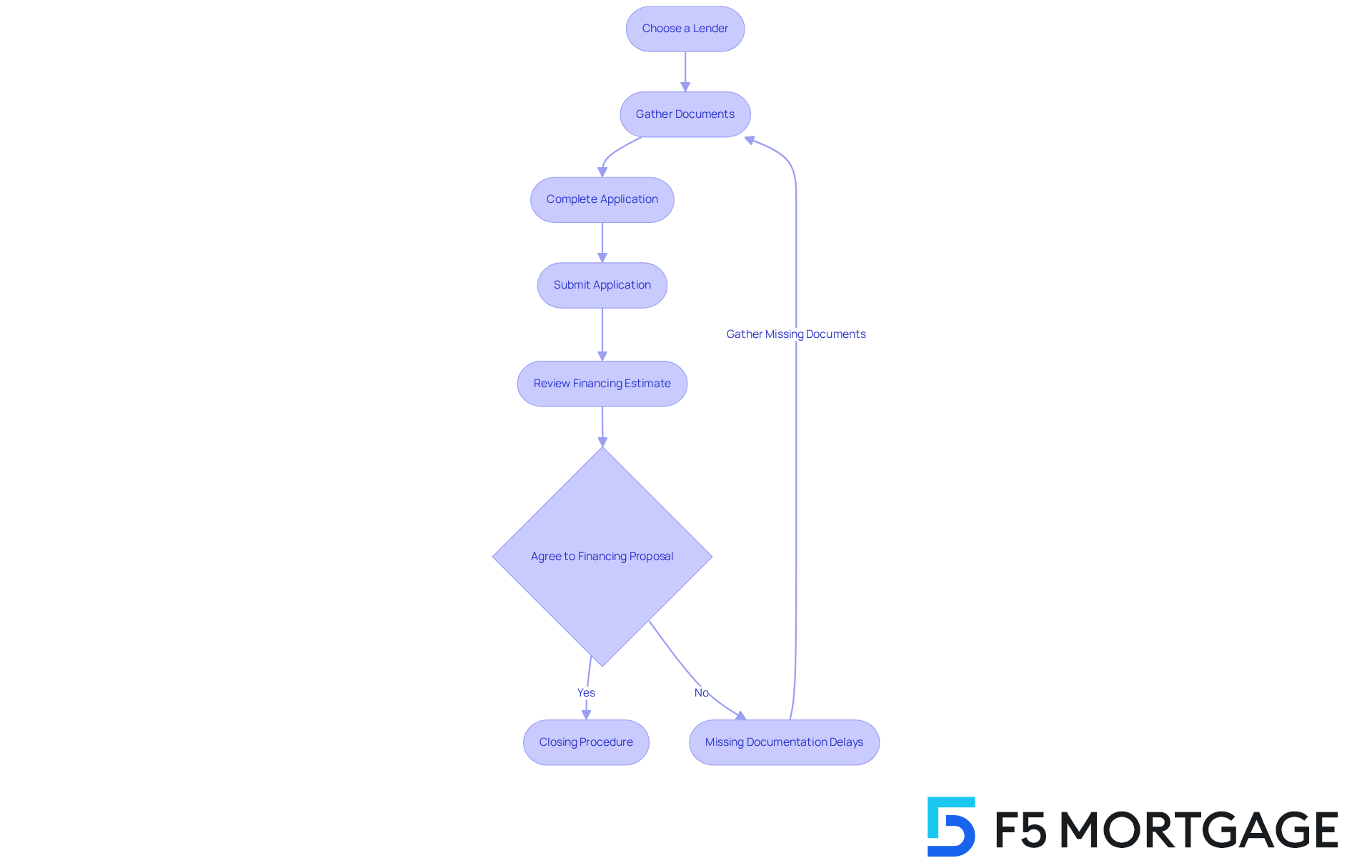

Choosing a lender like F5 Mortgage is an important step, and once you’ve gathered your documents, it’s time to complete the mortgage application. This usually means filling out a detailed form that asks for personal information, employment history, and financial details. Be ready to discuss your income, debts, and assets, especially your Debt-to-Income (DTI) ratio. Ideally, this should be below 43% for home loans. A better DTI can lead to more competitive mortgage rates, which is crucial for families looking to upgrade their homes.

After you submit your application, the financial institution will review your information and may request additional documentation. It’s essential to stay responsive and provide any requested information promptly to avoid delays. The lender will conduct a credit check and assess your financial situation. If you’re accepted, you’ll receive a financing estimate that outlines the conditions of your home purchase, including interest rates and closing costs. Take the time to review this document carefully and don’t hesitate to ask questions if anything is unclear. Once you agree to the financing proposal, you’ll move on to the closing procedure, where you’ll finalize the home financing and receive the keys to your new residence.

Did you know that missing documentation accounts for 60% of processing delays? That’s why it’s vital to have all required documents ready, such as:

- Recent pay stubs

- Complete tax returns

- Bank statements

Having complete documentation can reduce processing time by 30-50%, enhancing your chances of a smooth approval experience. Families navigating this process should maintain open communication with their loan officer at F5 Mortgage. Talk to them early and often; staying informed can significantly streamline the approval process. By being proactive and organized, you can enhance your chances of a smooth mortgage approval experience.

Conclusion

Understanding the complexities of securing a mortgage is crucial for families looking to make informed financial choices. This guide has highlighted the essential steps in navigating the mortgage process, from budgeting and assessing eligibility to selecting the right lender and completing the application successfully. By following these steps, families can set themselves up for a smoother experience in obtaining a mortgage that fits their financial goals.

Key insights include:

- The importance of calculating a comprehensive budget that covers all housing-related expenses

- Gathering essential financial documents

- Exploring various loan types and lenders

We know how challenging this can be, and that’s why it’s vital to maintain a strong credit score and be proactive during the application process to avoid common pitfalls that could lead to delays.

Ultimately, the journey to securing a mortgage isn’t just about numbers; it’s about building a stable foundation for your family’s future. By taking the time to understand the mortgage landscape and preparing thoroughly, families can empower themselves to make choices that lead to long-term financial security. Embrace this opportunity to take charge of your homeownership journey, and remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the first step to understanding my mortgage budget?

The first step is calculating your total monthly income, which includes salaries, bonuses, and any other income sources.

What should I consider when outlining my monthly expenses?

You should consider utilities, groceries, and any existing debts as part of your monthly expenses.

How can I visualize my financial situation more clearly?

Using a budgeting tool or calculator can help you visualize your financial situation more clearly.

What percentage of my gross monthly income should I aim to allocate to housing expenses?

Aim to keep your housing expenses, including your loan payment, property taxes, and insurance, to no more than 28% of your gross monthly income.

What additional costs should I factor in when budgeting for homeownership?

You should also factor in other homeownership costs such as maintenance and repairs.

What mortgage budgeting strategies do financial advisors recommend for families in 2025?

Financial advisors recommend researching different mortgage options, such as fixed-rate, adjustable-rate, FHA, and VA loans, to find what best suits your financial situation and long-term goals.

What is the typical percentage of income that American families allocate to housing costs?

American families typically allocate around 30% of their income to housing costs.

Are there tools available to help with budgeting for homebuying?

Yes, tools like the Freddie Mac budgeting guide offer valuable insights into creating a comprehensive homebuying budget.

How can understanding my financial situation help me in the homebuying process?

By understanding your financial situation and the expenses tied to homeownership, you can make informed choices that align with your family’s needs.